View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fiction Resume

GREG GARRETT Professor of English/ 2013 Baylor Centennial Professor Baylor University Waco, TX 76798-7404 (254) 710-6879 [email protected] SELECTED PUBLICATIONS Nonfiction A Long, Long Way: Hollywood’s Unfinished Journey from Racism to Reconciliation. New York: Oxford University Press, 2020. A lead trade title for Spring 2020. Featured in Publishers Weekly, LitHub, Read the Spirit. In Conversation: Rowan Williams and Greg Garrett. With Rowan Williams. New York: Church Publishing, 2019/London: SPCK, 2020. Featured in Publishers Weekly, Read the Spirit, BBC Radio. The Courage to See: Daily Inspiration from Great Literature. With Sabrina Fountain. Louisville: Westminster John Knox Press, 2019. Featured in Read the Spirit, BBC Radio. Living with the Living Dead: The Wisdom of the Zombie Apocalypse. New York: Oxford University Press, 2017. A lead trade title for Spring 2017. Featured in The Spectator, Vice, Christianity Today, Church News, The Baptist Standard, BBC Radio, The Daily Mirror, Christianity, and many other media sources. Featured book at the Edinburgh International Festival of Books, the Greenbelt Festival (UK), and the Texas Book Festival. My Church Is Not Dying: Episcopalians in the 21st Century. New York: Morehouse Publishing, 2015. Featured in Christian Century. Entertaining Judgment: The Afterlife in Popular Imagination. Oxford: Oxford University Press, 2015. A lead trade title for Spring 2015. Starred review in Library Journal. Lead reviews in The New Statesman and Christianity Today. Excerpted as lead article in Salon.com and featured in Christian Century. Faithful Citizenship: Christianity and Politics for the 21st Century. Englewood, CO: Patheos Press, 2012. Featured in Read the Spirit. The Other Jesus: Leaving a Religion of Fear for the God of Love. -

The 635 Is Dead, Long Live the 635A!

MICROPHONE FACTS for the operating engineer from ~feeZb.)6,e,® ELECTRO-VOICE, INCORPORATED BUCHANAN, MICHIGAN 49107 616 / 695-6831 LOU BURROUGHS PAUL FRANKLIN October, 1965 THE 635 IS DEAD, LONG LIVE THE 635A! By the time you receive this letter, the long popular Model 635 will have been replaced by the all-new Model 635A. There is an increasing demand for a small, lightweight, high output microphone for stand and hand held use. It was with these things in mind that field tests began many months ago on a redesign of the Model 635. During the field investigations into the design of the 635A various prototypes passed through many hands and a number of comments and opinions were accumulated guiding us to a more complete and versatile microphone than we alone could have conceived. I want to take this opportunity to thank those of you who helped guide us to the final product. Following are some of the answers found through tests we were able to make under your operating conditions. STEEL CASE DESIGN A steel case proved to be superior for shielding purposes and when machined from one particular special steel alloy proved to be exceptional from a mechanical shock standpoint. Thus it was ideal for use in a micro phone designed for hand held use where it is subject to the roughest treatment a microphone will receive in normal operations. I have one unit that was purposely dropped on hardwood and concrete floors twenty-seven times during tests without altering its frequency response. INTERNAL SHOCK ABSORBER A great deal of the ability of the 635A to withstand these many drops is due to the steel case, but there is another contributing unit, an internal jelly-like nest supporting the dynamic element. -

Akron General Medical Center, Goodwill Industries, and the Canton Repository

2011 Stark County Collaborative Poll Prepared for: Stark County Health Needs Assessment Committee Prepared by: The Center for Marketing and Opinion Research (CMOR) www.CMOResearch.com (330) 564-4211 Office Research Funded by: TABLE OF CONTENTS Page Executive Summary 3 Survey Questions 11 Survey Results 14 Overall needs and health 14 General health 19 Access to care 21 Exercise 29 Smoking/tobacco, alcohol, and prescription drug use 32 Obesity and access to healthy food 42 Immunizations 49 Texting and driving 52 APPENDIX A: Survey Results by Race 54 APPENDIX B: Survey Results by Location 66 APPENDIX C: Survey Results by Income 70 APPENDIX D: Quality of Life 74 APPENDIX E: Demographic Information 83 APPENDIX F: Research Methodology 104 2 Center for Marketing and Opinion Research 2011 Stark Poll- Stark County Health Needs Assessment Executive Summary The Stark County Health Needs Assessment Committee asked a series of questions as part of the 2011 Stark County Health Needs Assessment on the Stark County Collaborative Poll. The Stark County Health Needs Assessment Committee’s involvement with the 2011 Stark Poll was funded by Alliance Community Hospital, Aultman Health Foundation, and Mercy Medical Center and was coordinated by the Stark County Health Department. The questions focused on the following areas: overall needs and health, general physical and mental health, access to care, immunizations, smoking and tobacco use, alcohol consumption, prescription medication abuse, obesity and access to healthy food, exercise and texting while driving. Where possible, comparative data from previous Stark Poll administrations are included throughout the analysis. Overall Needs and Health First, all respondents were asked what they thought was the greatest unmet health need in Stark County. -

New Solar Research Yukon's CKRW Is 50 Uganda

December 2019 Volume 65 No. 7 . New solar research . Yukon’s CKRW is 50 . Uganda: African monitor . Cape Greco goes silent . Radio art sells for $52m . Overseas Russian radio . Oban, Sheigra DXpeditions Hon. President* Bernard Brown, 130 Ashland Road West, Sutton-in-Ashfield, Notts. NG17 2HS Secretary* Herman Boel, Papeveld 3, B-9320 Erembodegem (Aalst), Vlaanderen (Belgium) +32-476-524258 [email protected] Treasurer* Martin Hall, Glackin, 199 Clashmore, Lochinver, Lairg, Sutherland IV27 4JQ 01571-855360 [email protected] MWN General Steve Whitt, Landsvale, High Catton, Yorkshire YO41 1EH Editor* 01759-373704 [email protected] (editorial & stop press news) Membership Paul Crankshaw, 3 North Neuk, Troon, Ayrshire KA10 6TT Secretary 01292-316008 [email protected] (all changes of name or address) MWN Despatch Peter Wells, 9 Hadlow Way, Lancing, Sussex BN15 9DE 01903 851517 [email protected] (printing/ despatch enquiries) Publisher VACANCY [email protected] (all orders for club publications & CDs) MWN Contributing Editors (* = MWC Officer; all addresses are UK unless indicated) DX Loggings Martin Hall, Glackin, 199 Clashmore, Lochinver, Lairg, Sutherland IV27 4JQ 01571-855360 [email protected] Mailbag Herman Boel, Papeveld 3, B-9320 Erembodegem (Aalst), Vlaanderen (Belgium) +32-476-524258 [email protected] Home Front John Williams, 100 Gravel Lane, Hemel Hempstead, Herts HP1 1SB 01442-408567 [email protected] Eurolog John Williams, 100 Gravel Lane, Hemel Hempstead, Herts HP1 1SB World News Ton Timmerman, H. Heijermanspln 10, 2024 JJ Haarlem, The Netherlands [email protected] Beacons/Utility Desk VACANCY [email protected] Central American Tore Larsson, Frejagatan 14A, SE-521 43 Falköping, Sweden Desk +-46-515-13702 fax: 00-46-515-723519 [email protected] S. -

Rfp4430vp Athleticsmarketing.Pdf

Cleveland State University Athletics Marketing and Media Rights Inventory Updated as of 1/5/10 Athletics Marketing and Media Rights Opportunities During the last three seasons, the Men’s Basketball Program has an average attendance of 2,800. The following represents the Athletics Department sponsorship and advertising inventory: Radio Broadcast The Broadcast of Men’s Basketball games are carried on 1220 AM WHKW (50,000 watts), which serves the Greater Cleveland market and 1440 AM WHKZ (5,000 watts), which serves the Warren/Youngstown market. Selected Men’s Basketball games are carried on WTAM- AM (50,000 watts) which is the home of the Cleveland Browns, Cavaliers and Indians). Available inventory includes: :30 Commercial Spots - one spot in every game (minimum of 30 spots) Opening and Closing Billboards - one opening and one closing billboard in every game (minimum of 30) In-Game Features - title sponsorship of various features and segments (e.g. starting line- ups, half-time show, post game shows, play of the game, etc) in every game (minimum of 30) including live mentions prior to and during segments In-Game Live Reads - one :15 live read in every men’s basketball game (minimum of 30) A Coaches Show featuring Men’s Head Basketball Coach Gary Waters is carried on WTAM- AM. The show is broadcast 12-16 times per season. The University has four (4) minutes of commercial inventory per show. Television Broadcast A select number of Men’s Basketball games are broadcast on SportsTime Ohio. Six to eight Men’s Basketball games are broadcast. In addition, SportsTime Ohio broadcasts the Coaches Show featuring Coach Waters. -

Public Notice Page 1 of 2 PUBLIC NOTICE Federal Communications Commission News Media Information 202/418-0500 Fax-On-Demand 202/418-2830 445 12Th St., S.W

Call Sign - Public Notice Page 1 of 2 PUBLIC NOTICE Federal Communications Commission News media information 202/418-0500 Fax-On-Demand 202/418-2830 445 12th St., S.W. Internet: http://www.fcc.gov Washington, D.C. 20554 ftp.fcc.gov Report No. 413 Mass Media Bureau Call Sign Actions 08/29/2001 During the period from 08/12/2001 to 08/25/2001 the Commission accepted applications to assign call signs to, or change the call signs of the following broadcast stations. Call Signs Reserved for Pending Sales Applicants Call Sign Service Requested By City State File-Number Former Call Sign KCVK FM LAKE AREA EDUCATIONAL BROADCASTING FOUNDATION OTTERVILLE MO BALH-20010702ACR KOTT WICE FM JOYNER RADIO, INC. CLARKSVILLE VA BALH-20010226AAB WJLC New or Modified Call Signs Row Effective Former Call Call Sign Service Assigned To City State File Number Number Date Sign 1 08/13/2001 KHHT FM AMFM RADIO LICENSES LLC LOS ANGELES CA KCMG 2 08/13/2001 WBPG TV KB PRIME MEDIA LLC GULF SHORES AL WGMP WKMJ- 3 08/13/2001 FM VICTOR BROADCASTING CORPORATION HANCOCK MI WMPL-FM FM 4 08/13/2001 WLDR AM FORT BEND BROADCASTING COMPANY KINGSLEY MI WJZZ WLDR- GREAT NORTHERN BROADCASTING 5 08/13/2001 FM TRAVERSE CITY MI WLDR FM SYSTEM, INC. 6 08/14/2001 KIHS FM CSN INTERNATIONAL ADEL IA 19990104MI New BALH- 7 08/14/2001 WKVU FM EDUCATIONAL MEDIA FOUNDATION UTICA NY WVVC 20010404AAQ 8 08/14/2001 WYYL FM FLINN BROADCASTING CORPORATION GERMANTOWN TN WKSL 9 08/15/2001 KQBB FM CENTER BROADCASTING CO., INC. -

OHSAA Statewide Football Broadcast Listing the OHSAA Is Pleased to Compile a List of Radio Stations Around Ohio That Broadcast High School Football Games

OHIO HIGH SCHOOL ATHLETIC ASSOCIATION 4080 Roselea Place, Columbus, OH 43214 Phone 614‐267‐2502 | Fax 614‐267‐1677 www.OHSAA.org | Twitter.com/OHSAASports | Facebook.com/OHSAA OHSAA Statewide Football Broadcast Listing The OHSAA is pleased to compile a list of radio stations around Ohio that broadcast high school football games. Please contact Tim Stried at [email protected] to update information. In addition, stations have the opportunity to request a waiver of playoff broadcast rights fees in exchange for carrying selected state championship broadcasts of the OHSAA Radio Network. 2016 Football Plan A: Stations that carry three or more football state championship game broadcasts of the OHSAA Radio Network shall not pay any broadcast rights fees for football playoff games they broadcast. (Phone line charges or hook‐up fees may apply according to the site.) 2016 Football Plan B: Stations that carry one or two football state championship game broadcasts of the OHSAA Radio Network shall pay a reduced broadcast rights fee of $25 2016‐17 Events Football Playoffs Preview Show, Nov. 1 for football playoff games they broadcast. (Phone line charges or hook‐up fees may Football Championships, December 1‐3 apply according to the site.) Basketball Tournament Tip‐off Pregame Shows (6), February and March 2016‐17 Full Affiliate Status: Stations are also able to enter into affiliate status for the Girls Basketball State Tourn., March 16‐18 entire school year, which can waive regional and state tournament rights fees in all Boys Basketball State Tourn., March 23‐25 Baseball State Tournament, June 1‐3 sports. -

View Annual Report

BLOCK PROGRAMMING NEWS TALK STATIONS SALEM WEB NETWORK BOARD OF DIRECTORS TRANSFER AGENT AND REGISTRAR PROVIDES STABLE AND ACHIEVE 15% INCREASE MONTHLY PAGE VIEWS Stuart W. Epperson Information concerning the transfer or exchange of CONSISTENT GROWTH IN REVENUE DOUBLE TO 95 MILLION Chairman of the Board stock, lost certificates, change of address and other share transfer matters should be directed to Salem Edward G. Atsinger III Communications’ transfer agent at: President and Chief Executive Officer THE BANK OF NEW YORK David Davenport Shareholder Relations Department Distinguished Professor P.O. Box 11002 of Public Policy and Law Church Street Station ������� ������������� Pepperdine University New York, NY 10286 (800) 524-4458 Eric H. Halvorson Executive in Residence Email: [email protected] Pepperdine University http://www.stockbny.com �������������� Roland S. Hinz Publisher / Editor-in-Chief Hi-Torque Publishing SHAREHOLDER CONTACT AND FINANCIAL INFORMATION Judge Paul Pressler A copy of Salem Communications’ Annual Report on ��������� Partner Form 10-K, filed with the Securities and Exchange Woodfill & Pressler, LLP Commission, is available without charge upon written request to: Richard A. Riddle Consultant / Independent Businessman Investor Relations Salem Communications Corporation Dennis M. Weinberg 4880 Santa Rosa Road Retired WellPoint Camarillo, CA 93012 Executive Vice President (805) 987-0400 and Co-Founder ANNUAL MEETING RADIO | INTERNET | PRINT CORPORATE EXECUTIVE OFFICERS Salem Communications’ Annual Meeting of Stuart W. Epperson Shareholders will be held June 6, 2007 Salem Communications is a leading radio broadcaster, Chairman of the Board at 9:30 am at the: Internet content provider and magazine publisher Edward G. Atsinger III Westlake Village Inn serving the growing audience interested in President and Chief Executive Officer 31943 Agoura Road Westlake Village, CA 91361 Christian and family themed content Joe D. -

530 CIAO BRAMPTON on ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb

frequency callsign city format identification slogan latitude longitude last change in listing kHz d m s d m s (yy-mmm) 530 CIAO BRAMPTON ON ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb 540 CBKO COAL HARBOUR BC VARIETY CBC RADIO ONE N50 36 4 W127 34 23 09-May 540 CBXQ # UCLUELET BC VARIETY CBC RADIO ONE N48 56 44 W125 33 7 16-Oct 540 CBYW WELLS BC VARIETY CBC RADIO ONE N53 6 25 W121 32 46 09-May 540 CBT GRAND FALLS NL VARIETY CBC RADIO ONE N48 57 3 W055 37 34 00-Jul 540 CBMM # SENNETERRE QC VARIETY CBC RADIO ONE N48 22 42 W077 13 28 18-Feb 540 CBK REGINA SK VARIETY CBC RADIO ONE N51 40 48 W105 26 49 00-Jul 540 WASG DAPHNE AL BLK GSPL/RELIGION N30 44 44 W088 5 40 17-Sep 540 KRXA CARMEL VALLEY CA SPANISH RELIGION EL SEMBRADOR RADIO N36 39 36 W121 32 29 14-Aug 540 KVIP REDDING CA RELIGION SRN VERY INSPIRING N40 37 25 W122 16 49 09-Dec 540 WFLF PINE HILLS FL TALK FOX NEWSRADIO 93.1 N28 22 52 W081 47 31 18-Oct 540 WDAK COLUMBUS GA NEWS/TALK FOX NEWSRADIO 540 N32 25 58 W084 57 2 13-Dec 540 KWMT FORT DODGE IA C&W FOX TRUE COUNTRY N42 29 45 W094 12 27 13-Dec 540 KMLB MONROE LA NEWS/TALK/SPORTS ABC NEWSTALK 105.7&540 N32 32 36 W092 10 45 19-Jan 540 WGOP POCOMOKE CITY MD EZL/OLDIES N38 3 11 W075 34 11 18-Oct 540 WXYG SAUK RAPIDS MN CLASSIC ROCK THE GOAT N45 36 18 W094 8 21 17-May 540 KNMX LAS VEGAS NM SPANISH VARIETY NBC K NEW MEXICO N35 34 25 W105 10 17 13-Nov 540 WBWD ISLIP NY SOUTH ASIAN BOLLY 540 N40 45 4 W073 12 52 18-Dec 540 WRGC SYLVA NC VARIETY NBC THE RIVER N35 23 35 W083 11 38 18-Jun 540 WETC # WENDELL-ZEBULON NC RELIGION EWTN DEVINE MERCY R. -

Healthline Radio Show with Dr

HealthLine Radio Show with Dr. Bob Marshall, PhD Call in to have your own health questions answered on the air Radio Show Toll-Free #: 888-588-7576 LIVE Weekday Shows More Weekday Shows California, Riverside (and vicinity) KCAA 1050 AM 2:30 to 3 p.m.(PST) Hawaii, Honolulu (and vicinity) KWAI 1080 AM 1 to 1:30 p.m. (HT) California, San Francisco/Oakdale (and vicinity) KCBC 770 AM 2:30 to 3 p.m.(PST) Illinois, Chicago (and vicinity) (M - Th) WYLL 1160 AM 2:30 to 3 p.m. (CST) Colorado, Denver (and vicinity) KLTT 670 AM 3:30 to 4 p.m.(MST) Indiana, Indianapolis (and vicinity) WBRI 1500AM/96.7FM 1:30 to 2 p.m. (EST) Michigan, Detroit (and vicinity) WRDT 560 AM 5:30 to 6 p.m.(EST) Iowa, Council Bluffs (and vicinity) KLNG 1560 AM 8:30 to 9 a.m. (CST) Minnesota, Minneapolis (and vicinity) KDIZ 1570 AM 4:30 to 5 p.m.(CST) Massachusetts, Boston (and vicinity) WEZE 590 AM 3:30 to 4 p.m. (EST) New York, Albany (and vicinity) WDCD 1540AM/96.7FM 5:30 to 6 p.m.(EST) Missouri, St. Louis (East & S. Illinois) KXEN 1010 AM 3 to 3:30 p.m. (CST) Oregon, Portland (and vicinity) KKPZ 1330 AM 2:30 to 3 p.m.(PST) New Jersey, Teaneck (and vicinity) (M & Tu) WVNJ 1160 AM 6 to 6:30 p.m. (EST) Tennessee, Nashville (and vicinity) WNQM 1300 AM 4:30 to 5 p.m.(CST) New York, Albany (and vicinity) WDCD 1540AM/96.7FM 12:30 to 1 p.m. -

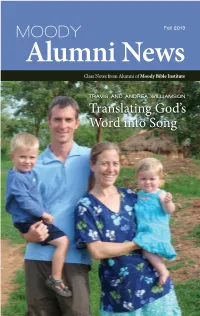

Alumni News Class Notes from Alumni of Moody Bible Institute

MOODY Fall 2013 Alumni News Class Notes from Alumni of Moody Bible Institute TRAVIS AND ANDREA WILLIAMSON Translating God’s Word into Song From the Executive Director Contents Dear friends, With a new academic school year in full swing, it’s always exciting to see the enthusiasm and passion of students, faculty, and staff at Moody. As each of you know, Moody is an amazing place to prepare for ministry. Now in our 128th year, Moody is still equipping students to impact the world for Christ. 10 12 In this issue, we feature Travis and Andrea Williamson, a Now in our couple who met at Moody and discovered their life’s calling to serve as Bible translators in Ethiopia. You’ll also read about 128th year, three of Moody Bible Institute’s music ensembles who recently Moody is still traveled to three continents to share Christ through music. And in response to our invitation to share a Moody legacy story, equipping alumnus Joia (Smith) Lucht gave a fascinating account of how students to God answered a relative’s prayer and led several generations of 16 18 her family to train at Moody for global ministry. impact the In addition to students and alumni, Moody’s media ministries world for are also involved in global outreach. In June, a team from In This Issue Christ. Moody Radio held a Global Partners Training conference in Ghana, West Africa, training African broadcasters in media ministry. The conference was very well received and fits Singing God’s Praises Around the World Moody’s strategic direction to equip people with the truth International Snapshots from Moody’s Music Ensembles of God’s Word across the globe, cultures, and generations. -

Healthline Radio Show with Dr

HealthLine Radio Show with Dr. Bob Marshall, PhD Weekday Showtimes California, Riverside (and vicinity) KCAA 1050 AM 2:30 to 3 p.m.(PST) New Jersey, Teaneck (and vicinity) (M & Tu) WVNJ 1160 AM 6 to 6:30 p.m.(EST) California, San Francisco/Oakdale (and vicinity) KCBC 770 AM 2:30 to 3 p.m.(PST) New York, Albany (and vicinity) WDCD 1540AM/96.7FM 12:30 to 1 p.m.(EST) Colorado, Denver (and vicinity) KLTT 670 AM 3:30 to 4 p.m.(MST) New York, Albany (and vicinity) WDCD 1540AM/96.7FM 5:30 to 6 p.m.(EST) Hawaii, Honolulu (and vicinity) KWAI 1080 AM 1 to 1:30 p.m.(HT) Ohio, Cleveland (and vicinity) WHKW 1220 AM 4 to 4:30 p.m.(EST) Illinois, Chicago (and vicinity) (M - Th) WYLL 1160 AM 2:30 to 3 p.m.(CST) Ohio, Cleveland (and vicinity) WINT 1330AM/101.5FM 6:30 to 7 p.m.(EST) Indiana, Indianapolis (and vicinity) WBRI 1500AM/96.7FM 1:30 to 2 p.m.(EST) Oregon, Portland (and vicinity) KKPZ 1330 AM 2:30 to 3 p.m.(PST) Iowa, Council Bluffs (and vicinity) KLNG 1560 AM 8:30 to 9 a.m.(CST) Tennessee, Nashville (and vicinity) WNQM 1300 AM 4:30 to 5 p.m.(CST) Massachusetts, Boston (and vicinity) WEZE 590 AM 3:30 to 4 p.m.(EST) Virginia, Norfolk (and vicinity) WKQA 1110 AM 6 to 6:30 p.m.(EST) Michigan, Detroit (and vicinity) WRDT 560 AM 5:30 to 6 p.m.(EST) Minnesota, Minneapolis (and vicinity) KDIZ 1570 AM 4:30 to 5 p.m.(CST) Missouri, St.