United States Securities and Exchange Commission Washington, D.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AMGEN INC. V. SANOFI

Case: 20-1074 Document: 159 Page: 1 Filed: 06/21/2021 NOTE: This order is nonprecedential. United States Court of Appeals for the Federal Circuit ______________________ AMGEN INC., AMGEN MANUFACTURING, LIMITED, AMGEN USA, INC., Plaintiffs-Appellants v. SANOFI, AVENTISUB LLC, FKA AVENTIS PHARMACEUTICALS INC., REGENERON PHARMACEUTICALS INC., SANOFI-AVENTIS U.S. LLC, Defendants-Appellees ______________________ 2020-1074 ______________________ Appeal from the United States District Court for the District of Delaware in Nos. 1:14-cv-01317-RGA, 1:14-cv- 01349-RGA, 1:14-cv-01393-RGA, 1:14-cv-01414-RGA, Judge Richard G. Andrews. ______________________ JEFFREY A. LAMKEN, MoloLamken LLP, Washington, DC, filed a petition for rehearing en banc for plaintiffs-ap- pellants. Also represented by SARAH JUSTINE NEWMAN, MICHAEL GREGORY PATTILLO, JR.; SARA MARGOLIS, New York, NY; EMILY JOHNSON, ERICA S. OLSON, STEVEN TANG, STUART WATT, WENDY A. WHITEFORD, Amgen Inc., Thou- sand Oaks, CA; KEITH HUMMEL, Cravath Swaine & Moore LLP, New York, NY; WILLIAM G. GAEDE, III, McDermott Case: 20-1074 Document: 159 Page: 2 Filed: 06/21/2021 2 AMGEN INC. v. SANOFI Will & Emery LLP, Menlo Park, CA; CHRISTOPHER B. MEAD, Schertler Onorato Mead & Sears LLP, Washington, DC; JAMES L. HIGGINS, MELANIE K. SHARP, Young, Cona- way, Stargatt & Taylor, LLP, Wilmington, DE. Plaintiff- appellant Amgen Inc. also represented by SARAH CHAPIN COLUMBIA, McDermott, Will & Emery LLP, Boston, MA; LAUREN MARTIN, Quinn Emanuel Urquhart & Sullivan LLP, Boston, MA. MATTHEW WOLF, Arnold & Porter Kaye Scholer LLP, Washington, DC, filed a response for defendants-appellees. Also represented by VICTORIA REINES; DAVID K. BARR, DANIEL REISNER, New York, NY; DEBORAH E. -

Mark One) (X) QUARTERLY REPORT PURSUANT to SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT of 1934

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-Q (Mark One) (X) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 1997 ------------------ OR ( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _________ to _________ Commission File Number 0-19034 ------- REGENERON PHARMACEUTICALS, INC. ------------------------------------------------------ (Exact name of registrant as specified in its charter) New York 13-3444607 ------------------------------- ------------------------------------ (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 777 Old Saw Mill River Road Tarrytown, New York 10591-6707 ---------------------------------------- ---------- (Address of principal executive offices) (Zip code) (914) 347-7000 ---------------------------------------------------- (Registrant's telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ----- ----- Indicate the number of shares outstanding of each of the issuer's classes of common stock as of November 3, 1997: Class of Common Stock -

Sixth Circuit I.O.P

RECOMMENDED FOR FULL-TEXT PUBLICATION Pursuant to Sixth Circuit I.O.P. 32.1(b) File Name: 15a0199p.06 UNITED STATES COURT OF APPEALS FOR THE SIXTH CIRCUIT _________________ DINO RIKOS et al., ┐ Plaintiffs-Appellees, │ │ │ No. 14-4088 v. │ > │ THE PROCTER & GAMBLE COMPANY, │ Defendant-Appellant. │ ┘ Appeal from the United States District Court for the Southern District of Ohio at Cincinnati. No. 1:11-cv-00226—Timothy S. Black, District Judge. Argued: June 16, 2015 Decided and Filed: August 20, 2015 Before: MOORE and COOK, Circuit Judges; COHN, District Judge.* _________________ COUNSEL ARGUED: Brian J. Murray, JONES DAY, Chicago, Illinois, for Appellant. Timothy G. Blood, BLOOD HURST & O’REARDON, San Diego, California, for Appellees. ON BRIEF: Brian J. Murray, JONES DAY, Chicago, Illinois, D. Jeffrey Ireland, FARUKI IRELAND & COX P.L.L., Cincinnati, Ohio, Joanne Lichtman, BAKER & HOSTETLER LLP, Cleveland, Ohio, Chad A. Readler, Rachel Bloomekatz, JONES DAY, Columbus, Ohio, for Appellant. Timothy G. Blood, Leslie E. Hurst, Thomas J. O’Reardon II, BLOOD HURST & O’REARDON, San Diego, California, for Appellees. MOORE, J., delivered the opinion of the court in which COHN, D.J., joined. COHN, D.J. (pg. 37), delivered a separate concurring opinion. COOK, J. (pp. 38–40), delivered a separate dissenting opinion. *The Honorable Avern Cohn, United States District Judge for the Eastern District of Michigan, sitting by designation. 1 No. 14-4088 Rikos et al. v. The Procter & Gamble Co. Page 2 _________________ OPINION _________________ KAREN NELSON MOORE, Circuit Judge. The named plaintiffs-appellees (“Plaintiffs”) are three individuals who purchased Align, Procter & Gamble’s (“P&G”) probiotic nutritional supplement, and found that the product did not work as advertised—that is, it did not promote their digestive health. -

In the United States District Court for the District of Delaware

Case 1:20-cv-00561-UNA Document 1 Filed 04/24/20 Page 1 of 27 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE AMGEN INC. and AMGEN MANUFACTURING, LIMITED, C.A. No. ________ Plaintiffs, v. HOSPIRA, INC. and PFIZER INC., DEMAND FOR JURY TRIAL Defendants. COMPLAINT Plaintiffs Amgen Inc. and Amgen Manufacturing, Limited (collectively, “Plaintiffs”), by and through their undersigned attorneys, for their Complaint against Defendants Hospira, Inc. and Pfizer Inc. (collectively, “Defendants”) hereby allege as follows: THE PARTIES 1. Amgen Inc. is a corporation existing under the laws of the State of Delaware, with its principal place of business at One Amgen Center Drive, Thousand Oaks, California, 91320. Amgen Inc. discovers, develops, manufactures, and sells innovative therapeutic products based on advances in molecular biology, recombinant DNA technology, and chemistry. Founded in 1980, Amgen Inc. is a pioneer in the development of biological human therapeutics. Today, Amgen Inc. is one of the largest biotechnology companies in the world, fueled in part by the success of NEUPOGEN® (filgrastim). 2. Amgen Manufacturing, Limited (“AML”) is a corporation existing under the laws of Bermuda with its principal place of business in Juncos, Puerto Rico. AML manufactures and sells biologic medicines for treating particular diseases in humans. AML is a wholly-owned subsidiary of Amgen Inc. Case 1:20-cv-00561-UNA Document 1 Filed 04/24/20 Page 2 of 27 PageID #: 2 3. On information and belief, Hospira, Inc. (“Hospira”) is a corporation existing under the laws of the State of Delaware, with its principal place of business at 275 North Field Drive, Lake Forest, Illinois 60045. -

Surprises in the Industry's Most Profitable Companies

June 20, 2008 Surprises in the industry's most profitable companies Evaluate Vantage An analysis of the industry’s most profitable companies last year throws up some surprising names within the top ten – ViroPharma tops the league table with a net income margin of 47%, generating all its profits from sales of anti-bacterial agent Vancocin. Interestingly, two Indian generic firms feature, Sun Pharmaceutical Industries and Glenmark Pharmaceuticals, perhaps dispelling the notion that margins from selling generics are always low. Of the big pharma players, only those US groups with mature product portfolios, namely Pfizer, Merck & Co and Amgen, make it into the list. However, looking at forecast margins for the current year, the table below also reveals that Merck & Co drops out of the top ten, impacted by significantly lower sales from its cholesterol franchise. Alcon replaces Merck, suggesting one good reason why Novartis recently decided to fork out $11bn to acquire a 25% stake in the eye-care company. This analysis from EvaluatePharma is based on dividing normalised net income (excluding exceptional items) by the total revenues, to generate a net margin percentage. It only includes companies that have reported two consecutive years of profit, with incomes in excess of $50m in both 2007 and 2008. 2007 - top 10 companies Net Margin Net Income - Normalised ($m) Total Revenues ($m) 2007 2006 2007 2007 ViroPharma 47% 66 95 204 Sun Pharmaceutical Industries 44% 159 371 837 Gilead Sciences 38% 1,204 1,615 4,230 Biovail 35% 428 293 843 OSI Pharmaceuticals -

13-ICML Abbvie Acerta Pharma Amgen (Europe) Gmbh Bayer

13th INTERNATIONAL CONFERENCE ON MALIGNANT LYMPHOMA Lugano, Switzerland, June 17-20, 2015 13-ICML THE CONFERENCE ORGANIZERS WISH TO THANK THE FOLLOWING SPONSORS FOR THEIR UNRESTRICTED FINANCIAL SUPPORT: Abbvie Acerta Pharma Amgen (Europe) GmbH Bayer HealthCare Pharmaceuticals, Inc. Bristol-Myers Squibb Celgene Corporation CTI Life Sciences Ltd. F. Hoffmann-La Roche Ltd . www.roche.com Gilead Sciences, Inc. Gilead Sciences Europe Ltd. Infinity Pharmaceuticals, Inc. Institut Biochimique SA – IBSA Janssen Pharmaceutical Companies of Johnson & Johnson Medicom Worldwide, Inc. Mentrik Biotech, LLC Mundipharma Oncology www.mundipharma.ch Novartis Oncology Pfizer Oncology Seattle Genetics, Inc. Servier sigma-tau Research Switzerland SA Spectrum Pharmaceuticals, Inc. Takeda Oncology Vifor SA THE CONFERENCE ORGANIZERS WISH TO THANK THE FOLLOWING CONTRIBUTORS FOR THEIR SUPPORT : American Association for Cancer Research – AACR Arcobaleno - Comunità Tariffale Ticino e Moesano CALYM, the Carnot Lymphoma Institute City of Lugano www.lugano.ch/ European School of Oncology – ESO www.eso.net European Society for Medical www.esmo.org Oncology – ESMO European Society for Radiotherapy and Oncology – ESTRO Hotel Splendide Royal www.splendide.ch International Extranodal Lymphoma Study Group - IELSG International Lymphoma Radiation Oncology Group - ILROG Kompetenznetz Maligne Lymphome e.V. – KML www.LHRM.de Leukämiehilfe Rhein-Main g.e.V. - LHRM Lugano MICE Convention Bureau www.luganomice.ch Lugano University Campus http://www.lymphomahub.co Lymphoma HUB m/search/ICML%25202015 Omega SA Repubblica e Cantone Ticino/Fondo Swisslos San Salvatore Foundation Schweizerische Patientenorganisation für Lymphombetroffene und Angehörige - ho / noho Swiss Cancer League Swiss Cancer Research Foundation Swiss International Air Lines The Leukemia Lymphoma Society Ticino Tourism www.ticino.ch . -

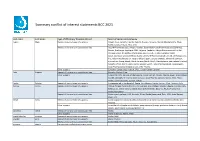

Summary Conflict of Interest Statements BCC 2021

Summary conflict of interest statements BCC 2021 Last name First name Type of affiliation/ financial interest Name of commercial company Aapro Matti Receipt of grants/research supports: Amgen, Eisai, Genomic Health, Helsinn, Hospira, Novartis, Merck, Mundipharma, Pfizer, Rache, Sandoz, Tesaro, Teva, Vifor Receipt of honoraria or consultation fees: Accord Pharmaceuticals, Amgen, Astellas, Bayer HealthCare Pharmaceuticals (Schering), Biocon, Boehringer Ingelheim, BMS, Celgene, Cephalon, Chugai Pharmaceutical Co. Ltd., Clinigen Group, Dr.Reddy's Laboratories, Eisai Co. Ltd., Eli Lilly, Genomic Health (Exact Sciences), GlaxoSmithKline (GSK), Glenmark Pharmaceuticals Limited, Gl Therapeutics, lnc., Helsinn Healthcare SA, Hospira (Pfizer), lpsen, Janssen Biotech, Johnson & Johnson, Kyowa Kirin Group, Merck, Merck Serono (Merck KGaA), Mundipharma International Limited, Novartis, Pfizer, Pierre Fabre, Rache, Sandoz, Sanofi, Taiho Pharmaceutical, Tesaro (GSK), Teva Pharmaceutical lndustries Ltd., Vifor Pharma Other support: European Cancer Organisation, SPCC, Cancer Center Genolier Aebi Stephan Receipt of honoraria or consultation fees: Novartis, Roche, Pfizer Other support: Support for CME lectures of the Lucerne Cancer Center: Amgen, Astellas, Bayer, Bristol-Myers Squibb, Debiopharm International SA, Eisai, Ipsen Pharma, Janssen, Merck, MSD, Pfizer, Roche, Sanofi Genzyme, Servier, Takeda André Fabrice Receipt of grants/research supports: Comepensated to the hospital: Roche, AstraZeneca, Daiichi Sankyo, Pfizer, Novartis, Lilly Barrios Carlos -

David Meline Joins Moderna As Chief Financial Officer

David Meline Joins Moderna as Chief Financial Officer June 4, 2020 CAMBRIDGE, Mass.--(BUSINESS WIRE)--Jun. 4, 2020-- Moderna, Inc., (Nasdaq: MRNA) a clinical stage biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines to create a new generation of transformative medicines for patients, today announced that David Meline has joined Moderna as Chief Financial Officer, effective Monday, June 8, 2020. He will serve on Moderna’s Executive Committee and report to Chief Executive Officer Stéphane Bancel. “I am pleased to welcome David to Moderna as our Chief Financial Officer and to the Executive Committee. As we prepare for the Phase 3 studies of our SARS-CoV-2 vaccine and our CMV vaccine, we are entering another critical phase for the Company. We have started to build commercial capabilities and started to set up commercial subsidiaries in several countries,” said Stéphane Bancel, Chief Executive Officer of Moderna. “David’s global biopharmaceutical industry and commercial experience along with his track record as CFO of Amgen for the last 6 years and before that, as CFO of 3M, make him a great addition to our team. I look forward to partnering with David to grow Moderna to a global enterprise focused on development and delivery of novel therapeutics and vaccines.” Mr. Meline joins Moderna from Amgen (Nasdaq: AMGN), where he served as Chief Financial Officer and EVP from 2014 through 2019. At Amgen, he was responsible for all finance, information systems and global business services activities across 100 countries. In this role, Mr. Meline led enterprise-wide transformation while increasing growth and productivity and reducing development cycle time. -

About Amgen Fact Sheet Updates, Per Year

ABOUT AMGEN AMGEN MISSION To serve patients Amgen is committed to unlocking the potential of biology for patients suffering from serious illnesses by discovering, developing, manufacturing and delivering AMGEN QUICK FACTS innovative human therapeutics. This approach begins by using tools like Headquarters Thousand Oaks, California advanced human genetics to unravel the complexities of disease and understand the fundamentals of human biology. Staff Approximately 22,000 worldwide Our belief—and the core of our strategy—is that innovative, highly Stock Listing differentiated medicines that provide large clinical benefits in addressing NASDAQ: AMGN serious diseases are medicines that will not only help patients, but also will help Chairman and CEO reduce the social and economic burden of disease in society today. Robert A. Bradway Amgen focuses on areas of high unmet medical need and leverages its 2019 Financial Highlights expertise to strive for solutions that improve health outcomes and dramatically Total revenue: $23.4 billion improve people’s lives. A biotechnology innovator since 1980, Amgen has Product sales: $22.2 billion grown to be one of the world’s leading independent biotechnology companies, R&D expense: $4.0 billion has reached millions of patients around the world and is developing a pipeline Address/Phone of medicines with breakaway potential. One Amgen Center Drive Thousand Oaks, CA 91320-1799 INNOVATIVE MEDICINES Main: (805) 447-1000 We have a presence in approximately 100 countries and regions worldwide and our innovative Investors: (805) 447-1060 medicines have reached millions of people in the fight against serious illnesses. We focus on six PRODUCTS therapeutic areas: cardiovascular disease, oncology, bone health, neuroscience, nephrology Aimovig® (erenumab-aooe) and inflammation. -

Drug Pricing Investigation Abbvie—Humira and Imbruvica

Drug Pricing Investigation AbbVie—Humira and Imbruvica Staff Report Committee on Oversight and Reform U.S. House of Representatives May 2021 oversight.house.gov EXECUTIVE SUMMARY This staff report describes the actions of AbbVie Inc. in repeatedly raising the prices of two of its blockbuster drugs: Humira (adalimumab) and Imbruvica (ibrutinib). These price hikes contributed to billions of dollars in corporate profits and enriched company executives while harming American patients and taxpayers. AbbVie pursued a variety of tactics to increase drug sales while raising prices for Americans, including exploiting the patent system to extend its market monopoly, abusing orphan drug protections to further block competition, and engaging in anticompetitive pricing practices. Humira, a drug used to treat rheumatoid arthritis and other autoimmune diseases, is the highest grossing drug in the world. In 2020 alone, AbbVie collected $16 billion in U.S. net revenue for Humira. Today, AbbVie charges approximately $77,000 for a year’s supply of Humira—470% more than when the drug was launched in 2003. AbbVie and its partner Janssen Biotech, Inc., a Johnson & Johnson subsidiary, are the sole U.S. manufacturers of Imbruvica, a drug approved to treat mantle cell lymphoma and certain other forms of cancer. Under the companies’ collaboration agreement, AbbVie is responsible for marketing Imbruvica in the United States, including pricing decisions. Today, AbbVie and Janssen charge over $181,529 for a year’s supply of Imbruvica—82% more than when the drug was launched in 2013. Experts estimate that by 2026, Imbruvica will be the fourth highest grossing drug in the United States, in part because of price increases. -

Biosimilars: 2019 a Year in Review

January 16, 2020 Webinar Series: Biosimilars Biosimilars: 2019 A Year in Review John Adkisson Tasha Francis Jenny Shmuel Principal Associate Principal Twin Cities Twin Cities Boston TODAY’S AGENDA • U.S. Market for Biosimilars • FDA Biosimilar Guidance • Biosimilar Legislation • Biosimilar Litigation • Antitrust Developments • Post Grant Activity • Looking Forward to 2020 fr.com | 2 FDA Approved 26 Biosimilars by End of 2019 Biosimilar Biologic Reference Product FDA Approval Date Biosimilar Code 1 Zarxio (Sandoz) Neupogen (Amgen) March 2015 Filgrastim-sndz 2 Inflectra (Pfizer/Celltrion) Remicade (J&J) April 2016 Infliximab-dyyb 3 Erelzi (Sandoz) Enbrel (Amgen) August 2016 Etanercept-szzs 4 Amjevita (Amgen) Humira (AbbVie) September 2016 Adalimumab-atto 5 Renflexis (Samsung Bioepis/Merck) Remicade (J&J) April 2017 Infliximab-abda 6 Cyltezo / BI-695501 (BI) Humira (AbbVie) August 2017 Adalimumab-adbm 7 Mvasi (Amgen) Avastin (Roche) September 2017 Bevacizumab-awwb 8 Ogivri (Mylan) Herceptin (Genentech/Roche) December 2017 Trastuzumab-dkst 9 Ixifi (Pfizer) Remicade (J&J) December 2017 Infliximab-qbtx 10 Retacrit (Pfizer/Hospira) Epogen/Procrit (Amgen/J&J) May 2018 Epoetin alfa-epbx 11 Fulphila (Mylan/Biocon) Neulasta (Amgen) June 2018 Pegfilgrastim-jmdb 12 Nivestym (Pfizer) Neupogen (Amgen) July 2018 Filgrastim-aafi 13 Hyrimoz (Sandoz) Humira (AbbVie) November 2018 Adalimumab-adaz 14 Udencya / CHS-1701 (Coherus) Neulasta (Amgen) November 2018 Pegfilgrastim-cbqv 15 Truxima (Celltrion/Teva) Rituxan (Roche/Genentech) November 2018 Rituximab-abbs -

Appendix A: Overview of Selected Collaborations 1

Appendix A: Overview of Selected Collaborations 1 Appendix A: Overview of Selected Collaborations The following appendix provides an overview of selected biopharmaceutical collaborations to advance efforts focused in the following areas: Research & Development, Public Health & Improving Patient Outcomes, Manufacturing & Distribution, Improving Access. Partnerships were grouped together based on a singular, or in some cases, overlapping focus area. The selected examples below, provide a brief overview of the collaboration’s purpose, partners, approach used to generate results and any successes yielding from the group’s efforts. R&D 3 Antimicrobial Resistance (AMR) Action Fund ____________________________________________________________________ 3 Alzheimer's Disease Neuroimaging Initiative (ADNI) _______________________________________________________________ 3 AstraZeneca’s Open Innovation _______________________________________________________________________________ 4 Lung Cancer Master Protocol (Lung-MAP) ______________________________________________________________________ 7 Multiple Sclerosis Partnership ________________________________________________________________________________ 7 Northeast ALS Consortium __________________________________________________________________________________ 8 One Brave Idea ___________________________________________________________________________________________ 8 Parkinson’s Disease Education Consortium (PDEC) _______________________________________________________________ 9 Rare Disease Cures