Chapterанаii Budget and Financial Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AC with District Dist

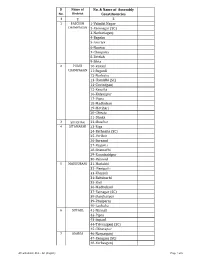

Sl Name of No. & Name of Assembly No. District Constituencies 1 2 3 1 PASCHIM 1-Valmiki Nagar CHAMPARAN 2-Ramnagar (SC) 3-Narkatiaganj 4-Bagaha 5-Lauriya 6-Nautan 7-Chanpatia 8-Bettiah 9-Sikta 2 PURVI 10-Raxaul CHAMPARAN 11-Sugauli 12-Narkatia 13-Harsidhi (SC) 14-Govindganj 15-Kesaria 16-Kalyanpur 17-Pipra 18-Madhuban 19-Motihari 20-Chiraia 21-Dhaka 3 SHEOHAR 22-Sheohar 4 SITAMARHI 23-Riga 24-Bathnaha (SC) 25-Parihar 26-Sursand 27-Bajpatti 28-Sitamarhi 29-Runnisaidpur 30-Belsand 5 MADHUBANI 31-Harlakhi 32- Benipatti 33-Khajauli 34-Babubarhi 35-Bisfi 36-Madhubani 37-Rajnagar (SC) 38-Jhanjharpur 39-Phulparas 40-Laukaha 6 SUPAUL 41-Nirmali 42-Pipra 43-Supaul 44-Triveniganj (SC) 45-Chhatapur 7 ARARIA 46-Narpatganj 47-Raniganj (SC) 48-Forbesganj AC with district Dist. - AC (English) Page 1 of 6 Sl Name of No. & Name of Assembly No. District Constituencies 1 2 3 49-Araria 50-Jokihat 51-Sikti 8 KISHANGANJ 52-Bahadurganj 53-Thakurganj 54-Kishanganj 55-Kochadhaman 9 PURNIA 56-Amour 57-Baisi 58-Kasba 59-Banmankhi (SC) 60-Rupauli 61-Dhamdaha 62-Purnia 10 KATIHAR 63-Katihar 64-Kadwa 65-Balrampur 66-Pranpur 67-Manihari (ST) 68-Barari 69-Korha (SC) 11 MADHEPURA 70-Alamnagar 71-Bihariganj 72-Singheshwar (SC) 73-Madhepura 12 SAHARSA 74-Sonbarsha (SC) 75-Saharsa 76-Simri Bakhtiarpur 77-Mahishi 13 DARBHANGA 78-Kusheshwar Asthan (SC) 79-Gaura Bauram 80-Benipur 81-Alinagar 82-Darbhanga Rural 83-Darbhanga 84-Hayaghat 85-Bahadurpur 86-Keoti 87-Jale 14 MUZAFFARPUR 88-Gaighat 89-Aurai 90-Minapur 91-Bochaha (SC) 92-Sakra (SC) 93-Kurhani 94-Muzaffarpur 95-Kanti 96-Baruraj AC with district Dist. -

Rural Management in Action- Caselets Volume 6 Ii MGNCRE

Rural Management in Action in - Caselets Caselets Volume Rural Management in Action Caselets Volume 6 6 Government of India MoE Ministry of Education Editorial Board Dr W G Prasanna Kumar Dr K N Rekha First Edition: 2020 ISBN: Price: ₹ 50/- All Rights Reserved No part of this book may be reproduced in any form or by any means without the prior permission of the publisher. Disclaimer The editor or publishers do not assume responsibility for the statements/opinions expressed by the authors in this book. © Mahatma Gandhi National Council of Rural Education (MGNCRE) Department of Higher Education Ministry of Education, Government of India 5-10-174, Shakkar Bhavan, Ground Floor, Fateh Maidan Road, Hyderabad - 500 004 Telangana State. Tel: 040-23422112, 23212120, Fax: 040-23212114 E-mail : [email protected] Website : www.mgncre.org Published by: Mahatma Gandhi National Council of Rural Education (MGNCRE), Hyderabad About the Book This book is a compilation of few issues and rural concerns of one of the most backward states of India i.e. Bihar. Bihar had a glorious past, a golden era in the history of ancient India. Its glorious history can boast of being the founding place of two major religions of world, Jain Dharma and Boudh Dharma. It has also a place in Sikhism as 10th and last guru of Sikh religion Guru Gobind Singh Ji was from Patliputra (Patna). Soon after independence in the ranking of various states of India, Bihar figured in top states in revenues and per capita income. Bihar state started lagging behind among states and a major reason was the Central Government’s biased rule of Rail Freight equalisation which came in to force in the year 1952. -

Block: Piro Class-6-8 Subject: Social Science Dist:-Bhojpur Provisional Merit List Block Teacher Niyojan-2019-20

BLOCK TEACHER NIYOJAN-2019-20 BLOCK: PIRO CLASS-6-8 SUBJECT: SOCIAL SCIENCE DIST:-BHOJPUR PROVISIONAL MERIT LIST 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 MATRIC INTER GRADUATION TRAINING FREE BTET/CT WEIG SUM OF AVG OF TAGE APPL.S. NAME OF SE D. FUL MARK ET TOTAL S.N. FATHER DOB ADDRESS CAT DIS. MARKS MARKS FULL MARKS FULL FULL PERCENT PERCEN OF REMARKS N. APPLICANT X FIGH L S MARKS MERIT OBTAI %GE OBTAIN MARK %GE OBTAINE MARK %GE MARK %GE AGE TAGE BTET/ T. MAR OBTAI % NED ED S D S S CTET KS NED MOHD ARANGI-01 NAZIA 1 1776 MONIR 18/4/1995 F USIA UR N N 457 500 91.4 434 600 72.3333 3330 4500 74 1675 2000 83.75 321.4833 80.37 62.66 2 82.371 MONIR ANSARI GHAZIPUR DAYASHAN PRAGYA KAILASHPUR 2 P/197 KAR 22/12/1996 F EWS N N 409 500 81.8 432 500 86.4 740 1000 74 762 1000 76.2 318.4 79.60 68 2 81.6 PANDEY I BUXAR PANDEY NEERAJ BHRIGUNA BIHIYA 3 976 KUMAR 02.01.1993 M UR N N 403 500 80.6 413 500 82.6 964 1500 64.2667 1064 1300 81.8462 309.3128 77.33 72.41 4 81.328 TH MISHRA BHOJPUR MISHRA SHREE DEVRADH, SUNITA 4 1785 DHAR 03.01.1986 F TIYAR, EWS N N 537 700 76.7143 683 900 75.8889 1179 1500 78.6 1054 1300 81.0769 312.2801 78.07 55.33 2 80.07 KUMARI DUBEY BHOJPUR VIPUL NAWAL GAUSGANJA 5 1770 KUMAR KISHOR 01.04.1979 M UR N N 711 900 79 693 900 77 1177 1500 78.4667 1834 2400 76.4167 310.8833 77.72 62.66 2 79.721 RA SINGH SINGH DHAMANIA, HIMANSHU RAMESHW 6 424 26/01/1996 M GARAHANI, EBC N N 419 500 83.8 350 500 70 722 1000 72.2 998 1300 76.7692 302.7692 75.69 70.67 4 79.692 SHEKHAR AR PRASAD BHOJPUR ROHAI, ASHWANI -

Dist. Rohtas, Bihar Usari Gidha

83°15'0"E 83°30'0"E 83°45'0"E 84°0'0"E 84°15'0"E 84°30'0"E MEDANI PUR SAISER JAMSONA SEMARI ITWAN BISIKALA BHARA SARA Koath (NP) © D A W A TT H BHUI SAHI NAUN BABHNAUL GIDHA DIST. ROHTAS, BIHAR USARI GIDHA DERGAUN GARA BHANPUR LILWACH GUNSEJ DAWATH GOSAL DIH SIOBAHAR AGRER KALA NARWAR 30 S U R Y A P U R A JAM RODH 0 S U R Y A P U R A KARANJ .H KUCHHILA N SURAJ PURA MOHINI N HARIBANS PUR SURAJ PURA N " " 0 BALIHAR 0 ' KUSUMHRA MORAUNA ' 5 CHITAWN 5 NAUWAN AKODHA D II N A R A 1 SARAYA 30 1 ° N.H 0 JAMORI ° 5 DINARA TENUAJ 5 2 KOCHAS CHITAWN 2 MAHARODH NONHAR SHIWPUR KHAIRA BHUDHAR MORAUNA CHITTAINI K O C H A S RAJPUR B IIK R A M G A N JJ Bikramganj (NP) LAHERI KANJAR MUNJI SAMHUTI GHUSIYA-KALAN I2 MANPUR BIKRAMGANJ BALATHARI CHANDI ENGLISH KATHRAI CHILHAR;UWA BALIA GHUSIYAI2 KHURD INDEX MAP REDIA SARAWAN JONHI KARAKAT PACHIM CHAMPAR* KAPASIYA GHUSIYAKALA CHIKSIL SAKLA KARMAINI AGARSI DIHRA ± AKODHI MOTHA SONBARSA ARANG KHAIRA SAHMAL MANI JAI SHREE DANWAR MANJHAULI GHUSIYAKALA KIRHI SHIWAN KARAHANSI MANJHAULI AMONA PURBI CHAMPARAN BAKSARA GARURA SITAMARHI BARAHRI KARUP SEMARI K A R A K A TT SHEOHAR DHARAMPURA I2 GOPALGANJ BENSAGAR MADHUBANI DHANHARA S A N JJH A U LL IISANJHAULI KAITHI AMARTHA KISHANGANJ AMAITHI SUPAUL KARGAHAR SOTWA GAMHARIYA ARARIA ARARUWA SENDUWAR UDAI PUR GORARI SIWAN MUZAFFARPUR BHOKHARI NONSARI BURHAWAL DARBHANGA RUPAITHA DEO SAMARDIHA KHIRIYANW K A R G A H A R Nokha (NP) BARNA SARAN SHIYAWAK SAMASTIPUR BARADIH SAHARSAMADHEPURA PURNIA GHUSIA CHATTONA VAISHALI I2 ) BASDIHA NOKHA PARARIYA PARASIYA THORSON MANGRAWAN HATHINI -

Annexure-V State/Circle Wise List of Post Offices Modernised/Upgraded

State/Circle wise list of Post Offices modernised/upgraded for Automatic Teller Machine (ATM) Annexure-V Sl No. State/UT Circle Office Regional Office Divisional Office Name of Operational Post Office ATMs Pin 1 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA PRAKASAM Addanki SO 523201 2 Andhra Pradesh ANDHRA PRADESH KURNOOL KURNOOL Adoni H.O 518301 3 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM AMALAPURAM Amalapuram H.O 533201 4 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Anantapur H.O 515001 5 Andhra Pradesh ANDHRA PRADESH Vijayawada Machilipatnam Avanigadda H.O 521121 6 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA TENALI Bapatla H.O 522101 7 Andhra Pradesh ANDHRA PRADESH Vijayawada Bhimavaram Bhimavaram H.O 534201 8 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA VIJAYAWADA Buckinghampet H.O 520002 9 Andhra Pradesh ANDHRA PRADESH KURNOOL TIRUPATI Chandragiri H.O 517101 10 Andhra Pradesh ANDHRA PRADESH Vijayawada Prakasam Chirala H.O 523155 11 Andhra Pradesh ANDHRA PRADESH KURNOOL CHITTOOR Chittoor H.O 517001 12 Andhra Pradesh ANDHRA PRADESH KURNOOL CUDDAPAH Cuddapah H.O 516001 13 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM VISAKHAPATNAM Dabagardens S.O 530020 14 Andhra Pradesh ANDHRA PRADESH KURNOOL HINDUPUR Dharmavaram H.O 515671 15 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA ELURU Eluru H.O 534001 16 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudivada Gudivada H.O 521301 17 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudur Gudur H.O 524101 18 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Guntakal H.O 515801 19 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA -

DISTRICT : Muzaffarpur

District District District District District Sl. No. Name of Husband's/Father,s AddressDate of Catego Full Marks Percent Choice-1 Choice-2 Choice-3 Choice-4 Choice-5 Candidate Name Birth ry Marks Obtained age (With Rank) (With Rank) (With Rank) (With Rank) (With Rank) DISTRICT : Muzaffarpur 1 KIRAN KUMARIARVIND KUMAR kiran kumari c/o arvind 10-Dec-66 GEN 700 603 86.14 Muzaffarpur (1) Samastipur (1) Darbhanga (1) Vaishali (1) Champaran-E (1) kumar vill+po-parsara dis-muzaffarpur 2 ARCHANA SRI ARUN vill-ratanpur post- 11-Aug-85 ST 900 757 84.11 Muzaffarpur (2) KUMARI CHAUDHARY jagdishparn vhaya- kalyanapur dist- muzaffarpur pin-848302 3PREM LATA SHARI NAND LAL village raja bigha, p.s. 10-Jan-79 GEN 700 566 80.86 Saran (2) Muzaffarpur (3) Darbhanga (2) Gaya (4) Champaran-E (2) KUMARI PRASAD dhanarua. p.o barni district patna pin code 804452 4 REENA SINHASRI DINESH SINGH dinesh singh, d/o- sita 31-Dec-76 BC 900 721 80.11 Siwan (2) Begusarai (3) Muzaffarpur (4) Samastipur (4) Vaishali (5) sharan singh, vill- ruiya, post- ruiya bangra, p.s.- jiradei, distt- siwan 5NILAM SHRI GUJESHWER nilam srivastav c/o-shri 06-Jan-69 BC 700 554 79.14 Gopalganj (2) Siwan (3) Saran (3) Muzaffarpur (5) Patna (14) SRIVASTAV PRASAD akhilesh prasad vill-manichapar, po-hathua dis-gopalginj pin-841436 6 BEENA KUMARIMAHARANGHI vill-mahrana 01-Oct-75 BC 900 700 77.78 Munger (17) Lakhisarai (11) Bhagalpur (15) Muzaffarpur (6) Jamui (12) MATHO po-dahara dis-munger pin-811201 7 KANAK LATASRI ANIL KUMAR village+post- dahibhatta, 23-Dec-85 GEN 700 541 77.29 Gopalganj (5) -

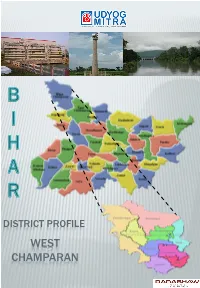

West Champaran Introduction

DISTRICT PROFILE WEST CHAMPARAN INTRODUCTION West Champaran is an administrative district in the state of Bihar. West Champaran district was carved out of old champaran district in the year 1972. It is part of Tirhut division. West Champaran is surrounded by hilly region of Nepal in the North, Gopalganj & part of East Champaran district in the south, in the east it is surrounded by East Champaran and in the west Padrauna & Deoria districts of Uttar Pradesh. The mother-tongue of this region is Bhojpuri. The district has its border with Nepal, it has an international importance. The international border is open at five blocks of the district, namely, Bagha- II, Ramnagar, Gaunaha, Mainatand & Sikta, extending from north- west corner to south–east covering a distance of 35 kms . HISTORICAL BACKGROUND The history of the district during the late medieval period and the British period is linked with the history of Bettiah Raj. The British Raj palace occupies a large area in the centre of the town. In 1910 at the request of Maharani, the palace was built after the plan of Graham's palace in Calcutta. The Court Of Wards is at present holding the property of Bettiah Raj. The rise of nationalism in Bettiah in early 20th century is intimately connected with indigo plantation. Raj Kumar Shukla, an ordinary raiyat and indigo cultivator of Champaran met Gandhiji and explained the plight of the cultivators and the atrocities of the planters on the raiyats. Gandhijii came to Champaran in 1917 and listened to the problems of the cultivators and the started the movement known as Champaran Satyagraha movement to end the oppression of the British indigo planters. -

Sitamarhi.Pdf

District District District District District Sl. No. Name of Husband's/Father,s AddressDate of Catego Full Marks Percent Choice-1 Choice-2 Choice-3 Choice-4 Choice-5 Candidate Name Birth ry Marks Obtained age (With Rank) (With Rank) (With Rank) (With Rank) (With Rank) DISTRICT : Sitamarahi 1 NEERU KUMARIKEDAR PANDEY vill-pusa sadpur 15-Jan-78 GEN 700 539 77 Muzaffarpur (8) Samastipur (6) Sitamarahi (1) Vaishali (7) Saran (5) po-sadpur dis-samastipur 2 RUPAM KUMARISANJIV KUMAR vill+post- mahamadpur, 15-Feb-80 GEN 900 686 76.22 Muzaffarpur (10) Samastipur (8) Darbhanga (4) Sitamarahi (2) Vaishali (10) badal, p.s.- sakari, via- silaut, distt- muzaffarpur, pin- 843119 3 USHA KUMARISRI NAND KISHOR c/o- sri nand kishor 28-Jul-68 BC 900 673 74.78 Patna (37) Vaishali (21) Saran (11) Saran (11) Sitamarahi (3) PRASAD prasad, vill- kurji, p.s.- digha, post- sadakat asram, distt- patna 4 MANORAMA MUNA PRASADE vill-kundbapar 25-Dec-75 MBC 900 668 74.22 Sitamarahi (4) Begusarai (13) Samastipur (15) Purnia (8) Araria (2) KUMARI po-akangardhi ps-akangarsari dis-nalanda 5 MEENA KUMARIRAM JEE SARMA vill-muradpur 24-Jan-68 GEN 900 658 73.11 Sitamarahi (5) Sheohar (2) Darbhanga (12) Madhubani (1) Muzaffarpur (21) po-dumda ps-sitamarahi 6 ANURADHA GORELAL MAHTO gorelal mahto, mohalla- 11-Mar-76 BC 900 657 73 Sheikhpura (31) Sitamarahi (6) Saran (16) Nawada (42) Jamui (45) SINHA khandpar baburam talab fatka ke pas, post- sheikhpura, district sheikhpura, p.s. shekipura, ward no. 4 7 NIVA KUMARISRI SAURAV vill-baluaa j, po- raeni , 05-Aug-79 GEN 900 657 73 Muzaffarpur (22) Samastipur (26) Darbhanga (14) Vaishali (32) Sitamarahi (7) KUMAR ps- sakara, dist muzaffarpur 843121 8RINA KUMARISRI KUMAR MAHTO d/o sri kumar mahto, 08-Dec-83 SC 500 365 73 Champaran-E (6) Champaran-W Sitamarahi (8) Madhubani (4) Patna (69) village- sakhuanwan, (4) post- gounoli, p.s. -

Break-Up of Contesting Candidates

1- Dhanaha 1. No. and Name of the Constituency : : 1 - Dhanaha 2. Form Unique Serial Number (FUSN) Prefix : : KMQ 3. Type of Constituency (Gen/SC/ST) : : GEN 4. Name and Designation of the Returning Officer : Sri M.Jaya Deputy Director, Consolidation, West Champaran 5. Date of Poll 13/11/05 6. Date of Repoll (if any) - 7. Date of Commencement of Counting 22-Nov-2005 8. Date of Declaration of Result 22-Nov-2005 9. Data About Polling Stations : Regular Polling Stations - 129 Average No. of Electors Per Polling Station - 876 Auxilliary Polling Stations 9 Average No. of Voters Per Polling Station - 429 Total Polling Stations 138 10. Data About Candidates : Men Women Total No. of Nomination Filed : 11 0 11 No. of Nomination Rejected : 0 0 0 No. of Nomination found correct after scrutiny : 11 0 11 No. of Withdrawals : 0 0 0 No. of Contesting Candidates : 11 0 11 No. of Candidates who forfeited their deposits : 8 0 8 Break-Up of Contesting Candidates National Parties : 1 0 1 State Parties : 4 0 4 Registered (Unrecognised) Parties : 2 0 2 Independents : 4 0 4 11. Details about Electors : General Service Total Male 68,015 5 68,020 Female 52,823 3 52,826 Total 120,838 8 120,846 12. Details about Voters : General Postal Total Male 33,424 0 33,424 Female 25,829 0 25,829 Total 59,253 0 59,253 Rejected Votes 0 Missing Votes 0 1- Dhanaha 13. Names of Contesting Candidates and their details : Sl. Candidate Name & Address SC/ Sex Party Symbol Final No. -

School with School Code.Xlsx

blkname schcd schname schmgt_desc schcat_desc Department SASARAM 10320100101 P S BANSA Primary only with grades 1 to 5 of Education Private SASARAM 10320100102 DEDICATED PUBLIC SCHOOL Secondary with grades 1 to 10 Unaided Department SASARAM 10320100301 P S DURGAPUR Primary only with grades 1 to 5 of Education Department SASARAM 10320100401 M S AMRA TALAB Upper Primary with grades 1 to 8 of Education Private SASARAM 10320100402 JEMS D . C . C SCHOOL KARBANDIYA Upper Primary with grades 1 to 8 Unaided Private SASARAM 10320100403 R.B.S PUBLIC SCHOOL Upper Primary with grades 1 to 8 Unaided Un- SASARAM 10320100404 DAYA NIDHI INTERNATIONAL SCHOOL Upper Primary with grades 1 to 8 Recognised THE MANAV BHARTI PUBLIC SCHOOL Un- SASARAM 10320100405 Upper Primary with grades 1 to 8 AMRA TALAB Recognised Un- SASARAM 10320100406 J.P MISSION SCHOOL Upper Primary with grades 1 to 8 Recognised NEW BAL VIKASH ENGLISH SCHOOL Un- SASARAM 10320100407 Upper Primary with grades 1 to 8 AMARA Recognised Department SASARAM 10320100501 URDU P S AMARI Primary only with grades 1 to 5 of Education Department SASARAM 10320100502 NEW P S AMARI Primary only with grades 1 to 5 of Education Department SASARAM 10320100601 UPGRADED H S DAWANPUR (2013-14) Higher Secondary with grades 1 to 12 of Education Un- SASARAM 10320100602 BABA KIDS GARDEN SCHOOL Upper Primary with grades 1 to 8 Recognised Department SASARAM 10320100702 NEW P S KARMA Primary only with grades 1 to 5 of Education Department SASARAM 10320101001 P S ADAMAPUR Primary only with grades 1 to 5 of Education -

Citizen Registration Report ( District : Rohtas) S.No

20-Aug-2018 06:04:22 PM Citizen Registration Report ( District : Rohtas) S.No. District Block Panchayat Dealer License FPShop No Name Mobile No 1 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 ARUN KUMAR CHOUBEY 8294376001 2 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 ANJANI KANT PANDEY 8002120143 3 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 MURHARAM ANSARI 8521925135 4 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 LAL BIHARI RAM 9801106495 5 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 PRABHA DEVI 9661912855 6 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 RAMABADAN SINGH 8809298872 7 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 BISHUNPATO DEVI 9576665648 8 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 KRISHNA PANDEY 8521868036 9 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 RAM NATH CHAUBEY 9939478255 10 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 BAIJNATH CHOUBEY 9939477255 11 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 JANARAN PANDEY 9162199711 12 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 SURENDRA SINGH 9006039260 13 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 GOVARDHAN CHAUBEY 9431680020 14 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 SUDHIR KUMAR SINGH 9455057992 15 Rohtas Akorhi Gola Tet Rarh Ajit Kumar Singh 26/07 123400300096 RAVI SHANKAR SINGH 9572138265 16 Rohtas -

West Champaran District, Bihar State

भूजल सूचना पुस्तिका पस्चचमी च륍पारण स्जला, बिहार Ground Water Information Booklet West Champaran District, Bihar State ADMINISTRATIVE MAP WEST CHAMPARAN DISTRICT, BIHAR N 0 5 10 15 20 Km Scale Masan R GAONAHA SIDHAW RAMNAGAR PIPRASI MAINATAND BAGAHA NARKATIAGANJ LAURIYA MADHUBANI SIKTA BHITAHA CHANPATTIA GandakJOGAPATTI R MANJHAULIA District Boundary BETTIAH Block Boundary THAKRAHA BAIRIA Road Railway NAUTAN River Block Headquarter के न्द्रीय भमू मजल िो셍 ड Central Ground water Board Ministry of Water Resources जल संसाधन मंत्रालय (Govt. of India) (भारि सरकार) Mid-Eastern Region Patna मध्य-पर्वू ी क्षेत्र पटना मसिंिर 2013 September 2013 1 Prepared By - Dr. Rakesh Singh, Scientist – ‘B’ 2 WEST CHAMPARAN, BIHAR S. No CONTENTS PAGE NO. 1.0 Introduction 6 - 10 1.1 Administrative details 1.2 Basin/sub-basin, Drainage 1.3 Irrigation Practices 1.4 Studies/Activities by CGWB 2.0 Climate and Rainfall 11 3.0 Geomorphology and Soils 11 - 12 4.0 Ground Water Scenario 12 – 19 4.1 Hydrogeology 4.2 Ground Water Resources 4.3 Ground Water Quality 4.4 Status of Ground Water Development 5.0 Ground Water Management Strategy 19 – 20 5.1 Ground Water Development 5.2 Water Conservation and Artificial Recharge 6.0 Ground Water related issue and problems 20 7.0 Mass Awareness and Training Activity 20 8.0 Area Notified by CGWB/SGWA 20 9.0 Recommendations 20 FIGURES 1.0 Index map of West Champaran district 2.0 Month wise rainfall plot for the district 3.0 Hydrogeological map of West Champaran district 4.0 Aquifer disposition in West Champaran 5.0 Depth to Water Level map (May 2011) 6.0 Depth to Water Level map (November 2011) 7.0 Block wise Dynamic Ground Water (GW) Resource of West Champaran district TABLES 1.0 Boundary details of West Champaran district 2.0 List of Blocks in West Champaran district 3.0 Land use pattern in West Champaran district 4.0 HNS locations of West Champaran 5.0 Blockwise Dynamic Ground Water Resource of West Champaran District (2008-09) 6.0 Exploration data of West Champaran 7.0 Chemical parameters of ground water in West Champaran 3 WEST CHAMPARAN - AT A GLANCE 1.