Annual Report and Accounts 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Building Products SECTOR INSIGHT//BUILDING PRODUCTS

SECTOR INSIGHT Building Products SECTOR INSIGHT//BUILDING PRODUCTS Contents p2 Building products overview p4 M&A Review p6 Deciphering the UK housing sector conundrum p9 Deal insight, opening doors pg10 Our expertise DEALS DONE RIGHT. LIVINGSTONEPARTNERS.COM BUILDING PRODUCTS OVERVIEW The construction sector has proved to be relatively resilient since Brexit, bringing welcome relief to those who had concerns about the sector’s ability to weather the uncertainty that followed last June’s historic decision to leave the EU. Future sector development activity will be The leading UK key builders’ merchanting recently downgraded its 2018 forecast spearheaded by a considerable increase groups have also benefitted from the for the sector from 1.2% to 0.7%, the in infrastructure spending, underpinned benign outlook, with their average EV / slowest rate of growth in six years, citing by a long term national infrastructure EBITDA multiples rising by almost 50% a combination of a softening economy and construction pipeline valued at over since the EU referendum. Several, such as and rising costs. This follows on from £500bn – over two-thirds of which is Grafton and Wolesely, are seeking to drive the PMI Index hitting an 11 month low of allocated to 219 major projects in the growth internationally whilst the likes of SIG 5.9% in July, driven by a combination of Energy and Transport sectors. Included and Travis Perkins continue to realign their lower commerical building volumes and in this are transformative projects such extensive portfolio of businesses. heightened macro-uncertainty delaying as Hinkley Point C, HS2 and the Thames projects. Tideway Tunnel, which will provide a It is not all plain sailing, with inflation significant fillip to a vast array of suppliers rearing its head at a faster rate recently. -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

Our Vision Is to Lead the Future of Housebuilding by Putting Customers

Strategic Report Governance Financial Statements Other Information Welcome to Key highlights1 Barratt Developments Continued strong performance Our vision is to lead 20172 2016² Change the future of housebuilding Total completions3 (plots) 17,395 17,319 0.4% by putting customers first Revenue (£m) 4,650.2 4,235.2 9.8% and at the heart Gross margin (%) 20.0 18.9 1.1 ppts Adjusted gross margin4 (%) 20.2 18.9 1.3 ppts of everything we do. Profit from operations (£m) 799.2 668.4 19.6% By investing in our people, Adjusted profit from operations4 (£m) 808.0 668.4 20.9% we are leading construction Operating margin (%) 17.2 15.8 1.4 ppts Adjusted operating margin4 (%) 17.4 15.8 1.6 ppts to create great places Profit before tax (£m) 765.1 682.3 12.1% where people aspire Adjusted profit before tax4 (£m) 773.9 682.3 13.4% to live and generating ROCE (%) 29.8 27.1 2.7 ppts sustainable returns Total dividend per share (pence) 41.7 30.7 35.8% for our shareholders. Net cash (£m) 723.7 592.0 22.2% Net assets (£m) 4,322.2 4,010.2 7.8% 1 Refer to page 175 for definitions of KPIs. 2 Unless otherwise stated, all numbers quoted exclude joint ventures (‘JV’) and are for the year ended 30 June throughout this Annual Report and Accounts. 3 Includes JV completions in which the Group has an interest. 4 Calculated before commercial adjusted item disclosed in note 2.2 of the Financial Statements. -

Here Possible

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to the action you should take you should immediately seek advice from your stockbroker, bank manager, solicitor, accountant or other independent professional advisor duly authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares in SIG plc, please forward this document and the Form of Proxy as soon as possible to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee. SIG plc (Registered in England No. 998314) Chairman’s Letter to Shareholders and Notice of Annual General Meeting The Annual General Meeting is to be held at the offices of SIG Plc, 10 Eastbourne Terrace, London, W2 6LG on Tuesday 30 June 2020 at 11am The Notice of Annual General Meeting is set out on pages 7 to 9 of this Document. A Form of Proxy for use at the Annual General Meeting is enclosed. SIG plc Notice of Annual General Meeting 2020 01 SIG Notice of Meeting-2020.indd 1 29/05/2020 16:37:24 26982 29 May 2020 4:37 pm Proof 10 SIG plc (Registered in England No. 998314) DIRECTORS: REGISTERED OFFICE A.J. Allner 10 Eastbourne Terrace S.R Francis London K.H.M Kearney-Croft W2 6LG H.C Allum I.B. Duncan G.D.C Kent A.C. Lovell 5 June 2020 Dear Shareholder, ANNUAL GENERAL MEETING 2020 NOTICE OF MEETING I am writing to explain in detail the items of business contained in the Notice of Annual General Meeting (the “AGM”) of SIG plc (the “Company”), to be held at 11am on Tuesday 30 June 2020 at the offices of SIG Plc, 10 Eastbourne Terrace, London, W2 6LG. -

20080319 Trading Notice Functional 0049

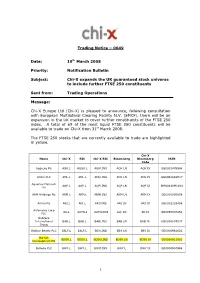

Trading Notice – 0049 Date: 19 th March 2008 Priority: Notification Bulletin Subject: Chi-X expands the UK guaranteed stock universe to include further FTSE 250 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce, following consultation with European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the UK market to cover further constituents of the FTSE 250 index. A total of 69 of the most liquid FTSE 250 constituents will be available to trade on Chi-X from 31 st March 2008. The FTSE 250 stocks that are currently available to trade are highlighted in yellow. Chi-X Name Chi-X RIC Chi-X RIC Bloomberg Bloomberg ISIN Code Aggreko Plc AGK.L AGGK.L AGKl.INS AGK LN AGK IX GB0001478998 Amlin PLC AML.L AML.L AMLl.INS AML LN AML IX GB00B2988H17 Aquarius Platinum AQP.L AQP.L AQPl.INS AQP LN AQP IX BMG0440M1284 Ltd ARM Holdings Plc ARM.L ARM.L ARMl.INS ARM LN ARM IX GB0000595859 Arriva Plc ARI.L ARI.L ARIl.INS ARI LN ARI IX GB0002303468 Autonomy Corp AU.L AUTN.L AUTNl.INS AU/ LN AU IX GB0055007982 PLC Babcock International BAB.L BAB.L BABl.INS BAB LN BAB IX GB0009697037 Group Balfour Beatty PLC BALF.L BALF.L BBYl.INS BBY LN BBY IX GB0000961622 Barratt BDEV.L BDEV.L BDEVl.INS BDEV LN BDEV IX GB0000811801 Development Plc Bellway PLC BWY.L BWY.L BWYl.INS BWY.L BWY IX GB0000904986 1 Biffa PLC BIFF.L BIFF.L BIFFl.INS BIFF LN BIFF IX GB00B129PL77 Bradford & Bingley BB.L BB.L BBl.INS BB/ LN BB IX GB0002228152 PLC Bunzl PLC BNZL.L BNZL.L BNZLl.INS BNZL LN BNZL IX GB00B0744B38 Burberry -

UK Shorting Madness

Truth Creates Light Edison Group UK Short Monitor Top UK Shorts October A.G. Barr PLC This chart shows UK companies that were CAPITA PLC subjected to the greatest shorting activity in terms of percentage of issued share capital, in October. INTU PROPERTIES PLC NMC HEALTH PLC JUPITER FUND MANAGEMENT PLC Kier Group plc KINGFISHER PLC CREST NICHOLSON HLDGS PLC METRO BANK PLC EASYJET PLC PLUS500 LTD CINEWORLD GROUP GREENCORE GROUP PLC PEARSON PLC Royal Mail Plc SIG PLC BABCOCK INTL GROUP PLC Flutter Entertainment plc WOOD GROUP (JOHN) PLC 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 Amount Shorted (%) 2 Top Total UK Shorts PLUS500 LTD Here we demonstrate the top 20 most shorted stocks in terms of % of issued share capital, at present. PEARSON PLC GREENCORE GROUP PLC WEIR GROUP PLC/THE Royal Mail Plc SIG PLC Flutter Entertainment plc GW PHARMACEUTICALS PLC CARILLION PLC Arrow Global Group plc Kier Group plc BABCOCK INTL GROUP PLC IQE PLC DEBENHAMS PLC CINEWORLD GROUP METRO BANK PLC WOOD GROUP (JOHN) PLC 0.00 2.00 4.00 6.00 8.00 10.00 12.00 Amount shorted (%) 3 4 This chart shows both new shorts and shorts that shorts and shorts new both shows chart This most 20 top the from in 2019 closed been have above) (slide UK. the in companies shorted AA PLC JUPITER FUND MANAGEMENT PLC PLUS500 LTD PEARSON PLC GREENCORE GROUP PLC WEIR GROUP PLC/THE Royal Mail Plc SIG PLC Flutter Entertainment plc GW PHARMACEUTICALS PLC 2019 Open 2019 CARILLION PLC 2019 Closed 2019 Arrow Global Group plc Kier Group plc BABCOCK INTL GROUP PLC IQE PLC DEBENHAMS PLC Closed vs. -

Www .Sheffieldtod Ay.Co

4 TOP100 COMPANIES-LISTINGSBYTURNOVER Latest dateof of accountsfiled Pre-Tax es ye 06 Telephone 04 at Companies Turnover Profits Number emplo 20 20 Company Name Address Number Principal Activity House £’000’s £’000’s 11 Sig Plc Hillsborough Works, Langsett Road, Sheffield, South Yorkshire, S6 2LW0114 2856300 Distribution of insulation and other products for the construction industry 31/12/2005 1,639,332 86,811 7,824 22 Outokumpu Stainless Ltd Main Administration Building, PO Box 161, Europa Link, S9 1TZ 0114 2443311 Stainless steel producer 31/12/2004 1,000,900 500 1,629 3- Dixon Motor Holdings Ltd Lakeside Icon, First Point, Balby Carr Bank, Doncaster,DN4 5JQ 0114 2753585 Motor Dealers 31/12/2004 756,431 -19,856 2,626 43 Dfs Trading Ltd 1Rockingham Way, Redhouse Interchange, Doncaster,DN6 7NA 01303 330365 Furnituremanufacturer and retailer 31/07/2005 575,700 57,500 2,484 54 Cpl Industries Ltd Mill Lane, Wingerworth, Chesterfield, Derbyshire, S42 6NG 01246 277001 Manufacturer and distributor of solid fuels and distributor of oil and gas 31/03/2005 510,000 01,211 65 UK Coal Plc Harworth Park, Blyth Road, Harworth, Doncaster,DN11 8DB 01302 751751 Coal extraction 31/12/2005 341,214 -62,094 4,320 77 Keepmoat Plc Heavens Walk, Doncaster,South Yorkshire, DN4 5HZ 01302 346620 Housing regeneration and private house building holding company 31/03/2005 334,685 33,147 1,967 88 Forgings International Holdings Ltd Firth House, PO Box 644 Meadowhall Road, Sheffield, S9 1JD 0114 2193000 Forgings, alloys, tool steel and laboratory equipment 30/09/2005 -

Community Interest Company Report

Community Interest Company Report 1st April 2012 - 31st March 2013 Community Interest Company Report 1st April 2012 - 31st March 2013 Contents Part 1 - General Description of the Company’s Activity & Impact P2 1.0 Company Overview P2 2.0 Insulate Hampshire P3 3.0 Wrap Up Leeds P5 4.0 Wakefield Low Carbon Communities P6 5.0 National Free Home Insulation Scheme P6 6.0 The BIG Energy Upgrade P7 7.0 CESP - North West P8 8.0 Eggborough Power Limited P8 9.0 West Yorkshire Green Deal Demonstrators P9 10.0 Green Deal Winchester Project P10 11.0 Southern Gas Networks P10 12.0 Green Deal P11 13.0 West Yorkshire Hotspots P13 14.0 Yorkshire and the Humber Microgeneration Partnership P14 15.0 Energy Help Loan P14 16.0 Support & Consultation P15 17.0 Company Expansion P15 Part 2 - Consultation with Stakeholders P16 Part 3 - Directors’ Remuneration P17 Part 4 - Transfers of Assets Other than for Full Consideration P17 Part 1 General Description of the Company’s Activity & Impact This report covers the period: 1st April 2012 - 31st March 2013 1.0 Company Overview Yorkshire Energy Services CIC is an award winning Community Interest Company operating within the sustainable energy sector. Based in Halifax, West Yorkshire and Andover, Hampshire, the company offers project management, expert advice and affordable energy saving solutions that help householders, organisations and public sector bodies reduce carbon emissions. As a trusted provider of energy saving products since May 2000, Yorkshire Energy Services has consistently delivered large scale area based initiatives on behalf of leading Local Authorities. -

FY21 Preliminary Results Statement

10 June 2021 Mitie Group plc Full Year results for the twelve months to 31 March 2021 “A defining year of strategic progress and financial resilience” • Good trading resilience through COVID-19: revenue including share of joint ventures and associates of £2,589m1, up 19.1%; excluding the contribution from Interserve, revenue was 1.6% lower • Group revenue1 of £2,560m (FY20 £2,174m) • Operating profit before other items4 of £63.4m (FY20 £86.1m) - impacted by revenue mix and reduced project work due to COVID-19 • Stronger second half with revenue growth of 6.5% versus previous year • Interserve Facilities Management (“Interserve”) acquisition performing better than expected, accelerating value creation. £6.2m cost and revenue synergies achieved in FY21. Cost synergies raised to £42m (from £35m) achieved by FY23 – at same cost • Market leadership in our three core markets: Cleaning, Security and Technical Services • Strengthened balance sheet: £190m rights issue; £250m RCF refinanced; and BBB Investment Grade credit rating achieved • Average daily net debt significantly reduced to £47.1m (FY20 £327.6m) post-IFRS 16 • Outlook for FY22 anticipated to be materially ahead of our prior expectations Results for the twelve months ended 31 March 2021 Twelve months to 31 March 2021 Twelve months to 31 March 2020 £m unless otherwise specified Before other Before other Other items2 Other items2 Total items2 items2 Total Revenue including share of JVs & associates1 2,589 - 2,589 2,174 - 2,174 Group revenue1 2,560 - 2,560 2,174 - 2,174 Revenue excluding -

Company Date Type Resid Proposal Vote Rescode GOODWIN PLC 02

Company Date Type ResId Proposal Vote ResCode GOODWIN PLC 02/10/2019 AGM 1 Receive the Annual Report Oppose 201 GOODWIN PLC 02/10/2019 AGM 2 Approve the Dividend For 401 GOODWIN PLC 02/10/2019 AGM 3 Re-elect Mr. J. Connolly For 301 GOODWIN PLC 02/10/2019 AGM 4 Re-elect Mr. S. C. Birks For 301 GOODWIN PLC 02/10/2019 AGM 5 Re-elect Mr. B. R. E. Goodwin Oppose 301 GOODWIN PLC 02/10/2019 AGM 6 Re-affirm the appointment of Mr. T. J. W. Goodwin as Chairman Oppose 301 GOODWIN PLC 02/10/2019 AGM 7 Re-affirm the appointment of Mr. M. S. Goodwin as Managing Director of the Mechanical Engineering Division. Oppose 301 GOODWIN PLC 02/10/2019 AGM 8 Re-affirm the appointment of Mr. S. R. Goodwin as Managing Director of the Refractory Engineering Division Oppose 301 GOODWIN PLC 02/10/2019 AGM 9 Re-affirm the position of Mrs. J. E. Kelly Non-Executive Director as Chair of the Audit Committee Oppose 314 GOODWIN PLC 02/10/2019 AGM 10 Re-affirm the position of Mr. J. W. Goodwin as member of the Audit Committee Oppose 314 GOODWIN PLC 02/10/2019 AGM 11 Re-affirm the position of Mr. R. S. Goodwin as member of the Audit Committee Oppose 314 GOODWIN PLC 02/10/2019 AGM 12 Re-affirm the position of Mrs. P. Ashley as member of the Audit Committee Oppose 314 GOODWIN PLC 02/10/2019 AGM 13 Approve the Remuneration Report Oppose 202 GOODWIN PLC 02/10/2019 AGM 14 Approve Remuneration Policy Oppose 206 GOODWIN PLC 02/10/2019 AGM 15 Appoint the Auditors and Allow the Board to Determine their Remuneration Oppose 502 PHOTO-ME INTERNATIONAL PLC 03/10/2019 AGM 1 Receive the -

Revenue Up, Gross Profit Up, Profit Before Tax Upand Cash at Bank Up

the yorkshire report REVENUE UP, GROSS PROFIT UP, PROFIT BEFORE TAX UP AND CASH AT BANK UP the region’s recovery is continuing and there are even better prospects ahead 2 What is the o yorkshire 14 Yorkshire Report? on the up & up revenue £91bn (up 5%) taking the region’s gross profit £20bn (up 4%) temperature, examining its health and considering the figures profit before tax £3bn (up 18%) best course of treatment… key cash at bank £10bn (up 22%) We compile the latest published accounts of Yorkshire’s 150 biggest companies (by revenue) and aggregate the figures to create a barometer of economic health for our region. Please note that we refer to the top 150 companies collectively as ‘the Group’ throughout the report and, as the Group’s composition changes every twelve months, year-on-year comparisons may not be like-for-like. CURRENT PREVIOUS CHANGE YEAR YEAR % As a proud region with a strong sense of identity, Yorkshire has its own distinct Revenue £90.7bn £88.7bn 2% economy. So why shouldn’t it have its Operating profit £4.56bn £4.34bn 5% very own annual review? That was the highlights thinking behind the first BDO Yorkshire Effective tax rate 32.0% 28.5% 12% Report and now, seven years later, we have charted our fictional Group through Dividend £0.9bn £1.4bn (36%) some of the most turbulent economic times in our region’s history. Investment in £3.4bn 2.9bn 17% property, plant & machinery No. of employees 470,000 479,000 (2%) Average salary £24,340 £23,730 3% Average director’s £183,000 £178,000 3% emolument Gearing 37% 41% (10%) 2014 | the yorkshire report 1 The latest results for the Group, comprising Yorkshire’s Top 150 companies, show the region’s recovery continuing and even better prospects ahead welcome contents It’s a pleasure, after a number of tough years for the region, to introduce such an upbeat Yorkshire Welcome 01 report.