Securities Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation

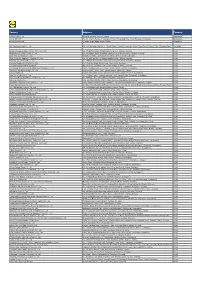

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation - Chinese Producers of Wooden Cabinets and Vanities Company Name Company Information Company Name: A Shipping A Shipping Street Address: Room 1102, No. 288 Building No 4., Wuhua Road, Hongkou City: Shanghai Company Name: AA Cabinetry AA Cabinetry Street Address: Fanzhong Road Minzhong Town City: Zhongshan Company Name: Achiever Import and Export Co., Ltd. Street Address: No. 103 Taihe Road Gaoming Achiever Import And Export Co., City: Foshan Ltd. Country: PRC Phone: 0757-88828138 Company Name: Adornus Cabinetry Street Address: No.1 Man Xing Road Adornus Cabinetry City: Manshan Town, Lingang District Country: PRC Company Name: Aershin Cabinet Street Address: No.88 Xingyuan Avenue City: Rugao Aershin Cabinet Province/State: Jiangsu Country: PRC Phone: 13801858741 Website: http://www.aershin.com/i14470-m28456.htmIS Company Name: Air Sea Transport Street Address: 10F No. 71, Sung Chiang Road Air Sea Transport City: Taipei Country: Taiwan Company Name: All Ways Forwarding (PRe) Co., Ltd. Street Address: No. 268 South Zhongshan Rd. All Ways Forwarding (China) Co., City: Huangpu Ltd. Zip Code: 200010 Country: PRC Company Name: All Ways Logistics International (Asia Pacific) LLC. Street Address: Room 1106, No. 969 South, Zhongshan Road All Ways Logisitcs Asia City: Shanghai Country: PRC Company Name: Allan Street Address: No.188, Fengtai Road City: Hefei Allan Province/State: Anhui Zip Code: 23041 Country: PRC Company Name: Alliance Asia Co Lim Street Address: 2176 Rm100710 F Ho King Ctr No 2 6 Fa Yuen Street Alliance Asia Co Li City: Mongkok Country: PRC Company Name: ALMI Shipping and Logistics Street Address: Room 601 No. -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated. -

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Federal Register/Vol. 84, No. 196/Wednesday, October 9, 2019/Notices

54106 Federal Register / Vol. 84, No. 196 / Wednesday, October 9, 2019 / Notices Dated: October 3, 2019. on April 2, 2019.1 On August 5, 2019, product coverage comments and Joan Nagielski, Commerce postponed the preliminary rebuttal responses submitted to the Human Resources Specialist, Office of determination of this investigation and record for this investigation, and Employment and Compensation, Department the revised deadline is now October 2, accompanying discussion and analysis of Commerce Human Capital Client Services, 2019.2 For a complete description of the of all comments timely received, see the Office of Human Resources Management, events that followed the initiation of Preliminary Scope Decision Office of the Secretary, Department of this investigation, see the Preliminary Memorandum.6 Commerce is Commerce. Decision Memorandum.3 A list of topics preliminarily modifying the scope [FR Doc. 2019–21987 Filed 10–8–19; 8:45 am] included in the Preliminary Decision language as it appeared in the Initiation BILLING CODE 3510–24–P Memorandum is included as Appendix Notice. See the revised scope in II to this notice. The Preliminary Appendix I to this notice. Decision Memorandum is a public DEPARTMENT OF COMMERCE document and is on file electronically Methodology via Enforcement and Compliance’s Commerce is conducting this International Trade Administration Antidumping and Countervailing Duty investigation in accordance with section Centralized Electronic Service System 731 of the Act. Commerce has [A–570–106] (ACCESS). ACCESS is available to calculated export prices in accordance registered users at https:// with section 772(a) of the Act. Because Wooden Cabinets and Vanities and access.trade.gov, and to all parties in the China is a non-market economy, within Components Thereof From the Central Records Unit, room B8024 of the the meaning of section 771(18) of the People’s Republic of China: main Commerce building. -

No. Manufacture Name Address Country Certificate of Registration No. Date of Registration Date of Expiry 1 DIGO CREATIVE ENTERPR

รายชื่อโรงงานที่ทําผลิตภัณฑในตางประเทศที่ไดรับการขึ้นทะเบียน List of Registered Foreign Manufacturer ขอบขายตามมาตรฐานเลขที่ มอก.685 เลม 1-2540 ของเลน TIS 685-2540 : Toys Part 1 General requirements No. Manufacture name Address Country Certificate of Date of Date of Expiry Registration No. Registration 1 DIGO CREATIVE ENTERPRISE NO. 126, LANE 899, GUANGTAI, JINHUI TOWN, PEOPLE' S R685-161 31-Mar-2017 29-Mar-2020 CO., LTD FENGXIAN DISTRICT, SHANG HAI REPUBLIC OF CHINA 2 DONG GUAN YONG RONG NAN QU INDUSTRIAL ZONE, SHA TOU PEOPLE' S R685-164 21-Mar-2017 19-Mar-2020 PLASTIC PRODUCTS CO., VILLAGE, CHANGAN TOWN, DONGGUAN CITY REPUBLIC OF LTD. (SHA TOU BRANCH) GUANGDONG PROVINCE CHINA 3 DONGGUAN KING SURPRISE HE'NAN INDUSTRIAL DISTRICT, JINXIA, PEOPLE' S R685-169 20-Mar-2017 18-Mar-2020 INDUSTRIAL CO., LTD. CHANG'AN TOWN, DONGGUAN CITY, REPUBLIC OF GUANDONG PROVINCE CHINA 4 DONGGUAN ZHONGMA TOYS FUYONG VILLAGE, WANGNIUDUN TOWN, PEOPLE' S R685-172 8-May-2017 6-May-2020 CO., LTD. DONGGUAN CITY, GUANGDONG PROVINCE. REPUBLIC OF CHINA 1/57 รายชื่อโรงงานที่ทําผลิตภัณฑในตางประเทศที่ไดรับการขึ้นทะเบียน List of Registered Foreign Manufacturer ขอบขายตามมาตรฐานเลขที่ มอก.685 เลม 1-2540 ของเลน TIS 685-2540 : Toys Part 1 General requirements No. Manufacture name Address Country Certificate of Date of Date of Expiry Registration No. Registration 5 FORTE-MIND 68 XINAN ROAD, BEIHAI INDUSTRIAL ZONE, PEOPLE' S R685-242 20-Jun-2017 19-Jun-2020 INDUSTRIAL(BEIHAI) GUANGXI REPUBLIC OF COMPANY LIMITED CHINA 6 GD-TSENG ENTERPRISE CO., NO. 474-1, YIJIAO ST., EAST DIST., CHIAYI CITY TAIWAN R685-179 15-May-2017 13-May-2020 LTD. 7 GUANGDONG ZHIGAO THE 3 rd INDUSTRIAL DISTRICT,JUZHOU, PEOPLE' S R685-183 10-Apr-2017 8-Apr-2020 CULTURAL & CREATIVE INC. -

“Customer Advisory Temporary Suspension of Cargo Acceptance to South China During 2021 Chinese New Year Holiday”

“Customer Advisory Temporary Suspension of cargo acceptance to South China during 2021 Chinese New Year Holiday” Friday 8th Dec 2020 Dear Valued Customers, Due to the COVID-19 quarantine requirements for the ship crews onboard to the coastal feeder running between South China and Hong Kong waters, feeder operators announced their services to be suspended from mid-Jan to the end of Feb 2021. In consideration of this situation, ONE will temporarily suspend the acceptance of the cargo bound for the ports in the South China area and Fujian, listed below through South China main ports with the estimated arrival date to the main ports described in the table below: Port of Discharge/Destination Restriction Restricted period Cargo Direct discharge at Hong Kong, Yantian, No restriction N/A All types size of Shekou, Nansha, via trunck vessels equipment, including Hazardous, Reefer, and Awkward cargo For the ports in South China, Hainan, Temporary suspend ETA to Hong Kong, All types size of Guangxi and “Pearl River Delta” area cargo acceptance Yantian, Shekou, equipment, including but not limited to Beihai, Chiwan, Nansha during 5th including DachanBay, Fangcheng, Guigang, Haikou, Jan to 23rd Feb Hazardous, Reefer, Qinzhou, Shekou, Shenwan, Wuzhou, 2021 and Awkward cargo Xiaolan, Xinhui, Yangpu, Yantian, Zhanjiang, and Zhongshan Port Authority Terminal For the ports in South China, Hainan, Temporary suspend ETA to Hong Kong, All types size of Guangxi, and “Pearl River Delta” area cargo acceptance Yantian, Shekou, equipment, excluding the ports mentioned above Nansha during 10th including Jan to 23rd Feb Hazardous, Reefer, 2021 and Awkward cargo For the ports in Fujian including but not Temporary suspend ETA to Hong Kong, All types size of limited to Xiamen, Fuzhou, Fuqing, cargo acceptance Yantian, Shekou, equipment, Quanzhou Nansha during 5th including Jan to 23rd Feb Hazardous, Reefer, 2021 and Awkward cargo This list reflects the expectation as of 4th Dec 2020 and is subject to change. -

SAR Exemption Report

Test Report No.: FM181219N049 RF EXPOSURE REPORT Applicant Zhongshan Jibao Electronic Co.,Ltd No.17, No.19, Dapaizhong Road, Haigang Village, Shenwan Town, Zhongshan City, Address Guangdong, China Manufacturer or Zhongshan Jibao Electronic Co.,Ltd Supplier No.17, No.19, Dapaizhong Road, Haigang Village, Shenwan Town, Zhongshan City, Address Guangdong, China Product Electronic Baby Scale Brand Name N/A Model BY90 Additional Model & N/A Model Difference Date of tests Dec. 19, 2018~ Jan. 21, 2019 FCC Part 2 (Section 2.1093) KDB 447498 D01 IEEE C95.1 CONCLUSION: The submitted sample was found to COMPLY with the test requirement Tested by Breeze Jiang Approved by Glyn He Project Engineer / EMC Department Supervisor / EMC Department Date: May 30, 2019 This report is governed by, and incorporates by reference, CPS Conditions of Service as posted at the date of issuance of this report at http://www.bureauveritas.com/home/about-us/our-business/cps/about-us/terms-conditions/ and is intended for your exclusive use. Any copying or replication of this report to or for any other person or entity, or use of our name or trademark, is permitted only with our prior written permission. This report sets forth our findings solely with respect to the test samples identified herein. The results set forth in this report are not indicative or representative of the quality or characteristics of the lot from which a test sample was taken or any similar or identical product unless specifically and expressly noted. Our report includes all of the tests requested by you and the results thereof based upon the information that you provided to us. -

Global Factory List As of August 3Rd, 2020

Global Factory List as of August 3rd, 2020 Target is committed to providing increased supply chain transparency. To meet this objective, Target publishes a list of all tier one factories that produce our owned-brand products, national brand products where Target is the importer of record, as well as tier two apparel textile mills and wet processing facilities. Target partners with its vendors and suppliers to maintain an accurate factory list. The list below represents factories as of August 3rd, 2020. This list is subject to change and updates will be provided on a quarterly basis. Factory Name State/Province City Address AMERICAN SAMOA American Samoa Plant Pago Pago 368 Route 1,Tutuila Island ARGENTINA Angel Estrada Cla. S.A, Buenos Aires Ciudad de Buenos Aires Ruta Nacional N 38 Km. 1,155,Provincia de La Rioja AUSTRIA Tiroler Glashuette GmbH Werk: Schneegattern Oberosterreich Lengau Kobernauserwaldstrase 25, BAHRAIN WestPoint Home Bahrain W.L.L. Al Manamah (Al Asimah) Riffa Building #1912, Road # 5146, Block 951,South Alba Industrial Area, Askar BANGLADESH Campex (BD) Limited Chittagong zila Chattogram Building-FS SFB#06, Sector#01, Road#02, Chittagong Export Processing Zone,, Canvas Garments (Pvt.) Ltd Chittagong zila Chattogram 301, North Baizid Bostami Road,,Nasirabad I/A, Canvas Building Chittagong Asian Apparels Chittagong zila Chattogram 132 Nasirabad Indstrial Area,Chattogram Clifton Cotton Mills Ltd Chittagong zila Chattogram CDA plot no-D28,28-d/2 Char Ragmatia Kalurghat, Clifton Textile Chittagong zila Chattogram 180 Nasirabad Industrial Area,Baizid Bostami Road Fashion Watch Limited Chittagong zila Chattogram 1363/A 1364 Askarabad, D.T. Road,Doublemoring, Chattogram, Bangladesh Fortune Apparels Ltd Chittagong zila Chattogram 135/142 Nasirabad Industrial Area,Chattogram KDS Garment Industries Ltd. -

IMPORTANT: This Announcement Is Important and Requires Your Immediate Attention

IMPORTANT: This announcement is important and requires your immediate attention. If you are in any doubt about the contents of this announcement, you should consult your bank manager, legal adviser, accountant or other independent financial adviser. ChinaAMC Xinghua Mixed Securities Investment Fund Summary Prospectus (Updated) (2016 No.2) The Hong Kong Representative of ChinaAMC Xinghua Mixed Securities Investment Fund (the “Fund”) wishes to inform Unitholders and prospective investors of the Fund that China Asset Management Co., Ltd., the Fund Manager of the Fund, has issued the “ChinaAMC Xinghua Mixed Securities Investment Fund Summary Prospectus (Updated) (2016 No.2)” (the “Summary”). Please see the attached Summary for details. Please note that in the Summary, except ChinaAMC Xinghua Mixed Securities Investment Fund, all other funds are not authorized in Hong Kong and not available to Hong Kong residents. The Fund Manager accepts responsibility for the accuracy of the information contained in this announcement. Unitholders who have any enquiries regarding the above may contact the Hong Kong Representative at 37/F, Bank of China Tower, 1 Garden Road, Central, Hong Kong or the enquiry hotline at (852) 3406 8686 during office hours or by electronic mail at [email protected]. China Asset Management Co., Ltd. Hong Kong Representative, 25 November 2016 ChinaAMC Xinghua Mixed Securities Investment Fund Summary Prospectus (Updated) 2016 No.2 Fund Manager: China Asset Management Co., Ltd. Fund Custodian: China Construction Bank Corporation ChinaAMC Xinghua Mixed Securities Investment Fund Summary Prospectus (updated) IMPORTANT The ChinaAMC Xinghua Mixed Securities Investment Fund is transformed from the Xinghua Securities Investment Fund. In accordance with the resolution of the Fund Unitholders’ Meeting of Xinghua Securities Investment Fund approved by the Zheng Jian Xu Ke [2013] No. -

GF Industry Leaders Mixed Assets Fund Updated Prospectus

GF Industry Leaders Mixed Assets Fund Updated Prospectus Fund Manager: GF Fund Management Co. Ltd. Fund Custodian: Industrial and Commercial Bank of China Ltd. Date: December 2018 [Important Notes] GF Industry Leaders Mixed Assets Fund (the “Fund”) has been approved by the China Securities Regulatory Commission (CSRC) Zheng Jian Xu Ke [2010] no. 950 on July 12, 2010. The Fund Contract is effective from November 23, 2010. The Fund Manager guarantees that the contents of the Prospectus are true, accurate, and complete. This Prospectus has been approved by the CSRC; but the CSRC’s approval of the offering of the Fund neither represents its substantive judgment or guarantee on the value and return of the Fund, nor indicates that there is no risk when investing in the Fund. Investment involves risks. Investors shall read the Prospectus carefully when subscribing to this Fund. The performance of other funds under the management of the Fund Manager does not constitute any guarantee for the performance of the Fund. The Fund Manager shall manage and use the fund assets according to the principles of due diligence, honesty, good faith, and prudence, but does not guarantee any profits or minimum returns on the Fund. The Fund invests in the securities market, and the net value of the Fund will fluctuate due to factors such as fluctuations in the securities market. Before investing in the Fund, investors shall have a good understanding on the product characteristics of the Fund, and will be exposed to various types of risks involved in the investment of the Fund, which include the following: systematic risks formed by the effects of environmental factors, such as political, economic and social factors on securities prices, specific non-systematic risks of individual securities, liquidity risk arising from continued significant redemptions by the Investors of the Fund, management risk of the Fund during the management of the Fund by the Fund Manager, and other specific risks of the Fund. -

China Merchants Port Group Co., Ltd. Interim Report 2020

CHINA MERCHANTS PORT GROUP CO., LTD. INTERIM REPORT 2020 Date of Disclosure: 29 August 2020 1 China Merchants Port Group Co., Ltd. Interim Report 2020 Part I Important Notes, Table of Contents and Definitions The Board of Directors (or the “Board”), the Supervisory Committee as well as the directors, supervisors and senior management of China Merchants Port Group Co., Ltd. (hereinafter referred to as the “Company”) hereby guarantee the factuality, accuracy and completeness of the contents of this Report and its summary, and shall be jointly and severally liable for any misrepresentations, misleading statements or material omissions therein. Bai Jingtao, the Company’s legal representative, Lu Yongxin, the Company’s Acting Chief Financial Officer, and Sun Ligan, the person-in-charge of the accounting organ hereby guarantee that the financial statements carried in this Report are factual, accurate and complete. All the Company’s directors have attended the Board meeting for the review of this Report and its summary. Any forward-looking statements such as future plans or development strategies mentioned herein shall not be considered as the Company’s promises to investors. And investors are reminded to exercise caution when making investment decisions. Possible risks faced by the Company and countermeasures have been explained in “Part IV Operating Performance Discussion and Analysis” herein, which investors are kindly reminded to pay attention to. Securities Times, Shanghai Securities News, Ta Kung Pao (HK) and www.cninfo.com.cn have been designated by the Company for information disclosure. And all information about the Company shall be subject to what’s disclosed on the aforesaid media. -

Interim Results Announcement for the Six Months Ended June 30, 2020

(GDR under the symbol “HTSC”) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED JUNE 30, 2020 The Board of Huatai Securities Co., Ltd. (the "Company") hereby announces the unaudited interim results of the Company and its subsidiaries for the six months ended June 30, 2020. This interim results announcement contains the text of the interim report of the Company for 2020. THE PUBLICATION OF INTERIM RESULTS ANNOUNCEMENT AND INTERIM REPORT This interim results announcement of the Company will be available on the website of London Stock Exchange (www.londonstockexchange.com), the website of National Storage Mechanism (data.fca.org.uk/#/nsm/nationalstoragemechanism), and the website of the Company (www.htsc.com.cn), respectively. The interim report of the Company for 2020 will be available on the website of London Stock Exchange (www.londonstockexchange.com), the website of the National Storage Mechanism (data.fca.org.uk/#/nsm/nationalstoragemechanism) and the website of the Company in due course on or before September 30, 2020. DEFINITIONS Unless the context otherwise requires, capitalized terms used in this announcement shall have the same meanings as those defined in the section headed “Definitions” in the interim report of the Company for 2020 as set out in this announcement. By order of the Board Zhang Hui Joint Company Secretary Jiangsu, the PRC, August 26, 2020 CONTENTS Important Notice .............................................................................................................. 2 Definitions ......................................................................................................................