June 2020 Monthly Release Notes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

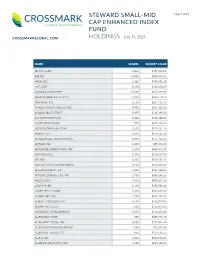

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

JPMORGAN TRUST II Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-05-26 | Period of Report: 2021-03-31 SEC Accession No. 0001752724-21-111489 (HTML Version on secdatabase.com) FILER JPMORGAN TRUST II Mailing Address Business Address 277 PARK AVENUE 277 PARK AVENUE CIK:763852| IRS No.: 000000000 | State of Incorp.:DE NEW YORK NY 10172 NEW YORK NY 10172 Type: NPORT-P | Act: 40 | File No.: 811-04236 | Film No.: 21962894 800-480-4111 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document JPMorgan Small Cap Value Fund SCHEDULE OF PORTFOLIO INVESTMENTS AS OF MARCH 31, 2021 (Unaudited) Investments Shares (000) Value ($000) COMMON STOCKS 96.7% Aerospace & Defense 1.1% AAR Corp. * 107 4,473 Astronics Corp. * 208 3,754 Maxar Technologies, Inc. 109 4,111 Moog, Inc., Class A 33 2,711 Triumph Group, Inc. * 45 831 15,880 Air Freight & Logistics 0.5% Echo Global Logistics, Inc. * 223 6,995 Hub Group, Inc., Class A * 6 404 7,399 Airlines 1.1% Allegiant Travel Co. * 19 4,710 Hawaiian Holdings, Inc. * 108 2,891 SkyWest, Inc. * 156 8,499 16,100 Auto Components 1.6% Adient plc * 122 5,392 American Axle & Manufacturing Holdings, Inc. * 48 461 Cooper Tire & Rubber Co. 47 2,653 Dana, Inc. 226 5,495 Gentherm, Inc. * 69 5,084 Goodyear Tire & Rubber Co. (The) * 245 4,306 23,391 Banks 15.6% 1st Source Corp. 59 2,783 American National Bankshares, Inc. 3 109 Atlantic Capital Bancshares, Inc. * 41 998 Atlantic Union Bankshares Corp. -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

First Midwest Bancorp, Inc. Announces Change to Virtual 2020 Annual Meeting of Stockholders

FOR IMMEDIATE RELEASE FIRST MIDWEST BANCORP, INC. ANNOUNCES CHANGE TO VIRTUAL 2020 ANNUAL MEETING OF STOCKHOLDERS CHICAGO, IL, May 7, 2020 – First Midwest Bancorp, Inc. (the “Company” or “First Midwest”) today announced that its 2020 Annual Meeting of Stockholders will be held in a virtual meeting format to protect the health, safety and well-being of its stockholders and colleagues during the coronavirus (COVID-19) pandemic, and taking into account related governmental directives and guidance. As such, stockholders will not be able to attend the annual meeting in person. The annual meeting will continue to be held, as previously announced, on Wednesday, May 20, 2020, at 9:00 a.m. Central time. Stockholders of record as of the close of business on March 27, 2020, the record date for the annual meeting, may attend the meeting at www.meetingcenter.io/253702787 (meeting password: FMBI2020) by logging in and entering the control number found on the proxy card previously distributed. Once admitted to the annual meeting, stockholders should follow the instructions on the website. Additional information regarding participation at the annual meeting will be available at www.firstmidwest.com/investorrelations and in the Company’s supplement to its proxy statement filed with the Securities and Exchange Commission. The Company encourages stockholders to vote their shares via the Internet, by telephone or by mail, as described in the proxy statement and on the proxy card sent to stockholders, even if they plan to attend the annual meeting virtually. By voting in advance, shares will be counted as present and voted at the annual meeting even if the stockholder decides later not to attend the meeting. -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

First Midwest Bancorp Completes Acquisition of Bridgeview Bank

FOR IMMEDIATE RELEASE FIRST MIDWEST BANCORP COMPLETES ACQUISITION OF BRIDGEVIEW BANK CHICAGO, IL – May 13, 2019 – First Midwest Bancorp, Inc. (“First Midwest”), the holding company of First Midwest Bank, today announced it has completed its acquisition of Bridgeview Bank. First Midwest announced this transaction on December 6, 2018. “We are very excited to welcome Bridgeview Bank clients and colleagues to First Midwest,” said Michael L. Scudder, Chairman and Chief Executive Officer of First Midwest. “We look forward to building upon the legacy of exceptional client service and community engagement that Bridgeview Bank has personified over these many years. We are equally excited to bring to our newest clients a broader array of products and online capabilities, as well as access to one of Chicagoland’s largest branch networks.” At the closing of the transaction, Bridgeview Bank had approximately $1.1 billion in total assets, $755 million in loans and $1 billion in deposits, of which 71% are core deposits. All Bridgeview Bank branches have been converted to First Midwest branches. About First Midwest First Midwest (NASDAQ: FMBI) is a relationship-focused financial institution and one of the largest independent publicly traded bank holding companies based on assets headquartered in Chicago and the Midwest, with approximately $17 billion of assets and $12 billion of assets under management. First Midwest’s principal subsidiary, First Midwest Bank, and other affiliates provide a full range of commercial, treasury management, equipment leasing, consumer, wealth management, trust and private banking products and services through locations in metropolitan Chicago, northwest Indiana, southeast Wisconsin, central and western Illinois, and eastern Iowa. -

Privacy Policy

Rev. 02/2020 WHAT DOES FIRST MIDWEST BANK FACTS DO WITH YOUR PERSONAL INFORMATION? Why? Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. What? The types of personal information we collect and share depend on the product or service you have with us. This information can include: Social Security Number and income Account balances and credit history Credit scores and transaction history When you are no longer our customer, we continue to share your information as described in this notice. How? All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons First Midwest Bank chooses to share; and whether you can limit this sharing. Does First Midwest Reasons we can share your personal information Bank share? Can you limit this sharing? For our everyday business purposes − such as to process your transactions, maintain your account(s), respond to court orders and legal Yes No investigations, or report to credit bureaus For our marketing purposes − to offer our products and services to you Yes No For joint marketing with other financial companies Yes No For our affiliates’ everyday business purposes − information about your transactions and experiences Yes No For our affiliates’ everyday business purposes − information about your creditworthiness No We don’t share For our affiliates to market to you Yes Yes For nonaffiliates to market to you No We don’t share To limit direct Call 800-322-3623–our menu will prompt you through your choice(s). -

First Midwest Bancorp, Inc. to Acquire the National Bank & Trust

FOR IMMEDIATE RELEASE FIRST MIDWEST BANCORP, INC. TO ACQUIRE THE NATIONAL BANK & TRUST COMPANY OF SYCAMORE First Midwest Continues to Expand in Northern Illinois ITASCA, IL, November 12, 2015 – First Midwest Bancorp, Inc. (“First Midwest”) (NASDAQ NGS: FMBI), headquartered in Itasca, Illinois and the parent company of First Midwest Bank, today announced that it has entered into a definitive agreement to acquire NI Bancshares Corporation (OTCPINK: NIBA), the holding company for The National Bank & Trust Company of Sycamore (“NB&T”), based in Sycamore, Illinois. NB&T operates ten offices in DeKalb, Kane and LaSalle Counties in northern Illinois, and has approximately $680 million in total assets, $600 million in deposits, of which 89% are core deposits, and $415 million in loans. NB&T also has over $700 million in trust assets under administration. “We are very excited to announce this transaction and look forward to welcoming the clients and employees of NB&T to First Midwest. For nearly 150 years, NB&T has held an important role in the communities it serves and has developed long-standing relationships with its clients by serving as their valued and trusted financial partner,” said Michael L. Scudder, President and Chief Executive Officer of First Midwest. “In addition to expanding our banking presence in the attractive DeKalb County and surrounding markets, this transaction significantly increases our wealth management business, solidifying our position as one of Illinois’ leading wealth management providers.” “We are extremely pleased to join the First Midwest family,” said Michael A. Cullen, President and Chief Executive Officer of NI Bancshares Corporation. “NB&T and First Midwest share a similar culture as well as a shared vision and understanding of community banking, with an emphasis on responding quickly and effectively to meet client needs. -

Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Federal Reserve Release H.2 Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received No. 7 Week Ending February 15, 2020 Updated February 24, 2020 Board of Governors of the Federal Reserve System, Washington, DC 20551 H.2 Board Actions February 9, 2020 to February 15, 2020 Testimony and Statements Monetary Policy -- statement by Chair Powell before the House Committee on Financial Services on February 11 and the Senate Committee on Banking, Housing, and Urban Affairs on February 12. - Published, February 11, 2020 Enforcement Deutsche Bank AG, Frankfurt am Main, Germany -- cease-and-desist order dated April 20, 2017, terminated February 11, 2020. - Announced, February 13, 2020 Discover Financial Services, Riverwoods, Illinois -- written agreement dated May 26, 2015, terminated February 5, 2020. - Announced, February 13, 2020 JPMorgan Chase & Co., New York, New York -- cease-and-desist order dated November 17, 2016, terminated February 11, 2020. - Announced, February 13, 2020 The Royal Bank of Scotland PLC, Edinburgh, Scotland, and RBS Securities Inc. (n.k.a NatWest Markets Securities Inc.), Stamford, Connecticut -- cease-and-desist order dated May 20, 2015, terminated February 12, 2020. - Announced, February 13, 2020 (A/C) = Addition or Correction Board - Page 1 1of H.2 Actions under delegated authority February 9, 2020 to February 15, 2020 S&R Supervision and Regulation RBOPS Reserve Bank Operations and Payment Systems C&CA Consumer and Community Affairs IF International Finance FOMC Federal Open Market Committee MA Monetary Affairs Bank Branches, Domestic New York Five Star Bank, Warsaw, New York -- to establish branches at 2222 Seneca Street, Buffalo, and 451 Elmwood Avenue. -

3Rd Quarter 2019

3rd Quarter 2019 DWISCUSSIONISCONSIN CMOMMUNITYATERIALS BANK LANDSCAPE Financial Institutions Group Table of Contents SECTION DESCRIPTION I. 3rd Quarter Feature – 2019 FDIC Deposit Data II. Wisconsin Bank Regulatory Data III. Overview - Janney Montgomery Scott LLC Disclaimer Janney Montgomery Scott LLC prohibits its employees from directly or indirectly offering a favorable research rating or specific price target, or offering to change a rating or price target, as consideration or inducement either for the receipt of business or for compensation. 2 I. 3RD QUARTER FEATURE – 2019 FDIC DEPOSIT DATA 2019 Deposit Market Share – Wisconsin Wisconsin Wisconsin 2019 2019 2019 Number of Deposits In Total Market 2019 Number of Deposits In Total Market Rank Institution (ST) Branches Market ($000) Share(%) Rank Institution (ST) Branches Market ($000) Share(%) 1 U.S. Bancorp (MN) 128 26,079,944 17.46 26 Bremer Financial Corporation (MN) 11 804,096 0.54 2 Bank of Montreal 191 21,466,429 14.37 27 Park Bancorporation, Inc. (WI) 12 800,852 0.54 3 Associated Banc-Corp (WI) 196 17,354,814 11.62 28 Bank Street Capital Corporation (WI) 19 783,362 0.52 4 JPMorgan Chase & Co. (NY) 61 10,028,346 6.71 29 Sword Financial Corporation (WI) 19 767,496 0.51 5 Wells Fargo & Company (CA) 43 4,379,794 2.93 30 Westbury Bancorp, Inc. (WI) 10 725,430 0.49 6 Johnson Financial Group, Inc. (WI) 37 4,015,275 2.69 31 Centre 1 Bancorp, Inc. (WI) 14 721,846 0.48 7 Nicolet Bankshares, Inc. (WI) 39 2,861,704 1.92 32 PSB Holdings, Inc. -

FIRST MIDWEST BANCORP, INC. ANNOUNCES 2021 FIRST QUARTER RESULTS – EPS up 100% from a YEAR AGO CHICAGO, IL, April 20, 2021 – First Midwest Bancorp, Inc

FOR IMMEDIATE RELEASE FIRST MIDWEST BANCORP, INC. ANNOUNCES 2021 FIRST QUARTER RESULTS – EPS UP 100% FROM A YEAR AGO CHICAGO, IL, April 20, 2021 – First Midwest Bancorp, Inc. (the "Company" or "First Midwest"), the holding company of First Midwest Bank (the "Bank"), today reported results of operations and financial condition for the first quarter of 2021. Net income applicable to common shares for the first quarter of 2021 was $41 million, or $0.36 per diluted common share, compared to $37 million, or $0.33 per diluted common share, for the fourth quarter of 2020, and $19 million, or $0.18 per diluted common share, for the first quarter of 2020. Comparative results for the first quarter of 2021 and the fourth and first quarters of 2020 were, in certain cases, impacted by the timing of costs related to bank acquisition and branch consolidation, as well as the recognition of certain income tax benefits. Such results were also impacted by the Company’s response to the COVID-19 pandemic (the "pandemic"), as well as governments' responses to the pandemic. The Company's responses included repositioning its balance sheet which impacted its performance. To facilitate comparison between periods, adjustments to reported results have been made to reflect these impacts. For additional detail on these adjustments, see the "Non-GAAP Financial Information" section presented later in this release. SELECT FIRST QUARTER HIGHLIGHTS • Improved diluted EPS to $0.36, up 9% and 100% from the fourth and first quarters of 2020, respectively. ◦ Diluted EPS, adjusted(1) of $0.37, declined 14% from the fourth quarter of 2020, impacted by lower income from the Paycheck Protection Program ("PPP"), partly offset by lower provisioning for loan losses. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP