First Lien Water System Revenue and Refunding Bonds 2010 Series a (Tax Exempt) Base CUSIP: 736754 DATED: Date of Delivery DUE: May 1, As Shown on Inside Cover

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Faculty Senate, 2 March 2020

Faculty Senate, 2 March 2020 In accordance with the Bylaws, the agenda and supporting documents are sent to senators and ex-officio members in advance of meetings so that members of Senate can consider action items, study documents, and confer with colleagues. In the case of lengthy documents, only a summary will be included with the agenda. Full curricular proposals are available through the Online Curriculum Management System: pdx.smartcatalogiq.com/Curriculum-Management-System/Dashboard/ Curriculum-Dashboard If there are questions or concerns about agenda items, please consult the appropriate parties and make every attempt to resolve them before the meeting, so as not to delay Senate business. Items on the Consent Agenda are approved (proposals or motions) or received (reports) without further discussion, unless a senator gives notice to the Secretary in writing prior to the meeting, or from the floor prior to the end of roll call. Any senator may pull any item from the Consent Agenda for separate consideration, provided timely notice is given. Senators are reminded that the Constitution specifies that the Secretary be provided with the name of any alternate. An alternate is a faculty member from the same Senate division as the faculty senator who is empowered to act on the senator’s behalf in discussions and votes. An alternate may represent only one senator at any given meeting. A senator who misses more than three meetings consecutively will be dropped from the Senate roster. Introduction of amendments to Faculty Constitution www.pdx.edu/faculty-senate PORTLAND STATE UNIVERSITY FACULTY SENATE To: Faculty Senators and Ex-officio Members of the Faculty Senate From: Richard H. -

Portland State Vikings 2020 Football Prospectus

PORTLAND STATE VIKINGS 2020 FOOTBALL PROSPECTUS SR QB Davis Alexander JR S Anthony Adams 3,445 yards total offense 2019 1st team All-American 30 total touchdowns in 2019 19 pass breakups, 5 INTs PORTLAND STATE VIKINGS 2019-20 SEASON SCHEDULE Date Opponent Location Kickoff TV ‘19 W-L Last Meeting Series Sept. 5 at Arizona Tucson, AZ 4-8 1st meeting 0-0 Sept. 12 Bye Sept. 19 at Oregon State Corvallis, OR 5-7 2017: OSU 35-32 OSU 5-0 Sept. 26 MONTANA STATE* Hillsboro Stadium 2:05 p.m. 11-4 2018: MSU 43-23 MSU 21-10 Oct. 3 at Southern Utah* Cedar City, UT 3-9 2019: PSU 52-31 PSU 10-4 Oct. 10 at Idaho* Moscow, ID 5-7 2019: PSU 24-0 UI 12-2 Oct. 17 IDAHO STATE* Hillsboro Stadium 2:05 p.m. 3-9 2019: ISU 51-24 ISU 26-18-1 Oct. 24 NORTH DAKOTA Hillsboro Stadium 2:05 p.m. 7-5 2018: UND 17-10 UND 6-2 Oct. 31 CAL POLY* Hillsboro Stadium 2:05 p.m. 3-8 2017: CP 35-28 CP 13-11 Nov. 7 at Weber State* Ogden, UT 11-4 2017: WSU 63-17 WSU 22-13 Nov. 14 at Sacramento State* Sacramento, CA 9-4 2018: PSU 41-14 PSU 23-12 Nov. 20 EASTERN WASHINGTON* Hillsboro Stadium 7:05 p.m. 7-5 2019: EWU 53-46 EWU 21-20-1 *Big Sky Conference game Live Audio Streaming: www.GoViks.com Live Streaming Video: Pluto TV Channel 532, www.WatchBigSky.com, www.Pluto.tv Live Stats: www.ViksLive.com 2020 VIKINGS FOOTBALL PORTLAND STATE VIKINGS ATHLETICS DEPARTMENT INFORMATION Physical Address ____________________ Viking Pavilion at the Peter W. -

PORTLAND STATE VIKINGS 2018-19 Team Roster

PORTLAND STATE VIKINGS 2018-19 Team Roster 2018-19 Portland State Vikings: Front row, left to right: Jim Wallis, Skylar Rubalcaba, Jase Coburn, Zach Payne, Barret Peery, Chris Skinkis, Scott Sommer, Bill Barton. Middle row: Kevin Garza, Alberto De La Torre, Holland Woods, Derek Brown, Michael Mayhew, Michael Nuga, Kyle Greeley, Vonte Carter, Deante Strickland, Parker Jamm, Cameron Parenti. Back Row: Jamie Orme, Trey Wood, Robert McCoy, Brendan Rumel, Sal Nuhu, Filip Fullerton, Rashaad Goolsby, Juwan Williams, John Quarterman. No. Name Pos. Hgt. Wgt. Yr. Exp. Hometown (Schools) NAME PRONUNCIATIONS 0 Derek Brown G 6-0 180 SR 1V Federal Way, WA (Auburn Riverside/Everett CC) Vonte Carter VON-tay Michael Nuga NEW-guh 1 Michael Nuga G 6-2 180 JR JC Toronto, Canada (Clarkson Academy/Eastern Florida JC) Sal Nuhu NEW-hoo 2 Michael Mayhew G 6-2 190 SR 2V Flower Mound, TX (Marcus HS/Hill (TX) College) Jamie Orme ORM Brendan Rumel RUM-ul 3 Holland Woods G 6-0 170 SO 1V Phoenix, AZ (Apollo HS) Deante Strickland DEE-on-tay 4 Brendan Rumel F 6-10 240 SO 1V/RS Tucson, AZ (Rincon HS) VIKINGS BY YEAR 5 Kyle Greeley G 6-4 200 FR HS Salem, OR (West Salem HS) Freshmen: 3 10 Robert McCoy F 6-7 195 JR JC Chicago, IL (Eisenhower HS/San Diego CC) Sophomores: 2 11 Deante Strickland G 5-10 180 SR 1V Portland, OR (Central Catholic HS/Casper (WY) College) Juniors: 5 Seniors: 5 12 Trey Wood F 6-9 190 FR HS Anthem, AZ (Anthem HS) 13 Jamie Orme F 6-7 200 SR 1V Seattle, WA (O’Dea HS/Highline CC) VIKINGS BY SIZE Deante Strickland 5-10 15 Vonte Carter G 6-2 175 SR 1V Portland, -

All-Time Viking Records

VIKING RECORD BOOK Most Games Rushing for 200 yards ALL-TIME Career: 9-Charles Dunn, 1997-00 Season: 4-Charles Dunn, 2000; Ryan Fuqua, 2001 VIKING RECORDS Consecutive: 3-Charles Dunn, 2000; Ryan Fuqua, 2001 Best Rushing Average VIKING PASSING RECORDS Career: 6.1-DJ Adams, 2012-13 (420-2,567) Season: 7.6-Ryan Fuqua, 2001 (210-1,586) Most Passes Attempted Career: 1,607-Neil Lomax, 1977-80 (42 games) Most Rushing Touchdowns Season: 516-Neil Lomax, 1979 (11 games) Career: 54-Charles Dunn, 1997-00 Game: 77-Neil Lomax, 1979 at Northern Colorado Season: 21-Jeff Salta, 1976; Charles Dunn, 2000 Consecutive Passes, no INTs: 342-Jimmy Blanchard, 1999 (NCAA record) Game: 6-Jeff Salta, 1976 vs. Eastern Montana Most Passes Completed Career: 938-Neil Lomax, 1977-80 VIKING RECEIVING RECORDS Season: 299-Neil Lomax, 1979 Most Receptions Game: 44-Neil Lomax, 1979 at Northern Colorado; Career: 223-Orshawante Bryant, 1997-00 Drew Hubel, 2008 vs. Eastern Washington Season: 90-Stuart Gaussoin, 1979 (9 games) Game: 16-Stuart Gaussoin, 1979 vs. Northern Colorado; Best Completion Percentage Mario D’Ambrosio, 2008 vs. Eastern Washington Career: .646-John Charles, 1991-92 (341/528) Season: .672-Don Bailey, 1990 (137/204) Most Yards Receiving Game: .917-Bill Matos, 1992 vs. Calgary (11/12) Career: 3,449-Orshawante Bryant, 1997-00 Season: 1,299-Randy Nelson, 1969 (10 games) Most Yards Passing Game: 276-Terry Charles, 1999 vs. Montana (12 receptions) Career: 13,220-Neil Lomax, 1977-80 (42 games) Season: 4,094-Neil Lomax, 1980 (11 games) Most Yards Per Catch Game: 623-Drew Hubel, 2008 vs. -

Tackling Justice Free Streetcar Access for Portland State Record-Breaking

This season’s new recruit NEWS............................2 OPINION.........................4 FREE ARTS & CULTURE............6 Women’s golf signs Washington transfer A Ram Choi The Vanguard is published SPORTS..........................10 SPORTS paGE 12 every Wednesday PSUVANGUARD.COMPSUVANGUARD.COM PORTLAND STATE UNIVERSITY PSUVANGUARD.COM PORTLAND STATE UNIVERSITY PUBLISHED SINCE 1946 PORTLAND STATE UNIVERSITY PUBLISHED SINCE 1946 WEDNESDAY, JUNE 27, 2012 | VOL. 67 NO. 1 MILES SANGUINEttI/VANGUARD STAFF FREE RIDE: Free streetcar passes for PSU students, faculty and staff will be implemented Sept. 1. Free streetcar access KARL KUCHS/VANGUARD STAFF TAYLOR MArtINEK, a tight end for the PSU football team, tackled a cell phone thief June 11. for Portland State PSU signs on as The free passes are scheduled to be saw some vigilante-inspired ex- Portland Streetcar implemented on Sept. 1, coinciding citement as Martinek, on his usual with TriMet and Portland Streetcar’s Tackling justice commute to school, witnessed sponsor elimination of the free rail zone. After Tyler Adams, 18, allegedly steal a the shift, all students and staff will be smart phone from a young wom- DESMOND FULLER able to board the streetcar and use stu- Vikings tight end chases, an and flee near the MAX stop VANGUARD STAFF dent or employee photo identification catches thief at Southwest Fifth Avenue and cards as a valid fare. Morrison Street. This fall, riding the streetcar will be as “We know anecdotally that many ALEX MIERJESKI And on June 11, one victory said “I was standing there, and some easy as showing your student ID. PSU community members cur- VANGUARD STAFF less about his prowess as a foot- girl was standing in front of me, and Portland State will soon become a rently utilize the free rail zone for Taylor Martinek, a tight end for baller than it did about his charac- I just saw some guy come out of no- sponsor of Portland Streetcar, signing short trips in the central city,” said the Portland State Vikings foot- ter as a natural Good Samaritan. -

THE BIG SKY CONFERENCE CONFERENCE the Big Sky Conference Enters Its 57Th Year and 31St Gave the League Eight Members

LEAGUE INFORMATION ANNUAL BIG SKY THE BIG SKY CONFERENCE CONFERENCE The Big Sky Conference enters its 57th year and 31st gave the league eight members. The Big Sky Conference FOOTBALL year of women’s competition during the 2019-20 academic conference grew to Football Members CHAMPIONS year. nine schools in 1987 with the addition UC Davis Cal Poly Four of the current league members – Idaho State of Eastern Washington. 1963: Idaho State Eastern Washington 1964: Montana State University, The University of Montana, Montana State and The 1990s saw change in the Idaho Weber State – have been with the league since its birth. makeup of the league, beginning in Idaho State 1965: Weber State, Idaho Northern Arizona University enters its 50th season in 1992 when Nevada departed and put Montana 1966: Montana State the league, giving the league five members with at least 50 the Big Sky back at eight teams. In Montana State 1967: Montana State years of continuous membership. 1996 Boise State and Idaho left and at Northern Arizona 1968: Weber State, Montana State, Northern Colorado Idaho Fellow charter member the University of Idaho the same time the conference added Portland State 1969: Montana returned most of its sports to the Big Sky on July 1, 2014, Portland State, Sacramento State and Sacramento State 1970: Montana then its football program moved from the FBS level to FCS in Cal State Northridge. The Big Sky main- Southern Utah 1971: Idaho 2018, rejoining the Big Sky Conference. tained nine teams for five years before Weber State 1972: Montana State North Dakota left the Big Sky Conference following the Cal State Northridge departed in the 1973: Boise State 2017-18 academic year. -

Oregon MESA Receives $216,000 Grant for Invention Education

INDEX An everyday love story NEWS............................2 FREE ARTS...............................6 The Vanguard is published every Tuesday and Thursday Academy Award-winner Ernest Borgnine to ARTS & CULTURE OPINION.........................10 appear for screening of the film Marty PAGE SIX SPORTS..........................14 PPSUVANGUARD.COMSUVANGUARD.COM PORTLAND STATE UNIVERSITY PUBLISHED SINCE 1946 PORTLAND STATE UNIVERSITY PUBLISHED SINCE 1946 TUESDAY, APRIL 3, 2012 • VOL. 66 NO. 45 New PSU Oregon MESA receives $216,000 Entrepreneurial Center hits the grant for invention education ground running Lemelson Foundation grant to Executive Director Shelley help MESA expand Gunton aims to help students turn ideas into reality programs across SaM LLOYD Oregon VANGUARD STAFF AUSTEN RUZICka The Portland State University Center for VANGUARD STAFF Innovation and Entrepreneurship has a single staff member: Executive Director Shelley Gunton. regon Mathematics, Engineering, But with extensive experience in growing busi- Science and Achievement recently nesses from ideas, Gunton knows how to get O received a $216,000 grant from the things off the ground, and her sights are set on Portland-based Lemelson Foundation to ex- launching the new center, which will act as a pand its focus on invention education. MESA hub for students, faculty, staff and anyone seek- programs provide early pathways for the next— ing to start a business. and future—generation of engineers and scien- Gunton, who has been involved in the field tists, giving support and tools to Oregon middle of entrepreneurship extensively since 2005, and high school students. Its programs teach stepped into her role as executive director of the students in the early stages of their educational COURTESY OF DAVID CORONADO/OREGON MESA MESA Day Ockley Green School students showcase their wind energy designs to judges. -

Second Lien Sewer System Revenue Bonds, 2010 Series A

NEW ISSUECOMPETITIVE RATINGS: BOOK-ENTRY ONLY Moody’s Aa3 Standard & Poor’s AA In the opinion of K&L Gates LLP, Portland, Oregon, Bond Counsel, assuming compliance with certain covenants of the City, interest on the 2010 Series A Bonds is excludable from gross income of the owners of the 2010 Series A Bonds for federal income tax purposes under existing law. Interest on the 2010 Series A Bonds is not an item of tax preference for purposes of the federal alternative minimum tax imposed on either individuals or corporations and is not included in adjusted current earnings for the purpose of computing the federal alternative minimum tax imposed on certain corporations. In the opinion of Bond Counsel, interest on the 2010 Series A Bonds is exempt from Oregon personal income tax under existing law. See “Tax Matters” herein for a discussion of the opinion of Bond Counsel. City of Portland, Oregon $407,850,000 Second Lien Sewer System Revenue Bonds 2010 Series A BASE CUSIP: 736742 DATED: Date of Delivery DUE: As shown on inside cover The Second Lien Sewer System Revenue Bonds, 2010 Series A (the “2010 Series A Bonds”) will be issued in registered book-entry form only, in denominations of $5,000 or integral multiples thereof. The 2010 Series A Bonds, when executed and delivered, will be registered in the name of Cede & Co., as the registered owner and nominee for The Depository Trust Company, New York, New York (“DTC”). DTC will act as securities depository for the 2010 Series A Bonds. While Cede & Co. is the registered owner of the 2010 Series A Bonds (the “Owner”) as nominee of DTC, references herein to the Bondowners shall mean Cede & Co., as aforesaid, and shall not mean the Beneficial Owners of the 2010 Series A Bonds. -

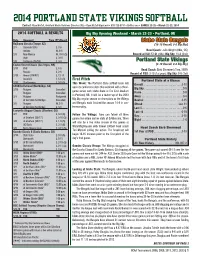

2014 Portland State Vikings Softball

2014 PORTLAND STATE VIKINGS SOFTBALL Contact: Ryan McCall, Assistant Media Relations Director (SB) • [email protected] • 503-725-5744 • GoViks.com • GAMES 23-25 • March 22-23, 2014 2014 SOFTBALL & RESULTS Big Sky Opening Weekend • March 22-23 • Portland, OR Date Opponent Time (PT)/Result Idaho State Bengals Kajikawa Classic (Tempe, AZ) (15-10 Overall, 0-0 Big Sky) 2/7 Colorado State L, 2-6 Indiana W, 8-6 Head Coach: Julie Wright (Ohio, ‘95) 2/8 New Mexico W, 10-0 (5) Record at ISU: 57-91 (4th); Big Sky: 14-4 (2nd) Utah L, 3-10 2/9 California [24/24] L, 3-8 Portland State Vikings Easton Desert Classic (Las Vegas, NV) (3-19 Overall, 0-0 Big Sky) 2/14 BYU L, 4-5 Head Coach: Barb Sherwood (Troy, 1999) Nevada L, 2-6 Record at PSU: 3-19 (1st year); Big Sky: 0-0 (1st) 2/15 Hawaii [RV/RV] L, 12-13 Seattle U L, 5-6 (9) First Pitch Portland State at a Glance 2/16 Chattanooga L, 3-9 (5) This Week: The Portland State softball team will CSUN Invitational (Northridge, CA) Overall . 3-19 open its conference slate this weekend with a three- Big Sky . .0-0 2/28 Rutgers Cancelled game series with Idaho State at Erv Lind Stadium Rutgers Cancelled Home . 0-0 3/1 Rutgers Postponed in Portland, OR. It will be a match-up of the 2013 Away . .0-4 at Cal State Northridge Cancelled Big Sky regular season co-champions as the Vikings Neutral . -

PSU's Viking Football's Defeated Angelo State in the Moreno, Linebacker Jeff Bockert, Regular Schedule Included Five First Round of the Playoffs

Portland State University PDXScholar University Archives: Campus Publications & The iV king (Yearbooks) Productions 1995 Viking 1995 Portland State University Let us know how access to this document benefits ouy . Follow this and additional works at: http://pdxscholar.library.pdx.edu/viking Part of the Higher Education Commons, and the United States History Commons Recommended Citation Portland State University, "Viking 1995" (1995). The Viking (Yearbooks). Book 37. http://pdxscholar.library.pdx.edu/viking/37 This Book is brought to you for free and open access. It has been accepted for inclusion in The iV king (Yearbooks) by an authorized administrator of PDXScholar. For more information, please contact [email protected]. UNIVERSITY STATE Vi iking Yearbook Magazine Jenna L. Clausen editor Jennifer L. Peterson assistant editor T.R. Wood Vanguard File Photos photography Lois Breedlove advisor PORTLAND 1 T 2 Viking Yearbook Magazine 1994-1995 Opening 4 A View of the World 10 People 36 Sports 58 Features 90 The Arts 102 Final Words 174 3 Photo by T.R. Wood 5 6 Vanguard File Photo Vanguard File Photo 8 Vanguard File Photo 10 A view of the he first reports were surprising enough: OJ. behind at a discreet distance heeding a warning from Simpson was suspected in the brutal slashing Simpson's driver that O.J. had a gun. murder of his ex-wife Nicole and her friend, As a national television audience watched— TRonald Goldman. virtually all network programming was pre-empted— O.J. Simpson had always lived life on camera, Simpson's white Bronco moved hypnotically along the first as a football star, then as a sportscaster, fabled freeways. -

College Football Conferences

Big 12 College 6Ohio State Buckeyes Football 4Oklahoma Sooners Conferences ACC 7Michigan Wolverines 15Texas Longhorns 2Clemson Tigers 12Penn State Nittany Lions FBS (Division I-A) 24Iowa State Cyclones 20Syracuse Orange Michigan State Spartans (Athletic Scholarships) 16West Virginia Mountaineers NC State Wolfpack Maryland Terrapins American Athletic TCU Horned Frogs Boston College Eagles Indiana Hoosiers Houston Cougars Baylor Bears Florida State Seminoles Rutgers Scarlet Knights Memphis Tigers Kansas State Wildcats Wake Forest Demon Deacons 22Northwestern Wildcats Tulane Green Wave Texas Tech Red Raiders Louisville Cardinals Wisconsin Badgers SMU Mustangs Oklahoma State Cowboys Pittsburgh Panthers Purdue Boilermakers Navy Midshipmen Kansas Jayhawks Georgia Tech Yellow Jackets Iowa Hawkeyes Tulsa Golden Hurricane Virginia Cavaliers Nebraska Cornhuskers 8UCF Knights Miami Hurricanes Minnesota Golden Gophers Temple Owls Virginia Tech Hokies Illinois Fighting Illini Cincinnati Bearcats Duke Blue Devils South Florida Bulls North Carolina Tar Heels East Carolina Pirates UConn Huskies Conference USA Big Ten UAB Blazers North Texas Mean Green Toledo Rockets San Diego State Aztecs California Golden Bears Oregon State Beavers Louisiana Tech Bulldogs Western Michigan Broncos UNLV Rebels 17Utah Utes San Jose State Spartans Southern Mississippi Golden Eagles Ball State Cardinals 25Boise State Broncos Arizona State Sun Devils Central Michigan Chippewas UTSA Roadrunners Buffalo Bulls Utah State Aggies USC Trojans UTEP Miners Miami (OH) RedHawks -

2019-20 Portland State Women's Basketball Opponents

BIG SKY CONFERENCE The Big Sky Conference enters its 67th year and 32nd year of women’s competition during CONFERENCE DIRECTORY & INFORMATION the 2019-20 academic year. The venerable Division I Big Sky Conference Mailing and Street Address: observed its 50th birthday on July 1, 2013. 286 South, 200 West Four of the current league members – Idaho Suite #110 State University, The University of Montana, Farmington, UT 84025 Montana State and Weber State – have been Phone: (801) 392-1978 with the league since its birth. Fellow charter Fax: (801) 392-5568 member the University of Idaho returned most www.bigskyconf.com of its sports to the Big Sky on July 1, 2014. Northern Arizona University enters its 48th Founded: 1963 season in the league, giving the league five Affiliation: NCAA I members with at least 40 years of continuous membership. Sports Sponsored The Big Sky Conference welcomed MEN: Cross Country, Football*, Basketball*, Indoor Track & Field, Outdoor Track & Field, Southern Utah as a full member on July 1, Tennis*, Golf* Big Sky 2012 as full members. UC Davis and Cal Poly WOMEN: Cross Country, Volleyball*, Basketball*, Indoor Track & Women’s joined as football affiliate members. Eastern Field, Outdoor Track & Field, Golf*, Tennis*, Soccer*, Softball* Basketball Washington University, the University of Membership Northern Colorado, Portland State University * Conference champion receives automatic bid to NCAA Tournament E. Washington and Sacramento State round out the current Idaho membership. Commissioner: Tom Wistrcill Idaho State The league has become one of the strongest Deputy Commissioner: Dan Satter Montana Division I conferences in the West and is a Senior Associate Commissioner/Compliance/Governance/SWA: Montana State national leader in the Football Championship Jaynee Nadolski Northern Arizona Subdivision.