TCFD Climate Change Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vedanta Refer to Important Disclosures at the End of This Report

India Equity Research | Metals & Mining October 5, 2020 Result Update Vedanta Refer to important disclosures at the end of this report Q1 beats estimates; promoter entities dip in CIHL cash pool before delisting CMP: Rs 137 TP: Rs 170 (▲) Rating: BUY (■) Upside: 23.7 % as of (October 4, 2020) 12 months . Cairn India Holdings Ltd, a 100% subsidiary of Vedanta Ltd (Ved Ltd), has provided a loan Change in Estimates of Rs23.11bn to promoter entity Vedanta Resources (Ved Plc) which can extend up to EPS Chg FY21E/FY22E (%) -/ Rs79.05bn ($1.05bn) in loans and guarantees. Contours of the transaction are awaited. Target Price change (%) 33.9 . Ved Ltd is treating this loan as cash in its books, even though the money has been Target Period (Months) 12 transferred outside its books, which we believe is not the best way of accounting loans Previous Reco BUY given to parent. Emkay vs Consensus EPS Estimates . Management has reduced Rs42.76/sh of book value in Ved Ltd books through the write- off of a substantial portion of the O&G book despite Brent hovering around $43/bbl. But FY21E FY22E advance given to promoter entity KCM is treated as recoverable despite the appointment Emkay 5.7 18.2 of a provisional liquidator in KCM. Consensus 7.1 15.0 Mean Consensus TP (12M) Rs 148 . Maintain Buy with a revised TP of Rs170 as delisting price target as we remove the 30% holdCo discount which we applied in the past for the valuation of Ved Ltd as a listed entity Stock Details on SoTP basis. -

Vedanta Limited and Cairn India Revise Terms for Merger

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION 22 July 2016 VEDANTA LIMITED AND CAIRN INDIA REVISE TERMS FOR MERGER Vedanta Limited, Cairn India Limited (“Cairn India”) and Vedanta Resources plc (“Vedanta plc” together with its subsidiaries, the “Group”), today announce revised and final terms to the recommended merger between Vedanta Limited and Cairn India (the “Transaction”), that was announced on 14 June 2015. Key Highlights o The Boards of Vedanta Limited and Cairn India have today approved revised and final terms for the Transaction, taking into account prevailing market conditions and having regard to underlying commercial factors. o Pursuant to the revised and final terms, each Cairn India minority shareholder will receive for each equity share held: - 1 equity share in Vedanta Limited; and - 4 Redeemable Preference Shares with a face value of INR 10 in Vedanta Limited, with a coupon of 7.5% and tenure of 18 months from issuance. - Implied premium of 20% to one month VWAP of Cairn India share price. o The recent commodity price environment has further strengthened the strategic rationale of the Transaction outlined at the announcement: - Diversified Tier-I portfolio de-risks earnings volatility and drives stable cash flows through the cycle. - Strong historical evidence over the last 10 years, of diversified resources companies generating total shareholder returns superior to single-commodity companies. - Improved ability to allocate capital to the highest return projects across the portfolio. -

Provisional Rea Mar16.Pdf

Western Regional Power Committee Page:A-1(1/7) REGIONAL ENERGY ACCOUNT UNDER ABT FOR MARCH 2016 No: WRPC/Comml-I/3/ABTREA/2016/ 3.0 Dated: 6 th April 2016 DETAILS OF AVAILABILITY/ENTITLEMENT FIGURES IN RESPECT OF NTPC STATIONS IN WR FOR THE MONTH OF MARCH 2016 Station KSTPS VSTPS 1 VSTPS 2 VSTPS 3 Kawas GPS Gandhar GPS SSTPS-II KSTPS-III NSPCL Sipat-I RGPPL VSTPS#4 MAUDA Plant Availability Factor (%) for MARCH 2016 95.2910 98.6383 95.5684 101.3365 98.4253 99.0109 102.2019 100.0287 56.3423 98.9473 0.0000 94.1670 100.6719 Cumulative Plant Availability Factor (%) up to MARCH 2016 90.4582 91.5769 88.3867 93.5932 100.4661 99.6250 96.1324 88.3138 93.4200 87.8533 0.0000 94.6820 97.4164 0.072143 853,070,400 695,640,000 695,640,000 473,566,416 474,425,215 699,360,000 Entitlement (KWH)/ Station Percentage (%) maQya p`doSa C<aIsagaZ gaaovaa dmana dIva dadra nagar hvaolaI [ndaOr saOja HVDC HVDC Maharashtra (NVVN JAMMU & NVVN-POWER kula Total gaujarat GUVNL MP PTCL CSEB maharaYT/ MSEDCL GOA DD DNH INDORE SEZ VINDHYACHAL BHADRAWATI SAIL BHILAI Coal Power) KASHMIR A/C BPDB Entitlement (KWH) 1,389,372,500 238,178,504 318,444,359 138,937,250 440,344,950 140,210,031 32,639,521 35,711,742 - KSTPS 2,538,383 6838492 26464767 Percentage (%) 100.0000 17.1429 22.9200 10.0000 31.6938 10.0916 2.3492 2.5704 0.0000 0.1827 0.4922 1.9048 Entitlement (KWH) 841,454,004 153,599,013 295,756,305 - 306,925,124 24,521,983 8,911,193 29,533,572 - 507,396 1,682,908 1,570,154 VSTPS 1 6160285 6678621 Percentage (%) 100.0000 18.2540 35.1483 0.0000 36.4756 2.9142 1.0590 3.5098 -

Credit Research Challenge 2017-18 Team 149

Credit Research Challenge 2017-18 Team 149 1 AA+ Executive Summary Business Risk – Good Solvency – Good The businesses are fairly diversified both Paid up a significant amount of its debt recently geographically and in terms of product offering and increased its D-to-E from 0.63 to 0.48 Compliance with the changing policies Operating current ratio has also improved from regarding environmental and legal aspects 0.45 to 0.52 Ability to maintain, retain and acquire new Ability to meet debt payments as DSCR has mining licenses across different metals increased from 2.19 to 3.53 Distance to Default – Good AA+ Outlook – Stable Vedanta has a probability of default of 4%, which has increased in the recent 2-3 years. However, it Steady capital expenditure to increase capacity still seems under control and aim to reduce the debt in the future Debt Covenants: Recent acquisition of Cairn to bring in fresh revenues and improve diversification Debt/EBITDA = 1.17 < 3.75 Strong Corporate Governance policy (UK CG EBITDA/ Interest Expense = 3.64 > 3 Code since 2014) NA / Debt = 3.18 > 1.4 2 AA+ Our Agenda Business Description Industry Overview & Competitive Positioning Investment Summary Management and Corporate Governance Capital Structure Liquidity Analysis Financial Analysis Credit Rating Matrix and KMV Model 3 AA+ Business Description Vedanta Limited is a subsidiary of Vedanta Resources (50.1% stake) and is into 6 diversified businesses Vedanta Resources’ Copper, Iron ore, COPPER Power and Aluminum sites in Jharsuguda and Lanjigarh are -

NSE Circular

Circular NSE National Stock Exchange of India Limited DEPARTMENT : LISTING Download Ref. No.: NSE/CML/43417 Date : February 03, 2020 Circular Ref. No.: 0127/2020 To All Members, Sub: Listing of privately placed securities on the debt market segment of the Exchange In pursuance of Regulation 3.1.1 of the National Stock Exchange Debt Market (Trading) Regulations, it is hereby notified that the privately placed debt instruments as specified in the Annexure, have been admitted to dealings on the Debt Market Segment of the Exchange with effect from today, the designated security codes thereof shall be as specified in Annexure. For and on behalf of National Stock Exchange of India Limited Amit Phatak Deputy Manager Toll Free Number 1800 266 0058 ANNEXURE 1. Fresh Issue a. Commercial Papers Name of the Company Vedanta Limited Security Description VL CP 30/03/20 Sr. 778 Sec Type CP Security VL Issue 300320 Series Sr. 778 ISIN INE205A14US0 No. of Securities/Quantity 5000 Face Value 500000 Issue Price 495237 Date of Allotment 31-Jan-2020 Date of Redemption 30-Mar-2020 Name of the Company Coromandel International Limited Security Description CIL CP 30/03/2020 Sec Type CP Security CIL Issue 300320 Series - ISIN INE169A14GH0 No. of Securities/Quantity 6000 Face Value 500000 Issue Price 495670 2 Date of Allotment 31-Jan-2020 Date of Redemption 30-Mar-2020 Name of the Company Vedanta Limited Security Description VL CP 31/03/20 Sr. 779 Sec Type CP Security VL Issue 310320 Series Sr. 779 ISIN INE205A14UR2 No. of Securities/Quantity 10000 Face Value 500000 Issue Price 495157 Date of Allotment 31-Jan-2020 Date of Redemption 31-Mar-2020 Name of the Company Vedanta Limited Security Description VL CP 30/04/20 Sr. -

Disposed Mining Plan Received Between 21/08/2015 and 20/08/2016

DISPOSED MINING PLAN RECEIVED BETWEEN 21/08/2015 AND 20/08/2016 Sl.No. Name of Mining plan,Id No. Date of Date of Date of Approved/Not approved Remark for non_approval and Owner Receipt receipt of Disposal modified copy Ajmer regional office 1 MORAK (02/76) 24/09/2015 28/01/2016 10/06/2016 Approved MCR-1631 MANGLAM CEMENTS LIMITED 2 DHEDWAS 15/10/2015 29/04/2016 18/05/2016 Approved MCR-1632 JINDAL SAW LIMITED 3 LAMPIYA 627/05 15/10/2015 06/01/2016 04/04/2016 Approved MCR-1633 JINDAL SAW LIMITED 4 RAJSHREE -II 03/11/2015 08/01/2016 08/06/2016 Approved MCR-1634 ULTRA TECH CEMENT LIMITED 5 BAGHOLI (10/98) 03/11/2015 22/02/2016 18/05/2016 Not approved MCR-1635 NILKANTH CONCAST PVT. LTD. 6 KAYAR 03/11/2015 20/05/2016 Approved SOM- 631 HINDUSTAN ZINC LTD. 7 PAWANA 02/95 01/01/2016 18/06/2016 12/07/2016 Approved MCR-1636 NAND LAL AGARWAL & SONS 8 NARDA 04/01/2016 14/03/2016 21/06/2016 Not approved dUE TO NOT COMPLIANCE OF ALL THE MCR-1637 SCRUTINY POINTS. PRATEEK INDUSTRIES 9 KHERATALA 25/01/2016 04/05/2016 14/06/2016 Approved MCR-1639 WOLKEM INDUSTRIES LTD 10 DHULKHERA 12/02/2016 26/05/2016 13/06/2016 Approved MCR-1640 STEEL AUTHORITY OF INDIA LIMITED 11 Marwad - Mundwa 03/94 01/03/2016 28/07/2016 Not approved DUE TO NON SUBMISSION OF FINAL COPIES MCR-1642 AMBUJA CEMENT LTD 12 NAD 12/98 01/03/2016 08/07/2016 01/08/2016 Not approved DUE TO TECHNICAL CORRECTION. -

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

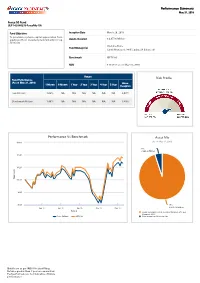

Risk Profile Performance Vs Benchmark Asset Mix Performance Summary

Performance Summary May 31, 2019 Focus 50 Fund ULIF 142 04/02/19 FocusFifty 105 Fund Objective: Inception Date March 20, 2019 To provide long-term capital appreciation from ₹ equity portfolio invested predominantly in top Assets Invested 4,877.6 Million 50 stocks Jitendra Arora Fund Manager(s) Funds Managed: 34 (6 Equity, 28 Balanced) Benchmark NIFTY 50 NAV ₹ 10.2675 as on May 31, 2019 Return Risk Profile Fund Performance (As on May 31, 2019 ) Since 1 Month 6 Month 1 Year 2 Year 3 Year 4 Year 5 Year Inception Fund Return 1.22% NA NA NA NA NA NA 2.68% Benchmark Return 1.49% NA NA NA NA NA NA 3.49% Performance Vs Benchmark Asset Mix (As on May 31, 2019) 10.60 5% ₹ 240.27 Million 10.40 10.20 ) ₹ V in ( NA 10.00 9.80 9.60 95% Apr 19 Apr 19 Apr 19 May 19 May 19 ₹ 4637.30 Million Period Equity and Equity related securities Minimum 90% and Maximum 100% Focus 50 Fund NIFTY 50 Debt Instruments Maximum 10% Details are as per IRDAI Product Filing. Returns greater than 1 year are annualized. Past performance is not indicative of future performance. Performance Summary May 31, 2019 % of Invested Top 10 Sectors * Assets Financial and insurance activities 23.75% Computer programming consultancy and related activities 13.30% Manufacture of coke and refined petroleum products 10.69% Infrastructure 7.91% Manufacture of tobacco products 5.08% Manufacture of chemicals and chemical products 4.85% Manufacture of motor vehicles trailers and semi-trailers 3.89% Manufacture of pharmaceuticalsmedicinal chemical and botanical 2.26% products Manufacture of other transport equipment 2.19% Manufacture of Basic Metals 1.98% OTHERS 24.10% *As per IRDAI NIC industry classification Details are as per IRDAI Product Filing. -

Disposed Mining Plan Received Between 21/11/2014 and 20/11/2015

DISPOSED MINING PLAN RECEIVED BETWEEN 21/11/2014 AND 20/11/2015 Sl.No. Name of Mining plan,Id No. Date of Date of Date of Approved/Not approved Remark for non_approval and Owner Receipt receipt of Disposal modified copy Ajmer regional office 1 PATELI 21/2014 26/11/2014 18/02/2015 13/03/2015 Not approved Returned to applicant as mineral is MCR-1555 declared under minor mineral category. MAA SHARDA MINES AND MINERALS 2 GUNGA 88/2014 26/11/2014 18/02/2015 06/04/2015 Approved MCR-1556 KALAVATI DEVI W/O LALIT KUMAR 3 LUNIYAS 16/2012 28/11/2014 02/03/2015 18/03/2015 Not approved Returned to party as mineral is MCR-1557 declared under minor mineral category MAHA LAXMI MINES AND MINERALS 4 DHARVI 90/2012 03/12/2014 17/03/2015 17/04/2015 Approved MCR-1558 NAINARAM JATIYA 5 PATELI(24/2014) 18/12/2014 18/02/2015 13/03/2015 Not approved Returned to applicant as mineral is MCR-1559 declared under minor mineral category. SACHIYAY MATA MINES & MINERALS 6 DHARVI (NETRON KI DHANI) 22/12/2014 16/04/2015 19/05/2015 Approved MCR-1560 PRAKASH KANWAR W/O JITENDRA SINGH RATHOR 7 JASE KA GAON 22/12/2014 16/04/2015 08/05/2015 Approved MCR-1561 INDU DEVI W/O RAMESWAR PAREEK 8 DIPAS 140/11 30/12/2014 10/04/2015 25/05/2015 Approved MCR-1562 M/S OJASWAI MARBLES & GRANITES PVT. LTD. 9 INDAWER 42/14 30/12/2014 16/02/2015 17/03/2015 Not approved Returnde to the party as mineral is MCR-1563 declared under the minor minerals NARSINGH RAM JAT catagory 10 INDAWER 43/14 30/12/2014 19/02/2015 17/03/2015 Not approved Returned to the party as mineral is MCR-1564 declared under -

About Vedanta Limited (Formerly Sesa Sterlite Limited.)

Vedanta Limited (Formerly known as Sesa Sterlite Ltd./ Sesa Goa Ltd.) Regd. Office: Vedanta Limited 1st Floor, ‘C’ wing, Unit 103, Corporate Avenue, Atul Projects, Chakala, Andheri (East), Mumbai 400093, Maharashtra, India. www.vedantalimited.com CIN: L13209GA1965PLC000044 ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- PRESS RELEASE Vedanta Samaritans rescue 40 Tourists in Goa 40 tourists on March 10th 2007 were enjoying the beauty of Goa in the tourist boat named Pascoal II which operates from Daula Paula to Bat Island but to their bad luck the tourist boat engine failed in the middle of the sea and it started to drift into sea with heavy rolling. Luckily at the same time Vedanta’s Launch names Sonshi was returning from the Transhipper and spotted the tourist in distress who were frantically waving for help. Vedanta’s barge Master Sricanta Gaonkar realized the precarious situation of tourist boat and immediately went towards them for help. He safely approached the boat Pascoal II & secured the boat to the Sonshi’s stern with a rope, immediately informed Vedanta control office, who in turn alerted Mormugao Port Signal Station control. Finally the day was saved, the tourist were successfully rescued, and they arrived at the jetty and were received by the Harbor Police and the Fire brigade. Master Sricanta Gaonkar and crew of Vedanta’s launch Sonshi were thanked by all and sundry for saving lives of so many people. In life we all aspire to be heroes but only few have the courage. Master Sricanta Gaonkar and his crew, Driver Mr.Santosh Adharkar, Assitant Driver Mr. Dipin Morzo, Sailor Mr. Roldao Dias, Sailor Mr. -

Arising out of SLP (Civil) No.7172 of 2020) GOVERNMENT of INDIA …APPELLANTS Versus 1

REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 3185 OF 2020 (Arising out of SLP (Civil) No.7172 of 2020) GOVERNMENT OF INDIA …APPELLANTS Versus 1. VEDANTA LIMITED (Formerly Cairn India Ltd.) 2. RAVVA OIL (SINGAPORE) PTE. LTD. 3. VIDEOCON INDUSTRIES LIMITED … RESPONDENTS J U D G M E N T INDEX I Background Facts 2 II Relevant Terms of the Production Sharing Contract 3 III Genesis of Dispute 8 IV Challenge to the Award before the Seat Courts at Kuala Lumpur 13 V Submissions on behalf of the Appellants 15 VI Submissions on behalf of the Respondents 22 VII Discussion and Analysis 28 Part A Limitation for filing an enforcement/ execution petition of a foreign 28 award under Section 47 of the 1996 Act Part B Scheme of the 1996 Act for enforcement of New York Convention 37 awards Part C Whether the Malaysian Courts were justified in applying the 44 Malaysian law of public policy while deciding the challenge to the foreign award? Part D Whether the foreign award is in conflict with the Public Policy of 54 India? 1 INDU MALHOTRA, J. Leave granted. The present Civil Appeal has been filed by the Government of India to challenge the Judgment and Order dated 19 February 2020 passed by the Delhi High Court, wherein the application under Section 48 of the Arbitration and Conciliation Act, 1996 being I.A. No. 3558 of 2015 filed by the Government of India has been dismissed; the Application filed under Section 47 read with 49 being O.M.P. -

Sterlite Industries (India)

Vedanta Limited Regd. Office: Vedanta Limited 1st Floor, ‘C’ Wing, Unit 103, Corporate Avenue, Atul Projects, Chakala, Andheri (East), Mumbai 400093, Maharashtra. www.vedantalimited.com CIN: L13209MH1965PLC291394 th 29 January 2021 Vedanta Limited Consolidated Results for the Third Quarter ended 31st December 2020 EBITDA for Q3 FY2021 of ₹ 7,695 crores, up by 18% q-o-q and y-o-y, highest in last 11 quarters Attributable PAT (before exceptional items and tax on dividend) of ₹ 3,017 crores, up 51% q-o-q Mumbai, India: Vedanta Limited today announced its unaudited consolidated results for the Third quarter (Q3) and Nine Months ended 31st December 2020. Financial & Corporate Highlights • Strong financial performance in Q3 FY2021 o Revenues of ₹ 22,498 crores, up 8% q-o-q, primarily due to increase in commodity prices and higher sales at Aluminium, Iron ore and Steel business o Robust EBITDA margin1 of 39%, highest in last 4 years o EBITDA of ₹ 7,695 crores, up 18% q-o-q and y-o-y, highest quarterly performance for > 2 years o Attributable PAT (before exceptional items and tax on dividend) of ₹ 3,017 crores, up 51% q-o-q • Strong Balance Sheet o Continuing double-digit Return on Capital Employed (ROCE) of c. 13% o Net Debt/EBITDA at 1.5x, maintained at low level o Liquidity position with total cash & cash equivalents at ₹ 27,055 crores Registered Office: Vedanta Limited 1st Floor, ‘C’ Wing, Unit 103, Corporate Avenue, Atul Projects, Chakala, Page 1 of 10 Andheri (East), Mumbai 400093, Maharashtra, India. CIN: L13209MH1965PLC291394 Sensitivity: