Oicci Publications 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 (8Th Session) NATIONAL ASSEMBLY SECRETARIAT

1 (8th Session) NATIONAL ASSEMBLY SECRETARIAT ———— “QUESTIONS FOR ORAL ANSWERS AND THEIR REPLIES” to be asked at a sitting of the National Assembly to be held on Wednesday, the 20th February, 2019 1. *Mr. Junaid Akbar: Will the Minister for Religious Affairs and Inter-faith Harmony be pleased to state whether there is any proposal under consideration of the Government to give subsidy on Hajj; if so, the details; if not, the reasons thereof? Minister for Religious Affairs and Interfaith Harmony (Mr. NoorulHaq Qadri): No. Hajj being one of the pillars of Islam, is mandatory for only those Muslims who are financially and physically able to do so. 2. *Prof. Dr. Shahnaz Baloch: Will the Minister for Industries and Production be pleased to state: (a) the steps taken by the Government to promote new industries including cottage in Balochistan; (b) the steps taken by the Government for employment of the people of Balochistan in cottage and new industries; (c) whether it is a fact that no new industry has been established in Balochistan; if so, the reasons thereof; and (d) whether Federal Government has any plan in this regard? Reply not received. 2 3. *Mr. Ali Gohar Khan: Will the Minister for Industries and Production be pleased to state the reasons for not paying the outstanding amounts to the contractors who are supplying merchandise to the Utility Stores? Minister for Industries and Production: The underlined idea for creating Utility Stores Corporation (USC) was to facilitate the low income group of the society by providing subsidized provisions and stores. -

PAKISTAN NEWS DIGEST July 2020

July 2020 PAKISTAN NEWS DIGEST July 2020 A Select Summary of News, Views and Trends from the Pakistani Media Prepared by Dr. Zainab Akhter Dr. Nazir Ahmad Mir Dr. Mohammad Eisa Dr. Ashok Behuria MANOHAR PARRIKAR INSTITUTE FOR DEFENCE STUDIES AND ANALYSES 1-Development Enclave, Near USI Delhi Cantonment, New Delhi-110010 PAKISTAN NEWS DIGEST, July 2020 CONTENTS POLITICAL DEVELOPMENTS ........................................................................... 06 ECONOMIC ISSSUES............................................................................................ 08 SECURITY SITUATION ........................................................................................ 11 PROVINCES ®IONS Balochistan ................................................................................................................. 13 GB ................................................................................................................................ 15 URDU & ELECTRONIC MEDIA Urdu ............................................................................................................................ 20 Electronic .................................................................................................................... 27 STATISTICS BOMBINGS, SHOOTINGS AND DISAPPEARANCES ...................................... 29 MP-IDSA, New Delhi 1 POLITICAL DEVELOPMENTS Dangerous delusions, Zahid Hussain, Dawn, 01 July1 Speaking at a dinner for coalition lawmakers recently, the prime minister had boasted: “we are the only choice”. Maybe -

Briefs PTI Senators Receiving Bribe Offers, Says PM

Soon From LAHORE & KARACHI A sister publication of CENTRELINE & DNA News Agency www.islamabadpost.com.pk ISLAMABAD EDITION IslamabadTuesday, March 09, 2021 Pakistan’s First AndP Only DiplomaticO Daily STPrice Rs. 20 First Lady attends NCOC to review Meghan Markle Serena Hotels’ Int’l its decision on accuses royal Women Day event reopening schools family of racism Detailed News On Page-08 Detailed News On Page-08 Detailed News On Page-01 Briefs PTI senators Govt to empower receiving bribe women DNA offers, says PM ISLAMABAD: Federal Minister for Infor- “These people first spend money to get mation and Broadcast- elected and then spend the same money ing Senator Shibli Faraz [on illegal activities],” said PM Imran said on Monday that em- powerment of women aNSaR mahmooD Bhatti was imperative to make Govt has ‘solid society civilized and en- ISLAMABAD: The election for the post of lightened. In a tweet on Senate chairperson hasn’t already begun evidence’ of the occasion of Interna- and PTI senators are being offered money tional Women’s Day he to sell their votes, claimed Prime Minister corruption said, “We are committed Imran Khan on Monday. The prime minis- to empowering women in ter was chairing a meeting of the party’s zuBaiR ahmeD society by ensuring equal members where he said that the recent- opportunities and rights ISLAMABAD: European Union’s Ambassador to Pakistan, Ms. Androulla Kaminara ly-held Senate elections proved the suspi- ISLAMABAD: The government will pres- called on President Dr Arif Alvi, at Aiwan-e-Sadr. – DNA for development”. He said cions that the PTI government had. -

KPT Newsletter April-June Page 1

CONTENTS Federal Minister for Maritime Affairs inaugurated 02 the launch of Seafarers Card at KPT Head Office Federal Minister for Railways inaugurated 04 containers Freight Train Service Thailand BOI Delegation held meeting 05 with Chairman KPT KPT Anti-Encroachment Cell performed 06 active operations 08 Training Courses / Activities 10 Picture Gallery 12 KPT Handled Deepest Draught Vessel 13 Port Operation 14 Sports 16 Opinions FROM THEEDITOR’S DESK Shariq Amin Farooqi arachi Port Trust (KPT), squaring well at the end of the last quarter of the K scal year 2018-19, sails towards success while remaining on growth trajectory. Port Operations have shown improvement during the ending quarter as KPT handled a record of 18900 tons of rock phosphate during the 24 hours operations on 7th April. KPT has also handled the deepest 15.4 meters draught vessel at South Wharf terminal "SAPT" during the ending last quarter of scal year 2018-19. Containers freight train service also has commenced operations from Karachi Port to further facilitate the trade community. Remaining cognizant of the hardships faced by Pakistani Seafarers, KPT has provided space to NADRA for the launch of machine readable seafarers’ identity document facility centre at KPT Head Oce. NADRA has completely equipped the facility in accordance with the ILO Convention "C-185" to facilitate Pakistani Seafarers. Delegation visiting KPT is a regular feature, Thai Board of Investment delegation visited KPT during the ending quarter and took keen interest in future project endeavors of KPT. Situation evolving under CPEC regime oers lucrative investment prospects to the investors. Compliments to the KPT players who have shown nesse, skills and sporting temperament to win national games represented Pakistan and won medals in games, like Martial Arts, Kick Boxing and Badminton. -

Sl. No Constituency Name of Member Status 1 NA-1 Moulana Abdul Akbar Chitrali P 2 NA-2 Dr

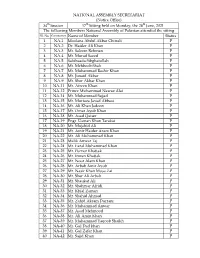

NATIONAL ASSEMBLY SECRETARIAT (Notice Office) 34th Session 4th Sitting held on Friday, the 11th June, 2021 The following Members National Assembly of Pakistan attended the sitting Sl. No Constituency Name of Member Status 1 NA-1 Moulana Abdul Akbar Chitrali P 2 NA-2 Dr. Haider Ali Khan P 3 NA-3 Mr. Saleem Rehman P 4 NA-4 Mr. Murad Saeed P 5 NA-5 Sahibzada Sibghatullah P 6 NA-6 Mr. Mehboob Shah P 7 NA-7 Mr. Muhammad Bashir Khan P 8 NA-8 Mr. Junaid Akbar P 9 NA-9 Mr. Sher Akbar Khan P 10 NA-10 Mr. Ibadullah Khan P 11 NA-11 Mr. Afreen Khan P 12 NA-12 Prince Muhammad Nawaz Alai P 13 NA-13 Mr. Saleh Muhammad P 14 NA-14 Mr. Muhammad Sajjad P 15 NA-15 Mr. Murtaza Javed Abbasi P 16 NA-16 Mr. Ali Khan Jadoon P 17 NA-17 Mr. Omar Ayub Khan P 18 NA-18 Mr. Asad Qaiser P 19 NA-19 Engr. Usman Khan Tarakai P 20 NA-21 Mr. Amir Haider Azam Khan P 21 NA-22 Mr. Ali Muhammad Khan P 22 NA-23 Malik Anwar Taj P 23 NA-24 Mr. Fazal Muhammad Khan P 24 NA-25 Mr. Pervez Khattak P 25 NA-26 Mr. Imran Khattak P 26 NA-27 Mr. Noor Alam Khan P 27 NA-28 Mr. Arbab Amir Ayub P 28 NA-29 Mr. Nasir Khan Musa Zai P 29 NA-30 Mr. Sher Ali Arbab P 30 NA-31 Mr. Shaukat Ali P 31 NA-32 Mr. -

PM Wants Food Prices Reined in Within 15 Days

PM Wants Food Prices Reined In Within 15 Days ISLAMABAD: Taking notice of widespread criticism of the government over unprecedented inflation in the country, Prime Minister Imran Khan on Saturday directed the members of his economic team to take immediate steps to bring down the prices of basic food commodities — especially wheat, wheat flour, sugar, rice and pulses — within a fortnight, sources said. The directives were issued by the prime minister while presiding over a meeting at his Banigala residence which was attended by Adviser to the PM on Finance and Revenue Dr Abdul Hafeez Shaikh, federal Minister for Economic Affairs Hammad Azhar, federal Minister for Maritime Affairs Syed Ali Haider Zaidi, Special Assistant to the PM (SAPM) on Poverty Alleviation and Social Protection Dr Sania Nishtar, SAPM on Overseas Pakistanis and Human Development Zulfi Bukhari, senior Pakistan Tehreek-i-Insaf (PTI) leaders Jahangir Tareen and Shahbaz Gill, besides the chairman of the Utility Stores Corporation. One of the participants of the meeting quoted the prime minister as stating that if a government could not provide relief and basic commodities to the masses, it had no right to stay in power. Tells Meeting Inflation Is The Result Of ‘Corruption And Plundering’ Of Previous Governments In the meeting, the sources said, the participants reviewed the demand and supply position of the basic food items. They said the prime minister had categorically told the economic team that he wanted to see the prices of essential commodities coming down quickly and that he wanted results in just 15 days. Mr Khan was of the opinion that inflation was the result of “corruption and plundering” of the previous governments. -

PM Terms Karachi Country's Financial

3rd January, 2019 PM terms Karachi country’s financial hub ISLAMABAD: Terming Karachi as financial hub of the country, Prime Minister Imran Khan has announced to bring acceleration in work for the developmental projects being steered by the federal government in the metropolis. In high echelon meeting to discuss the projects currently undertaken by the federal government for Karachi at the Prime Minister Office (PMO) on Wednesday, the Prime Minster has assigned an Additional Secretary of the PMO to coordinate for bringing improvement and supervision of the pace of work in the federal government’s projects in Karachi. Sindh Governor Imran Ismail was present in the meeting. He will be point-man of the federal government for Karachi’s development. The meeting was also attended by Federal Ministers Asad Umar, Murad Saeed, Syed Ali Haider Zaidi, Khalid Maqbool Siddique, Faisal Wowda, member Sindh Assembly Samar Ali Khan, Chief Executive Karachi Infrastructure Development Company Limited Muhammad Saleh Farooqi, Secretary Communication Adnan Asdra and relevant other senior officials. The Prime Minister while maintaining that Karachi is financial hub of the country said that the city has pivotal role in country’s economy and its stability and progress. Imran Khan reminded that the federal government is fully aware of civic problems of Karachi, transport, potable water, sewerage, housing and other complexities. Political observers have reminded that Sindh’s PPP government had been resisting such moves in past since it considers such actions as encroachment on the jurisdiction of the provincial government. The Wednesday decision pertaining to Karachi has peculiar significance in the backdrop of ongoing tug of war between the federal and Sindh government on the question of disputed JIT report that has entangled ruling PPP leadership in various serious offences along with placing 172 individuals on exit control list (ECL). -

Monday, 14Th January, 2019

NATIONAL ASSEMBLY SECRETARIAT BULLETIN OF THE ASSEMBLY (7th SESSION) Date Monday, the 14th January, 2019 Commenced at 4.56 P.M. Adjourned at 8.07 P.M. Total working hours 02 Hour 36 Minutes Presided by Mr. Asad Qaisar, Speaker, National Assembly of the Islamic Republic of Pakistan. Attendance 270 1. TILAWAT, NAAT AND NATIONAL ANTHEM Tilawat by Qari Ibrar Hussain Naat by Syed Zeeshan National anthem PANEL OF CHAIRPERSONS In pursuance of sub-rule (1) of rule 13 of the Rules of Procedure and Conduct of Business in the National Assembly, 2007, the following members, in order of precedence, were nominated to form a Panel of Chairpersons for the 7th Session of the National Assembly:- 1. MS. MUNAZA HASSAN 2. MR. MOHAMMAD PERVAIZ MALIK 3. MR. ATTA ULLAH 4. SHAZIA MARRI 5. MR. IQBAL MUHAMMAD ALI KHAN 6. MR. MUHAMMAD ISRAR TAREEN FATEHA The House offered Fateha for the departed souls of,- (i) Syed Ali Raza Abidi, Ex-MNA; (ii) father of Mr. Noor-ul-Haq Qadri, Minister for Religious Affairs and Inter-Faith Harmony; (iii) Mr. Nasir Khan, Ex-MNA; and (iv) soldiers of Frontier Constabulary martyred in Balochistan. 1 QUESTIONS 2. Questions entered in a separate list to Questions No. 147, 151, 155, 8, 60 and 62 be asked and answers given. were asked and their answers given. LEAVE APPLICATIONS The leave applications of the Members who requested for grant of leave were read out by the honourable Speaker and granted. RESOLUTION PASSED BY THE NATIONAL ASSEMBLY Syed Amin-ul-Haq, MNA moved a resolution strongly condemning the murder of Syed Ali Raza Abidi, Ex-MNA and paying tribute to his services, which was unanimously adopted by House. -

Oicci Newsletter June 2020

OICCI NEWSLETTER JUNE 2020 OVERSEAS INVESTORS CHAMBER OF COMMERCE AND INDUSTRY Table of Contents Contents Page No. OICCI Managing Committee 2020 02 OICCI Managing Committee Members meet Prime Minister 05 Imran Khan OICCI Media Briefing for Senior Media Representatives in 07 Islamabad COVID-19 support measures by OICCI 09 Training session on Ease of Doing Business Survey by World 10 Bank, Board of Investment and Sindh Investment Department OICCI organizes session on ‘Creating a Gender Equal World’ 12 Key Highlights of OICCI Taxation Proposals for Federal Budget 14 2020-2021 OICCI Taxation Proposals: 2020-2021 Score Card 16 Post budget: Members concerns taken up with the ministry of 19 Finance and FBR OICCI for abolition of Sindh Development & Maintenance 20 Infrastructure Fee OICCI highlights issues with IPOP 20 Economic Indicators 21 1 | P a g e OICCI Managing Committee 2020 Shazad G. Dada – President until June 30, 2020 Chief Executive Officer, Standard Chartered Bank (Pakistan) Limited Haroon Rashid – Vice President (to become President as of July 1, 2020) Managing Director, Shell Pakistan Limited M. Abdul Aleem – Secretary General Overseas Investors Chamber of Commerce and Industry (OICCI) Irfan Siddiqui (to assume the role of Vice President as of July 1, 2020) President and Chief Executive Officer, Meezan Bank Limited 2 | P a g e Anis Ahmed Managing Director, Abbott Laboratories (Pakistan) Limited Asad Said Jafar Chairman & Chief Executive Officer, Signify Pakistan Limited Atsushi Fujii Chief Executive for Pakistan, Mitsubishi Corporation -

Thursday, the 10Th June, 2021 at 4.00 P.M

NATIONAL ASSEMBLY SECRETARIAT ORDERS OF THE DAY for the meeting of the National Assembly to be held on Thursday, the 10th June, 2021 at 4.00 p.m. 1. Tilawat, Hadith, Naat and national anthem. CALLING ATTENTION NOTICE 2. MR. MUHAMMAD ASIM NAZIR MR. RAZA NASRULLAH MR. SHER ALI ARBAB to invite attention of the Minister for Communications to a matter of urgent public importance regarding suspension of public transport buses on Motorway by the Motorway Police, causing grave concern amongst the public. INTRODUCTION OF BILLS 3. MR. ZAHEER-UD-DIN BABAR AWAN, Adviser to the Prime Minister on Parliamentary Affairs to introduce a Bill to make provisions for the constitution of Pakistan Allied Health Professionals Council [The Pakistan Allied Health Professionals Council Bill, 2021]. 4. MR. ZAHEER-UD-DIN BABAR AWAN, Adviser to the Prime Minister on Parliamentary Affairs to introduce a Bill further to amend the Pakistan Nursing Council Act, 1973 [The Pakistan Nursing Council (Amendment) Bill, 2021. 5. SHEIKH RASHID AHMED, Minister for Interior to introduce a Bill to amend the Mutual Legal Assistance (Criminal Matters) Act, 2020 [The Mutual Legal Assistance (Criminal Matters) (Amendment) Bill, 2021 MOTION 6. MIR AMER ALI KHAN MAGSI, Chairman Standing Committee on Maritime Affairs, to move that the delay in the presentation of the report of the Standing Committee on the Bill further to amend the Port Qasim Authority Act, 1973 [The Port Qasim Authority (Amendment) Bill, 2021], till today be condoned. REPORT OF THE STANDING COMMITTEE - PRESENTATION OF: 7. MIR AMER ALI KHAN MAGSI, Chairman Standing Committee on Maritime Affairs, to present the report of the Standing Committee on the Bill further to amend the Port Qasim Authority Act, 1973 [The Port Qasim Authority (Amendment) Bill, 2021]. -

Wednesday, the 4Th December, 2019 at 4.00 P.M

NATIONAL ASSEMBLY SECRETARIAT ORDERS OF THE DAY for the meeting of the National Assembly to be held on Wednesday, the 4th December, 2019 at 4.00 p.m. 1. Tilawat, Naat and national anthem. QUESTIONS 2. Questions entered in a separate list to be asked and answers given. CALLING ATTENTION NOTICE 3. MR. MUHAMMAD ALAMGIR KHAN to invite attention of the Minister for States and Frontier Regions to a matter of urgent public importance regarding non-implementation of FATA reforms in true spirit, causing grave concern amongst the public. ORDINANCE TO BE LAID BEFORE THE NATIONAL ASSEMBLY 4. MR. ASAD UMER, Minister for Planning, Development and Reform to lay the China Pakistan Economic Corridor Authority Ordinance, 2019 (No. XII of 2019) before the National Assembly as required by clause (2) of Article 89 of the Constitution of the Islamic Republic of Pakistan. INTRODUCTION OF BILLS 5. SYED ALI HAIDER ZAIDI, Minister for Maritime Affairs to introduce a Bill further to amend the Port Qasim Authority Act, 1973 [The Port Qasim Authority (Amendment) Bill, 2019]. 6. MR. PERVEZ KHATTAK, Minister for Defence to introduce a Bill to amend the Surveying and Mapping Act, 2014 [The Surveying and Mapping (Amendment) Bill, 2019]. 7. SYED ALI HAIDER ZAIDI, Minister for Maritime Affairs to introduce a Bill further to amend the Gwadar Port Authority Ordinance, 2002 [The Gwadar Port Authority (Amendment) Bill, 2019]. 8. MR. MUHAMMAD MIAN SOOMRO, Minister for Privatization to introduce a Bill further to amend the Privatization Commission Ordinance, 2000 [The Privatization Commission (Amendment) Bill, 2019]. RESOLUTION 9. DR. KHALID MAQBOOL SIDDIQUI, Minister for Information Technology and Telecommunication to move the following Resolution:- “That the National Assembly resolves to extend the National Information Technology Board Ordinance, 2019 (X of 2019) for a further period of one hundred and twenty days w.e.f 22nd December, 2019 under proviso to sub- paragraph (ii) of paragraph (a) of clause (2) of Article 89 of the Constitution of the Islamic Republic of Pakistan”. -

Sl. No Constituency Name of Member Status 1 NA-1 Moulana Abdul Akbar Chitrali P 2 NA-2 Dr

NATIONAL ASSEMBLY SECRETARIAT (Notice Office) 34th Session 17th Sitting held on Monday, the 28th June, 2021 The following Members National Assembly of Pakistan attended the sitting Sl. No Constituency Name of Member Status 1 NA-1 Moulana Abdul Akbar Chitrali P 2 NA-2 Dr. Haider Ali Khan P 3 NA-3 Mr. Saleem Rehman P 4 NA-4 Mr. Murad Saeed P 5 NA-5 Sahibzada Sibghatullah P 6 NA-6 Mr. Mehboob Shah P 7 NA-7 Mr. Muhammad Bashir Khan P 8 NA-8 Mr. Junaid Akbar P 9 NA-9 Mr. Sher Akbar Khan P 10 NA-11 Mr. Afreen Khan P 11 NA-12 Prince Muhammad Nawaz Alai P 12 NA-14 Mr. Muhammad Sajjad P 13 NA-15 Mr. Murtaza Javed Abbasi P 14 NA-16 Mr. Ali Khan Jadoon P 15 NA-17 Mr. Omar Ayub Khan P 16 NA-18 Mr. Asad Qaiser P 17 NA-19 Engr. Usman Khan Tarakai P 18 NA-20 Mr. Mujahid Ali P 19 NA-21 Mr. Amir Haider Azam Khan P 20 NA-22 Mr. Ali Muhammad Khan P 21 NA-23 Malik Anwar Taj P 22 NA-24 Mr. Fazal Muhammad Khan P 23 NA-25 Mr. Pervez Khattak P 24 NA-26 Mr. Imran Khattak P 25 NA-27 Mr. Noor Alam Khan P 26 NA-28 Mr. Arbab Amir Ayub P 27 NA-29 Mr. Nasir Khan Musa Zai P 28 NA-30 Mr. Sher Ali Arbab P 29 NA-31 Mr. Shaukat Ali P 30 NA-32 Mr. Shehryar Afridi P 31 NA-33 Mr.