Credit Card Offer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How to Find the Best Credit Card for You

How to find the best credit card for you Why should you shop around? Comparing offers before applying for a credit card helps you find the right card for your needs, and helps make sure you’re not paying higher fees or interest rates than you have to. Consider two credit cards: One carries an 18 percent interest rate, the other 15 percent. If you owed $3,000 on each and could only afford to pay $100 per month, it would cost more and take longer 1. Decide how you plan to pay off the higher-rate card. to use the card The table below shows examples of what it might You may plan to pay off your take to pay off a $3,000 credit card balance, paying balance every month to avoid $100 per month, at two different interest rates. interest charges. But the reality is, many credit card holders don’t. If you already have a credit card, let APR Interest Months history be your guide. If you have carried balances in the past, or think 18% = $1,015 41 you are likely to do so, consider 15% = $783 38 credit cards that have the lowest interest rates. These cards typically do not offer rewards and do not The higher-rate card would cost you an extra charge an annual fee. $232. If you pay only the minimum payment every month, it would cost you even more. If you have consistently paid off your balance every month, then you So, not shopping around could be more expensive may want to focus more on fees and than you think. -

How to Be a Savvy CREDIT CARD OWNER

How to Be a Savvy CREDIT CARD OWNER When used responsibly, credit WHAT TO COMPARE WHEN LOOKING FOR A CREDIT CARD cards can be a useful tool to make major purchases and handle APR The cost of “borrowing” money when you use the card, emergencies. They can help you also known as the Annual Percentage Rate (APR). Be sure to compare both introductory and standard rates. build a solid credit history so you can get loans with low interest Fees such as annual fees, balance transfer fees, late rates, buy cheaper insurance and fees, penalties, over-limit fees and cash advance fees. even get a better cell plan. And Benefits including the type of rewards offered (points they can help you earn rewards for travel/merchandise, cash back, etc.) and what it takes and protect purchases in case of to redeem them, as well as other perks like extended warranties, insurance and travel assistance. theft or damage. WHAT’S IN A NUMBER? Your score matters. Your credit score reflects your credit history and affects how much interest you will pay when you get a credit card. A small difference in rate can cost you hundreds more in interest. Check your credit score. You can request your credit score from the three major credit reporting agencies: Equifax, Experian and TransUnion. Get a free copy of your credit report every year from AnnualCreditReport.com Make sure all the information is accurate and up to date. Your APR can vary by transaction type. Be sure you know what you’re paying and stay ABCs of APRs on top of any rate changes. -

New Credit Card Rules

WHAT YOU NEED TO KNOW: New Credit Card Rules The Federal Reserve’s new rules for credit card companies mean new credit card protections for you. Here are some key changes you should expect from your credit card company beginning on February 22, 2010. What your credit card company has to tell you When they plan to increase your rate or other fees. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees, and late fees) that ap- ply to your account; or make other signifi cant changes to the terms of your card. If your credit card company is going to make changes to the terms of your card, it must give you the option to cancel the card before certain fee increases take effect. If you take that option, however, your credit card company may close your account and increase your monthly payment, subject to certain limitations. For example, they can require you to pay the balance off in fi ve years, or they can double the percentage of your balance used to calculate your minimum payment (which will result in faster repayment than under the terms of your account). The company does not have to send you a 45-day advance notice if you have a variable interest rate tied to an index; if the index goes up, the company does not have to provide notice before your rate goes up; your introductory rate expires and reverts to the previously disclosed “go-to” rate; your rate increases because you are in a workout agreement and you haven’t made your payments as agreed. -

Bow Credit Card Agreement

CREDIT CARD AGREEMENT (Personal Accounts) By requesting or accepting any Standard MasterCard, account. If we accept a payment from you in excess of your Standard Visa, Platinum MasterCard, Platinum Visa, outstanding balance, your available Credit Limit will not be Platinum Rewards MasterCard, or Platinum Rewards Visa increased by the amount of the overpayment nor will we be account (individually or collectively called “Credit Card required to authorize transactions for an amount in excess account” or “Account”) with Bank of the West, you agree to of your Credit Limit. be bound by all the terms of this Agreement. In this 3. Temporary Reduction of Credit Limit. Merchants, Agreement, the words “you” or “your” mean everyone who such as car rental companies and hotels, may request prior has requested or accepted a Credit Card account with us. credit approval from us for an estimated amount of your The words “we,” “us,” “our,” or “Bank” mean Bank of the Purchases, even if you ultimately do not pay by credit. If our West. If you do not accept this Agreement, you must notify approval is granted, your available Credit Limit will us in writing within 5 days after receipt. Use of your card or temporarily be reduced by the amount authorized by us. If any feature (including a balance transfer) of your Credit you do not ultimately use your Credit Card account to pay Card Agreement shall constitute acceptance of this for your Purchases or if the actual amount of Purchases Agreement. posted to your Credit Card account varies from the 1. Use. Your Standard MasterCard, Standard Visa, estimated amount approved by us, it is the responsibility of Platinum MasterCard, Platinum Visa, Platinum Rewards the merchant, not us, to cancel the prior credit approval MasterCard, or Platinum Rewards Visa card (individually or based on the estimated amount. -

Advertising Guidelines GUIDELINES

PAYMENT SOLUTIONS ADVERTISINGAdvertising Guidelines GUIDELINES © 2020 Synchrony Financial. All rights reserved. No reuse without prior written consent from Synchrony Financial. Home Table of Contents Understanding Offer Channel Monthly Additional the Guidelines Descriptions Examples Payment Guidance Advertising References © 2020 Synchrony Financial. All rights reserved. No reuse without priorProprietary written andconsent Confidential from Synchrony Financial. Home Understanding the Guidelines Discover More © 2020 Synchrony Financial. All rights reserved. No reuse without prior written consent from Synchrony Financial. Home Understanding Offer Channel Monthly Payment Additional the Guidelines Descriptions Examples Advertising Guidance Guide Overview Guide Overview These Advertising Guidelines provide information to help advertise promotional financing offers associated with Synchrony Bank’s credit card products. For more specific guidance not covered in these Guidelines, please contact your Synchrony Regulatory Representative. Overview Advertising and marketing to prospective customers is one of the most important activities we do. It promotes product awareness, the availability of credit to all creditworthy customers and provides information about our products and services with a view toward urging action on the part of the recipient. In responding to the “call to action” communicated by marketing efforts, customers are relying on the clarity and truthfulness of statements made in the marketing piece. As a valued Synchrony partner, you -

Credit Cards: Applications and Choosing the Best Card

® ® KFSBOPFQVLCB?O>PH>¨ FK@LIKUQBKPFLK KPQFQRQBLCDOF@RIQROB>KA>QRO>IBPLRO@BP KLTELT KLTKLT G1801 Credit Cards: Applications and Choosing the Best Card Sandy D. Preston, Extension Educator Kathy Prochaska-Cue, Extension Family Economist Deciding which credit card is best for you may Grace period is the time period when a balance can be be as simple as carefully reading the application and carried on the account without additional interest being charged, deciding how you’ll use it. typically 20 to 25 days. Usually, no grace period is allowed for cash advances or for any new purchases if you did not pay your bill in full the previous billing cycle. Interest begins as The Disclosure Box soon as you get a new cash advance or buy something if you did not pay your entire bill the last time it came. All credit card applications must include the following The minimum finance charge is the amount of interest information in a disclosure box printed somewhere on the charged if there is a balance, even if the finance charge cal- application: culated from the account balance is less than the minimum. APR (or annual percentage rate) gives the interest rate Minimum finance charges generally are 50 cents. being charged when figured on an annual basis. Both fixed Some cards charge an annual fee. This fee appears on the and variable interest rates are being charged on credit cards monthly bill when due. When charged, annual fees typically today. If variable, know what the rate is indexed to and how range from $20 to $100 annually. -

Bank First, N.A. Consumer Credit Card Agreement

Bank First, N.A. Consumer Credit Card Agreement This Bank First Credit Card Agreement (the “Agreement”), which includes the Statement of Terms and Conditions, explains the terms that will govern your use of the Bank First Credit Card (“Card”). “Account” means your account with us. In this Agreement, “we,” “us,” and “our” mean Bank First, N.A. and its agents, authorized representatives, successors, and assigns. “You” and “your” mean each and all of the persons who are granted, accept, or use the account and persons responsible for paying the account. About your Card Use When you use, sign or retain the Card, you are agreeing to the terms of this Agreement, which include any subsequent amendments. You certify that the information you have given Bank First for the purpose of obtaining credit is true and complete. You also give us the right to verify and obtain additional information regarding your credit standing. You also agree to repay all debits, finance charges, or other fees or charges arising from the use of the Card. You are responsible and agree to pay us for charges made by yourself and any other person you authorize to use the Card. You may not use the Card for any illegal or unlawful transaction including illegal internet gambling, and we may decline to authorize any transaction that we believe poses an undue risk of illegality. This Agreement is negotiated in the State of Wisconsin and is governed by applicable federal and Wisconsin law. Information, including rates, finance charges, or other terms, in this disclosure is accurate as of May 1, 2019. -

Nationwide Building Society

NATIONWIDE BUILDING SOCIETY (incorporated in England and Wales under the UK Building Societies Act 1986, as amended) $20,000,000,000 Senior Preferred, Senior Non-Preferred and Subordinated Medium-Term Notes Due Twelve Months or More from Date of Issue ______________ We may issue at various times up to $20,000,000,000 aggregate principal amount outstanding at any time of senior preferred, senior non-preferred or subordinated medium-term notes denominated in U.S. dollars or in other currencies or composite currencies. The notes will be issued in series and each series will be the subject of final terms (each “Final Terms”). We are privately placing the notes on a delayed or continuous basis to the placement agents named below (the “Placement Agents”) or through the Placement Agents to qualified institutional buyers as described in this Base Prospectus under the section entitled “Plan of Distribution.” This document constitutes a base prospectus (“Base Prospectus”) for the purposes of Directive 2003/71/EC (as amended, including by Directive 2010/73/EU) and includes any relevant implementing measure in a relevant Member State of the European Economic Area) (the “Prospectus Directive”). Application has been made to the United Kingdom Financial Conduct Authority (the “FCA”), in its capacity as competent authority for the purposes of the Prospectus Directive and relevant implementing measures in the United Kingdom (the “UK Listing Authority”) for the document to be approved as a Base Prospectus issued in compliance with the Prospectus Directive and relevant implementing measures in the United Kingdom for the purpose of giving information with regard to the issue of notes issued under this program. -

Risk Management for the Period Ended 30 June 2013 (Unaudited) All Amounts Are Stated in £M Unless Otherwise Indicated

Risk management For the period ended 30 June 2013 (unaudited) All amounts are stated in £m unless otherwise indicated The Disclosure and Transparency Rules (DTR 4.2.7) require that a description of the principal risks and uncertainties are given in the interim financial report in respect of the remaining six months of the financial year. The short term outlook continues to be challenging for the Bank. The Bank has developed a recapitalisation plan (‘the Plan’), which has the key objective to significantly strengthen the Bank’s capital base and to refocus its strategy around its strength in core relationship banking providing current accounts, residential mortgages and savings products to individuals and small business banking. Its successful completion is critical to stabilising the Bank’s position and, as such, is in the long term interest of all stakeholders. Other risks are consistent with those described in the Bank’s risk management section of the 2012 financial statements on pages 54 to 79. 1. Credit risk 1.1 Overview Credit risk is one of the principal risks identified in the risk management framework and is an integral part of our business activities. It is inherent in both traditional banking products (revolving credit lines, loans, mortgages, commitments to lend, and contingent liabilities such as letters of credit) and in 'traded products' (derivative contracts such as forwards, swaps and options, repurchase agreements, securities borrowing and lending transactions). All authority to take credit risk derives from the Banking Group's Board. This authority is delegated to the Chief Executive Officer (CEO) and then on to other individuals. -

Mastercard Application and Solicitation Disclosure

P.O. Box 123 Effective: 8/03/2020 Annapolis Junction, MD 20701-0123 301-497-7000 • 800-787-8328 towerfcu.org IMPORTANT CREDIT CARD DISCLOSURES Important Note: This document contains disclosures for all three of Tower Federal Credit Union's credit card products. Please ensure that you are reviewing the terms specific to the product for which you wish to apply. 1. World Mastercard.........................................Page 2 2. Gold Mastercard................................................Page 3 3. Empower Mastercard..............................................Page 4 P.O. Box 123 APPLICATION AND SOLICITATION DISCLOSURE Annapolis Junction, MD 20701-0123 301-497-7000 • 800-787-8328 towerfcu.org WORLD MASTERCARD® IMPORTANT CREDIT CARD DISCLOSURES The following disclosure represents important details concerning your credit card. The information about costs of the card are accurate as of July 1, 2020. You can contact us toll free at (800) 787-8328 or the address above to inquire if any changes occurred since the effective date. INTEREST RATES and INTEREST CHARGES: Annual Percentage Rate (APR) 1.99% Introductory APR for 12 months as of account opening. for Purchases After that, your Standard APR will be 10.99% - 17.99% depending on your credit history. This APR will vary with the market based on the Prime Rate. APR for Cash Advances 10.99% - 17.99% depending on your credit history. This APR will vary with the market and Balance Transfers based on the Prime Rate. Paying Interest Your due date is at least 25 days after we mail your billing statement. We will not charge you interest on purchases if you pay your entire outstanding balance by the due date each month. -

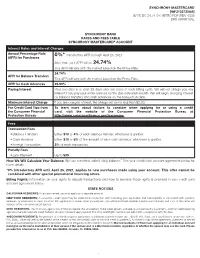

Synchrony Bank Rates and Fees Table

SYNCHRONY MASTERCARD [WF2132730AA] (8/19) DC 24.74 0% INTRO PDF (REV 4/20) DPS APPROVAL SYNCHRONY BANK RATES AND FEES TABLE SYNCHRONY MASTERCARD® ACCOUNT Interest Rates and Interest Charges Annual Percentage Rate 0%* introductory APR through April 25, 2021 (APR) for Purchases After that, your APR will be 24.74% This APR will vary with the market based on the Prime Rate. 24.74% APR for Balance Transfers This APR will vary with the market based on the Prime Rate. APR for Cash Advances 29.99% Paying Interest Your due date is at least 23 days after the close of each billing cycle. We will not charge you any interest if you pay your entire balance by the due date each month. We will begin charging interest on balance transfers and cash advances on the transaction date. Minimum Interest Charge If you are charged interest, the charge will be no less than $2.00. For Credit Card Tips from To learn more about factors to consider when applying for or using a credit the Consumer Financial card, visit the website of the Consumer Financial Protection Bureau at Protection Bureau http://www.consumerfinance.gov/learnmore. Fees Transaction Fees • Balance Transfers Either $10 or 4% of each balance transfer, whichever is greater. • Cash Advance Either $10 or 5% of the amount of each cash advance, whichever is greater. • Foreign Transaction 3% of each transaction. Penalty Fees • Late Payment Up to $39. How We Will Calculate Your Balance: We use a method called “daily balance.” See your credit card account agreement below for more details. -

Reducing Credit Card Debt FCS721

FCS721 Reducing Credit Card Debt It’s easy to whip out a credit card to pay for everything from utility bills to movie tickets. You may use credit cards for hundreds of purchases every year. Credit cards are easy to use. But credit card use can spin out of control. High interest rates, fees, penalties and out-of-control spending may increase debt faster than your ability to pay. Whether you owe a few hundred dollars or several thousand, these steps can help you reduce your credit card debt. Total your debt. • Pay off the credit card with the highest Gather your credit card bills and list the interest rate first. Each month pay the amount you owe, the minimum payment minimum payment on all your credit cards and the interest rate for each card. (Use except the one with the highest interest the chart on the back of this sheet.) rate. Pay as much as you possibly can on this card each month until it is paid Check your credit report. off. Then start on the card with the next Look for any debt you might have over- highest interest rate. Always pay the looked. If you find mistakes, have them minimum balance on all of the others. corrected. You can order a free credit Keep doing this until they are all paid off. report annually from each of the major credit reporting agencies by going online • Pay off the credit card with the lowest at www.annualcreditreport.com or by calling balance first. Each month pay the 1-877-322-8228.