Food Service - Hotel Restaurant Institutional

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dodo Brands FY 2020 Earnings Release

Kirill Vyrypaev, CFO [email protected] Dodo Brands Reports Full Year and Fourth Quarter 2020 Results Moscow, Russia - 6 April 2021 11:00 AM GMT - DP Global Group Limited (“Dodo Brands” or the “Company”), home of Dodo Pizza, the largest pizza chain in Russia and the fastest-growing pizza chain in the world, announces its financial results in accordance with International Financial Reporting Standards (IFRS) for the fourth quarter and the fiscal year ended 31 December 2020. Key Financial Highlights ■ Global system sales increased by 38.2% in the fourth quarter; 27.1% in fiscal 2020. ■ Added 28 net new units in the fourth quarter; 103 net new units in the fiscal 2020. Finished the year with 679 units in 14 countries. ■ Eurasia (Russia, Kazakhstan, Belarus) comparable system sales increased 17.6% in the fourth quarter; 5.3% in fiscal 2020. ■ International Master Franchising (IMF) comparable system sales increased 33.9% in the fourth quarter; 11.3% in fiscal 2020. ■ Adjusted EBITDA (ex. IFRS 16) increased to RUB 202 million for fiscal 2020 vs negative RUB (12) million for fiscal 2019. ■ Free Cash Flow of negative RUB (28) million for fiscal 2020 vs negative RUB (41) million for fiscal 2019. ■ RUB 111 million net cash (ex. IFRS 16) as of end of fiscal 2020. Significant Events ■ Dodo Pizza was recognized as the fastest-growing pizza chain in the world by Technomic. ■ Dodo Pizza shared the #1 position as the most trusted foodservice brand in Russia as per the Romir agency. ■ Launched the first franchised Dodo Pizza unit in Munich, Germany, our 14th market of presence. -

Restaurants in Vilnius - Updated February 2020 - Tripadvisor

2/18/2020 THE 10 BEST Restaurants in Vilnius - Updated February 2020 - Tripadvisor Vilnius Restaurants in Vilnius 80 results match your Sort by: Relevance filters Clear all filters Restaurants Pizza View map Establishment Type Restaurants Quick Bites 1. Jurgis ir Drakonas Pilies Dessert 151 reviews · Open Now Coffee & Tea Pizza, European · $ Show more “Great pizza, cozy atmosphere.” “... yourself to tasty neapolitan Pizza!” Meals Breakfast Brunch Lunch Dinner 2. Jurgis ir Drakonas Ogmios 599 reviews · Open Now Price Pizza, European · $$ - $$$ · Menu Cheap Eats “Perfect pizza, perfect place for kids” “... want a truly delicious Italian pizza.” Mid-range Cuisine European Eastern European Pizza 3. Jurgis ir Drakonas Pylimo Asian 1,041 reviews · Open Now Pizza, European · $$ - $$$ · Menu Show more https://www.tripadvisor.com/Restaurants-g274951-Vilnius_Vilnius_County.html 1/10 2/18/2020 THE 10 BEST Restaurants in Vilnius - Updated February 2020 - Tripadvisor Show more “That was good” “Great place, delicious food” Dishes Salad Beef Burger Fish Show more 4. Jurgis ir Drakonas Akropolio 226 reviews · Open Now Dietary Pizza, European · $$ - $$$ Restrictions “Gaile and Violeta” “Great food and service!” Vegetarian Friendly Vegan Options Gluten Free Options Good for 5. Uzupio picerija 439 reviews · Open Now Families with Italian, Pizza · $$ - $$$ · Menu children “Best cosy pizza place in Vilnius” Kids “... and one maxi pizza margherita!” Large groups Business meetings Show more Restaurant features Takeout Serves Alcohol Reservations 6. Pizza di Ascari Table Service 89 reviews · Open Now Italian, Pizza · $ Show more “My favourite pizza place” “Awesome pizza” https://www.tripadvisor.com/Restaurants-g274951-Vilnius_Vilnius_County.html 2/10 2/18/2020 THE 10 BEST Restaurants in Vilnius - Updated February 2020 - Tripadvisor 7. -

Selected Preregistered Epps 2021 Buyers List

SELECTED PREREGISTERED EPPS 2021 BUYERS LIST Abel & Cole Dr Oetker Little Ships Ltd Aldi Dram-A-Drinks Limited M&S Food Alongi Catering Easy Café Marriott Hotels Amarone Restaurant EasyPizza Melia Hotels UK Amazon EAT Ltd Morrison’s Amore Ristorante e Pizzaria EKO Food National Trust ASDA Ekon equipment NHS Ask Italian El Murrino NISA Retail Ltd. Association of Convenience Elmwood Catering Nomads bar ltd Stores Enoteca Rosso Novikov Italian Restaurants Atheneaum Club Eximpco Oakman Inns & Restaurants Azure Wood Fired Pizza Farmers Markets Ocado Azzurri Group Farmfoods Olleco Bakkavor Food Ltd Field 2 Fork Catering Paesano Pizza Bare Bones Pizza Figaro’s Pizza Papa John’s Pizza Barratt Business Hospitality Firezza Ltd Park Plaza Hotels Basilico LLC Five Firs Partridges Shops Bath Pizza Co Fleur Delish Pasta Evangelists Bella Italia Franco Manca Pastability Ltd Bella Pizza Fuller’s Pubs Peeled Business Solutions Bellavita Shops Fulton’s Foods Pelican public house Biddulph's Pizzeria Go-Go Pizza Pinewood Bar and Cafe Bidfood UK Great Western Pirandello Ltd Big Slice Pizza Greggs Pizza Corner Booker Plc Griffith Foods PIZZA PER TE Boston Pizza Custom Culinary Pizza Pilgrims Brick Pizza Gruppo s&n srls Pizza Pollo Budgens GWF Pizza Ltd Pizzaburger Buxted Park Hotel Hallmark PizzaExpress California Pizza Kitchen Harrods Food Hall PizzaHut CAMRA Heriot Watt University Pizzarte Carluccio’s Heron Foods (B&M) Pizze & Delizie Casual Dining Group Hilton Hotels & Resorts Prezzo Cavendish Ships Stores Hilton London Metropol Propeller Pizzas Chinese -

How Dodo Pizza's Marketing Team Improved Productivity by Using

Dodo Pizza How Dodo Pizza’s Marketing Team Improved Productivity By Using Wrike Dodo Pizza is an international pizza chain located in 14 countries, including Russia, the SUCCESS STORY U.S., China, and Europe. The Dodo Pizza franchise uses the custom cloud enterprise FACTS resource planning (ERP) system, Dodo IS, which facilitates online ordering via website and mobile app, order queue and coordination of deliveries, supply management, sales 2x analysis, etc. Founder and CEO Fyodor Ovchinnikov believes that the key concept of team’s productivity Dodo Pizza is openness and transparency of processes. The IT system helps scale work- flows due to important metrics and indicators, controls the quality of pizzas, and serves customers in over 600 restaurants all over the world. 50% reduction of risks of opening new pizza The Challenge restaurants Dodo Pizza faced serious structural changes about a year ago, and it became more dif- ficult to work in the chaos. The company previously had two departments: product and CASE SUMMARY marketing. The business had to synchronize team processes and workflows, which is why it decided to merge both departments. Customer Dodo Pizza “We started looking for a flexible project management system with certain features for Agile teams,” says Anastasia Detinkina, Delivery Operations Manager at Dodo Pizza. Headquarters “We needed a tool that allowed us to organize marketing workflows and support devel- Moscow, Russia opment processes, such as prioritizing the backlog, managing sprints, and viewing work progress. We decided to choose Wrike as the platform since it met our requirements Industry and needs.” Fast food restaurant chain # of employees The Solution 320 (without retail chain) Before working with Wrike, teams analyzed and optimized their current processes. -

Almaty Retail Guide

ALMATY Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | Almaty | 2019 0 Almaty remains the largest city in Kazakhstan, its key business centre and primary retail destination; despite not being the country’s capital city. Almaty has almost 3 times the number of international companies operating within the city than in Nur-Sultan, providing ever-stronger competition against the capital. Almaty has recently been challenged by the economic instability in the region adversely affecting the retail sector. However, the city still benefits from increasing retail turnover, a low unemployment rate, the highest standard of living in Kazakhstan and a growing population. Almaty’s retail sector comprises a mix of traditional ‘bazaar‘-style markets, western-style shopping malls and a small element of on-street retail. Consumers are gradually moving away from shopping at markets and the success of shopping malls indicates a growing consumer demand for this type of retail format. More developers are adopting global retail concepts and trends. The market is witnessing a shift from primarily shopping destinations to one-stop shopping, dining and entertainment experience. Based on the total international-standard retail stock in the city of 423,000 sqm of leasable area and using the estimated population of 2 million people, the volume of retail space per 1,000 capita stands at 210 sqm, that is comparatively less ALMATY mature than developed European markets. Economic uncertainty adversely affected the Almaty retail development pipeline, which as a result is currently comprised of OVERVIEW a few existing projects scheduled for refurbishment and expansion of the existing shopping areas. -

Download the Visitors Guide

VISITORS GUIDE 1 Find Yourself South of the Ordinary. 1 You don’t have to know how to get there. You’ll know it when you see it. Real places. Real food. Real life. Miles of winding roads and windier waterways. Stories without endings. Pages unturned. It’s all there. And it’s always been there, just waiting. There’s nowhere else you really need to be. Not really. So why not… explore? There’s plenty to find, if you let yourself look around. You’ll know it when you see it. 2 HERNANDO Anderson’s Pottery your-own fruit and vegetables, fireworks, hayrides, Handmade stoneware pottery is thrown on a potter’s a corn maize, “Trail of Terror”, pumpkin picking and wheel and glazes are mixed by hand. Each piece is breakfast, brunch or dinner with the Easter Bunny and dishwasher safe, nontoxic, oven proof and can be Santa. Also, choose and cut your own Christmas tree. used in the microwave. Call for appointment. 008 Love Road · 662-429-2540 · www.gocedarhillfarm.com 2701 Scott Road · 662-429-7922 · cell 901-828-0873 www.jimandersonpottery.com DeSoto Arts Council Gallery The DeSoto Arts Council serves as the countywide Baptist Industrial College Marker home for the arts with space for exhibits, classes, Founded in 1900 by the North Mississippi Baptist meetings and special events with local artisans’ work. Educational Convention, the college was the first school Be sure and visit the gift shop. Check the website in DeSoto County to offer instruction through grade for a schedule of events and workshops. -

Franchising in the Largest Country on Earth

FEATURE RUSSIA: FRANCHISING IN THE LARGEST COUNTRY ON EARTH Russia may win in terms of sheer land mass, but when it comes to franchising potential, the country’s story gets a little more complicated 48 GLOBAL FRANCHISE | ISSUE 5.5 WORDS BY KIERAN MCLOONE olitically, socially, and franchise markets within Russia. financially, Russia is To ignore Russia’s other “You may be in demand P often viewed as a large cities would be a mistake, and trendy in somewhere literal world apart however, and these include St. from what we’ve come to Petersburg (with around 5.5 like the U.K., but because understand as western culture. million inhabitants), Novosibirsk This could be due to the fact that (1.66 million), and Nizhniy nobody knows you in Russian culture and news isn't Novogorod (1.25 million). In total, widely publicized in the West, Russia has 12 cities with over Russia, it’s all about which extends to the current one million inhabitants, and a positioning of its burgeoning further 201 smaller cities that providing value” franchise industry. contain between 100,000 and one You may be surprised, then, million people. As expected from brands within the country are to learn that past its mysterious a country so large, the on-paper of Russian origin, and of the exterior, the Russian franchise opportunity for franchisors in remaining 35 per cent, nearly industry isn’t just similar to Russia stretches as far as the eye half of that figure is comprised what can be found in the West; it can see – and then some. -

Fast Food Sector Keeps Expanding As Economy Cools Russian Federation

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 11/13/2014 GAIN Report Number: RSATO033 Russian Federation Post: Moscow ATO Fast Food Sector Keeps Expanding As Economy Cools Report Categories: Agriculture in the News Agricultural Situation Agriculture in the Economy Approved By: Erik W. Hansen Prepared By: ATO Moscow Staff Report Highlights: The fast food sector in Russia has grown sharply in recent years as consumers having seen nearly 30 percent current value growth in 2013. Russian consumers demand well-known, affordable, and consistent quality standards provided by chained restaurants. Approximately100 fast food operators manage almost 3,800 chain restaurants in Russia. Today fast food is the most popular segment for young and middle-aged Russian consumers. Research has shown that more than 54 percent of fast food restaurants visitors are from 18 to 34 years old with average monthly income of 30,000 rubles. While the economic slowdown and currency devaluation are slowing down fast food expansion plans in Russia, research has shown that consumers are switching from higher end restaurants to mid-level and fast food type establishments which should help fast food chains weather the challenging economic times. General Information: Fast food remained one of the main foodservice engines in 2013 and has continued to grow in the current year. Chained fast food is performing particularly well and has seen current value growth of nearly 30 percent in 2013. Such strong growth is caused, in large part, to the growing overall popularity of franchising in Russia, making it one of the main tools of fast food business development. -

Addressing the Liability and Regulatory Implications of Emerging Technologies

Torts of the Future Addressing the Liability and Regulatory Implications of Emerging Technologies MARCH 2017 © U.S. Chamber Institute for Legal Reform, March 2017. All rights reserved. This publication, or part thereof, may not be reproduced in any form without the written permission of the U.S. Chamber Institute for Legal Reform. Forward requests for permission to reprint to: Reprint Permission Office, U.S. Chamber Institute for Legal Reform, 1615 H Street, N.W., Washington, D.C. 20062-2000 (202.463.5724). 2 Torts of the Future Table of Contents Executive Summary ................................................................................................................................. 1 Autonomous Vehicles ............................................................................................................................. 5 Commercial Use of Drones .................................................................................................................. 13 Private Space Exploration .................................................................................................................... 24 The Sharing Economy ........................................................................................................................... 32 The Internet of Things ........................................................................................................................... 42 Guiding Principles for Addressing the Liability and Regulatory Implications of Emerging Technologies ................................................................................................................... -

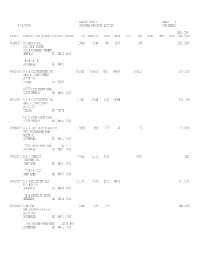

1 8/01/2018 Personal Property Listing Pgm-Paedrl Bus

DESOTO COUNTY PAGE- 1 8/01/2018 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. TAX ______PARCEL _____________________________________NAME/MAILING ADDRESS/PHYSICAL ADDRESS ____TRUE ________ASSESSED ____FURN ____MECH ____LESD ____INVT ____BANK ____DEBT ____MISC ____TYPE ____DIST 001692000 #1 AUTO STORE 13662 2049 654 1197 198 1022 2400 C/O JOHN TURNER 503 N HIGHLAND STREET MEMPHIS TN 38122 4521 8108 HWY 51 SOUTHAVEN MS 38671 000103000 A & B DISTRIBUTING INC 4503421 675514 40237 86064 549213 339 1300 4800 E. 42ND STREET SUITE 400 ODESSA TX 79762 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 000103001 A & B DISTRIBUTING INC 417651 62648 5660 56988 339 1306 4800 E. 42ND STREET SUITE 400 ODESSA TX 79762 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 002663000 A & B FAST AUTO GLASS INC 5938 891 770 46 75 31 2400 7020 TCHULAHOMA ROAD SUITE #1 SOUTHAVEN MS 38671 0000 7020 TCHULAHOMA ROAD SUITE 1 SOUTHAVEN MS 38671 0000 002132000 A & J TOBACCO 74082 11112 4362 6750 3221 7128 HWY 301 HORN LAKE MS 38637 0000 7128 HWY 301 HORN LAKE MS 38637 0000 002722000 A C SPECIALTIES LLC 271145 40672 2131 38541 314 5101 P O BOX 277 HERNANDO MS 38632 0000 3425 MAGNOLIA DRIVE HERNANDO MS 38632 0000 001532000 A MC INC 2468 370 370 588 3400 946 GOODMAN ROAD EAST SUITE 8-A SOUTHAVEN MS 38671 0000 946 GOODMAN ROAD EAST SUITE 8-A SOUTHAVEN MS 38671 0000 DESOTO COUNTY PAGE- 2 8/01/2018 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. TAX ______PARCEL _____________________________________NAME/MAILING ADDRESS/PHYSICAL ADDRESS ____TRUE ________ASSESSED ____FURN ____MECH ____LESD -

Option 3 Common Errors 19GRLC Final 26 Oct

Common Errors in International Expansion Singapore November 5, 2019 Who is the audience for this session? Franchisors, Franchisees, Investors, Suppliers, Marketers, Financial Managers, Operators, and others: • Planning their first international venture • Recently opened their first international location(s) • Need to re-assess an existing business • Successfully operating internationally Why talk about errors in international expansion? • They all seem to be common sense • But at some point, almost every franchisor or franchisee has committed one or more of these • Today’s objective is simply to provide an opportunity to learn from some common pitfalls “Those who cannot remember the past are condemned to repeat it” -George Santayana The Life of Reason: Reason in Common Sense. Scribner’s, 1905 Today’s panel Jim Hartenstein jim @ hartensteinglobal.com • International franchise consulting • GRLC Advisory Council • SVP-International at Little Caesars • SVP-International at Wendy’s • Also Regional VP-Latin America/Caribbean • Previous international General Management and Marketing experience at Goodyear, American Express, and TNT Express Nicolas Boudet NBoudet @ Wingstop.com • President-International at Wingstop, Inc. • Group President-International at Focus Brands • Chief Development Officer/Head of US Franchising at Taco Bell Corp. • Chief Development Officer- Latin America/Caribbean at Yum! Brands • SVP-Real Estate at Club Med, Inc. • VP Joint Venture Real Estate at Starwood Walid Hajj w @ kairos.cc • Founder at Cravia • >100 locations -

Federal State Educational Facility of Higher Education Saint Petersburg State University Graduate School of Management

Federal state educational facility of higher education Saint Petersburg State University Graduate School of Management Master Thesis FACTORS AFFECTING THE FRANCHISE CHOICE IN RESTAURANT INDUSTRY IN RUSSIAN MARKET AND ROLE OF DIGITALIZATION IN THEM 2nd-year student of Master program, Master in Management IODKO Valerii Research advisor: Associate professor YABLONSKY Sergey A. Saint-Petersburg 2020 ЗАЯВЛЕНИЕ О САМОСТОЯТЕЛЬНОМ ХАРАКТЕРЕ ВЫПОЛНЕНИЯ ВЫПУСКНОЙ КВАЛИФИКАЦИОННОЙ РАБОТЫ Я, Иодко Валерий Юрьевич, студент второго курса магистратуры направления «Менеджмент», заявляю, что в моей магистерской диссертации на тему «Факторы, влияющие на выбор франшизы в ресторанной индустрии на российском рынке и роль диджитализации в них», представленной в службу обеспечения программ магистратуры для последующей передачи в государственную аттестационную комиссию для публичной защиты, не содержится элементов плагиата. Все прямые заимствования из печатных и электронных источников, а также из защищенных ранее выпускных квалификационных работ, кандидатских и докторских диссертаций имеют соответствующие ссылки. Мне известно содержание п. 9.7.1 Правил обучения по основным образовательным программам высшего и среднего профессионального образования в СПбГУ о том, что «ВКР выполняется индивидуально каждым студентом под руководством назначенного ему научного руководителя», и п. 51 Устава федерального государственного бюджетного образовательного учреждения высшего профессионального образования «Санкт- Петербургский государственный университет» о том, что «студент