Creating Outstanding Spaces for Health Services in Our Communities Our Business at a Glance Investing to Support Primary Healthcare Infrastructure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

XINT F UK Real Estate NTR GBP Index

Created on 30 th 08 2019 XINT F UK Real Estate NTR GBP Index GBp The XINT F UK Real Estate NTR GBP Index is designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. This index measures the Net Total Return, reflecting the tax adjustment of Property Income Dividends (PIDs). INDEX PERFORMANCE - PRICE RETURN GBp 110 108 106 104 102 100 98 96 94 92 90 Jun 2019 Jul 2019 Aug 2019 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M - 3M - From 4 Jul 2019 6M - 6M - To 15 Aug 2019 1Y - 1Y - Return -8.53% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Segro PLC 16.29% 854,105 16.29% Real Estate Land Securities Group PLC 10.49% 550,208 10.49% Real Estate British Land Company PLC 9.17% 480,919 9.17% Real Estate Derwent London PLC 6.03% 316,409 6.03% Real Estate Unite Group PLC 5.76% 302,120 5.76% Real Estate Tritax Big Box REIT Plc 4.54% 238,191 4.54% Real Estate Shaftesbury PLC 3.62% 189,641 3.62% Real Estate Great Portland Estates PLC 3.59% 188,127 3.59% Real Estate Hammerson PLC 3.31% 173,427 3.31% Real Estate Assura PLC 3.15% 165,041 3.15% Real Estate Total 3,458,187 65.95% This information has been prepared by Index Intelligence GmbH (“IIG”). -

REAL ESTATE July 2020

LISTED MARKETS – REAL ESTATE July 2020 Leo Zielinski Partner Tel. +44 (0)7980 809031 [email protected] John Rodgers Partner Tel. +44 (0)7810 307422 [email protected] Will Strachan Partner Tel. +44 (0)7929 885859 [email protected] Lloyd Davies We track the share price movement and regulatory announcements Partner of 57 real estate owning listed entities (“Gerald Eve tracked index”). Tel. +44 (0)7767 311254 A summary of the Gerald Eve tracked index in terms of GAV, NAV, [email protected] LTV, Dividend, Share Price, Market Cap, Discount/Premium to NAV and their respective weekly movement is attached. Lorenzo Solazzo Data Analyst We provide a comparison to share price data from 3 February 2020 Tel. +44 (0)783 309 5582 [email protected] (pre-Covid-19 level) to present day to demonstrate the impact across certain entities as a direct result of Covid-19. James Brown Surveyor As at 30 of June, the Gerald Eve tracked index is currently down 30% to pre- Tel. +44 (0)7464 656563 Covid-19 level, under-performing the FTSE350 which is slowly recovering and is [email protected] now down 16%. The tracked listed REITs share price decreased on average 3% since 1 June 2020 (March: -25%, April: +6%, May: -3%). To provide context around the share price movement, the average discount to NAV is currently 31% against 3% pre-Covid-19. It is unsurprising to note that specialist sector entities across Industrial, Healthcare and Supermarkets have out-performed the REIT universe relative to other strategies within the Gerald Eve tracked index. -

Assura Financing Plc (Incorporated in England with Limited Liability with Registered Number 10023274) £300,000,000 1.500 Per Cent

Assura Financing plc (incorporated in England with limited liability with registered number 10023274) £300,000,000 1.500 per cent. Guaranteed Bonds due 2030 Issue Price 99.763 per cent. The £300,000,000 1.500 per cent. Guaranteed Bonds due 2030 (the “Bonds”) will be issued by Assura Financing plc (the “Issuer”) and guaranteed as set out below. Interest on the Bonds is payable annually in arrear on 15 September in each year. Payments on the Bonds will be made without deduction for or on account of taxes of the United Kingdom (the “UK”) to the extent described under “Terms and Conditions of the Bonds — Taxation”. The Bonds will initially be fully, unconditionally and irrevocably guaranteed on a joint and several basis by Assura plc (the “Company” or the “Group Parent”) and certain subsidiaries of the Group Parent named under “Overview – Guarantor(s)” below (each a “Guarantor”, and together the “Guarantors”). The Bonds mature on 15 September 2030 at their principal amount together with accrued interest. The Bonds are subject to redemption in whole, at their (i) Make Whole Redemption Price (as defined herein), together with accrued interest, at the option of the Issuer at any time prior to 15 June 2030; (ii) principal amount, together with accrued interest, at the option of the Issuer at any time on or after 15 June 2030; and (iii) principal amount, together with accrued interest, at the option of the Issuer at any time in the event of certain changes affecting taxes of the UK. In addition, upon the occurrence of certain change of control events which result in a negative ratings action being taken by a relevant credit rating agency, each holder of Bonds (a “Bondholder”) shall have the option to require the Issuer to redeem or, at the Issuer’s option, purchase (or procure the purchase of) the Bonds of such Bondholder at their principal amount, together with accrued interest. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

XINT F UK Real Estate P GBP Index

As of December 30, 2020 XINT F UK Real Estate P GBP Index DE000A13PXZ5 GBP The XINT F UK Real Estate P GBP Index is a free-float adjusted index, designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 120 115 110 105 100 95 90 85 80 75 70 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 69.43% 3M 23.80% From 14.02.2020 6M 21.90% 6M 21.90% To 19.03.2020 1Y -17.08% 1Y -17.08% Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (GBPm) Weight % Industry Sector Segro PLC 11,298 19.84 Real Estate Land Securities Group PLC 4,910 8.62 Real Estate British Land Company PLC 4,630 8.13 Real Estate Unite Group PLC 3,341 5.87 Real Estate Derwent London PLC 3,136 5.51 Real Estate Tritax Big Box REIT Plc 2,866 5.03 Real Estate LondonMetric Property PLC 2,059 3.61 Real Estate Assura PLC 2,021 3.55 Real Estate Primary Health Properties PLC 1,989 3.49 Real Estate Grainger PLC 1,900 3.34 Real Estate Total 38,151 66.99 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Active Global Real Estate Securities Manager (August 11, 2021, Regular Retirement Board Meeting)

Item No. 10: Annual Presentation by Dimensional Fund Advisors – Active Global Real Estate Securities Manager (August 11, 2021, Regular Retirement Board Meeting) INVESTMENT MANAGER SUMMARY MANAGEMENT Firm Name Dimensional Fund Advisors (DFA) Manager Tenure with Fund 8.5 Years Investment Strategy/Vehicle Global Real Estate Securities Contract Expiration 2/28/2022 ASSETS Total Firm AUM $ 660.0 Billion Total Firm Assets in Strategy $ 11.0 Billion RP - $ 33.0 Million Total Assets Managed for the Plan HP - $ 8.3 Million As of 06/30/2021 PERFORMANCE As of 06/30/2021 1-Year 3-Year 5-Year ITD¹ DFA Global Real Estate (gross) 32.76% 9.95% 6.76% 7.75% DFA Global Real Estate (net) 32.45% 9.69% 6.51% 7.46% FTSE EPRA/NAREIT Developed Index 34.83% 7.39% 5.97% 6.38% Difference (net) -2.38% 2.30% 0.53% 1.08% ¹ Inception to date 03/31/2013 FEES Current Fee 0.24% Net Expense Ratio WATCH STATUS N/A PREVIOUSLY DISCLOSED LITIGATION N/A 10 Los Angeles Water and Power Employees’ Retirement Plan August 11, 2021 Ted Simpson, CFA, Regional Director and Vice President Patrick Brown, CFA, Portfolio Manager This information is provided for registered investment advisors and institutional investors and is not intended for public use. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. -

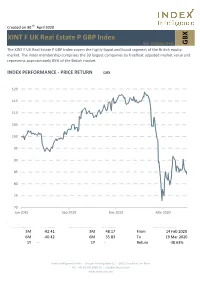

GBX XINT F UK Real Estate P GBP Index

Created on 30 th April 2020 XINT F UK Real Estate P GBP Index ISIN: DE000A13PXZ5 GBX The XINT F UK Real Estate P GBP Index covers the highly liquid and liquid segment of the British equity market. The index membership comprises the 39 largest companies by freefloat adjusted market value and represents approximately 85% of the British market. INDEX PERFORMANCE - PRICE RETURN GBX 120 115 110 105 100 95 90 85 80 75 70 Jun 2019 Sep 2019 Dec 2019 Mar 2020 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -92.41 3M 48.17 From 14 Feb 2020 6M -40.42 6M 35.83 To 19 Mar 2020 1Y - 1Y - Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Segro PLC 18.87% 903,501 18.87% Real Estate Land Securities Group PLC 9.84% 471,302 9.84% Real Estate British Land Company PLC 7.85% 375,854 7.85% Real Estate Derwent London PLC 6.50% 311,232 6.50% Real Estate Unite Group PLC 5.32% 254,662 5.32% Real Estate Tritax Big Box REIT Plc 4.29% 205,609 4.29% Real Estate Primary Health Properties PLC 3.87% 185,126 3.87% Real Estate Assura PLC 3.76% 179,927 3.76% Real Estate Great Portland Estates PLC 3.59% 171,818 3.59% Real Estate Big Yellow Group PLC 3.43% 164,027 3.43% Real Estate Total 3,223,058 67.32% This information has been prepared by Index Intelligence GmbH (“IIG”). -

2021 Quarterly Report (Unaudited)

JANUARY 31, 2021 2021 Quarterly Report (Unaudited) iShares Trust Table of Contents Page iShares Cohen & Steers REIT ETF.......................................................................................................................................... 3 iShares Core Dividend Growth ETF ........................................................................................................................................ 5 iShares Core High Dividend ETF............................................................................................................................................ 11 iShares Core U.S. REIT ETF ............................................................................................................................................... 14 iShares Dow Jones U.S. ETF ............................................................................................................................................... 17 iShares Global REIT ETF................................................................................................................................................... 29 iShares International Developed Real Estate ETF............................................................................................................................ 34 iShares International Select Dividend ETF................................................................................................................................... 38 iShares Morningstar Large-Cap ETF ....................................................................................................................................... -

Vanguard Global Ex-U.S. Real Estate Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Global ex-U.S. Real Estate Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

Morningstar Report

Report as of 30 Sep 2021 VT Gravis Real Assets ICVC - VT Gravis UK Listed Property PAIF Fund A GBP Income Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™ Property - Indirect Other Not Categorized Not Benchmarked Not Rated Used throughout report Investment Objective Performance It is intended that the Fund will be a PAIF at all times, and, 139 as such, its investment objective is to carry on Property 126 Investment Business and to manage cash raised from 113 investors for investment in the Property Investment 100 Business. In so doing the objective of the Fund is to provide 87 some capital growth through market cycles (7 years) whilst 74 delivering a periodic income. 2016 2017 2018 2019 2020 2021-08 - - - - -5.43 26.94 Fund Risk Measures Trailing Returns % Fund Quarterly Returns % Q1 Q2 Q3 Q4 3Y Alpha - 3Y Sharpe Ratio - 3 Months 8.18 2021 2.59 9.19 - - 3Y Beta - 3Y Std Dev - 6 Months 18.45 2020 -19.59 9.13 -0.81 8.66 3Y R-Squared - 3Y Risk - 1 Year 30.84 2019 - - - - 3Y Info Ratio - 5Y Risk - 3 Years Annualised - 2018 - - - - 3Y Tracking Error - 10Y Risk - 5 Years Annualised - 2017 - - - - 10 Years Annualised - Data as of 29/09/2021 Portfolio 30 Jun 2021 Asset Allocation % Net Equity Style Box™ Mkt Cap % Fund America Europe Asia Large Size Stocks 64.16 Giant 0.00 Bonds 0.00 Mid Large 13.65 Cash 3.56 Medium 63.76 Other 32.29 Small Small 22.59 Value Blend Growth Micro 0.00 Style Average Mkt Cap (Mil) Fund Ave Mkt Cap GBP 2,293.23 <25 25-50 50-75 >75 Top Holdings Stock Sector Weightings % Fund World Regions % Fund Holding Name Sector % hCyclical 100.00 Americas 0.00 Segro PLC u 8.76 rBasic Materials - United States 0.00 Tritax Big Box Ord - 7.46 tConsumer Cyclical 4.04 Canada 0.00 UNITE Group PLC u 6.70 yFinancial Services - Latin America 0.00 Grainger PLC 6.54 Real Estate 95.96 u u Greater Europe 100.00 Assura PLC u 5.66 jSensitive 0.00 United Kingdom 100.00 Safestore Holdings PLC.. -

Factsheet 1 29 May 2020

MONTHLY FACTSHEET 1 29 MAY 2020 Company overview OVERVIEW Name VT Gravis UK Listed Property The VT Gravis UK Listed Property Fund (the “Fund”) is a Non UCITs Retail Scheme (NURS) Open Ended Fund Investment Company (OEIC) with Property Alternative Investment Fund (PAIF) status. Regulatory Status FCA Authorised NURS OEIC The Fund invests primarily in UK Real Estate Investment Trusts, is unconstrained, and currently with PAIF Status excludes exposure to retail property companies. The Fund is advised by Gravis Advisory Limited who also advise the VT Gravis UK Infrastructure Income Fund and the VT Gravis Clean Energy Income Sector IA Property Other Fund. Launch Date 31 October 2019 Fund Size £28.34m FUND OBJECTIVES Net Asset Value A Acc (£): 91.99p – To achieve capital growth through market cycles* per share as at 29 A Inc (£): 90.45p – To invest in a diversified portfolio of London Stock Exchange listed securities, consisting primarily April 2020 F Acc (£): 92.36p F Inc (£): 90.83p of Real Estate Investment Trusts and potentially some bonds and closed ended funds. Share Classes Income and Accumulation – Avoid exposure to retail property companies at launch – Aims to deliver a regular income expected to be 4% per annum after charges. (£, $, €) Min. Investment £100 PERFORMANCE CHART Capped fund 0.7% (AMC & OCF) operating charges Simulated Portfolio (Total Return after charges) 31/10/2015 – 31/10/2019 150 Dividends Quarterly MSCI UK IMI Core Real Estate in GBP (Total Return) 140 Simulated Portfolio (Total Return) Objectives 4% dividend yield Capital growth 130 Inflation protection 120 Classification Non-complex 110 Liquidity Daily dealing 100 ISINs A Acc (£): GB00BK8VW755 A Inc (£): GB00BK8VW532 90 A Acc ($): GB00BK8VYN55 A Inc ($): GB00BK8VMH57 A Acc (€): GB00BK8VW862 80 A Inc (€): GB00BK8VW649 70 EXPOSURE Oct 15 Apr 16 Oct 16 Apr 17 Oct 17 Apr 18 Oct 18 Apr 19 Oct 19 F Acc (£): GB00BKDZ8Y17 Feeder ISINs Hypothetical past performance is not necessarily indicative of future results.