Seaweed Nation: Indonesia’S New Growth Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BAB II GAMBARAN UMUM OBJEK PENELITIAN 2.1 Gambaran Umum

BAB II GAMBARAN UMUM OBJEK PENELITIAN 2.1 Gambaran Umum Provinsi DKI Jakarta 2.1.1 Keadaan Geografis Provinsi DKI Jakarta dalam lingkup kerangka Negara Kesatuan Republik Indonesia (NKRI) memiliki peran strategis, yaitu sebagai ibukota negara. Provinsi DKI Jakarta yang merupakan ibukota negara sehingga tidak memiliki kawasan terpencil maupun kawasan pedalaman. Secara astronomis Provinsi DKI Jakarta terletak antara 6o12’ Lintang Selatan dan 106o48’ Bujur Timur. Dilihat dari posisi geostrategis, Provinsi DKI Jakarta terletak di sisi utara bagian barat Pulau Jawa, dengan bagian utara berbatasan langsung dengan Laut Jawa, sedangkan sisi timur dan selatan Provinsi DKI Jakarta berbatasan langsung dengan wilayah Provinsi Jawa Barat, serta sisi barat yang berbatasan dengan Provinsi Banten. Sebagian wilayah Provinsi DKI Jakarta merupakan kawasan pesisir, dengan luas wilayah pesisir sekitar 155 km yang membentang dari timur ke barat kurang lebih 35 km, dan menjorok ke darat sekitar 4-10 km. Selain memiliki kawasan pesisir, DKI Jakarta juga memiliki 110 pulau yang tersebar pada 2 (dua) Kecamatan yang berada di wilayah Kabupaten Administrasi Kepulauan Seribu. 40 41 Gambar 2.1 Peta Provinsi DKI Jakarta Sumber: Jakarta.go.id DKI Jakarta dianalisis dari aspek ketinggian dan kemiringan lahan, yaitu terletak pada dataran rendah dengan ketinggian rata-rata kurang lebih 7 meter di 42 atas permukaan laut. Sedangkan, sekitar 40 persen wilayah Provinsi DKI Jakarta berupa dataran yang permukaan tanahnya berada 1-1,5 meter di bawah muka laut pasang. Dengan kondisi kemiringan lahan yang demikian, ditambah dengan 17 sungai yang mengalir di Provinsi DKI Jakarta menyebabkan kecenderungan semakin rentannya wilayah Jakarta tergenang air dan banjir pada musim hujan. -

Kode Dan Data Wilayah Administrasi Pemerintahan Provinsi Dki Jakarta

KODE DAN DATA WILAYAH ADMINISTRASI PEMERINTAHAN PROVINSI DKI JAKARTA JUMLAH N A M A / J U M L A H LUAS JUMLAH NAMA PROVINSI / K O D E WILAYAH PENDUDUK K E T E R A N G A N (Jiwa) **) KABUPATEN / KOTA KAB KOTA KECAMATAN KELURAHAN D E S A (Km2) 31 DKI JAKARTA 31.01 1 KAB. ADM. KEP. SERIBU 2 6 - 10,18 21.018 31.01.01 1 Kepulauan Seribu 3 - Utara 31.01.01.1001 1 Pulau Panggang 31.01.01.1002 2 Pulau Kelapa 31.01.01.1003 3 Pulau Harapan 31.01.02 2 Kepulauan Seribu 3 - Selatan. 31.01.02.1001 1 Pulau Tidung 31.01.02.1002 2 Pulau Pari 31.01.02.1003 3 Pulau Untung Jawa 31.71 2 KODYA JAKARTA PUSAT 8 44 - 52,38 792.407 31.71.01 1 Gambir 6 - 31.71.01.1001 1 Gambir 31.71.01.1002 2 Cideng 31.71.01.1003 3 Petojo Utara 31.71.01.1004 4 Petojo Selatan 31.71.01.1005 5 Kebon Pala 31.71.01.1006 6 Duri Pulo 31.71.02 2 Sawah Besar 5 - 31.71.02.1001 1 Pasar Baru 31.71.02.1002 2 Karang Anyar 31.71.02.1003 3 Kartini 31.71.02.1004 4 Gunung Sahari Utara 31.71.02.1005 5 Mangga Dua Selatan 31.71.03 3 Kemayoran 8 - 31.71.03.1001 1 Kemayoran 31.71.03.1002 2 Kebon Kosong 31.71.03.1003 3 Harapan Mulia 31.71.03.1004 4 Serdang 1 N A M A / J U M L A H LUAS JUMLAH NAMA PROVINSI / JUMLAH WILAYAH PENDUDUK K E T E R A N G A N K O D E KABUPATEN / KOTA KAB KOTA KECAMATAN KELURAHAN D E S A (Km2) (Jiwa) **) 31.71.03.1005 5 Gunung Sahari Selatan 31.71.03.1006 6 Cempaka Baru 31.71.03.1007 7 Sumur Batu 31.71.03.1008 8 Utan Panjang 31.71.04 4 Senen 6 - 31.71.04.1001 1 Senen 31.71.04.1002 2 Kenari 31.71.04.1003 3 Paseban 31.71.04.1004 4 Kramat 31.71.04.1005 5 Kwitang 31.71.04.1006 6 Bungur -

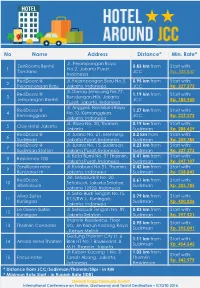

No Name Address Distance* Min. Rate*

No Name Address Distance* Min. Rate* Jl. Pejompongan Raya ZenRooms Benhil 0.83 km from Start with: 1 No.2, Jakarta Pusat, Tondano JCC Rp. 338,842 Indonesia RedDoorz @ Jl. Pejompongan Baru No.5, 0.95 km from Start with: 2 Pejompongan Baru Jakarta, Indonesia JCC Rp. 227,272 Jl. Danau Jempang No.77, RedDoorz @ 1.19 km from Start with: 3 Bendungan Hilir, Jakarta Jempangan Benhil JCC Rp. 185,950 Pusat, Jakarta, Indonesia Jl. Anggrek Neli Murni Raya RedDoorz @ 1.27 km from Start with: 4 No.10, Kemanggisan, Kemanggisan JCC Rp. 227,273 Jakarta, Indonesia JL. Blora No. 20, Thamrin, 0.19 km from Start with: 5 Clay Hotel Jakarta Jakarta Sudirman Rp. 288,429 RedDoorz @ Jl. Juana No. 21, Menteng, 0.2 km from Start with: 6 Sudirman Jakarta Pusat, Indonesia Sudirman Rp. 205,785 RedDoorz @ Jl. Juana No. 15, Sudirman, 0.23 km from Start with: 7 Sudirman Station Jakarta Pusat, Indonesia Sudirman Rp. 227,273 Jl. Kota Bumi No. 31 Thamrin, 0.41 km from Start with: 8 Residence 100 Jakarta Pusat, Indonesia Sudirman Rp. 247,107 ZensRoom near Jl. Kotabumi No.31, Thamrin, 0.42 km from Start with: 9 Bundaran HI Jakarta, Indonesia Sudirman Rp. 238,842 Jln. Setiabudi 8 No. 20. RedDoorz 0.61 km from Start with: 10 Setiabudi, Jakarta Selatan, @Setiabudi Sudirman Rp. 205,785 Jakarta 12920, Indonesia Jl. Setia Budi Tengah No.15, Alivio Suites 0.79 km from Start with: 11 RT.5/RW.1, Kuningan, Kuningan Sudirman Rp. 400,826 Jakarta, Indonesia Le Green Suites Jl. Setiabudi Tengah No. -

Indonesia's Sustainable Development Projects

a INDONESIA’S SUSTAINABLE DEVELOPMENT PROJECTS PREFACE Indonesia highly committed to implementing and achieving the Sustainable Development Goals (SDGs). Under the coordination of the Ministry of National Development Planning/Bappenas, Indonesia has mainstreamed SDGs into National Medium-Term Development Plan (RPJMN) and elaborated in the Government Work Plan (RKP) annual budget documents. In its implementation, Indonesia upholds the SDGs principles, namely (i) universal development principles, (ii) integration, (iii) no one left behind, and (iv) inclusive principles. Achievement of the ambitious SDGs targets, a set of international commitments to end poverty and build a better world by 2030, will require significant investment. The investment gap for the SDGs remains significant. Additional long-term resources need to be mobilized from all resources to implement the 2030 Agenda for Sustainable Development. In addition, it needs to be ensured that investment for the SDGs is inclusive and leaves no one behind. Indonesia is one of the countries that was given the opportunity to offer investment opportunities related to sustainable development in the 2019 Sustainable Development Goals Investment (SDGI) Fair in New York on April 15-17 2019. The SDGI Fair provides a platform, for governments, the private sectors, philanthropies and financial intermediaries, for “closing the SDG investment gap” through its focus on national and international efforts to accelerate the mobilization of sufficient investment for sustainable development. Therefore, Indonesia would like to take this opportunity to convey various concrete investment for SDGs. The book “Indonesia’s Sustainable Development Project” shows and describes investment opportunities in Indonesia that support the achievement of related SDGs goals and targets. -

Daftar Lembaga Pemantau Yang Terakreditasi Di Kpu Provinsi Dki Jakarta

DAFTAR LEMBAGA PEMANTAU YANG TERAKREDITASI DI KPU PROVINSI DKI JAKARTA NOMOR NO. NAMA LEMBAGA ALAMAT AKREDITASI 1 2 3 4 1. KOMITE INDEPENDEN 387/KPU-Prov- Jl. Bukit Duri Tanjakan XVI RT/RW. PEMANTAU PEMILU (KIPP) 010/VIII/2016 008/008, Tebet, Jakarta Selatan. DKI JAKARTA Email : [email protected] 2. PERKUMPULAN UNTUK 388/KPU-Prov- Jl.Tebet Timur IVA No.1, Tebet, PEMILU DAN DEMOKRASI 010/VIII/2016 Jakarta Selatan (PERLUDEM) Tlp : 021-8300004 Fax : 83795697 3. JARINGAN PENDIDIKAN 471/KPU-Prov- Jln. Manggarai Utara I RT.007, RW. PEMILIH UNTUK RAKYAT 010/X/2016 02, No. H- 4, Manggarai, Tebet, (JPPR) Jakarta Selatan, 12850 Tlp : 83706467 Fax : 83780308 Email : [email protected] www.jppr.or.id 4. PIJAR KEADILAN 472/KPU-Prov- Majapahit Permai Blok B112, Jl. 010/X/2016 Majapahit No.18-24, Jakbar 5. PRESIDIUM PUSAT 553/KPU-Prov- Jl.Kampung Melayu Kecil II, RECLASSEERING 010/XI/2016 RT.004/RW.010, No.08, Kelurahan INDONESIA Bukit Duri, Kecamatan Tebet, Kotamadya Jakarta Tlp : 91261445 Fax : 8353589 DAFTAR LEMBAGA SURVEI/JAJAK PENDAPAT YANG MENDAFTAR KE KPU PROVINSI DKI JAKARTA NO. NAMA LEMBAGA ALAMAT LEMBAGA 1 2 3 1 LINGKARAN SURVEI KOMPLEK BUKIT GADING MEDITERANIA BLOK EB INDONESIA NO.5 KELAPA GADING, JAKARTA UTARA. TELP. 021-4514704. FAX. 021-45857336 www.lsi.co.id 2 JARINGAN ISU KOMPLEK BUKIT GADING MEDITERANIA BLOK EB PUBLIK NO.5 KELAPA GADING, JAKARTA UTARA. TELP. 021-4514704. FAX. 021-45857336 www.lsi.co.id 3 PT. SANDS ANALITIK GEDUNG GRAHA AKTIVA LT. 5. SUITE 503. JL. INDONESIA *) HR. RASUNA SAID BLOK X-1 KAV 03. -

Daftar Rumah Sakit Rujukan Berdasarkan KMK Dan Kepgub

#jakartatanggapcorona DAFTAR RUMAH SAKIT RUJUKAN PENANGGULANGAN COVID-19 DI PROVINSI DKI JAKARTA Sesuai dengan KMK No. HK.01.07/MENKES/169/2020 dan Kepgub No. 494 Tahun 2020 RUMAH SAKIT 17 Pemprov DKI Jakarta @DKIJakarta jakarta.go.id #jakartatanggapcorona JAKARTA BARAT RS PELNI RS MITRA KELUARGA Jl. Aipda K.S. Tubun No. 92-94, Kelurahan KALIDERES Slipi, Kecamatan Palmerah, Jakarta Barat Jl. Peta Selatan No. 1, Kelurahan Kalideres, RS JANTUNG DAN Kecamatan Kalideres, Jakarta Barat PEMBULUH DARAH RS SILOAM KEBON JERUK HARAPAN KITA JI. Raya Perjuangan Kav. 8, Kelurahan Kebon Jeruk, Kecamatan Jl. Letjen S. Parman Kav. 87, Slipi, Kelurahan Kebon Jeruk, Jakarta Barat Kota Bambu Utara, Kecamatan Palmerah, Jakarta Barat RS PONDOK INDAH RS ANAK DAN BUNDA PURI INDAH HARAPAN KITA JI. Puri Indah Raya Blok S-2, Kelurahan Kembangan Selatan, Kecamatan Jl. Letjen S. Parman Kav. 87, Slipi, Kelurahan Kembangan, Jakarta Barat Kota Bambu Utara, Kecamatan Palmerah, Jakarta Barat RS SUMBER WARAS RS KHUSUS KANKER Jl. Kyai Tapa No. 1, Kelurahan Tomang, Kecamatan Grogol Petamburan, Jakarta DHARMAIS Barat Jl. Letjen S. Parman Kav. 84-86, Slipi, Kelurahan Kota Bambu Selatan, Kecamatan Palmerah, Jakarta Barat RS HERMINA DAAN MOGOT Jl. Kintamani Raya No. 2, Kawasan Daan RS CIPUTRA Mogot Baru, Kelurahan Kalideres, Kecamatan Kalideres, Jakarta Barat JI. Boulevard Blok G-01/01 Citra 5 Garden City, Kelurahan Pegadungan, Kecamatan Kalideres, Jakarta Barat RSUD KALIDERES Jl. Satu Maret No. 48 RT001/04, RS GRHA KEDOYA Kelurahan Pegadungan, Kecamatan Kalideres, Jakarta Barat Jl. Panjang Arteri 26, Kelurahan Kedoya Utara, Kecamatan Kebon Jeruk, Jakarta Barat RSUD CENGKARENG Jl. Kamal Raya Bumi Cengkareng Indah Cengkareng Timur, Jakarta Barat 27 Pemprov DKI Jakarta @DKIJakarta jakarta.go.id #jakartatanggapcorona JAKARTA PUSAT RSUD TARAKAN RS ABDUL RADJAK Jl. -

Floods in North Sumatera, West Java, Bengkulu and DKI Jakarta Provinces

Information bulletin Indonesia: Floods in North Sumatera, West Java, Bengkulu and DKI Jakarta provinces Glide n° FL-2019-000182-IDN Date of issue: 2 January 2020 Date of disaster: 28 December 2019 – now Point of contact: Arifin M. Hadi, PMI Head of Disaster Management Heather Fehr, IFRC Disaster Risk Management Delegate Operation start date: 28 December 2019 Category of disaster: Yellow Host National Society: Indonesian Red Cross (Palang Merah Indonesia) Number of people affected: approximately Number of people to be assisted: TBC (assessment is 10,000,000 affected, 31,232 IDP and 16 deaths ongoing) This bulletin is issued for information only and reflects the current situation and details available at this time. The Indonesian Red Cross – Palang Merah Indonesia (PMI), with the support of the International Federation of Red Cross and Red Crescent Societies (IFRC), are continuing to monitor and respond to the situation with local and national resources. If required, additional financial resources will be sought via the relevant IFRC international disaster response mechanism. The situation Torrential rainfall from Tuesday, 31 December 2019, until Wednesday, 1 January 2020 morning triggered floods in Jakarta (all five municipalities: North, West, East, Central and South), West Java (districts of West Bandung, Karawang, Bogor, Bekasi and Bekasi City) and Banten Province (district of Lebak, South Tangerang, and Tangerang City). The Indonesian National Board for Disaster Management, locally known as Badan Nasional Penanggulangan Bencana (BNPB), reported that the flooding spots has reached 268, while in Jakarta alone 158 flooding spots are identified. The most affected area in Jakarta is East Jakarta with 65 flood spots. -

Daftar Izin Kantor Jasa Penilai Publik (KJPP) Per 1 Agustus 2019 No No Induk Nama KJPP No Izin KJPP Tgl Izin Klasifikasi Izin Domisili Alamat Tlp Fax

Daftar Izin Kantor Jasa Penilai Publik (KJPP) Per 1 Agustus 2019 No No Induk Nama KJPP No Izin KJPP Tgl Izin Klasifikasi Izin Domisili Alamat Tlp Fax Golden Plaza Blok G 43-44, Jl. Rs. Fatmawati No.15 1 2.09.0051 Abdullah Fitriantoro & Rekan 674/KM.1/2009 13-Jul-09 Properti dan Bisnis Jakarta 021-7659718 021-7659721 Rt.005/001, Jakarta Selatan 12320 Kelapa Dua Residence Blok D No 10, RT 001 RW 007, 2 3.13.0052 Achmad Fa'izin 227/KM.1/2013 23-Apr-13 Properti Depok 021-70770040 021-77219233 Kelurahan Tugu, Kecamatan Cimanggis, Depok, 16451 Graha SBR Lantai 4, Jalan Raya Tanjung Barat No.146, 3 2.08.0003 Aditya Iskandar dan Rekan 772/KM.1/2008 26-Nov-08 Properti Jakarta RT.014/004 Kelurahan Tanjung Barat, Kecamatan 021-782 3135 Jagakarsa, Jakarta Selatan 12530 Ruko Freesia Garden No. 29, Jalan Jombang Raya No Tangerang 4 2.15.0134 Agus, Ali, Firdaus dan Rekan 926/KM.1/2015 14-Dec-15 Properti dan Bisnis 148, Kelurahan Pondok Jaya, Kecamatan Pondok Aren, 021-22214296 021-22214196 Selatan Tangerang Selatan 021- Buaran Persada 25 Lt.3, Jl. Jend. Pol. Soekamto, 5 2.09.0037 Agus, Firdaus & Rekan 459/KM.1/2009 28-Apr-09 Properti Jakarta 86612346/866123 021-86614145 Jakarta Timur 13460 47 Ruko Palem Ganda Asri 1, Blok B/A 10 No.3, Jl. Raden 6 2.18.0155 Ahmad Arif Maulana dan Rekan 515/KM.1/2018 7-Aug-18 Properti Tangerang Saleh RT 01 RW 016, Kelurahan Karang Tengah, Kec. -

FLOODS FL-2007-000023-IDN 5 February 2007 the Federation’S Mission Is to Improve the Lives of Vulnerable People by Mobilizing the Power of Humanity

Information Bulletin no. 01/2007 Glide no: INDONESIA: FLOODS FL-2007-000023-IDN 5 February 2007 The Federation’s mission is to improve the lives of vulnerable people by mobilizing the power of humanity. It is the world’s largest humanitarian organization and its millions of volunteers are active in over 185 countries. In Brief This Bulletin is being issued for information only, and reflects the situation and the information available at this time. The Federation is not seeking funding or other assistance from donors for this operation at this time. For further information specifically related to this operation please contact: • Indonesian Red Cross (PMI): Mr. Arifin M. Hadi (acting head of disaster management division); mobile: +62.811.943.952; telephone: +62.21.799.2325 ext. 222; email: [email protected] • Federation country delegation in Indonesia: Bob McKerrow (head of delegation); email: [email protected]; mobile: +62.81.182.4859, phone: +62.21.7919.1841 (ext. 107); fax: +62.21.7918.0905 • Federation secretariat in Geneva (Asia Pacific department): Josse Gillijns (regional officer); email: [email protected] ; phone: +44.22.730.4224, fax: +41.22 733.0395 or Priya Nair; email: [email protected] ; phone: + 44-22.730.4296. The Situation Heavy rains since the 1 February 2007 have caused massive flooding in the Indonesian capital of Jakarta. According to the Indonesian Red Cross (PMI), floods have killed at least seven people and made nearly 270,000 people homeless. It is estimated that nearly 60% of the city is now inundated with water following days of torrential rains which have caused rivers to burst, pouring muddy waters up to 4 m deep into homes and buildings. -

243 Daftar SP 2

Entry LKO Lampiran Siaran Pers No. 90/HM/KOMINFO/03/2021 tentang Publikasi Penyelenggara Pos yang Mendapat Sanksi Teguran Tertulis dan Sanksi Teguran Kedua melalui Website No Nama Perusahaan Alamat Perusahaan Alamat Ijin Alamat Operasional Propinsi No Ijin Jenis Pelayanan Tahun Ijin Status Ijin Tahun LKO Jl. Kalimantan No. 34, RT. 003 / RW. 002, Kel. Kasin, Kec. Jl. Kalimantan No. 34 RT. 003/02, Kel. Kasin, Kec. 1 Tirta Jaya Trapac Jl. Kalimantan No. 36 Malang JAWA TIMUR 020 Tahun 2016 Paket 2016 Aktif 2020 Klojen, Malang, Jawa Timur Klojen, Malang, Jawa Timur Ruko Palm Spring Blok D2 No. 6, Kel. Taman Baloi, Kec. Ruko Palm Spring Blok D2 No. 6, Kel. Taman Baloi, Kec. Ruko Palm Spring Blok D2 No. 6, Kel. Taman Baloi, 2 Vicky Mandiri KEPULAUAN RIAU 097 Tahun 2016 Paket 2016 Aktif 2020 Batam Kota, Batam, Kepulauan Riau Batam Kota, Batam, Kepulauan Riau Kec. Batam Kota, Batam, Kepulauan Riau Pusat Niaga Roxy Mas Blok C-3/34, Jl. KH. Hasyim Ashari Pusat Niaga Roxy Mas Blok C-3/34, Jl. KH. Hasyim Ashari Pusat Niaga Roxy Mas Blok C-3/34, Jl. KH. Hasyim 3 Aeronusa Inti Raya No. 125, Kel. Cideng, Kec. Gambir, Jakarta Pusat, DKI No. 125, Kel. Cideng, Kec. Gambir, Jakarta Pusat, DKI Ashari No. 125, Kel. Cideng, Kec. Gambir, Jakarta DKI JAKARTA 079 Tahun 2016 Paket 2016 Aktif 2020 Jakarta Jakarta Pusat, DKI Jakarta Jl. Mangga Besar VIII, No. 12 -J, Kel. Tamansari, Kec. Jl. Mangga Besar VIII, No. 12 -J, Kel. Tamansari, Kec. Jl. Mangga Dua Dalam Komplek Ruko Bahan Komunikasi Tertulis / 4 Akas Kartika Sakti DKI JAKARTA 037 Tahun 2016 2016 Aktif 2020 Tamansari, Jakarta Barat, DKI Jakarta Tamansari, Jakarta Barat, DKI Jakarta Bangunan Blok H.2 No. -

NO. NPSN NAMA SEKOLAH ALAMAT 1 20100289 SMP 1908 Jl

NO. NPSN NAMA SEKOLAH ALAMAT 1 20100289 SMP 1908 Jl. Petamburan III No. 41, Tanah Abang 2 20100290 SMP 1945 Jl. H. Awaludin, Tanah Abang 3 20106349 SMP ADVENT I JAKARTA Jl. Kramat Pulo No. 16, S e n e n 4 20100291 SMP ADVENT III Jl. Sawo No. 27, Menteng 5 20106350 SMP ADVENT SALEMBA Jl. Salemba Raya No. 47, S e n e n 6 20100292 SMP AL IRSYAD Jl. KH. Hasyim Ashari No. 27, Gambir 7 20106351 SMP AL MA'MUR Jl. Raden Saleh Raya No. 30, Menteng 8 20100293 SMP AN NUR Jl. KS. Tubun Raya No. 29, Tanah Abang 9 20100308 SMP AT-TAQWA Jl. Rawajali Selatan VI No.18, Sawah Besar 10 20100334 SMP BETHEL Jl. KS. Tubun No. 253, Tanah Abang 11 20106353 SMP BUDI MULIA Jl. Mangga Besar Raya No. 135, Sawah Besar 12 20106354 SMP BUNDA MULIA Jl. AM. Sangaji No. 20, Gambir 13 20106355 SMP CEMPAKA Jl. Cemp. Putih Barat 21, Cempaka Putih 14 20106356 SMP DHARMA BAKTI Jl. Madani Raya No. 7, Cempaka Putih 15 20100310 SMP GAJAH MADA Jl. Murdai No.1, Cempaka Putih 16 20100325 SMP GIKI 5 Jl. Cilamaya No. 1, Gambir 17 20100326 SMP HATI SUCI Jl. Hati Suci No. 2, Tanah Abang 18 20106360 SMP ISLAM AL JIHAD Jl. Kramat Jaya No. 38, Johar Baru 19 20100327 SMP ISLAM AL-IHSAN Jl. Kebon Kacang IX No. 57, Tanah Abang 20 20106361 SMP ISLAM MANHALUNNASYIIN Jl. Dwi Warna II No. 5 Karang Anyar, Sawah Besar 21 20106362 SMP ISLAM MERANTI Jl. Kali Baru Timur V/13-15, S e n e n 22 20106363 SMP ISLAM MIFTAHUSSA'ADAH Jl. -

Download (555Kb)

The effectiveness of special carriages for female in protecting female train passengers L S Putranto1 and A N Tajudin1 1 Civil Engineering Department, Tarumanagara University, Jakarta 11440, Indonesia Abstract. PT Kereta Commuter Indonesia (KCI) is one of PT Kereta Api (KA) Indonesia managing Greater Jakarta Commuter Trains. PT KCI started to provide special carriages for females during peak hours in 2011. Up to December 2019, PT KCI has 1,100 units of electrical carriages. In 2019, the average daily passengers were 979.853 on weekdays with maximum daily passengers of 1,154,080. PT MRT Jakarta started to provide special carriages for females during peak hours in May 2019, about 2 months after its opening of phase 1a from Lebak Bulus to Bundaran HI. By operating 16 transit units the average daily passengers are 83,000 with maximum daily passengers 93,000. The availability of special carriages for females was intended to protect female passengers from criminal acts and sexual harassment. However according to previous research an media coverage, the special carriages were not consistently provide a positive impact to female passengers. This research is intended to evaluate this issue and provide recommendations regarding this service. Keywords: Special carriages for female, protecting, female train passengers 1. Introduction PT Kereta Commuter Indonesia (KCI) is one of PT Kereta Api (KA) Indonesia managing Greater Jakarta Commuter Trains. According to its official website accessed in 2020 [1], PT KCI started to modernize electrical train services, simplified the provided routes into only six main routes, provide special carriages for female during peak hours, and rebranding the airconditioned economy class electrical train services with new name, commuter line in 2011.