India Daily, October 25, 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Detailed Property Analysis Report of Sobha International City in Sector 109, Gurgaon

PROPINSIGHT A Detailed Property Analysis Report 40,000+ 10,000+ 1,200+ Projects Builders Localities Report Created On - 17 Aug, 2016 Price Insight This section aims to show the detailed price of a project and split it into its various components including hidden ones. Various price trends are also shown in this section. Project Insight This section compares your project with similar projects in the locality on construction parameters like livability rating, safety rating, launch date, etc. What is Builder Insight PROPINSIGHT? This section delves into the details about the builder and tries to give the user a perspective about the history of the builder as well as his current endeavours. Locality Info This section aims to showcase various amenities viz. pre-schools, schools, parks, restaurants, hospitals and shopping complexes near a project. Sobha International City Sector 109, Gurgaon 3.68 Cr onwards Livability Score 8.1/ 10 Configurations Possession Starts 3,4,5 Bedroom Villa Mar `18 Pricing Comparison Comparison of detailed prices with various other similar projects Pricing Trends Price appreciation and trends for the project as well as the locality What is PRICE INSIGHT? Price versus Time to completion An understanding of how the current project’s prices are performing vis-a-vis other projects in the same locality Demand Comparison An understanding of how the strong/weak is the demand of current project and the current locality vis-a-vis others Price Trend Of Sobha International City Sobha International City VS Sector 109, Gurgaon -

India Daily, July 30, 2009

INDIA DAILY July 30, 2009 India 29-Jul 1-day1-mo 3-mo Sensex 15,173 (1.0) 2.6 33.1 Nifty 4,514 (1.1) 2.8 29.9 Contents Global/Regional indices Dow Jones 9,071 (0.3) 6.3 10.8 Results Nasdaq Composite 1,968 (0.4) 6.7 14.9 Sterlite Industries: On expected lines FTSE 4,548 0.4 5.9 8.5 Jindal Steel and Power: Power storm Nikkie 10,083 (0.3) 1.3 14.2 Hang Seng 20,136 (2.4) 9.6 29.7 Cairn India: The real story starts now KOSPI 1,520 (0.3) 9.3 11.0 Tata Steel: Results below expectations Value traded - India Cash (NSE+BSE) 307.6 236.1 260.2 Hero Honda: Quarter not good enough for 11X EV/EBITDA Derivatives (NSE) 1,165.1 475.9 801 Punjab National Bank: Well managed on core front, but restructured assets are high Deri. open interest 982.6 587 987 Cipla: In line results Sesa Goa: Weak realizations Forex/money market Sun TV Network: In-line 1QFY10 results; valuations limit upside potential Change, basis points 29-Jul 1-day 1-mo 3-mo Lanco Infratech: Healthy growth in execution led by construction division Rs/US$ 48.4 18 30 (176) 10yr govt bond, % 7.1 - 13 89 Housing Development & Infrastructure: Reinitiate with ADD as financial strain eases Net investment (US$mn) 24-Jul MTD CYTD IRB Infrastructure Developers: Results boosted by construction business FIIs 153 1,500 6,470 Corporation Bank: Reports strong operational performance, retain BUY . -

Annual Report 2018-19

6thANNUAL REPORT 2018-19 Content 1. Corporate Information Pg. 3 2. Gosree Story Pg. 4 3. Brief profile of the Board & Management Pg. 6 4. Our Journey So Far Pg. 10 5. Notice of AGM and Directors’ report Pg. 13 6. Directors' Report for the year 2018-19 Pg. 20 7. Report on the Audit of the Standalone Financial Statements Pg. 62 8. Balance Sheet Pg. 68 9. Report on the Audit of the Consolidated Financial Statements Pg. 89 10. Consolidated Balance Sheet Pg. 93 11. Report on the Standalone Financial Statements Gosree Insurance Broking Pvt Ltd Pg. 113 12. Balance Sheet (Gosree Insurance Broking Pvt Ltd) Pg. 119 13. Report on the Standalone Financial Statements Gosreeinvestments & Risks Pvt Ltd Pg. 128 14. Balance Sheet (Gosreeinvestments & Risks Pvt Ltd) Pg. 134 Inauguration of new corporate office on 26th November 2018 In a function held at our new corporate office, adjacent to Oberron Mall, NH Byepass, Sri. Mohanachandran Nair, (Prasanthi Group, Kollam), the main promoter of the Company lighted the lamp followed by Sri. Sidharth Ram (Leo Group), M.G. Menon (Mampillikalam Group), Mrs. Chandrika Devi (formerly of RBI), CA Vishnu Prasad, Chandra Mohana Prasad Directors of the Company and Sri. G. Sreeram (Former MD of Dhanlakmi Bank). Sri. P.G. Jayakumar MD & CEO welcomed the gathering and Sri. T. S. Jagadeesan, MD proposed Vote of Thanks. Sri. Sambu Namboodiri (Associated Chemicals), Sri. Ranganathan (Finance Director, Eastern Group), CA Venugopal (Auditor of the Company M/S Krishnamoorthy & Krishnamoorthy) and the management & staff, customers and well- wishers of the Company were present. -

Equity Dividend for the Year 2013-14 (2Nd Interim)

WOCKHARDT LIMITED - EQUITY DIVIDEND FOR THE YEAR 2013-14 (2ND INTERIM) Details of unclaimed dividend amount as on date of Annual General Meeting (AGM Date - 2nd August, 2017) SI Name of the Shareholder Address State Pin code Folio No / DP ID Dividend Proposed Date Client ID no. Amount of Transfer to unclaimed in IEPF No. (Rs.) 1 A ARUNKUMAR FLAT NO 302 PLOT NO 355 356 SRUJANAL Andhra Pradesh 500085 IN30051316929442 70.00 16-Mar-2021 BHAGYANAGAR HILLS ADDAGUTTA SOCIETY KUKATPALLY BALANAGAR RANGAREDDY HYDERABAD ANDHRA PRADESH INDIA 2 A C RAJAMANI 35 AZAD SREET ARCOT Tamil Nadu 632503 IN30039412524449 50.00 16-Mar-2021 3 A D RAMYA 6/25 SUN SANDS APTS 4TH SEAWAR D Tamil Nadu 600041 1207650000003316 50.00 16-Mar-2021 TIRUVANMIYUR CHENNAI 4 A K GARG C/O M/S ANAND SWAROOP FATEHGANJ Uttar Pradesh 203001 W0000966 1500.00 16-Mar-2021 [MANDI] BULUNDSHAHAR 5 A M LAZAR ALAMIPALLY KANHANGAD Kerala 671315 W0029284 3000.00 16-Mar-2021 6 A M NARASIMMABHARATHI NO 140/3 BAZAAR STREET AMMIYARKUPPAM Tamil Nadu 631301 1203320004114751 125.00 16-Mar-2021 PALLIPET-TK THIRUVALLUR DT THIRUVALLUR 7 A MALLIKARJUNA RAO DOOR NO 1/1814 Y M PALLI KADAPA Andhra Pradesh 516004 IN30232410966260 250.00 16-Mar-2021 8 A RAMAPRASAD L 4-45-1 ASHOK HOUSE PEDAWALTAIR Andhra Pradesh 530017 1204470001115722 165.00 16-Mar-2021 VISAKHAPATNAM 9 A S SARBUNEESABEGUM OLD NO:1-38 B NEW NO:94 KEELAVELI Tamil Nadu 614809 1201090004870249 100.00 16-Mar-2021 THETHANKUDI SOUTH VEDHARANYAM NAGAPPATTINAM 10 A SAMUVEL CHIRISTIN 39/1 KEEZHA RAMAN PUTHOOR Tamil Nadu 629004 IN30177417179558 1000.00 -

SIEMENS LIMITED List of Outstanding Warrants As on 18Th March, 2020 (Payment Date:- 14Th February, 2020) Sr No

SIEMENS LIMITED List of outstanding warrants as on 18th March, 2020 (Payment date:- 14th February, 2020) Sr No. First Name Middle Name Last Name Address Pincode Folio Amount 1 A P RAJALAKSHMY A-6 VARUN I RAHEJA TOWNSHIP MALAD EAST MUMBAI 400097 A0004682 49.00 2 A RAJENDRAN B-4, KUMARAGURU FLATS 12, SIVAKAMIPURAM 4TH STREET, TIRUVANMIYUR CHENNAI 600041 1203690000017100 56.00 3 A G MANJULA 619 J II BLOCK RAJAJINAGAR BANGALORE 560010 A6000651 70.00 4 A GEORGE NO.35, SNEHA, 2ND CROSS, 2ND MAIN, CAMBRIDGE LAYOUT EXTENSION, ULSOOR, BANGALORE 560008 IN30023912036499 70.00 5 A GEORGE NO.263 MURPHY TOWN ULSOOR BANGALORE 560008 A6000604 70.00 6 A JAGADEESWARAN 37A TATABAD STREET NO 7 COIMBATORE COIMBATORE 641012 IN30108022118859 70.00 7 A PADMAJA G44 MADHURA NAGAR COLONY YOUSUFGUDA HYDERABAD 500037 A0005290 70.00 8 A RAJAGOPAL 260/4 10TH K M HOSUR ROAD BOMMANAHALLI BANGALORE 560068 A6000603 70.00 9 A G HARIKRISHNAN 'GOKULUM' 62 STJOHNS ROAD BANGALORE 560042 A6000410 140.00 10 A NARAYANASWAMY NO: 60 3RD CROSS CUBBON PET BANGALORE 560002 A6000582 140.00 11 A RAMESH KUMAR 10 VELLALAR STREET VALAYALKARA STREET KARUR 639001 IN30039413174239 140.00 12 A SUDHEENDHRA NO.68 5TH CROSS N.R.COLONY. BANGALORE 560019 A6000451 140.00 13 A THILAKACHAR NO.6275TH CROSS 1ST STAGE 2ND BLOCK BANASANKARI BANGALORE 560050 A6000418 140.00 14 A YUVARAJ # 18 5TH CROSS V G S LAYOUT EJIPURA BANGALORE 560047 A6000426 140.00 15 A KRISHNA MURTHY # 411 AMRUTH NAGAR ANDHRA MUNIAPPA LAYOUT CHELEKERE KALYAN NAGAR POST BANGALORE 560043 A6000358 210.00 16 A MANI NO 12 ANANDHI NILAYAM -

ANNUAL REPORT 2019-20 Driven by Commitment Powered by Values

ANNUAL REPORT 2019-20 Driven by Commitment Powered by Values Gosree Finance Limited 41/889-A3, Moopen Complex N.H.Bye pass, Service Road Padivattom, Edappally PO Cochin-682024, Kerala, India +91 484 2803854 +91 7593 877 877 www.gosreenance.com 2019-20 2019-20 7TH ANNUAL REPORT Content 1. Corporate Information Pg. 5 2. Gosree Story Pg. 6 3. Brief profile of the Board & Management Pg. 8 4. Our Journey So Far Pg. 12 5. List of Branches Pg. 14 5. Notice of AGM Pg. 15 6. Directors' Report for the year 2019-20 Pg. 37 7. Report on the Audit of the Standalone Financial Statements Pg. 71 8. Balance Sheet Pg. 81 9. Report on the Audit of the Consolidated Financial Statements Pg. 109 10. Consolidated Balance Sheet Pg. 116 11. Report on the Financial Statements Gosree Insurance Broking Services Pvt Ltd Pg. 143 12. Balance Sheet (Gosree Insurance Broking Services Pvt Ltd) Pg. 152 13. Report on the Financial Statements Gosree Investments & Risk Services Pvt Ltd Pg. 164 14. Balance Sheet (Gosree Investments & Risk Services Pvt Ltd) Pg. 174 Annual Report 2019-20 CORPORATE INFORMATION Inauguration of Gold Loan Board of Directors Banks 1. GopalanKutty Menon Director & Chairman of the board 1. Federal Bank business at our Kollam branch by 2. Jayakumar. P.G Managing Director & CEO 2. Lakshmi Vilas Bank Promoter Sri. Mohanachandran 3. T.S. Jagadeesan Managing Director 3. AU Small Finance Bank Nair on 21 Aug 2020 4. T.S. Anantharaman Director 4. State Bank of india 5. R.K. Bhoodes Director 5. Union Bank of India Inauguration of Gold Loan at kollam Branch 6. -

Unpaid-Dividend-31St

STATEMENT OF UNPAID DIVIDEND AS ON 25.08.2018, DECLARED AT THE AGM OF THE COMPANY HELD ON 20TH JULY, 2018 ( AS PER THE PROVISION OF THE U/S. 124(2) OF THE COMPANIES ACT, 2013 Folio/ DP. ID./ CL. ID. Dividend Amount (Rs.) Name of Shareholder Address 0000009 MR ASHWANI CHOUDHRY 292.50 A-3/85 JANAKPURI,NEW DELHI,110058 0000010 MRS KANTA CHAUDHRY 292.50 A-3/85 JANAKPURI,NEW DELHI,110058 0000011 MR SHIVINDER SINGH 292.50 A-3/85 JANAKPURI,NEW DELHI,110058 0000047 MR RAJINDER KUMAR SACHDEVA 877.50 1405 DR MUKERJEE NAGAR,DELHI,110009 0000081 MISS SHVETA AJMANI 650.00 WZ 108 A/I,BASAI DARAPUR,MOTI NAGAR,NEW DELHI,110015 0000133 MRS VEERAN 292.50 2300 SECTOR 23 C,CHANDIGARH,160023 0000276 MR ANIL KUAMR SONI 325.00 6 ARJUN NAGAR P O SAFDAR JUNG,ENCLAVE,NEW DELHI, ,110029 0000292 MISS SHALU BANSAL 97.50 C-76 ASHOK VIHAR PHASE-I,DELHI,110052 0000293 MR RISHI KUMAR BANSAL 97.50 C-76 ASHOK VIHAR PHASE-1,DELHI,110052 0000346 MRS DEEPIKA KAPOOR 585.00 D-6/17 VASANT VIHAR,NEW DELHI,110057 0000354 MR RAJ KUMAR 325.00 5592 NEW CHANDRAWAL (1ST FLOOR),OPP BACHOOMAL AGARWAL PRY SCHOOL,KAMLA NAGAR DELHI, ,110007 0000359 MRS LATA KURAL 260.00 C-22 MANSAROVAR PARK,SHAHDARA DELHI,110032 0000367 MRS SANTOSH MADHOK 877.50 4/3 SHANTI NIKETAN,NEW DELHI,110021 0000370 MR PRAN NATH KOHLI 195.00 1825 LAXMI NAVAMI STREET,NR IMPERIAL CINEMA,PAHARGANJ,NEW DELHI,110055 0000381 MRS ASHA RANI JERATH 585.00 SECTOR 7A HOUSE NO 25,FARIDABAD,121002 0000383 SANJAY KUMAR ARYA 292.50 89/3 RAMGALI VISHWAS NAGAR,SHAHDARA DELHI,110032 0000388 MISS SADHNA 292.50 E-30 LAJPAT NAGAR-IST,NEW -

Form Ia Guruvayyur Road, District Thrissur, Kerala

At For Client-M/s SOBHA LIMITED May, 2018 Schedule: 8 (b), Category: B Built Up Area – 2, 56,017 sqm QCI Certificate no. NABET/EIA/1619/RA 0064 PREPARED BY GRASS ROOTS RESEARCH & CREATION INDIA (P) LTD. (Accredited by QCI/NABET, Approved by MoEFCC, GoI, ISO 9001:2008 Certified Co.) F-374-375, Sector-63, Noida, U.P. Ph.: 0120- 4044630, Telefax: 0120- 2406519 Email: [email protected], [email protected] Website: http://www.grc-india.com GRC INDIA TRAINING & ANALYTICAL LABORATORY (Accredited by NABL, Recognized by MoEFCC, GoI) A unit of GRC India CONTENTS S.NO DESCRIPTION PAGE NO. 1. Land Environment 25-30 2. Water Environment 30-37 3. Vegetation 37-38 4. Fauna 38 5. Air Environment 38-42 6. Aesthetics 42-43 7. Socio-Economic Aspects 43-44 8. Building Materials 44-45 9. Energy Conservation 45-50 10. Environment Management Plan 50-79 ENVIRONMENTAL CLEARANCE FOR INTEGRATED COMPLEX “SOBHA CITY” AT PUZHAKKAL, FORM IA GURUVAYYUR ROAD, DISTRICT THRISSUR, KERALA FORM IA CHECK LIST OF ENVIRONMENTAL IMPACTS SECTION 1- LAND ENVIRONMENT 1.1 Will the existing land use get significantly altered from the project that is consistent with the surroundings? (Proposed land use must conform to the approved Master Plan/Development Plan of the area. Change of land use, if any and the statutory approval from the competent authority are submitted). Attach Maps of (i) site location, (ii) surrounding features of the proposed site (within 500 meters) and (iii) the site (indicating levels & contours) to appropriate scales. If not available attach only conceptual plans. -

Website Upload 31.3.2020.Xlsx

Oberoi Realty Limited Details of unclaimed and unpaid dividends (for FY2012-13 to FY2018-19) as on March 31, 2020 Investor First Investor Middle Investor Address Country State District Pin Code Nature Amount Due date Remark Name Name Last of transfer Name to IEPF Aanand Govindani Anand Cutpeice Centre Sadar Bazar INDIA Chhattisgarh 493118 Amount for unclaimed 40.00 21-Aug- Already and unpaid dividend 2020 transferred to IEPF ABHILASHA JAIN KAYASTH MOHALLA OLD CITY INDIA Rajasthan 305802 Amount for unclaimed 80.00 21-Aug- Already KISHANGARH KISHANGARH and unpaid dividend 2020 transferred to IEPF ABHIRAM MOHANTY NEHRU NAGAR 8TH LINE NEAR BURMA INDIA Orissa 760003 Amount for unclaimed 600.00 21-Aug- Already COLONY BERHAMPUR BERHAMPUR and unpaid dividend 2020 transferred to ORISSA INDIA IEPF ABHITAJ TAYAL 122 ANAJ MANDI FATEHABAD INDIA Haryana 125050 Amount for unclaimed 400.00 21-Aug- Already and unpaid dividend 2020 transferred to IEPF ABRAHAM JOSEPH KALLIVAYALIL HOUSE KALAKETTY P O INDIA Kerala 686508 Amount for unclaimed 40.00 21-Aug- Already KOTTAYAM KERALA and unpaid dividend 2020 transferred to IEPF ADESH KUMAR JAIN D/1121 INDIRA NAGAR LUCKNOW INDIA Uttar Pradesh LUCKNOW Amount for unclaimed 4000.00 21-Aug- Already and unpaid dividend 2020 transferred to IEPF AJIT KUMAR SINGH MOHALLA - SATYANAGA BLOCK FIELD INDIA Bihar 814133 Amount for unclaimed 28.00 21-Aug- Already GODDA PO AND DI GODDA and unpaid dividend 2020 transferred to IEPF AKVV PRASAD 3 26 MUTHYALUPETA KAPASAKUDDI INDIA Andhra 532322 Amount for unclaimed 16.00 21-Aug- Already -

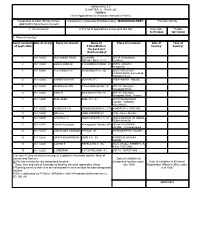

(CHAPTER V , PARA 25) FORM 9 List of Applications for Inclusion

ANNEXURE 5.8 (CHAPTER V , PARA 25) FORM 9 List of Applications for inclusion received in Form 6 Designated location identity (where Constituency (Assembly/£Parliamentary): WADAKKANCHERY Revision identity applications have been received) 1. List number@ 2. Period of applications (covered in this list) From date To date 16/11/2020 16/11/2020 3. Place of hearing * Serial number$ Date of receipt Name of claimant Name of Place of residence Date of Time of of application Father/Mother/ hearing* hearing* Husband and (Relationship)# 1 16/11/2020 MUHAMMED RASIK SULAIMAN 26/139, Pathamkallu, MOITHEENKUTTY (F) Parlikkad, , 2 16/11/2020 GOKUL RAMESH K R RAMESH KUMAR (F) 20/553, KEERTHI HARSHAM, , , 3 16/11/2020 Neena Nixon P D Vrinda Nixon P D (O) 22/281PORATHUR PANOKKARAN, pullanikkad, Wadakkanchery, , 4 16/11/2020 VISHNU VIJAYAN VIJAYAN (F) THEYYANATH HOUSE, , , , 5 16/11/2020 Muralidharan M N P Govindankutty Nair (F) 10/444C, Nikunjam, Kalleppady Road, , , 6 16/11/2020 Rajani R Muralidharan M N (H) 10/444C, Nikunjam, Kalleppady Road, Thrissur, , 7 16/11/2020 ANEL BABU BABU P V (F) 9/439,PANANCHERY HOUSE, THIROOR, KILLANNUR, , 8 16/11/2020 NIVEDHYA K G GIREESHKUMAR K V (F) KANDIRUTHY, PUTHUR, , , 9 16/11/2020 Ajith Jose JOSE VARUNNI (F) 489A, Anjoor, Mundur, , 10 16/11/2020 APARNA E A AMBUJAKSHAN E A (F) 504/ELAMTHIRUTHI HOUSE, PERINGANNUR, , , 11 16/11/2020 Valsala Venugopal Venugopalan Panicker (H) 10/294 KALARIKKAL HOUSE, , Peramangalam, , 12 16/11/2020 JUSTIN NALLATHAMBI NELSON (F) PUTHANVEETTIL HOUSE, , , , 13 16/11/2020 MANYA MANIKANDAN VIBIN -

Outcome of 100Th Annual General Meeting of the Bank

SEC /271/2021 August 12, 2021 BSE Limited, National Stock Exchange of India Ltd., Phiroze Jeejeebhoy Towers, Exchange plaza, 5th floor, Dalal Street, Bandra-kurla Complex, Mumbai 400001. Bandra (E), Mumbai 400051. Scrip code: 542867 Symbol: CSBBANK Dear Sir/Madam, Proceedings of the 100th Annual General Meeting of the Bank and e-voting results. -------------------------------------------------------------------------------------------------------------------------------------- Pursuant to Regulations 30 and 44 (3) of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 and in continuation of our letter nos. SEC/207/2021 dated July 06, 2021 and SEC/239/2021 dated July 21, 2021, we would like to inform you that the 100th Annual General Meeting (“AGM”) of the Members of the Bank was held on Thursday, August 12, 2021 at 11:00 a.m. through Video Conferencing (“VC”) / Other Audio Visual Means (“OAVM”), in accordance with the circulars issued by the Ministry of Corporate Affairs (“MCA”) and Securities and Exchange Board of India (“SEBI”) in view of the continuing Covid-19 pandemic and the social distancing is a norm to be followed consequently and further to inform you that all the business as mentioned in the Notice of the AGM dated July 05, 2021 were passed with requisite majority. Accordingly, we hereby submit the following: 1. Proceedings of the 100th AGM as required under Regulation 30 read with Part A of Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 as Annexure – I. 2. Chairman’s and Managing Director & CEO’s speeches as read out during the AGM as Annexure II and Annexure III, respectively. -

MMTC Unpaid Dividend 2012-13

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e-form IEPF-2 CIN/BCIN L51909DL1963GOI004033 Prefill Company/Bank Name MMTC LIMITED Date Of AGM(DD-MON-YYYY) 28-SEP-2016 Sum of unpaid and unclaimed dividend 65539.60 Sum of interest on matured debentures 0.00 Sum of matured deposit 0.00 Sum of interest on matured deposit 0.00 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id- Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD-MON-YYYY) NAVNEET KUMAR GOEL PREM PRAKASH GOEL 92, Ground Floor State Bank Colony AzadINDIA Pur Delhi Delhi 110009 M00000024 Amount for Unclaimed and Unpaid Dividend0.10 30-Oct-2020 MEENAKSHI GUPTA SUNIL KUMAR GUPTA B-5, Tagore Road Adarsh Nagar DelhiINDIA Delhi 110033 M00000027 Amount for Unclaimed and Unpaid Dividend0.10 30-Oct-2020 SARLA DEVI GOEL PREM PRAKASH GOEL 92,ground Floor State Bank Colony AzadINDIA Pur Delhi Delhi 110009 M00000028 Amount for Unclaimed and Unpaid Dividend0.10 30-Oct-2020 ANUPAMA GOEL V K GOEL 92 State Bank Colony