July 4-8: Strong Market After the Long Awaited Rate Hike

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Harvest Funds (Hong Kong) Etf (An Umbrella Unit Trust Established in Hong Kong)

HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) SEMI-ANNUAL REPORT 1ST JANUARY 2016 TO 30TH JUNE 2016 www.harvestglobal.com.hk HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) CONTENTS PAGE Report of the Manager to the Unitholders 1 - 2 Statement of Financial Position (Unaudited) 3 Statement of Comprehensive Income (Unaudited) 4 Statement of Changes in Net Assets Attributable to Unitholders (Unaudited) 5 Statement of Cash Flows (Unaudited) 6 Investment Portfolio (Unaudited) 7 – 29 Statement of Movements in Investment Portfolio (Unaudited) 30 – 75 Performance Record (Unaudited) 76 Underlying Index Constituent Stocks Disclosure (Unaudited) 77 Report on Investment Overweight (Unaudited) 78 Management and Administration 79 - 81 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) REPORT OF THE MANAGER TO THE UNITHOLDERS Fund Performance A summary of the performance of the Sub-Fund1 is given below (as at 30 June 2016): Harvest MSCI China A Index ETF 1H-2016 (without dividend reinvested) MSCI China A Index2 -17.61% Harvest MSCI China A Index ETF NAV-to-NAV3 (RMB Counter) -17.60% Harvest MSCI China A Index ETF Market-to-Market4 (RMB Counter) -19.54% Harvest MSCI China A Index ETF NAV-to-NAV3 (HKD Counter) -18.51% Harvest MSCI China A Index ETF Market-to-Market4 (HKD Counter) -20.82% Source: Harvest Global Investments Limited, Bloomberg. 1 Past performance figures shown are not indicative of the future performance of the Sub-Fund. -

Government Pension Fund Global Holding of Equities at 31 December

Government Pension Fund Global Holding of equities at 31 December 2011 et value K) K) arket value arket ark wnership wnership ector ector oting oting NO NO S M ( V O S M ( V O AUSTRALIA David Jones Ltd Consumer Services 51 018 951 0.67% 0.67% Abacus Property Group Financials 22 995 524 0.51% 0.51% Deep Yellow Ltd Basic Materials 2 644 029 0.29% 0.29% ABC Learning Centres Ltd Consumer Services 1 672 0.50% 0.50% Dexus Property Group Financials 158 816 463 0.65% 0.65% Acrux Ltd Health Care 16 824 771 0.58% 0.58% Discovery Metals Ltd Basic Materials 25 004 853 0.71% 0.71% Adelaide Brighton Ltd Industrials 54 271 215 0.48% 0.48% Downer EDI Ltd Industrials 55 616 672 0.66% 0.66% AED Oil Ltd Oil & Gas 642 658 0.30% 0.30% DuluxGroup Ltd Industrials 104 835 466 1.61% 1.61% AGL Energy Ltd Utilities 259 696 118 0.64% 0.64% Echo Entertainment Group Ltd Consumer Services 97 268 039 0.64% 0.64% AJ Lucas Group Ltd Industrials 1 743 778 0.24% 0.24% Elders Ltd Consumer Goods 3 899 317 0.55% 0.55% Alesco Corp Ltd Industrials 3 440 168 0.52% 0.52% Emeco Holdings Ltd Industrials 24 130 089 0.65% 0.65% Alliance Resources Ltd Basic Materials 762 474 0.17% 0.17% Energy Resources of Australia Ltd Basic Materials 10 573 558 0.27% 0.27% Alumina Ltd Basic Materials 110 036 341 0.66% 0.66% Energy World Corp Ltd Utilities 35 210 692 0.48% 0.48% Amcor Ltd/Australia Industrials 474 366 213 0.89% 0.89% Envestra Ltd Utilities 31 301 292 0.46% 0.46% AMP Ltd Financials 444 770 671 0.63% 0.63% Equatorial Resources Ltd Basic Materials 6 626 114 0.57% 0.57% Ampella Mining -

China Universal International Etf Series – C-Shares Csi Healthcare Index Etf

Semi-Annual Report (Unaudited) CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) For the period from 5 May 2014 (date of inception) to 30 June 2014 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 - 2 STATEMENT OF FINANCIAL POSITION 3 STATEMENT OF COMPREHENSIVE INCOME 4 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNIITHOLDERS 5 INVESTMENT PORTFOLIO (UNAUDITED) 6 - 7 MOVEMENTS IN INVESTMENT PORTFOLIO (UNAUDITED) 8 - 10 PERFORMANCE RECORD (UNAUDITED) 11 1 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER China Universal Asset Management (Hong Kong) SERVICE AGENT OR CONVERSION AGENT Company Limited HK Conversion Agency Services Limited 3710-11, 37/F, Two IFC 2nd Floor, Infinitus Plaza 8 Finance Street 199 Des Voeux Road Central Central, Hong Kong Hong Kong DIRECTORS OF THE MANAGER AUDITORS LIN Li Jun Ernst & Young LI Wen 22/F, CITIC Tower ZHANG Hui 1 Tim Mei Avenue Central ADVISER Hong Kong China Universal Asset Management Company Limited 22/F, Aurora Plaza PARTICIPATING DEALERS No. 99 Fucheng Road BOCI Securities Limited Pudong District 20/F, Bank of China Tower, Shanghai 200120 1 Garden Road, China Hong Kong RQFII CUSTODIAN -

CIMB-Principal China Direct Opportunities Fund-Class USD 31 July 2019

CIMB-Principal China Direct Opportunities Fund-Class USD 31 July 2019 Fund Objective Fund Performance The Fund seeks opportunities through 0% investments primarily in China A-Shares 8 8 8 8 8 8 8 8 8 8 9 9 9 9 9 9 9 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 r r y n l g p t v c n b r r y n l a p a u Ju u e c o e a e a p a u Ju with the aim to provide capital - 5%M A M J A S O N D J F M A M J appreciation. The Fund is established with a multi-class structure and is - 10% allowed to establish new Class(es) from - 15% time to time. - 20% Currency: ISIN Code: USD MYU1002GF009 - 25% Bloomberg Ticker: - 30% CPCDUSD MK - 35% Fund Information - 40% Domicile Malaysia Fund Benchmark Base Currency RMB Past performance does not guarantee future results. Asset allocation and diversification do not ensure a profit or protect against a loss. Fund Inception 8 March 2018 Benchmark CSI500 Index Cumulative Performance (%) Since Application Fee Up to 5.50% of the NAV YTD 1 Month 3 Months 6 Months 1-Year 3-Year 5-Year Inception per unit Fund 18.26 -1.38 -6.35 15.10 -6.16 N/A N/A -22.61 Management Up to 1.80% per annum Benchmark/Target Return 17.30 -1.20 -9.61 14.33 -6.31 N/A N/A -26.46 Fee of the NAV of the Class Trustee Fee Up to 0.06% per annum Calendar Year Returns (%) 2018 2017 2016 2015 2014 2013 of the NAV of the Fund Fund N/A N/A N/A N/A N/A N/A Switching Fee USD35 Benchmark N/A N/A N/A N/A N/A N/A Fund Size USD 24.26 million Note: March 2018 to July 2019. -

C-Shares CSI 300 Index ETF Semi-Annual Report 2016

Semi-Annual Report (Unaudited) CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI 300 INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) For the period from 1 January 2016 to 30 June 2016 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI 300 INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 STATEMENT OF FINANCIAL POSITION 2 STATEMENT OF COMPREHENSIVE INCOME 3 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNITHOLDERS 4 INVESTMENT PORTFOLIO (Unaudited) 5 - 12 MOVEMENTS IN INVESTMENT PORTFOLIO (Unaudited) 13 - 23 PERFORMANCE RECORD (Unaudited) 24 CHINA UNIVERSAL INTERNATIONAL ETF SERIES –C-SHARES CSI 300 INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER SERVICE AGENT OR CONVERSION AGENT China Universal Asset Management (Hong Kong) Company HK Conversion Agency Services Limited Limited 1/F One & Two Exchange Square 3710-11, Two International Finance Centre 8 Connaught Place 8 Finance Street Central, Hong Kong Central Hong Kong AUDITORS Ernst & Young DIRECTORS OF THE MANAGER 22/F, CITIC Tower LI Wen 1 Tim Mei Avenue WAN Qing Central ZHANG Hui Hong Kong ADVISER TRUSTEE China Universal Asset Management Company Limited BOCI-Prudential Trustee Limited 22/F, Aurora Plaza 12/F & 25/F, Citicorp Centre No. 99 Fucheng Road 18 Whitfield Road Pudong District Causeway Bay Shanghai 200120 Hong Kong China CUSTODIAN RQFII CUSTODIAN -

FTSE Publications

2 FTSE Russell Publications FTSE MPF Asia Pacific ex Japan 19 August 2021 Australia & New Zealand Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 360 Security (A) (SC SH) <0.005 CHINA Anta Sports Products (P Chip) 0.36 CHINA Bank of Jiangsu (A) (SC SH) 0.01 CHINA 3M India 0.01 INDIA Apollo Hospitals Enterprise 0.07 INDIA Bank Of Nanjing (A) (SC SH) 0.02 CHINA 3SBio (P Chip) 0.02 CHINA ASE Technology Holding 0.19 TAIWAN Bank of Ningbo (A) (SC SZ) 0.03 CHINA AAC Technologies Holdings 0.07 HONG Ashok Leyland 0.03 INDIA Bank of Qingdao (A) (SC SZ) <0.005 CHINA KONG Asia Cement 0.06 TAIWAN Bank of Shanghai (A) (SC SH) 0.02 CHINA ABB India 0.02 INDIA Asian Paints 0.25 INDIA Bank of Suzhou (A) (SC SZ) <0.005 CHINA Aboitiz Power 0.01 PHILIPPINES ASM Pacific Technology 0.06 HONG Bank of The Philippine Islands 0.04 PHILIPPINES ACC 0.03 INDIA KONG Bank of ZhengZhou (A) (SC SZ) <0.005 CHINA Accton Technology 0.09 TAIWAN ASMedia Technology 0.03 TAIWAN Bank Rakyat Indonesia 0.2 INDONESIA Acer 0.04 TAIWAN Asset World 0.01 THAILAND Banpu 0.03 THAILAND ADAMA (A) (SC SZ) <0.005 CHINA Astra Agro Lestari <0.005 INDONESIA Baoshan Iron & Steel (A) (SC SH) 0.02 CHINA Adani Enterprises 0.07 INDIA Astra International 0.09 INDONESIA Barito Pacific 0.02 INDONESIA Adani Gas 0.05 INDIA Astral 0.03 INDIA Bata India 0.02 INDIA Adani Green Energy 0.08 INDIA Astro Malaysia Holdings 0.01 MALAYSIA Bayer Cropscience 0.01 INDIA Adani Ports and Special -

FTSE Total China Connect

FTSE Russell Publications 20 May 2019 FTSE Total China Connect Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 360 Security (A) (SC SH) 0.05 CHINA Beijing Changjiu Logistics (A) (SC SH) <0.005 CHINA Central China Securities (H) 0.01 CHINA 3SBio (P Chip) 0.08 CHINA Beijing Dabeinong Technology Group (A) (SC 0.03 CHINA CGN Power (H) 0.11 CHINA 51job ADR (N Shares) 0.06 CHINA SZ) Changchun High & New Technology Industry 0.08 CHINA 58.com ADS (N Shares) 0.22 CHINA Beijing Enlight Media (A) (SC SZ) 0.04 CHINA Group (A) (SC SZ) ADAMA (A) (SC SZ) 0.01 CHINA Beijing Enterprises Holdings (Red Chip) 0.1 CHINA Changjiang Securities (A) (SC SZ) 0.06 CHINA Aecc Aero Engine Control (A) (SC SZ) 0.01 CHINA Beijing Enterprises Water Group (Red Chip) 0.11 CHINA Changsha Jingjia Microelectronics (A) (SC SZ) 0.02 CHINA AECC Aviation Power (A) (SC SH) 0.09 CHINA Beijing Jetsen Technology (A) (SC SZ) 0.03 CHINA Changyuan Group (A) (SC SH) 0.01 CHINA Agile Group Holdings (P Chip) 0.08 CHINA Beijing Jingneng Clean Energy (H) 0.01 CHINA Chaozhou Three-Circle Group (A) (SC SZ) 0.06 CHINA Agricultural Bank of China (A) (SC SH) 0.74 CHINA Beijing Jingneng Power (A) (SC SH) 0.02 CHINA Chengdu Kanghong Pharmaceuticals Group (A) 0.02 CHINA Agricultural Bank of China (H) 0.49 CHINA Beijing Jingyuntong Technology (A) (SC SH) 0.01 CHINA (SC SZ) Aier Eye Hospital Group (A) (SC SZ) 0.13 CHINA Beijing Kunlun Tech (A) (SC SZ) 0.03 CHINA Chengdu Xingrong -

2010 ADDITIONAL INFORMATION Page 4 of 44 4

2010 ANNUAL REPORT ADDITIONAL INFORMATION Annual Report 2010 – Additional Information I. Tables of returns 1. Auditors’ Report ................................................................................................. 1 2. General Notes .................................................................................................... 4 3. Short Term Investments ....................................................................................... 6 4. Real Return Bonds .............................................................................................. 8 5. Long Term Bonds ............................................................................................... 10 6. Bonds .............................................................................................................. 12 7. Bonds - Fixed Income ......................................................................................... 14 8. Canadian Equity ................................................................................................ 16 9. Publicly Traded Canadian Equity Markets ............................................................. 18 10. EAFE Foreign Equity .......................................................................................... 20 11. U.S. Equity ....................................................................................................... 22 12. Emerging Markets Equity .................................................................................... 24 13. Publicly Traded Emerging Market Equity -

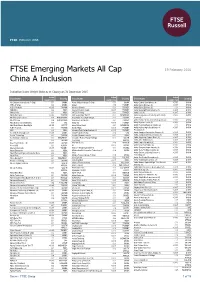

FTSE Emerging Markets All Cap China a Inclusion

FTSE PUBLICATIONS FTSE Emerging Markets All Cap 19 February 2016 China A Inclusion Indicative Index Weight Data as at Closing on 31 December 2015 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 361 Degrees International (P Chip) 0.01 CHINA Ajisen China Holdings (P Chip) 0.01 CHINA Anhui Golden Seed Winery (A) <0.005 CHINA 3SBio (P Chip) 0.03 CHINA Akbank 0.13 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA A.G.V. Products <0.005 TAIWAN Akcansa Cimento 0.01 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA ABB India 0.02 INDIA Akenerji Elektrik Uretim <0.005 TURKEY Anhui Guofeng Plastic Industry (A) <0.005 CHINA Abbott India 0.01 INDIA AKFEN Holding 0.01 TURKEY Anhui Heli (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN AKR Corporindo Tbk PT 0.02 INDONESIA Anhui Hengyuan Coal Industry & Electricity <0.005 CHINA Aboitiz Equity Ventures 0.08 PHILIPPINES Aksa Akrilik Ve Kimya Sanayii 0.01 TURKEY Power (A) Aboitiz Power 0.04 PHILIPPINES Aksa Enerji Uretim AS 0.01 TURKEY Anhui Honglu Steel Construction (group) (A) <0.005 CHINA Abu Dhabi Commercial Bank 0.09 UAE Aksigorta <0.005 TURKEY Anhui Huamao Textile (A) <0.005 CHINA Abu Dhabi Islamic Bank Egypt <0.005 EGYPT Alam Sutera Realty 0.01 INDONESIA Anhui Huaxing Chemical Industry (A) 0.01 CHINA AcBel Polytech 0.01 TAIWAN Alarko Hldgs <0.005 TURKEY Anhui Huilong Agricultural Means of <0.005 CHINA ACC 0.03 INDIA Albaraka Turk Katilim Bankasi AS <0.005 TURKEY Production (A) Accelink Technologies (A) <0.005 CHINA Aldar Properties PJSC 0.06 UAE Anhui Jianghuai Automotive Chassis (A) <0.005 CHINA Accton Technology 0.01 TAIWAN Alembic Pharmaceuticals 0.01 INDIA Anhui Jiangnan Chemical Industry (A) <0.005 CHINA Ace Hardware Indonesia 0.01 INDONESIA Alexander Forbes Equity Holdings 0.01 SOUTH Anhui Jingcheng Copper Share (A) <0.005 CHINA Acer 0.03 TAIWAN Proprietary AFRICA Anhui Jinhe Industrial (A) <0.005 CHINA Aces Electronic Co. -

FTSE China A

2 FTSE Russell Publications 19 August 2021 FTSE China A Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 360 Security (A) 0.04 CHINA Beijing Originwater Technology (A) 0.05 CHINA China Gezhouba Group Company (A) 0.07 CHINA 3PEAK (A) 0.08 CHINA Beijing Roborock Technology (A) 0.16 CHINA China Grand Automotive Service (A) 0.05 CHINA ADAMA (A) 0.02 CHINA Beijing Shiji Information Technology (A) 0.08 CHINA China Great Wall Securities (A) 0.06 CHINA Addsino (A) 0.06 CHINA Beijing Shougang (A) 0.05 CHINA China Greatwall Technology Group (A) 0.09 CHINA Aecc Aero Engine Control (A) 0.03 CHINA Beijing Shunxin Agriculture (A) 0.07 CHINA China International Capital (A) 0.12 CHINA AECC Aviation Power (A) 0.3 CHINA Beijing Sinnet Technology (A) 0.05 CHINA China International Marine Containers (A) 0.06 CHINA Agricultural Bank of China (A) 0.89 CHINA Beijing SJ Environmental Protection and New 0.03 CHINA China International Travel Service (A) 1.25 CHINA Aier Eye Hospital Group (A) 0.81 CHINA Material (A) China Jushi (A) 0.13 CHINA Air China (A) 0.09 CHINA Beijing SL Pharmaceutical (A) 0.02 CHINA China Life Insurance (A) 0.38 CHINA Aisino Corporation (A) 0.05 CHINA Beijing Teamsun Technology (A) 0.02 CHINA China Meheco Group (A) 0.03 CHINA All Winner Technology (A) 0.05 CHINA Beijing Tiantan Biological Products (A) 0.1 CHINA China Merchants Bank (A) 2.39 CHINA Alpha Group (A) 0.02 CHINA Beijing Tongrentang (A) 0.12 CHINA China Merchants -

C-Shares CSI Healthcare Index ETF Semi-Annual Report 2016

Semi-Annual Report (Unaudited) CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) For the period from 1 January 2016 to 30 June 2016 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 STATEMENT OF FINANCIAL POSITION 2 STATEMENT OF COMPREHENSIVE INCOME 3 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNITHOLDERS 4 INVESTMENT PORTFOLIO (UNAUDITED) 5 - 7 MOVEMENTS IN INVESTMENT PORTFOLIO (UNAUDITED) 8 - 10 PERFORMANCE RECORD (UNAUDITED) 11 0 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER SERVICE AGENT OR CONVERSION AGENT China Universal Asset Management (Hong Kong) Company HK Conversion Agency Services Limited Limited 2nd Floor, Infinitus Plaza 3710-11, Two International Finance Centre 199 Des Voeux Road Central 8 Finance Street Hong Kong Central Hong Kong AUDITORS Ernst & Young DIRECTORS OF THE MANAGER 22/F, CITIC Tower LI Wen 1 Tim Mei Avenue WAN Qing Central ZHANG Hui Hong Kong ADVISER TRUSTEE China Universal Asset Management Company Limited BOCI-Prudential Trustee Limited 22/F, Aurora Plaza 12/F & 25/F, Citicorp Centre No. 99 Fucheng Road 18 Whitfield Road Pudong District Causeway Bay Shanghai 200120 Hong Kong China CUSTODIAN -

HAITONG CSI300 INDEX ETF (A Sub-Fund of the Haitong ETF Series As an Umbrella Unit Trust Under Hong Kong Law)

Unaudited Semi-Annual Report 2018 HAITONG ETF SERIES – HAITONG CSI300 INDEX ETF (A sub-fund of the Haitong ETF series as an umbrella unit trust under Hong Kong law) For the period from 1 January 2018 to 30 June 2018 HAITONG CSI300 INDEX ETF (A SUB-FUND OF HAITONG ETF SERIES) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 – 2 REPORT OF THE MANAGER TO THE UNITHOLDERS 3 STATEMENT OF FINANCIAL POSITION (UNAUDITED) 4 INVESTMENT PORTFOLIO (UNAUDITED) 5 – 12 STATEMENT OF MOVEMENTS IN INVESTMENT PORTFOLIO (UNAUDITED) 13 – 26 PERFORMANCE TABLE (UNAUDITED) 27 DISTRIBUTION DISCLOSURE (UNAUDITED) 28 UNDERLYING INDEX CONSTITUENT STOCKS DISCLOSURE 29 REPORT ON INVESTMENT OVERWEIGHT (UNAUDITED) 30 HAITONG CSI300 INDEX ETF (A SUB-FUND OF HAITONG ETF SERIES) MANAGEMENT AND ADMINISTRATION Directors of the Manager Manager Lo Wai Ho Haitong International Asset Management (HK) Sun Tong Limited Yang Jianxin 22/F, Li Po Chun Chambers Chen Xuan 189 Des Voeux Road Central Poon Mo Yiu Hong Kong Trustee and Registrar Auditors HSBC Institutional Trust Services (Asia) Limited Ernst & Young 1 Queen’s Road Central 22/F, CITIC Tower Hong Kong 1 Tim Mei Avenue Central Hong Kong Service Agent Custodian HK Conversion Agency Services Limited The Hongkong and Shanghai Banking 2/F, Infinitus Plaza Corporation Limited 199 Des Voeux Road Central 1 Queen’s Road Central Hong Kong Hong Kong Legal Advisers to the Manager PRC Custodian King & Wood Mallesons HSBC Bank (China) Company Limited 13/F, Gloucester Tower 33/F, HSBC Building Shanghai IFC The Landmark 8 Century Avenue, Pudong