OMV Petrom Celebrates 20 Years Since Its Listing on the Bucharest Stock Exchange

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OMV Aktiengesellschaft Case Studies 1 of 2 , ANTAGE Responded

LAbOrAtOry KnOwLedge. deLiVered.™ OMV Aktiengesellschaft Harmonizing Austria’s Largest Integrated Oil and Gas Company C LABVANTAGE OMV Aktiengesellschaft Company Background With group sales of 42.65 billion EUR and a workforce of nearly 30K employees in 2012, OMV Aktiengesellschaft is Austria’s largest listed industrial company. In late 2004, OMV acquired a major share of 51% of the privatized Romanian oil company, Petrom, and became the market leader in Central and Eastern Europe. OMV is active in Romania and Austria and holds a balanced international portfolio in Exploration and Production. As of 2012, OMV had oil and gas reserves of approximately 1.12 billion barrels of oil equivalent (BOE) and a production of approximately 303,000 BOE per day. In Gas and Power, OMV sold about 437 terawatt-hours of gas. In addition, it operated a 2,000km long gas pipeline network with a marketed capacity of around 103 billion cubic meters of natural gas in Austria. With a trading volume of around 528 terawatt-hours, OMV’s gas trading platform, the Central European Gas Hub, is amongst the most important hubs in Continental Europe. In Refining and Marketing, OMV had an annual refining capacity of 22 million tons and approximately 4,400 filling stations in 13 countries at the end of 2012. System Sought A When the major share of Petrom was taken over by OMV, two specialized internal laboratories became s available within E&P, both serving mostly their local OMV appreciated market and sometimes the OMV branch office. After the browser-based E major equipment investments for ICPT Campina were LiMs because it could done to adjust the analytical standards to the ones already existing in the Gänserndorf laboratory, the be used in a number St next step in supporting the harmonization of laboratory of labs and countries operations was to have a common approach in data management. -

Webgis OMV PETROM S.A

OMV PETROM S.A. Exploration & Production The Solution is using: ArcGIS Server Advanced WebOffice 6 GeoNIS ArcGIS Desktop WebGIS The Company With activities in the business segments of Exploration and Production, Refining, Marketing and Power, OMV Petrom had in 2008 a production of 188,476 boe/day. OMV Petrom has a maximum refining capacity of 8 million metric tons per year, approximately 550 filling stations in Romania and 269 filling stations in Moldova, Bulgaria and Serbia. In 2008, the turnover of the company was EUR 4,552 mn and EBITDA was EUR 969 million. After its privati- zation in 2004, the company recorded pozitive results. The modernization process initiated in 2005 is underway in accor- dance. The Needs To find and operate new reserves OMV Petrom must under- stand needed infrastructure, business condition and environ- mental factors within a geographic framework. The implementation of an Enterprise GIS within the organiza- tion can optimize the usage of the available data within OMV Petrom. Starting to build up an Enterprise Geodatabase with data from whole Romania was just the first step. The use of ArcGIS Desktop needs high-level educated GIS professionals and very often the user doesn’t need the full desktop GIS functionality. The logical answer for this requirement was the implementa- tion of a WebGIS for the company wide use of GIS data. Not all users should get allowed to view all GIS data and re- lated entities like documents or scans. Therefore fine grained user role based access control is a must. A strong need for efficient administration tools for being able to manage change requests fast and easily was submitted to handle migration from employees from one branch office to another. -

OMV Petrom Reports Perspective Oil Deposits in Romania Research Drills

OMV Petrom reports perspective oil deposits in Romania research drills OMV Petrom (SNP) informed natural gas carrier company Transgaz Medias (TGN) that there are “beautiful” perspectives regarding the gas deposits in the Black Sea, the chief of the company’s gas Dispatch, Mihai Patarniche said yesterday in a seminar on energy, quoted by Mediafax. Answering questions asked by the media, he added that, when the extraction of gas in the Black Sea will begin, “tens of millions” of EUR will be necessary to lay the pipelines that will carry the gas to shore, with the government most likely to become involved in the operation. OMV Petrom and ExxonMobil could extract 6.5 billion cubic metres of gas each year from the Neptun perimeter in the Black Sea, according to preliminary estimations, a quantity equivalent to half of Romania’s annual consumption. The two companies jointly explore the Neptun perimeter of the Black Sea. In February last year, the two companies announced a significant gas find when drilling the Domino-1 well, with preliminary estimations speaking about 42-84 bln cubic meters of natural gas. If subsequent operations will confirm the technical and commercial feasibility of gas extraction in the Neptun block, the cumulated value of investments in the exploration and development phases might reach several billions of USD. The extraction of gas in the Black Sea is expected to start towards the end of the decade.Asked if OMV Petrom will be able to export the gas extracted from the Black Sea, the Transgaz official have an affirmative answer. “If Romania is obtuse, Petrom can export, although it cannot do whatever it likes, because it is under Romanian jurisdiction,” Patarniche explained. -

Omv Petrom and Teraplast Shares Will Be Included in Ftse Indices Dedicated to Emerging Markets and Strengthen Romania's Weight in the Global Provider Indices

PRESS RELEASE AUGUST 23rd, 2021 OMV PETROM AND TERAPLAST SHARES WILL BE INCLUDED IN FTSE INDICES DEDICATED TO EMERGING MARKETS AND STRENGTHEN ROMANIA'S WEIGHT IN THE GLOBAL PROVIDER INDICES • OMV Petrom (SNP) and TeraPlast (TRP) shares will be included, as of September 20th, in FTSE indices for Emerging Markets, joining Banca Transilvania (TLV) and Nuclearelectrica (SNN) shares. • Romania thus consolidates its weight in FTSE Russell indices, having five companies present in all the global provider’s indices: Banca Transilvania, Nuclearelectrica, OMV Petrom, TeraPlast and Bittnet (BNET). The inclusion of OMV Petrom, the largest energy company in South-Eastern Europe, and TeraPlast, the leader of the PVC pipe market and one of the most important players on the Romanian installations market, in FTSE Global Equity Index Series was decided by the global index provider following the half-yearly review, announced on Friday, August 20th. The two companies will be part of the index starting with September 20th. `FTSE’s decision regarding the inclusion of OMV Petrom in the All-Cap indices and, at the same time, TeraPlast’s upgrade from FTSE Global Micro-Cap index to FTSE Global All-Cap index validates the potential of the Romanian capital market and its dynamism. In just one year, Romania's presence in FTSE Russell indices has increased from three to five companies and we are glad that we are present with as diverse fields as possible, from energy and financial, to IT, because we present a relevant picture to global investors in regarding the offer of companies in which they can invest on BVB. -

Romania: Petrom Power Plant Non-Technical Summary [EBRD

NON-TECHNICAL SUMMARY PETROBRAZI 860MW COMBINED CYCLE POWER PROJECT ROMANIA at PETROM REFINERY, PLOIESTI, ROMANIA January 2009 Petrom S.A. Power Division 239 Calea Dorobanţilor 010567, Bucharest Romania Tel. + 40 (21) 4060101 Fax + 40 (21) 4060436 TABLE OF CONTENTS Section Page 1. INTRODUCTION............................................................................................................... 1 1.1. Project Outline............................................................................................................... 1 1.1.1. Combined Cycle Power Plant ................................................................................... 1 1.1.2. Natural Gas Pipeline ................................................................................................. 3 1.1.3. Overhead Line (OHL) Connection............................................................................. 3 1.2. Benefits.......................................................................................................................... 5 1.3. Alternatives....................................................................................................................6 2. ENVIRONMENTAL IMPACT PROCESS .......................................................................... 7 2.1. Public Relations and Information Disclosure................................................................. 8 2.1.1. Combined Cycle Power Plant (CCPP)...................................................................... 8 2.1.2. Natural Gas Pipeline ................................................................................................ -

Accelerated Bookbuild Offering of OMV Petrom S.A

________________________________________________________________________________________________________ To: Bucharest Stock Exchange Report date: Financial Supervisory Authority 15 September 2020 London Stock Exchange Name of the issuing entity: Current report according to Article 99 (s) of the Code of the Bucharest Stock Exchange Market Operator, Title Fondul Proprietatea S.A. II, Issuers and Financial Instruments NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN Registered office: PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR ANY OTHER 78-80 Buzesti Street JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO. PLEASE SEE THE IMPORTANT th NOTICE AT THE END OF THIS ANNOUNCEMENT. 7 floor, district 1, Bucharest, 011017 THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) NO. Phone/fax number: 596/2014. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW Tel.: + 40 21 200 9600 CONSIDERED TO BE IN THE PUBLIC DOMAIN. Fax: + 40 21 200 9631 Email: Important events to be reported: [email protected] Internet: Accelerated bookbuild offering of a base deal of minimum approximately www.fondulproprietatea.ro Sole Registration Code 1.4 billion existing shares in OMV Petrom S.A. with the Trade Register Office: Franklin Templeton Investment Management Ltd. United Kingdom Bucharest 18253260 Branch, in its capacity as Investment Manager of Fondul Proprietatea S.A. (the Order number in the Trade "Fund") announces the launch of an accelerated bookbuild offering of a base Register: J40/21901/2005 deal of minimum approximately 1.4 billion existing shares in OMV Petrom S.A. -

Omv Petrom Together with Enel X to Install 10 Fast Charging Stations for Electric Cars in Filling Stations in Romania

Media Relations T +40 372 115 694 F +40 372-87.33.42 [email protected] enelX.ro OMV PETROM TOGETHER WITH ENEL X TO INSTALL 10 FAST CHARGING STATIONS FOR ELECTRIC CARS IN FILLING STATIONS IN ROMANIA ➢ Each charging station will have an available power of minimum 50 kW ➢ Charging cycle for 80% of car battery to take up to approximately 25 minutes Bucharest , September 9, 2020 - OMV Petrom, the largest energy company in Southeastern Europe, and Enel X România, member of Enel X, the division of advanced energy services of Enel Group, will install 10 fast charging stations for electric cars, in OMV and Petrom filling stations, during the next months. The fast charging stations will be installed in OMV and Petrom filling stations covering a distance of approximately 380 kilometers on the main roads in Romania, connecting cities from the east, center and west of the country. In this way, OMV Petrom and Enel X continue their plans to develop the charging points network in Romania, thus encouraging the customers’ road mobility by electric cars. All charging stations for electric cars installed within the partnership will have an available power of minimum 50 kW, and a charging cycle for 80% of a car battery capacity will be done in approximately 25 minutes. “We believe that the answer to our customers’ mobility needs is a mix of fuels and alternative solutions. Through this partnership, we contribute to the development of the national charging infrastructure to enable the transit of electric cars in Romania. We estimate that, by the end of 2021, over 40 charging stations for electric cars will be installed in our regional network”, said Radu Căprău, member of OMV Petrom Executive Board, responsible for Downstream Oil. -

Romania Diagnostic Jakov Milatovic and Mateusz Szczurek

Romania Diagnostic Jakov Milatovic and Mateusz Szczurek January 2020 This report was prepared by Jakov Milatovic, Principal Economist at the Economics, Policy and Governance (EPG) department at the EBRD, under the supervision of Mateusz Szczurek, the Lead Regional Economist, and analytical support of Dan Meshulam, intern at EPG. Important contributions to the analysis were made by Dimitris Sourvanos and Oleg Levitin on political economy and governance, Kjetil Tvedt on the state of transport and municipal infrastructure, Dejan Vasiljev on access to finance, Marko Stermsek and Elias Habbar-Baylac on labour market, gender and inclusion issues, Giorgio Manenti on knowledge economy, and Philipp Paetzold on value chains analysis. We are grateful for guidance and comments provided by Mattia Romani (Managing Director, EPG), Artur Radziwill (Director, Country Economics and Policy) and Peter Sanfey (Deputy Director, Country Economics and Policy). We are also grateful to numerous other colleagues in EPG for helpful contributions. The report has benefited from comments from EBRD colleagues in other departments, including Banking, Office of the Chief Economist, Office of the General Counsel, Country Strategy and Results Management, Energy Efficiency and Climate Change. The views expressed in this paper are those of the authors only and not necessarily those of the EBRD. The report is based on latest available data. Country diagnostics are an EBRD tool to identify the main obstacles to entrepreneurship and private sector development and to help shape the Bank’s strategic priorities and project selection in new country strategies. Each diagnostic informs the EBRD’s policy engagement with the authorities in the country. Each country diagnostic assesses the progress and challenges of the country of operations in developing a sustainable market economy. -

Study on Companies from the Energy Sector from the Perspective of Performance Through the Operating Cash Flow

energies Article Study on Companies from the Energy Sector from the Perspective of Performance through the Operating Cash Flow 1 1 1, 2 Claudia Diana Sabău-Popa , Luminit, a Rus , Dana Simona Gherai *, Codrut, a Mare 1 and Ioan Gheorghe T, ara 1 Department of Finance—Accounting, Faculty of Economic Sciences, University of Oradea, 410087 Oradea, Romania; [email protected] (C.D.S.-P.); [email protected] (L.R.); [email protected] (I.G.T, .) 2 Department of Statistics-Forecasts-Mathematics, Faculty of Economics and Business Administration, Babes-Bolyai University, 400000 Cluj-Napoca, Romania; [email protected] * Correspondence: [email protected] Abstract: In this paper we analyzed the link between companies’ performance, in terms of cash and income, and the labor productivity or management rates, in case of the companies from the energy sector listed on the Bucharest Stock Exchange. We focused on the energy sector because of the impact that its expansion has on the evolution of economies around the world and because of its dynamics in the sense of gradually shifting to the use of energy from renewable sources. We have used panel regression models to analyze the operating cash flow and the profitability rates and the determination of a causal or dependency relationship with labor productivity or management rates. The results of this study show a significant negative correlation between operating cash flows and the average duration of stock rotation, and no correlation between productivity and the operating cash flow. Instead, the average duration of stock turnover does not at all influence the profitability Citation: Sab˘au-Popa,C.D.; Rus, L.; rates, and productivity is always significant for the return on assets, ie forthe return on equitywith Gherai, D.S.; Mare, C.; T, ara, I.G. -

An Early Evidence on Csr Reporting in the Context of Covid-19

Journal of Public Administration, Finance and Law AN EARLY EVIDENCE ON CSR REPORTING IN THE CONTEXT OF COVID-19 Oana Cristina STOICA Bucharest University of Economic Studies, Accounting Doctoral School Bucharest, Romania [email protected] Abstract: This study has investigated whether companies listed on Bucharest Stock Exchange have been prepared for Covid-19 risk and what are the measures and initiatives taken by them in terms of sustainability. Using a sample of seven listed companies that meet the criteria required by the Directive EU/95/2014 for disclosing non-financial information, the present paper has found that companies have mostly not been prepared for such a risk, but they immediately responded and have taken measures in order to protect their employees. In terms of social initiatives, only one company in the sample disclosed such information which is most related to supporting medical institution to combat and treat Covid-19. Keywords: CSR reporting, Covid-19, employees, social initiatives This article was presented at 12th edition of the Annual International Conference Globalization and Higher Education in Economics and Business Administration (GEBA 2020), held at the Alexandru Ioan Cuza University, Faculty of Economics and Business Administration in Iasi, Romania from the 22nd to 23rd of October 2020 INTRODUCTION Non-financial reporting is likely to provide a better picture of a firm’s performance (Wang and Sarkis, 2017) in comparison with financial reporting only. In the past few years, investors and other stakeholders which are interested in corporate information about firm’s business model, long-term strategy and value creation have started to give an increasingly attention on this type of reports. -

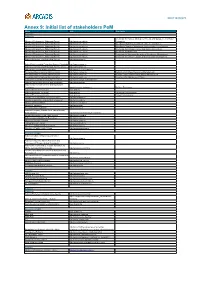

Annex 9: Initial List of Stakeholders

BE0114000978 Annex 9: Initial list of stakeholders PoM Name Web Directorate Romania Authority Directorate for Policies, Strategies, Projects and Management of Water Ministry of Environment, Water and Forest http://www.mmediu.ro Resourses Ministry of Environment, Water and Forest http://www.mmediu.ro River Basin Planning Department - Scheme Directories Ministry of Environment, Water and Forest http://www.mmediu.ro River Basin Planning Department - Hydrographic Constructions Ministry of Environment, Water and Forest http://www.mmediu.ro Directorate for Pollution Control and Impact Assessment Ministry of Environment, Water and Forest http://www.mmediu.ro Directorate for Biodiversity Ministry of Environment, Water and Forest http://www.mmediu.ro Directorate for Waste and Hazardous Substances Management Ministry of Environment, Water and Forest http://www.mmediu.ro Directorate for Climate Change and Sustainable Development National Environmental Protection Agency http://www.anpm.ro Nationl Environmental Protection Agency Constanta http://apmct.anpm.ro National Environmental Protection Agency Tulcea http://apmtl.anpm.ro National Meteorlogical Administration http://www.meteoromania.ro Romanian Waters National Administration http://www.rowater.ro Department for Water Resources Management Romanian Waters National Administration http://www.rowater.ro Department for Hydrotechnical Works Management Romanian Waters National Administration http://www.rowater.ro Department for Management Plans Dobrogea-Litoral Water Basin Administration http://www.rowater.ro/dadobrogea -

FDI ERSTE Equity Romania in Anul 2017

Raport privind activitatea FDI ERSTE Equity Romania in anul 2017 Draga cititorule, Erste Asset Management a elaborat in anul 2016 primul studiu din Romania, cu focus pe fondurile de investitii. Concluziile principale ale studiului Erste Asset Management releva faptul ca protectia financiara este principalul motiv pentru care romanii plaseaza bani in fondurile de investitii. Studiul releva ca pentru romani nevoia de protectie financiara este in stransa legatura cu dorinta de a avea un suport in momente neprevazute sau dificile, mai degraba decat grija fata de viitor. Mitul gresit al sumei mari de bani necesare pentru a investi, alaturi de perceptia blocarii banilor pentru o perioada lunga de timp sunt principalele bariere in calea neparticiparii intr-un fond de investitii. Despre Fondurile de Investitii s-au spus multe: ca sunt complicate, ca nu sunt pentru oricine. Putini romani, sub 5% din populatia activa a tarii, se numara printre cei care stiu exact ce este un Fond de Investitii sau cum functioneaza el. De aceea, in a doua jumatate a anului 2016 am gandit un program de educatie financiara “Romania Investeste” in care am cautat sa explicam fiecare termen, fiecare produs, fiecare mit, astfel oricine sa poata decide singur daca investitiile sunt potrivite, cand si in ce sa investeasca. Am inceput cu pagina de Facebook si apoi am lansat, la finele anului 2017, platforma www.romaniainvesteste.ro Majoritatea activitatilor desfasurate in decursul anului 2017 au fost concentrate pe educatie financiara. Astfel, am fost prezenti la evenimente precum „Emerging Funding for the Real Economy”, „Asociati in afaceri”, „Expertii alaturi de dumneavoastra”, „Banii Tai Expo 2017”, am dezvoltat parteneriatele cu cluburile de investitori din intreaga tara si am sustinut prelegeri si sesiuni stiintifice la facultatile economice din cadrul centrelor universitare: Bucuresti, Cluj, Craiova, Iasi si Oradea.