2019 Pricing Grid Numismatic Gold Platinum Palladium Liberty

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

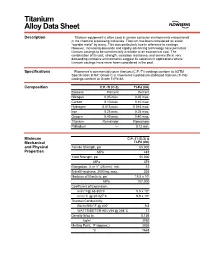

Titanium Alloy Data Sheet

M Titanium Alloy Data Sheet Description Titanium equipment is often used in severe corrosive environments encountered in the chemical processing industries. Titanium has been considered an exotic “wonder metal” by many. This was particularly true in reference to castings. However, increasing demands and rapidly advancing technology have permitted titanium castings to be commercially available at an economical cost. The combination of its cost, strength, corrosion resistance, and service life in very demanding corrosive environments suggest its selection in applications where titanium castings have never been considered in the past. Specifications Flowserve’s commercially pure titanium (C.P.-Ti) castings conform to ASTM Specification B367, Grade C-3. Flowserve’s palladium stabilized titanium (Ti-Pd) castings conform to Grade Ti-Pd 8A. Composition C.P.-Ti (C-3) Ti-Pd (8A) Element Percent Percent Nitrogen 0.05 max. 0.05 max. Carbon 0.10 max. 0.10 max. Hydrogen 0.015 max. 0.015 max. Iron 0.25 max. 0.25 max. Oxygen 0.40 max. 0.40 max. Titanium Remainder Remainder Palladium –– 0.12 min. Minimum C.P.-Ti (C-3) & Mechanical Ti-Pd (8A) and Physical Tensile Strength, psi 65,000 Properties MPa 448 Yield Strength, psi 55,000 MPa 379 Elongation, % in 1" (25 mm), min. 12 Brinell Hardness, 3000 kg, max. 235 Modulus of Elasticity, psi 15.5 x 106 MPa 107,000 Coefficient of Expansion, in/in/°F@ 68-800°F 5.5 x 10-6 m/m/°C @ 20-427°C 9.9 x 10-6 Thermal Conductivity, Btu/hr/ft/ft2/°F @ 400° 9.8 WATTS/METER-KELVIN @ 204°C 17 Density lb/cu in 0.136 kg/m3 3760 Melting Point, °F (approx.) 3035 °C 1668 Titanium Alloy Data Sheet (continued) Corrosion The outstanding mechanical and physical properties of titanium, combined with its Resistance unexpected corrosion resistance in many environments, makes it an excellent choice for particularly aggressive environments like wet chlorine, chlorine dioxide, sodium and calcium hypochlorite, chlorinated brines, chloride salt solutions, nitric acid, chromic acid, and hydrobromic acid. -

The Platinum/Palladium Process

9 The Platinum/Palladium Process OVERVIEW AND EXPECTATIONS In the majority of the classes and workshops that I’ve taught over the years, “the platinum/palladium process” is the answer that surfaces first when I ask the question, “What process do you want to learn the most?” In this chapter you will learn how, and, as in previous chapters, I begin with a little history. Then you will learn the chemistry and sequence of the various stages to a finished print. This chapter gives you alternatives to traditional platinum/palladium chemistry and provides you with a simple sensitizer “drop chart” that is based on the type of negative you are working with, rather than the print you would like to make. I also provide the beginnings of a trouble-shooting list to assist in hunting down problems that may be showing up in your work. Finally, you’ll get some brief alternative ideas for combining platinum/palladium with other techniques such as Van Dyke and gum bichromate. A LITTLE HISTORY Like most refined non-silver and alternative photographic processes, the art of platinum/palladium printing was developed in pieces over time by a number of dedicated artists and scientists. In 1830, Ferdinand Gehlen recorded the action and effects of light on platinum chloride, noting that UV light would alter the color of platinum salts and cause the ferric salts to precipitate out into a ferrous state. At around the same time, Johann Wolfgang Dobereiner (1780–1849) observed the decomposition of ferric oxalate on exposure to UV light and scientifically defined its sensitivity. -

THE USE of MIXED MEDIA in the PRODUCTION of METAL ART by Mensah, Emmanuel (B.A. Industrial Art, Metals)

THE USE OF MIXED MEDIA IN THE PRODUCTION OF METAL ART By Mensah, Emmanuel (B.A. Industrial Art, Metals) A Thesis submitted to the School of Graduate Studies, Kwame Nkrumah University of Science and Technology In partial fulfillment of the requirements for the degree of MASTER OF ARTS (ART EDUCATION) Faculty of Art, College of Art and Social Sciences March 2011 © 2011, Department of General Art Studies DECLARATION I hereby declare that this submission is my own work toward the M.A Art Education degree and that, to the best of my knowledge, it contains no materials previously published by another person or material which has been accepted for the award of any other degree of the university, except where due acknowledgement has been made in the text. ……………………………….. ……………………………….. ………………………….. Student’s name & ID Signature Date Certified by ……………………………….. ……………………………….. ………………………….. Supervisor’s Name Signature Date Certified by ……………………………….. ……………………………….. ………………………….. Head of Department’s Name Signature Date ii ABSTRACT The focus of this study was to explore and incorporate various artistic and non artistic media into the production of metal art. The researcher was particularly interested in integrating more non metallic materials that are not traditional to the production of metal art in the decoration, finishing and the protective coating of metal art works. Basic hand forming techniques including raising, chasing and repoussé, piercing and soldering were employed in the execution of the works. Other techniques such as painting, dyeing and macramé were also used. Non metallic media that were used in the production of the works included leather, nail polish, acrylic paint, epoxy, formica glue, graphite, eye pencil, lagging, foam, wood, shoe polish, shoe lace, eggshell paper, spray paint, cotton cords and correction fluid. -

Gemstones by Donald W

GEMSTONES By Donald W. olson Domestic survey data and tables were prepared by Nicholas A. Muniz, statistical assistant, and the world production table was prepared by Glenn J. Wallace, international data coordinator. In this report, the terms “gem” and “gemstone” mean any gemstones and on the cutting and polishing of large diamond mineral or organic material (such as amber, pearl, petrified wood, stones. Industry employment is estimated to range from 1,000 to and shell) used for personal adornment, display, or object of art ,500 workers (U.S. International Trade Commission, 1997, p. 1). because it possesses beauty, durability, and rarity. Of more than Most natural gemstone producers in the United states 4,000 mineral species, only about 100 possess all these attributes and are small businesses that are widely dispersed and operate are considered to be gemstones. Silicates other than quartz are the independently. the small producers probably have an average largest group of gemstones; oxides and quartz are the second largest of less than three employees, including those who only work (table 1). Gemstones are subdivided into diamond and colored part time. the number of gemstone mines operating from gemstones, which in this report designates all natural nondiamond year to year fluctuates because the uncertainty associated with gems. In addition, laboratory-created gemstones, cultured pearls, the discovery and marketing of gem-quality minerals makes and gemstone simulants are discussed but are treated separately it difficult to obtain financing for developing and sustaining from natural gemstones (table 2). Trade data in this report are economically viable deposits (U.S. -

The Platinum Group Metals As Coating Materials

Issue No. 38 – February 2012 Updated from Original August 2002 Publication The Platinum Group Metals as Coating Materials How precious is your metal - An overview on The platinum group metals consist of platinum and palladium, as well as rhodium, iridium, the use of the platinum osmium, and ruthenium. They can be found in the transition metals on the periodic table of the elements. A close-up of this part of the table is shown in Figure 1. Palladium is currently the group metals as contact surfaces for electronic only metal of the group in widespread use in electrical contacts, although platinum was widely connectors. used in the past. Rhodium is only used in electrical contact applications requiring very high hardness and wear resistance. The other three metals in the group are used mainly in other industrial applications. Pure, electroplated platinum and palladium have a hardness of around 200 to 400 HV, although . Platinum they may also be applied by cladding. Both have a conductivity of around 16% IACS. Thus they are harder than gold, but slightly less conductive. At one time, their prices were . Palladium competitive with gold, and gold-flashed palladium coatings were even used as less expensive alternatives to gold coatings. However, both of these metals are much more expensive than gold . Rhodium (at least at the time of this writing). Due to its cost, gold-flashed palladium is now used mainly in applications which require greater hardness and wear resistance than hard gold alone. Ruthenium Rhodium is much harder than platinum and palladium, typically 800-1000 HV, with an . -

Pulse Plating of Silver-Palladium Alloys

Pulse Plating of Silver-Palladium Alloys By Dong Shou-Jiang, Y. Fukumoto and T. Hayashi Current pulses at 200 to 400 mA/cm2 with an on-time of NaOH. in the unstirred bath at 45° C, alloy coatings of 0.1 msec and an average current density of 4 mA/cm2 3-µm-thick were deposited at 6 coulombs to prepare were the optimum pulsing conditions for depositing samples for inspecting surface morphology and deter- bright, smooth silver alloy containing about 25 percent mining alloy composition. The electrode potential was palladium. Deposit composition appeared to be measured with an oscillograph just before the current was controlled by diffusion polarization. A high overpotential switched off. during pulse plating seemed effective for the formation of Table 1 shows the current wave forms used in this study. fine-grained alloy deposits. Experiments with constant average current density were conducted with variable pulse current density (iP) and variable on- and off-times (ton and toff). Changes in the ilver-palladium alloys have found many applica- concentrations of metal ions in the cathode diffusion layer tions in the electronic industry as a replacement were rather small with the pulsed cycles we adopted, for hard gold on electrical contacts.1 Although permitting an evaluation of the influence of the electrode thiocyanate, 2 cyanide3 and chloride4 baths have potential on alloy deposition. To determine the influence of beens studied, no practical process for plating Ag-Pd alloys the concentration of metal ions, experiments with variable from these solutions has been developed, because the average current density were also conducted using variable deposits had a poor appearance and were limited to a pulse current density and off-time. -

The Role of Palladium in Enhancing Corrosion Resistance of Titanium

The Role of Palladium in Enhancing Corrosion Resistance of Titanium By J. B. Cotton Research Department, Imperial Metal Industries (Kynoch) Limited, Birmingham high rate of corrosion is observed, and this is It is well known that the addition of then succeeded by a very significant reduction about 0.2 per cent palladium to in the corrosion rate. In the early work on titanium signijicantly increases its titanium-palladium alloys it was thought that resistance to corrosion in non-oxidising during this induction period preferential solu- acids. It has usually been assumed that tion of titanium took place, that when suffi- the palladium is present as elemental cient metallic palladium was available at the particles at the metal surface and that metal surface the anodic passivation mechan- these function electrochemically to pro- ism followed, and that this resulted in the vide anodic passivation of the titanium diminution of the corrosion rate. matrix. It has, however, now been There was, however, some doubt as to the demonstrated that even in low concentra- form in which titanium was present in tion palladium additions to titanium titanium-palladium alloys and further investi- farm Ti,Pd, and that before onset of gation has now shown that even at a con- passioation the palladium dissolves in centration as low as 0.15 wt per cent the the corrodent and is then reprecipitated palladium is present as Ti,Pd. Fig. I shows in elemental form from solution. This the presence of an elongated Ti,Pd phase in process is accompanied by the growth of the Ti-0.15 per cent Pd alloy at a magnifica- a protectivejilm of TiO,. -

Kum Boo on Argentium Sterling Silver © Cynthia Eid 2011

Kum Boo on Argentium Sterling Silver © Cynthia Eid 2011 Definition and history Kum Boo is the Korean name for a technique for applying gold to silver. In the Korean language, it translates as “attached gold”. The technique has variations seen in Chinese and Japanese metalworks, as well as in Korea, and is also used to attach gold to iron, steel, and copper. It is possible to use the process to attach gold to colored gold alloys, palladium, and platinum. Spelling Because Korean does not use our alphabet, there are other spellings, such as Keum- boo. I spell it as Kum Boo, because in a conversation with Komeila Okim, we decided that is closest to a phonetic spelling. How it Works Gold attaches to fine silver in a diffusion bond, through heat and pressure. The heat source may be a torch, a lab hot plate, a kitchen hot plate, an ultralite kiln, or whatever heat source is available, to heat the metals to 650-850°F. Pressure is usually applied with steel, agate, or pyrex burnishers. Preparation of Silver Step One: Cut, Solder, Texture.....the Silver It is wise to start with a small piece, which is flat, or has a gently curved surface. In my experience, the gold bonds best to a surface with a shallow texture. A bit of “tooth” seems to give the metals a mechanical bond in addition to the bond of the atoms. Examples of what I find to be good textures to use include: -Texture from a grinding stone or diamond-bur made with a flexible shaft -Texture of sanding. -

Palladium: the “Wise” Precious Metal

Palladium: The “Wise” Precious Metal Precious Metal Insights PreciousFeaturing Metal the Aberdeen Insights Standard Physical Palladium Shares ETF (PALL) 02 of 04 Precious Metal Insights Named after Pallas Athena, the Greek goddess of wisdom, palladium is from the same group of metals as platinum, but has the flexibility and pliability of gold.1 It’s one of the rarest metals on earth, and is 15x more scarce than its “sister” metal, platinum. Palladium is also one of the few precious metals whose demand is driven by industrial use not jewelry or investment.2 To better familiarize you and clients with this extremely rare precious metal, here are a few salient facts about palladium. Supply & Demand Palladium supply is geographically constrained with over 79% of mine production evenly distributed between South Africa and Russia. The remaining mine production comes from Canada, Zimbabwe, and the U.S. This geographic concentration of mine production leaves palladium subject to supply interruptions due to economic and geopolitical disruptions. It is forecasted that there will be a deep shortfall in palladium, somewhere in the order of one million ounces per year, over the next several years, due to continued rising demand for the metal, particularly from China.2 The majority of palladium’s demand stems from the following sectors:2 80-85% automotive* Palladium demand is primarily driven by use in catalytic converters for gasoline-engine automobiles. Key markets for gasoline vehicle sales include the United States and China, which are expected to see demand growth over the coming years stemming from China’s ongoing adoption of more stringent emissions regulations.3 Additionally, China’s increasing population is expected to buy more cars as economic development continues, which puts palladium in an attractive position.4 10-15% industry & technology* The remainder of palladium’s demand comes from industrial and technological applications, including electronics, dental, chemical, and other industrial applications. -

Electroplated Palladium Coating As a Nickel Migration (Thermal) Barrier

Electroplated Palladium Coating As a Nickel Migration (Thermal) Barrier By J.K. Lim, J.S. Russo and E. Antonier Recent industry studies indicate that palladium plating palladium electrodeposit as a migration barrier and plating provides a barrier to nickel migration at elevated tem- composite for the chip carrier used. The intent of this study peratures. Coupled with a known thermal barrier such as was to determine whether a specific palladium plating chem- nickel cobalt, the resulting plating surface should have istry could provide a nickel migration barrier and improve good hermetic sealing characteristics. Twenty-seven Ni- chip carrier solderability. Co plated chip carriers were coated with an acid palla- dium strike and electrolytic palladium deposits.* Three Experimental Procedure different plating combinations were used: Ni-Co/Au (Pd The tests conducted during this evaluation are based on one strike), Ni-Co/Pd, and Ni-Co/Pd/Au. Ni-Co/Au plated central theme; namely, which plating applications or coating carriers were used as the standard. The test samples systems would yield the most hermetic and void-free solder achieved equivalent or better nickel migration and sol- joints. In all cases, the least amount of nickel diffusion and derability results than the standard (less than 10 atomic solder dewetting are the most desirable conditions. These percent nickel migration** and nearly 100 percent solder standards have been developed and refined during the last flow). five years and more recently used to evaluate the quality of plated hardware.5 A description of the three plating groups Palladium appears to exhibit several attributes that can be selected for this study is given below: applied to micro-electronics packages. -

Palladium-Copper-Gold Alloys for the Separation of Hydrogen Gas

Université du Québec Institut National de la Recherche Scientifique Centre Énergie, Matériaux et Télécomunications Palladium-Copper-Gold Alloys for the Separation of Hydrogen Gas by Bruno Manuel Honrado Guerreiro, M.Sc. A thesis submitted for the achievement of the degree of Philosophiae doctor (Ph.D.) in Energy and Materials Science December 2015 Jury Members President of the jury: Prof. Andreas Ruediger (INRS-EMT) Internal Examiner: Prof. Lionel Roué (INRS-EMT) External Examiner: Prof. Pierre Bénard (UQTR) External Examiner: Prof. Sasha Omanovic (McGill University) Director of Research: Prof. Daniel Guay (INRS-EMT) © All rights reserved – Bruno Guerreiro, 2015 Abstract The industrial applications of hydrogen gas have made this simple diatomic molecule an important worldwide commodity in the chemical, oil and even food sectors. Moreover, hydrogen gas is a promising energy carrier that aims the delivery of clean energy, bypassing the environmental problems created by carbon-based fuels. Hydrogen production is, however, still reliant on steam reforming of natural gas and coal gasification, despite the innumerous alternatives available. In order to introduce hydrogen in the energy market, hydrogen production costs need to be reduced, and more specifically, hydrogen purification needs to be simplified. In this regard, the use of dense palladium-based membranes for hydrogen purification are especially attractive, but their wide industrial application is impaired mostly by the high cost of palladium and by hydrogen sulfide poisoning. In the current work, the potential use of palladium-copper-gold alloys as membranes for the separation of hydrogen gas was tested. PdCuAu alloys were first prepared by pulsed electrochemical co-deposition on a titanium substrate from Pd(NO3)2, Cu(NO3)2 and Au(OH)3 in HNO3 0.35 M, over a wide composition range ([Pd] = 14-74 at.%, [Cu] = 2-82 at.%, [Au] = 0-66 at.%). -

Using Blended Finance to Build Financial Resilience for Women

Call for Proposals: Using Blended Finance to Build Financial Resilience for Women WHAT? Our quest is simple. We want to drive significant amounts of private investment capital to support women in developing countries. We are looking for your bold ideas, and actionable plans as well as the scale-up of proven solutions and the right people who will get it done. We expect you to show us how you will leverage USAID funds to mobilize and invest private sector capital to benefit women. USAID’s Women’s Global Prosperity Program (W-GDP) is committed to closing the gender financing gap at scale and creating financial resilience for lower income women in the developing world. The program’s Invest in Women portfolio uses blended finance to catalyze private capital and mobilize sustained private sector involvement for women-owned or led businesses; businesses that disproportionately hire women; and businesses that deliver services and technologies particularly suited to serving women. WHY? Inequality and a lack of access to financial services can leave women in developing countries and their businesses more susceptible to, and less prepared for economic shocks. W-GDP can play a key role in strengthening women’s financial resilience and access to markets, to better manage risk during challenging times and to successfully sustain their livelihoods and achieve continued economic advancement. W-GDP’s Invest in Women program also lowers the risk for commercial investors in new markets, using blended finance approaches to spur new and additional investment, products, and services to create sustained economic opportunities for women. HOW? We will award up to US$6 million in total funding to the winning proposal(s), with a minimum eligible bid of US$1 million.