Earning Results Briefing for 3Q/2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Convocation of the 14Th Annual General Meeting of Shareholders

Disclaimer: Please note that the following is a translation of the original Japanese documents prepared only for reference purposes. The Japanese original shall take precedence in the case of any discrepancies between this translation and the original. The Company assumes no responsibility for direct, indirect or any other forms of damages arising from this translation. Securities code: 9412 June 9, 2021 To Our Shareholders, Shinji Takada, Representative Director, Chairman SKY Perfect JSAT Holdings Inc. 8-1, Akasaka 1-chome, Minato-ku, Tokyo Notice of Convocation of the 14th Annual General Meeting of Shareholders We would like to inform you that the 14th Annual General Meeting of Shareholders of SKY Perfect JSAT Holdings Inc. (the “Company”) will be held as described below. For the sake of preventing the spread of new coronavirus (COVID-19) infections and ensuring safety at the meeting venue, shareholders are requested to refrain from attending the meeting where possible. In lieu of attending the meeting, you can exercise your voting rights in advance either in writing or via the Internet, etc. Please review the attached Reference Documents for General Meeting of Shareholders and exercise your voting rights following the “Guide to Exercising Voting Rights in Advance” on page 4 by 5:30 p.m. Japan time on Thursday, June 24, 2021. Please visit the Company’s website for a video of the meeting to be posted on a later date. Details 1. Date and Time: Friday, June 25, 2021, at 10:00 a.m. (The reception will commence at 9:00 a.m.) The reason the date for this Annual General Meeting of Shareholders is far apart from the date of that in the previous year (July 30, 2020) is that with telecommuting applied to all officers and employees from the perspective of preventing the spread of COVID-19 infections and ensuring safety, delays in major operations were unavoidable last year, so the meeting was postponed to July. -

1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp

Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp. 125 1721 Comsys Holdings Corp. 50 1801 Taisei Corp. 50 1802 Obayashi Corp. 50 1803 Shimizu Corp. 50 1808 Haseko Corp. 250 1812 Kajima Corp. 50 1925 Daiwa House Industry Co., Ltd. 50 1928 Sekisui House, Ltd. 50 1963 JGC Corp. 50 2002 Nisshin Seifun Group Inc. 50 2269 Meiji Holdings Co., Ltd. 250 2282 Nh Foods Ltd. 50 2432 DeNA Co., Ltd. 500/3 2501 Sapporo Holdings Ltd. 250 2502 Asahi Group Holdings, Ltd. 50 2503 Kirin Holdings Co., Ltd. 50 2531 Takara Holdings Inc. 50 2768 Sojitz Corp. 500 2801 Kikkoman Corp. 50 2802 Ajinomoto Co., Inc. 50 2871 Nichirei Corp. 100 2914 Japan Tobacco Inc. 50 3086 J.Front Retailing Co., Ltd. 100 3099 Isetan Mitsukoshi Holdings Ltd. 50 3101 Toyobo Co., Ltd. 50 3103 Unitika Ltd. 50 3105 Nisshinbo Holdings Inc. 50 3289 Tokyu Fudosan Holdings Corp. 50 3382 Seven & i Holdings Co., Ltd. 50 3401 Teijin Ltd. 250 3402 Toray Industries, Inc. 50 3405 Kuraray Co., Ltd. 50 3407 Asahi Kasei Corp. 50 3436 SUMCO Corp. 500 3861 Oji Holdings Corp. 50 3863 Nippon Paper Industries Co., Ltd. 500 3865 Hokuetsu Kishu Paper Co., Ltd. 50 4004 Showa Denko K.K. 500 4005 Sumitomo Chemical Co., Ltd. 50 4021 Nissan Chemical Industries, Ltd. 50 4042 Tosoh Corp. 50 4043 Tokuyama Corp. 50 WF-101-E-20170803 Copyright © Nikkei Inc. All rights reserved. 1/5 Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 4061 Denka Co., Ltd. -

Japan-Brazil Space Sector Workshop Agenda

Japan-Brazil Space Sector Workshop Sergio Sobral de Oliveira Auditorium (IAI building) INPE’s headquarters São José dos Campos, SP, Brazil Agenda Day1: August 26 Welcome and Opening Remarks 9:00 João BRAGA: Vice Director and Coordinator of Regional Centers, INPE 9:05 Himilcon de Castro CARVALHO: Director of Space Policy and Strategic Investments, AEB 9:10 Tomonori NISHIMURA: Chairman of Space Industry Mission, Senior Vice President, NEC Corporation 9:15 Shuichi KANEKO: Director, Space Industry Office, Ministry of Economy, Trade and Industry (METI) 9:20 Introduction of Participants Brazilian Space Activities – Part 1: Space Program and Space Engineering 9:40 Overview of the Brazilian Space Program – AEB - Himilcon de Castro CARVALHO 9:50 INPE - Institutional Video 10:10 Space Engineering and Technology (ETE-INPE) – Mario QUINTINO 10:20 Integration and Testing Laboratory (LIT-INPE) – Ciro HERNANDES 10:30 Satellite Tracking and Control Center (CRC – INPE) – Pawel ROZENFELD 10:40 Q&A / Discussions 11:00 - 11:15: Break Japanese Space Industry – Part 1 11:15 Shigeyoshi HATA: Senior Vice President: The Society of Japanese Aerospace Companies(SJAC) [Satellite System] 11:25 ・NEC Corporation - Shigeki KUZUOKA 11:35 ・Mitsubishi Electric Corporation - Tadahiko INADA [Launch Vehicle] 11:45 ・IHI Aerospace Co., Ltd. - Shigeki KINAI 11:55 ・Mitsubishi Heavy Industries, Ltd. - Shoichiro ASADA 12:05 ・IHI Corporation - Kazunori KAWASAKI 12:15 Q&A / Discussions 13:00 - 14:15: Lunch Break Brazilian Space Industry 14:30 ・Brazilian Aerospace Private Sector (AIAB) – Walter BARTELS 14:50 ・Equatorial – César GHIZONI 15:10 ・Fibraforte - Jadir Nogueira BARBOSA 15:30 ・Star One – Lincoln OLIVEIRA 16:00 Q&A / Discussions 16:15 - 16:30: Break Japanese Space Industry - Part 2 [Satellite Application Service] 16:30 ・Mitsubishi Corporation– George TAKAHASHI 16:45 ・SKY Perfect JSAT Corporation - Takaomi NAGASHIMA 17:00 ・PASCO CORPORATION – Kenichi MIYAKAWA 17:15 ・Japan Space Imaging Corporation (JSI) - Masahiro ONUKI 17:30 ・Hitachi, Ltd. -

Putnam Panagora Market Neutral Fund Q3 Portfolio Holdings

Putnam PanAgora Market Neutral Fund The fund's portfolio 5/31/20 (Unaudited) INVESTMENT COMPANIES (46.1%)(a) Shares Value Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. 640 $3,635 State Street Institutional U.S. Government Money Market Fund 3,939,067 3,939,067 Total investment companies (cost $3,943,561) $3,942,702 UNITS (11.0%)(a) Units Value Acamar Partners Acquisition Corp.(NON) 419 $4,291 Alussa Energy Acquisition Corp. (Cayman Islands)(NON) 856 8,483 Amplitude Healthcare Acquisition Corp.(NON) 2,947 29,529 B. Riley Principal Merger Corp. II(NON) 2,620 26,174 CC Neuberger Principal Holdings I(NON) 2,652 27,024 Chardan Healthcare Acquisition 2 Corp.(NON) 2,652 26,493 CHP Merger Corp.(NON) 2,747 27,745 CIIG Merger Corp.(NON) 4,529 45,335 Collective Growth Corp.(NON) 2,803 27,890 DFP Healthcare Acquisitions Corp.(NON) 2,866 28,746 dMY Technology Group, Inc.(NON) 2,885 29,196 East Stone Acquisition Corp.(NON) 4,230 42,089 FinServ Acquisition Corp.(NON) 831 8,194 Foley Trasimene Acquisition Corp.(NON) 2,626 26,917 Fortress Value Acquisition Corp.(NON) 2,652 26,547 Galileo Acquisition Corp.(NON) 888 8,827 GigCapital3, Inc.(NON) 2,833 28,160 Gores Holdings IV, Inc.(NON) 1,306 13,844 Greenrose Acquisition Corp.(NON) 3,350 32,931 GX Acquisition Corp.(NON) 417 4,233 Healthcare Merger Corp.(NON) 2,705 28,105 InterPrivate Acquisition Corp.(NON) 2,918 29,180 Jaws Acquisition Corp.(NON) 2,620 27,038 Juniper Industrial Holdings, Inc.(NON) 841 8,418 Landcadia Holdings II, Inc.(NON) 1,165 12,174 LGL Systems Acquisition Corp.(NON) 2,568 25,629 Lifesci Acquisition Corp.(NON) 2,866 29,806 LIV Capital Acquisition Corp. -

Securing Japan an Assessment of Japan´S Strategy for Space

Full Report Securing Japan An assessment of Japan´s strategy for space Report: Title: “ESPI Report 74 - Securing Japan - Full Report” Published: July 2020 ISSN: 2218-0931 (print) • 2076-6688 (online) Editor and publisher: European Space Policy Institute (ESPI) Schwarzenbergplatz 6 • 1030 Vienna • Austria Phone: +43 1 718 11 18 -0 E-Mail: [email protected] Website: www.espi.or.at Rights reserved - No part of this report may be reproduced or transmitted in any form or for any purpose without permission from ESPI. Citations and extracts to be published by other means are subject to mentioning “ESPI Report 74 - Securing Japan - Full Report, July 2020. All rights reserved” and sample transmission to ESPI before publishing. ESPI is not responsible for any losses, injury or damage caused to any person or property (including under contract, by negligence, product liability or otherwise) whether they may be direct or indirect, special, incidental or consequential, resulting from the information contained in this publication. Design: copylot.at Cover page picture credit: European Space Agency (ESA) TABLE OF CONTENT 1 INTRODUCTION ............................................................................................................................. 1 1.1 Background and rationales ............................................................................................................. 1 1.2 Objectives of the Study ................................................................................................................... 2 1.3 Methodology -

News Release

News Release September 2, 2008 SKY Perfect JSAT Holdings Inc. - SKY PerfecTV! HD Declaration - Starting the High-Definition Broadcast Service “SKY PerfecTV! HD” via SKY PerfecTV! 124/128-degree CS Digital Broadcasting Service SKY Perfect Communications Inc. (Head Office: Minato-ku, Tokyo; President and Representative Director: Masao Nito), a wholly-owned subsidiary of SKY Perfect JSAT Holdings Inc. (Head Office: Minato-ku, Tokyo; President and Representative Director: Masanori Akiyama), announced the new content of its high-definition broadcast service, scheduled to start from October, 2008 via SKY PerfecTV! 124/128-degree CS digital broadcasting service. News Release September 2, 2008 SKY Perfect Communications Inc. - SKY PerfecTV! HD Declaration - Starting the High-Definition Broadcast Service “SKY PerfecTV! HD” via SKY PerfecTV! 124/128-degree CS Digital Broadcasting Service This is to announce that SKY Perfect Communications Inc. (Head Office: Minato-ku, Tokyo; President and Representative Director: Masao Nito; “SKY Perfect”) has determined the content of its high-definition broadcast service, scheduled to start from October, 2008 via SKY PerfecTV! 124/128-degree CS digital broadcasting service ( “SKY PerfecTV!”). SKY Perfect will expand the number of channels in the 1st phase of high-definition broadcasting service starting from October 1, 2008 and the 2nd phase of high-definition broadcasting service starting from October, 2009. The number of high-definition broadcast channels starting in the 1st phase will be 15 including Pay Per View (PPV) channels, and starting in the 2nd phase the number will be increased to 70 or more in total. SKY Perfect inaugurated the SKY PerfecTV! broadcasting service in 1996 and has since then expanded the business to its present 285 channels. -

SKY Perfect JSAT and Kymeta Sign Strategic Partnership & Investment

News Release March 8, 2017 SKY Perfect JSAT Corporation SKY Perfect JSAT and Kymeta Sign Strategic Partnership & Investment Agreement to deliver new satellite connectivity options for moving vehicles SKY Perfect JSAT Corporation (Head Office: Minato-ku, Tokyo; Representative Director, President & Chief Executive Officer: Shinji Takada; SJC) announces that SJC and Kymeta ( Head Office: Redmond WA; founder, President & Chief Executive Officer Nathan Kundtz) have signed a strategic partnership agreement to provide new mobile satellite communications technology to the Japanese market and for SJC has also recently become an investor in Kymeta. Kymeta has developed a satellite antenna technology that harnesses the traits of metamaterials . This electronic beamforming mTenna (Kymeta mTenna™) technology enables moving vehicles to leverage high throughput connectivity via satellite. SJC expects Kymeta mTenna™ technology will make it possible to provide high-throughput connectivity to mobile platforms such as emergency first response vehicles, transportation, IoT applications and more. SJC and Kymeta will pursue business development. .As a part of this engagement, Kymeta will create solutions for SJC’s current and future customer needs. The two companies are planning a Kymeta product demo in Japan around 2017 Summer which will be the first opportunity for Kymeta to demonstrate in Asia Pacific SJC will continue to develop new areas of satellite business globally. About SKY Perfect JSAT SKY Perfect JSAT is a lease in the coveraging fieds of broadcasing and communicatinos. It is Asia’s largest satellite opeortor with a fleet of 18 satellites, and Japan’s only provider of both multi-channel pay TV broadcasting and satellite communications services. SKY Perfect JSAT delivers a broad range of entertainment trhough the SKY PerfejcTV! Platform, the most extensive in Japan with a total of 3 million subscribers. -

ACXW Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value ETF (AVDV) May 28, 2021 Avantis International Small Cap Value ETF - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.4% Australia — 8.0% Adairs Ltd. 64,691 233,414 Adbri Ltd. 444,216 1,141,164 Aeris Resources Ltd.(1) 238,800 31,179 Alkane Resources Ltd.(1)(2) 152,741 103,278 Alliance Aviation Services Ltd.(1) 50,306 171,065 Asaleo Care Ltd. 212,115 229,790 Aurelia Metals Ltd. 716,008 245,064 Austal Ltd. 283,491 520,718 Australian Finance Group Ltd. 186,297 400,567 Australian Pharmaceutical Industries Ltd. 419,111 373,258 Bank of Queensland Ltd. 555,800 3,869,929 Beach Energy Ltd. 2,204,143 2,167,414 Bendigo & Adelaide Bank Ltd. 252,445 2,042,517 Boral Ltd.(1) 116,988 619,401 Calix Ltd.(1) 39,671 84,060 Cedar Woods Properties Ltd. 8,294 45,011 Champion Iron Ltd.(1) 492,380 2,502,893 Collins Foods Ltd. 16,697 160,894 Coronado Global Resources, Inc.(1) 453,537 242,887 CSR Ltd. 651,143 2,799,491 Dacian Gold Ltd.(1) 129,467 28,363 Deterra Royalties Ltd. 179,435 579,460 Eclipx Group Ltd.(1) 432,641 710,525 Emeco Holdings Ltd.(1) 476,645 332,757 EML Payments Ltd.(1) 327,130 862,970 Galaxy Resources Ltd.(1) 3,318 9,808 Genworth Mortgage Insurance Australia Ltd.(1) 442,504 945,096 Gold Road Resources Ltd. 660,222 763,347 GrainCorp Ltd., A Shares 347,275 1,343,019 Grange Resources Ltd. -

UTM Project in Japan

Global UTM Conference 2017 UTM Project in Japan June 26 2017 Hiroyuki Ushijima Ministry of Economy, Trade and Industry (METI) Overview 1. UAS Industry in Japan 2. Roadmap of UAS Industry promotion 3. UTM Research & Development Project 4. Test Site for UTM Development 1 UAS Industry in Japan Yamaha Motor developed a single rotor UAV in Japan in the 1980s. Today over 1/3 of Japanese rice has pesticides applied by UAS. With the emergence of multirotor type, UAS are widely used and makers are developing various types of UAS in Japan. Disaster Agriculture Surveying Inspection Delivery Response Yamaha Motor Aero Sense DENSO Fuji Imvac PRODRONE enRoute TERRA DRONE Luce Search Multicopter Labo ACSL 2 Role of METI and JCAB METI and JCAB work together for the development of safe use of UAS. METI has a mission to promote UAS industry, while JCAB establish and enforce regulations for UAS flight. Promotion Regulation of UAS Industry of UAS Flight Manufacturing Industries Bureau, Japan Civil Aviation Bureau (JCAB), Ministry of Economy, Trade and Ministry of Land, Infrastructure, Industry (METI) Transport and Tourism (MLIT) Robotics Policy Office, Industrial Machinery Division 3 Policy of UAS Promotion The Public-Private Council to realize Prime Minister Shinzo Abe’s vision for UAS, formulated the “Roadmap for the Aerial Industrial Revolution.” We will aim to make parcel delivery by drone a reality, as soon as three years from now. November 5 2015 from December 7 2015 Public-Private Council for UAS Promotion and Regulation Roadmap for the Aerial -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

Changes to the Nikkei Stock Average

PRESS RELEASE a sample translation original release in Japanese September 6, 2021 Nikkei Inc. Changes to the Nikkei Stock Average Nikkei Inc. will make the following changes to the Nikkei Stock Average (Nikkei 225) constituents as a result of the annual review. This release also includes the changes to the presumed par value in response to the stock split and the stock consolidation (reverse split) of the constituents. Please note that “Change from Presumed Par Value to Price Adjustment Factor” and “Maximum number of constituents reshuffle” in the “Changes to the Index Guidebook and the Constituents Selection Rules of the Nikkei Stock Average” announced dated July 5 become effective from this year’s annual reshuffle. 1. Constituents change because of the annual review Date Code Addition* Code Deletion KEYENCE CORPORATION 6861 3105 Nisshinbo Holdings Inc. (0.1) Murata Manufacturing Co., Oct. 1 6981 5901 Toyo Seikan Group Holdings, Ltd. Ltd. (0.8) 7974 Nintendo Co., Ltd. (0.1) 9412 SKY Perfect JSAT Holdings Inc. * Number in the parenthesis is Price Adjustment Factor. < Note > In accordance with the Constituents Selection Rules, KEYENCE (Technology sector), Murata Manufacturing (Technology sector), and Nintendo (Consumer goods/services sector) will be added because of high liquidity. Nisshinbo (Technology sector), Toyo Seikan Group (Materials sector), SKY Perfect JSAT (Technology sector) will be deleted as a result of the adjustment of the number of constituents among sectors (deleted from the over-weighted sector). These changes will be made before the opening of the market on October 1. * “Sectors” are industrial sectors defined by aggregating Nikkei 36 industry classification system into 6 broad categories. -

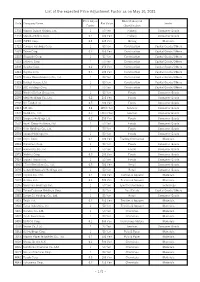

List of the Expected Price Adjustment Factor As on May 10, 2021

List of the expected Price Adjustment Factor as on May 10, 2021 Price Adjust Nikkei Industrial Code Company Name Par Value Sector Factor Classification 1332 Nippon Suisan Kaisha, Ltd. 1 50 Yen Fishery Consumer Goods 1333 Maruha Nichiro Corp. 0.1 500 Yen Fishery Consumer Goods 1605 INPEX Corp. 0.4 125 Yen Mining Materials 1721 Comsys Holdings Corp. 1 50 Yen Construction Capital Goods/Others 1801 Taisei Corp. 0.2 250 Yen Construction Capital Goods/Others 1802 Obayashi Corp. 1 50 Yen Construction Capital Goods/Others 1803 Shimizu Corp. 1 50 Yen Construction Capital Goods/Others 1808 Haseko Corp. 0.2 250 Yen Construction Capital Goods/Others 1812 Kajima Corp. 0.5 100 Yen Construction Capital Goods/Others 1925 Daiwa House Industry Co., Ltd. 1 50 Yen Construction Capital Goods/Others 1928 Sekisui House, Ltd. 1 50 Yen Construction Capital Goods/Others 1963 JGC Holdings Corp. 1 50 Yen Construction Capital Goods/Others 2002 Nisshin Seifun Group Inc. 1 50 Yen Foods Consumer Goods 2269 Meiji Holdings Co., Ltd. 0.2 250 Yen Foods Consumer Goods 2282 NH Foods Ltd. 0.5 100 Yen Foods Consumer Goods 2413 M3, Inc. 2.4 125/6 Yen Services Consumer Goods 2432 DeNA Co., Ltd. 0.3 500/3 Yen Services Consumer Goods 2501 Sapporo Holdings Ltd. 0.2 250 Yen Foods Consumer Goods 2502 Asahi Group Holdings, Ltd. 1 50 Yen Foods Consumer Goods 2503 Kirin Holdings Co., Ltd. 1 50 Yen Foods Consumer Goods 2531 Takara Holdings Inc. 1 50 Yen Foods Consumer Goods 2768 Sojitz Corp. 0.1 500 Yen Trading Companies Materials 2801 Kikkoman Corp.