A. INTRODUCTION 1. Mr Speaker, Sir, I Thank All Members for Their Views and Suggestions. I Have Listened Closely to All of Them

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Asian Studies 2021

World Scientific Connecting Great Minds ASIAN STUDIES 2021 AVAILABLE IN PRINT AND DIGITAL MORE DIGITAL PRODUCTS ON WORLDSCINET HighlightsHighlights Asian Studies Catalogue 2021 page 5 page 6 page 6 page 7 Editor-in-Chief: Kym Anderson edited by Bambang Susantono, edited by Kai Hong Phua Editor-in-Chief: Mark Beeson (University of Adelaide and Australian Donghyun Park & Shu Tian (Lee Kuan Yew School of Public Policy, (University of Western National University, Australia) (Asian Development Bank, Philippines) National University of Singapore), et al. Australia, Australia) page 9 page 14 page 14 page 14 by Tommy Koh by Cuihong Cai by Victor Fung-Shuen Sit by Sui Yao (Ambassador-at-Large, (Fudan University, China) (University of Hong Kong, (Central University of Finance Singapore) & Lay Hwee Yeo Hong Kong) and Economics, China) (European Union Centre, Singapore) page 18 page 19 page 19 page 20 by Jinghao Zhou edited by Zuraidah Ibrahim by Alfredo Toro Hardy by Yadong Luo (Hobart and William Smith & Jeffie Lam (South China (Venezuelan Scholar (University of Miami, USA) Colleges, USA) Morning Post, Hong Kong) and Diplomat) page 26 page 29 page 32 page 32 by Cheng Li by & by Gungwu Wang edited by Kerry Brown Stephan Feuchtwang (Brookings Institution, USA) (National University of (King’s College London, UK) Hans Steinmüller (London Singapore, Singapore) School of Economics, UK) About World Scientific Publishing World Scientific Publishing is a leading independent publisher of books and journals for the scholarly, research, professional and educational communities. The company publishes about 600 books annually and over 140 journals in various fields. World Scientific collaborates with prestigious organisations like the Nobel Foundation & US ASIA PACIFIC ..................................... -

Eleventh Parliament of Singapore (Second Session) Written Answers to Questions for Oral Answer Not Answered By

ELEVENTH PARLIAMENT OF SINGAPORE (SECOND SESSION) _________________ WRITTEN ANSWERS TO QUESTIONS FOR ORAL ANSWER NOT ANSWERED BY 3.00 PM MONDAY, 19 OCTOBER 2009 6 80 SCHOOL CHILDREN AS RUNNERS FOR LOAN SHARKS *23. Er Lee Bee Wah: To ask the Minister for Education (a) what action is the Ministry taking to prevent school children from being lured into working as runners for loan sharks; and (b) how many students have been caught for such activities in the past 12 months. Dr Ng Eng Hen: Police data indicate that from 1 Oct 2008 to 30 Sep 2009, 136 youths were arrested for loanshark and related harassment activities, of which almost half were students. Ultimately, parents are primary caregivers of their children. They must take responsibility to monitor the after-school activities of their children and know who their children are interacting with so as to provide timely guidance to their children. The reasons for school children being lured into working for such activities are complex. Even as we reiterate the responsibility of parents to mould their children’s character, schools can play a complementary reinforcing role in this respect. Schools raise awareness of their students to illegal activities through the formal curriculum and a variety of character development and life-skills programmes, in order to teach them to discern right from wrong. The actions taken by schools include counselling and support, and as a last resort, disciplinary actions. Schools also engage the parents and community to work in partnership in nurturing our young holistically. Schools have adopted a variety of strategies to facilitate communication with parents and keep them informed about the needs of their children. -

Mribune Cam U N September 1999 P 5 Ewspaper of N9ee Ann Polytechnic Vol

Ngee mribune cam u N September 1999 P 5 ewspaper of N9ee Ann Polytechnic Vol. 20 No. 2 NP's latest hangout vidc a conducive environment for students cram- We conducted a sur'\·ey and realized that students a one-slop infonnation centre where they can ac- by B~arati Jagdisb ming for 1cs1S. "This is a very cosy environment like 10 frcqucnl coffee places. By introduci ng a cess infonnation from the polytechnic adminis- and I enjoy studying here. The upgraded facili- 11 a hid 10 inject \Orne,~, inkl campus life. modem coffee- house on campus we want to lrati bn. obtain course ~ hedules, book sports fa- ties seem very good. but we don't really know Ngce Ann Polytechnic (N P) has ~ivcn 1he make students feel that school is a "cool" place ci lities. make transacti ons and pay their tuition what specific services are offered here," said fee s. The SSJC is open from 8J0 am 10 4.30 pm I Atnum 3 drama1ic face -lift 10 hang out too. Staff members were also fo r the Joseph Yew, 26, third-year Electronics and Com- The refurbished atrium no1 only se rves as a idea. as thi s gives them a place to re lax as well. .. on weekdays and from 8.30 am 10 12 pm on Sal- pu1er Engineering (ECE) srndent. cooduci vc !)Crvice--oricmed environment Mr Mui said posters outlining the for s1udems. but ex udes a fuoky atmos- services available will be put up around phere as we ll. the Atrium in the nex.t few weeks. -

Outram Times

A PUBLICATION FOR OUTRAMIANS, BY OUTRAMIANS OUTRAM TIMES HIGHLIGHTS THE SG50 ISSUE OSS: Small Scale Singa- A TIME FOR REMINISCE NCE & REFLECTION... pore? Singas on 6 AUGUST 2015 Outram Hill A Cemetery in Outram? OUTRAM SECONDARY— A SMALL SCALE SINGAPORE? By Kristabelle Lau, Vivian Ang and Elizabeth Cai Top Traits of Outramians making learning and achieving anyone proud. Just like Singapore, Have you thought about our priority. Hence our school, the students of Outram Secondary Sporting although small, is still able to Legends, Long how similar Singapore and have worked hard to win awards Forgotten? Outram Secondary School leave its mark on Singapore as and have proven that we are a force Singapore leaves her mark on really are? Read on to find to be reckoned with. In Conversa- the world. tion: Mr Loh out the interesting DIFFERENT and Mr Singh similarities! Our differences make us similar. Our SG50 Singapore is extremely different Poems SMALL from other countries. Outram Secondary School is extremely Compared to other schools different from other schools. With Outram Secondary is rather nothing but brains and wits, Singa- small. Like a tiny village we can pore turned from third world ALSO INSIDE bond really fast. It is obvious THIS ISSUE: that Singapore is also tiny, sewer to first world paradise. Ou- miniscule in fact, compared to UNDERDOGS tram Secondary School is also Outramian’s 9 other countries. The state Johor extremely different from other Talk is already many times bigger Singapore is one of the smallest schools. With bonding events that than Singapore (27 times to be countries in the world. -

Annual Report 2011/2012 THROUGH SPORTS Singapore Sports Council 230 Stadium Boulevard Singapore 397799 Tel: (+65) 6500 5000 Fax: (+65) 6440 9205

SERVING THE COMMUNITY THROUGH SPORTS THROUGH COMMUNITY THE SERVING SERVING THE Singapore Sports Council Annual Report 2011/2012 Report Annual Council Sports Singapore THROUGH SPORTS Singapore Sports Council 230 Stadium Boulevard Singapore 397799 Tel: (+65) 6500 5000 Fax: (+65) 6440 9205 This report is printed on paper certified according to the FSCTM standard. ANNUAL 2011/ For more information, please visit fsc.org. REPORT 2012 VISION A Sporting Singapore. Our Way of Life MISSION Developing sports champions & creating enjoyable sporting experiences for Singapore This page has been intentionally left blank. Serving the Community through Sports CONTENTS 04 07 10 12 Chairman’s Vision2030 SSC Council SSC Senior Message Members Management 13 14 16 18 Corporate Lion City Cup brings World Netball Singapore’s Pride Governance out the community Champs ignite at the 2011 in force memories, SEA Games community spirit and international prestige 20 22 24 26 People rise and Community Capturing Singapore Sports shine at Standard fun gets better Community Hub changing Chartered every year at Moments online, our Sporting Marathon the OCBC Cycle on air Landscape Singapore 2011 Singapore 28 29 30 32 Back to school Living Better Singapore Sports Investing in with dual-use Through Sports at Institute: nurturing the future with scheme school Pasir Ris SRC Singapore’s Fundamental fields & indoor sports talents for Movement Skills sports halls sporting glory & SwimSafer 33 34 36 38 Emergency New SSC MOUs NSAs growing Financial training pays off as to enhance capabilities for Statements early intervention capabilities of the Sporting 2011/2012 saves lives Future Leaders Community Singapore Sports Council 02 Annual Report 2011/ 2012 THROUGH SPORTS Singapore Sports Council Serving the Community through Sports Annual Report 2011/ 2012 03 A Message from the Chairman of Singapore Sports Council The past 12 months have been accessible spaces for our people to exciting for our sporting community live better through sport. -

AND JUNIOR SWIMMER Marchswimmingworldswimmingworld 2004 VOL

RECRUITING REALITIES AND JUNIOR SWIMMER MARCHSwimmingWorldSwimmingWorld 2004 VOL. 45 NO.3 $3.95 USA $4.50 CAN College Preview: Tigers to Triumph? Stanford’s Captain Kirk Olympic Trials: Will Lightning Strike Again? Tara Kirk Stanford University American Record Holder 03> 7425274 81718 GET YOUR FEET WET AT WWW.SWIMINFO.COM 2004 Summer Performance Suit Name: Kona Surf Maxback Introducing Kona Surf for Summer Relaxed. Soulful. Timeless. Just a few adjectives used when describing this classic Hawaiiana floral design. Keep in mind it’s a competitive print, so remember to say “Aloha” while passing. At TYR, we live and dream swimming. It’s in our DNA. And that’s the kind of passion and commitment that goes into each and every one of our suits and accessories. TYR. Always in front. To learn more about TYR, visit us at www.tyr.com or ask for our 2004 TYR Summer Performance Guide at your local swim dealer. 2004 © TYR Sport, Inc. All Rights Reserved March 2004 Volume 45 No. 3 SwimmingWorldSwimmingWorldAND JUNIOR SWIMMER FEATURES Cover Story Stanford’s Shining Light 20 By Spike Gillespie Senior captain Tara Kirk knows how to light things up for Stanford, not only with her million-dollar smile, but with her speedy accomplishments in the pool as well. (Cover photo by David Gonzales) Color NCAAs Orange and Blue 24 By John Lohn Auburn should capture a second straight men’s NCAA Division I champi- onship, once again proving itself to be the premier collegiate swimming program in the land. Auburn Poised for Three-peat 29 By Emily Melina Fifteen All-Americans, 449 returning points—on paper, it all adds up to a third straight NCAA Division I title for the women’s swimming team at Auburn. -

FY 2010 Committee of Supply Debate 1St Reply by Minister

FY 2011 COMMITTEE OF SUPPLY DEBATE: 1ST REPLY BY DR NG ENG HEN, MINISTER FOR EDUCATION AND SECOND MINISTER FOR DEFENCE ON INVESTING IN EDUCATION FOR THE 21st CENTURY Social Mobility – The Singapore Story: Past, Present and Future 1. I thank the many MPs who have spoken passionately about education during the Budget Debate and this COS. There were many issues raised, but I would like to devote my response to a central theme – social mobility, raised today by Mrs Josephine Teo, Mdm Halimah Yacob, Mr Christopher de Souza and Miss Irene Ng and many others during the Budget Debate – because it stands at the heart of our education policies, indeed our whole of Government initiatives. My colleagues will deal with specific issues later. Social Mobility in our Early Years – A Massive Rising Tide 2. From 1960 to 2010, Singapore’s per capita nominal GDP rose 100-fold, from US$400 to more than US$40,000 today. This remarkable achievement has been variously depicted. Monikers abound – “sleepy fishing village to world-class hub”, “colonial backwater to economic powerhouse”, “Third World to First”, etc. 3. But for me, “The Singapore Story” probably best captures this economic transformation. It was a massive rising tide that lifted all boats, with a reach that extended deep into the heartlands. Stagnant pools turned into thriving waterways as the tidal rise was sustained over 40-odd years. 4. As a result, social mobility occurred en masse both of Singapore compared to other countries and within the society with remarkable improvements in almost all conventional measures of living standards. -

Our 40-Year Journey Together

THE NATIONAL RECORD RECORD THE NATIONAL TSG THE R Y O P th R S A S 40 R A N N I V E SPORT SINGAPORE ANNUAL REPORT 2013/2014 SPORT SINGAPORE SPECIAL EDITION: OUR 40-YEAR Sport Singapore 3 Stadium Drive, Singapore 397630 Tel: 6500 5000 Fax: 6440 9205 JOURNEY TOGETHER 1993 – 2002 MOVERS, SHAKERS, RECORD BREAKERS 28 A WINNING SPIRIT MAKES CONTENTS A WINNING TEAM 1973 – 1982 32 PIONEER’S PACE EMBARKING ON A LIFELONG SPORTING 14 JOURNEY BUILDING A NATIONAL TREASURE 33 17 A GREATER VISION DAYS OF GOLD AND GLORY THROUGH KEY RECOMMENDATIONS 19 SPARKING THE SPORTSMAN’S SPIRIT 02 CHAIRMAN’S MESSAGE 05 BOARD MEMBERS 08 SENIOR MANAGEMENT 10 CORPORATE GOVERNANCE 2003 – 2012 2013 ONWARD 11 THE NEXT LAP GOING THE DISTANCE VISION 2030 36 42 THE PASSION TO GROW A SUPPORTING AN ACTIVE SPORTING CULTURE SINGAPORE 40 46 FAREWELL GRAND ENHANCING CAPABILITIES OLD DAME, HELLO THROUGH IMPROVED SPORTS HUB! COOPERATION THE 1983 – 1992 41 49 TO BUILD A SPORTING SINGAPORE NATIONAL CUTTING-EDGE A TORCH TO LIGHT SPORTS SUPPORT OUR WAY AHEAD RECORD 22 BLUEPRINT FOR OUR 49 The National Record is a special SPORTING NATION TEAM SPORTSG edition of the Singapore Sports CELEBRATES THE Council’s (SSC) Annual Report 24 BIG 40 and pays tribute to our 40 SUPPORT TO GO THE years of efforts in shaping EXTRA MILE 49 Singapore’s sporting landscape. A SPORTING As of 1 April 2014, SSC is known 25 FUTURE FOR ALL as Sport Singapore (SportSG). HOSTING A NEW ERA OF SPORTS AND ENTERTAINMENT Sport helps us define how we feel about ourselves, our community MR RICHARD SEOW YUNG LIANG and our country. -

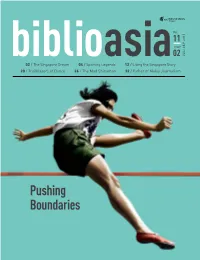

Jul–Sep 2015

Vol. 11 Issue biblioasia02 2015 JUL–SEP 02 / The Singapore Dream 04 / Sporting Legends 12 / Living the Singapore Story 20 / Trailblazers of Dance 26 / The Mad Chinaman 32 / Father of Malay Journalism Pushing Boundaries BiblioAsia Director’s Note Editorial & CONTENTS Vol. 11 / Issue 02 Jul–Sep 2015 Production Singapore’s stellar performance at the 28th Southeast Asia (SEA) Games is proof that Managing Editor our athletes have the guts and gumption to push the boundaries and achieve sporting Francis Dorai excellence. Singapore’s haul of 259 medals – 84 gold, 73 silver and 102 bronze – which put us in second place at the medal standings behind Thailand – is no mean feat for a tiny Editors OPINION nation whose athletes had to compete against the region’s elite. Singapore delivered its Veronica Chee Stephanie Pee best showing since the 1993 Games – when it won 164 medals – and in the process broke more than 100 SEA Games as well as many national and personal records. Editorial Support This issue of BiblioAsia, aptly themed “Pushing Boundaries”, celebrates the achieve- Masamah Ahmad ments and personal stories of Singaporeans – athletes, entertainers, dancers, civil serv- ants, the ordinary man in the street – especially those who defied the odds and overcame Design and Print adversity to fulfil their dreams. Oxygen Studio Designs Pte Ltd Former journalist Chua Chong Jin relives the glory days of some of Singapore’s Contributors 02 iconic names in sports, such as weightlifter Tan Howe Liang who won a silver at the 1960 Chua Chong Jin, Seizing the Singapore Dream Rome Olympics; high-jumper Lloyd Valberg, the first athlete to represent Singapore at the Han Foo Kwang, Parag Khanna, Olympics in 1948; and sprinter C. -

How We Are Changing Through Vision 2030

BETTER THROUGH SPORT Kinder, Healthier, Prouder How we are changing through Vision 2030 Contents July 2017 * Vol. 4. Live Better Through Sport 04 Chairman’s Note 32 ActiveSG • Jr. NBA Singapore 2017 06 Journeys through Sport returns to Singapore for 2nd consecutive year • Ready for KL! • Getting Active at Recess • Swift and Steady • Flying Disc soars higher through • The Sultan of Selangor’s Cup 2017 new ActiveSG Club • HSBC World Rugby 7s Rock the Stadium 38 SportCares • Victory and Learning at the SEA 7s Running the Extra Mile • Sentosa Island joins GetActive! Singapore as new Host 40 Team Nila Meet the Eyes Behind the Lenses 18 Cover Story Changing through Vision 2030 42 Personal Journey Mark Richmond 26 Singapore Sports Institute @9th ASEAN SCHOOL GAMES Prime Minister Lee visits Team Singapore 43 This is Your Brain 28 Team Singapore • All in the Family 46 Move Right, Eat Right • Playing for #1 48 LIVE Active Ambassadors 30 CoachSG Our new Social Media Influencers • Raising the Game for Coaches • Winning through Game for Life 50 Our Play Nation This publication is produced by Sport Singapore. Connect with us at sportsingapore.gov.sg. For enquiries or feedback, please email: [email protected] Project Contributors: Ang Sin Hwee, Bernard Tham, Chelvam Raman, Cheryl Teo, Clifford Wong, Diana Seng, Eric Ong, Fayeruz Surahman, Frankie Tan, Gina Tan, Gwendalynn Kho, Hamdan Osman, Gary Yeo, Gerald Leong, Grace Gan, Harbans Singh, John Yeong, Jiaren Low, Juvena Teo, Katrina Engle, Kevin Tan, Lai Chin Kwang, Laura Reid, Lee Huei Chern, Leslie Lim, Lynnette Chng, Mark Richmond, Ng Chrong Meng, Ng Ee Theng, Pauline Loo, Parames Seenivasagam, Richard Swinbourne, Rostam Umar, Sheryl Lim, Su Chun Wei, Toh Boon Yi, Troy Engle, Wayne Ang, Zulkiflee Mohd Zaki Cover photo by Lim Yong Teck Content page photo by Andy Pascua 03 Chairman’s Note When you’re a volunteer photographer for Health among our staff. -

Download Muse SG Vol 8 Issue 3

VOLUME 8, ISSUE 3 Foreword In today’s ethos of honouring the human context and experience, museology has taken on a new stance. Visitors today can look forward to museums sited within communities and exhibitions with high relatability. The National Heritage Board’s Assistant Chief Executive of Museums and Programmes, Tan Boon Hui, discusses the museology landscape today (page 22), just as the National Museum of Singapore and the Asian Civilisations Museum unveil their revamped galleries and architecture to reflect their positions in the fabric of our country’s past, present and future. Right-siting and mediation has become key to preserving the stories behind exhibits, while providing context of artefacts in today’s milieu. The repositioning of the Asian Civilisations Museum’s entrance is storytelling at its best. The entrance now directs visitors to the historical precinct of the representative Straits Settlements port: The Singapore River. The diverse historic sites along the Singapore River Walk bring back the memories of coolies, samsui women, lightermen, merchants and traders who toiled and made their lives by the river. There is something poignant in being able to retrace the steps of our forefathers at existing places and bridges that span our history, right after experiencing the museums (page 29). Besides our physical and architectural monuments, stories of resilience, humble beginnings and the strength of collective efforts shine through age and time in the Heroes and Icons exhibition of WE: Defining Stories (page 15). They serve as enduring reminders of how far a young nation has come, as well as the limitless possibilities of the human spirit. -

S a Lt & L Igh T

SALT Sample Spreads. For Review Only Most of our waking hours are spent at work. For many, we spend more time in the office than we spend with family and loved ones. But we don’t stop being a Christian when we clock in at work; we’ve all faced the challenge of living out our beliefs amid the & SALT often competing demands of our professions. Living out our faith at work isn’t always the easiest, most straightforward journey. LIGHT This compilation from Christian portal Salt&Light shares stories of encouragement and equipping on how to navigate that balance. Read about fellow believers in the marketplace, and how they overcame the challenge & of being “in the world but not of the world”. Draw inspiration from these true accounts from Singapore and beyond, so that you too may experience personal growth in our relationship with God and living out His Kingdom calling. of Faith at Work at of Faith Inspirational Stories LIGHT Salt&Light is a digital gathering place for Christians to unite in spirit and purpose to see God in the 9-to-5, to influence and to impact, to find meaning in the mundane, to wrestle with doubt and despair in faith – and find amazing grace for the journey ahead. Inspirational Stories of Faith at Work Marshall Cavendish FICTION Editions ISBN 978-981-4893-71-8 ,!7IJ8B4-ijdhbi! Sample Spreads. For Review Only SALT & LIGHT Inspirational Stories of Faith at Work Sample Spreads. For Review Only © 2021 Salt&Light Private Limited Contents Published by Marshall Cavendish Editions An imprint of Marshall Cavendish International Introduction • 8 Work My two copper coins: A doctor returns to the frontlines • 11 All rights reserved No part of this publication may be reproduced, stored in a retrieval system or Desi Trisnawati: Helping others succeed was part of her MasterChef transmitted, in any form or by any means, electronic, mechanical, photocopying, Indonesia victory • 16 recording or otherwise, without the prior permission of the copyright owner.