Kraft Reports Strong Revenue Growth in 2007; Enters 2008 with Good Momentum

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ten Fun Facts About Chocolate FOOD

Ten Fun Facts About Chocolate I will bet you didn’t know this about chocolate! 10 fun facts about the world’s favourite treat. 1. Chocolate comes from a fruit tree; it’s made from a seed. 2. It takes 400 cocoa beans to make one pound of chocolate. 3. Each cacao tree produces approximately 2,500 beans. 4. Cacao beans were so valuable to early Mesoamericans that they were used as currency. 5. “Cacao” is how you say “cocoa” in Spanish. 6. A farmer must wait four to five years for a cacao tree to produce its first beans. 7. Spanish royalty gave cakes of cacao in their dowries. 8. Theobroma Cacaois the tree that produces cocoa beans, and it means “food of the gods.” Carolus Linnaeus, the father of plant taxonomy, named it. 9. Chocolate has over 600 flavour compounds while red wine has just 200. 10. Chocolate milk is an effective post work-out recovery drink FOOD 20 Things You Never Knew About Chocolate BY KATE ERBLAND OCTOBER 28, 2018 1. THERE ARE MULTIPLE CELEBRATIONS OF CHOCOLATE EACH YEAR. Holiday makers are constantly on the hunt for a reason to munch on chocolate, so the calendar offers plenty of excuses to buy a bar. July 7 is also Chocolate Day, a nod to the historical tradition that the day marks when chocolate was first brought to Europe on July 7, 1550, though a number of sources argue that it might have hit the continent’s shores as far back as 1504, thanks to Christopher Columbus. Official day or not, we do know that chocolate first arrived in Europe some time in the 16th century. -

Earnings Release Listen to Webcast

February 12, 2014 Mondelez International Reports 2013 Results Financial Schedules and GAAP to Non-GAAP Information Earnings Release Listen to Webcast Full Year Highlights ● Net revenues increased 0.8%; Organic Net Revenues(1) grew 3.9%, despite a (0.8)pp impact from lower coffee revenues ● Strong market share performance(2) with nearly 70% of revenues gaining or holding share ● Emerging markets revenues increased nearly 9%; BRIC markets up nearly 10% ● Operating Income margin was 11.2%; Adjusted Operating Income(1) margin was 12.0% ● Diluted EPS was $2.19; Adjusted EPS(1) was $1.51, up 13.5% on a constant currency basis ● Company repurchased $2.7 billion of shares ● Net debt reduced by $0.5 billion; tendered and refinanced $3 billion of higher cost debt Fourth Quarter Highlights ● Net revenues decreased 0.1%; Organic Net Revenues increased 2.5%, despite a (0.7)pp impact from lower coffee revenues ● Operating Income margin was 10.6%; Adjusted Operating Income margin increased 2.9 pp to 13.9% ● Diluted EPS was $1.00; Adjusted EPS was $0.42, up 16% on a constant currency basis 2014 Outlook ● Organic Net Revenue to grow at or above category growth, approximately 4% ● Adjusted Operating Income growth of low double digits on a constant currency basis, resulting in an expected Adjusted Operating Income margin in the high 12% range ● Adjusted EPS of $1.73 to $1.78, up double digits on a constant currency basis DEERFIELD, Ill., Feb. 12, 2014 /PRNewswire/ -- Mondelez International, Inc. (NASDAQ: MDLZ) today reported 2013 results, in line with recent expectations. -

Curriculum Vitae

Career BIO - JOSE GORBEA Jose Gorbea joined HP in 2017 and is Head of HP Graphics Solutions for Brands in EMEA. Jose is a passionate marketing leader & keynote speaker with solid expertise & thought leadership across the marketing mix, coupled with a strong track record on revitalizing brands by inspiring teams to deliver breakthrough brand strategies & award-winning campaigns. He has led for nearly 20 years the overall marketing strategy & execution of well established brands such as Kit Kat, Crunch, Cadbury, Milka, Toblerone, belVita, Ritz, Philadelphia, Trident and Stimorol across numerous geographies such as Latam, Europe and Global. In his last role at Mondelez, he was the Head of Marketing & Digital Operations for Europe. Jose has helped shape the marketing culture in global organizations with a socially responsible, competitive & winning mindset by strengthening marketing capabilities in Nestle, Mondelez and HP. Jose holds a digital marketing certification from the Google Marketing Academy which makes him an asset for delivering brand solutions in a digital world. • Recognized by CNN's Grupo Expansion with a Marketing Monster Award in delivering one of the best performing marketing campaigns of 2010 in Mexico with the Nestle 'Carlos V' brand (Link → http://expansion.mx/monstruos- de-la-mercadotecnia-2010/2010/10/20/nestle-juega-y-reposiciona-a-carlos-v) • Recognized by Mondelez with the 'Best Brand Revitalization' Award in 2016 for successfully turning around the Stimorol chewing gum brand in Europe. SCHOLARSHIP / CERTIFICATIONS • IBEROAMERICANA UNIVERSITY – Mexico City - Business Management Bachelor Degree (1996-2000) / Marketing Specialty Degree (1999-2000) • GOOGLE DIGITAL ACADEMY – Europe - Squared Guru Certification – Digital Marketing (2017) PROFESSIONAL EXPERIENCE • MONDELEZ EUROPE – Zurich, Switzerland - Marketing & Digital Operations Head - Europe – (Feb’16 – Aug’17) - Gum Category Lead Europe – (Mar’14 – Jan’16) - Innovation Platform Lead – Toblerone, Cadbury and Milka – (Jan’11 – Mar’14) • NESTLE MEXICO - Sr. -

Mondelez International Announces $50 Million Investment Opportunity for UK Coffee Site

November 7, 2014 Mondelez International Announces $50 Million Investment Opportunity for UK Coffee Site - Proposal coincides with Banbury coffee plant's 50th anniversary - Planned investment highlights success of Tassimo single-serve beverage system - Part of a multi-year, $1.5 billion investment in European manufacturing BANBURY, England, Nov. 7, 2014 /PRNewswire/ -- Mondelez International, the world's pre-eminent maker of chocolate, biscuits, gum and candy as well as the second largest player in the global coffee market, today announced plans to invest $50 million (£30 million) in its Banbury, UK factory to build two new lines that will manufacture Tassimo beverage capsules. Tassimo is Europe's fastest growing single-serve system, brewing a wide variety of beverages including Jacobs and Costa coffees and Cadbury hot chocolate. The decision is part of Mondelez International's multi-year investment in European manufacturing, under which $1.5 billion has been invested since 2010. The planned investment will create close to 80 roles and coincides with the 50th anniversary of the Banbury factory, which produces coffee brands such as Kenco, Carte Noire and Maxwell House. The Tassimo capsules produced in Banbury will be exported to Western European coffee markets in France and Spain as well as distributed in the UK. "Tassimo is a key driver of growth for our European coffee business, so this $50 million opportunity is a great one for Banbury," said Phil Hodges, Senior Vice President, Integrated Supply Chain, Mondelez Europe. "Over the past 18 months, we've made similar investments in Bournville and Sheffield, underscoring our commitment to UK manufacturing. -

2004 Annual Meeting of Stockholders Kraft Foods Inc. April 27, 2004 East Hanover, New Jersey

2004 Annual Meeting of Stockholders Kraft Foods Inc. April 27, 2004 East Hanover, New Jersey Louis Camilleri, Chairman of the Board: Good morning, ladies and gentlemen. Thank you for coming. I am Louis Camilleri, Chairman of the Board of Kraft Foods Inc. The 2004 Annual Meeting of Stockholders is now called to order. It is my pleasure to welcome the stockholders here in East Hanover, as well as those of you who are joining us via live webcast. I’d like to introduce the executives here on the stage with me. First David Johnson, President of Kraft’s North America Commercial unit. Next is Hugh Roberts, President of our International Commercial unit. Also with us is Marc Firestone, Kraft’s Executive Vice President, General Counsel and Corporate Secretary. As you know, Roger Deromedi, Kraft’s CEO, has been out on leave, with a serious viral infection. We are delighted that he is making a complete recovery and will be back in the office May 10 to resume his full responsibilities. Next, I would like to introduce Larry Borek of PricewaterhouseCoopers, our auditors. He is in the audience, and he will be available to answer questions after the meeting. Larry, will you please stand? Thank you. The agenda and procedures for the meeting have been placed on your seat. I particularly want to remind everyone of the time limits for questions and comments and the fact that all questions and comments should be addressed to me as Chairman. The secretary will now present certain formal documents. Marc… Marc Firestone, Executive Vice President, General Counsel and Corporate Secretary: Thank you, Mr. -

Discovering Gems in Social Media That Will Add Value to Your Business CIO Forum

Discovering Gems In Social Media That Will Add Value To Your Business CIO Forum 13 November 2014, Oslo Key Messages … “ The complexity of digital media, having to manage it from a global to a local level, is growing exponentially – # of pages, content, ownership, governance, aligned across brands, etc.” “ This creates tremendous opportunity and risk challenges for all organizations.” “ Today, I will share two examples of how organizations advantage both: 1. Understanding, measuring and mitigating risk 2. Developing strategic, competitive insight “ One guarantee – it is an evolutionary process and who knows what more will come.” Page 2 CIO Forum. 12 November 2014, Oslo. © Ernst & Young, 2014 Volumes / channels keep growing and growing and growing Mondelez and 9 of its Leading Brands on Social Media (1 January 2010 to 15 Mar 2013) 1 2 4 3 Source: EY Research, conducted using licensed toolset from [1] products: Belvita, Cadbury, Carte Noire, Côte d’or, Halls, Hollywood, Jacobs, Kenco, Milka, Oreo, Crimson Hexagon. As of 15 March 2013. Philadelphia, Stimorol, Tassimo, Toblerone, Trident, Page 3 CIO Forum. 12 November 2014, Oslo. © Ernst & Young, 2014 Current social media analysis simply reveals the tip … Marketing and Brand and community product Issues and programming Competitor sentiment complaints insight Page 4 CIO Forum. 12 November 2014, Oslo. © Ernst & Young, 2014 … of an iceberg of insight. A “deeper dive” can reveal so much more. Marketing and Brand and community product Issues and programming Competitor sentiment complaints insight Customer Risk management Competitive experience benchmarking design Stakeholder Consumer Acquisition analysis insight targeting Operating model efficiency Legal debate Supply chain Strategic improvements direction Human resource strategy Counterfeiting and trafficking Page 5 CIO Forum. -

Enel Green Power's Renewable Energy Is Part of the History of Mondelēz International's Business Unit in Mexico

Media Relations T (55) 6200 3787 [email protected] enelgreenpower.com ENEL GREEN POWER'S RENEWABLE ENERGY IS PART OF THE HISTORY OF MONDELĒZ INTERNATIONAL'S BUSINESS UNIT IN MEXICO • Enel Green Power supplies up to 77 GWh annually to two Mondelēz International factories with wind energy from its 200 MW Amistad I wind farm located in Ciudad Acuña, Coahuila. • Thanks to this relationship, Mondelēz International has avoided the emission of approximately 33,000 tons of CO2 per year. Mexico City, October 7th, 2020 – Enel Green Power México (EGPM), the renewables subsidiary of Enel Group, joins the celebration of the 8th anniversary of Mondelēz International in the country, by commemorating two years of successful collaboration through an electric power supply contract. Derived from this contract, Mondelēz International has received up to 77 GWh per year of renewable energy to its factories located in the State of Mexico and Puebla. Thanks to the renewable energy supplied by EGPM´s Amistad I wind farm; Mondelēz International has avoided the emission of around 33,000 tons of CO2 per year, equivalent to almost 80% of its emission reduction target for Latin America in 2020. Similarly, this energy is capable of producing approximately more than 100,000 tons annually of product from brands such as Halls, Trident, Bubbaloo, Oreo, Tang and Philadelphia and is enough to light approximately 33,000 Mexican homes for an entire year. “It is an honor for Enel Green Power México to contribute to Mondelēz International environmental objectives and efforts to accelerate energy transition in the country. Today more and more companies are convinced that renewable energies are not only sustainable, but also profitable, which is why this type of agreements serve as a relevant growth path for clean sources in Mexico”, stated Paolo Romanacci, Country Manager of Enel Green Power Mexico. -

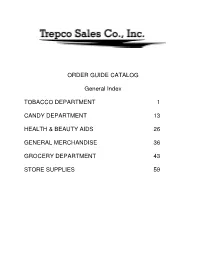

ORDER GUIDE CATALOG General Index TOBACCO DEPARTMENT 1

ORDER GUIDE CATALOG General Index TOBACCO DEPARTMENT 1 CANDY DEPARTMENT 13 HEALTH & BEAUTY AIDS 26 GENERAL MERCHANDISE 36 GROCERY DEPARTMENT 43 STORE SUPPLIES 59 GENERAL INDEX TOBACCO DEPARTMENT 1 MINTS - LIFESAVERS 15 MUSCLE RUBS - SPORTS CREAMS 27 CIGAR - 2/PK SPECIAL 12 MINTS - TIC TAC 15 NASAL SPRAY 28 CIGARETTE PAPERS / TUBES 1 MISC. COOKIES 22 PAIN RELIEF - MENSTRUAL 26 CIGARS, BOX 6 NABISCO BIG BAGS 99c 24 PETROLEUM JELLY 29 CIGARS, FILTERED 3 NABISCO GROCERY PACK 24 PREGNANCY TESTS 33 CIGARS, PACKS 4 NABISCO SINGLE SERVE 24 RAZOR BALDES 30 DRY SNUF, POCKET & LARGE CAN 8 NABISCO SLUG PACKS 24 RAZORS 30 LIGHTERS 12 NOVELTY CANDY 17 SANITARY NAPKINS 32 R.Y.O. ACCESSORIES 2 PEG BAG CANDY 20 SHAMPOO 31 SMOKER ITEMS, MISC 2 PICKLES 25 SHAVING CREAM 30 SPECIALTY CIGARETTES 3 SATHERS CANDY 2/1.00 21 SINUS MEDICINE 26 TOBACCO LARGE TINS 11 SEEDS & NUTS 23 SKIN CARE / FACE-HAND CREAM 31 TOBACCO RYO CIGARETTE BLEND 10 SNACKS 23 SLEEPING AIDS 29 TOBACCO, CHEWING 8 THEATRE PACK CANDY 20 STIMULANTS 28 TOBACCO, PIPE BAG & POUCH 9 SUNTAN LOTION 31 TOBACCO, PLUG 9 HEALTH & BEAUTY AIDS 26 SUPPOSITORIES / OINTMENTS 28 TOBACCO, ROLL SNUFF 7 AFTER SHAVE 31 THROAT SPRAY & LOZENS 28 ALLERGY MEDICATION 27 TOOTHACHE REMEDY 35 CANDY DEPARTMENT 13 ANALGESIC 50/2 BOX 26 TOOTHBRUSHES 35 19 ANALGESICS - CHILDREN 26 TOOTHPASTE 34 5 SUGARFREE GUM 13 ANALGESICS - STANDARD 26 ANTACIDS - TUMS 15 ANTACIDS 27 GENERAL MERCHANDISE 36 ANTACIDS- ROLAIDS 15 ANTI-DIHARRHEAL MEDICINE 27 AIR FRESHENERS 39 CANDY - 25c 16 ANTISEPTICS 29 AUTO ACCESSORIES 39 CANDY - 5c 16 BABY -

Chocolatiers and Chocolate Experiences in Flanders & Brussels

Inspiration guide for trade Chocolatiers and Chocolate Experiences IN FLANDERS & BRUSSELS 1 We are not a country of chocolate. We are a country of chocolatiers. And chocolate experiences. INTRODUCTION Belgian chocolatiers are famous and appreciated the world over for their excellent craftmanship and sense of innovation. What makes Belgian chocolatiers so special? Where can visitors buy a box of genuine pralines to delight their friends and family when they go back home? Where can chocolate lovers go for a chocolate experience like a workshop, a tasting or pairing? Every day, people ask VISITFLANDERS in Belgium and abroad these questions and many more. To answer the most frequently asked questions, we have produced this brochure. It covers all the main aspects of chocolate and chocolate experiences in Flanders and Brussels. 2 Discover Flanders ................................................. 4 Chocolatiers and shops .........................................7 Chocolate museums ........................................... 33 Chocolate experiences: > Chocolate demonstrations (with tastings) .. 39 > Chocolate workshops ................................... 43 > Chocolate tastings ........................................ 49 > Chocolate pairings ........................................ 53 Chocolate events ................................................ 56 Tearooms, cafés and bars .................................. 59 Guided chocolate walks ..................................... 65 Incoming operators and DMC‘s at your disposal .................................74 -

Think 53: Food Talks Dan Jurafsky & Yoshiko Matsumoto

Think 53: Food Talks Dan Jurafsky & Yoshiko Matsumoto Sound Symbolism and Synesthesia (and Wheat Thins and Rocky Road) Thursday, April 13, 2017 Conventionalism vs. Naturalism Conventionalism: What’s in a name? that which we call a rose By any other name would smell as sweet Shakespeare, Romeo and Juliet Naturalism: There is an inherently correct name for everything for both “Greeks and barbarians.” Plato, Cratylus John Locke 1632-1704 “Thus we may conceive how words, which were by nature so well adapted to that purpose, came to be made use of by men as the signs of their ideas; not by any natural connection that there is between particular articulate sounds and certain ideas, for then there would be but one language amongst all men; but by a voluntary imposition, whereby such a word is made arbitrarily the mark of such an idea.” Of the Signification of Words Book 3 Chapter II Xúnzi 荀子 Written by Xún Kuàng荀況 Confucian scholar, 3rd century BCE “Names have no intrinsic appropriateness. One agrees to use a certain name and issues an order to that effect, and if the agreement is abided by and becomes a matter of custom, then the name may be said to be appropriate… Names have no intrinsic reality.” What could Naturalism Mean? Now the letter r, as I was saying, appeared to the imposer of names an excellent instrument for the expression of motion; and he frequently uses the letter for this purpose: for example, in the actual words rein and roe he represents motion by r; also in the words tromos (trembling), trachus (rugged); and again, in words -

Mondelēz Union Network

Mondelēz Union Network What is ? Mondelez is a global snack foods company which came into being on October 2, 2012 when the former Kraft Foods Inc. was split into two, resulting in the creation of two separate companies, both headquartered in the USA. Mondelēz took the “snacks” products (biscuits, confectionery, salty crackers, nuts, gum, Tang), giving it about two-thirds the revenue of the former Kraft. The remaining “grocery” products were stuffed into a North American (only) company now known as Kraft Foods Group. Former Kraft CEO Irene Rosenfeld now heads up Mondelēz. If you worked for the former Kraft or one of its subsidiaries manufacturing or distributing snack products, including former Danone or Cadbury products, you now work for Mondelēz or one of its subsidiaries. In some countries, the name change will not be immediate. Mondelēz Kraft Foods Group Oreo, Chips Ahoy, Fig Kraft macaroni and cheese Newtons, SnackWell’s, Stove Top stuffing Nilla wafers, Mallomars Kool-Aid and Capri Sun Nabisco crackers including drinks Ritz, Triscuit, Teddy Grahams, Deli brands including Oscar Honey Maid, Premium Mayer, Louis Rich, saltines, Planters nuts, Lunchables, Deli Creations, Cheese Nips, Wheat Thins, Claussen pickles Lu biscuits Philadelphia cream cheese Philadelphia cream cheese Kraft, Velveeta and Cracker Toblerone chocolate, Milka Barrel cheese candy bars, Cadbury, Green and Black’s Jell-O Trident/ Dentyne gum Cool Whip/Miracle Whip Halls A-1 steak sauce, Grey Poupon mustard Tang Vegemite Jacobs coffee Maxwell House coffee 888 Brand names in red are ‘power brands’ each generating revenue over USD 1 billion In North America, Maxwell House coffee is ‘grocery’ (Kraft Foods Group), but elsewhere coffee is Mondelēz. -

Newsletter No

May 2021 Newsletter No. 8 Swiss IP News We provide you with updates on new decisions, the relevant legislative process and other trends in the fields of intellectual property and unfair competition law from a Swiss perspective. Newsletter No. 8 May 2021 TOBLERONE vs. SWISSONE In a recently published judgement of The attacked SWISSONE chocolate bar 31 December 2020 (HG 20 87), the looks as follows: By Roger Staub Commercial Court of Bern dismissed a Dr. iur., Attorney at Law request for a preliminary injunction Partner which Kraft Foods had filed against Cocoa Telephone +41 58 658 52 89 Luxury’s SWISSONE chocolate bar. Kraft [email protected] Foods had claimed that the SWISSONE chocolate bar infringed its various TOBLERONE trademarks and it also asser- ted unfair competition claims. The court denied both trademark infringement and It consists of a series of rounded tetrahe- unfair competition claims. As for now, the dra including small emphasis or gradation judgement on preliminary measures has in the form of rounded triangles. The become final. Kraft Foods is however still series of these tetrahedra may be free to file a lawsuit on the merits. reminiscent of a group of mountains. The SWISSONE chocolate bar comes in square Background (cuboid-shaped) packaging with prominent TOBLERONE is a popular Swiss chocolate and centrally placed bright golden and Benno Fischer-Siddiqui bar brand, which is most known for its SWISSONE lettering on all three sides of MLaw, Attorney at Law distinctive shape: a series of joined the packaging. Two stylized mountain Associate triangles, resembling a group of moun- silhouettes are placed in the “O” of the Telephone +41 58 658 52 51 tains or pyramids.