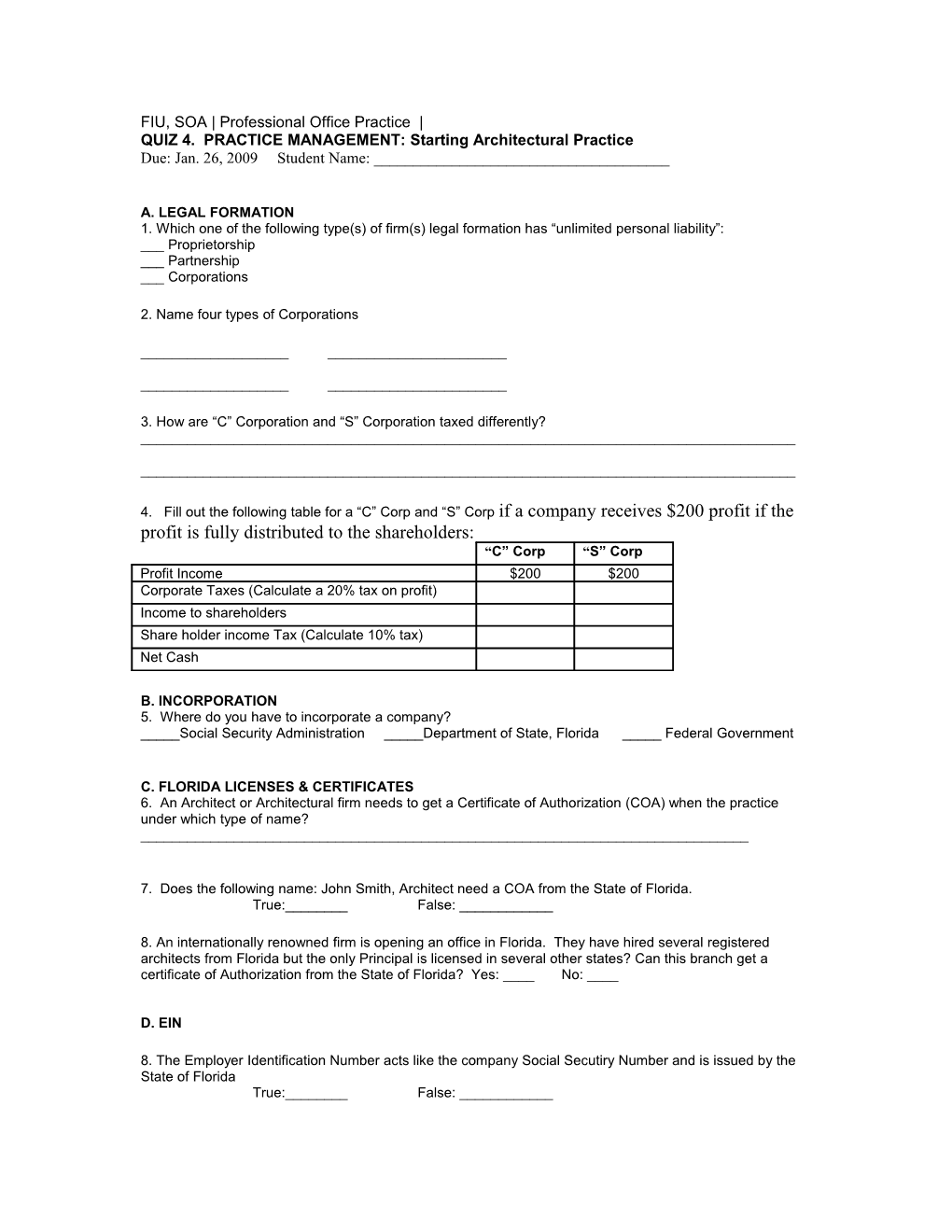

FIU, SOA | Professional Office Practice | QUIZ 4. PRACTICE MANAGEMENT: Starting Architectural Practice Due: Jan. 26, 2009 Student Name: ______

A. LEGAL FORMATION 1. Which one of the following type(s) of firm(s) legal formation has “unlimited personal liability”: ___ Proprietorship ___ Partnership ___ Corporations

2. Name four types of Corporations

______

______

3. How are “C” Corporation and “S” Corporation taxed differently? ______

______

4. Fill out the following table for a “C” Corp and “S” Corp if a company receives $200 profit if the profit is fully distributed to the shareholders: “C” Corp “S” Corp Profit Income $200 $200 Corporate Taxes (Calculate a 20% tax on profit) Income to shareholders Share holder income Tax (Calculate 10% tax) Net Cash

B. INCORPORATION 5. Where do you have to incorporate a company? _____Social Security Administration _____Department of State, Florida _____ Federal Government

C. FLORIDA LICENSES & CERTIFICATES 6. An Architect or Architectural firm needs to get a Certificate of Authorization (COA) when the practice under which type of name? ______

7. Does the following name: John Smith, Architect need a COA from the State of Florida. True:______False: ______

8. An internationally renowned firm is opening an office in Florida. They have hired several registered architects from Florida but the only Principal is licensed in several other states? Can this branch get a certificate of Authorization from the State of Florida? Yes: ____ No: ____

D. EIN

8. The Employer Identification Number acts like the company Social Secutiry Number and is issued by the State of Florida True:______False: ______