Free Trade: What Now? by Jagdish Bhagwati This Is the Text Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

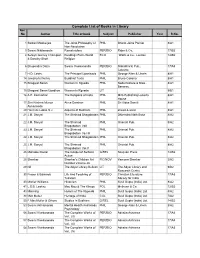

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Economics & Finance 2011

Economics & Finance 2011 press.princeton.edu Contents General Interest 1 Economic Theory & Research 15 Game Theory 18 Finance 19 Econometrics, Mathematical & Applied Economics 24 Innovation & Entrepreneurship 26 Political Economy, Trade & Development 27 Public Policy 30 Economic History & History of Economics 31 Economic Sociology & Related Interest 36 Economics of Education 42 Classic Textbooks 43 Index/Order Form 44 TEXT Professors who wish to consider a book from this catalog for course use may request an examination copy. For more information please visit: press.princeton.edu/class.html New Winner of the 2010 Business Book of the Year Award, Financial Times/Goldman Sachs Fault Lines How Hidden Fractures Still Threaten the World Economy Raghuram G. Rajan “What caused the crisis? . There is an embarrassment of causes— especially embarrassing when you recall how few people saw where they might lead. Raghuram Rajan . was one of the few to sound an alarm before 2007. That gives his novel and sometimes surprising thesis added authority. He argues in his excellent new book that the roots of the calamity go wider and deeper still.” —Clive Crook, Financial Times Raghuram G. Rajan is the Eric J. Gleacher Distinguished Service Profes- “Excellent . deserve[s] to sor of Finance at the University of Chicago Booth School of Business and be widely read.” former chief economist at the International Monetary Fund. —Economist 2010. 272 pages. Cl: 978-0-691-14683-6 $26.95 | £18.95 Not for sale in India ForthcominG Blind Spots Why We Fail to Do What’s Right and What to Do about It Max H. Bazerman & Ann E. -

HLA MYINT 105 Neoclassical Development Analysis: Its Strengths and Limitations 107 Comment Sir Alec Cairn Cross 137 Comment Gustav Ranis 144

Public Disclosure Authorized pi9neers In Devero ment Public Disclosure Authorized Second Theodore W. Schultz Gottfried Haberler HlaMyint Arnold C. Harberger Ceiso Furtado Public Disclosure Authorized Gerald M. Meier, editor PUBLISHED FOR THE WORLD BANK OXFORD UNIVERSITY PRESS Public Disclosure Authorized Oxford University Press NEW YORK OXFORD LONDON GLASGOW TORONTO MELBOURNE WELLINGTON HONG KONG TOKYO KUALA LUMPUR SINGAPORE JAKARTA DELHI BOMBAY CALCUTTA MADRAS KARACHI NAIROBI DAR ES SALAAM CAPE TOWN © 1987 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, N.W., Washington, D.C. 20433, U.S.A. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior permission of Oxford University Press. Manufactured in the United States of America. First printing January 1987 The World Bank does not accept responsibility for the views expressed herein, which are those of the authors and should not be attributed to the World Bank or to its affiliated organizations. Library of Congress Cataloging-in-Publication Data Pioneers in development. Second series. Includes index. 1. Economic development. I. Schultz, Theodore William, 1902 II. Meier, Gerald M. HD74.P56 1987 338.9 86-23511 ISBN 0-19-520542-1 Contents Preface vii Introduction On Getting Policies Right Gerald M. Meier 3 Pioneers THEODORE W. SCHULTZ 15 Tensions between Economics and Politics in Dealing with Agriculture 17 Comment Nurul Islam 39 GOTTFRIED HABERLER 49 Liberal and Illiberal Development Policy 51 Comment Max Corden 84 Comment Ronald Findlay 92 HLA MYINT 105 Neoclassical Development Analysis: Its Strengths and Limitations 107 Comment Sir Alec Cairn cross 137 Comment Gustav Ranis 144 ARNOLD C. -

Avinash Dixit Princeton University

This is a slightly revised version of an article in The American Economist, Spring 1994. It will be published in Passion and Craft: How Economists Work, ed. Michael Szenberg, University of Michigan Press, 1998. MY SYSTEM OF WORK (NOT!) by Avinash Dixit Princeton University Among the signals of approaching senility, few can be clearer than being asked to write an article on one's methods of work. The profession's implied judgment is that one's time is better spent giving helpful tips to younger researchers than doing new work oneself. However, of all the lessons I have learnt during a quarter century of research, the one I have found most valuable is always to work as if one were still twenty-three. From such a young perspective, I find it difficult to give advice to anyone. The reason why I agreed to write this piece will appear later. I hope readers will take it for what it is -- scattered and brash remarks of someone who pretends to have a perpetually juvenile mind, and not the distilled wisdom of a middle-aged has-been. Writing such a piece poses a basic problem at any age. There are no sure-fire rules for doing good research, and no routes that clearly lead to failure. Ask any six economists and you will get six dozen recipes for success. Each of the six will flatly contradict one or more of the others. And all of them may be right -- for some readers and at some times. So you should take all such suggestions with skepticism. -

A Journal of Current Economic and Political Affairs Index

A JOURNAL OF CURRENT ECONOMIC AND POLITICAL AFFAIRS INDEX SUBJECT INDEX Administrative Reorganisation (Ed) 1281 ANDHRA "Factory Workers in India"; ADVERTISING Nagarjunasagar Project ; Whose Arthur Nieoff 1809 Creative Advertising (Ed) 1676 Baby? (L C) 1375 "Growth of Labour Legislation in Maharaja Slips Up (Kd) 1645 Opposition to Land Revenue India Since 1939 and Its Im African Trade, Trends in (S) 1069 Bill (L C) 1043 pact on Economic Develop Afro-Asia, Emerging (Ed) 1073 Asian Economic Cooperation; ment"; R D Vtdyarthi 1655 AGRICULTURAL CREDIT D T Lakdawala (S A) 1231 "India's Urban Future": Agricultural Refinance Coropora- Asian Games Fiasco (Ed) 1428 Roy Turner (Ed) 1409 tion (Ed) 1866 ASSAM "Industrial Jurisprudence"; S R Cooperative Credit (WN) 1866 Fools' Paradise (Evacuation of Samant 1655 More on Agriculture Refinance Tezpur) (L C) 1872 "Law of Industrial Disputes in (Ed) 1898 No Finance for Assam (W N) 1868 India"; R F Rustomji 1655 Rural Credit: Whither Now? Oil Royalty Dispute (L C) 1041 'Macro-Economics"; F S Broo- (Ed) 1835 ATOMIC POWER man 1689 AGRICULTURE Control over Tarapur (W N) 1529 "Rise and Fall of Third Agricultural Underemployment Wan for Nuclear Power (W N) 1530 Reich : A History of Nazi in Uttar Pradesh; A Qaynm Tarapur Project (Ed) 1285 Germany": William L Shirer 1945 (SA) 1961 AUSTERITY "Sonic Aspects of Industrial Fin- Crop Estimates. 1961-62 (S) 1453 'Auks' of Indian Economy (Ed) 1249 ance in India"; George Rosen 1845 Need for Subsidy to Agriculture; AUTOMOBILES ''Techno-Economic Surveys" of L Merzer (SA) -

Post-Autistic Economics Review Issue No

sanity, humanity and science post-autistic economics review Issue no. 41, 5 March 2007 back issues at www.paecon.net Subscribers: 9,461 from over 150 countries Subscriptions are free. To subscribe, email "subscribe". To unsubscribe, email "unsubscribe". Send to : [email protected] In this issue: - What would post-autistic trade policy be? Alan Goodacre (University of Stirling, UK) ........................................................................................ 2 - On the need for a heterodox health economics Robert McMaster (University of Aberdeen, UK) ........................................................................... 9 - True cost environmental accounting for a post-autistic economy David A. Bainbridge (Alliant International University, USA) ..................................................... 23 - Does John Kenneth Galbraith have a legacy? Richard Parker (Harvard University, USA) .................................................................................. 29 - Labour rights in China Tim Costello, Brendan Smith and Jeremy Brecher (USA) ............................... 34 - Endogenous growth theory: the most recent “revolution” in economics Peter T. Manicas (University of Hawaii, USA) ............................................................................ 39 - Submissions, etc. ............................................................................................................................... 54 1 post-autistic economics review, issue no. 41 What would post-autistic trade policy be? Alan Goodacre -

The Morality of Capitalism What Your Professors Won’T Tell You

The Morality of Capitalism What Your Professors Won’t Tell You Edited by Tom G. Palmer Students For Liberty Atlas Network Centre for Civil Society Liberal Youth Forum AtlasNetwork.org StudentsForLiberty.org LYFIndia.org CCS.in New Delhi, India Copyright © 2011 by Students for Liberty and Altas Economic Research Foundation Published by Centre for Civil Society in partnership with Students For Liberty & Atlas Network. General permission to reprint was granted by the Atlas Economic Research Foundation. “The Market Economy and the Distribution of Wealth,” by Ludwig Lachman reprinted by permission of the Institute for Human Studies. “Human Betterment through Globalization,” by Vernon Smith reprinted by permission of the Foundation for Economic Education. “Does the Free Market Corrode Moral Character? To the Contrary,” by Jagdish Bhagwati reprinted by permission of the John Templeton Foundation. All other essays published by permission of the authors. Edited by Tom G. Palmer Cover Design by Sadaf Hussain The editor gratefully acknowledges the assistance in preparing this book, not only of the authors and copyright holders, but of the members of Students For Liberty, most especially Clark Ruper, Brandon Wasicsko, and Ankur Chawla, who worked tirelessly to format and prepare the essays for publication. Their dedication and zeal for liberty is itself an inspiration. For information and other requests please write Centre for Civil Society A-69 Hauz Khas, New Delhi 110016 Voice: +91 11 2653 7456 email: [email protected] website: www.ccs.in Printed at: Mehra Impressions 102, Tihar, Opp. Subhash Nagar, New Delhi, India ISBN: 81-87984-02-3 Table of Contents Foreword The Dharma of Capitalism ..............................................................................................5 By Gurchuran Das Introduction The Morality of Capitalism .............................................................................................9 By Tom G. -

PRESS INFORMATION BUREAU GOVERNMENT of INDIA PRESS NOTE RESULT of the CIVIL SERVICES (PRELIMINARY) EXAMINATION, 2019 Dated: 12Th July, 2019

PRESS INFORMATION BUREAU GOVERNMENT OF INDIA PRESS NOTE RESULT OF THE CIVIL SERVICES (PRELIMINARY) EXAMINATION, 2019 Dated: 12th July, 2019 On the basis of the result of the Civil Services (Preliminary) Examination, 2019 held on 02/06/2019, the candidates with the following Roll Numbers have qualified for admission to the Civil Services (Main) Examination, 2019. The candidature of these candidates is provisional. In accordance with the Rules of the Examination, all these candidates have to apply again in the Detailed Application Form-I (DAF-I) for the Civil Services (Main) Examination, 2019, which will be available on the website of the Union Public Service Commission (https://upsconline.nic.in) during the period from 01/08/2019 (Thursday) to 16/08/2019 (Friday) till 6:00 P.M. All the qualified candidates are advised to fill up the DAF-I ONLINE and submit the same ONLINE for admission to the Civil Services (Main) Examination, 2019 to be held from Friday, the 20/09/2019. Important instructions for filling up of the DAF-I and its submission will also be available on the website. The candidates who have been declared successful have to first get themselves registered on the relevant page of the above website before filling up the ONLINE DAF-I. The qualified candidates are further advised to refer to the Rules of the Civil Services Examination, 2019 published in the Gazette of India (Extraordinary) of Department of Personnel and Training Notification dated 19.02.2019. It may be noted that mere submission of DAF-I does not, ipso facto, confer upon the candidates any right for admission to the Civil Services (Main) Examination, 2019. -

Growth and Poverty

GROWTH AND POVERTY GROWTH AND POVERTY The Great Debate Pradeep S Mehta Bipul Chatterjee GROWTH AND POVERTY The Great Debate Published by D-217, Bhaskar Marg, Bani Park Jaipur 302016, India Tel: +91.141.228 2821, Fax: +91.141.228 2485 Email: [email protected] Web site: www.cuts-international.org ©CUTS International, 2011 First published: June 2011 The material in this publication may be reproduced in whole or in part and in any form for education or non-profit uses, without special permission from the copyright holders, provided acknowledgment of the source is made. The publishers would appreciate receiving a copy of any publication, which uses this publication as a source. No use of this publication may be made for resale or other commercial purposes without prior written permission of CUTS. The views expressed here are those of the commentators/authors and can therefore in no way be taken to reflect the positions of CUTS International and the institutions with which the commentators/authors are affiliated. ISBN: 978-81-8257-149-5 Printed in India by Jaipur Printers Private Limited, Jaipur #1106 Contents Acknowledgement ix Reflections xi Abbreviations xv Foreword xvii Simply not Debatable! xxi Part I: Professor Jagdish Bhagwatis Lecture to the Parliament of India Indian Reforms:Yesterday and Today 3 Part II: The Debate on Growth and Poverty Its a Myth that Reforms are not Helping the Poor 21 G Srinivasan Selected Reflections from the Debate 24 Abhijit Banerjee 24 Arvind Panagariya 25 R Vaidyanathan 27 Alok Ray 28 Basudeb Chaudhuri 29 Indira -

Memorandum (Academic)

Office of the Vice-Provost and Associate Vice-President memorandum (Academic) DATE: April 17, 2020 TO: Senate FROM: Dr. Dwight Deugo, Vice-Provost and Associate Vice-President (Academic), and Chair, Senate Quality Assurance and Planning Committee RE: Economic Policy master’s-level graduate diplomas (Type 2 & 3) New Program Approval _____________________________________________________________________________ SAPC Motion THAT SQAPC recommends to SENATE the approval of the proposed Graduate Diplomas in Economic Policy to commence Winter 2021. Senate Motion THAT Senate approve the master’s-level graduate diplomas in Economic Policy to commence with effect from Winter 2021. Background The program is a graduate diploma in Economic Policy in the Department of Economics. The principal goal is to expose anyone with an undergraduate degree and at least some formal training in undergraduate economics to a wide range of issues related to the formulation of economic policy. It will target non-economists working on economic policy in government, central banks and other organizations as well as people who already have an undergraduate degree in Economics wishing to take courses that are at the forefront of current economic policy debates. Attachments Self-Study with Appendices Courseleaf entries Faculty CVs (volume II) Quality Assurance Framework and Carleton’s Institutional Quality Assurance Process (IQAP) Upon the above motion being passed by Senate, the required documentation will be submitted to the Quality Council for its review and a decision -

Dreams of My Father, Prison for My Mother: the H-4 Nonimmigrant Visa Dilemma and the Need for an "Immigration- Status Spousal Support"

Scholarly Commons @ UNLV Boyd Law Scholarly Works Faculty Scholarship 2014 Dreams of My Father, Prison for My Mother: The H-4 Nonimmigrant Visa Dilemma and the Need for an "Immigration- Status Spousal Support" Stewart Chang University of Nevada, Las Vegas -- William S. Boyd School of Law Follow this and additional works at: https://scholars.law.unlv.edu/facpub Part of the Family Law Commons, Immigration Law Commons, Law and Gender Commons, and the Law and Race Commons Recommended Citation Chang, Stewart, "Dreams of My Father, Prison for My Mother: The H-4 Nonimmigrant Visa Dilemma and the Need for an "Immigration-Status Spousal Support"" (2014). Scholarly Works. 1110. https://scholars.law.unlv.edu/facpub/1110 This Article is brought to you by the Scholarly Commons @ UNLV Boyd Law, an institutional repository administered by the Wiener-Rogers Law Library at the William S. Boyd School of Law. For more information, please contact [email protected]. Dreams of My Father, Prison for My Mother: The H-4 Nonimmigrant Visa Dilemma and the Need for an "Immigration-Status Spousal Support" Stewart Chang* For many years during my public interest practice, I conducted a le- gal clinic working with the Asian Indian immigrant community in Artesia, California. The advocacy organization that I worked with regularly referred Asian Indian clients having marital difficulties to me. Cases involving women who were admitted as derivative H-4 beneficiaries on their husbands' H-lB employment-based visas were particularly problematic. Some of these cases involved emotional and physical abuse, others neglect and infidelity, still oth- ers simply spouses no longer getting along. -

Name Wise Roll Ordr List of Written Qualified Candidates

CIVIL SERVICES (PRELIMINARY) EXAMINATION,2019 NAME WISE ROLL ORDR LIST OF WRITTEN QUALIFIED CANDIDATES __________________________________________________________________ SR. NO. ROLL NO. NAME _________________________________________________________________ 1 0100007 SENTA ARVIND DEVJIBHAI 2 0100057 ASHANK KUMAR SINGH 3 0100059 DHRUV DHAIVAT KETANBHAI 4 0100123 YADAV PRAMODKUMAR RAMAKANT 5 0100179 DHILA SHANTIBEN VELA 6 0100218 VISMAY A BHARAI 7 0100320 RAJAT KUMAR DAMACHYA 8 0100385 DESAI ANKUR BALDEVBHAI 9 0100389 PATEL PRASHANT ARVINDBHAI 10 0100653 MADAN LAL DELU 11 0100708 DANGAR BHARGAV BACHUBHAI 12 0100972 ANTIYA KALPESHKUMAR GANESHBHAI 13 0101024 DHAVALKUMAR PARSOTAM HEDAMBA 14 0101232 BAROT HIREN JITENDRABHAI 15 0101310 BAROT JIGNESHKUMAR NIRANJANKUM 16 0101436 PATEL KARAN KAMLESHBHAI 17 0101667 ANURAG CHOUDHARY 18 0101803 PARMAR ABHISHEK 19 0101854 PATANI TEJASKUMAR D 20 0102028 RUPELLA SANDEEP MUKESHKUMAR 21 0102270 THACKER DHAVALKUMAR GHANSHYAMB 22 0102449 VAGHELA JAYRAJSINH M 23 0102599 PATEL RAVIKUMAR BHOGILAL 24 0102613 JHAVERI VISHAL JAYANTBHAI 25 0102744 NANJI NARANBHAI BHANUSHALI 26 0102994 SANJAY MEENA 27 0103047 PRASHANTKUMAR RAJNIKANT PATEL CIVIL SERVICES (PRELIMINARY) EXAMINATION,2019 NAME WISE ROLL ORDR LIST OF WRITTEN QUALIFIED CANDIDATES __________________________________________________________________ SR. NO. ROLL NO. NAME _________________________________________________________________ 28 0103273 CHAUHAN SIDDHARTH HASMUKHRAY 29 0103289 SAURABH GANGWAL 30 0103414 ARVIND SINGH YADAV 31 0103750 PARESHKUMAR T