Section 4000 Managing the Program

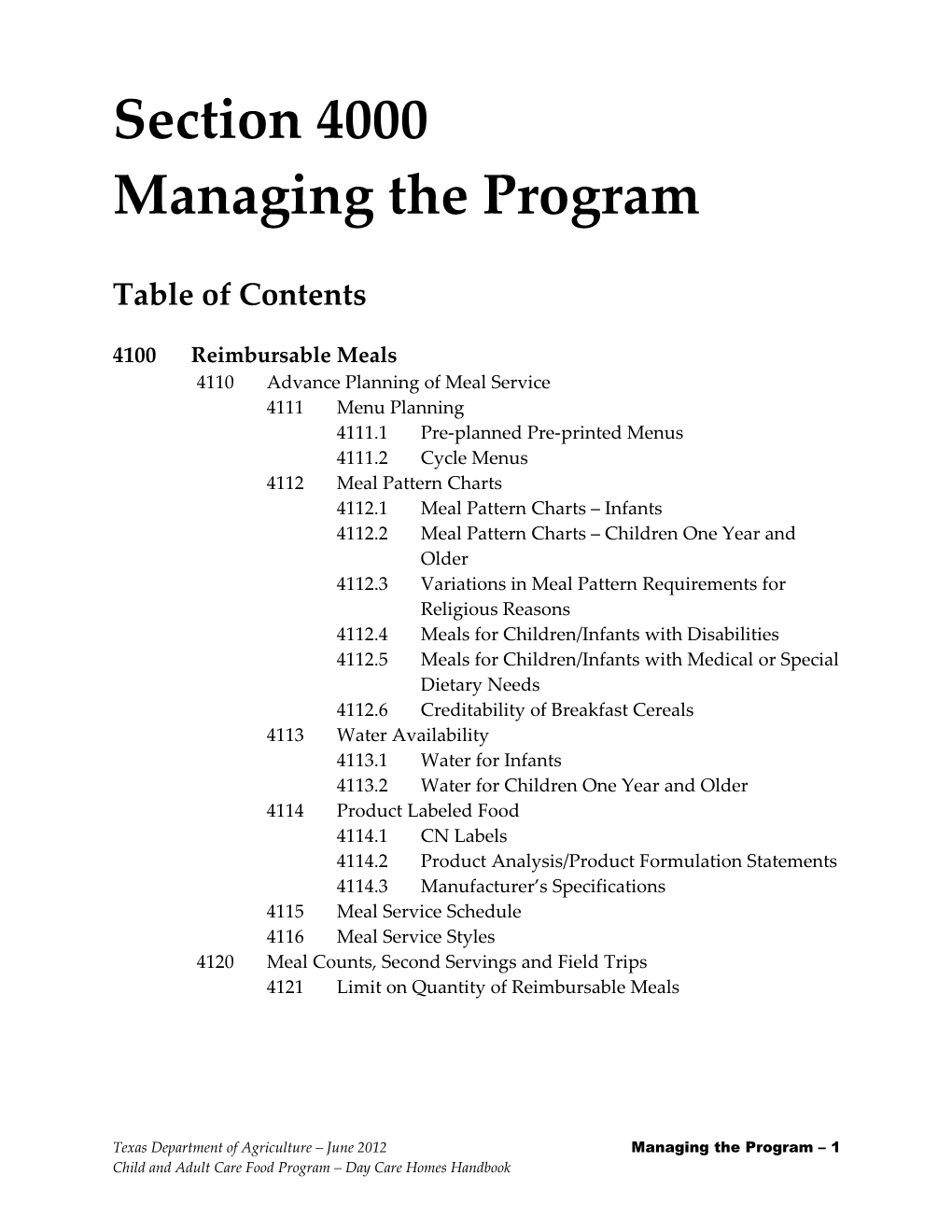

Table of Contents

4100 Reimbursable Meals 4110 Advance Planning of Meal Service 4111 Menu Planning 4111.1 Pre-planned Pre-printed Menus 4111.2 Cycle Menus 4112 Meal Pattern Charts 4112.1 Meal Pattern Charts – Infants 4112.2 Meal Pattern Charts – Children One Year and Older 4112.3 Variations in Meal Pattern Requirements for Religious Reasons 4112.4 Meals for Children/Infants with Disabilities 4112.5 Meals for Children/Infants with Medical or Special Dietary Needs 4112.6 Creditability of Breakfast Cereals 4113 Water Availability 4113.1 Water for Infants 4113.2 Water for Children One Year and Older 4114 Product Labeled Food 4114.1 CN Labels 4114.2 Product Analysis/Product Formulation Statements 4114.3 Manufacturer’s Specifications 4115 Meal Service Schedule 4116 Meal Service Styles 4120 Meal Counts, Second Servings and Field Trips 4121 Limit on Quantity of Reimbursable Meals

Texas Department of Agriculture – June 2012 Managing the Program – 1 Child and Adult Care Food Program – Day Care Homes Handbook 4122 Meal Counts 4122.1 Meal Service Record 4122.2 Second Meals during One Meal Service 4123 Field Trips

4200 Two-Tiered Reimbursement Provisions 4210 Tier I and Tier II Providers 4211 Tier I Providers 4212 Tier II Providers 4220 Area-Eligible Tier I Providers 4221 Area-Eligible Tier I Providers Based on School Data 4222 Area-Eligible Tier I Providers Based on Census Data 4223 Resident Children in Area-Eligible Tier I Homes 4223.1 Annual Renewal of Eligibility 4223.2 Letter to Provider 4223.3 Automatic Eligibility for Head Start/Early Head Start/Even Start Participants 4230 Income of Categorically Eligible Tier I Providers 4231 Resident Children in Income/Categorically Eligible Tier I Homes 4240 Tier II Providers 4241 Resident Children in Tier II Homes 4242 Nonresident Children in Tier II Homes 4250 Foster Children in Tier I and Tier II Homes 4260 Notification of Tier I/Tier II Determinations 4270 Claims for Reimbursement 4271 Reimbursement Based on Tier Determination 4272 Claims for Meal Reimbursement 4280 Documentation and Reporting 4290 Confidentiality and Sharing Eligibility Information

4300 Program Administration 4310 Management and Monitoring 4311 Pre-Approval Visits 4312 Parental Notification 4313 Distribution of Women, Infants, and Children (WIC) Supplemental Food Program Materials 4314 Enrollment of Children 4315 Policy Statement

2 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 4316 State Government Privacy Policy 4320 Enrolling, Terminating or Making Changes to Day Care Homes 4321 Denials 4322 Resuming Provider Participation 4323 Open Enrollment 4324 Transfers 4330 Training 4331 Contracting Entity Training 4332 Provider Training 4333 Training Documentation 4340 Monitoring Reviews 4341 Review Averaging 4341.1 How to Establish Your Averaging Cycle 4342 Meal Edit Checks 4343 Five-Day Reconciliation 4344 Household Contacts 4350 Nonprofit Food Service 4351 Administrative Costs 4351.1 Administrative Labor Costs 4351.2 Documentation Requirements for Administrative Labor Costs 4351.3 Unallowable Costs 4353 Program Income 4354 Net Costs 4360 Filing Claims 4361 Submittal Deadline 4362 Late Claims 4362.1 One-Time Exception 4362.2 Good Cause 4363 Adjusted Claims 4364 Upward Adjusted Amended Claims 4370 Food Service Operations 4371 On-Site Food Preparation 4372 Estimating Costs 4373 Inventories 4374 Inventory Adjustments 4375 Recycled Food 4376 Storage 4377 Purchased Meals

Texas Department of Agriculture – June 2012 Managing the Program – 3 Child and Adult Care Food Program – Day Care Homes Handbook 4380 Serious Deficiency Process for Providers 4381 Suspension of Provider Participation 4390 Operation During a Pandemic

4400 Program Documentation 4410 Retention Period 4420 Availability of Records 4430 Types of Records 4430.1 Provider Record Keeping Requirements 4440 Required Forms

4 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 4000 Managing the Program

By agreeing to participate in the CACFP, the contracting entity (CE) must accept full administrative and financial responsibility for operating the program, as well as full administrative and financial responsibility of the operation of the program in the day care homes it sponsors. These responsibilities are described in federal and state laws, regulations and policies and in the CE’s approved application and FND Permanent Agreement. The CE must not deviate from its approved budget and application/management plan without F&N’s written consent.

Either directly or through its providers, a CE must:

Prepare and serve reimbursable meals. Operate a nonprofit food service. Manage program activities. Document the program activities as required.

4100 Reimbursable Meals

The CACFP meal patterns guide the preparation of well-balanced and nutritious meals. The lunch pattern should provide children with approximately one-third of their recommended dietary allowance (RDA), while the breakfast pattern should provide approximately one-fourth of their RDA. It is recommended that thirty percent of calories come from fat from meals over several days. Salt and sodium should be used in moderation. The CACFP meal patterns are a flexible framework that enables the provider to choose from a wide variety of foods when planning and serving nutritious meals. Variations in the meal patterns can be considered for religious, cultural, and ethnic eating preferences when planning menus.

4110 Advance Planning of Meal Service

Providers are encouraged to plan meals at least two weeks in advance of a meal service to assist in food-purchasing, cost control and the scheduling of food preparation. Using the appropriate USDA meal pattern and DFPS' Child Care Licensing requirements, CEs should help providers vary the form, size, shape, color, texture, flavor, and temperature of foods that they offer. CEs should review providers' menus in advance to reduce the number of disallowed meals. Some children's diets often lack sufficient nutrients, such as iron and vitamins A and C, F&N recommends using foods that are good sources of these nutrients.

Texas Department of Agriculture – June 2012 Managing the Program – 5 Child and Adult Care Food Program – Day Care Homes Handbook 4111 Menu Planning

4111.1 Pre-planned Pre-printed Menus

CEs must ensure that providers prepare a menu record for each meal service on a daily basis. CEs cannot:

Require the use of pre-planned, pre-printed menus. Provide pre-planned, pre-printed menus, except as a training tool.

Individual providers may use pre-planned, pre-printed menus that they have developed for their own use. Each day, they must:

Verify that the items on the pre-printed menu were served as listed, or that acceptable substitutions were made. Identify the individual who recorded the information. Record the date.

EXAMPLE: On the first day of a pre-printed 10-day menu, the provider served all of the items listed. Prior to the end of the day, the provider must notate that each item was served and initial and date the menu record.

If a substitution is made, the item must be added to the pre-printed menu record. Providers should record the substitution without obscuring the readability of the original item.

EXAMPLE: A provider served each of the items that were listed on a lunch menu prepared 10 days earlier, except corn was substituted for green beans on the ninth day. Prior to the end of the ninth day, the provider must:

Strike through the words “green beans.” Record “corn”. Notate that other items were served as planned. Initial and date the entries.

Providers must use Form H1539, Day Care Home Meal Service Record to record their menus, or alternate. CEs must ensure all required information is documented and maintained if an alternate menu is used.

6 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 4111.2 Cycle Menus

Cycle menus repeat themselves over a period of time, usually three to six weeks. Using cycle menus provides a variety of meals, reduces cost, and makes it easier for providers to plan their children's favorite combinations. Providers may repeat a non-cycle menu with any frequency that they desire, e.g., one-month.

4112 Meal Pattern Charts

The meal pattern charts show the minimum amounts of each meal component that must be served to each child to qualify for reimbursement. Providers may choose to serve additional foods. Serving sizes vary for children of different ages.

4112.1 Meal Pattern Charts – Infants

(See next page for the INFANT MEAL PATTERN.)

Texas Department of Agriculture – June 2012 Managing the Program – 7 Child and Adult Care Food Program – Day Care Homes Handbook INFANT MEAL PATTERN

Meal Type Birth through 4 Months through 8 Months through 3 Months 7 Months 11 Months

BREAKFAST • 4-6 fluid ounces (fl oz) of • 4-8 fl oz of formula 1 or • 6-8 fl oz of formula 1 or formula 1 or breastmilk 2,3. breastmilk 2,3 ; breastmilk 2,3 ; and and • 0-3 tablespoons (Tbsp) of • 2-4 Tbsp of infant cereal 1 ; infant cereal 1,4. and • 1-4 Tbsp of fruit or vegetable or both. LUNCH OR • 4-6 fl oz of formula 1 or • 4-8 fl oz of formula 1 or • 6-8 fl oz of formula 1 or 2,3 2,3 2,3 SUPPER breastmilk . breastmilk ; breastmilk ; and and • 0-3 Tbsp of infant cereal 1,4 ; • 1-4 Tbsp of fruit or vegetable and or both ; and • 0-3 Tbsp of fruit or vegetable or both 4. • 2-4 Tbsp of infant cereal 1 ; and/or • 1-4 Tbsp of meat, fish, poultry, egg yolk, cooked dry beans or peas; or • 1/2-2 oz. of cheese; or • 1-4 oz. (volume) of cottage cheese; or • 1-4 oz. (weight) of cheese food, or cheese spread. SNACK • 4-6 fl oz of formula 1 or • 4-6 fl oz of formula 1 or • 2-4 fl oz of formula 1 or breastmilk 2,3. breastmilk 2,3. breastmilk 2,3, or fruit juice 5 ; and • 0-1/2 slice of bread 4,6 or 0-2 crackers 4,6.

1 Infant formula and dry infant cereal must be iron-fortified. 2 Breastmilk or formula, or portions of both, may be served; however, it is recommended that breastmilk be served in place of formula from birth through 11 months. 3 For some breastfed infants who regularly consume less than the minimum amount of breastmilk per feeding, a serving of less than the minimum amount of breastmilk may be offered, with additional breastmilk offered if the infant is still hungry. 4 A serving of this component is required only when the infant is developmentally ready to accept it. 5 Fruit juice must be full-strength. Texas Department of Family and Protective Services Child Care Licensing does not allow juice to be served to infants less than 12 months of age. 6 A serving of this component must be made from whole-grain or enriched meal or flour. (See the Food Buying Guide for more details.) Chart Revised by TDA F&N– Sep 2011

8 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook Texas Department of Agriculture – June 2012 Managing the Program – 9 Child and Adult Care Food Program – Day Care Homes Handbook NOTE: Meal component substitutions to any component of the infant meal pattern due to an infant’s disability, or medical or special dietary need must be supported by a medical statement. Refer to Items 4112.4, Meals for Children with Disabilities and 4112.5, Children with Special Dietary Needs.

Providers must offer at least one infant formula that meets the infant meal pattern requirements. A parent (or guardian) may decline the infant formula that is offered by the provider and supply an alternate infant formula. The provider must have a statement from the parent (or guardian) declining the infant formula offered by the provider in order to claim the meal.

According to CACFP requirements, in order to claim meals for reimbursement for infants 4 through 7 months, the provider is required to serve infant cereal and other foods when the infant is developmentally ready to accept them.

Providers must include in their program documentation the following elements in order to claim reimbursement for meals that are served to infants:

Infant's name; Infant's date of birth; Name of provider; The name and type of infant formula the provider will provide; Whether the parent (or guardian): o Will bring the breastmilk; o Will bring the infant formula (Adequate information must be provided by the parent (or guardian) about the alternate infant formula to determine whether the infant formula meets infant meal pattern requirements (e.g., the name brand of the infant formula and whether the infant formula is iron-fortified); o Will bring solid foods that the infant is developmentally ready to accept; o Wants the provider to provide the infant formula; o Wants the provider to provide infant cereal and other food items that the infant is developmentally ready to accept according to the Infant Meal Pattern; Parent’s (or guardian's) signature; and Date of signature.

For an example, refer to Item 11700, Sample CACFP Infant Feeding Preference – Providers.

NOTE: As situations change, such as a physician or recognized medical authority changing the infant’s formula, the provider must update the information in the infant’s file. The provider

10 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook must update the information within one month of the infant moving from one age category to the next.

An infant formula is considered to meet program requirements when it:

Meets requirements of the infant meal pattern; or Does not meet the infant meal pattern requirements, but a medical statement to support the substitution is maintained.

BIRTH THROUGH THREE MONTHS

If the… Then the provider may claim reimbursement when the provider … Provider provides Provides the infant formula/breastmilk1 in the minimum quantity the infant formula, specified in the infant meal pattern. Parent (or guardian) Has a statement from the parent (or guardian) declining the infant provides the infant formula offered by the provider; formula/breastmilk1, Provides the infant formula/breastmilk1 in the minimum quantity specified in the infant meal pattern; and Feeds the infant.

FOUR THROUGH SEVEN MONTHS

If the… Then the provider may claim reimbursement when the provider … Provider provides all Provides the infant a complete meal (including required2 meal of the meal components) in the minimum quantity specified in the infant meal components, pattern. Provider provides the Provides the infant a complete meal (including required2 meal infant formula, components) in the minimum quantity specified in the infant meal pattern. Parent (or guardian) Has a statement from the parent (or guardian) declining the infant provides the infant formula offered by the provider; and formula/breastmilk1, Provides the infant a complete meal (including required2 meal components) in the minimum quantity specified in the infant meal pattern. Parent (or guardian) Has a statement from the parent (or guardian) declining specific provides some of the meal components (e.g., infant formula or solid food) offered by the meal components, provider; and Provides at least one of the required2 meal components in the minimum quantity specified in the infant meal pattern.

1 This includes breastmilk provided to the parent (or guardian) by a wet nurse. 2 If the infant is developmentally ready for solid foods, then the optional meal component(s) are required and no longer considered as options and must be served on a gradual basis to the infant. The determination to be developmentally ready should be made by the infant’s parent (or guardian).

Texas Department of Agriculture – June 2012 Managing the Program – 11 Child and Adult Care Food Program – Day Care Homes Handbook EIGHT THROUGH 11 MONTHS

If the… Then the provider may claim reimbursement when the provider … Provider provides all Provides the infant a complete meal (including required2 meal of the meal components) in the minimum quantity specified in the infant meal components, pattern. Provider provides the Provides all other required2 meal components in the minimum infant formula, quantity specified in the infant meal pattern. Parent (or guardian) Has a statement from the parent (or guardian) declining the infant provides the infant formula offered by the provider; and formula/breastmilk1, Provides all other required2 meal components in the minimum quantity specified in the infant meal pattern. Parent (or guardian) Has a statement from the parent (or guardian) declining specific provides some of the meal components (e.g., infant formula or solid food) offered by the meal components, provider; and Provides at least one of the required2 meal components in the minimum quantity specified in the infant meal pattern.

1 This includes breastmilk provided to the parent (or guardian) by a wet nurse. 2 If the infant is being served a snack, and the infant is developmentally ready for bread or crackers, then the optional meal component(s) for a snack are required and no longer considered as options and must be served on a gradual basis to the infant. The determination to be developmentally ready should be made by the infant’s parent (or guardian).

A provider may claim reimbursement for meals in which the provider breast-feeds or supplies the breastmilk for her own infant as long as:

The provider's own child participates in the meal service; At least one non-resident child participated in a meal service that day; and Breastmilk/infant formula is the only required component and the provider supplies the breastmilk.

4112.2 Meal Pattern Charts – Children One Year and Older

(See the following pages for the MEAL PATTERN CHARTS for Children One Year and Older.)

12 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook CHILD CARE MEAL PATTERN FOR CHILDREN ONE YEAR OLD OR OLDER

BREAKFAST FOOD COMPONENTS Age 1 - 2 Age 3 - 5 Age 6 - 121 Serve All Three Components for a Reimbursable Meal Milk2,3 • Milk, fluid 2,3 1/2 cup (4 fl oz) 3/4 cup (6 fl oz) 1 cup (8 fl oz)

Vegetables/ Fruits4 • Vegetable(s) and/or fruit(s) or 1/4 cup 1/2 cup 1/2 cup

• Full strength vegetable or 1/4 cup 1/2 cup 1/2 cup fruit juice 4, or

• An equivalent quantity of any combination of vegetable(s), fruit(s) and juice 4

Grains/Breads5,6 • Bread 5, or 1/2 slice 1/2 slice 1 slice

• Cornbread, biscuits, rolls, 1/2 serving 1/2 serving 1 serving muffins, etc.5, or

6 6 • Cold dry cereal 5,6, or 1/4 cup or 1/3 oz 1/3 cup or 1/2 oz 3/4 cup or 1 oz 6

• Cooked cereal 5, or 1/4 cup 1/4 cup 1/2 cup

• Cooked pasta or noodle 1/4 cup 1/4 cup 1/2 cup products 5, or • Cooked cereal grains 5, or 1/4 cup 1/4 cup 1/2 cup

• An equivalent quantity of any combination of Grains/Breads 1 Children ages 13 through 18 must be served minimum or larger portion sizes specified in this column for children ages 6 through 12. 2 USDA requires children ages 2 and older be served low-fat (1%) or non-fat (skim) milk. Texas Department of Family and Protective Services Child Care Licensing (TDFPS CCL) does not allow flavored (sweetened) milk, except for special occasions. 3 USDA requires water be made available at all meals and upon request, but does not take the place of milk. TDFPS CCL requires that water is always available to each child and is served at every snack, mealtime, and after active play in a safe and sanitary manner. 4 Fruit or vegetable juice must be full-strength. You may serve an equivalent quantity of any combination of vegetable(s) or fruit(s), and juice. TDFPS CCL only allows juice to be served once daily in the amounts of up to 4 ounces of juice for children ages 12 months through 5 years of age and 6 ounces for children ages 6 years and older. 5 Bread, pasta or noodle products, and cereal grains, must be whole-grain or enriched. Cornbread, biscuits, rolls, muffins, etc. must be made with whole grain or enriched meal or flour. Cereal must be whole-grain or enriched or fortified. 6 Either volume (cup) or weight (oz), whichever is less. (See your Food Buying Guide for more details.) Chart Revised by TDA F&N – Dec 2011

Texas Department of Agriculture – June 2012 Managing the Program – 13 Child and Adult Care Food Program – Day Care Homes Handbook CHILD CARE MEAL PATTERN FOR CHILDREN ONE YEAR OLD OR OLDER (cont.)

LUNCH or SUPPER FOOD COMPONENTS Age 1 - 2 Age 3 - 5 Age 6 - 121 Serve All Four Components for a Reimbursable Meal Milk2,3 • Milk, fluid 2,3 1/2 cup (4 fl oz) 3/4 cup (6 fl oz) 1 cup (8 fl oz) Vegetables/ • Vegetable(s) and/or fruit(s) 1/4 cup total 1/2 cup total 3/4 cup total Fruits4 (2 or more) Grains/Breads5 • Bread 5, or 1/2 slice 1/2 slice 1 slice • Cornbread, biscuits, rolls, 1/2 serving 1/2 serving 1 serving muffins, etc.5, or

• Cooked pasta or noodle 1/4 cup 1/4 cup 1/2 cup products 5, or

• Cooked cereal grains 5, or 1/4 cup 1/4 cup 1/2 cup

• An equivalent quantity of any combination of Grains/Breads Meat/ Meat • Lean meat or poultry or fish 6, 1 oz 1 1/2 oz 2 oz Alternates6,7,8,9 or • Alternate protein products 7, or 1 oz 1 1/2 oz 2 oz

• Cheese, or 1 oz 1 1/2 oz 2 oz

• Egg (large), or 1/2 large egg 3/4 large egg 1 large egg

• Cooked dry beans or peas, or 1/4 cup 3/8 cup 1/2 cup

• Peanut butter or soynut butter, 2 Tbsp 3 Tbsp 4 Tbsp or other nut or seed butters, or

8 8 8 • Peanuts or soynuts or tree nuts 1/2 oz = 50% 3/4 oz = 50% 1 oz = 50% or seeds 8,9, or

• Yogurt - plain or flavored, 4 oz or 1/2 cup 6 oz or 3/4 cup 8 oz or 1 cup unsweetened or sweetened, or

• An equivalent quantity of any combination of the above Meat/Meat Alternates Notes continued on next page

14 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 1 Children ages 13 through 18 must be served minimum or larger portion sizes specified in this column for children ages 6 through 12. 2 USDA requires children ages 2 and older be served low-fat (1%) or non-fat (skim) milk. Texas Department of Family and Protective Services Child Care Licensing (TDFPS CCL) does not allow flavored (sweetened) milk, except for special occasions. 3 USDA requires water be made available at all meals and upon request, but does not take the place of milk. TDFPS CCL requires that water is always available to each child and is served at every snack, mealtime, and after active play in a safe and sanitary manner. 4 Serve two or more kinds of vegetable(s) and/or fruit(s). Full-strength vegetable or fruit juice may be counted to meet not more than one-half of this requirement. TDFPS CCL only allows juice to be served once daily in the amounts of up to 4 ounces of juice for children ages 12 months through 5 years of age and 6 ounces for children ages 6 years and older. 5 Bread, pasta or noodle products, and cereal grains, must be whole-grain or enriched. Cornbread, biscuits, rolls, muffins, etc. must be made with whole grain or enriched meal or flour. Cereal must be whole-grain or enriched or fortified. 6 A serving consists of the edible portion of cooked lean meat or poultry or fish. 7 Alternate protein products must meet requirements in Appendix A of 7 CFR Part 226. 8 Nuts and seeds may meet only one-half of the total Meat/Meat Alternate serving and must be combined with another Meat/Meat Alternate to fulfill the lunch or supper requirement. 1 ounce of nuts or seeds is equal to 1 ounce of cooked lean meat, poultry, or fish. 9 Nuts and seeds are generally not recommended to be served to children ages 1-3 since they present a choking hazard. If served, nuts and seeds should be finely minced. (See your Food Buying Guide for more details.) Chart Revised by TDA F&N – Dec 2011

Texas Department of Agriculture – June 2012 Managing the Program – 15 Child and Adult Care Food Program – Day Care Homes Handbook CHILD CARE MEAL PATTERN FOR CHILDREN ONE YEAR OLD OR OLDER (cont.)

SNACKS Age 1 - 2 Age 3 - 5 Age 6 - 121 Select Two of the Four Components

Milk2,3 • Milk, fluid 2,3 1/2 cup (4 fl oz) 1/2 cup (4 fl oz) 1 cup (8 fl oz) Vegetables/ • Vegetable(s) and/or fruit(s), or 1/2 cup 1/2 cup 3/4 cup 4,5 Fruits • Full strength vegetable or fruit 1/2 cup 1/2 cup 3/4 cup juice 4,5, or

• An equivalent quantity of any combination of vegetable(s), fruit(s) and juice 4,5 Grains/Breads6,7 • Bread 6, or 1/2 slice 1/2 slice 1 slice • Cornbread, biscuits, rolls, 1/2 serving 1/2 serving 1 serving muffins, etc.6, or

7 7 7 • Cold dry cereal 6, or 1/4 cup or 1/3 oz 1/3 cup or 1/2 oz 3/4 cup or 1 oz

• Cooked cereal 6, or 1/4 cup 1/4 cup 1/2 cup

• Cooked pasta or noodle 1/4 cup 1/4 cup 1/2 cup products 6, or

• Cooked cereal grains 6, or 1/4 cup 1/4 cup 1/2 cup

• An equivalent quantity of any combination of Grains/Breads Meat/ Meat • Lean meat or poultry or fish8, 1/2 oz 1/2 oz 1 oz Alternates8,9,10,11 or • Alternate protein products9, or 1/2 oz 1/2 oz 1 oz

• Cheese, or 1/2 oz 1/2 oz 1 oz

• Egg (large), or 1/2 large egg 1/2 large egg 1/2 large egg

• Cooked dry beans or peas, or 1/8 cup 1/8 cup 1/4 cup

• Peanut butter or soynut butter, 1 Tbsp 1 Tbsp 2 Tbsp or other nut or seed butters, or

10 10 10 • Peanuts or soynuts or tree nuts 1/2 oz = 50% 1/2 oz = 50% 1 oz = 50% or seeds 10,11, or

• Yogurt - plain or flavored, 2 oz or 1/4 cup 2 oz or 1/4 cup 4 oz or 1/2 cup unsweetened or sweetened, or • An equivalent quantity of any combination of the above Meat/Meat Alternates Notes continued on next page

16 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 1 Children ages 13 through 18 must be served minimum or larger portion sizes specified in this column for children ages 6 through 12. 2 USDA requires children ages 2 and older be served low-fat (1%) or non-fat (skim) milk. Texas Department of Family and Protective Services Child Care Licensing (TDFPS CCL) does not allow flavored (sweetened) milk, except for special occasions. 3 USDA requires water be made available at all meals and upon request, but does not take the place of milk. TDFPS CCL requires that water is always available to each child and is served at every snack, mealtime, and after active play in a safe and sanitary manner. 4 Fruit or vegetable juice must be full-strength. You may serve an equivalent quantity of any combination of vegetable(s) or fruit(s), and juice. TDFPS CCL only allows juice to be served once daily in the amounts of up to 4 ounces of juice for children ages 12 months through 5 years of age and 6 ounces for children ages 6 years and older. 5 Juice may not be served when milk is the only other component. 6 Bread, pasta or noodle products, and cereal grains, must be whole-grain or enriched. Cornbread, biscuits, rolls, muffins, etc. must be made with whole grain or enriched meal or flour. Cereal must be whole-grain or enriched or fortified. 7 Either volume (cup) or weight (oz), whichever is less. 8 A serving consists of the edible portion of cooked lean meat or poultry or fish. 9 Alternate protein products must meet requirements in Appendix A of 7 CFR Part 226. 10 Nuts and seeds may meet only one-half of the total Meat/Meat Alternate serving and must be combined with another Meat/Meat Alternate to fulfill the lunch or supper requirement. 1 ounce of nuts or seeds is equal to 1 ounce of cooked lean meat, poultry, or fish. 11 Nuts and seeds are generally not recommended to be served to children ages 1-3 since they present a choking hazard. If served, nuts and seeds should be finely minced. (See your Food Buying Guide for more details.) Chart Revised by TDA F&N – Dec 2011

Texas Department of Agriculture – June 2012 Managing the Program – 17 Child and Adult Care Food Program – Day Care Homes Handbook In addition to the meal pattern requirements, providers must also adhere to the following guidance:

Children 12 and older may be served adult size portions but must be served at least the minimum amount for children age 6 to 12. “Cup” means a standard measuring cup of 8 oz. Bread, pasta or noodle products, and cereal grains must be wholegrain or enriched. Biscuits, rolls, muffins, etc., must be made with wholegrain or enriched meal or flour. Cereal must be wholegrain, enriched, or fortified. For products made with corn meal or corn flour, such as cornbread and corn tortillas; the label must have: o “Whole corn” (or other “whole” corn designations, such as whole grain corn, whole ground corn, whole cornmeal, whole corn flour, etc.); or o “Enriched” corn (or other “enriched” corn designations, such as enriched yellow cornmeal, enriched corn flour, enriched corn grits, etc.). All serving sizes and equivalents must be as specified in the Food Buying Guide as published by USDA. A link to the FBG is located on the TDA website at http://squaremeals.org, under F&N Resources, Tools & Links. The FBG Calculator for Child Nutrition Programs is also available. The calculator allows users to build shopping lists of foods from the FBG and determine how much of each item to purchase to provide enough servings for children in their program. Juice cannot be used as the second component of a snack if milk is the first component. The minimum serving size for cereal is measured by volume (cup) or weight (oz.), whichever is less. At lunch or supper, you must serve two or more kinds of vegetable and/or fruit. Full strength vegetable or fruit juice may be counted toward a maximum of one-half of this requirement. The minimum amounts shown for meat, poultry or fish are edible portions as served. USDA determines whether a specific tree nut or seed may be served as a meat alternate. At lunch or supper, tree nuts and seeds may be counted toward a maximum of one-half of this requirement. Nuts or seeds must be combined with another meat/meat alternate to fulfill the requirement. For the purpose of determining combinations, one ounce of nuts or seeds is equal to one ounce of cooked lean meat, poultry, or fish. The following items cannot be used to satisfy the meat/meat alternate component for a snack: o Frozen yogurt. o Yogurt bars. o Yogurt covered fruits or nuts. o Yogurt flavored products. o Homemade yogurt.

18 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook Fluid milk served to children ages two and older must be pasteurized fluid milk that meets State and local standards, and must be: o Fat-free or low-fat milk o Fat-free or low-fat lactose reduced milk o Fat-free or low-fat lactose free milk o Fat-free or low-fat buttermilk o Fat-free or low-fat acidified milk Fluid milk may be flavored or unflavored (DFPS regulation prohibit serving flavored milk) Whole milk and reduced-fat (2%) milk may not be served to children two year and older

NOTE: Commercially added flavorings such as fruit, fruit juice, juice, nuts, seeds, or granola cannot be counted as the second component of a snack.

General Guidelines

TDA is committed to the 3E’s of Healthy Living – Education, Exercise and Eating Right. As part of that commitment, the CACFP initiative “Promoting Healthy Eating and Physical Activity for a Healthier Lifestyle” is the TDA F&N avenue to promote a healthier lifestyle, including healthy eating and physical activity for children ages 2 – 5 years. F&N partnered with CACFP contracting entities from both independent centers and sponsoring organizations to recommend changes to the Child Care Meal Patterns to comply with the 2005 Dietary Guidelines for Americans.

The recommended modifications are voluntary, but if day care home providers implement these minor changes to the meal patterns, they will lower total fat, saturated fat, trans fatty acids, added sugars and calories. At the same time, they will increase fruit, vegetable, vitamins A and C, fiber and whole grain consumption.

The recommended modifications are as follows:

Serve juice only once daily, for breakfast or snack (juice must not be served from a bottle). Serve one fresh or frozen fruit or vegetable daily for a required Vegetables/Fruits component at any meal service. Serve one good source of Vitamin C daily. Serve one good source of Vitamin A three days per week. (See the list on page 19 for examples of vitamin A and C rich foods) Serve one whole grain daily (whole grain must be the first ingredient listed), for a required Grains/Breads component at any meal service. Serve Grains/Breads food items listed in Exhibit A: Group C through Group G of the Food Buying Guide no more than twice a week for a snack only. Serve ready-to-eat cereals with no more than 10 grams of sugar per serving.

Texas Department of Agriculture – June 2012 Managing the Program – 19 Child and Adult Care Food Program – Day Care Homes Handbook Do not serve vegetable or fruit juice as a Vegetables/Fruits component for lunch or supper.

CEs are encouraged to request that their day care home providers make these modifications to promote healthier eating habits.

NOTE: The modifications recommended above do not replace the component and serving size requirements in the CACFP Meal Patterns.

Vitamins A and C Rich Foods

Foods for Vitamin A Foods for Vitamin C ¼ cup serving (about 1500 International Units (IU)) ¼ cup serving (about 15-25 milligrams (mg)) Beet greens Broccoli Carrots Brussel sprouts Cherries, red sour Chili peppers, red and green Chili peppers, red Orange juice Collards Oranges Kale Peppers, sweet red and green Mangoes Cantaloupe Mixed Vegetables Cauliflower Mustard greens Collards Peas and carrots (canned or frozen) Grapefruit Peppers, sweet red Grapefruit juice Pumpkin Kiwi fruit Spinach Mangoes Squash, winter (acorn, butternut, hubbord) Mustard greens Sweet potatoes Papayas Turnip greens Pineapple juice (canned-vitamin C restored) Strawberries ¼ cup serving (about 750-1500 IU) Tangerine juice Apricots Tangerines Broccoli Cantaloupe ¼ cup serving (about 8-15 mg) Papayas Asparagus Purple plums (canned) Cabbage Honeydew melon ½ cup serving (about 750-1500 IU) Okra Potatoes (baked, broiled or steamed) Asparagus, green Potatoes (reconstituted instant mashed-vitamin C restored) Chili peppers, green Raspberries, red Endive, curly Sauerkraut Nectarines Spinach Peaches (except canned) Sweet potatoes (except those canned in syrup) Prunes Tomatoes Tomatoes Tomato juice or reconstituted paste or puree Tomato juice or reconstituted paste or puree Turnip greens

20 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook Vegetable juice 4112.3 Variations in Meal Pattern Requirements for Religious Reasons

F&N may approve variations in meal patterns to meet religious needs. If a provider wants to serve meals that vary from USDA Meal Patterns, the CE must submit an alternate meal pattern with justification to F&N.

Jewish facilities may be exempted from the enrichment portion of the bread requirement if they choose to substitute unenriched matzo for the required grains/breads component during the observance of Passover.

Jewish facilities may also be exempted from the meal pattern requirement that milk be served with all lunches and suppers. This exemption applies only to meals containing meat or poultry since Jewish Dietary Law allows milk to be served with meat alternates such as fish, cheese, eggs, nut and seed butter, and nuts and seeds. Jewish facilities that request an exemption must choose from the following three options:

Option I – Serve an equal amount of full-strength juice in place of milk with lunch or supper. Juice substituted for milk cannot contribute to the vegetable/fruit requirement.

If the facility operates five days a week, it may substitute juice for milk twice per week for lunches and twice per week for suppers, but is only allowed one substitution per day.

If the facility operates seven days a week, it may substitute juice for milk three times per week for lunches and three times per week for suppers, but is only allowed one substitution per day.

Milk substitutions are limited since milk is a primary source of calcium and riboflavin. When using Option I, providers should serve other sources of calcium, e.g., broccoli and greens, and riboflavin, e.g., dark green and yellow fruits and vegetables and whole-grain or enriched breads and cereals.

Option II – Serve milk at an appropriate time before or after the meal service period, in accordance with applicable Jewish Dietary Law.

Option III – Serve a snack juice component at lunch or supper. Serve the lunch or supper milk component as part of a snack.

NOTE: An exemption is not necessary for breakfasts.

Texas Department of Agriculture – June 2012 Managing the Program – 21 Child and Adult Care Food Program – Day Care Homes Handbook Seventh-Day Adventists may use meat analogues (plant protein products) at the 100% level to meet the meat/meat alternate component and quantity requirements for breakfasts, lunches, suppers, and snacks.

Meat analogues are nutritionally comparable to and acceptable as meat alternates. They are foods of plant origin, usually soy and wheat, which are made to resemble meat, poultry and fish in appearance, texture, and flavor. A food buying guide supplement list of creditable meat analogues is located in section 11000, Resources.

Providers must notify their sponsor to request an exemption. The CE must obtain approval for an exemption from F&N prior to claiming reimbursement.

4112.4 Meals for Children/Infants with Disabilities

Providers are required to provide meal component substitutions to a disabled child/infant when supported by a medical statement signed by a licensed physician. The determination of whether or not a child/infant has a disability that restricts his or her diet is to be made on an individual basis by a licensed physician. The physician’s medical statement of the child’s / infant’s disability must be based on the regulatory criteria for “disabled child/infant” and contain a finding that the disability restricts the child’s/infant’s diet.

The medical statement must identify:

The child’s/infant’s disability and an explanation of why the disability restricts the child’s/infant’s diet; The major life activity affected by the disability; The food or foods to be omitted from the child’s/infant’s diet; The food or choice of foods to be used as substitutions; and Any other restrictions and/or requirements specific to the child’s/infant’s disability (i.e. caloric modifications or the substitution of a liquid nutritive formula).

NOTE: If the child’s/infant’s disability requires only textural modification(s) to the regular program meal, as opposed to a meal pattern substitution, then the medical statement is recommended, but not required.

Children/infants with food allergies or intolerances, or obese children/infants do not meet the regulatory criteria for “disabled child/infant”. However, if the physician’s assessment finds that the food allergy may result in severe, life-threatening reactions (anaphylactic reactions) or the obesity is severe enough to substantially limit a major life activity, then the child/infant

22 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook meets the definition of “disabled child/infant”, and the provider must make the substitutions prescribed by the licensed physician and supported by the physician’s medical statement.

Providers must:

Keep on file a copy of the licensed physician’s medical statement; Provide a copy of the licensed physician’s medical statement to their sponsor; Provide the meal substitutions at no additional cost to the child’s/infant’s parent (or guardian); and Document meal substitutions.

F&N strongly encourages providers to work closely with the parent (or guardian) for the health, well-being and education of children/infants with disabilities to ensure that reasonable accommodations are made to allow children/infants with disabilities to participate in the meal service. This is particularly important when accommodating children/infants whose disability(ies) requires significant modifications or personal assistance.

The reimbursement rate for meals served to children/infants with disabilities is the same standard rate as all other program meals.

4112.5 Meals for Children/Infants with Medical or Special Dietary Needs

Children/infants who are not a “disabled child/infant” but who are unable to consume a food item because of medical or other special dietary needs may be served substitutions. This includes children/infants with food intolerance(s) (e.g., lactose intolerant or food allergy).

The parent (or guardian) of a child with a medical or special dietary need must be supported by a medical statement signed by a recognized medical authority (Exception: this requirement does not apply to milk substitutions that meet requirements as described below). In these cases, recognized medical authority may include physicians, physician assistants or nurse practitioners.

The medical statement must include the following:

Identification of the medical or special dietary need that restricts the child's/infant’s diet; Food or foods to be omitted from the child’s/infant’s diet; and Food or choice of foods to be used as substitutions.

The decision as to whether or not the provider will provide the substitutions is at the discretion of the provider. A provider is not required to satisfy the unique dietary needs of each child/infant. F&N urges providers to make every effort to satisfy the unique medical or special

Texas Department of Agriculture – June 2012 Managing the Program – 23 Child and Adult Care Food Program – Day Care Homes Handbook dietary needs of each child/infant; however, we recognize that this may not always be possible due to operational and financial constraints. If a provider chooses to provide substitutions for children/infants with medical or special dietary needs, then the provider must:

Provide substitutions on a case-by-case basis; Maintain the required medical statement, or parental statement, in their files; Provide a copy of the required medical statement, or parental statement, to their sponsor; Provide the meal at no additional cost to the child’s/infant’s parent (or guardian); and Document the meal substitution.

EXAMPLE: "Lactose Intolerant" describes a difficulty digesting the sugar found in milk and milk foods. Symptoms associated with lactose intolerance may be reduced or eliminated if:

Small, frequent portions of milk are consumed rather than large portions; Milk or milk foods are consumed with other foods or a meal; or Acidophilus milk, yogurt with active cultures, ice cream, cottage cheese and aged hard cheeses like cheddar and Swiss are consumed.

Children who cannot consume fluid milk due to medical or special dietary needs may be served non-dairy beverages in lieu of fluid milk. Non-dairy beverages must be nutritionally equivalent to milk and meet the nutritional standards for fortification of calcium, protein, vitamin A, vitamin D, and other nutrient levels found in cow’s milk as outlined below:

Nutrient Per Cup Nutrient Per Cup Calcium 276 mg.* Magnesium 24 mg.* Protein 8 g.* Phosphorus 222 mg.* Vitamin A 500 IU.* Potassium 349 mg.* Vitamin D 100 IU.* Riboflavin 0.44 mg.* Vitamin B-12 1.1 mcg.* *mg = milligrams; g = grams; IU = international units; mcg = micrograms

Parents or guardians may request in writing non-dairy milk substitutions without providing a medical statement. CEs and provider must ensure the substitution meets the requirements as stated above. The written request from the parent or guardian must identity the medical or special dietary need that restricts the diet of the child. For example, a parent who has a child who follows a vegan diet may request soy milk be served to their child instead of cow’s milk.

If a child/infant is lactose intolerant, providers are encouraged to determine the availability of lactose-reduced or lactose-free milk/formula. Providers are also encouraged to provide lactose-

24 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook reduced or lactose-free milk as a fluid milk choice as a creditable part of a reimbursable meal. Providers cannot assess additional charges to the child’s parent (or guardian) for the substitution(s).

Texas Department of Agriculture – June 2012 Managing the Program – 25 Child and Adult Care Food Program – Day Care Homes Handbook If a provider serves a meal without milk or an approvable substitution as outlined above, to a child, the meal cannot be claimed unless there is a valid medical statement on file.

Refer to Section 11000, Resources, for a list of Iron Fortified Infant Formulas that do not require a medical statement.

Additionally, children/infants with chewing and swallowing difficulties may require textural modifications that include softer foods, e.g., cooked carrots rather than raw carrots, or foods that are chopped, ground, or blended.

Textural modifications can usually be made to the regular program meal; therefore, a physician's medical statement indicating the appropriate food texture is recommended, but not required.

F&N strongly encourages providers to work closely with the parent (or guardian) for the health, well-being and education of children/infants with medical or special dietary needs to ensure that reasonable accommodations are made to allow children/infants with medical or special dietary needs to participate in the meal service. This is particularly important when accommodating children/infants whose medical or special dietary needs require significant modifications or personal assistance.

The reimbursement rate for meals served to children/infants with medical or special dietary needs is the same standard rate as all other program meals.

4112.6 Creditability of Breakfast Cereals

A breakfast cereal is creditable if any of the following are true:

1. The cereal is labeled as whole grain (100% of the grain component is whole grain); 2. The cereal is labeled as “enriched”; 3. The cereal is labeled as “fortified”; 4. The ingredient statement shows that the primary grain ingredient is either whole grain, enriched flour or meal, bran or germ; or 5. Manufacturer documentation provides the gram amount of creditable grains per serving.

Refer to the flow chart in Section Three, on Page 3-7 of the Food Buying Guide for Child Nutrition Programs (FBG) for information regarding options to determine the creditability of breakfast cereals.

26 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook Some cereal manufacturers, however, no longer attach the words “fortified” or “enriched” to the name of the cereal on the label. In addition, some cereal manufacturers add the words “whole grain” or “made with whole grain” to the product label even if the grain component is not 100% whole grain, thus making it difficult to determine if the cereal is creditable.

If the cereal label does not give enough information to complete the steps in the FBG flow chart mentioned above, CEs and providers may use the nutrient criteria entitled the Food and Nutrition Service (FNS) Nutrient Criteria for Breakfast Cereals below as an option for determining creditability of breakfast cereals.

To provide consistency in determining grains/breads creditability, the FNS Nutrient Criteria for Breakfast Cereals is based on the minimum required amounts of selected nutrients in one slice of enriched bread. The FNS Nutrition Criteria for Breakfast Cereals does not replace the guidance in the FBG or how to determine the creditability of a grain/bread, as discussed in Item 4112.2; it just provides an additional option to determine creditability.

If using the FNS Nutrient Criteria for Breakfast Cereals to determine creditability, then the product must contain the minimum levels of all five nutrients listed below.

FNS Nutrient Criteria for Breakfast Cereals Served to Children Ages One and Older Required Cereal Portion Size Minimum % Minimum Weight of Nutrient Ready-to-Eat Ready- Daily Value Nutrient per Portion (whichever to-Cook (%DV) of or amount Nutrient per weighs less) Portion Thiamin (B1) 1.0 ounce or 25 grams 6.7 % or 0.10 mg ¾ cup dry Riboflavin (B2) 1.0 ounce or 25 grams 3.5 % or 0.06 mg ¾ cup dry Niacin (B3) 1.0 ounce or 25 grams 4.2 % or 0.84 mg ¾ cup dry Folic Acid (B9) 1.0 ounce or 25 grams 5.0 % or 20.0 mcg ¾ cup dry Iron 1.0 ounce or 25 grams 3.9 % or 0.70 mg ¾ cup dry

NOTE: The FNS Nutrient Criteria for Breakfast Cereals are set for specific portion sizes. The portion size for ready-to-eat breakfast cereals is one ounce or ¾ cup, whichever amount weighs less. The portion size for cooked cereal is 25 grams of ready-to-cook dry cereal regardless of the amount of cooked cereal served or the amount of liquid added to cook the cereal.

Texas Department of Agriculture – June 2012 Managing the Program – 27 Child and Adult Care Food Program – Day Care Homes Handbook If the serving size on the Nutrition Facts Label matches the cereal portion listed in the FNS Nutrient Criteria for Breakfast Cereals chart, then CEs and providers can compare the nutrients listed on the Nutrition Facts Label to the FNS Nutrient Criteria for Breakfast Cereals.

If the serving size on the Nutrition Facts Label does not match the cereal portion listed in the FNS Nutrient Criteria for Breakfast Cereals chart, then CEs and providers will need to convert the nutrient values from the label to determine the amount of nutrients in the required cereal portion size.

The nutrient values can be converted using the online United States Department of Agriculture (USDA), Agricultural Research Service (ARS), Nutrient Data Laboratory; National Nutrient Database for Standard Reference or sponsors and providers can manually calculate the nutrient values.

It is recommended that CEs and providers use the ARS National Nutrient Database for Standard Reference. The ARS National Nutrient Database for Standard Reference can be found at http://www.nal.usda.gov/fnic/foodcomp/search/.

4113 Water Availability in the CACFP

Potable (suitable for drinking) water must be made available to children one year and older throughout the day, including mealtimes, to drink upon their request, but does not have to be made available for self-serve. Even though water must be made available during mealtimes it is not part of the reimbursable meal and cannot be served in lieu of fluid milk. See below for specific guidelines for infants and children one year and older.

4113.1 Water for Infants

USDA recommends that parents consult their infant’s health care provider regarding feeding water to infants. However, it is generally recommended that:

Formula-fed infants in a normal climate should not be fed more water than the quantity found in properly diluted formula. Partially breast-fed and formula-fed infants in a hot climate should be fed water (about four to eight ounces per day, unless otherwise indicated by a health care provider). Breast-fed and formula-fed infants, in a normal climate who are fed a variety of solid foods, especially high protein foods, e.g., meats, egg yolks, should be fed some water (a total of about four to eight ounces per day, unless otherwise indicated by a health care provider). Exclusively breast-fed infants in hot humid climates should not be fed additional water besides what is in breast milk.

28 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook NOTE: Child care providers should obtain parental approval before feeding water to an infant. When in doubt, parents should consult their infant's health care provider.

Most fruit juices are diluted with water. Infants should only be provided juice in a cup and the amount should be limited (fewer than four ounces of juice). Parents should consult their infant's health care provider regarding the total amount of fruit juice and water to feed an infant each day. Plain water and fruit juice are meant to be fed in relatively small amounts to older infants as a source of fluid, which supplements a nutritionally balanced diet. Feeding an excessive amount of water, juice or other diluted liquid, places an infant at risk of water intoxication.

4113.2 Water for Children One Year and Older

CEs must ensure that their providers make potable water available, upon demand, for children throughout the day, including mealtimes. This can be accomplished by:

Having cups available next to the kitchen sink faucet; Placing water pitchers and cups out in easy to reach areas for children to access as needed; Providing water to a child when requested.

Day care homes are encouraged to provide water during snack meal services when no other beverage is being served and in place of high calorie sweetened drinks (juice drinks, soda, sports drinks) served outside of meal times.

NOTE: See meal pattern chart notes for additional Texas Department of Family and Protective Services Child Care Licensing requirements.

4114 Product Labeled Food

Commercially prepared products (e.g., ravioli, pizza, egg rolls, Smuckers Uncrustables, etc.), including those prepared by restaurants, “fast food” outlets, etc. must have one of the following in order to identify the food’s contribution to the meal pattern requirements:

A child nutrition (CN) label; A product analysis/product formulation statement from the food manufacturer; or Manufacturer’s specification.

For menu items in which a CN label, product analysis/product formulation statement or manufacturer’s specification cannot be obtained, it is recommended that additional food items are served that meet the meal pattern requirement to reduce the risk the meal will be disallowed.

Texas Department of Agriculture – June 2012 Managing the Program – 29 Child and Adult Care Food Program – Day Care Homes Handbook 4114.1 CN Labels

Products containing the CN label will have the following information printed on the principal display panel of the label:

Product name. Ingredients listed in descending order by weight. Inspection legend for the appropriate inspection. Establishment number (for meat, poultry, and seafood items only). Manufacturers or distributor’s name and address. CN label statement. The CN label statement must be an integral part of the product label and include the following information: o CN logo, the distinctive border around the CN statement. o Six-digit product identification number which will appear in the upper right hand corner of the CN label statement. o A statement of the product’s contribution toward meal pattern requirements for the Child Nutrition Programs. o A statement specifying that the use of the CN logo and label statement is authorized by Food and Nutrition Services (FNS). o The month and year the label was approved by FNS.

If a provider purchases a product without a CN label and the product does not meet CACFP requirements, the meal/snack will not be reimbursable unless the provider or CE has a product analysis/product formulation statement or manufacturer’s specification for the item.

CN Labels are limited to: Entrée items (Main dish products) which contribute a minimum of 0.5 ounces equivalent meat/meat alternate toward meal pattern requirements. Examples of these products include but are not limited to beef patties, cheese or meat pizzas, meat or cheese and bean burritos, egg rolls, and breaded fish portions; and 50-percent juice drinks and juice drink products which contain at least 50 percent full- strength juice by volume. This includes such products such as grape drink, fruit punch, and juice bars.

Manufacturers may not, under any circumstances, place the CN logo and contribution statement on fact sheets or other product information.

30 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 4114.2 Product Analysis/Product Formulation Statements

A product analysis/product formulation statement from a food manufacturer must contain:

A detailed explanation of what the product actually contains. The amount of each ingredient in the product by weight or measure, as appropriate. A certifying statement as to the contribution of the product to the meal pattern. The signature of a high-ranking official employed by the manufacturer.

CEs and providers are responsible for:

Reviewing the manufacturer’s product analysis or product formulation statement before serving to determine the credibility of information provided by the manufacturer. Ensuring the proper documentation is maintained on each commercially prepared product used to meet USDA meal pattern requirements. Assuring that the food product meets specifications and has the correct code number. Sample product formulation statement that have been developed to assist CEs and providers when documenting the creditable amount of food in products to meet meal pattern requirements are located in Section 11000, Resources.

4114.3 Manufacturer’s Specification

Manufacturer’s specifications can be acquired from the manufacturer of the product to identify the food’s contribution to the meal pattern requirements.

For menu items in which a manufacturer’s specification cannot be obtained, it is recommended that additional food items be served that meet meal pattern requirement to be counted towards a creditable and reimbursable meal.

4115 Meal Service Schedule

Each meal and snack must be reported individually on the appropriate DCH Claim for Reimbursement. CEs and providers must ensure that the following meal service times are observed:

Three hours must elapse between the beginning of breakfast and the beginning of lunch. Four hours must elapse between the beginning of lunch and the beginning of supper, when a snack is not served in between. Two hours must elapse between the beginning of a: o Meal service and the beginning of a snack. o Snack and the beginning of a meal service. o Snack and the beginning of another snack.

Texas Department of Agriculture – June 2012 Managing the Program – 31 Child and Adult Care Food Program – Day Care Homes Handbook NOTE: When determining meal service times, a snack is not a meal.

The following conditions also apply to the meal service schedule:

The duration of a meal service must not exceed two hours The duration of a snack service must not exceed one hour. Service of supper must begin no earlier that 5:00 p.m., but no later than 7:00 p.m. It must end no later than 8:00 p.m. A meal service cannot begin any later than 30 minutes before the ending time (close of business) indicated as the normal hours of child care operations on the Provider Application – Day Care Homes.

Providers may use a different schedule for infants younger than one year old.

4116 Meal Service Styles

Providers may serve meals:

As a unit (cafeteria style). Family style.

In either type of meal service, the provider must ensure that the minimum quantities of each meal component are available to each child.

At lunch or supper, the minimum quantity of the vegetable and fruit component is the combined amount of each of the two or more fruit or vegetable items that are served. In cafeteria style meal service, each child must be served at least the minimum amount of each component.

In family style meal service:

A sufficient amount of prepared food must be placed on each table to provide the full, required portions of each of the food components for all children at the table, and to accommodate adults if they eat with the children. Children should initially be offered the full required portion of each meal component. The family style meal service allows children to make choices in selecting foods and the size of initial servings. It is the responsibility of the provider, during the course of the meal, to actively encourage each child to accept service of the full required portion for each food component of the meal pattern, e.g., if a child initially refuses a food component, or initially does not accept the full

32 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook required portion of a meal component, the provider should offer the food component to the child again. Second meals cannot be claimed for reimbursement.

In some instances it may be appropriate to offer only some components family style. However, any component not served family style, in an otherwise family style meal service, must be served according to the criteria for cafeteria style service, which dictates that the full portion of each component must be served to each child. For example, if you serve a meal family style with the exception of milk, then each child must be served at least the full minimum portion of milk.

Although we strongly encourage allowing children to serve themselves in a family style meal service, it is not required.

Regardless of which meal service style is chosen, CEs and providers may not separate children based on gender during a meal service, whether or not that child is participating in the meal service. Refer to Section 6000 for further information.

4120 Meal Counts, Second Servings and Field Trips

4121 Limit on Quantity of Reimbursable Meals

Providers may serve any or all of the following:

Meals Snacks Breakfast A.M. Lunch P.M. Supper Evening

Providers may claim reimbursement for a maximum of two meals and one snack or two snacks and one meal per child per day if the meals/snacks meet meal pattern requirements and are:

Served to children who are properly enrolled for and participating in child care. Eaten in the day care home. Served to children who meet CACFP age requirements. Supplied by the provider.

EXCEPTION: Refer to Item 4112, Meal Pattern Charts, for exceptions concerning infant meals provided by the parent/guardian.

Served at a time that F&N has approved. Served by a provider that F&N has approved for participation in the CACFP.

Texas Department of Agriculture – June 2012 Managing the Program – 33 Child and Adult Care Food Program – Day Care Homes Handbook Prepared by a source (self-prep or vended) that F&N has approved. Providers cannot claim reimbursement for meals or snacks that are provided by a child’s parent/guardian, e.g., a sack lunch. Additionally, meals or snacks cannot be claimed that are served to:

Adults. Children in excess of the day care homes licensed capacity. Children not properly enrolled. The children of one provider in the care of another provider unless substitute care is being offered and the child is enrolled with the substitute provider. (The provider for whom substitute care is offered cannot claim reimbursement for any meals during the period of substitute care). The provider’s school-age children (during regular school hours), unless the children are home schooled and all CACFP requirements are met. The provider’s own child, unless a nonresident child enrolled for child care is participating in the meal service. The provider’s own child, unless the child is eligible for free or reduced-price meals.

4122 Meal Counts

The CE’s and provider’s meal count system must provide accurate counts of reimbursable meals served to eligible children. A meal is reimbursable if an eligible child receives all required components in the correct quantities.

4122.1 Meal Service Record

Providers must record meal counts and attendance on a daily basis. It is recommended providers record meal counts at the point of service where they observe that an eligible child receives a creditable meal. A meal is creditable when a child receives all required components in the correct quantities.

Providers must record meal counts on Form H1539, Day Care Home Meal Service Record, or an alternate form.

CEs must ensure that all items on the form are completed, including the:

Date of food service. Day of the week. Names of all children (participants) enrolled in day care. Age of each child.

34 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook Meal counts, by meal type, for each participant. Attendance. Form H1539 contains a certification statement that must be signed and dated by the provider.

4122.2 Second Meals During One Meal Service

CEs and providers must plan and prepare meals with the intent of serving no more than one of each approved meal type per child per day.

Second meals may be claimed only if:

The second meals were served due to an unanticipated fluctuation in participation resulting from conditions beyond the provider’s control. The meals were served cafeteria style. CEs and providers may not claim second meals under any condition when the meals are served family style. The second meals complied with USDA meal patterns. The second meals were served to eligible program participants. The CE submits documentation justifying the second meals. F&N approves the justification for serving second meals due to reasons beyond the provider’s control.

Menu records, or other documentation, must show that the quantity of each prepared component was adequate for each meal served (including any second meals) and contained the minimum of each required component.

4123 Field Trips

The Texas Department of Family and Protective Services (DFPS) consider organized activities directly related to the provision of child care, e.g., field trips, to be an “extension of the day care home and subject to regulation.”

Therefore, providers may claim reimbursement for meals that are served during a field trip if:

The activity is directly related to child care. All program requirements are met.

Program requirements include, but are not limited to, the following:

Meals must meet meal pattern requirements for the appropriate age group and must be served to eligible children. All state and local health department standards, including maintaining food at proper temperatures, must be followed.

Texas Department of Agriculture – June 2012 Managing the Program – 35 Child and Adult Care Food Program – Day Care Homes Handbook Meal counts for meals served to eligible children must be documented on Form H1539, Day Care Home Meal Service Record, or alternate form. Meals must be provided by the approved source (self-preparation or vended). Meals purchased from restaurants or “fast food” outlets are not reimbursable without a product analysis from the food manufacturer. Meals that are served to children who are in transit to the provider’s or their homes cannot be claimed as reimbursable meals.

CEs are not required to obtain prior approval from F&N to claim meals served on a field trip. However, CEs may require that providers obtain prior approval for field trips as a condition of reimbursement for meals served off-site.

Occasionally, field trips will include a visit to a Summer Food Service Program (SFSP) site. CEs and providers cannot claim reimbursement for meals that are provided and served by SFSP sites.

4200 Two-Tiered Reimbursement Provisions

Reimbursement for meals is based on a two-tiered rate structure. Providers receive reimbursement for meals served to enrolled children based on economic need as determined by one of the following:

The location of the provider. The income of the provider. The household income of each participating child.

CEs must determine whether its providers can claim Tier I or Tier II reimbursement. CEs will use school data (provided by TEA), census data, or the provider’s household income information to determination if the day care home can be classified as Tier I and receive Tier I reimbursement for all eligible meals served. A provider that does not qualify as Tier I will receive Tier II reimbursement.

A provider may qualify as either Tier I or Tier II for any given month. However, no provider may be claimed in both categories for an individual month.

CE’s determination of a provider’s Tier status is provided through TX-UNPS on the provider application screen, or on the paper forms Provider Application – Day Care Homes. CEs must maintain documentation that supports a provider’s Tier I determination.

36 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook 4210 Tier I and Tier II Providers

4211 Tier I Providers

Providers qualify as Tier I if:

Their homes are located in geographic areas shown to be low-income by school data or by census data. o A Tier I determination based on school data or census data is valid for five years from the effective date of the determination, e.g. if, on July 1, 2011, the provider is determined to be Tier I, the determination is valid through July 31 2016. They are determined to be low-income based on income information obtained from the provider. o A Tier I determination based on the provider's household income is valid for one year from the effective date of the determination. For example, if on July 1, 2011, you determine that a provider qualifies as Tier I, the determination is valid through July 31, 2012.

Refer to sections 4220 and 4230 below for information on making Tier I determinations.

4212 Tier II Providers

Providers will receive Tier II reimbursement if they do not qualify as Tier I. However, Tier II providers that choose to have the CE determine eligibility of the enrolled children for Tier I or Tier II can receive Tier I reimbursement for meal served to those children who qualify for Tier I.

Refer to section 4240 below for information on making Tier II determinations.

NOTE: CEs must inform Tier II providers annually that they can request reclassification based on new census data.

4220 Area-Eligible Tier I Providers

A provider who is eligible for Tier I reimbursement based school or census data, i.e. an area- eligible provider, will receive Tier I reimbursement for all nonresident enrolled children. The provider will not complete a CACFP Meal Benefit Income Eligibility Form for the nonresident children.

Area eligibility is based on the geographical location of a provider. Therefore, if an area-eligible provider changes location, the CE must reassess the provider's eligibility.

Texas Department of Agriculture – June 2012 Managing the Program – 37 Child and Adult Care Food Program – Day Care Homes Handbook 4221 Area-Eligible Tier I Providers Based on School Data

CE must use the list of schools located at www.squaremeals.org under CACFP Administration and Forms, to make tier determinations based on school data. CEs may not obtain or use more recent data from schools. Updated school lists are posted each year. The school in whose attendance area the provider is located must be on the current list of schools at the time the tier determination is made.

The percentage of income-eligible children for the school in whose attendance area the provider is located must be equal to or greater than 50 percent.

NOTE: CEs may not round up a percentage. A percentage such as 49.94 cannot be rounded up and would not qualify the provider as area-eligible.

CEs must verify with the school, by written or verbal verification, that the provider is located in the school’s attendance area. CEs must also verify with the school, by written or verbal verification, that the school in whose attendance area the provider is located draws their attendance from a specific neighborhood.

EXCEPTION: Some rural areas or small towns will have a single school that serves the entire town or ISD. In this case, it is acceptable for the “specific neighborhood” from which the school draws attendance to be the entire town or ISD.

Written documentation may include a map with school boundaries, a letter confirming school boundaries, etc. Verbal documentation may include a telephone conversation with an ISD official knowledgeable in school boundaries.

NOTE: CEs may not use data for magnet schools, charter schools, or alternate schools that serve the entire ISD, in determining a provider’s eligibility.

CEs must verify, by written or verbal verification from the ISD, that the school in whose attendance area the provider is located does not target their attendance to children with special needs. Schools such as alternate schools and schools that primarily or only serve children with disabilities, etc., may not be used.

CEs must retain documentation of all school data used in a tier determination. Documentation includes, but is not limited to, the list of schools, copies of all written information that you receive from school officials (i.e., maps of school boundaries, letters confirming school boundaries, etc.), and written documentation of all verbal information received from school officials.

38 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook Documentation of verbal contacts with school officials must include:

The name of the school being used for the tier determination and the district in which the school is located; The name of the school official who was contacted; The date the school official was contacted; The phone number for the school official contacted; and The specific information you were given by the school official.

Failure to retain the required documentation could result in denial of a provider’s Tier I eligibility and adverse action against the CE.

School data may not be used if any of the following occurs:

The school in whose attendance area the provider is located is not on the current list of schools provided by TDA; The CE is unable to obtain written documentation or verbal verification from the school that the provider lives in an eligible attendance area; The school in whose attendance area the provider is located does not draw its attendance from a specific neighborhood (for example, the school is a magnet school, charter school, or alternate school); The school in whose attendance area the provider is located targets its attendance to children with special needs (for example, the school is an alternate school or serves primarily or only children with disabilities, etc.); The percentage of eligible children for the school in whose attendance area the provider is located is not equal to or greater than 50 percent.

4222 Area-Eligible Tier I Providers Based on Census Data

Area eligibility of a provider for Tier I reimbursement can also be determined by using Census data. Tier I determinations based on census data are valid for five years from the effective date of determination. CEs must print the page that proves the day care home is located in an eligible census block.

Current census data is available by utilizing the Food Research and Action Center (FRAC) mapping website. Links to FRAC’s website are located at www.squaremeals.org, select Child and Adult Care Food Program and a link to the website is located on the home page. A link is also located on the far right side of the CACFP Administration & Forms page.

Texas Department of Agriculture – June 2012 Managing the Program – 39 Child and Adult Care Food Program – Day Care Homes Handbook FRAC provides links to CACFP mapping and SFSP mapping. Day care homes may receive Tier I reimbursement if they are located in an eligible area based on either the CACFP data or the SFSP data.

The Census Bureau will be updating the census information annually. CEs may re-determine a Tier II day care homes’ eligibility annually when new data is made available.

4223 Resident Children in Area-Eligible Tier I Homes

Area-eligible Tier I providers who want to claim their own resident child(ren) must complete a CACFP Meal Benefit Income Eligibility Form.

"Provider's own children" includes all residential children in the household who are part of the economic unit of the family. A family is defined as a group of related or unrelated individuals who are not residents of an institution or boarding house, but who are living together as one economic unit. An economic unit is a group of related or unrelated people who share housing and/or all significant income and expenses. Children whose parents or guardians have made a contractual agreement, whether formal or informal, with a provider for residential care, and whose relationship with the provider is defined primarily by the child care situation, are not considered the "provider's own."

CEs must review the CACFP Meal Benefit Income Eligibility Form to verify that it contains: 1. Name of the child(ren) for whom the application is made; 2. A signature of an adult household member; 3. The date of signature; 4. TANF number – a nine-digit case number beginning with “0” or “1” or any eight digit number that does not begin with a “0”; or a 5. SNAP case number; or a Acceptable SNAP case numbers include: o Eligibility Determination Group Number (EDG#) – an eight digit or nine- digit number located on the provider’s TIERS letter. The eight-digit number can begin with any number except “0”. The nine-digit number can begin with any number between “0” and “9”. o SAVERR case number – a nine-digit number beginning with a “0” or “1”. 6. FDPIR case number.

40 – Managing the Program Texas Department of Agriculture – June 2012 Child and Adult Care Food Program – Day Care Homes Handbook NOTES: Eligibility Benefits Transfer (EBT) or Lone Star Card account numbers are not acceptable SNAP case numbers on the application. If this occurs, contact the applicant to obtain the valid SNAP or TANF eligibility number. A copy of the SAVER award letter (Form H1009) is not acceptable documentation for eligibility.

If a TANF, SNAP or FDPIR case number is not provided, or if incomplete or incorrect numbers are provided, the application must include: Names of all household members. Last four digits of the social security number of the adult household member who signs the form (or check the “I do not have a Social Security Number” box, if the adult household member signing the form has no social security number). Current income of each household member, by source of income (including the child enrolled for child care).