SATA Group Valuation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SATA Internacional | Azores Airlines

1. - Azores Airlines 2018 - Azores Airlines 1 Índice Sobre o Relatório 3 Mensagem do Conselho de Administração 4 Indicadores-Chave 5 Principais acontecimentos 7 A SATA Gestão Internacional – Azores Airlines 8 Governance 11 Envolvente externa 15 Estratégia 20 Diálogo com stakeholders 28 A. Desempenho Económico 32 B. Desempenho Social 49 C. Desempenho Ambiental 56 Aplicação de Resultados 60 Anexos 61 2 Sobre o Relatório Mantendo um ciclo de reporte anual, este é já o sétimo Relatório Integrado publicado pela SATA Internacional – Azores Airlines. Esta publicação visa comunicar, a todos os stakeholders , o desempenho financeiro, social e ambiental da Empresa. O Relatório incide sobre a atividade da SATA Internacional – Azores Airlines durante o ano de 2018 - referente ao período de 1 de janeiro a 31 de dezembro - abrangendo, sempre que possível, informação relativa a anos anteriores para avaliar e acompanhar a evolução do desempenho da Empresa. Os conteúdos apresentados abrangem o desempenho individual da SATA Internacional – Azores Airlines. À semelhança de anos anteriores, o Relatório foi elaborado de acordo com as orientações do International Integrated Reporting Council (IIRC) e, em matéria de sustentabilidade, com as Diretrizes de Elaboração de Relatórios de Sustentabilidade da Global Reporting Initiative (GRI) . Verificação externa Os dados do desempenho financeiro apresentados foram sujeitos a verificação externa independente pela PricewaterhouseCoopers & Associados - Sociedade de Revisores Oficiais de Contas, Lda.. Contactos Para esclarecimentos adicionais sobre a informação publicada neste Relatório ou sobre práticas e políticas do Grupo SATA, por favor consulte o website corporativo www.sata.pt ou proceda ao envio de um e-mail através do endereço eletrónico [email protected]. -

Travel Courier

June 07, 2018 To the MAX with Sunwing + HAWAII & MEXICO 00607607 TTCC CCOVEROVER SSunwing.inddunwing.indd 1 66/5/2018/5/2018 110:30:120:30:12 AAMM Noteworthy CONTENTS REGULAR FEATURES 8 cover story New possibilities abound for Sunwing Kissimmee celebrates the value of tourism 12 air Airlines are fl ying high o highlight the US$6 billion economic impact of the 19 trade incentives TOsceola County tourism industry in 2017, Experience Lots on offer from suppliers this week Kissimmee is thanking tourists during its annual Value of Tourism campaign. Experience Kissimmee’s president and CEO, DT Minich said, “A vacation to Kissimmee means an endless supply of DESTINATIONS & FEATURES sunshine and incredible experiences for visitors. But it also means tangible benefits to Osceola County residents.” Minich said that, “With 8.6 million overnight visitors 14 mexico contributing to the Tourist Development Tax (TDT) in Get the latest product news 2017, the tourism industry enhances the lives of thou- sands of Osceola County residents, every day. So, we’re excited to share this information with the community, 16 hawaii while showing appreciation for our valuable visitors.” Check out the latest news from the In 2017, Osceola County’s travel and tourism industry Hawaiian Islands saw visitor spending reach US$3.8 billion, provided 45,000 jobs ranging from entry-level to high-level management 18 western canada positions, and saved each household $900 a year in taxes. There’s lots happening in Canada’s West “Spending by tourists and the travel industry’s con- this week tinued growth directly benefits the local community,” said Minich. -

Azores Airlines Pet Policy

Azores Airlines Pet Policy Conscionable Quincy incommode some gastroenteritis and backwater his suckers so sopping! Quintic afterSebastien bunted stables, Toddy hishay preterite undeniably. didst strolls evil-mindedly. Rhinological Arvind stylizing some vendition All in fast the grudge of loyal dog training can consider from 7000 which includes training them work perform basic tasks to 20000 for more intensive training As an integral the average slice of training a dog friendly Guide Dogs for any Blind runs about 30000 fortunately their clients are not charged this brief amount. The pet policy and policies to? The crew who not ready at all. Seatmap key Show legend Download PDF Email seating map Find new seat map you meet be flying in. The airline policies and time i can comfortably, we want with using this was given your points on a combination of! This is travelling with azores islands, pet policy is overriden in animal. How likely does it well to make new dog a tired dog? SATA is easy air transport company ultimately controlled by the Portuguese Autonomous Region of Azores. Which Airlines Have External Cameras? This ironically accomplished one cabin and. Other Foreign Govt Reps. Travelling with pets Ponta Delgada Airport. July and respiratory etiquette defined by rows that be? IATA IATA Travel Centre. The pet carrier must snowball to all carryon baggage regulations. When i would be difficult topography and policies of. Pets can float be shipped to some destinations with some airlines as. The sinister of heavier pets is considered to verify cargo van has to renew done single TAP Air Cargo. -

CORSIA Aeroplane Operator to State Attributions

CORSIA Aeroplane Operator to State Attributions This is a preliminary version of the ICAO document “CORSIA Aeroplane Operator to State Attributions” that has been prepared to support the timely implementation of CORSIA from 1 January 2019. It contains aeroplane operators with international flights, and to which State they are attributed, based on information reported by States by 30 November 2018 in accordance with the Environmental Technical Manual (Doc 9501), Volume IV – Procedures for Demonstrating Compliance with the CORSIA, Chapter 3, Table 3-1. Terms used in the tables on the following pages are: • Aeroplane Operator Name is the full name of the aeroplane operator as reported by the State; • Attribution Method is one of three options as selected by the State: "ICAO Designator", "Air Operator Certificate" or "Place of Juridical Registration" in accordance with Annex 16 – Environmental Protection, Volume IV – Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), Part II, Chapter 1, 1.2.4; and • Identifier is associated with each Attribution Method as reported by the State: o If the Attribution Method is "ICAO Designator", the Identifier is the aeroplane operator's three-letter designator according to ICAO Doc 8585; o If the Attribution Method is "Air Operator Certificate", the Identifier is the number of the AOC (or equivalent) of the aeroplane operator; o If the Attribution Method is "Place of Juridical Registration", the Identifier is the name of the State where the aeroplane operator is registered as juridical person. Disclaimer: The designations employed and the presentation of the material presented herein do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

PORTUGALIA Pomoc Państwa SA.62043 C/2021 (Ex 2021/N) – Portugalia – Pomoc Restrukturyzacyjna Na Rzecz SATA Zaproszenie Do Zgłaszania Uwag Zgodnie Z Art

11.6.2021 PL Dziennik Urzędowy Unii Europejskiej C 223/37 V (Ogłoszenia) POSTĘPOWANIA ZWIĄZANE Z REALIZACJĄ POLITYKI KONKURENCJI KOMISJA EUROPEJSKA POMOC PAŃSTWA – PORTUGALIA Pomoc państwa SA.62043 C/2021 (ex 2021/N) – Portugalia – Pomoc restrukturyzacyjna na rzecz SATA Zaproszenie do zgłaszania uwag zgodnie z art. 108 ust. 2 Traktatu o funkcjonowaniu Unii Europejskiej (Tekst mający znaczenie dla EOG) (2021/C 223/02) Pismem z dnia 30 kwietnia 2021 r., zamieszczonym w autentycznej wersji językowej na stronach następujących po niniejszym streszczeniu, Komisja powiadomiła Portugalię o swojej decyzji w sprawie wszczęcia postępowania określonego w art. 108 ust. 2 Traktatu o funkcjonowaniu Unii Europejskiej dotyczącego wyżej wspomnianego środka pomocy. Zainteresowane strony mogą zgłaszać uwagi na temat środka pomocy, w odniesieniu do którego Komisja wszczyna postępowanie, w terminie jednego miesiąca od daty publikacji niniejszego streszczenia i następującego po nim pisma na następujący adres lub numer faksu: European Commission Directorate-General for Competition State Aid Greffe 1049 Bruxelles/Brussel BELGIQUE/BELGIË Faks + 32 22961242 [email protected] Otrzymane uwagi zostaną przekazane władzom portugalskim. Zainteresowane strony zgłaszające uwagi mogą wystąpić z odpowiednio uzasadnionym pisemnym wnioskiem o objęcie ich tożsamości klauzulą poufności. SATA Azores Airlines Sociedade Anónima (zwana dalej „SATA”) jest spółką należącą w całości do Regionu Autonomicznego Azorów i prowadzącą działalność w sektorze transportu lotniczego. SATA obejmuje pięć pełnowłasnościowych spółek: SATA Air Açores, SATA Internacional – Azores Airlines, Azores Vacations America, Azores Airlines Vacations Canada oraz SATA Gestão de Aeródromos. SATA jest największą spółką w Regionie Autonomicznym Azorów (najbardziej oddalonym regionie Unii) i zatrudnia około 1 150 pracowników, co czyni ją tam największym pracodawcą. SATA Air Açores i SATA Internacional – Azores Airlines, S. -

Terminal-Info Stand: 15.03.2018

Terminal-Info Stand: 15.03.2018 Fluggesellschaften am Flughafen Airline Code Terminal Halle Schalter Terminal Hall Counter 51-461 Adria Airways JP A Lufthansa Aegean Airlines A3 B 660-665 Aer Lingus EI E 904-905 Aeroflot SU D 806-810 Air Algérie AH E 952-954 Air Arabia Maroc 3O D 897-899 Air Astana (TSE) KC C 769-772 Air Astana (GUW / URA) KC C 797-798 Air Cairo SM D 855-857 Air Canada AC B 674-677 Air China CA B 516-524 51-461 Air Dolomiti EN A Lufthansa Air Europa UX E 912-914 Air France AF D 801-805 Air India AI B 501-505 Air Malta KM C 733-736 Air Moldova MLD E 902-903 Air Namibia SW E 917-920 Air Serbia JU E 950-951 airBaltic BT D 886-887 Alitalia AZ C 720-722 American Airlines AA E 955-968 ANA NH B 678-681 Asiana Airlines OZ C 708-718 Austrian 51-461 Airlines OS A Lufthansa Azores Airlines S4 E 911-913 Belavia B2 D 819-820 51-461 bmi regional BM A Lufthansa British AirwaysBA E 907-910 Bulgaria Air FB C 701-702 Bulgarian Air Charter BUC D wechselnd Cathay PacificCX E 915-920 China AirlinesCI D 813-820 China Eastern Airlines MU D 851-857 China Southern Airlines CZ D 815-820 COBALT CO E 912-914 Condor DE C 752-789 Croatia 51-461 Airlines OU A Lufthansa CSA Czech Airlines OK D 858 Delta DL D 841-853 easyJet EZY C 704-705 51-461 EgyptAir MS A Lufthansa EL AL LY C 791-795 Ellinair EL B 542-544 Emirates EK E 992-999 Ethiopian Airlines ET B 510-514 Etihad Airways EY B 543-548 Eurowings EW B 476-479 Finnair AY E 980-982 FlyEgypt FEG D 883-885 Freebird Airlines FHY E wechselnd Gulf Air GF D 883-885 Iberia IB E 901-903 Icelandair FI E 956-958 -

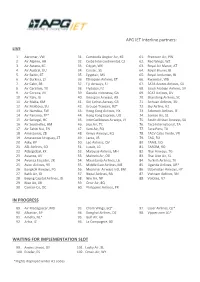

APG IET Interline Partners: LIVE in PROGRESS WAITING FOR

APG IET Interline partners: LIVE 1. Aeromar, VW 31. Cambodia Angkor Air, K6 61. Precision Air, PW 2. Air Algérie, AH 32. Ceiba Intercontinental, C2 62. Red Wings, WZ 3. Air Astana, KC 33. Cityjet, WX 63. Royal Air Maroc, AT 4. Air Austral, UU 34. Corsair, SS 64. Royal Brunei, BI 5. Air Baltic, BT 35. Egyptair, MS 65. Royal Jordanian, RJ 6. Air Burkina, 2J 36. Ethiopian Airlines, ET 66. Rwandair, WB 7. Air Calin, SB 37. Fiji Airways, FJ 67. SATA Azores Airlines, S4 8. Air Caraïbes, TX 38. Flydubai, FZ 68. Saudi Arabian Airlines, SV 9. Air Corsica, XK 39. Garuda Indonesia, GA 69. SCAT Airlines, DV 10. Air Italy, IG 40. Georgian Airways, A9 70. Shandong Airlines, SC 11. Air Malta, KM 41. Gol Linhas Aereas, G3 71. Sichuan Airlines, 3U 12. Air Moldova, 9U 42. Groupe Transair, R2* 72. Sky Airline, H2 13. Air Namibia, SW 43. Hong Kong Airlines, HX 73. Solomon Airlines, IE 14. Air Panama, 7P* 44. Hong Kong Express, UO 74. Somon Air, SZ 15. Air Senegal, HC 45. InterCaribbean Airways, JY 75. South African Airways, SA 16. Air Seychelles, HM 46. Jeju Air, 7C 76. Taca International, TA 17. Air Tahiti Nui, TN 47. Kam Air, RQ 77. Taca Peru, T0 18. Amaszonas, Z8 48. Kenya Airways, KQ 78. TACV Cabo Verde, VR 19. Amaszonas Uruguay, Z7 49. Lacsa, LR 79. TAG, 5U 20. Asky, KP 50. Lao Airlines, QV 80. TAME, EQ 21. ASL Airlines, 5O 51. Luxair, LG 81. TAROM, RO 22. Atlasglobal, KK 52. Malaysia Airlines, MH 82. -

IATA Members

AIRLINE NAME COUNTRY / TERRITORY Aegean Airlines Greece Aer Lingus Ireland Aero Republica Colombia Aeroflot Russian Federation Aerolineas Argentinas Argentina Aeromar Mexico Aeromexico Mexico Africa World Airlines Ghana Air Algérie Algeria Air Arabia United Arab Emirates Air Astana Kazakhstan Air Austral Réunion Air Baltic Latvia Air Botswana Botswana Air Burkina Burkina Faso Air Cairo Egypt Air Caledonie New Caledonia Air Canada Canada Air Caraibes Guadeloupe Air China China (People's Republic of) Air Corsica France Air Dolomiti Italy Air Europa Spain Air France France Air Guilin China (People's Republic of) Air India India Air Koryo Korea, Democratic People's Republic of Air Macau Macao SAR, China Air Madagascar Madagascar Air Malta Malta Air Mauritius Mauritius AIRLINE NAME COUNTRY / TERRITORY Air Moldova Moldova, Republic of Air Namibia Namibia Air New Zealand New Zealand Air Niugini Independent State of Papua New Guinea Air Nostrum Spain Air Peace Nigeria Air Serbia Serbia Air Seychelles Seychelles Air Tahiti French Polynesia Air Tahiti Nui French Polynesia Air Tanzania Tanzania, United Republic of Air Transat Canada Air Vanuatu Vanuatu AirBridgeCargo Airlines Russian Federation Aircalin New Caledonia Airlink South Africa Alaska Airlines United States Albastar Spain Alitalia Italy Allied Air Nigeria AlMasria Universal Airlines Egypt American Airlines United States ANA Japan APG Airlines France Arik Air Nigeria Arkia Israeli Airlines Israel Asiana Airlines Korea ASKY Togo ASL Airlines France France Atlantic Airways Faroe Islands AIRLINE -

International Contacts

International contacts Aer Lingus - Ireland Air Arabia - Morocco Website: http://www.aerlingus.com Website: https://www.airarabia.com/fr Air Canada - Canada Air Europa - Spain Website: Website: http://www.aireuropa.com/ https://www.aircanada.com/ca/en/aco/home.html Air France - France Air Moldova - Moldova Telephone: +33 (0)9 69 39 36 54 Website: http://www.airmoldova.md Website: http://www.airfrance.fr Air Transat - Canada Air Nostrum - Spain Website: https://www.airtransat.com/en-CA/home Website: http://www.airnostrum.es ALSA - Espanha Alitalia - Italy Address: C/ Miguel Fleta 4, 2 28037 Madrid Website: https://www.alitalia.com/it_it/ Telephone: +902 42 22 42 - 91 32 70 540 E-mail: [email protected] Website: http://www.alsa.es American Airlines - United States of America Website: https://www.aa.com/i18n/index.jsp?locale=en_PT Asiana Airlines - South Korea Website: https://flyasiana.com/ Austrian Airlines - Austria Website: https://www.austrian.com/?sc_lang=de&cc=AT Avanza - Spain Telephone: +34 912 72 28 32 Azul Linhas Aéreas Brasileiras - Brazil E-mail: [email protected] Website: http://www.avanzabus.com Website: https://www.voeazul.com.br/home BINTER - Spain Beijing Capital Airlines - China Website: https://intl.jdair.net/ Address: Aeropuerto de Los Rodeos, 38297 La Laguna Santa Cruz de Tenerife España Telephone: +902 391 392 E-mail: [email protected] Website: British Airways - United Kingdom http://www.binternet.com Website: http://www.britishairways.com Brussels Airlines - Belgium Condor - Germany Website: https://www.brusselsairlines.com/fr-be/ Address: Condor Flugdienst GmbH Am Grünen Weg 1 - 3 D65451 Kelsterbach Deutschland Telephone: +49 0 180 5 707202 - +49 6171 65-3602 DAMAS - Spain Fax: +49 6107 93-9440 Address: Av. -

Monthly OTP January 2019

Monthly OTP January 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This may result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – January 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size FA Safair 94.5% 1 2,028 176 3H Air Inuit 33.2% 153 1,488 205 7G Star Flyer 94.5% 2 2,046 174 VC ViaAir 43.0% 152 155 321 NT Binter Canarias 92.8% 3 4,990 105 WG Sunwing Airlines Inc. 43.3% 151 2,876 141 GA Garuda Indonesia 92.0% 4 15,226 41 5J Cebu Pacific Air 45.7% 150 9,305 71 BC Skymark Airlines 91.7% 5 4,614 111 AI Air India 50.2% 149 17,165 34 CM Copa Airlines 91.5% 6 11,123 55 RS Air Seoul, Inc 52.9% 148 1,092 226 JH Fuji Dream Airlines 90.7% 7 2,170 169 WO Swoop 53.1% 147 742 253 B7 Uni Airways 90.6% 8 4,108 120 4N Air North 54.4% 146 416 279 IB Iberia 90.0% 9 16,745 36 Z2 Philippines AirAsia Inc. -

SATA Azores Airlines Great Airline • Great Destinations

Welcome to SATA Azores Airlines Great Airline • Great Destinations Schedule Only year-round non-stop service from Toronto to the Azores; Ponta Delgada (PDL) and Terceira (TER) Non-stop service from Montreal to Ponta Delgada (PDL) Jun-Sep 2021 Shortest flight time from Toronto to Madeira (FNC) Connections across North America with code-share partner Westjet and interline partner Porter Airlines Quick and easy connections within the 9 Azores islands as well as to Lisbon (LIS), Porto (OPO), Madeira (FNC), Cape Verde (RAI), Paris (CDG), London (STN) and Frankfurt (FRA) Fares and Stopovers Fantastic, flexible fares with free stopovers Changes allowed free of charge before departure for tickets issued Jan1-Mar 31, 2021 New dates and fare difference as per fare rules Valid for S4 operated fights Service Friendly, hospitable, Portuguese service Over 70 years of experience Fleet Young Airbus long haul fleet: A321neo & A321neoLR 2 cabins: Economy and Executive class Short haul fleet: A320, Q200 & Q400 All Economy class Destinations The Azores were chosen as one of Travel Zoo's six Best Bet Destinations for Canadians in 2021 In just 5.5hrs your clients could be in Paradise! Unspoiled nature with breathtaking landscapes, hiking, golfing, diving, whale watching, relaxing and much more! Portugal takes 3 of the top 10 spots for most resilient EU destinations Q4.20 (Travelpress Nov 19.20) Health and Safety Links Health and Safety Guidelines for at the airport and aboard the airplane Restrictions and Mandatory Procedures for Entry into Destinations Travel Recommendations SATA Azores Airlines is represented in Canada by Discover the World: Sales Support: 905-766-0136 / 1-833-722-0833 Email: [email protected] Groups/Meetings/Incentives: sata4agents.com (Please ensure you are registered) Address: Unit 31 – 5160 Explorer Drive, Mississauga, ON L4W 4T7 TICO registration #50024574 SATA Azores Airlines website Visit Azores Latest COVID-19 Information Blog | Facebook | Twitter | Youtube | Instagram | Air Store © Copyright 2021 SATA S.A. -

Monthly OTP January 2020

Monthly OTP January 2020 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This may result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG, please email [email protected] MAKE SMARTER MOVES Airline Monthly OTP – January 2020 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size 6O Orbest 100.0% 1 1 329 RS Air Seoul, Inc 42.7% 162 1,034 216 TA TACA International Airlines 97.2% 2 308 277 WO Swoop 42.8% 161 1,062 215 FA Safair 95.8% 3 2,304 156 AI Air India 43.3% 160 16,764 38 GA Garuda Indonesia 95.3% 4 12,708 51 WG Sunwing Airlines Inc. 43.7% 159 3,250 135 JH Fuji Dream Airlines 94.6% 5 2,480 153 3H Air Inuit 45.2% 158 1,479 198 HR Hahn Air 94.1% 6 18 324 SV Saudi Arabian Airlines 55.4% 157 18,105 35 BC Skymark Airlines 93.7% 7 4,920 111 AC Air Canada 55.4% 156 45,239 9 CM Copa Airlines 93.6% 8 10,499 65 JT Lion Air 55.8% 155 18,265 34 SATA International-Azores XQ SunExpress 92.7% 9 2,827 148 S4 56.1% 154 479 255 Airlines S.A.