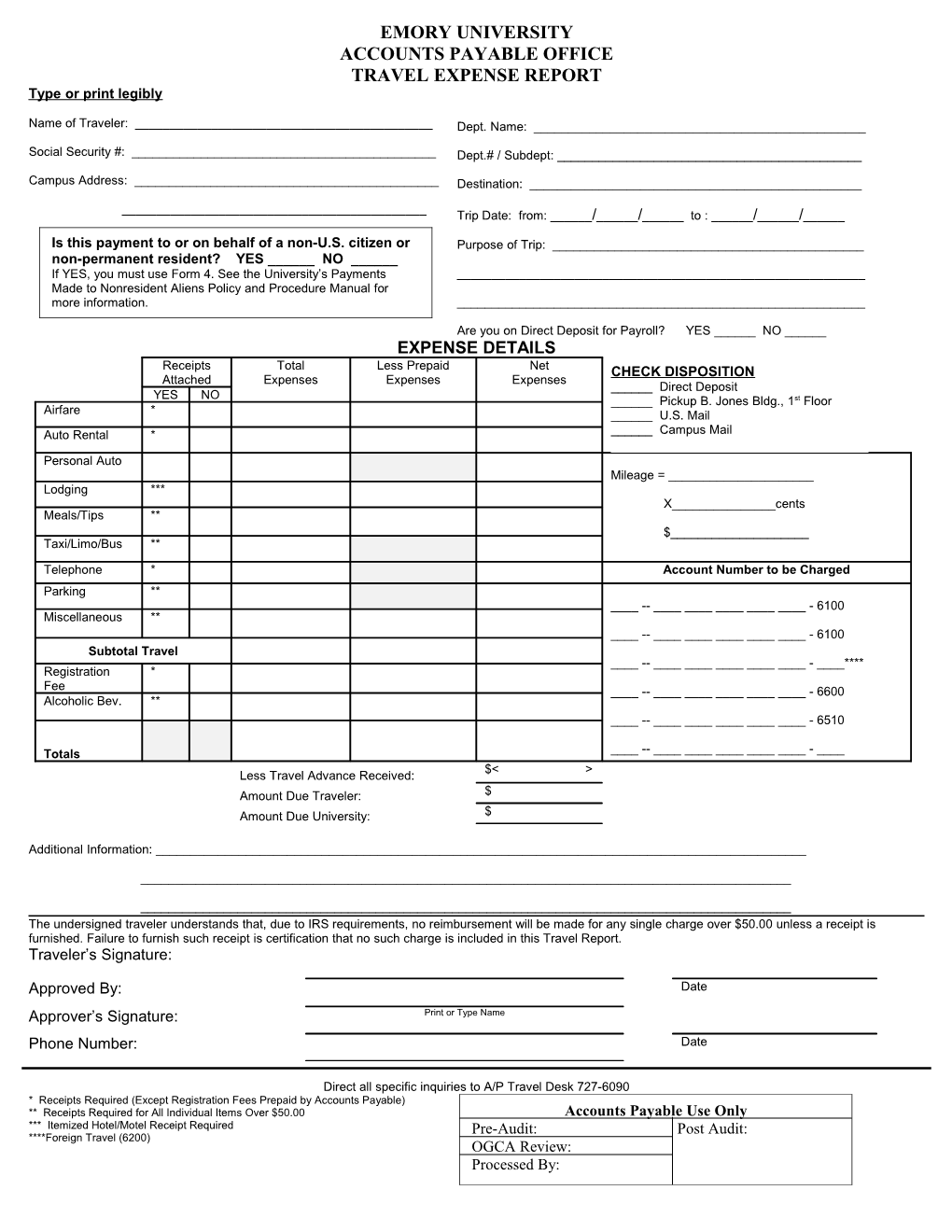

EMORY UNIVERSITY ACCOUNTS PAYABLE OFFICE TRAVEL EXPENSE REPORT Type or print legibly

Name of Traveler: ______Dept. Name: ______

Social Security #: ______Dept.# / Subdept: ______

Campus Address: ______Destination: ______

______Trip Date: from: ______/______/______to : ______/______/______

Is this payment to or on behalf of a non-U.S. citizen or Purpose of Trip: ______non-permanent resident? YES ______NO ______If YES, you must use Form 4. See the University’s Payments ______Made to Nonresident Aliens Policy and Procedure Manual for more information. ______

Are you on Direct Deposit for Payroll? YES ______NO ______EXPENSE DETAILS Receipts Total Less Prepaid Net CHECK DISPOSITION Attached Expenses Expenses Expenses ______Direct Deposit YES NO ______Pickup B. Jones Bldg., 1st Floor Airfare * ______U.S. Mail Auto Rental * ______Campus Mail

Personal Auto Mileage = ______Lodging *** X______cents Meals/Tips ** $______Taxi/Limo/Bus **

Telephone * Account Number to be Charged Parking ** ____ -- ______- 6100 Miscellaneous ** ____ -- ______- 6100 Subtotal Travel ____ -- ______- ____**** Registration * Fee ____ -- ______- 6600 Alcoholic Bev. ** ____ -- ______- 6510

Totals ____ -- ______- ____ $< > Less Travel Advance Received: Amount Due Traveler: $ Amount Due University: $

Additional Information: ______

______

______The undersigned traveler understands that, due to IRS requirements, no reimbursement will be made for any single charge over $50.00 unless a receipt is furnished. Failure to furnish such receipt is certification that no such charge is included in this Travel Report. Traveler’s Signature:

Approved By: Date Approver’s Signature: Print or Type Name Phone Number: Date

Direct all specific inquiries to A/P Travel Desk 727-6090 * Receipts Required (Except Registration Fees Prepaid by Accounts Payable) ** Receipts Required for All Individual Items Over $50.00 Accounts Payable Use Only *** Itemized Hotel/Motel Receipt Required Pre-Audit: Post Audit: ****Foreign Travel (6200) OGCA Review: Processed By: General University Policy Emory University expects to reimburse all reasonable and necessary travel expenses incurred while representing the University. It is expected that faculty/staff will exercise prudent judgment when incurring expenditures consistent with the flexibility afforded by policies and guidelines. These guidelines apply to the reimbursement from all University funds, irrespective of source.

Though travel paid from grants and contracts typically follows the overall University policy, some exceptions do exist. These include grantor pre-authorization required for foreign travel and use of United States flag carriers in connection with foreign travel. Also, automobile mileage and meal limits on certain grants and contracts (e.g., the State of Georgia) are at lower rates than the University policy. Overall, travel expenses charged to a grant or contract cannot exceed the more restrictive grant or contract clauses. University accounts must be used for any excess reimbursement above that allowed on the grant or contract.

Reimbursement requests must include the original signature of the traveler and the individual authorized to approve the travel. All employees (except Emory University Hospital) who receive payroll by direct deposit will be reimbursed by direct deposit.

Expenditure Limits and Constraints Generally, first class air travel is not reimbursable. The mileage allowance for business use of a personal automobile is $.31 per mile (effective 06/01/1996). Meals may be reimbursed up to $50 daily with no justification of the cost. For daily expenditures which exceed $50, justification and approval by an authorized signature must be included. For all individual meals costing more than $50, an original receipt is required by the IRS. If the cost of the meal includes guests, those persons must be identified and the business purpose of the meal indicated. Any purchase of alcoholic beverages must be separately identified on the reimbursement form (required by the federal government).

Expenditures Not Reimbursable Personal entertainment, valet services, and airline travel club fees, such as the Delta Crown Room are not reimbursable. The traveler will not be reimbursed for costs incurred by failure to cancel transportation, hotel reservations, conference registrations, or other travel-related activities. The traveler should not accept insurance offered by auto rental agencies as this expense is not reimbursable. Automobile upgrades are not reimbursable.

Receipts Required Airfare/Rail Ticket Stub (the original passenger receipt/coupon connected to the ticket which indicates the traveler’s name, destination, dates of travel, and cost) should be attached. Original receipts must be provided for lodging, vehicle rental, registration fees, and individual meals costing more than $50. Any other individual expense exceeding $50, such as parking or taxi/limo will not be reimbursed without a receipt. Receipts that are not letter size must be taped to a white sheet of paper (8 ½ x 11). Several receipts may be taped to each sheet of paper (one side only). This process will significantly improve the review of receipts and will assist in the scanning process. Please do not overlap receipts or turn vertically on the paper.

Travel Expense Checklist For Reviewer:

I have…

______Reviewed for proper account number and authorized signer.

______Ensured all required receipts are attached. a) The receipts are original. b) Receipts are attached for any expenditures over $50. c) The original passenger receipt/coupon from the airline ticket is attached. (Travel itineraries or boarding passes are excluded.) d) Receipts that are not letter sized must be taped to a white sheet of paper (one side only – 8 ½ x 11).

______Ensured the daily meal allowance does not exceed $50. I have provided a written explanation, approved by an authorized signer, for any day which exceeds this amount and a receipt for any meal over $50.

______Verified all math calculations including a review of mileage calculations ($.31 per mile).

______Provided a written explanation, approved by an authorized signer, for any change in airline reservations which resulted in additional charges.