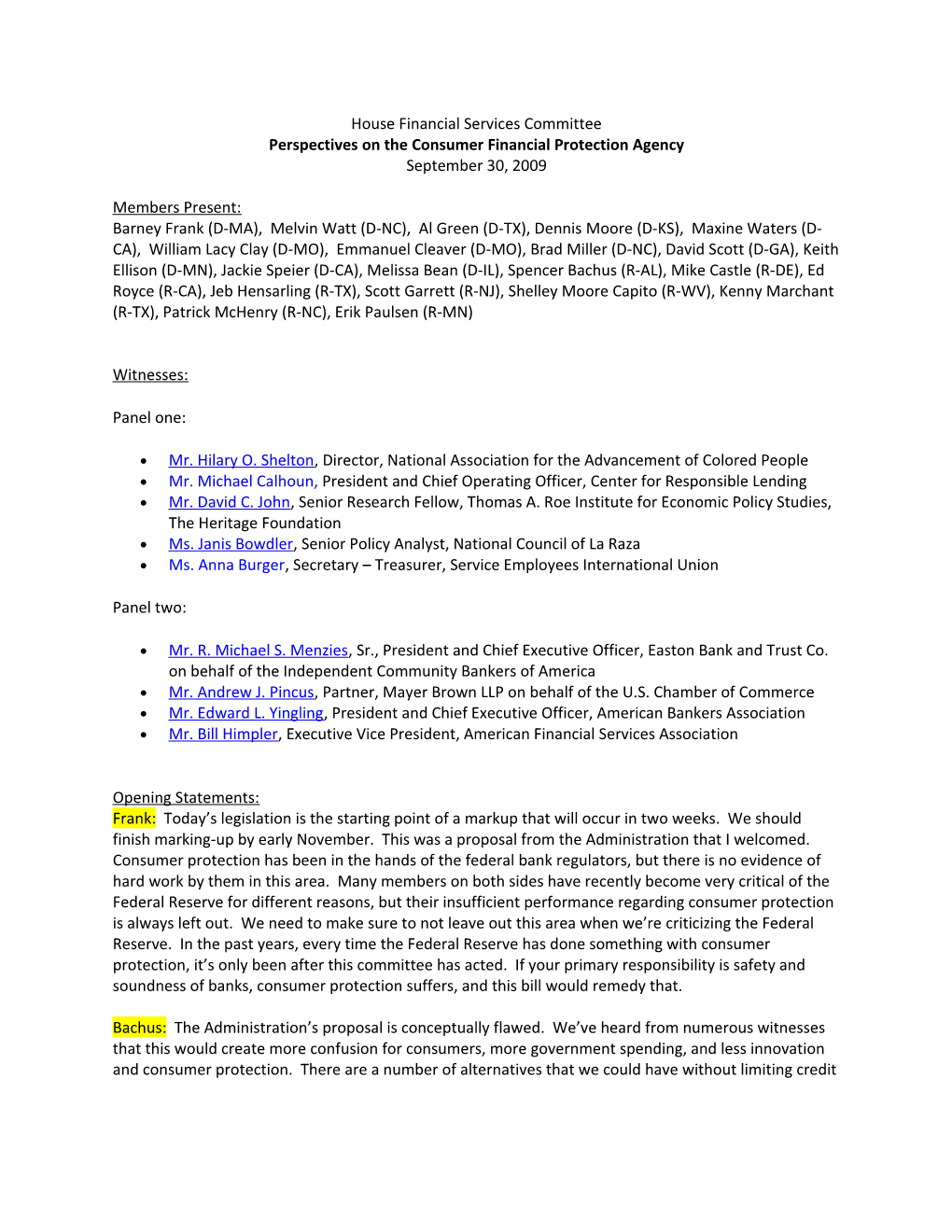

House Financial Services Committee Perspectives on the Consumer Financial Protection Agency September 30, 2009

Members Present: Barney Frank (D-MA), Melvin Watt (D-NC), Al Green (D-TX), Dennis Moore (D-KS), Maxine Waters (D- CA), William Lacy Clay (D-MO), Emmanuel Cleaver (D-MO), Brad Miller (D-NC), David Scott (D-GA), Keith Ellison (D-MN), Jackie Speier (D-CA), Melissa Bean (D-IL), Spencer Bachus (R-AL), Mike Castle (R-DE), Ed Royce (R-CA), Jeb Hensarling (R-TX), Scott Garrett (R-NJ), Shelley Moore Capito (R-WV), Kenny Marchant (R-TX), Patrick McHenry (R-NC), Erik Paulsen (R-MN)

Witnesses:

Panel one:

Mr. Hilary O. Shelton, Director, National Association for the Advancement of Colored People Mr. Michael Calhoun, President and Chief Operating Officer, Center for Responsible Lending Mr. David C. John, Senior Research Fellow, Thomas A. Roe Institute for Economic Policy Studies, The Heritage Foundation Ms. Janis Bowdler, Senior Policy Analyst, National Council of La Raza Ms. Anna Burger, Secretary – Treasurer, Service Employees International Union

Panel two:

Mr. R. Michael S. Menzies, Sr., President and Chief Executive Officer, Easton Bank and Trust Co. on behalf of the Independent Community Bankers of America Mr. Andrew J. Pincus, Partner, Mayer Brown LLP on behalf of the U.S. Chamber of Commerce Mr. Edward L. Yingling, President and Chief Executive Officer, American Bankers Association Mr. Bill Himpler, Executive Vice President, American Financial Services Association

Opening Statements: Frank: Today’s legislation is the starting point of a markup that will occur in two weeks. We should finish marking-up by early November. This was a proposal from the Administration that I welcomed. Consumer protection has been in the hands of the federal bank regulators, but there is no evidence of hard work by them in this area. Many members on both sides have recently become very critical of the Federal Reserve for different reasons, but their insufficient performance regarding consumer protection is always left out. We need to make sure to not leave out this area when we’re criticizing the Federal Reserve. In the past years, every time the Federal Reserve has done something with consumer protection, it’s only been after this committee has acted. If your primary responsibility is safety and soundness of banks, consumer protection suffers, and this bill would remedy that.

Bachus: The Administration’s proposal is conceptually flawed. We’ve heard from numerous witnesses that this would create more confusion for consumers, more government spending, and less innovation and consumer protection. There are a number of alternatives that we could have without limiting credit and creating a new government bureaucracy. The Republicans have an alternative proposal. This bill gives the agency the power to create products for consumers, and this is problematic.

Panel 1

Highlights from Witness Testimony: Shelton: We are very supportive of the CFPA. The lack of standard rules has been the financial stagnation of many families and communities. One effect has been the near collapse of our entire financial system. I’ve provided numerous examples of the effect this has had on racial and ethnic minorities and that they have been targeted. The CFPA would provide the government with the tools necessary to make sure that the rules are fair for everyone. We are supportive of the latest provision that creates an Office of Fair Opportunity. We would like to strengthen this legislation and see regulation of the CRA fall under the CFPA’s regulation. However, along with this, we still need stronger laws to prevent the other problems with the financial system.

Calhoun: What would’ve happened over the last 10 years if proposed reforms had been in place? The proposed CFPA would’ve prevented a lot of the problems. But if we do this wrong, it will make things worse. First, we need to create an independent agency. Second, we need to cover products, not labels. We need to make sure to prevent the gaps of unlevel rules. Third, we need to make sure not to insulate abusive practices with preemption. Fourth, we need to provide effective enforcement.

John: I thoroughly agree that consumer regulation has been faulty and that the regulators have not given this the attention it needs. I think it would be a better approach to coordinate efforts of the existing agencies. A council would be a better approach that has representatives from other agencies, appointed experts, and state representatives. States would have flexibility in implementing regulation. This approach would preserve regulation of state agencies that are currently under state regulation. It would also include the SEC and the CFTC. By using existing regulators, their individual efforts can be better monitored. Through proper congressional oversight, Congress and state legislators could better pinpoint the efforts.

Bowdler: Latino families have particularly been hard hit by the recent events. Market forces have created real barriers to accessing financial products even if the people are qualified. Federal regulators failed to act. We have to change the federal oversight system. We need greater accountability. The proposed CFPA would help fill the gaps of the system. Along with the creation of equal opportunity, it will help determine unfair practices targeted at certain groups of people. We think it should be strengthened in some ways. We need to eliminate loopholes for brokers and reinstate a community- level assessment.

Burger: We strongly support the CFPA, especially the whistleblower protection that it includes. We believe it is an important building block to reform.

Questions and Answers: Waters: You speak of the CFPA as a huge bureaucracy that would harm consumers rather than help them, and you say your council would be a better way to go about this. It sounds as if you’re just rearranging everything. You want to leave the same regulators in place who did not exercise this responsibility before. John: When you establish a new agency, the first thing you’re going to do is move people into a new place and disrupt activity. What I’m proposing is simple. When Congress has moved the regulators and said that they have not met their responsibilities, they’ve come up with good alternatives to get them to do the job. I think this council will serve the same purpose. It keeps the same regulators in place, and they’ll have a good idea about the institution that they’re regulating already. Moving everyone under one roof doesn’t necessarily improve the activities. Waters: In this crisis, as it was pointed out, certain communities were targeted. Do you think these communities who were targeted are still being hurt today? Would they be happy with this council? Bowdler: No, I don’t think that will give us the results we want. We want to get the good guys in our neighborhoods and make sure they’re competing to give us good products.

Castle: I’m concerned about what the consumers know and don’t know. I think we need to do a lot more financial literacy. I agree with the idea about the council. The CFPA will have the exclusive authority to promulgate the consumer protection rule, but should we provide other regulators with a check-and-balance with this power? Calhoun: The agencies did use joint guidance over the past few years with consumer protection, and it didn’t work. We supported the addition of the oversight board to the draft. John: The regulators who have a much better idea about what’s going on in their industry much have a strong influence in this. What I’m proposing doesn’t exist. It would be a formal arrangement, not just an informal agreement that exists now.

Frank: We seem to agree that we need a new agency. John: Well my council would just be a new arrangement. It would have a very limited statutory authority. Frank: You are proposing a new agency, but you’re just taking people from other agencies and putting them together. In the period before preemption around 2004, have you found many problems with conflicting mandates? John: I have not done any studies on that. Frank: This is not an anti-bank bill. It will force non-bank institutions to follow the same rules that banks have followed already. Also with financial literacy, we expect this to be an aspect of the CFPA.

Watt: You said that it seems to be implicit that there should be inclusion of states in your council, in implementing regulation, etc. Do you support maintaining states standards, and not preempting them at the federal level? John: I believe states should continue to have authority over the areas where they have already been regulating. Watt: There are a lot of entities that are not regulated banks. I think this CFPA would have full authority to check all other things that weren’t under federal regulation before. Calhoun: Yes, I think the recent changes in this bill make that clear, and that’s one of the most important things. Watt: With the preemption issue, one approach is going through and specifying things that are not preempted. There was a list that we came up with. Would this be an approach that might be acceptable in this context? Calhoun: I think the point is that states can enact laws unless they significantly impair federal laws. There are proposals to conserve preemption as well as expand preemption.

Hensarling: What are your views about what is fair and unfair? For example, pay day lending. Shelton: I think payday lending is absolutely necessary, but it’s extremely unfair. Hensarling: If it’s unfair, it could be outlawed by the CFPA. Shelton: Outlawed and regulated are different things. Some products should be made unlawful. Hensarling: You could look in the marketplace and find credit cards that have universal default. Is that unfair or abusive? Bowdler: That’s not really our approach that we would take with those kinds of products. We need to spot trends that have impacts. If a product has a routinely negative effect on a community, we want less harmful products to be promoted in that community. Hensarling: If the CFPA would outlaw certain credit cards, would that be a concern? Bowdler: We’ve never advocated for banning products and that’s not our approach. There are a lot of credit cards, loans, etc. that are not being used. We need incentives to get those positive products that actually build wealth.

Moore: Do you really think existing law could prevent another crisis? John: I think there are so many different causes of the crisis. If the laws that exist on the books had been properly enforced and carefully considered, I think it would’ve gone a long way to prevent a consumer product breakdown. One of the problems is that it is not one of the key responsibilities of the current regulatory agencies. I think you can make it one without disrupting the current system. Moore: What would you say was the important cause of the crisis? Shelton: Lack of consumer protection. John: I think they’re far too serious to be limited. Bowdler: You had unregulated entities flooding the market and the absence of banks that had favorable products. Burger: I agree.

McHenry: Can you regulate consumer protection from financial institutions without a safety and soundness provision being a part of that? John: No, you are likely to find a situation where a practice is encouraged that may be detrimental to the institution.

Clay: The Federal Reserve has asked for additional authority for protecting consumers, but we know what their record has been in this area. Do you feel as though we should give it to them? John: Well the Federal Reserve authority for systemic risk would not be possible. I would hope that the effective oversight would not be the regulator but in situations like this where questions are being asked. Clay: What would the CFPA’s role in financial literacy be? Calhoun: It’s not a solution, but it would be a part of it.

Marchant: Would your council accept complaints from the public? John: I think the individual regulators would accept the complaints from the public. Marchant: You would give the power to address systemic risk and make recommendations to the regulators? John: Yes.

Scott: Would it be better to allow bond credit to operate under the current regulatory regulation? Calhoun: I would caution against creating these exemptions. They have created danger in the past. Scott: I want to allow them to operate under current regulation.

Green: You’ve said the Council would create uniform standards for examinations of financial institutions and that the standards would not be imposed but recommended, so how would the recommendations become enforced? John: If the regulator does not adhere to a particular standard, it’s Congress’s responsibility. Green: So it would take an act of Congress to pressure the agency to adhere to it. You’ve also indicated that there should be one representative from each agency and elected representatives from the states. John: It would be one representative from each state agency. They would all have voting power.

Bean: Do you think the CFPA would do a good job updating the rules? Calhoun: Yes I do. Burger: We need an agency that looks at the consumers first and not last. Bowdler: We think this is an opportunity to promote good products and not just ban others. Bean: How large would the staff of the CFPA need to be? Calhoun: I think there are ways to encourage compliance and streamline this. I am concerned about unlimited preemption though, because the power to act is also the power to not act. I have fears about putting all eggs in one basket. Panel 2

Highlights from Panel Two Witness Testimony: Menzies: Community banks do not have geographical reach or huge legal departments. We cannot afford to place consumer protection below anything else. The CFPA will make it harder for community bankers to offer competitive products. Congress should address the too-big-to-fail firms and the non- bank financial institutions that are unencumbered by government regulation and accountability. We appreciate your changes to the bill, including the “plain vanilla” products provision. We object to the separation of safety and soundness from consumer protection. Community banks have done an excellent job of both of these. We agree that under-regulation caused the crisis, but we disagree with the solution of placing community banks under a new regulatory regime.

Pincus: We support enhancing consumer protection, but we oppose this bill because it will have unintended, harmful consequences to consumers. Separating consumer protection from safety and soundness is harmful.

Yingling: It is important to focus on what the problem areas were: need for more direct focus on consumer issues and more enforcement for non-banks. It is not clear why new authorities are needed with a CFPA. The CFPA goes well beyond addressing these weaknesses and unnecessarily proposes new burdens for banks. One of our major concerns is that it is not adequately focused on the non-bank. We support the preemption of state laws. Without them, there will be a confusing patchwork of laws. There has been little justification for the broad new powers of the CFPA. The delegation of authority of the CFPA is so vast that it would have power over all consumer laws. We oppose the creation of an entirely new agency because you cannot regulate the products from outside of that agency.

Himpler: Finance companies are regulated by consumer laws and state laws. We undergo vigorous examinations and are subject to oversight of state regulators. The CFPA would try to fix what is already working and uses a one-size-fits-all approach. There’s no guarantee that it would be better able to weed out bad practices. We should not think more bureaucracy is the best solution. Financial services customers would have less borrowing ability under the CFPA. Under their jurisdiction, finance companies will experience costs that will be passed onto borrowers. We believe that creation of the CFPA will not fulfill the goals of consumer protection.

Questions and Answers: Hensarling: I’ve heard some say the primary reason of this crisis because people like you steered consumers into risky products because of profits. How much profit do you really make? Menzies: What really caused the crisis? Do we believe it was community banks that people live with in the local communities? Hensarling: You still have concerns about mandatory plain vanilla or highly suggested plain vanilla? Menzies: I don’t think we’ve done a good job of clarifying this. The community banks are not in the business of products. We’re going to lose the competitive advantage that we have.

Watt: You say there’s no real case for change here, even after hearing about all of the experiences that we’ve been through. You’re concerned about one-size-fits-all, but there’s no size difference for protection consumers. There are consumers out there demanding that we do something to protect them, and you all say that we don’t need it. Yingling: I meant that the focus of such change needs to be on the two factors that really caused the problem. One was the lack of focus and the second is the enforcement was on the bank side and not the non-bank side. If you look at the actual authority, it wasn’t the problem. The regulators had the authority to address these issues, but they didn’t, so it’s an issue of focus.