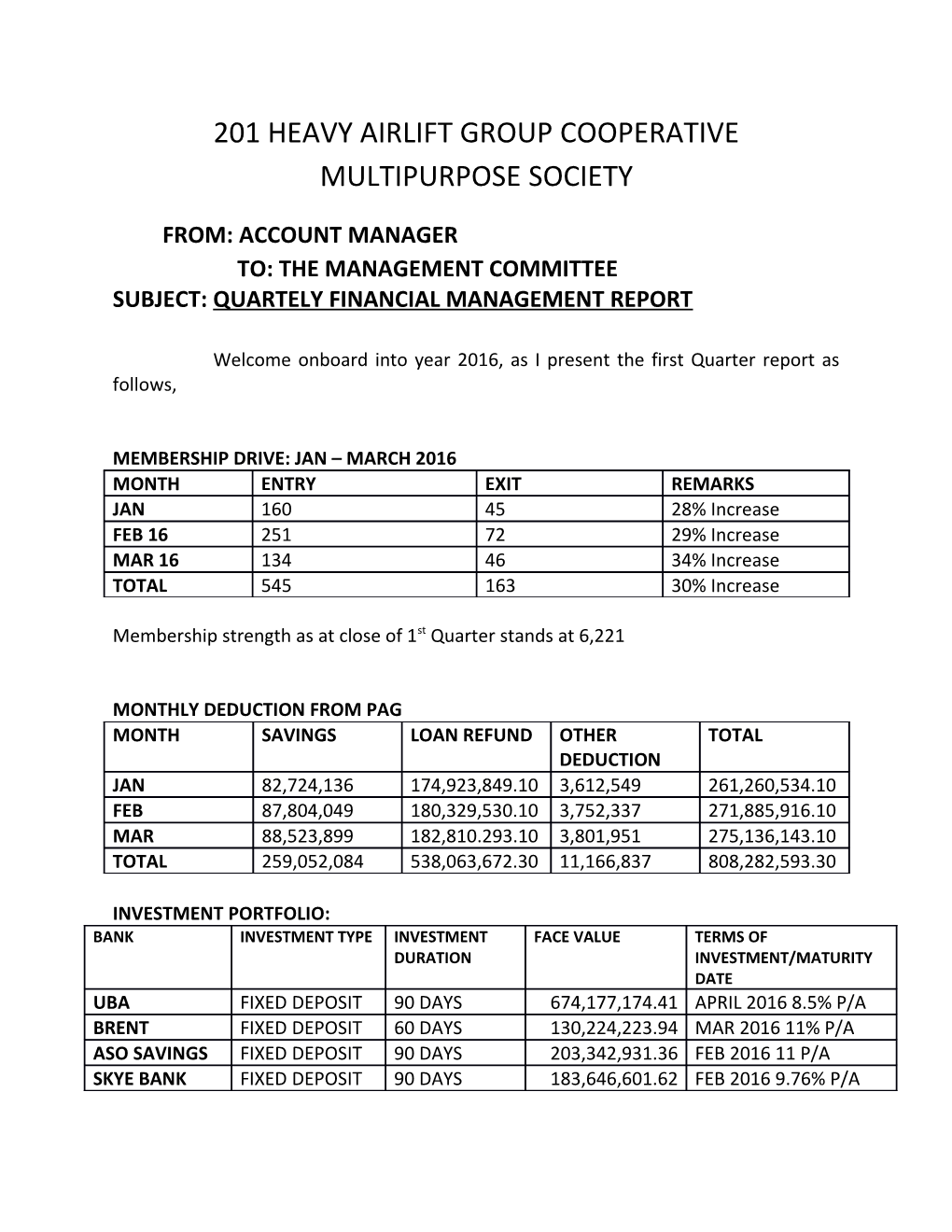

201 HEAVY AIRLIFT GROUP COOPERATIVE MULTIPURPOSE SOCIETY

FROM: ACCOUNT MANAGER TO: THE MANAGEMENT COMMITTEE SUBJECT: QUARTELY FINANCIAL MANAGEMENT REPORT

Welcome onboard into year 2016, as I present the first Quarter report as follows,

MEMBERSHIP DRIVE: JAN – MARCH 2016 MONTH ENTRY EXIT REMARKS JAN 160 45 28% Increase FEB 16 251 72 29% Increase MAR 16 134 46 34% Increase TOTAL 545 163 30% Increase

Membership strength as at close of 1st Quarter stands at 6,221

MONTHLY DEDUCTION FROM PAG MONTH SAVINGS LOAN REFUND OTHER TOTAL DEDUCTION JAN 82,724,136 174,923,849.10 3,612,549 261,260,534.10 FEB 87,804,049 180,329,530.10 3,752,337 271,885,916.10 MAR 88,523,899 182,810.293.10 3,801,951 275,136,143.10 TOTAL 259,052,084 538,063,672.30 11,166,837 808,282,593.30

INVESTMENT PORTFOLIO: BANK INVESTMENT TYPE INVESTMENT FACE VALUE TERMS OF DURATION INVESTMENT/MATURITY DATE UBA FIXED DEPOSIT 90 DAYS 674,177,174.41 APRIL 2016 8.5% P/A BRENT FIXED DEPOSIT 60 DAYS 130,224,223.94 MAR 2016 11% P/A ASO SAVINGS FIXED DEPOSIT 90 DAYS 203,342,931.36 FEB 2016 11 P/A SKYE BANK FIXED DEPOSIT 90 DAYS 183,646,601.62 FEB 2016 9.76% P/A Investment status of the cooperative society as at end of 1st quarter stands at ₦1,191,390,931.33 (One Billion, One hundred and Ninety One million, Three hundred and Ninety thousand, Nine hundred and Thirty One naira, Thirty Three kobo only).

LOAN MANAGEMENT MONTH LOAN GRANTED LOAN REFUND REMARKS JAN 254,573,600 174,923,849.10 68% Increase FEB 209,766,250 180,329,530,10 85% Increase MAR 226,260,600 182,810,293.10 80% Increase TOTAL 690,600,450 538,063,672.30 77% Increase

Total number of loan beneficiaries for the 1st Quarter 1,003 Members

STATEMENT OF ACTIVITIES FOR THE PERIOD ENDED 31st March 2016 INCOME GENERATED AMOUNT LOAN INTEREST RECEIVED 41,064,120.50 INVESTMENT INTEREST RECEIVED 12,694,423.04 TOTAL 53,758,543.54

LESS OPERATING EXPENCES AMOUNT STAFF SALARY & WAGES 965,000 Bookkeeper fees 1,700,000 Administrative Expenses 923,980 SUB TOTAL 3,588,980 NET SURPLUS REALISED 50,169,563.54

STATEMENT OF FINANCIAL POSITION AS AT March 31st 2016 CURRENT ASSETS AMOUNT Loan A/C 2,226,349,009.87 Investment A/C 1,191,390,931.33 Coop Shops 44,000,000 Receivables 275,136,143.10 Cash and Balances with Banks 121,633,114.34 Total 3,858,509,198.64 LIABILITIES/EQUITY Members Savings 3,475,795,140.97 Statutory Reserves 382,714,057.67 Total Net Worth 3,858,509,198.64 STAFF MANAGEMENT Staff performance for the 1st Quarter witness low performance this was due to the shortage of 2 staff in the cooperative department aside from the two Excos deployed to the cooperative secretariat to compliment the effort of the staff, we only have three working staff at the moment and their job is to attend to cooperative complains, process their loan and household equipment application forms, finally posting their ledger, however at the moment we have more than Six thousand cooperators to cover in a month, I appeal to the management committee to employ more capable and qualified hand to fill in the vacuum.

COMPLIANCE WITH THE SOCIETY FINANCIAL REGULATIONS The management committee conducts their affair within the abit of the society law and regulation.

ASSESMENT OF PROGRESS Membership strength: Recorded steady growth from less than six thousand members as at the end of 2015 now to over six thousand members

Surplus realized: Despite the economy challenges facing the country at the moment the society was able to realize ₦ 50,169,563.54 as surplus as at the end of 1 st quarter considering the 7% of expenditure over the income this shows the prudent management of the society resources by the current executives committee of the society.

Loan Management: Loan granted within the 1st Quarter was ₦ 690,600,450 with total number of 1,003 members as beneficiaries while ₦ 538,063,672.30 was refunded within the period which represents 77% of loan granted.

Net Worth: The Cooperative society net worth as at the close of 1st Quarter is ₦3,858,509,198.64 Report Overview: The management report has shown the financial performance of the management committee for the 1st quarter which reveals the level of progress recorded so far, I enjoin the management to maintain the trend.

Reporting

ABIDOYE GD ACCOUNT MANAGER