Dear All,

Afghan United Bank wishes to receive proposals from the advisory firms for the Compliance training of AUB staff and invites to submit a proposal for our consideration by no later than 4:30 pm, 31h January, 2017. Further details of our bank could be sought from http://www.afghanunitedbank.com/english/

The requested services, and other relevant information follows;

Requested Services Compliance/AML/CFT Training

Key Dates Proposal submission due: (4:30 pm, 31th January, 2017) Selection of Trainers: (05th Februray, 2017) Venue of the Training: AUB Training Centre – Head Office- Kabul Afghanistan.

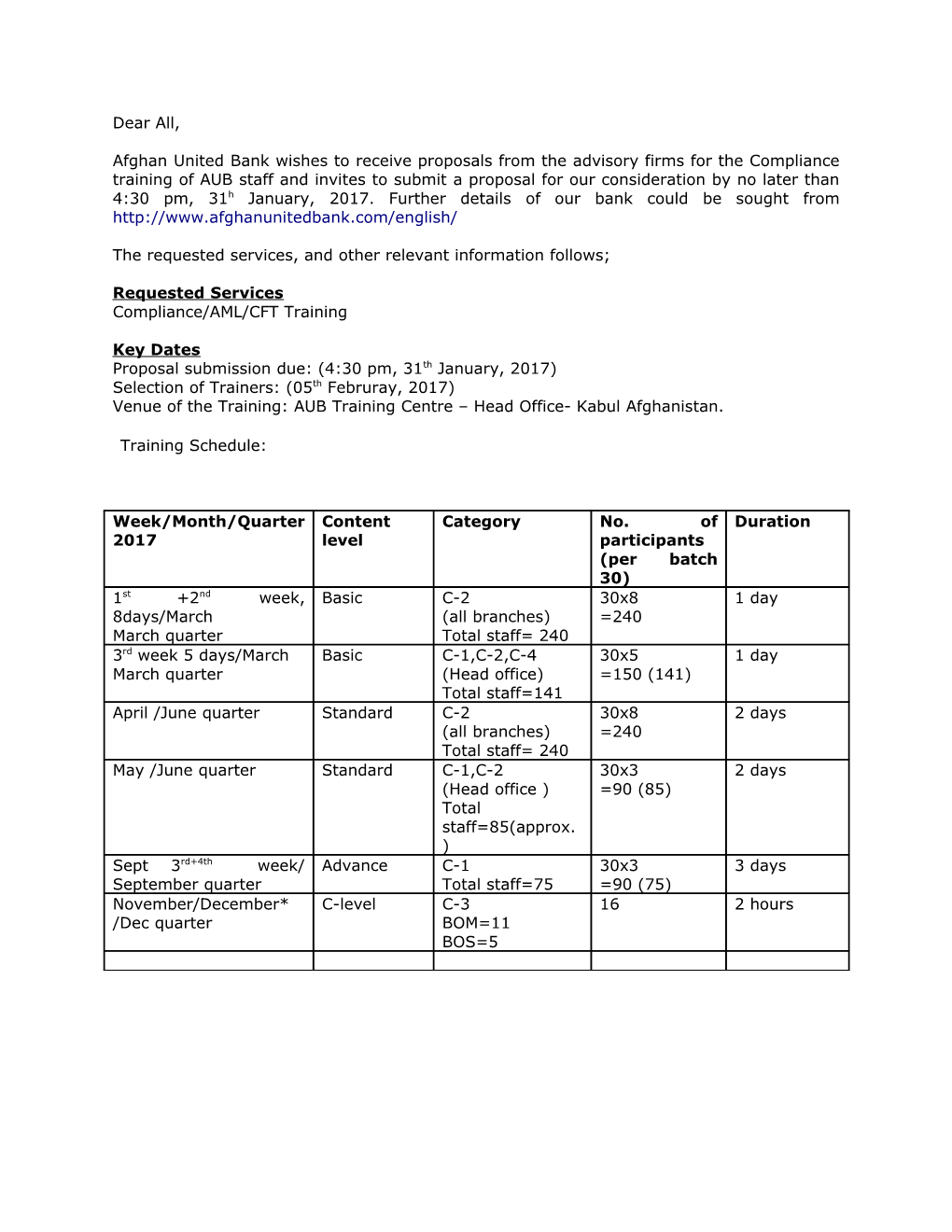

Training Schedule:

Week/Month/Quarter Content Category No. of Duration 2017 level participants (per batch 30) 1st +2nd week, Basic C-2 30x8 1 day 8days/March (all branches) =240 March quarter Total staff= 240 3rd week 5 days/March Basic C-1,C-2,C-4 30x5 1 day March quarter (Head office) =150 (141) Total staff=141 April /June quarter Standard C-2 30x8 2 days (all branches) =240 Total staff= 240 May /June quarter Standard C-1,C-2 30x3 2 days (Head office ) =90 (85) Total staff=85(approx. ) Sept 3rd+4th week/ Advance C-1 30x3 3 days September quarter Total staff=75 =90 (75) November/December* C-level C-3 16 2 hours /Dec quarter BOM=11 BOS=5 Scope of the Assignment Following is the Scope of Training that the subject firms are expected to provide to the AUB staff, but is not limited to:

Sl.No. Contents Subjects (minimum to cover) Target Category level Group Simulation 1. Basic a. overview of AML & CFT All staff C-1,C-,2,C-4 regulations; b. Internal risk based ML/CFT policies and procedures; c. STR/SAR reporting procedure; d. ongoing monitoring and sanction screening mechanism; e. Understand the bank’s Compliance program. f. Understand specific risks and red flags associated with customers, products, and transactions in their area of work g. Understand the concept of suspicion and suspicious transactions. h. Understand the suspicious transactions indicators i. Understand the internal reporting procedure for suspicions j. Understand legal provisions against unauthorized disclosure of reporting activity k. Understand potential penalties under the law l. KYC (know your customer) concept m. Customer Due Diligence (CDD) n. Enhance Due Diligence (EDD) e.g. for PEPs and religious bodies o. Account acceptance criterion p. Risk rating of customer as well as its Transaction profile 2. Standard a. Basic as above Branch C-2 b. Practical CDD, EDD, Customer staff, acceptance and retention with Relationship case study Managers c. Supply of information to management over suspicious transaction d. Systematic transaction monitoring and ongoing customer monitoring e. Understanding risk indicators in customer’s transaction profile and red-flagging in a practical sense. f. Advance level customer and beneficial owner identification, verification and risk profiling g. Updating of information and asset freezing h. Operation/assessment procedure of Self-Assessment Report & Independent Testing i. Periodic and Trigger Event Reviews, Independent Testing & Record keeping j. Working as 1st level defense of AML/CFT regulations k. Understanding all layers of ML/CFT 3. Advanced a. Basic and standard as above Control C-1 b. Advanced level understanding function of information flow and management and asset Designated freezing HO back c. Advanced level offices Staff operation/assessment procedure of Self-Assessment Report & Independent Testing d. Advanced level Periodic and Trigger Event Reviews, Independent Testing & Record keeping e. Investigation and monitoring of AML/CFT rules in the Bank e.g. KYC,KYE,CDD,EDD,Reporting suspicions activities f. Trade based money laundering training for the trade professional employees who deal with foreign or domestic trade g. UNSCR screening related training for all employees who deal with international transactions h. customer relations and account opening; credit fraud and ML related training for all the employees who deal with advance and credit of the bank i. Understanding corresponding banking and cross border transaction AML/CFT Risks j. Risk-based approach in the context of providing correspondent banking services k. Nested (downstream) correspondent banking l. Assessment of the respondent bank’s AML/CFT controls m. the role of banks processing cross-border wire transfers n. Ongoing Risk Monitoring with Higher risk scenario, Lower risk Scenario, Risk variables, Counter Measures for Risk , Enhanced due diligence measures, Simplified CDD measures, Ongoing due diligence etc.

4. C-level Summarized version of AML/CFT BOM & BOS C-3 regulation understanding as well as members managerial, leadership and policy making role on Bank wide compliance.

The training should include real-world examples of transactions that constituted money laundering and terrorist financing, and an awareness of the role that staff play in the overall process of detecting and punishing money launderers and terrorist financers.

Requested Proposal Information In responding to this request, we request the following information:

1. A description of your firm’s experience in providing training Services. 2. The names of all personnel expected to have with key responsibilities for the engagement, with accompanying biographies and qualifications.

4. The names and contact information for other Afghan Commercial Banks that have been serviced by the key parties to be assigned for such type of engagement so that AUB can contact these persons for reference purposes.

6. A description of your firm’s core competencies and an accompanying statement of why you believe that your firm’s services can add unique value.

8. Proposed fees quoted either as a fixed amount or rate per hour. Please be sure to clearly disclose if estimated incidental expenses such as travel and supplies will be included in your base fee, or if such costs will be billed in addition to the quoted base fee.

Proposals should be sent to: