March 28, 2018

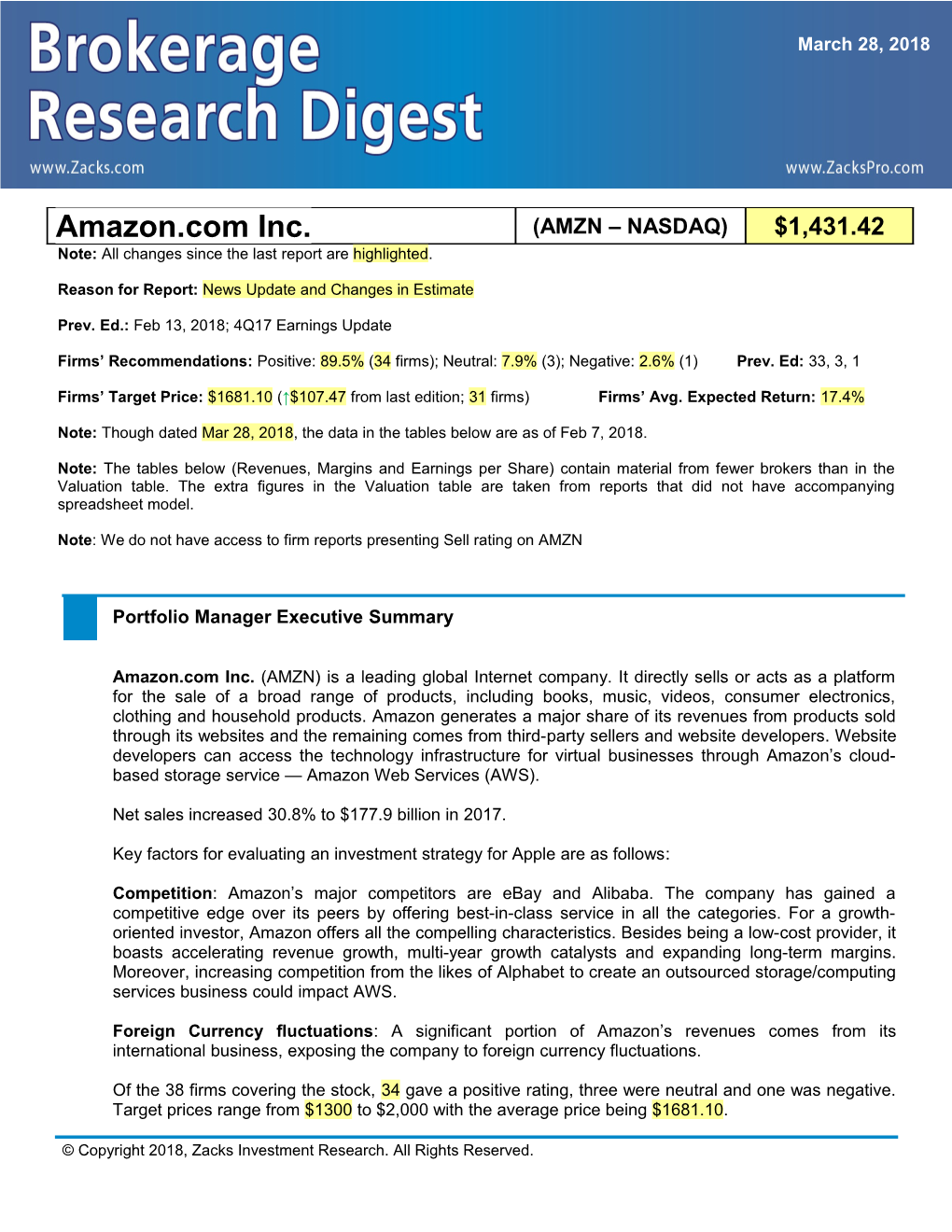

Amazon.com Inc. (AMZN – NASDAQ) $1,431.42 Note: All changes since the last report are highlighted.

Reason for Report: News Update and Changes in Estimate

Prev. Ed.: Feb 13, 2018; 4Q17 Earnings Update

Firms’ Recommendations: Positive: 89.5% (34 firms); Neutral: 7.9% (3); Negative: 2.6% (1) Prev. Ed: 33, 3, 1

Firms’ Target Price: $1681.10 (↑$107.47 from last edition; 31 firms) Firms’ Avg. Expected Return: 17.4%

Note: Though dated Mar 28, 2018, the data in the tables below are as of Feb 7, 2018.

Note: The tables below (Revenues, Margins and Earnings per Share) contain material from fewer brokers than in the Valuation table. The extra figures in the Valuation table are taken from reports that did not have accompanying spreadsheet model.

Note: We do not have access to firm reports presenting Sell rating on AMZN

Portfolio Manager Executive Summary

Amazon.com Inc. (AMZN) is a leading global Internet company. It directly sells or acts as a platform for the sale of a broad range of products, including books, music, videos, consumer electronics, clothing and household products. Amazon generates a major share of its revenues from products sold through its websites and the remaining comes from third-party sellers and website developers. Website developers can access the technology infrastructure for virtual businesses through Amazon’s cloud- based storage service — Amazon Web Services (AWS).

Net sales increased 30.8% to $177.9 billion in 2017.

Key factors for evaluating an investment strategy for Apple are as follows:

Competition: Amazon’s major competitors are eBay and Alibaba. The company has gained a competitive edge over its peers by offering best-in-class service in all the categories. For a growth- oriented investor, Amazon offers all the compelling characteristics. Besides being a low-cost provider, it boasts accelerating revenue growth, multi-year growth catalysts and expanding long-term margins. Moreover, increasing competition from the likes of Alphabet to create an outsourced storage/computing services business could impact AWS.

Foreign Currency fluctuations: A significant portion of Amazon’s revenues comes from its international business, exposing the company to foreign currency fluctuations.

Of the 38 firms covering the stock, 34 gave a positive rating, three were neutral and one was negative. Target prices range from $1300 to $2,000 with the average price being $1681.10.

© Copyright 2018, Zacks Investment Research. All Rights Reserved. Positive or equivalent (89.5%; 34 firms): These firms are optimistic about Amazon’s leading position in the e-commerce space and its high margin Amazon Web Services (AWS) business. They believe that the online retail space still has plenty of room to grow and Amazon’s size advantage, strong global network of fulfillment centers and investments in cutting-edge technologies will help it expand market share. They believe Amazon will continue to seize market share from competitors owing to its solid reputation for reliability, popular Prime loyalty program, and sophisticated network of fulfillment centers that drives selection and convenience. These firms are also encouraged by growth of the company’s high margin AWS business. They believe that the Whole Foods acquisition creates another growth opportunity through grocery expansion. Moreover, these firms believe that Amazon is well poised to gain share in new markets such as advertising, business-to-business commerce, and healthcare.

Neutral or equivalent (7.9%; 3 firms): These firms believe that Amazon has considerable long-term profit potential, but at the same time are concerned about profit growth that is likely to fluctuate given the company’s ongoing and planned heavy investments. Amazon continues to invest heavily in fulfillment centers, TV shows and movies, AWS, acquisitions, India expansion and what not. The firms believe that Amazon’s global margins are likely to be under pressure at least for a few years in the future. These firms are also worried about higher shipping costs and mounting competition in online retailing and cloud computing.

Negative or equivalent (2.6%; 1 firm):

Mar 28, 2018

Overview

Based in Seattle, WA, Amazon.com, Inc. (AMZN) is the world's leading online merchandiser with over 200 million active customers. The company, which began as a bookseller in 1995, sells a wide range of products through its online stores as well as through partnerships (and co-branded sites) with online and traditional retailers. It operates websites in the U.S., Canada, the U.K., Germany, France, China and Japan. Amazon was one of the first to sell online, setting a benchmark in the retail industry. The company operates websites that sell various products and services, which primarily include apparel, shoes and accessories; health and personal care; baby care products; books; camera and photography; and consumer electronics. Amazon Prime is a membership program that offers fast shipping of purchases.

Amazon and its affiliates operate websites under its own name and the Joyo Amazon websites at http://www.joyo.cn and http://www.amazon.cn. It also operates http://www.a9.com and http://www.alexa.com that enable search and navigation, and http://www.imdb.com, a movie database website. More information is available from the website, www.amazon.com.

The company’s fiscal year coincides with the calendar year.

Zacks Investment Research Page 2 www.zackspro.com Key investment considerations as identified by the firms are as follows:

Key Positive Arguments Key Negative Arguments Amazon is favorably positioned to capitalize Increased competition from traditional from two of the fastest growing global markets, retailers could force intense pricing e-commerce and cloud computing. pressure and advertising rate inflation.

New product offerings will be able to improve Heavy infrastructural and technological consumer’s buying efficiency. investments and low pricing strategy can dampen profitability. Leadership position in cloud computing will continue to boost revenues and margins Amazon.com continues to be vulnerable to forex volatility in the euro, pound, yen Amazon will continue to scale its international and Canadian dollar currencies. operations through Amazon Prime and the additional categories. Despite its strong competitive position, Amazon faces tough competition from Amazon has a strong balance sheet that other big Internet players, such as eBay provides flexibility for growth, acquisitions and and Alibaba. share buybacks.

Feb 13, 2018

Long-Term Growth

E-commerce and cloud computing markets are two of the fastest growing global markets. Firms believe that Amazon is well positioned to grow in these markets leveraging its leadership position, strong competitive position and reliability. Long-term planning and consequent heavy investments in fulfillment centers, cloud data centers and Prime loyalty program are believed to help the company increase its revenues and margins over the long run.

Firms are of the view that the company has a number of competitive advantages such as enhanced convenience and broader selection of products. The firms believe that efficient inventory and payables management will continue to positively impact the company’s free cash flow.

Firms are also positive about Prime, Amazon’s promotional shipping loyalty program. Prime memberships help repeat sales of not just general merchandise but also media (books, music, video, etc). Amazon continues to push advantages exclusively to Prime members thus encouraging them to spend more on Amazon. This in turn lures more users to Prime and generates more sales for Amazon.

Firms are also of the opinion that Amazon.com has laid a strong foundation for growth through its AWS business, leveraging on its early leader advantage. Amazon was one of the first companies to recognize the potential of web services and the flexibility that it could give to businesses. They believe that cloud is the next phase in technology and a significant growth driver for the company. It will eventually turn into a solid revenue stream for the company.

The company has successfully built highly defensible elements in its business model (efficient distribution systems, large and loyal customer base, aggressive/discounted pricing, vast product selection, consumer trust, hybrid offering from Amazon and third-party merchants) that are entirely underpinned by technology

Zacks Investment Research Page 3 www.zackspro.com and are believed by firms to allow the company to extend and differentiate via these advantages in the consumer market.

The firms are of the opinion that Amazon has experienced a sales shift toward its international operations. Amazon has been introducing several products for international markets that are expected to drive demand. Increasing product offerings and market penetration may offset persisting economic challenges. They expect Amazon to continue to gain market share internationally.

Lastly, offline retail offers vast opportunities to Amazon. With traditional retailers losing ground in Amazon’s online presence, the company has started to encroach upon their turf directly. The company has big brick-and-mortar plans with books and grocery. While this is Amazon’s way of handling competition in online retail, firms believe it will help the company to expand to the considerably large customer base that still prefers to and will continue to shop at physical stores.

Feb 13, 2018

Target Price/Valuation

Provided below is a summary of target price and rating as compiled by Zacks Research Digest:

Rating Distribution Positive 89.5%↑ Neutral 7.9%↓ Negative 2.6%↓ Avg. Target Price $1681.10↑ Digest High $2,000.00 Digest Low $1,300.00↑ Firms with Target Price/Total 31/38

Risks to the target price include increasing competition from online and multi-channel retailers, consumer spending patterns, higher shipping costs, inability to improve international profits, operating margin pressure from higher investments, execution risk associated with expansion into new product categories and markets; competition in digital downloads from Apple’s iTunes, slowdown in growth of international markets and foreign exchange rate volatility.

Zacks Investment Research Page 4 www.zackspro.com Recent Events

On Mar 28, 2018, Amazon.com announced that GoDaddy has selected Amazon Web Services (AWS). GoDaddy will migrate most of its infrastructure to AWS as part of a multi-year transition.

On Mar 26, 2018, Amazon announced that it has greenlit a straight-to-series order of a four-hour miniseries based on the epic saga of Hernan Cortes.

On Mar 20, 2018, Amazon announced that Prime Video is launching additional sports programming on the service underneath the All or Nothing series.

On Mar 19, 2018, Amazon unveiled GameOn, a cross-platform, competitive gaming service for developers, with which they can easily integrate competitions natively into their games on mobile, PC, and console through a set of flexible APIs.

On Mar 6, 2018, Amazon Studios announced it has greenlit Undone—a direct-to-series animated show co-created by Raphael Bob-Waksberg (BoJack Horseman) and Kate Purdy (BoJack Horseman). The series is expected to premiere in 2019 on Prime Video in over 200 countries and territories exclusively for Prime Members.

On Mar 3, 2018, Amazon reportedly decided not to sell any of the newer products from Google's smart home division Nest.

On Feb 28, 2018, Amazon launched Amazon Prime Music – an ad-free streaming service with innovative voice controls with digital assistant Alexa – for its Prime members in India.

On Feb 27, 2018, Amazon reportedly acquired Santa Monica, CA-based Ring, a well-known developer of internet connected video doorbell and camera devices. The deal will help Amazon expand in the home security market and improvise its in-house delivery services.

On Feb 27, 2018, Amazon and Lionsgate signed an exclusive multiyear agreement under which the latter will deliver a diverse line-up of Hollywood blockbusters to Amazon Prime Video customers across Mexico, Brazil and the rest of Latin America.

On Feb 26, 2018, Amazon greenlit a second season of the critically-acclaimed Prime Original series Lore.

On Feb 21, 2018, Amazon was reportedly selling branded over-the-counter medications such as Advil, Mucinex and Nicorette, as well as options from Perrigo's generic GoodSense brand on its global platform. Amazon's Basic Care line was launched in August 2017 and includes 60 products ranging from ibuprofen to hair regrowth treatment.

On Feb 15, 2018, the U.S. Environmental Protection Agency said that Amazon will pay a $1.2 million penalty to settle nearly 4,000 alleged violations of the U.S. law. This is likely to prevent harmful exposure to pesticides through illegal sales.

On Feb 1, 2018, Amazon reported 4Q17 results. Highlights are as follows:

Net sales of $60.45 billion surged 38.2% y/y GAAP EPS of $3.75 soared 143.3% y/y Cash flow from operations was $18.43 billion at the end of 4Q17 compared with $17.27 billion in the year-ago quarter.

Zacks Investment Research Page 5 www.zackspro.com On Jan 30, 2018, Amazon, Berkshire Hathaway and JPMorgan Chase announced that they would form an independent health care company for their employees in the United States.

On Dec 21, 2017, Amazon acquired Blink, a wireless security camera startup. The deal will give the online retail giant an increased share in the emerging and highly competitive connected home devices market. Though, the terms of the deal have not been disclosed, Blink said that it would continue to operate as part of Amazon and sell the same products it already does.

On Dec 19, 2017, Amazon reportedly plans to acquire Sqrrl Data Inc., a cyber security startup based in Massachusetts. However, Amazon and Sqrrl have not commented on the reports. Although the deal is yet to be finalized, Axios has reported that it could be worth more than $40 million.

Revenues

According to 4Q17 press release, net sales of $60.45 billion surged 38.2% y/y and was toward the high end of the management’s guided range of $56.0-$60.5 billion. After adjusting for foreign exchange, revenues increased 36% y/y.

Product sales (70% of sales) increased 35% y/y to $41.33 billion. Service sales (30% of sales) surged 46% from the year-ago quarter to $19.13 billion.

Bullish firms noted that Amazon’s top-line benefited from strong holiday sales, growth in AWS, and ongoing expansion in Prime membership and fulfillment center capacity.

Provided below is a summary of revenue as compiled by Zacks Research Digest:

Revenues ($ in millions) 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E

Total Revenues $43,741.0 $43,744.0 $60,453.0 $50,140.4 $135,987.0 $177,866.0 $233,845.8 $283,862.6

Digest High $43,741.0 $43,744.0 $60,453.0 $50,570.0 $135,987.0 $177,866.0 $235,720.0 $287,409.0

Digest Low $43,741.0 $43,744.0 $60,453.0 $49,510.0 $135,987.0 $177,866.0 $232,414.0 $278,053.0

Y/Y Growth 22.4% 33.7% 38.2% 40.4% 27.1% 30.8% 31.5% 21.4%

Q/Q Growth 33.7% 15.3% 38.2% -17.1%

2017 at a Glance

Amazon announced that more paid members joined Prime in 2017 than any previous year — both worldwide and in the United States. Prime Video app is now available on Apple TV in over 100 countries.

Amazon Prime Video launched original content like Breathe in India, as well as Pastewka and Glory is Gone in Germany.

Amazon launched Prime in the Netherlands and Luxembourg and added facility for customers in Belgium to join Prime and shop in Dutch. The company also launched Prime in Singapore.

Zacks Investment Research Page 6 www.zackspro.com In 2017, more than five billion items were shipped with Prime worldwide. Fire TV Stick and Echo Dot were the best-selling products across all of Amazon. Customers purchased tens of millions of Echo devices.

Again in 2017, AWS (9% of sales) surged almost 43% to $17.46 billion. Operating income increased 39.4% to $4.33 billion. The company added several enterprise customers including Expedia, Ellucian, DigitalGlobe, Turner, Symantec, Intuit, the National Football League (NFL), Capital One, Cerner, Bristol-Myers Squibb, Honeywell, Experian, FICO, Insitu, LexisNexis, Sysco, Discovery Communications, Dow Jones and Ubisoft.

Amazon added more than 30% to its fulfillment square footage in 2017. Fulfillment by Amazon ("FBA") shipped billions of items for small and medium-sized businesses.

Segment Details

North America revenues (61.7% of sales) jumped 42.2% from the year-ago quarter to $37.30 billion. International revenues (29.8% of sales) increased 29.2% to almost $14 billion.

Amazon Web Services (AWS) revenues surged 44.6% y/y to $5.11 billion, primarily driven by an expanding customer base. Management stated that customers are using additional products and services on top of compute/storage, which is driving incremental revenues.

AWS launched a new region in France and a second AWS Region in China during the quarter. The company plans to open 12 more Availability Zones (“AZ”) across four regions (Bahrain, Hong Kong, Sweden, and a second GovCloud Region in the United States) by 2019.

AWS now operates 52 AZ across 18 infrastructure regions globally.

Segment 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E Revenues North America- $26,240.0 $25,446.0 $37,302.0 $30,041.0 $79,784.0 $106,110.0 $140,519.3 $195,237.7 Sales International $13,965.0 $13,714.0 $18,038.0 $14,828.3 $43,984.0 $54,298.0 $68,772.2 $83,741.5 - Sales AWS $3,536.0 $4,584.0 $5,113.0 $5,241.9 $12,219.0 $17,458 $24,400.1 $32,526.1

Following is a graphical analysis of the revenue segments:

Zacks Investment Research Page 7 www.zackspro.com

Guidance

For 1Q18, Amazon expects net sales between $47.75 billion and $50.75 billion. The figure is anticipated to grow in the range of 34-42% on a y/y basis. Management anticipates a favorable impact of approximately $1.2 billion or 330 bps from foreign exchange rates.

Amazon continues to focus on lowering prices and integrating Prime as Whole Foods’ rewards program. Management stated that it will continue to focus on integrating AmazonFresh, Prime Now, and Whole Foods.

Firms’ Outlook

Most of the firms believe that Prime is a key driver of sales across various product categories. They expect the physical retail part of Amazon’s business to grow at a very high rate once it expands delivery capability. The firms contend that Prime subscriptions will continue to grow into a very important driver of video revenues. They also believe that AWS will continue to generate significant sales growth going forward.

Please refer to the AMZN Zacks Research Digest spreadsheet for more details on revenue estimates.

Zacks Investment Research Page 8 www.zackspro.com Margins

According to 4Q17 press release, operating expenses were $58.32 billion, 37.3% higher than the year- ago quarter. Cost of sales, fulfillment, marketing, technology & content, general & administrative and other operating expenses increased 32.9%, 56.9%, 36.9%, 38.9%, 45.6% and 76.5%, respectively.

As percentage of revenues, operating expenses declined 60 basis points (bps) on a y/y basis to 96.5%. Cost of sales and marketing expenses declined 250 bps and 10 bps, respectively. While fulfillment expenses increased 180 bps, technology & content and general & administrative expenses increased 10 bps each.

Operating income jumped 69.5% from the year-ago quarter to $2.13 billion. Operating margin expanded 60 bps from the year-ago quarter to 3.5%.

Segment wise, North America (61.7% of sales) operating income jumped 107.4% from the year-ago quarter to $1.69 billion. AWS operating income surged 46.2% y/y to $1.35 billion. International reported a loss of $919 million.

North America operating margin expanded 140 bps on a y/y basis to 4.5% driven by strong top-line growth, no operational or weather disruptions, and growing advertising business.

Provided below is a summary of margins as compiled by Zacks Research Digest:

Margins 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E Gross Margin 33.8% 37.0% 36.3% 38.0% 35.1% 37.1% 37.9% 39.0% Operating Margin 5.0% 3.4% 5.6% 4.2% 5.4% 4.8% 5.0% 6.2% Pre-Tax Margin 4.8% 3.3% 5.1% 3.7% 5.2% 4.6% 4.6% 5.9% Net Margin 3.5% 2.6% 4.3% 3.0% 3.7% 3.5% 3.6% 4.6% *Figures in the table are non-GAAP. Guidance

Operating income is expected between $300 million and $1.0 billion compared with $1.0 billion in 1Q17. Amazon cited continued investments in Alexa and the deleveraging of fulfillment in a seasonally weak quarter for retail to hurt operating margin.

Outlook

Firms believe that the operating income guidance reflects higher level of investment in North America retail. A few firms believe that heavy investment in a number of initiatives like Prime, AWS, India, logistics, video content, and Alexa will weigh on margins. They believe that Amazon is investing significantly in technology infrastructure to support growth, which will affect near-term margin expansion.

However, most of the firms believe that strong revenue growth and enhanced efficiency will drive profitability going forward. Bullish firms believe that AWS, Fulfillment by Amazon (“FBA”), and advertising will drive steady margin growth. They contend that effective utilization of the company’s distribution centers, low-pricing strategy and the global expansion of AWS will continue to improve productivity and consequently expand margins in the long haul.

Please refer to the AMZN Zacks Research Digest spreadsheet for more details on margin estimates.

Zacks Investment Research Page 9 www.zackspro.com Earnings per Share

According to 4Q17 press release, Amazon reported GAAP EPS of $3.75, which surged 143.3% y/y. U.S. Tax reform benefited EPS by roughly $1.60.

Provided below is a summary of EPS as compiled by Zacks Research Digest:

EPS 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E Digest Average $3.07 $2.31 $5.36 $3.01 $10.26 $12.76 $16.99 $25.89 Digest High $3.77 $3.91 $6.25 $3.39 $12.78 $15.15 $20.25 $30.59 Digest Low $2.68 $0.61 $3.94 $2.53 $8.80 $10.56 $13.88 $21.54 Y/Y Growth 45.8% 21.5% 74.2% 7.0% 93.4% 24.4% 33.1% 52.3% Q/Q Growth 61.8% -0.8% 132.1% -43.8%

Firms’ Outlook

The majority of the firms believe that increasing revenues, expanding AWS, product launches and increasing Prime numbers will continue to improve EPS going forward. However, rising infrastructure costs, price cuts, increasing investments and free shipping could put pressure on profitability.

Please refer to the AMZN Zacks Research Digest spreadsheet for more details on earnings estimates.

Jun 2, 2017

Research Analyst Aniruddha Ganguly Copy Editor Content Ed. QCA / Lead Analyst Aniruddha Ganguly No. of brokers reported/Total 34/38 brokers Reason for Update News Update

Zacks Investment Research Page 10 www.zackspro.com