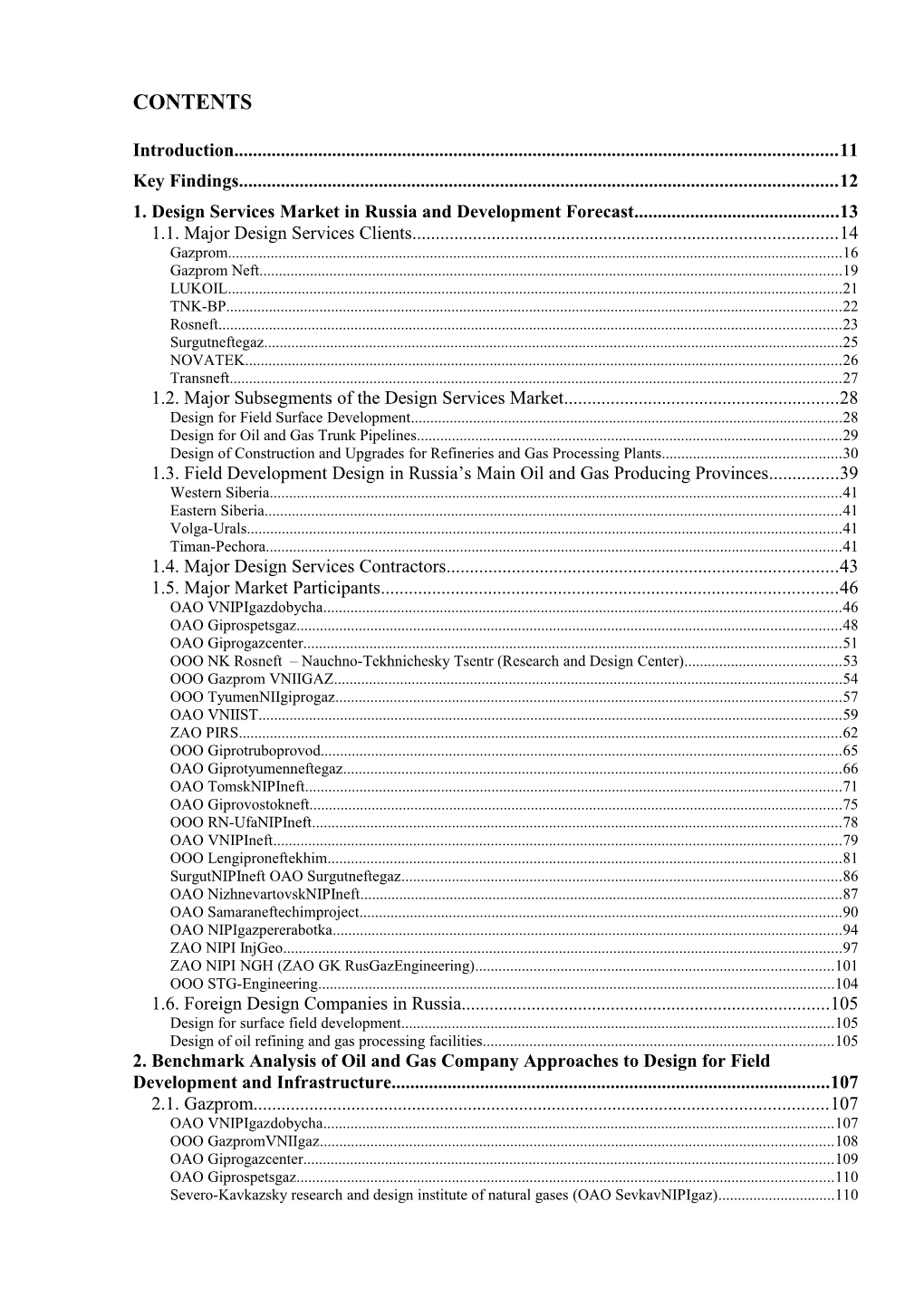

CONTENTS

Introduction...... 11 Key Findings...... 12 1. Design Services Market in Russia and Development Forecast...... 13 1.1. Major Design Services Clients...... 14 Gazprom...... 16 Gazprom Neft...... 19 LUKOIL...... 21 TNK-BP...... 22 Rosneft...... 23 Surgutneftegaz...... 25 NOVATEK...... 26 Transneft...... 27 1.2. Major Subsegments of the Design Services Market...... 28 Design for Field Surface Development...... 28 Design for Oil and Gas Trunk Pipelines...... 29 Design of Construction and Upgrades for Refineries and Gas Processing Plants...... 30 1.3. Field Development Design in Russia’s Main Oil and Gas Producing Provinces...... 39 Western Siberia...... 41 Eastern Siberia...... 41 Volga-Urals...... 41 Timan-Pechora...... 41 1.4. Major Design Services Contractors...... 43 1.5. Major Market Participants...... 46 OAO VNIPIgazdobycha...... 46 OAO Giprospetsgaz...... 48 OAO Giprogazcenter...... 51 OOO NK Rosneft – Nauchno-Tekhnichesky Tsentr (Research and Design Center)...... 53 OOO Gazprom VNIIGAZ...... 54 OOO TyumenNIIgiprogaz...... 57 OAO VNIIST...... 59 ZAO PIRS...... 62 OOO Giprotruboprovod...... 65 OAO Giprotyumenneftegaz...... 66 OAO TomskNIPIneft...... 71 OAO Giprovostokneft...... 75 OOO RN-UfaNIPIneft...... 78 OAO VNIPIneft...... 79 OOO Lengiproneftekhim...... 81 SurgutNIPIneft OAO Surgutneftegaz...... 86 OAO NizhnevartovskNIPIneft...... 87 OAO Samaraneftechimproject...... 90 OAO NIPIgazpererabotka...... 94 ZAO NIPI InjGeo...... 97 ZAO NIPI NGH (ZAO GK RusGazEngineering)...... 101 OOO STG-Engineering...... 104 1.6. Foreign Design Companies in Russia...... 105 Design for surface field development...... 105 Design of oil refining and gas processing facilities...... 105 2. Benchmark Analysis of Oil and Gas Company Approaches to Design for Field Development and Infrastructure...... 107 2.1. Gazprom...... 107 OAO VNIPIgazdobycha...... 107 OOO GazpromVNIIgaz...... 108 OAO Giprogazcenter...... 109 OAO Giprospetsgaz...... 110 Severo-Kavkazsky research and design institute of natural gases (OAO SevkavNIPIgaz)...... 110 DOAO CKBN OAO Gazprom...... 111 2.2. LUKOIL...... 115 OOO KogalymNIPIneft...... 115 OOO PermNIPIneft...... 115 OOO LUKOIL-VolgogradNIPImorneft...... 117 OOO PechorNIPIneft...... 117 2.3. Transneft...... 121 OAO Giprotruboprovod...... 121 2.4. Surgutneftegaz...... 123 SurgutNIPIneft...... 123 2.5. TNK-BP...... 125 2.6. Rosneft...... 126 OOO NK Rosneft – Research and Engineering Center...... 126 OOO RN - SakahlinNIPImorneft...... 127 OOO RN - UfaNIPIneft...... 127 OOO SamaraNIPIneft...... 127 OAO TomskNIPIneft VNK...... 128 OOO RN - KrasnoyarskNIPIneft...... 128 ZAO INNC (Izhevsk Scientific Oil Center)...... 129 2.7. Gazprom Neft...... 132 2.8. NOVATEK...... 134 LIST OF TABLES

Table 1. Gazprom’s projected major design scopes for surface field development facilities, from 2010 through 2015, RUB billion...... 17 Table 2. Estimate of Gazprom’s major design scopes for gas processing facility upgrades, from 2010 through 2015, thousand RUB...... 18 Table 3. Estimate of Gazprom’s major design scopes for gas processing facility construction, from 2010 through 2015, thousand RUB...... 18 Table 4. Estimate of Gazprom Neft’s major design scopes for oil and gas infrastructure, from 2010 through 2015, RUB billion...... 21 Table 5. Estimate of LUKOIL’s major design scopes for oil and gas infrastructure, from 2010 through 2015, RUB billion...... 22 Table 6. Estimate of TNK-BP’s major design scopes for oil and gas infrastructure, from 2010 through 2015, RUB billion...... 23 Table 7. Estimate of Rosneft’s major design scopes for oil and gas infrastructure, from 2010 through 2015, RUB billion...... 24 Table 8. Estimate of Surgutneftegaz’s major design scopes for oil and gas infrastructure, from 2010 through 2015, RUB billion...... 25 Table 9. Estimate of NOVATEK’s major design scopes for gas infrastructure, from 2010 through 2015, RUB billion...... 26 Table 10. Estimate of Transneft’s major design scopes for oil and gas infrastructure, from 2010 through 2015, RUB billion...... 27 Table 11. Revenues of major design companies in Russia and their market shares by total revenues, 2008....44 Table 12. VNIPIgazdobycha: financial performance indicators from 2006 through the 2nd quarter of 2009...47 Table 13. List of branch offices and divisions of Giprospetsgaz...... 48 Table 14. Giprospetsgaz clients in 2007 and 2008...... 49 Table 15. Giprospetsgaz contractors in 2007 and 2008...... 49 Table 16. Giprospetsgaz: financial performance indicators from 2006 through the 3nd quarter of 2009...... 50 Table 17. Giprospetsgaz revenue breakdown in 2007 and 2008...... 50 Table 18. Giprospetsgaz revenue breakdown by regions in 2007 and 2008...... 50 Table 19. Changes in Giprospetsgaz staff headcount from 2004 through 2009...... 50 Table 20. Breakdown of Giprogazcenter contracts by type of service in 2008...... 51 Table 21. Giprogazcenter: financial performance indicators from 2006 through 2008...... 52 Table 22. NK Rosneft - NTT: financial performance indicators from 2006 through 2008...... 53 Table 23. Gazprom VNIIGAZ: financial performance indicators from 2006 through 2008...... 55 Table 24. TyumenNIIgiprogaz: financial performance indicators from 2006 through 2008...... 58 Table 25. VNIIST: financial performance indicators from 2006 through 2008...... 61 Table 26a. VNIIST: revenue breakdown by type of operation from 2006 through 2008...... 61 Table 26b. VNIIST: revenue breakdown by type of operation from 2007 through 2008...... 61 Table 27. VNIIST: headcount by division in 2007 and 2008...... 62 Table 28. ZAO PIRS: financial performance indicators from 2006 through 2008...... 64 Table 29. Giprotruboprovod: financial performance indicators from 2006 through 2008...... 65 Table 30a. Giprotyumenneftegaz: financial performance indicators from 2006 through the 3rd quarter of 2009 ...... 69 Table 30b. Giprotyumenneftegaz: financial performance indicators from 2007 through 2008...... 69 Table 30c. Giprotyumenneftegaz: financial performance indicators...... 69 Table 30d. Giprotyumenneftegaz: financial performance indicators...... 69 Table 31. Giprotyumenneftegaz ’planned financial performance indicators, 2009-2011...... 70 Table 32. Key clients of TomskNIPIneft, 2008...... 73 Table 33. Subcontractors providing over 10 percent of total deliverables to TomskNIPIneft...... 74 Table 34. TomskNIPIneft: revenues from 2005 through 2007, thousand RUB...... 74 Table 35. TomskNIPIneft: financial performance indicators from 2006 through 2008...... 74 Table 36. Giprovostokneft: financial performance indicators from 2006 through the 3rd quarter of 2009...... 76 Table 37. Rn-UfaNIPIneft: financial performance indicators from 2005 through 2008...... 78 Table 38. VNIPIneft: financial performance indicators from 2006 through 2008...... 80 Table 39. VNIPIneft: planned staffing changes from 2009 through 2012...... 80 Table 40. Lengiproneftekhim: financial performance indicators from 2006 through...... 85 Table 41. SurgutNIPIneft: financial performance from 2007 through 2009...... 86 Table 42а. NizhnevartovskNIPIneft: financial performance from 2006 through 2008...... 88 Table 42b. NizhnevartovskNIPIneft: financial performance indicators from 2006 through 2008...... 89 Table 43. Samaraneftechimproject: financial performance indicators from 2006 through 2008...... 93 Table 44. Samaraneftechimproject: Design and surveys performed from 2004 through 2008...... 93 Table 45. NIPIgazpererabotka: financial performance indicators from 2006 through...... 96 Table 46. NIPIgazpererabotka:delivered work and average headcount in 2008...... 96 Table 47. NIPI InjGeo: financial performance indicators from 2006 through...... 100 Table 48. NIPI NGH: financial performance indicators from 2006 through 2008...... 103 Table 49. STG-Engineering: financial performance indicators from 2006 through...... 104

LIST OF FIGURES

Figure 1. Client-contractor-subcontractor interaction scheme in the segment of design services for oil refineries...... 32 Figure 2. Interfaces between design entities during field surface development design in Gazprom...... 113 Figure 3. Interfaces between design entities within Gazprom during design of gas trunk pipelines...... 114 Figure 4. Interfaces between design entities during field surface development design within LUKOIL...... 118 Figure 5. Interfaces between design entities for Transneft during design for oil trunk pipelines...... 122 Figure 6. Interfaces between design entities within Surgutneftegaz during field surface development design ...... 124 Figure 5. Interfaces between design entities for TNK-BP during field surface development design...... 125 Figure 8. Interfaces between design entities in Rosneft during field surface development design...... 130 Figure 9. Interfaces between design entities within Gazprom Neft during field surface development design 132 Figure 10. Interfaces between design entities in NOVATEK during field surface development design...... 134 LIST OF DIAGRAMS

Diagram 1. Actual and forecasted changes in the design market, from 2007 through 2015, RUB billion...... 13 Diagram 2. Actual and forecasted changes by design market segments, from 2007 through 2015, RUB billion ...... 13 Diagram 3. Shares of major clients by design market segments, percent, 2008...... 14 Diagram 4. Shares of major clients by design market segments, percent, 2009...... 15 Diagram 5. Actual and forecasted changes of design scopes by major clients from 2007 through 2015, RUB billion...... 16 Diagram 6. Actual and forecasted changes in expenditures on surface infrastructure design by Gazprom, from 2007 through 2015, billion RUB...... 17 Diagram 7. Actual and forecasted changes in expenditures on surface infrastructure design by Gazprom Neft, from 2007 through 2015, RUB billion...... 20 Diagram 8. Actual and forecasted changes in expenditures on surface infrastructure design by LUKOIL, from 2007 through 2015, RUB billion...... 21 Diagram 9. Actual and forecasted changes in expenditures on surface infrastructure design by TNK-BP, from 2007 through 2015, RUB billion...... 23 Diagram 10. Actual and forecasted changes in expenditures for surface infrastructure design by Rosneft, from 2007 through 2015, RUB billion...... 24 Diagram 11. Actual and forecasted changes in expenditures on surface infrastructure design by Surgutneftegaz, from 2007 through 2015, RUB billion...... 25 Diagram 12. Actual and forecasted changes in expenditures on surface infrastructure design by NOVATEK, from 2007 through 2015, RUB million...... 26 Diagram 13. Actual and forecasted changes in expenditures on surface infrastructure design by Transneft, from 2007 through 2015, RUB billion...... 27 Diagram 14. Scope of field surface development design in Russia’s main producing regions and forecasted development, from 2007 through 2015, RUB billion...... 28 Diagram 15. Actual and forecasted changes in field surface development design scopes in Russia’s main producing regions, from 2007 through 2015, RUB billion...... 29 Diagram 16. Actual and forecasted changes in design scopes for trunk pipelines, from 2007 through 2015, RUB billion...... 30 Diagram 17. Actual and forecasted changes in design scopes for refining and gas processing facilities, from 2007 through 2015, RUB billion...... 31 Diagram 18. Shares of Russia’s main producing provinces in the field surface development design segment, percent, 2008...... 39 Diagram 19. Shares of Russia’s main producing provinces in the field surface development design segment, percent, 2009...... 40 Diagram 20. Actual and forecasted changes in expenditures on field development design in main producing provinces, from 2007 through 2015, RUB billion...... 40 Diagram 21. Market shares of major players in design for oil and gas infrastructure facilities, 7percent, 2008 ...... 43