PROGRAM INFORMATION DOCUMENT (PID) APPRAISAL STAGE Report No.: AB3073 Operation Name Chile – Institutional Strengthening of the Ministry of Public Works DPL Region LATIN AMERICA AND CARIBBEAN Sector Roads and highways (60%); General water, sanitation and flood protection sector (20%); General public administration sector (20%) Project ID P100854 Borrower(s) REPUBLIC OF CHILE Implementing Agency INISTRY OF PUBLIC WORKS Date PID Prepared April 25, 2007 Date of Appraisal March 13, 2007 Authorization Date of Board Approval June 14, 2007

1. Country and Sector Background

Over the past four years, the Chilean economy has reestablished solid economic growth, fueled by robust domestic demand and record high copper prices. GDP growth accelerated from 2 - 3 percent in 2001 and 2002 to 5.7 percent in 2005. Growth in 2006 settled to 4.0 percent. Macroeconomic indicators also demonstrate a strong overall performance with declining levels of debt to GDP, rapidly increasing average income levels, and low and stable inflation.

The latest IMF Article IV Review completed in September 2006 commended Chilean authorities for their continued implementation of sound policies based on a cautious fiscal rule, a good inflation targeting framework, and trade liberalization. The IMF noted that these policies, combined with a solid financial system, have led to sustained economic growth and contributed to poverty reduction. With a disciplined fiscal policy, a broadly neutral monetary policy, and foreign currency earnings expanding as a result of historically high commodity prices, the Government’s primary concern has become the achievement of higher economic growth. In an updated assessment of developments and policies in Chile made in April 2007, IMF staff reiterate that the country's macroeconomic policies set or conform to best international practice in many areas. The economic slowdown in 2006 is explained partly by one-off disruptions in copper production, high energy costs, and lumpy investment, while the economy is expected to grow closely in line with potential this year.

Macroeconomic Outlook and Debt Sustainability

On March 11, 2006 Michelle Bachelet succeeded Ricardo Lagos as Chile's elected President— the fourth successive representative of the Concertación coalition to hold the office since 1990. The new government reaffirmed its commitment to the prudent macroeconomic management and the outward oriented economy of previous administrations while expanding access to public services that will help more Chileans contribute to the country's growth and development. The 2007 Budget, submitted to Congress on September 30th, 2006, is in line with these priorities. Total government spending will be increased by 8.9 percent in real terms, with more than two thirds of this increase going to social programs. The spending increase is to be financed in part through increased copper revenues.

The central government has become a net creditor, with debt claims equivalent to 7 percent of GDP at end-2006. Gross central government debt has fallen from 38.8 percent of GDP in 1991 to a record low of 5.3 percent of GDP at end-2006. Gross Central Bank debt declined from 52.8 percent of GDP in 1991 to 16.6 percent at end-2006. Low debt levels contribute toward insulating the economy from the adverse effects of external shocks and allow the government to pursue stabilization policies. Chile’s strong economic performance and continued favorable global conditions resulted in an upgrade of its Moody’s long-term foreign-currency credit rating in July 2006, from “Baa1” to “A2”, bringing it to the levels of new EU members such as Poland and Slovak Republic.

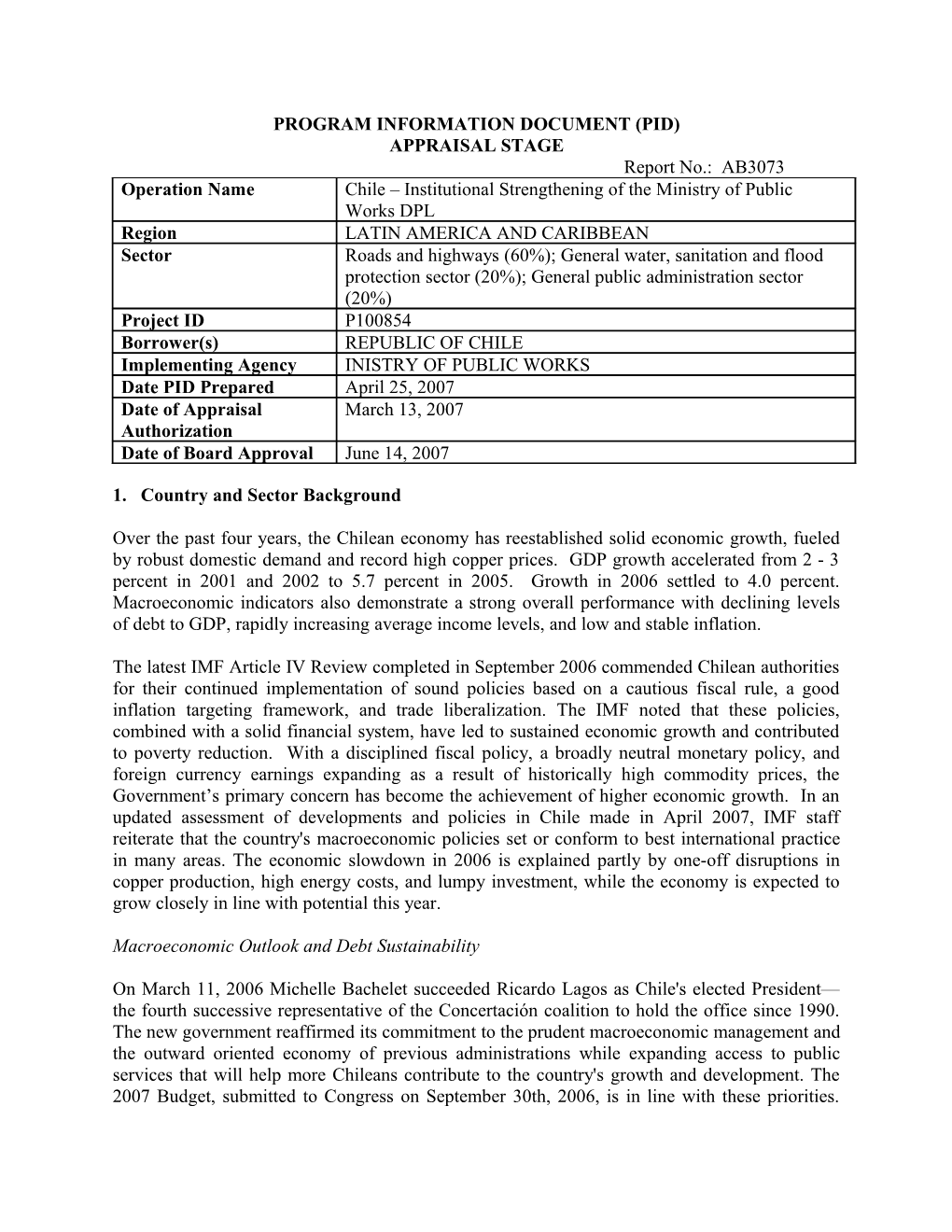

Looking ahead, the medium-term macroeconomic projections of the Chilean authorities are for real GDP growth to stabilize at about 5 percent per annum, which it considers the country’s sustainable growth rate (Table 1). The strong macroeconomic framework provides a solid basis for these growth projections, with stabilization policies having enhanced the country’s growth prospects. Public savings have grown to the point where the country is a net creditor and the Government’s credibility as a debt issuer in international markets has been further enhanced. Adverse shocks would be counterbalanced by the Government’s ability to pursue counter- cyclical fiscal policies, thereby reducing macroeconomic instability and ensuring the sustainability of social expenditures. In turn, the country is expected to reap the socio-economic benefits of the increased social expenditures since the early-1990s in terms of higher human capital and productivity. Table 1: Chile Macroeconomic Summary and Future Outlook 2003-2009

Table 1: Chile Macroeconomic Summary and Future Outlook 2003-2009

(in percent, unless otherwise stated) -- actual -- est. -- proj. -- 2003 2004 2005 2006 2007 2008 2009 National Accounts GDP growth 3.9 6.0 5.7 4.0 5.0 5.0 5.4 Domestic demand 4.9 7.5 11.0 6.0 6.3 5.3 5.3 Population (millions) 15.8 16.0 16.1 16.5 16.6 16.8 17.0 Balance of payments Current account (% of GDP) -1.3 1.7 0.6 3.6 -0.1 3.2 1.9 Imports of goods and services (% of GDP) 32.1 31.3 33.1 30.4 30.3 25.4 25.1 Exports of goods and services (% of GDP) 36.3 40.6 41.9 45.0 39.0 36.9 34.1 External indicators Total external debt (% of GDP) 58.4 45.8 39.0 32.3 27.2 25.7 24.3 Exchange rate (pa) Ps:US$ 691 610 560 530 … … … Inflation Annual Change in CPI (EOP) 1.1 2.4 3.7 2.6 3.4 2.9 3.0 Fiscal (Central government) Overall balance to GDP 1/ -0.4 2.1 4.7 7.9 4.4 1.1 0.4 Note: (est.) Estimated; (proj.) Projections. Source: Banco Central de Chile, DIPRES, World Bank and IMF projections

Chile’s actual medium-term growth could well be higher than projected in the authorities’ baseline scenario depending on how effectively the challenges are met. Chile has an enviable macroeconomic policy environment, solid financial sector and laudable institutions. The challenge now is to foster policies that encourage innovation; enhance educational quality and attainment for all Chileans, and provide adequate physical infrastructure for growth. One area of focus is the continued strengthening of the framework for infrastructure investment and service delivery. The proposed reform of the Ministry of Public Works is integral to this aim, as it is designed to improve growth prospects by improving administrative efficiency, reducing subsidies and contingent liabilities, and strengthening the competition framework in the infrastructure sector.

Latest Government Plan for Growth

To boost job creation and growth, President Bachelet created the “Infrastructure Development for Competitiveness Plan” at the inception of her administration to ensure that public infrastructure can help different productive sectors be more efficient. The Plan calls for a US$115 million increase in public spending on infrastructure in 2007, and it marks the first step in an ambitious program over four years, from 2007 to 2010. The Plan depends significantly on private sector involvement, through improved collaboration—in announcing the Plan, the President noted that the Public Works Ministry would be supervising infrastructure concessions worth US$2.2 billion between 2007 and 2010—and through tax incentives to stimulate private investment in public roads.

On March 13th, 2007, the Government announced the details of its “Chile Invests” Plan that provided details on the context in which this greater emphasis on infrastructure investment would be carried out. The new plan includes an initiative entitled, “Creating a More Agile Government,” which directly calls for the modernization of the Ministry of Public Works and describes the key points of the Institutional Strengthening Program. The Plan calls for a new legal structure for the Ministry that separates out responsibilities for roles and functions (e.g., planning, contract design, execution, oversight); strengthens technical capacities (e.g., through integrated project management); and creates the Superintendency of Public Works to regulate contracts and concessions.

Several other initiatives described in the new growth plan also support the objectives and components of the reform. Under “Accelerating Investments,” the President outlines a program for improving the execution and quality of public investments. This includes better planning coordination, greater oversight of investments and maximizing the competitive bidding processes in public works contracting—all core elements in the Institutional Strengthening Initiative. Under “Expanding Human and Capital Innovation,” the Presidency refers to the need for integrated plans for the development of key clusters or supply chains (“clusters claves”), such as the fishing, forestry, and mining industries. This concept is central to the Integrated Planning initiative underway at the Ministry of Public Works and the specific analysis referred to in the Growth Plan will serve as the basis for the first set of integrated investment plans undertaken at MOPW. Finally, “Making Chile a Tourism Destination” describes the importance of efficient and effective transport networks that link the regions—a primary concern of MOPW as it embarks on its institutional strengthening program.

2. Operation Objectives

The over-all policy objective of the Development Policy Loan is to support the Government’s reform of the Ministry of Public Works by strengthening its planning functions; developing performance standards for contracts and concessions; improving project management; strengthening regulatory oversight of public works and private contracts; and embedding the organizational changes in appropriate legal and normative structure. This, in turn, is meant to contribute to the Government’s objectives of greater efficiency in the use of public resources; and increased transparency, competition and citizen participation in the contracting and concessioning of public works.

3. Rationale for Bank Involvement

The objective of the joint IBRD-IFC Country Partnership Strategy (CPS) is to support Chile’s efforts to converge with OECD income levels and living standards by (i) accelerating growth and (ii) building a more equitable society. The Bank Group strategy is based on the maintenance of close engagement with the authorities, which in recent years has yielded important results in support of key Government programs and through flexible, timely support that advances Chile’s development vision and leverages the Bank’s comparative advantage in strategic sectors and global experience in difficult development challenges.

The Bank has worked closely with the authorities to identify areas where it might be best prepared to support these objectives: innovation and business climate; education; social protection; regional development; environmental management; and, centrally, infrastructure and public services.

The Government of Chile has requested the Bank’s involvement in this initiative in order to leverage the Bank’s experience in transport and logistics planning, the design of public-private contracts, regulatory frameworks, and organizational reform. In addition, the Bank offers a comparative advantage in its ability to draw upon global knowledge, sustain a policy dialogue, and exploit synergies with other operations and past experiences—both successful and incomplete—including, but not limited to the Infrastructure for Territorial Development Project and the Santiago Urban Transport DPL and TAL.

4. Financing

The Bank will support MOPW’s Reform Initiative with a US$ 30 million single-tranche Development Policy Loan and a Technical Assistance Loan in the amount of US$ 11.7 million.

5. Institutional and Implementation Arrangements

Because the sustainability of the program defined in the DPL is directly related to the successful implementation of the related TAL´s components, the Monitoring and Evaluation of each component of the Institutional Strengthening Program will be an integral part of tracking the sustainability of this DPL. Indeed, the TAL encompasses the reforms in all of the core business areas of the Ministry as well as the development of MOPW’s organizational and legal structure

6. Benefits and Risks

The first risk identified is the possible loss of a ministerial champion for reform due to political changes, which is rated as Moderate. Three measures have been taken to mitigate this risk. First, the DPL is reinforced by a Technical Assistance Loan which provides resources for execution of the reforms as well as explicit commitments toward the monitoring and evaluation of progress for each of the underlying tasks that comprise the Institutional Strengthening Program. Second, many important tasks included in the DPL and the TAL are not part of the political agenda or subjected to debate with concessionaires, namely improvements to the planning function, project management approach and changes in road contract design mechanisms. Third, the most politically sensitive reform initiative—increased role of independent regulation of concessions— has been directly championed by President Bachelet. The bills to create the Superintendency of Public Works and amend the Concession Law have been drafted and are currently under Cabinet review. There is a risk that the process of broadening MOPW’s planning approach could slow down the project pipeline and hinder investment flows. This risk is rated as “Modest”. As a mitigation measure, significant training and capacity building will be provided so that project staff can develop a greater understanding of planning tools at all levels of the organization. In addition, the planning training will be linked to that for integrated project managers so as deepen the application of the new planning tools. Finally, a realistic transition period should allow a pipeline of projects to develop under current approaches, then through short-term and regional plans and, finally, through longer-term and more integrated plans.

A third risk is that the re-balancing of risks in concession design and strengthening of regulation result in declining interest of the private sector in investment. This risk is assessed as “Modest” and three mitigation measures are in place. First, the project includes a concession design component that looks at appropriate risk-sharing from both economic and financial perspective. Second, the project comprises a detailed analysis of all MOPW contractual results as well as a market study that informs MOPW of characteristics of local and international markets, by sector. This will allow the design of contracts that maximize competition and maintain equilibrium between risks and rewards from the perspective of investors/operators. Finally, a parallel series of diagnoses will be conducted on bid procedures. The results of this analysis will be incorporated into the next generation of contract designs and bidding processes of the Ministry so as to assure attractive contracts, fair risk-sharing and maximum competition for the bids.

The fourth risk is the possibility that the bills creating the Superintendency of Public Works and amending the Concessions Law are not approved by Congress. This risk is considered “Modest,” as the President of the Republic, the Minister and the administration have engaged in extensive stakeholder consultations to draft a legal package that is both compelling to consumer groups, the general public, representatives of the majority coalition and to many key elements of the private sector, including the Chamber of Construction.

The last risk identified is the prospect of Congress not passing into law a new organizational structure for MOPW, which is considered as ”Substantial”. While it is very hard to predict the outcome of legislative initiatives, this risk is mitigated by the fact that the President of the Republic has offered a public commitment to the reform agenda and has specifically called for a new Ley Orgánica—that is, a Law on the Organizational Structure of MOPW. In addition, a separate proposed law for the Superintendency of Public Works enhances the possibility of a fundamental reform being enacted prior to a full legal change for the Ministry. Nonetheless, this risk is rated slightly higher than the other legal changes because the Structural Law is yet to be drafted, the timeframe for presentation to Cabinet and Congress will be longer, and the reaction from stakeholders to the impact of significant internal restructuring is uncertain.

Considering the considerable mitigation efforts that are part of the planned institutional strengthening activities and the result of an explicit presidential-level commitment to the reform, the overall risk rating for the DPL is considered as “Modest.”

7. Poverty and Social Impacts and Environment Aspects In Chile, the social impacts of investment activities such as land acquisition, resettlement or public health are categorized as components of environmental impacts and so this assessment combines social and environmental aspects under one heading.

The Bank recognizes that the Ministry of Public Works, like any agency involved in the financing of infrastructure projects, plays a central role in the environmentally and socially sustainable development of Chile’s economy. Nonetheless, it is the Bank’s view that this loan will result in no negative poverty, social or environmental impacts. In order to leverage the opportunity of the reform, the Bank and the Ministry have incorporated into the Institutional Strengthening Program—supported by the proposed Technical Assistance Loan—several tasks aimed at lessening the social and environmental impacts of public works. The tasks call for assessing and strengthening the areas of impact assessment, contract design and oversight as well as the feedback mechanism for consumers and third parties affected by project development. In addition, the Integrated Planning Component of the reform program is intended to introduce two rounds of public consultations into the early stages of investment planning so as to minimize negative social impacts and maximize consumer benefits.

Overall, the Bank has found that Chile has a strong system of social and environmental safeguards, particularly in terms of the legal and policy environment. Projects are categorized according to potential risk, magnitude and importance of social and environmental impacts, similar to the World Bank's approach. Currently, Two different types of environmental assessments are carried out, based on project category. A full Environmental Impact Study is required for projects which pose potential adverse impacts on health, natural resources, entail major resettlement of population, are located near protected areas or have a high potential of affecting the scenic value of an area or could potentially alter areas of high cultural or historical value. Projects that do not pose potentially adverse impacts are subject to more limited Environmental Impact assessments. In addition to the EA legislation, projects have to comply with specific environmental and natural resources legislation according to their particular setting. These specific norms refer to projects that can involve:

cutting trees in or near forested areas; construction activities in or near wetlands; activities which imply impacts on local fauna; land use plans imply additional restrictions on subproject location; water rights must be available for all water supply systems; wastewater treatment plants entail additional health permits; projects near cultural property sites follow specific legislations; and construction activities require permits for burrow pits, quarries and extraction of river materials.

Based on the strong legal and policy environment, and the Government's commitment to addressing environmental and social impacts, Chile is a strong candidate for making use of the country's own systems and gradually reducing the prescriptive approach to safeguards in Bank- funded operations. This is expected to bring about a more sustainable and consistent approach to safeguards at the country level, with reduced transaction costs and improved quality and consistency in individual operations. 8. Contact point Contact: Jordan Z. Schwartz Title: Senior Infrastructure Specialist Tel: (202) 458-0493 Fax: Email: [email protected]

9. For more information contact: The InfoShop The World Bank 1818 H Street, NW Washington, D.C. 20433 Telephone: (202) 458-4500 Fax: (202) 522-1500 Email: [email protected] Web: http://www.worldbank.org/infoshop