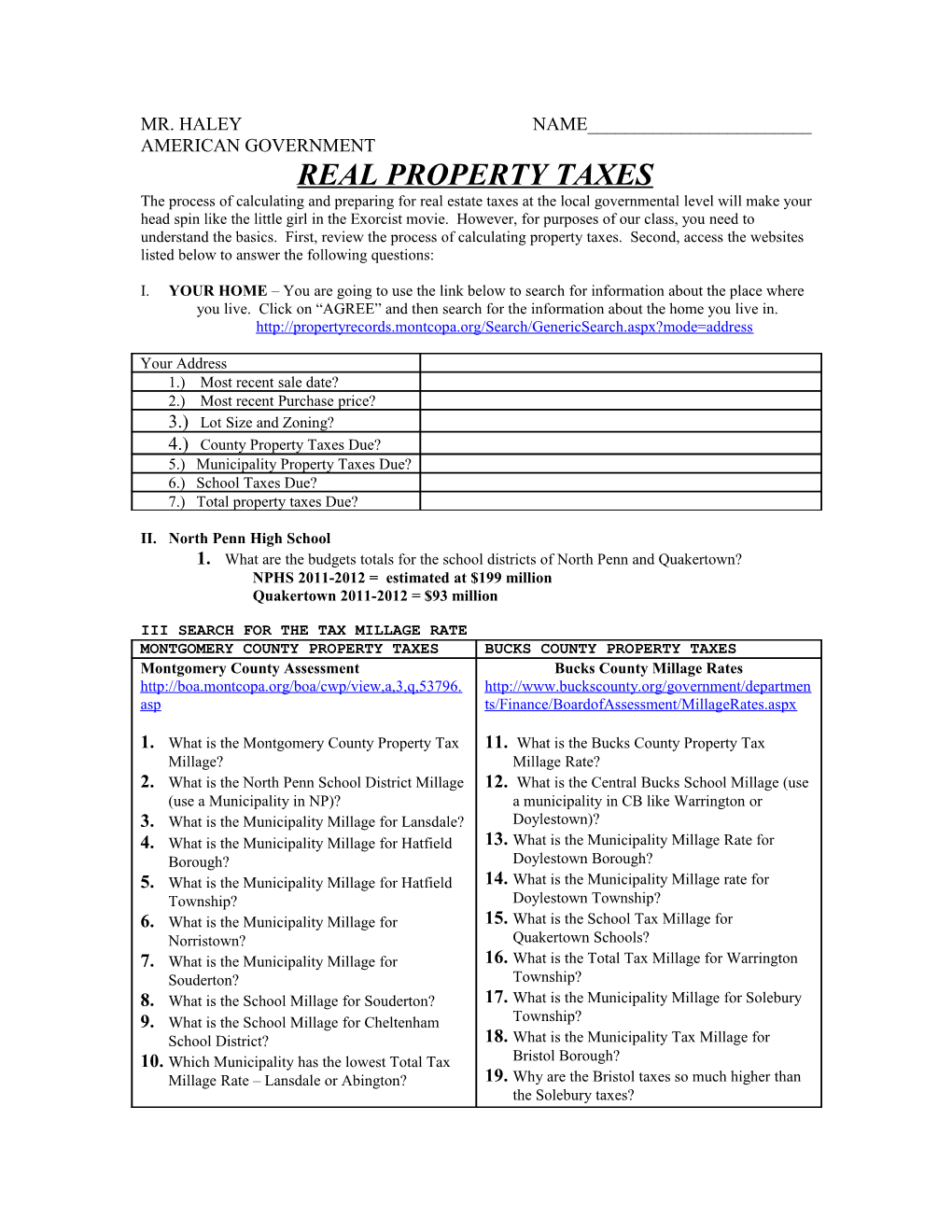

MR. HALEY NAME______AMERICAN GOVERNMENT REAL PROPERTY TAXES The process of calculating and preparing for real estate taxes at the local governmental level will make your head spin like the little girl in the Exorcist movie. However, for purposes of our class, you need to understand the basics. First, review the process of calculating property taxes. Second, access the websites listed below to answer the following questions:

I. YOUR HOME – You are going to use the link below to search for information about the place where you live. Click on “AGREE” and then search for the information about the home you live in. http://propertyrecords.montcopa.org/Search/GenericSearch.aspx?mode=address

Your Address 1.) Most recent sale date? 2.) Most recent Purchase price? 3.) Lot Size and Zoning? 4.) County Property Taxes Due? 5.) Municipality Property Taxes Due? 6.) School Taxes Due? 7.) Total property taxes Due?

II. North Penn High School 1. What are the budgets totals for the school districts of North Penn and Quakertown? NPHS 2011-2012 = estimated at $199 million Quakertown 2011-2012 = $93 million

III SEARCH FOR THE TAX MILLAGE RATE MONTGOMERY COUNTY PROPERTY TAXES BUCKS COUNTY PROPERTY TAXES Montgomery County Assessment Bucks County Millage Rates http://boa.montcopa.org/boa/cwp/view,a,3,q,53796. http://www.buckscounty.org/government/departmen asp ts/Finance/BoardofAssessment/MillageRates.aspx

1. What is the Montgomery County Property Tax 11. What is the Bucks County Property Tax Millage? Millage Rate? 2. What is the North Penn School District Millage 12. What is the Central Bucks School Millage (use (use a Municipality in NP)? a municipality in CB like Warrington or 3. What is the Municipality Millage for Lansdale? Doylestown)? 4. What is the Municipality Millage for Hatfield 13. What is the Municipality Millage Rate for Borough? Doylestown Borough? 5. What is the Municipality Millage for Hatfield 14. What is the Municipality Millage rate for Township? Doylestown Township? 6. What is the Municipality Millage for 15. What is the School Tax Millage for Norristown? Quakertown Schools? 7. What is the Municipality Millage for 16. What is the Total Tax Millage for Warrington Souderton? Township? 8. What is the School Millage for Souderton? 17. What is the Municipality Millage for Solebury 9. What is the School Millage for Cheltenham Township? School District? 18. What is the Municipality Tax Millage for 10. Which Municipality has the lowest Total Tax Bristol Borough? Millage Rate – Lansdale or Abington? 19. Why are the Bristol taxes so much higher than the Solebury taxes? IV. NEXT, YOU ARE TO CALCULATE THE PROPERTY TAXES DUE FOR THE FOLLOWING:

Remember to follow this calculation process:

ASSESSED VALUE X TAX MILLAGE (BUT MOVE THE DECIMAL 3 PLACES TO THE LEFT) = Property taxes Due

Example: A house assessed at $150,000 in Upper Gwynedd would pay a total property tax of ? $150,000 x 25.6633 Mills

But 1 mill is equal to 1/1000 or .001 – so move the decimal 3 places to the left

$150,000 x .0256633 = $3,849.50 Property taxes Due

20. Total Property Taxes due for a $200,00.00 (Assessed Value) house in Hatboro ______

21. County Property Taxes due for a $100,000 (assessed Value) condo in Towamencin ______

22. School Tax Due for a $100,000 (AV) townhouse in Lansdale Boro ______

23. Total Property tax Due for a $300,000 (AV) house in Souderton ______

24. Municipal Tax due for a $100,000 (AV) house in Norristown ______

25. Total Property Tax Due for a $450,000 (AV) house in Montgomeryville ______