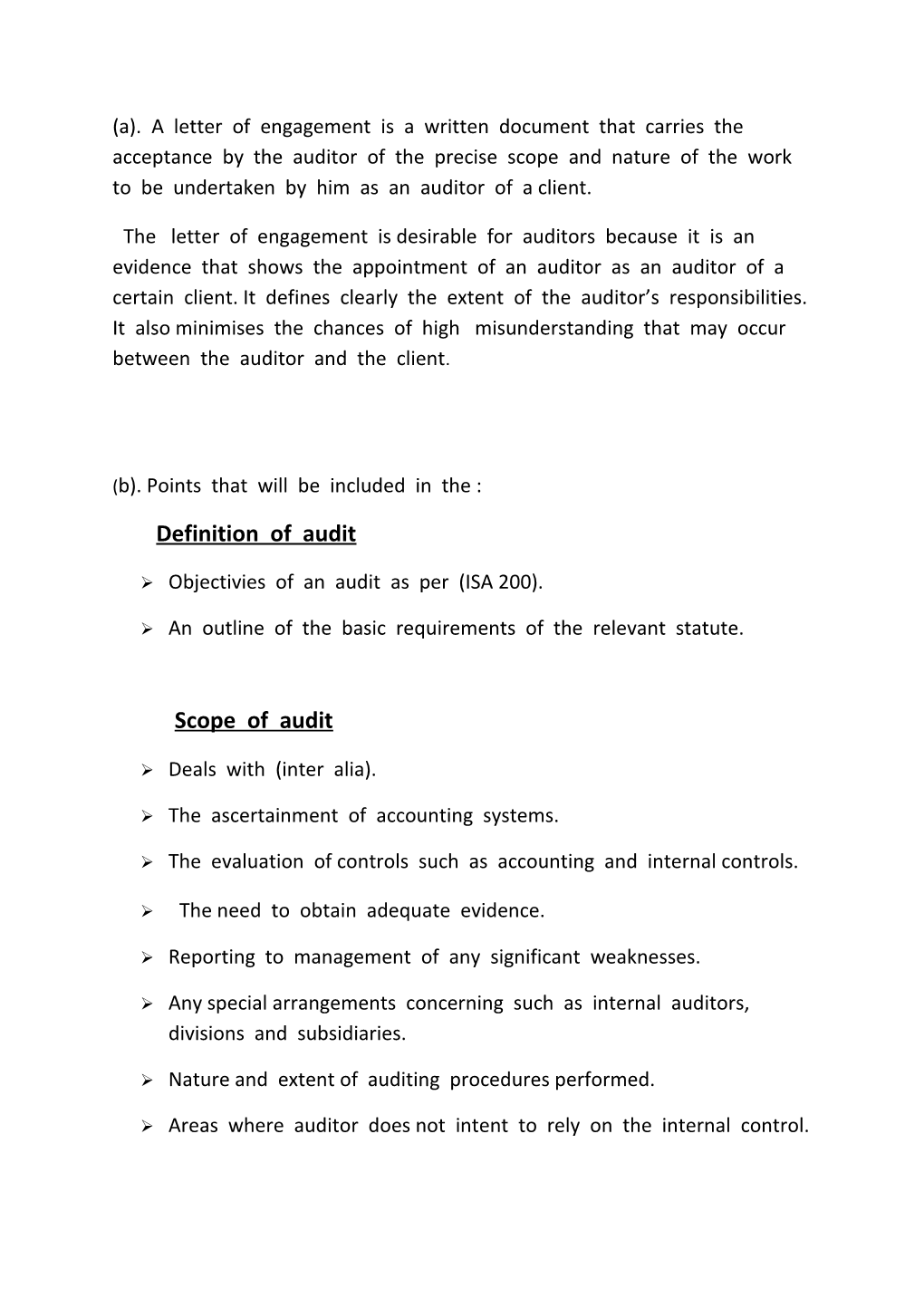

(a). A letter of engagement is a written document that carries the acceptance by the auditor of the precise scope and nature of the work to be undertaken by him as an auditor of a client.

The letter of engagement is desirable for auditors because it is an evidence that shows the appointment of an auditor as an auditor of a certain client. It defines clearly the extent of the auditor’s responsibilities. It also minimises the chances of high misunderstanding that may occur between the auditor and the client.

(b). Points that will be included in the :

Definition of audit

Objectivies of an audit as per (ISA 200).

An outline of the basic requirements of the relevant statute.

Scope of audit

Deals with (inter alia).

The ascertainment of accounting systems.

The evaluation of controls such as accounting and internal controls.

The need to obtain adequate evidence.

Reporting to management of any significant weaknesses.

Any special arrangements concerning such as internal auditors, divisions and subsidiaries.

Nature and extent of auditing procedures performed.

Areas where auditor does not intent to rely on the internal control. The responsibility of the client, not the auditor, to institute and maintain adequate systems and controls and to prepare financial statements.

Collection of audit evidence.

Fraud and Irregularities

Must be stressed that this is not the main purpose of the audit.

That the will plan his audit so that he has a reasonable expectation of detecting material miss-statements in the financial statements.

That there should be non-reliance on the auditor to uncover irregularities and frauds.

That the auditor is to exercise reasonable care and skill so that he may detect irregularities and frauds.

Accounting, Taxation and Other Services

The auditor may undertake services for his client in addition to his statutory duties as an auditor.

The clear responsibilities of the accountant and client in relation to these services and to thee day to day bookkeeping, the maintenance of all accounting records and the preparation of financial statements .

To agree the corporation tax liabilities of the company with the inspectors of tax.

That it will be the client’s responsibility for all other tax matters including returns, payment of advance corporate tax and forms.

That mention should be normally made of fees and the general basis on which they are computed and rendered. Auditors fees are based on the time necessarily spent by our partners and staff and commensurate with the skills and responsibility involved.

The audit work will be billed separately from other work.

References

Kumar.P. and Sachdeva .B. Auditing principles, 7th edition, Kalyani Publishers, 2003.

ACCA Paper F8 Text Audit and Assurance (International).

CHINHOYI UNIVESITY OF TECHNOLOGY

BARCHELOR OF SCIENCE (HNS) DEGREE IN ACCOUNTANCE

AUDITING PRINCIPLES AND PRACTISES (CUAC 202)

ASSIGNMEMT 1

QNS: Your firm has recently been appointed as auditors of Musengezi Ltd, a manufacturing company. It is commonly practice for auditors to sent a letter of engagement to new clients and increasingly to existing clients. Sent forth below are matters usually included in such letters:

I. Definition and Scope of audit

II. Fraud and Irregularities

III. Accounting, Taxation and other Services

IV. Fees Required:

(a). Explain why a letter of engagement is desirable for auditors. (3)

(b) in the case of each matter referred to above show what points will be included.(17)

NAME TAPIWA NHIDZA REGISTRATION NUMBER C109672M

d