FORM 9

NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES (or securities convertible or exchangeable into listed securities)

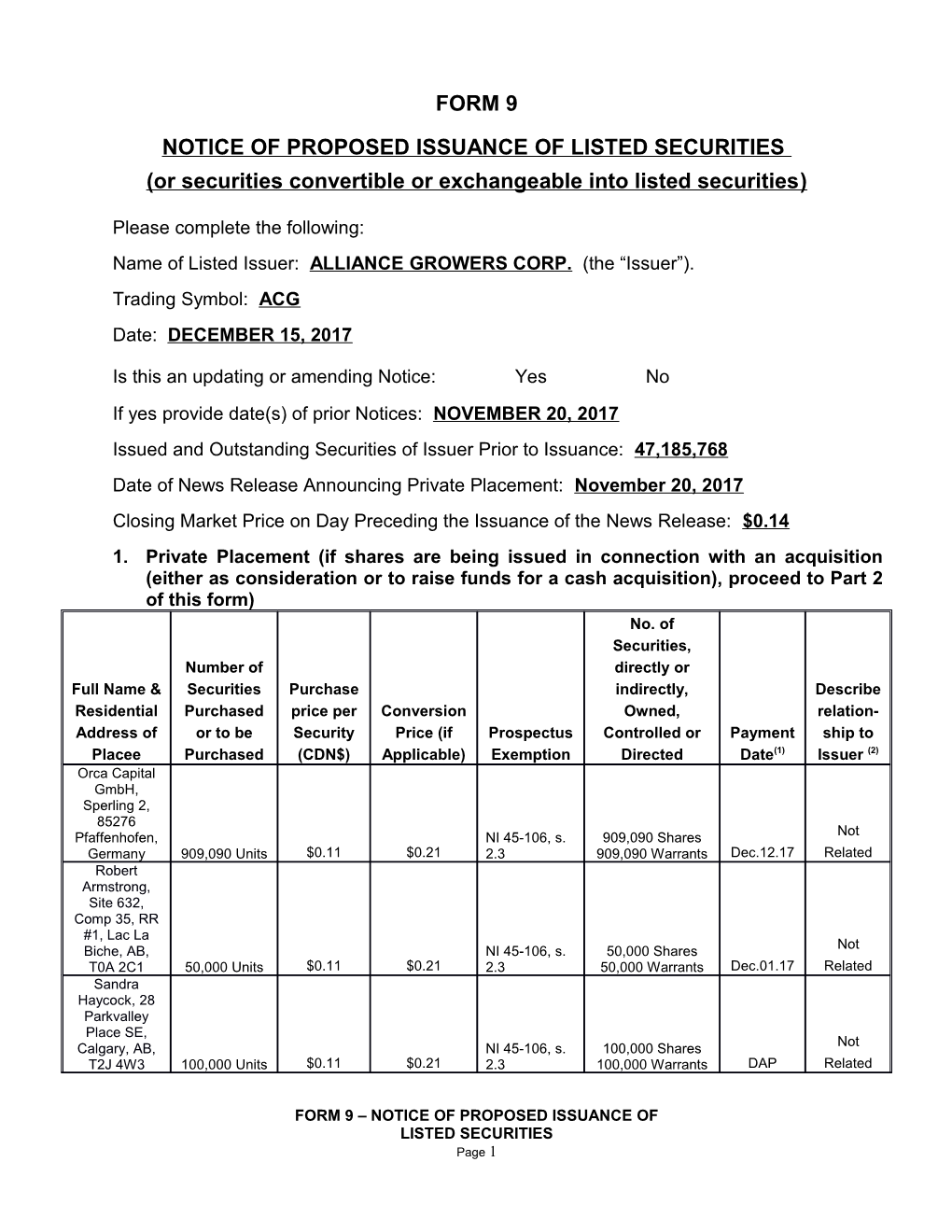

Please complete the following: Name of Listed Issuer: ALLIANCE GROWERS CORP. (the “Issuer”). Trading Symbol: ACG Date: DECEMBER 15, 2017

Is this an updating or amending Notice: Yes � No If yes provide date(s) of prior Notices: NOVEMBER 20, 2017 Issued and Outstanding Securities of Issuer Prior to Issuance: 47,185,768 Date of News Release Announcing Private Placement: November 20, 2017 Closing Market Price on Day Preceding the Issuance of the News Release: $0.14 1. Private Placement (if shares are being issued in connection with an acquisition (either as consideration or to raise funds for a cash acquisition), proceed to Part 2 of this form) No. of Securities, Number of directly or Full Name & Securities Purchase indirectly, Describe Residential Purchased price per Conversion Owned, relation- Address of or to be Security Price (if Prospectus Controlled or Payment ship to Placee Purchased (CDN$) Applicable) Exemption Directed Date(1) Issuer (2) Orca Capital GmbH, Sperling 2, 85276 Pfaffenhofen, NI 45-106, s. 909,090 Shares Not Germany 909,090 Units $0.11 $0.21 2.3 909,090 Warrants Dec.12.17 Related Robert Armstrong, Site 632, Comp 35, RR #1, Lac La Not Biche, AB, NI 45-106, s. 50,000 Shares T0A 2C1 50,000 Units $0.11 $0.21 2.3 50,000 Warrants Dec.01.17 Related Sandra Haycock, 28 Parkvalley Place SE, Not Calgary, AB, NI 45-106, s. 100,000 Shares T2J 4W3 100,000 Units $0.11 $0.21 2.3 100,000 Warrants DAP Related

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 1 Sonnenblumen Financial Services Inc., 500 – 666 300,000 Shares Burrard Street, Not Vancouver, BC, NI 45-106, s. 150,000 Warrants V6C 3P6 100,000 Units $0.11 $0.21 2.5 200,000 Options DAP Related Abimael Ribeiro, Garthland Place East, Not Victoria, BC, NI 45-106, s. 200,000 Shares V9A 4J4 200,000 Units $0.11 $0.21 2.3 200,000 Warrants Dec.13.17 Related Warren Attwell, 9246 Mainwaring Road, North Not Saanich, BC, NI 45-106, s. 200,000 Shares V8L 1K1 200,000 Units $0.11 $0.21 2.3 200,000 Warrants Dec.14.17 Related Nasim Tyab, 301 Stevens Drive, West Vancouver, NI 45-106, s. 200,000 Shares Not BC, V7S 1C7 200,000 Units $0.11 $0.21 2.3 200,000 Warrants Dec.13.17 Related Xinlin Huang, 802 – 1529 West Pender Street, Vancouver, NI 45-106, s. 205,000 Shares Not BC, V6G 2T1 100,000 Units $0.11 $0.21 2.5 150,000 Warrants DAP Related David Lavallee, 497 Nottingham Drive, 1,000,000 Shares Nanaimo, BC, 1,000,000 NI 45-106, s. 1,000,000 Not V9T 0C3 Units $0.11 $0.21 2.3 Warrants Nov.29.17 Related James Oleynick, 3939 Pine Street, Burnaby, BC, NI 45-106, s. 500,000 Shares Not V5G 1Z3 400,000 Units $0.11 $0.21 2.3 600,000 Warrants DAP Related Munir Ali, 303 – 570 Granville Street, Vancouver, NI 45-106, s. 100,000 Shares Not BC, V6C 3P1 100,000 Units $0.11 $0.21 2.3 100,000 Warrants DAP Related Graeme Sewell, 3003 Mathers Avenue, West 600,000 Shares Vancouver, NI 45-106, s. 100,000 Warrants Not BC, V7V 2K3 100,000 Units $0.11 $0.21 2.3 100,000 Options DAP Related Parkwood Limited Partnership Fund, 601 - 366 Adelaide Street West, Toronto, ON, NI 45-106, s. 454,545 Shares Not M5V 1R9 454,545 Units $0.11 $0.21 2.3 454,545 Warrants DAP Related

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 2 Samara Fund Ltd., 601 - 366 Adelaide Street West, Not Toronto, ON, NI 45-106, s. 454,545 Shares M5V 1R9 454,545 Units $0.11 $0.21 2.3 454,545 Warrants DAP Related Uber Strategis LP, 2925 - 200 Bay Street, Not Toronto, ON, NI 45-106, s. 500,000 Shares M5J 2J2 500,000 Units $0.11 $0.21 2.3 500,000 Warrants DAP Related Lewis Martin, 5 Purple Martin Court, Elmira, ON, NI 45-106, s. 100,000 Shares Not N3B 1A2 100,000 Units $0.11 $0.21 2.3 100,000 Warrants Dec.12.17 Related Eric Rosen, 182 Bayview Heights Drive, Not East York, NI 45-106, s. 200,000 Shares ON, M4G 2Y9 200,000 Units $0.11 $0.21 2.3 200,000 Warrants Nov.28.17 Related Aaron Besner, 3909 - 80 John Street, Toronto, ON, NI 45-106, s. 100,000 Shares Not M5V 3X4 100,000 Units $0.11 $0.21 2.3 100,000 Warrants Dec.07.17 Related Ian Lambert, 10279 Cope Lake Road, GD911, Wilberforce, NI 45-106, s. 480,500 Shares ON, K0L 3C0 50,000 Units $0.11 $0.21 2.5 150,000 Warrants DAP Related Canasia Data Corp., 10279 Cope Lake Road, GD911, Wilberforce, NI 45-106, s. 1,204,500 Shares ON, K0L 3C0 50,000 Units $0.11 $0.21 2.5 50,000 Warrants DAP Related Sylvain Huet, 118 Poirier, Chateauguay, NI 45-106, s. 100,000 Shares Not QC, J6K 2X3 100,000 Units $0.11 $0.21 2.5 100,000 Warrants Dec.04.17 Related Agata Kotras, 210 - 4950 L’Assomption, Not Montreal, QC, NI 45-106, s. 200,000 Shares H1T 0A3 200,000 Units $0.11 $0.21 2.3 200,000 Warrants Dec.12.17 Related Pericles Theoharis, 213 - 3 Westmount Square, Westmount, NI 45-106, s. 250,000 Shares Not QC, H3Z 2S2 250,000 Units $0.11 $0.21 2.3 250,000 Warrants Dec.12.17 Related Calico T.C.P. Internet Solutions Inc., 16 – 5890 Monkland Avenue, Not Montreal, QC, NI 45-106, s. 100,000 Shares H4A 1G2 100,000 Units $0.11 $0.21 2.3 100,000 Warrants Dec.11.17 Related FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 3 Dany Battat, 8440 Darnley Road, Montreal, QC, NI 45-106, s. 227,273 Shares Not H4T 1M4 227,273 Units $0.11 $0.21 2.3 227,273 Warrants Dec.04.17 Related Anna Dias, 323 baul des Prairies, Not Laval, QC, NI 45-106, s. 50,000 Shares H7N 2V6 50,000 Units $0.11 $0.21 2.3 50,000 Warrants Dec.12.17 Related Erwin Mah, 13242 Bristol, Not Pierrefonds, NI 45-106, s. 150,000 Shares QC, H9A 1L3 150,000 Units $0.11 $0.21 2.3 150,000 Warrants Dec.11.17 Related Kosta Kostic, 376 Grenfell Avenue, Mont- Royal, QC, NI 45-106, s. 50,000 Shares Not H3R 1G3 50,000 Units $0.11 $0.21 2.3 50,000 Warrants Dec.12.17 Related Allyson Taylor Partners, 15 Caron Pt, Baie Not D’urfe, QC, NI 45-106, s. 200,000 Shares H9X 2Z4 200,000 Units $0.11 $0.21 2.3 200,000 Warrants Dec.02.17 Related Jean Francois Lefebvre, 5839 Esplanade, Not Montreal, QC, NI 45-106, s. 100,000 Shares H2T 3A2 100,000 Units $0.11 $0.21 2.3 100,000 Warrants Dec.04.17 Related Karl Pereira, 215 Sir George Etienne Cartier, Montreal, QC, 107,000 Shares Not H4C 3A3 100,000 Units $0.11 $0.21 BC 45-534 100,000 Warrants Nov.29.17 Related Etienne Desmarais Desnoyers, 697 rue des Cornovillers, Not Boucherville, NI 45-106, s. 50,000 Shares QC, J4B 8W1 50,000 Units $0.11 $0.21 2.3 50,000 Warrants Dec.08.17 Related Simon Meagher, 6836 – 1st Avenue, Not Montreal, QC, NI 45-106, s. 100,000 Shares H1Y 3B4 100,000 Units $0.11 $0.21 2.3 100,000 Warrants Dec.04.17 Related Jean-Francois Mercier, 171 dulwich, St. Lambert, QC NI 45-106, s. 100,000 Shares Not J4P 2Y8 100,000 Units $0.11 $0.21 2.3 100,000 Warrants Dec.04.17 Related Thierry Tremblay, 285 Curzon, St. Not Lambert, QC, NI 45-106, s. 100,000 Shares J4P 2V3 100,000 Units $0.11 $0.21 2.3 100,000 Warrants DAP Related

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 4 John Karagiannidis, 1701 Francois Beaucourt, Not Laval, QC, NI 45-106, s. 185,000 Shares H7W 0C6 185,000 Units $0.11 $0.21 2.3 185,000 Warrants DAP Related Adam Ciampini, 5007 Bossborough, Not Montreal, QC, NI 45-106, s. 50,000 Shares H4V 2S2 50,000 Units $0.11 $0.21 2.3 50,000 Warrants DAP Related Nicholas Shinder, 668 Belmont Avenue, Not Westmount, NI 45-106, s. 100,000 Shares QC, H3Y 2W2 100,000 Units $0.11 $0.21 2.3 100,000 Warrants DAP Related

(1) Indicate date each placee advanced or is expected to advance payment for securities. Provide details of expected payment date, conditions to release of funds etc. Indicate if the placement funds been placed in trust pending receipt of all necessary approvals. (2) Indicate if Related Person.

1An issuance of non-convertible debt does not have to be reported unless it is a significant transaction as defined in Policy 7, in which case it is to be reported on Form 10.

1. Total amount of funds raised: $833,849.83

2. Provide full details of the use of the proceeds. The disclosure should be sufficiently complete to enable a reader to appreciate the significance of the transaction without reference to any other material.

PROCEEDS WILL BE USED PRIMARILY FOR THE BOTANY CENTRE, PROPERTY ACQUISITION AND PRELIMINARY PLANNING & DEVELOPMENT, PLUS FINALIZATION OF AGREEMENTS IN OTHER POTENTIALLY LUCRATIVE ARRANGEMENTS IN THE MEDICAL AND RECREATIONAL CANNABIS SPACE, AS WELL AS GENERAL WORKING CAPITAL.

3. Provide particulars of any proceeds which are to be paid to Related Persons of the Issuer: N/A

4. If securities are issued in forgiveness of indebtedness, provide details and attach the debt agreement(s) or other documentation evidencing the debt and the agreement to exchange the debt for securities. N/A

5. Description of securities to be issued:

(a) Class: UNITS CONSISTING OF 1 COMMON SHARE AND 1 COMMON SHARE PURCHASE WARRANT

(b) Number: 7,580,453

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 5 (c) Price per security: $0.11 PER COMMON SHARE

(d) Voting rights: ONE VOTE PER COMMON SHARE

6. Provide the following information if Warrants, (options) or other convertible securities are to be issued: 7. (a) Number: 7,580,453 WARRANTS

(b) Number of securities eligible to be purchased on exercise of Warrants (or options): 7,580,453 COMMON SHARES

(c) Exercise price: $0.21 PER WARRANT

(d) Expiry date: 2 YEARS FROM THE DATE OF ISSUANCE.

8. Provide the following information if debt securities are to be issued: N/A

(a) Aggregate principal amount

(b) Maturity date

(c) Interest rate

(d) Conversion terms

(e) Default provisions 9. Provide the following information for any agent’s fee, commission, bonus or finder’s fee, or other compensation paid or to be paid in connection with the placement (including warrants, options, etc.):

(a) Details of any dealer, agent, broker or other person receiving compensation in connection with the placement (name, address. If a corporation, identify persons owning or exercising voting control over 20% or more of the voting shares if known to the Issuer): Do not have an estimate at this time of what sales may be made by brokers

ECHELON WEALTH PARTNERS INC., 2500 – 130 KING STREET WEST, TORONTO, ON, M5X 2A2

SANDRA HAYCOCK, 28 PARKVALLEY PLACE SE, CALGARY, AB, T2J 4W3

PI FINANCIAL CORP., 1900 – 666 BURRARD STREET, VANCOUVER, BC, V6C 3N1

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 6 EMD FINANCIAL INC., 398 DE MAISONNEUVE OUEST, MONTREAL, QC, H3A 1L2

(b) Cash: $45,587.99

(c) Securities: 374,436 WARRANTS

(d) Other: N/A

(e) Expiry date of any options, warrants etc.: TWO YEARS AFTER ISSUE

(f) Exercise price of any options, warrants etc.: $0.21

10. State whether the sales agent, broker, dealer or other person receiving compensation in connection with the placement is Related Person or has any other relationship with the Issuer and provide details of the relationship: NOT RELATED PERSONS.

11. Describe any unusual particulars of the transaction (i.e. tax “flow through” shares, etc.): EXERCISE OF THE WARRANTS MAY BE ACCELERATED BY THE COMPANY, IF, AFTER THE EXPIRY OF THE HOLD PERIOD, THE SHARES TRADE AT OR ABOVE A WEIGHTED AVERAGE TRADING PRICE OF $0.30 PER SHARE FOR 10 CONSECUTIVE TRADING DAYS, BY GIVING WRITTEN NOTICE TO WARRANT HOLDERS THAT THE WARRANTS WILL EXPIRE 30 DAYS FROM THE DATE OF PROVIDING SUCH NOTICE .

12. State whether the private placement will result in a change of control. NO

13. Where there is a change in the control of the Issuer resulting from the issuance of the private placement shares, indicate the names of the new controlling shareholders. N/A

14. Each purchaser has been advised of the applicable securities legislation restricted or seasoning period. All certificates for securities issued which are subject to a hold period bear the appropriate legend restricting their transfer until the expiry of the applicable hold period required by National Instrument 45-102.

2. Acquisition

1. Provide details of the assets to be acquired by the Issuer (including the location of the assets, if applicable). The disclosure should be sufficiently complete to enable a reader to appreciate the significance of the transaction without reference to any other material: N/A

2. Provide details of the acquisition including the date, parties to and type of agreement (eg: sale, option, license etc.) and relationship to the Issuer. The disclosure should be sufficiently complete to enable a reader to appreciate the significance of the acquisition without reference to any other material: N/A FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 7 3. Provide the following information in relation to the total consideration for the acquisition (including details of all cash, securities or other consideration) and any required work commitments: N/A

(a) Total aggregate consideration in Canadian dollars

(b) Cash

(c) Securities (including options, warrants etc.) and dollar value

(d) Other

(e) Expiry date of options, warrants, etc. if any

(f) Exercise price of options, warrants, etc. if any

(g) Work commitments

4. State how the purchase or sale price was determined (e.g. arm’s-length negotiation, independent committee of the Board, third party valuation etc). N/A 5. Provide details of any appraisal or valuation of the subject of the acquisition known to management of the Issuer: N/A

6. The names of parties receiving securities of the Issuer pursuant to the acquisition and the number of securities to be issued are described as follows: N/A 7. Details of the steps taken by the Issuer to ensure that the vendor has good title to the assets being acquired: N/A 8. Provide the following information for any agent’s fee, commission, bonus or finder’s fee, or other compensation paid or to be paid in connection with the acquisition (including warrants, options, etc.): N/A (a) Details of any dealer, agent, broker or other person receiving compensation in connection with the acquisition (name, address. If a corporation, identify persons owning or exercising voting control over 20% or more of the voting shares if known to the Issuer) (b) Cash (c) Securities (d) Other (e) Expiry date of any options, warrants etc. (f) Exercise price of any options, warrants etc. 9. State whether the sales agent, broker or other person receiving compensation

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 8 in connection with the acquisition is a Related Person or has any other relationship with the Issuer and provide details of the relationship. N/A 10. If applicable, indicate whether the acquisition is the acquisition of an interest in property contiguous to or otherwise related to any other asset acquired in the last 12 months. N/A

Certificate Of Compliance The undersigned hereby certifies that: 1. The undersigned is a director and/or senior officer of the Issuer and has been duly authorized by a resolution of the board of directors of the Issuer to sign this Certificate of Compliance on behalf of the Issuer. 2. As of the date hereof there is not material information concerning the Issuer which has not been publicly disclosed. 3. The undersigned hereby certifies to the Exchange that the Issuer is in compliance with the requirements of applicable securities legislation (as such term is defined in National Instrument 14-101) and all Exchange Requirements (as defined in CSE Policy 1). 4. All of the information in this Form 9 Notice of Issuance of Securities is true. Dated: DECEMBER 15, 2017 Dennis Petke Name of Director or Senior Officer “Dennis Petke” Signature President & CEO Official Capacity

FORM 9 – NOTICE OF PROPOSED ISSUANCE OF LISTED SECURITIES Page 9