ChangeWave Research: Consumer Spending

March U.S. Consumer Spending Report Consumer Spending Continues to Climb in March – But Confidence & Expectations Stall Over Higher Gas Prices & Inflation

Paul Carton and Jean Crumrine

Overview: The momentum we saw in February’s consumer spending survey has continued into March – with ChangeWave’s latest survey pointing to yet another move upward and the best overall spending scores of the past eleven months. ChangeWave Research is a service of 451 Research.

The March 1 – 19 survey of 2,501 consumers shows spending upticks across multiple categories including Travel/ Vacation, Restaurants and Household Repairs/ Improvements. Moreover, Apple (AAPL) is a very big story in retail this month, with its new iPad release catapulting them to their highest level ever in the electronics marketplace.

Even as the spending momentum continues, rising concerns over higher energy costs and inflation are having an impact on consumer confidence which has experienced a slight pullback for the first time since August, and expectations which is flat.

Consumer Spending Continues to Climb

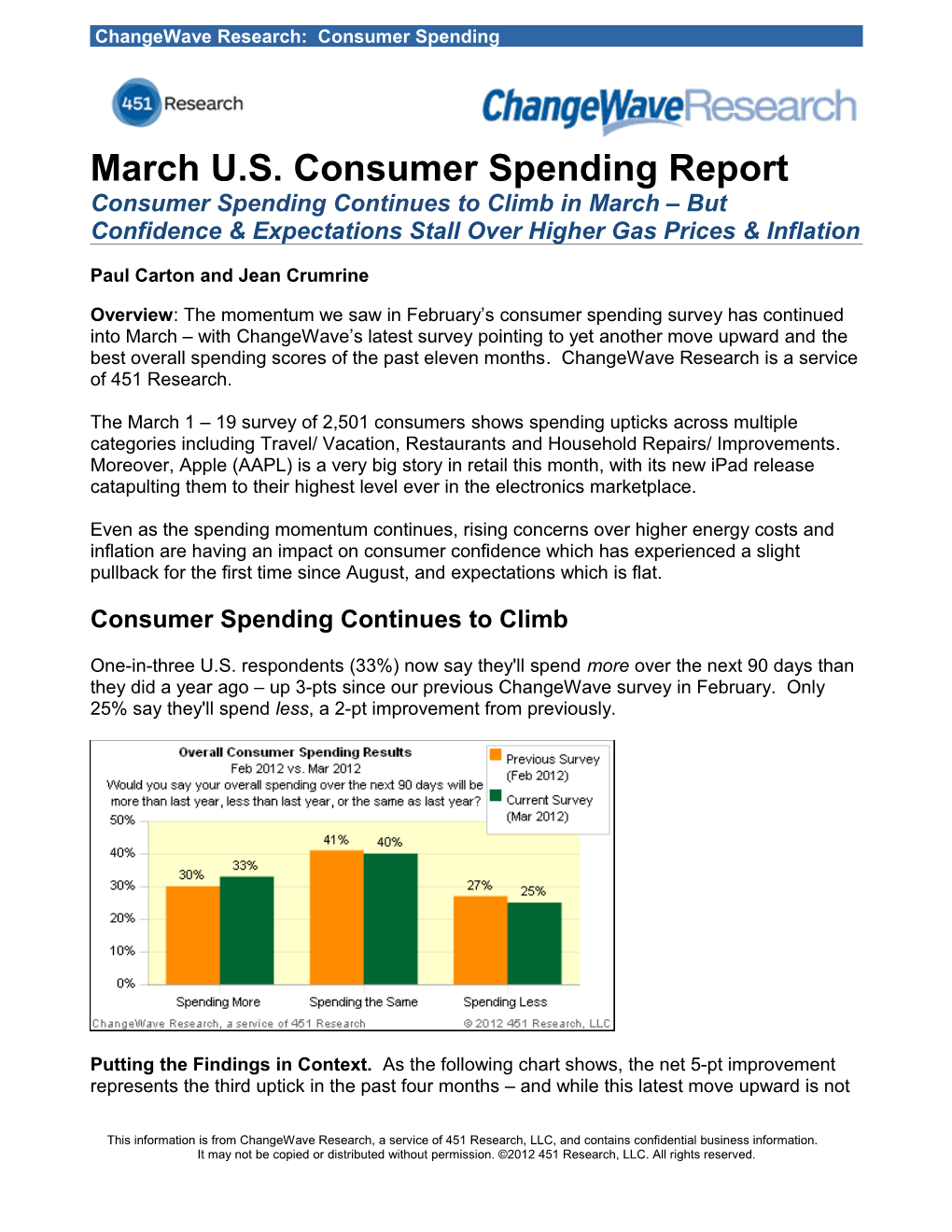

One-in-three U.S. respondents (33%) now say they'll spend more over the next 90 days than they did a year ago – up 3-pts since our previous ChangeWave survey in February. Only 25% say they'll spend less, a 2-pt improvement from previously.

Putting the Findings in Context. As the following chart shows, the net 5-pt improvement represents the third uptick in the past four months – and while this latest move upward is not

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. ChangeWave Research: Consumer Spending as big as the previous two, the March results represent the best overall spending scores of the past eleven months.

Individual Spending Categories

The consumer uptick is occurring across multiple categories, led by improved spending on Travel/ Vacation (+3), Restaurants (+3) and Household Repairs/ Improvements (+3).

In addition, Consumer Electronics is up 2-pts while Durable Goods is registering a slight 1- pt improvement.

Following the uptick in our February survey, Automobile spending is down 1-pt this month – but nonetheless we’re seeing the second best Auto reading of the past year. Retailer Trends

The Home Entertainment retail sector has a huge winner this month in Apple (AAPL). The announcement of their new iPad release has caused an explosion of new shoppers at Apple stores, with nearly one-in-four (23%) respondents saying they’ll shop there for home entertainment and computer networking products in the next 90 days. This represents a 4-pt

2 ChangeWave Research: Consumer Spending jump since February and Apple’s highest level ever in a ChangeWave survey, as the following chart points out:

Note that our March Consumer Tablet Demand report – which you will receive tomorrow –will provide a close-up look at iPad buying intentions among consumers going forward.

While Amazon (AMZN; 45%) is unchanged this month in the home entertainment market, it’s still the overall leader in this space and remains considerably above its pre-holiday levels.

After rising in February, Best Buy (BBY; 29%) is down 4-pts this month and has hit a new all- time low in a ChangeWave survey.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 3 ChangeWave Research: Consumer Spending

Major Retailers. The spending picture is relatively upbeat for the major retailers this month, with several showing upticks, led by Macy's (M; up 3-pts) and Kohl’s (KSS; up 3-pts). Target (TGT; up 2-pts), Bed, Bath and Beyond (BBBY; up 2-pts), T.J. Maxx (TJX; up 2-pts) and Sears (SHLD; up 2-pts) are also showing slight upticks.

While Costco (COST) is unchanged from February, it still holds the lead in terms of overall spending growth. Walmart (WMT) is down 1-pt since previously.

Consumer Confidence and Expectations Dip

Even as the spending momentum continues, consumer confidence has experienced a slight pullback for the first time since August, while consumer expectations are flat. Stock Market Confidence. While confidence in the stock market is still at relatively high levels, it’s down from February – with 36% saying they’re More Confident in the U.S. stock market than they were 90 days ago, and 24% saying they’re Less Confident, a net 8-pt decline.

4 ChangeWave Research: Consumer Spending

Consumer Expectations are Flat. A total of 35% believe the overall direction of the economy will improve over the next 90 days, up 2-pts from previously. But 23% think it will worsen, which is 2-pts more than previously.

Respondents were also asked about their investing plans going forward, and after five successive months of improvement the rate of money inflow into U.S. Stocks (+13; unchanged) has leveled off – although it still remains at a relatively high level. On a positive note, for the first time in nine months Non-U.S. Stocks (+2; up 3-pts) are registering a net money inflow. The Impact of Higher Energy Costs

The pullback in consumer expectations and confidence is largely being driven by rising concerns over higher energy costs and inflation.

Importantly, among consumers who are spending less, Inflation (39%) now ranks as the top reason why – up 6-pts since February. But Higher Energy Costs (29%; up 14-pts) has registered the biggest jump of all as a reason for why consumers are spending less – doubling just since a month ago.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 5 ChangeWave Research: Consumer Spending

6 ChangeWave Research: Consumer Spending Coping With Higher Gas Prices

We asked respondents whether rising prices at the gas pump had caused them to make changes to their normal routine – and 28% said yes.

Among this group, one-in-two (50%) say they’re Eating Out Less and one-in-three (32%) report they’re Working More From Home. Another 18% say they’re Taking More Weekend Trips and Fewer Long Vacations, while 14% are changing the way they Commute to Work.

Back in the spring and summer of 2008 oil prices rose all the way to $150 per barrel at their peak. How does the current impact of rising gas prices on consumer behavior compare with the impact we saw back in 2008?

First, let’s look at the impact of higher gas prices on consumer driving.

Has the rise in gasoline prices affected how much you drive?

Current Previous Survey Survey Mar ‘12 Jul ‘08 Yes, Very Much 6% 12% Yes, But Only 50% 64% Modestly No, Not At All 38% 24%

Currently, 6% say the rise in gas prices is Very Much affecting how much they drive, as opposed to 12% at the peak of the surge in energy prices in July 2008. Note that this group – consumers whose driving is being Very Much affected by rising gas prices – is a critically important group that we will continue to monitor closely in the coming months.

Another 50% of consumers say rising gas prices are Modestly affecting how much they drive, compared with the high of 64% back in July 2008.

Next we asked consumers to tell us the impact energy costs are having on their discretionary spending.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 7 ChangeWave Research: Consumer Spending What effect - if any - are energy costs (i.e., gasoline, heating oil, natural gas, electricity) currently having on your discretionary spending plans for the next 90 days?

While one-in-ten (10%) say their discretionary spending will be Much Lower due to energy costs over the next 90 days, that compares to 15% back in July 2008. Similarly, while 42% say their discretionary spending will be Somewhat Lower going forward, 60% were saying the same thing back in July 2008.

Importantly, the surge in inflation and energy prices is negatively impacting personal finances. The following chart shows that Reducing Debt (24%; down 6-pts) and Saving More Money (23%; down 2-pts) are declining as key reasons for why consumers say they are spending less.

There is one positive sign – fewer consumers are citing Reduced Income (38%; down 2-pts) as a reason for spending less, and it’s now at its second lowest level of the past two years.

Bottom Line: February’s consumer spending momentum has continued into March – with ChangeWave’s latest survey pointing to yet another move upward and the best overall spending scores of the past eleven months.

8 ChangeWave Research: Consumer Spending

With their new iPad release, Apple is the biggest story in consumer retail this month.

But even as spending momentum continues, rising concerns over higher energy costs and inflation have resulted in a slight pullback in consumer confidence for March, while consumer expectations are flat. Summary of Key Findings

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 9 ChangeWave Research: Consumer Spending Table of Contents

Summary of Key Findings 8

The Findings 10

(A) Overall U.S. Consumer Spending10

(B) Individual Spending Categories 12

(C) Home Entertainment Retailers 14

(D) Overall Retailer Trends 16

(E) Consumer Expectations and Confidence 18

(F) Impact of Higher Energy Costs 21

(G) Impact of the Economy on Investors 25

ChangeWave Research Methodology26

About ChangeWave Research 26

About 451 Research 26

10 ChangeWave Research: Consumer Spending The Findings

Introduction: The momentum we saw in February’s consumer spending survey has continued into March – with ChangeWave’s latest survey pointing to yet another move upward and the best overall spending scores of the past eleven months. ChangeWave Research is a service of 451 Research.

The March 1 – 19 survey of 2,501 consumers shows spending upticks across multiple categories including Travel/ Vacation, Restaurants and Household Repairs/ Improvements. Moreover, Apple (AAPL) is a very big story in retail this month, with its new iPad release catapulting them to their highest level ever in the electronics marketplace.

Even as the spending momentum continues, rising concerns over higher energy costs and inflation are having an impact on consumer confidence which has experienced a slight pullback for the first time since August, and expectations which is flat.

(A) Overall U.S. Consumer Spending

One-in-three U.S. respondents (33%) now say they'll spend more over the next 90 days than they did a year ago – up 3-pts since our previous ChangeWave survey in February. Only 25% say they'll spend less, a 2-pt improvement from previously.

Would you say your overall spending over the next 90 days will be more than last year, less than last year, or the same as last year? Previous Previou Previous Previou Previous Current Survey s Survey Survey s Survey Survey Feb ‘12 Jan ‘12 Nov ‘11 Survey Feb ‘11 Mar ‘12 Mar ‘11 More Spending Than 33% 30% 24% 22% 37% 35% Last Year Less Spending Than 25% 27% 31% 35% 26% 24% Last Year Spending Will Remain 40% 41% 43% 43% 36% 39% the Same as Last Year Don't Know 2% 2% 2% 1% 1% 1%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 11 ChangeWave Research: Consumer Spending

Putting the Findings in Context. As the following chart shows, the net 5-pt improvement represents the third uptick in the past four months – and while this latest move upward is not as big as the previous two, the March results represent the best overall spending scores of the past eleven months.

Note that the spending outlook has improved across all income categories.

Current Survey (Mar 2012) – Breakdown by Income Levels Less $100,001 Greater Than Total - Than $100,00 $150,000 $150,000 0 More Spending Than Last Year 33% 27% 32% 40% Less Spending Than Last Year 25% 30% 24% 19% Spending Will Remain the Same as 40% 39% 42% 41% Last Year

12 ChangeWave Research: Consumer Spending (B) Individual Spending Categories

Which of the following consumer items will you be spending more money on over the next 90 days compared to last year? (Check All That Apply) Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Mar ‘12 Feb ‘12 Jan ‘12 Dec ‘11 Nov ‘11 Mar ‘11 Feb ‘11 Household Repairs/ 33% 31% 28% 26% 27% 34% 31% Improvements Travel/Vacation 28% 26% 22% 22% 22% 29% 27% Consumer Electronics 17% 16% 16% 28% 24% 17% 17% Healthcare Services 14% 14% 16% 14% 12% 14% 15% Restaurants/Everyday 13% 12% 11% 14% 12% 15% 14% Entertainment Durable Goods for the 11% 11% 11% 12% 12% 13% 13% Home Children's Services 8% 6% 7% 6% 7% 8% 7% (e.g. camp, education, lessons, other activities) Automobile Purchase 7% 7% 6% 6% 6% 8% 8% Other Services (e.g. adult 3% 4% 4% 4% 3% 4% 4% education, fitness activities

And which of the following consumer items will you be spending less money on over the next 90 days than last year? (Check All That Apply) Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Mar ‘12 Feb ‘12 Jan ‘12 Dec ‘11 Nov ‘11 Mar ‘11 Feb ‘11 Consumer Electronics 29% 30% 31% 27% 29% 29% 29% Restaurants/Everyday 24% 26% 28% 28% 30% 25% 24% Entertainment Travel/Vacation 23% 24% 26% 27% 29% 23% 23% Durable Goods for the 21% 22% 22% 21% 24% 22% 21% Home Automobile Purchase 20% 19% 21% 21% 20% 19% 19% Household Repairs/ 13% 14% 15% 15% 15% 14% 15% Improvements Children's Services 8% 8% 7% 7% 8% 7% 6% (e.g. camp, education, lessons, other activities) Other Services (e.g. 8% 8% 7% 7% 8% 8% 8% adult education, fitness activities) Healthcare Services 6% 7% 7% 7% 7% 8% 7%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 13 ChangeWave Research: Consumer Spending Change in Net Difference Score - Current Survey (Mar 2012) vs. Previous Survey (Feb 2012) Current Previous Survey Survey Change in Net Net Net Difference Difference Difference Score Score Score (Mar ’12) (Feb ’12) Travel/Vacation +5 +2 +3 Restaurants/Everyday Entertainment -11 -14 +3 Household Repairs/Improvements +20 +17 +3 Consumer Electronics -12 -14 +2 Children’s Services (e.g. camp, education, lessons, 0 -2 +2 other activities) Durable Goods for the Home -10 -11 +1 Healthcare Services +8 +7 +1 Automobile Purchase -13 -12 -1 Other Services (e.g. adult education, health and fitness -5 -4 -1 activities)

The consumer uptick is occurring across multiple categories, led by improved spending on Travel/ Vacation (+3), Restaurants (+3) and Household Repairs/ Improvements (+3).

In addition, Consumer Electronics is up 2-pts while Durable Goods is registering a slight 1- pt improvement.

Following the uptick in our February survey, Automobile spending is down 1-pt this month – but nonetheless we’re seeing the second best Auto reading of the past year.

14 ChangeWave Research: Consumer Spending (C) Home Entertainment Retailers

The Home Entertainment retail sector has a huge winner this month in Apple (AAPL).

The announcement of their new iPad release has caused an explosion of new shoppers at Apple stores, with nearly one-in-four (23%) respondents saying they’ll shop there for home entertainment and computer networking products in the next 90 days. This represents a 4-pt jump since February and Apple’s highest level ever in a ChangeWave survey, as the following chart points out:

Note that our March Consumer Tablet Demand report – which you will receive tomorrow –will provide a close-up look at iPad buying intentions among consumers going forward.

While Amazon (AMZN; 45%) is unchanged this month in the home entertainment market, it’s still the overall leader in this space and remains considerably above its pre-holiday levels.

After rising in February, Best Buy (BBY; 29%) is down 4-pts this month and has hit a new all- time low in a ChangeWave survey.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 15 ChangeWave Research: Consumer Spending

Over the next 90 days, which of the following stores do you think you and your family will shop at for home entertainment and computer/ networking products? (Choose No More Than Three) Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Mar ‘12 Feb ‘12 Jan ‘12 Dec ‘11 Nov ‘11 Mar ‘11 Feb ‘11 Amazon 45% 45% 46% 47% 44% 35% 35% Best Buy 29% 33% 30% 35% 34% 34% 38% Apple 23% 19% 20% 21% 19% 17% 15% Costco 20% 23% 20% 23% 23% 21% 22% Walmart 11% 12% 13% 12% 14% 13% 14% Staples 8% 10% 10% 9% 8% 9% 9% Fry's Electronics 7% 9% 7% 8% 8% 7% 8% Sam's Club 7% 7% 7% 7% 9% 8% 7% eBay 6% 7% 7% 7% 6% 6% 7% Newegg 6% 7% 7% 7% 6% 7% 7% Target 5% 4% 4% 5% 6% 5% 5% TigerDirect 5% 6% 5% 5% 5% 5% 6% Office Depot 4% 5% 5% 5% 4% 6% 6% Micro Center 3% 3% 3% 3% 2% 3% 3% OfficeMax 3% 3% 3% 2% 3% 3% 3% BJ's Wholesale Club 2% 2% 2% 2% 2% 2% 2% Buy.com 2% 2% 3% 3% 3% 3% 3% Dell Online 2% 2% 2% 2% 2% 3% 3% FutureShop 2% 2% 2% 3% 3% 3% 3% Radio Shack 2% 2% 2% 2% 2% 2% 2% hhgregg 1% 2% 2% NA NA NA NA Other 5% 5% 5% 5% 6% 5% 5%

16 ChangeWave Research: Consumer Spending (D) Overall Retailer Trends

The spending picture is relatively upbeat for the major retailers this month, with several showing upticks, led by Macy's (M; up 3-pts) and Kohl’s (KSS; up 3-pts). Target (TGT; up 2- pts), Bed, Bath and Beyond (BBBY; up 2-pts), T.J. Maxx (TJX; up 2-pts) and Sears (SHLD; up 2-pts) are also showing slight upticks.

While Costco (COST) is unchanged from February, it still holds the lead in terms of overall spending growth. Walmart (WMT) is down 1-pt since previously.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 17 ChangeWave Research: Consumer Spending We want to learn more about how consumers will be spending their shopping dollars over the next 90 days. For each of the following stores, please tell us if you will be spending more money, about the same amount, or less money over the next 90 days compared with the previous 90 days.

Monthl Year- Same More Less y to-Year No Amount Net Money Money Change Chang Money of Score From e From Money Feb ‘12 Mar ‘11 Kohl's 5% 31% 7% -2 +3 +2 49% Macy's 4% 28% 9% -5 +3 0 51% Target 8% 49% 9% -1 +2 0 26% T.J. Maxx 3% 19% 4% -1 +2 +2 63% Bed, Bath & Beyond 3% 31% 7% -4 +2 +1 51% Sears 2% 23% 10% -8 +2 0 55% Costco 10% 36% 5% +5 0 -1 42% Sam's Club 4% 20% 3% +1 +1 0 63% BJ's Wholesale Club 1% 7% 1% 0 +1 0 81% Ross 1% 12% 3% -2 +1 0 73% Nordstrom 2% 14% 5% -3 +1 0 69% Dillard's 1% 9% 4% -3 +1 -1 77% JC Penney 3% 25% 8% -5 +1 +1 54% K-Mart 1% 15% 6% -5 +1 0 68% Walmart 8% 49% 9% -1 -1 0 25% Bloomingdale's 0% 4% 2% -2 -1 0 83%

18 ChangeWave Research: Consumer Spending (E) Consumer Confidence and Expectations Dip Even as the spending momentum continues, consumer confidence has experienced a slight pullback for the first time since August, while consumer expectations are flat.

Are you now more or less confident in the U.S. stock market compared to 90 days ago? Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Mar ‘12 Feb ‘12 Jan ‘12 Dec ‘11 Nov ‘11 Mar ‘11 Feb ‘11 More Confident 36% 39% 33% 21% 19% 22% 37% Than 90 Days Ago Less Confident 24% 19% 21% 39% 38% 41% 23% Than 90 Days Ago No Change 35% 38% 42% 36% 39% 34% 37% Don't Know 5% 4% 4% 4% 4% 3% 4%

Stock Market Confidence. While confidence in the stock market is still at relatively high levels, it’s down from February – with 36% saying they’re More Confident in the U.S. stock market than they were 90 days ago, and 24% saying they’re Less Confident, a net 8-pt decline.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 19 ChangeWave Research: Consumer Spending In your opinion, which of the following statements best describes the overall direction of the economy over the next 90 days? Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey P Nov ‘11 Mar ‘12 Feb ‘12 Jan ‘12 Mar ‘11 Feb ‘11 The economy is going 35% 33% 30% 2 17% 30% 41% to improve over the next 90 days The economy is going 23% 21% 25% 3 40% 35% 20% to worsen over the next 90 days The economy is going 41% 45% 44% 4 41% 34% 38% to remain the same over the next 90 days Consumer Expectations are Flat. A total of 35% believe the overall direction of the economy will improve over the next 90 days, up 2-pts from previously. But 23% think it will worsen, which is 2-pts more than previously.

20 ChangeWave Research: Consumer Spending On the other hand these consumer indicators are showing improvements:

Looking back at where you thought the economy was headed 3 months ago, would you say the current state of the economy is better than you thought it would be, about the same, or worse than you thought it would be? Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Mar ‘12 Feb ‘12 Jan ‘12 Dec ‘11 Nov ‘11 Mar ‘11 Feb ‘11 Better Than I thought 39% 31% 29% 23% 14% 28% 38% it Would be 3 Months Ago About the Same 50% 58% 58% 54% 55% 53% 52% Worse Than I 10% 10% 13% 22% 30% 18% 9% thought it Would be 3 Months Ago

Looking back, 39% say the current state of the economy is better than they thought it would be 90 days ago and only 10% say the economy is worse than they thought it would be – 8-pts improved.

We asked consumers how much they worry about someone in their family losing their job.

In a highly encouraging finding, only 26% report they worry A Great Deal (9%) or Quite a Bit (17%) about someone in their family losing their job – 5-pts better than a month ago, and the second best reading in two-and-one-half years.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 21 ChangeWave Research: Consumer Spending (F) The Impact of Higher Energy Costs

The pullback in consumer expectations and confidence is largely being driven by rising concerns over higher energy costs and inflation.

Importantly, among consumers who are spending less, Inflation (39%) now ranks as the top reason why – up 6-pts since February. But Higher Energy Costs (29%; up 14-pts) has registered the biggest jump of all as a reason for why consumers are spending less – doubling just since a month ago.

Coping With Higher Gas Prices

We asked respondents whether rising prices at the gas pump had caused them to make changes to their normal routine – and 28% said yes.

Among this group, one-in-two (50%) say they’re Eating Out Less and one-in-three (32%) report they’re Working More From Home. Another 18% say they’re Taking More Weekend Trips and Fewer Long Vacations, while 14% are changing the way they Commute to Work.

22 ChangeWave Research: Consumer Spending Back in the spring and summer of 2008 oil prices rose all the way to $150 per barrel at their peak. How does the current impact of rising gas prices on consumer behavior compare with the impact we saw back in 2008?

First, let’s look at the impact of higher gas prices on consumer driving.

Has the rise in gasoline prices affected how much you drive?

Current Previous Survey Survey Mar ‘12 Jul ‘08 Yes, Very Much 6% 12% Yes, But Only 50% 64% Modestly No, Not At All 38% 24%

Currently, 6% say the rise in gas prices is Very Much affecting how much they drive, as opposed to 12% at the peak of the surge in energy prices in July 2008. Note that this group – consumers whose driving is being Very Much affected by rising gas prices – is a critically important group that we will continue to monitor closely in the coming months.

Another 50% of consumers say rising gas prices are Modestly affecting how much they drive, compared with the high of 64% back in July 2008.

Next we asked consumers to tell us the impact energy costs are having on their discretionary spending.

What effect - if any - are energy costs (i.e., gasoline, heating oil, natural gas, electricity) currently having on your discretionary spending plans for the next 90 days? *

While one-in-ten (10%) say their discretionary spending will be Much Lower due to energy costs over the next 90 days, that compares to 15% back in July 2008. Similarly, while 42% say their discretionary spending will be Somewhat Lower going forward, 60% were saying the same thing back in July 2008.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 23 ChangeWave Research: Consumer Spending

Current Previous Survey Survey Mar ‘12 Jul ’08 My Discretionary Spending Will Be Much Lower 10% 15% Because of Current Energy Costs My Discretionary Spending Will Be Somewhat 42% 60% Lower Because of Current Energy Costs No Effect on My Discretionary Spending Plans 46% 24% My Discretionary Spending Will Be Somewhat 1% NA Higher Because of Current Energy Costs My Discretionary Spending Will Be Much Higher 0% NA Because of Current Energy Costs Don't Know 1% 1% * In the previous July 2008 survey the question asked was: “What effect – if any – are increased energy costs (i.e., gasoline, heating oil, natural gas, electricity) having on your discretionary spending plans for the next 90 days?”

Other Reasons Given By Consumers Who are Spending Less

Importantly, the surge in inflation and energy prices is negatively impacting personal finances. The following chart shows that Reducing Debt (24%; down 6-pts) and Saving More Money (23%; down 2-pts) are declining as key reasons for why consumers say they are spending less.

There is one positive sign – fewer consumers are citing Reduced Income (38%; down 2-pts) as a reason for spending less, and it’s now at its second lowest level of the past two years.

24 ChangeWave Research: Consumer Spending

Here’s the complete breakdown:

For those who will be spending less than last year, what are the most important reasons why? (Choose No More Than Three)

Reasons Given By Current Previous Previous Previous Previous Previous Previous Responde Survey Survey Survey Survey Survey Survey Survey nts Mar ‘12 Feb ‘12 Jan ‘12 Dec ‘11 Nov ‘11 Mar ‘11 Feb ‘11 Spending Less Cost of Living/Inflation Inflation/Inc 39% 33% 31% 32% 37% 38% 32% rease Cost of Living Higher 29% 15% 14% 14% 15% 27% 20% Energy Costs Medical 12% 13% 13% 13% 12% 9% 10% Expenses Education 6% 6% 7% 6% 7% 7% 5% Expenses Trying to Improve Personal Finances Reducing 24% 30% 29% 28% 29% 28% 31% Debt Saving 23% 25% 27% 32% 30% 26% 26% More Money Investing 9% 9% 9% 8% 8% 10% 8% More Money Big Ticket Purchases/Expenses Home 9% 7% 10% 10% 8% 7% 9% Improveme nt Expenses Recent 8% 7% 12% 8% 8% 7% 8% Purchase of Big Ticket Item(s) Purchased 1% 3% 2% 2% 2% 2% 3% This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 25 ChangeWave Research: Consumer Spending New Home Mortgage/Home Equity Costs Mortgage 3% 4% 3% 4% 3% 2% 4% Payment Increased Home 2% 1% 2% 1% 1% 2% 2% Equity Loan Payment Increased Other Reduced 38% 40% 38% 40% 40% 39% 43% Income Value of 9% 10% 11% 11% 12% 9% 10% Home Decreased Traveling 11% 10% 8% 9% 8% 10% 7% Less

26 ChangeWave Research: Consumer Spending (G) Impact of the Economy on Investors Respondents were also asked about their investing plans going forward, and after five successive months of improvement the rate of money inflow into U.S. Stocks (+13; unchanged) has leveled off – although it still remains at a relatively high level. On a positive note, for the first time in nine months Non-U.S. Stocks (+2; up 3-pts) are registering a net money inflow. In light of recent events, will you be investing more money or less money going forward in each of the following vehicles?

Here’s the complete breakdown: Same More Less Change No Net Amount Money Money in Net Money Score of Score Money Non-U.S. Stocks 13% 11% +2 +3 42% 25% Equity Options 10% 5% +5 +2 19% 55% Currencies 4% 3% +1 +2 10% 69% Going to Cash 11% 11% 0 +1 31% 32% U.S. Stocks 24% 11% +13 0 50% 12% Other Commodities 10% 4% +6 0 20% 53% Real Estate 10% 4% +6 0 23% 50% Short-Side Investments 8% 7% +1 0 15% 57% (stocks, ETFs, etc.) Index Options 4% 5% -1 0 13% 64% High-Yield/ Income/ Dividend 18% 3% +15 -1 26% 41% Focused Vehicles ETFs 13% 7% +6 -1 34% 36% Mutual Funds 6% 10% -4 -1 36% 38% Bonds 4% 10% -6 -1 25% 48% Gold 13% 4% +9 -2 23% 49% CDs (Certificates of Deposit) 2% 7% -6 -2 13% 65% Money Market Funds 3% 14% -11 -2 32% 38%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2012 451 Research, LLC. All rights reserved. 27 ChangeWave Research: Consumer Spending

ChangeWave Research Methodology

This report presents the findings of a recent ChangeWave survey on consumer spending patterns. The survey was conducted between March 1 – 19, 2012. A total of 2,501 U.S. respondents participated in the survey.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members of its research network.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies, and consumer and business trends in key market sectors, along with an in- depth perspective of the macro economy – well in advance of other available sources. About ChangeWave Research

ChangeWave Research, a service of 451 Research, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

451 Research, LLC, including its ChangeWave Research service, does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report. About 451 Research

451 Research, a division of The 451 Group, is a leading global analyst and data company focused on the business of enterprise IT innovation. Clients of 451 Research – at end-user, service-provider, vendor, and investor organizations – rely on 451 Research’s insight through a range of syndicated research and advisory services to support both strategic and tactical decision-making. For additional information on 451 Research, go to: 451research.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 240-200-3988 Suite 1301 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

28