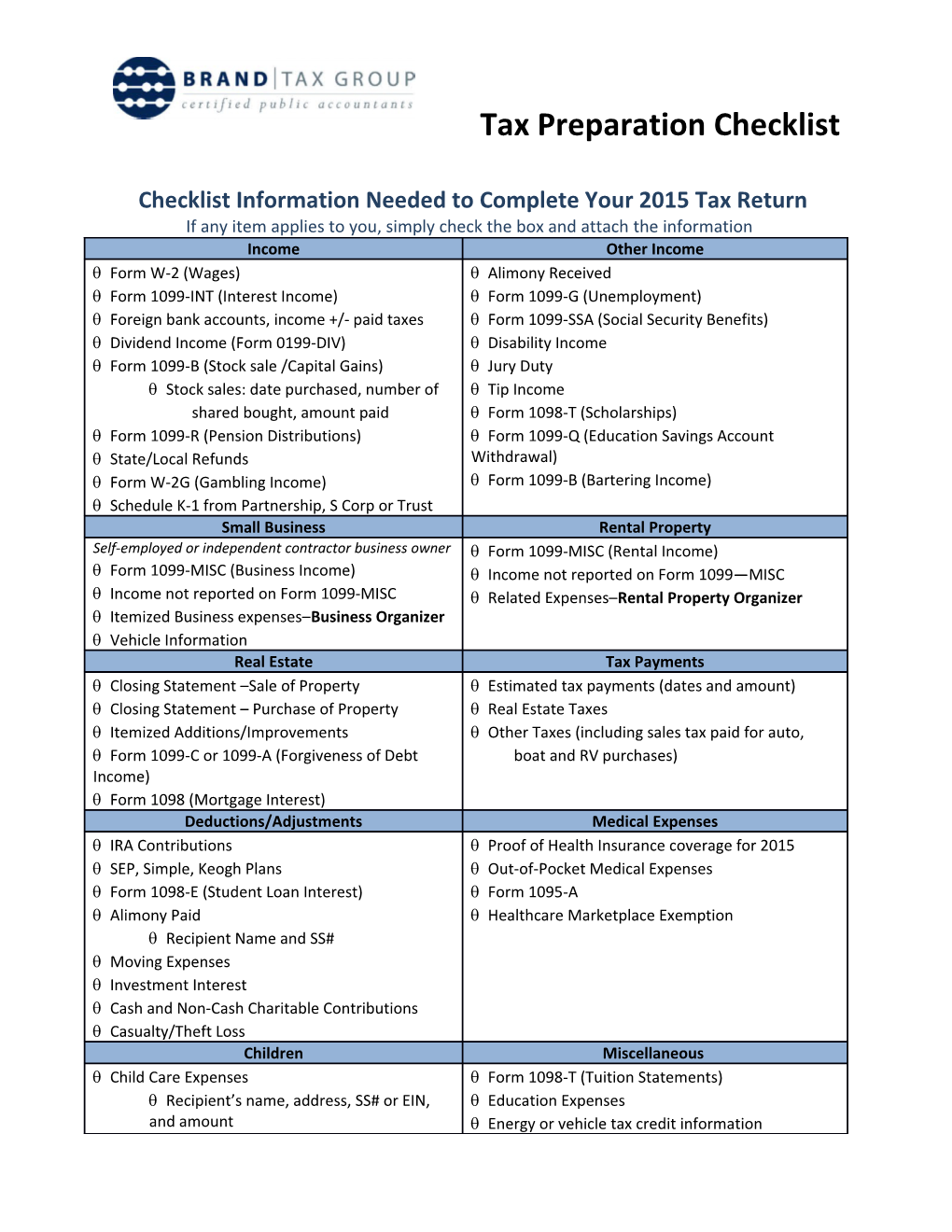

Tax Preparation Checklist

Checklist Information Needed to Complete Your 2015 Tax Return If any item applies to you, simply check the box and attach the information Income Other Income Form W-2 (Wages) Alimony Received Form 1099-INT (Interest Income) Form 1099-G (Unemployment) Foreign bank accounts, income +/- paid taxes Form 1099-SSA (Social Security Benefits) Dividend Income (Form 0199-DIV) Disability Income Form 1099-B (Stock sale /Capital Gains) Jury Duty Stock sales: date purchased, number of Tip Income shared bought, amount paid Form 1098-T (Scholarships) Form 1099-R (Pension Distributions) Form 1099-Q (Education Savings Account State/Local Refunds Withdrawal) Form W-2G (Gambling Income) Form 1099-B (Bartering Income) Schedule K-1 from Partnership, S Corp or Trust Small Business Rental Property Self-employed or independent contractor business owner Form 1099-MISC (Rental Income) Form 1099-MISC (Business Income) Income not reported on Form 1099—MISC Income not reported on Form 1099-MISC Related Expenses–Rental Property Organizer Itemized Business expenses–Business Organizer Vehicle Information Real Estate Tax Payments Closing Statement –Sale of Property Estimated tax payments (dates and amount) Closing Statement – Purchase of Property Real Estate Taxes Itemized Additions/Improvements Other Taxes (including sales tax paid for auto, Form 1099-C or 1099-A (Forgiveness of Debt boat and RV purchases) Income) Form 1098 (Mortgage Interest) Deductions/Adjustments Medical Expenses IRA Contributions Proof of Health Insurance coverage for 2015 SEP, Simple, Keogh Plans Out-of-Pocket Medical Expenses Form 1098-E (Student Loan Interest) Form 1095-A Alimony Paid Healthcare Marketplace Exemption Recipient Name and SS# Moving Expenses Investment Interest Cash and Non-Cash Charitable Contributions Casualty/Theft Loss Children Miscellaneous Child Care Expenses Form 1098-T (Tuition Statements) Recipient’s name, address, SS# or EIN, Education Expenses and amount Energy or vehicle tax credit information Tax Preparation Checklist Legal papers for adoption, divorce or separation Involving custody of dependant children