April 04, 2018

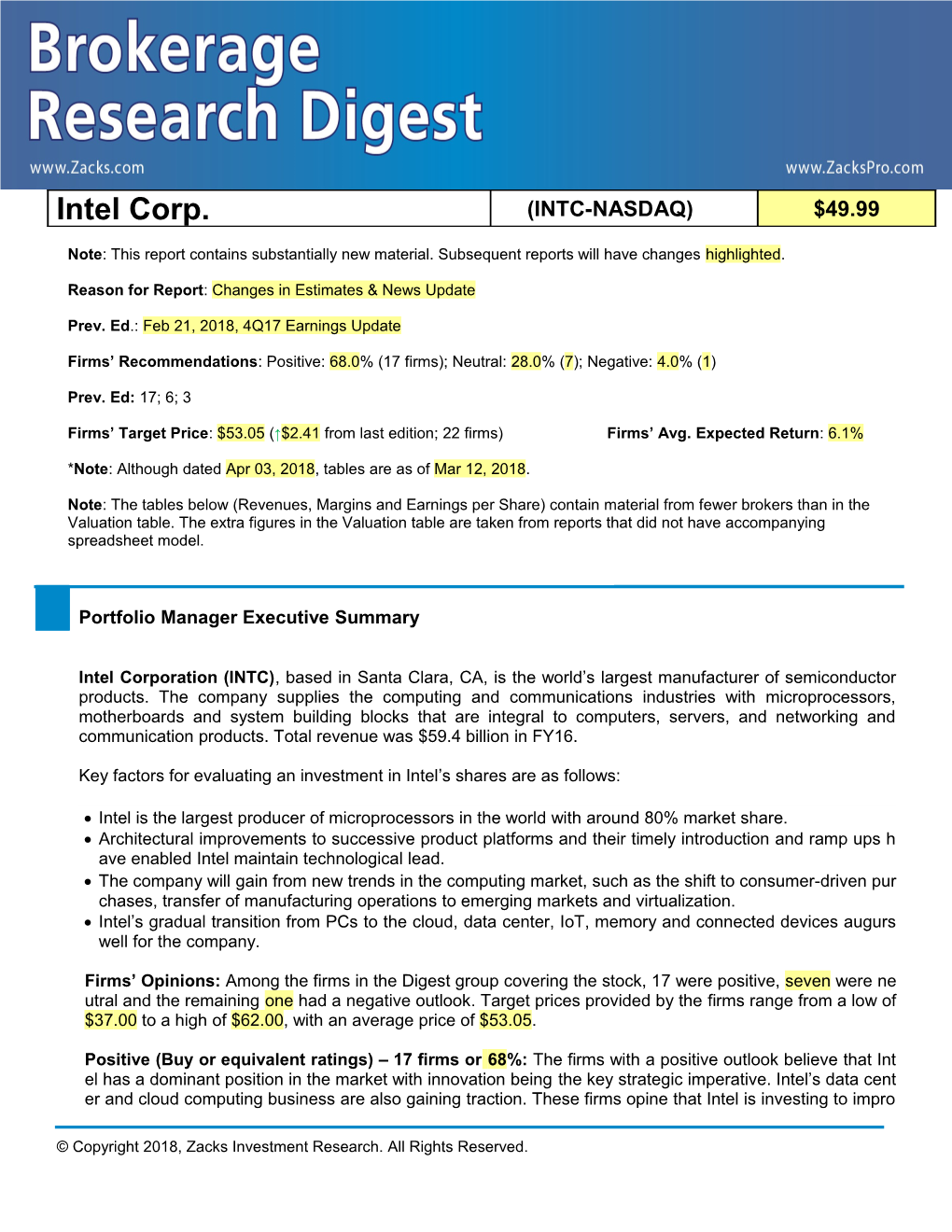

Intel Corp. (INTC-NASDAQ) $49.99

Note: This report contains substantially new material. Subsequent reports will have changes highlighted.

Reason for Report: Changes in Estimates & News Update

Prev. Ed.: Feb 21, 2018, 4Q17 Earnings Update

Firms’ Recommendations: Positive: 68.0% (17 firms); Neutral: 28.0% (7); Negative: 4.0% (1)

Prev. Ed: 17; 6; 3

Firms’ Target Price: $53.05 (↑$2.41 from last edition; 22 firms) Firms’ Avg. Expected Return: 6.1%

*Note: Although dated Apr 03, 2018, tables are as of Mar 12, 2018.

Note: The tables below (Revenues, Margins and Earnings per Share) contain material from fewer brokers than in the Valuation table. The extra figures in the Valuation table are taken from reports that did not have accompanying spreadsheet model.

Portfolio Manager Executive Summary

Intel Corporation (INTC), based in Santa Clara, CA, is the world’s largest manufacturer of semiconductor products. The company supplies the computing and communications industries with microprocessors, motherboards and system building blocks that are integral to computers, servers, and networking and communication products. Total revenue was $59.4 billion in FY16.

Key factors for evaluating an investment in Intel’s shares are as follows:

Intel is the largest producer of microprocessors in the world with around 80% market share. Architectural improvements to successive product platforms and their timely introduction and ramp ups h ave enabled Intel maintain technological lead. The company will gain from new trends in the computing market, such as the shift to consumer-driven pur chases, transfer of manufacturing operations to emerging markets and virtualization. Intel’s gradual transition from PCs to the cloud, data center, IoT, memory and connected devices augurs well for the company.

Firms’ Opinions: Among the firms in the Digest group covering the stock, 17 were positive, seven were ne utral and the remaining one had a negative outlook. Target prices provided by the firms range from a low of $37.00 to a high of $62.00, with an average price of $53.05.

Positive (Buy or equivalent ratings) – 17 firms or 68%: The firms with a positive outlook believe that Int el has a dominant position in the market with innovation being the key strategic imperative. Intel’s data cent er and cloud computing business are also gaining traction. These firms opine that Intel is investing to impro

© Copyright 2018, Zacks Investment Research. All Rights Reserved. ve its standing in the tablets, smartphones and Internet of Things (IoT) segments. Post the acquisition of M obileye, Intel has a competitive advantage in the autonomous driving market. Moreover, they also believe t hat the launch of the company’s 8th generation processors will be a huge positive.

Neutral (Hold or equivalent ratings) – 7 firms or 28%: These firms are on the sidelines as the majority of Intel’s revenues are from the PC market, the outlook for which is dismal. However, they are hopeful that this negative will be partially offset by impressive server revenues and Intel’s entry into smartphone, tablets and IoT market. But despite Intel’s expansion beyond the PC market, the progress is slow, which is a concern. Nevertheless, they believe that strong cash generation, an attractive dividend yield and a healthy share-repurchase program are factors that cannot be ignored. Moreover, these firms believe that Mobileye acquisition positions Intel in the autonomous driving market, which has significant growth potential in the long term.

Negative (Sell or equivalent ratings) – 1 firm or 4%: The firm is skeptical due to sluggish PC market growth and declining data center growth. Moreover, Intel has less competitive advantage in areas like autonomous driving, artificial intelligence (AI) and memory compared with the PC and enterprise data center businesses, which are rapidly declining. The firm also believes that Intel’s free cash flow will decline in FY17.

Summary: Intel’s product pipeline and its process technology roadmap indicate that the company will main tain its leadership position in the high-growth, high-margin data center segment. Despite slowing growth in PCs, Intel is strongly positioned in key emerging markets, where its offerings are likely to be popular becau se of the cost advantages. Internet of Things (IoT) represents less than 5% of Intel’s total sale but will grow in the coming years driven by increasing demands for semiconductor content to support connectivity in aut omobiles and household applications. However, increasing competition remains a headwind. Apr 03, 2018

Overview

Intel Corporation (INTC), based in Santa Clara, CA, is the world’s largest manufacturer of semiconductor products. The company supplies the computing and communications industries with microprocessors, motherboards and system building blocks that are integral to computers, servers and networking and communication products.

Key investment considerations as identified by the firms are as follows:

Zacks Investment Research Page 2 www.zackspro.com Key Positive Arguments Key Negative Arguments Intel is the leader in the microprocessor market Intel’s competitive advantage may get negatively and a significant player in the graphics chip impacted if the company fails to successfully leverage market. its process technology in migrating to the next With manufacturing facilities located at various geometry mode leveraging. strategic locations, the company enjoys benefits New markets, including consumer electronics, tablets of scale. and mobile phone markets have lower gross margins The more powerful and energy-efficient new below the corporate average. products are inducing corporate customers (both Intel owns its chip manufacturing facilities. Any big and small) to replace their PC fleets, slowdown will negatively impact Intel more than its indicating that the recovery in the client segment main competitors due to significant fixed expenses. will be both extended and intense. Capacity additions this year further increase this risk. Management changes and headcount A mature PC market is a matter of concern as PC reductions underscore more aggressive move shipments decline. toward a PC-centric model to the cloud/IoT Penetration into other markets such as wireless and ecosystem. networking communications has been slow. With cloud vendors opting to build large scale Competition arising out of alternative architectures datacenters, demand for Intel’s servers has especially in the Data Center Group could adversely increased. This has boosted revenue and gross impact Intel’s top-line growth. margin levels in spite of a sluggish PC market. Advanced Micro has changed its strategy, as it no longer wishes to be a low-cost provider. This is a big positive for Intel as its superior products will find it easier to steal the show in a more benign pricing environment. Emerging markets will drive growth at Intel, especially in the netbook category. Cash flow generation is strong at Intel and valuation remains attractive.

Depending on the end markets served, microprocessors, motherboards and chipsets are categorized into t he PC Client and Data Center Groups. The PC Client Group is targeted at notebooks, netbooks and deskto p computers. Some wireless connectivity products are also included in this segment. The Data Center Gro up targets the servers, workstations and other products for data center and cloud computing environments. Wired connectivity products are also included in the segment.

The segment Internet of Things Group also includes Intel’s embedded business. Software and Services is now a separate segment following the acquisition of McAfee. Also, the company formed the all-important M obile & Communications Group.

Intel’s major customers include original design manufacturers (ODMs), original equipment manufacturers (OEMs) such as Hewlett-Packard Company and Dell, which make computers, cell phones and other types of equipment; individuals and business customers, who buy Intel’s chips and printed circuit board-level pro ducts from distributors and other resellers; and other manufacturers of various types of industrial and com munications equipment.

The company’s most significant competitor is Advanced Micro Devices (AMD), which has offerings in almo st all of Intel’s served markets. Other competitors include VIA, NVIDIA, Freescale Semiconductor, Qualcom m and Texas Instruments. The company’s website is http://www.intel.com.

Note: Intel’s fiscal references coincide with the calendar year. Apr 03, 2018

Long-Term Growth

Zacks Investment Research Page 3 www.zackspro.com Intel is the largest manufacturer of microprocessors for computing platforms and is also well known for its integrated graphics chips. The company has successfully retained its dominant market position despite a few ups and downs. The long-term EPS growth of the company is projected to be 8.42%.

In the long term, PC shipments are expected to decline heavily and therefore Intel has been implementing a number of strategies to lessen its reliance on the PC market. The company has made significant investments in areas such as smartphones, tablets, Ultrabooks and IoT. However, growth has been slow. Analysts believe that these strategies will contribute significantly going ahead.

Intel’s foundry strategy will take shape in the coming years. The company is expanding its contract manufacturing (foundry) business by opening up foundry to other companies willing to use its technology. With PC demand going down, it is likely to result in idle factory space. So Intel is planning efficient factory utilization by offering manufacturing-process technology to high volume vendors. Qualcomm and Apple are potential customers. Firms believe that this strategy will allow the company to better participate in fast growing markets such as smartphones and mobile processors.

IoT offers immense growth opportunities to Intel. According to IDC, the global IoT market is anticipated to grow 13% annually, crossing $3 trillion by 2020. Firms believe that Intel will put in significant efforts to tap this fast growing market in the coming years.

The acquisition of Altera is helping Intel to strengthen its foothold in the data center market. In the long run, this move will help Intel to further improve its position in IoT. Moreover, the acquisition of Mobileye will strengthen the company’s position in the autonomous driving and ADAS markets.

Given the many growth drivers, the firms believe Intel’s growth prospects over the next 3–5 years are solid, although competition is likely to intensify, especially in the upcoming consumer-type markets.

Apr 03, 2018

Target Price/Valuation

Provided below is a summary of target price and rating as compiled by Zacks Research Digest:

Rating Distribution Positive 68.0%↑ Neutral 28.0%↑ Negative 4.0%↓ Avg. Target Price $53.05↑ Digest High $62.00↑ Digest Low $37.00↑ Analysts with Target Price/Total 22/25

According to the firms, risks to the achievement of price target include adverse conditions in the consumer PC market, execution risks associated with transitions to new architectures and processes, competitive pressure from ARM-based SoCs, market share changes, deterioration of mix advantages and regulatory risks.

Recent Events

Zacks Investment Research Page 4 www.zackspro.com On Mar 19, 2018, Intel announced Risa Lavizzo-Mourey’s election to board of directors.

On Mar 15, 2018, Intel declared $0.30 per share of quarterly dividend payable on June 1, 2018, to stockholders as on May 7, 2018.

On Feb 16, 2018, Intel announced retirement of David S. Pottruck from its Board of Directors, in effect after company’s 2018 Annual Stockholders’ Meeting.

On Jan 25, 2018, Intel reported 4Q17 results. Highlights are as follows:

Revenues increased 4.1% y/y to $17.05 billion. Non-GAAP EPS was $1.08, up almost 36.7% y/y.

On Jan 8, 2018, Intel’s CEO Brian Krzanich during a ‘Prime Keynote’ in the CES 2018 talked about the company’s initiatives in driverless vehicles and powering artificial intelligence (AI) technology through partnerships and strategic deals.

On Jan 3, 2018, Intel had encountered a major security issue. The security flaw could let attackers to access security keys, passwords, and cached files of a device's kernel memory. A hacker can access its platform and third-party information taking advantage of the system’s vulnerabilities, consequently posing a huge risk for users. The bug is apparently present in nearly every Intel CPU made within the last decade, and upcoming patches will negatively impact hardware performance.

Revenues

According to the 4Q17 press release, revenues totaled $17.05 billion, up 4.1% y/y and 5.6% q/q. After adjusting for the McAfee (formerly Intel Security Group) transaction, revenues increased 8%.

Top-line growth came on the back of impressive results from Data Center Group (“DCG”), Internet-of- Things Group (“IOTG”), Non-Volatile Memory Solutions (“NSG”) and Programmable Solutions Group (“PSG”), which contributed almost 46.4% (up from 44% in 3Q17) of the total revenues. These segments form the crux of Intel’s data-centric business, which increased 21% y/y in 4Q17.

Provided below is a summary of revenue projections as compiled by Zacks Digest:

Revenue ($ in M) 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E Digest High $16,374.0 $16,149.0 $17,053.0 $15,038.0 $59,486.0 $62,761.0 $65,020.0 $68,215.0 Digest Low $16,374.0 $16,149.0 $17,053.0 $15,000.0 $59,486.0 $62,761.0 $63,562.0 $61,706.0

Total Revenue $16,374.0 $16,149.0 $17,053.0 $15,007.8 $59,486.0 $62,761.0 $64,765.5 $66,268.8

Y/Y Growth 9.8% 2.4% 4.1% 1.4% 7.5% 5.5% 3.2% 2.3% Q/Q Growth 3.8% 9.4% 5.6% -12.0%

Segment Revenue Details

Zacks Investment Research Page 5 www.zackspro.com Client Computing Group (52.5% of revenues) — Intel bundles PCs, notebooks, 2-in-1s, tablets, modem, home gateway products and set-top box components under the Client Computing Group (“CCG”) segment, which aids comparison with the PC market numbers provided by IDC and Gartner.

Revenues declined 1.9% on a y/y basis but increased 1.1% sequentially to $8.95 billion.

Desktop revenues declined 8%, while notebook remained almost flat.

Modem and adjacencies (home gateway products and set-top box components) revenues increased 15% during the quarter.

On a y/y basis, desktop platform volumes declined 5%, while notebook platform volumes increased 5%. Average Selling Price (“ASP”) for desktop and notebook declined 2% and 5%, respectively.

CCG Revenues ($ 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E in M) Digest Average $9,129.0 $8,860.0 $8,954.0 $7,780.0 $32,908.0 $34,003.0 $33,320.0 $32,432.5

Y/Y Growth 4.3% -0.4% -1.9% -2.5% 2.1% 3.3% -2.0% -2.7% Q/Q Growth 2.7% 7.9% 1.1% -13.1%

Data Center Group (32.7% of revenues) — Revenues increased 19.6% y/y and 14.4% sequentially to $5.58 billion.

Platform volumes increased 10%, while platform ASP was up 8% on a y/y basis. Sequentially, platform volumes and ASP increased 3% and 12%, respectively.

Per Intel, cloud revenues advanced 35%, driven by robust volume growth and continued customer preference for higher performance products. Commercial service provider revenues grew 16% primarily owing to strong adoption of IA-based solutions. Revenues from adjacencies surged 35% y/y.

Enterprise & Government was up 11%. Enterprise benefited from strong ASPs driven by continued customer transition to Xeon Scalable product. Apart from strong on-going demand for public clouds, the company also observed strength in on-premise and hybrid cloud build-outs.

During the quarter, Intel shipped its first customer unit of first generation Nervana Neural Network Processor.

Lately, the company’s Movidius vision processing has gained strong adoption. The processor was selected by Alphabet’s Google division to develop its AIY vision kit. Amazon.com is also using the processor in its DeepLens, the world's first deep learning enabled video camera for developers.

Darvas' recently announced deep sense product line combined core CPU, Intel FPGA-based network video recorders along with Movidius VPU-based cameras.

DCG Revenues ($ 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E in M) Digest Average $4,668.0 $4,878.0 $5,582.0 $4,800.5 $17,236.0 $19,064.0 $20,878.0 $22,709.5

Y/Y Growth 8.4% 7.4% 19.6% 13.4% 7.9% 10.6% 9.5% 8.8% Q/Q Growth 2.8% 11.6% 14.4% -14.0%

Internet of Things Group (5.2% of revenues) — Revenues jumped 21.1% from the year-ago quarter and 3.5% quarter over quarter to $879 million.

Zacks Investment Research Page 6 www.zackspro.com Growth was backed by strength in retail, video and transportation applications.

IoTG Revenues ($ 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E in M) Digest Average $726.0 $849.0 $879.0 $827.5 $2,638.0 $3,169.0 $3,607.5 $4,074.5

Y/Y Growth 16.2% 23.2% 21.1% 14.8% 14.8% 20.1% 13.8% 12.9% Q/Q Growth 5.4% 17.9% 3.5% -5.9%

Non-Volatile Memory Solutions Group (5.2% of revenues) — Revenues increased 8.9% y/y but remained almost flat sequentially at $889 million. Strong demand for data center FFT solution and demand signals outpacing supply drove y/y growth.

NVMS Revenues ($ 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E in M) Digest Average $816.0 $891.0 $889.0 $957.5 $2,576.0 $3,520.0 $4,390.0 $5,264.5

Y/Y Growth 24.8% 37.3% 8.9% 10.6% -0.8% 36.6% 24.7% 19.9% Q/Q Growth 25.7% 1.9% -0.2% 7.7%

Programmable Solutions Group (3.3% of revenues) — The Altera business is now the Programmable Solutions Group, which surged 35.2% from the year-ago quarter and 21.1% sequentially to $568 million. Strength in data center, automotive and embedded drove top-line growth.

During the quarter, Intel launched FPGA SDK for OpenCL solution. The company also expanded the features of the Stratix 10 product line that now includes the first SoC FPGA with an armed processor at more than 1 million logic elements and the industry's first FPGA with integrated HBM2 memory.

PSG Revenues ($ 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E in M) Digest Average $420.0 $469.0 $568.0 $462.5 $1,669.0 $1,902.5 $1,998.5 $2,077.5

Y/Y Growth 37.3% 35.2% 8.8% -0.8% 14.0% 5.1% 4.0% Q/Q Growth -1.2% 1.9% 21.1% -18.6%

Intel also has a residual segment, which now includes results of operations from MobilEye, New Technology Group and other adjustments. The segment reported revenues of $181 million down 70.6% y/y and 10.4% sequentially.

Mobileye generated $128 million in revenues, increasing from $82 million delivered in 3Q17. The company has already launched 15 new programs in FY18. Intel currently has level two plus and level three design wins with 11 automakers that collectively represent more than 50% of global vehicle production.

During the quarter, Intel announced level through five autonomous driving platform based on EyeQ5 and Atom, which will sample over the next few months.

All Other 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E Revenues ($ in M) Digest Average $615.0 $202.0 $181.0 $191.5 $2,360.0 $1,103.0 $812.0 $1,067.5

Zacks Investment Research Page 7 www.zackspro.com Y/Y Growth 7.7% -65.2% -70.6% -66.8% 4.4% -53.3% -26.4% 31.5% Q/Q Growth 5.9% 40.3% -10.4% 5.8%

Guidance

Intel guided 1Q18 non-GAAP revenues of around $15 billion (+/-$500 million), up 5% y/y excluding McAfee.

Data-centric part of the business is projected to grow in the mid-teens range, while PC centric is expected to decline in low-single digits.

For FY18, management expects revenues of almost $65 billion (+/- $1 billion), up 4% y/y excluding McAfee.

Data-centric part of the business is projected to grow in the mid-teens range, while PC centric is expected to decline in low-single digits for FY18.

Management expects NSG to remain profitable in FY18.

Firms’ Outlook

Bullish firms believe that CCG revenues will be driven by market share gains in modem and continued stability in PCs, high performance and new security hardware features. Moreover, Intel’s focus on developing custom ASICs and integrated FPGAs will help it address the needs of artificial intelligence (AI) and machine learning.

Further, bullish firms believe that Data Center Group revenues will benefit from the Purley product cycle in FY18.

Some firms believe that solid server revenues will largely offset PC-related declines. Moreover, with the acquisition of Mobileye and the launch of Nervana, Intel is expected to gain rapid traction in the ADAS and autonomous driving market.

Recently, Intel revealed a number of partnerships in the AI space. The company announced few important partnerships — with BMW, Nissan, Volkswagen AG, and Ferrari — which show Intel’s growing dominance in providing AI platforms which will power future vehicles.

During the quarter, Intel announced level through five autonomous driving platform based on EyeQ5 and Atom, which will sample over the next few months. The company also joined forces with SAIC Motor and NavInfo to extend crowdsourced map building to China. SAIC Motor will build cars of Level 3, 4, and 5. These vehicles will be powered by Mobileye technology, which means it will be able to handle most driving situations itself.

However, increasing competition from AMD’s EPYC processor is anticipated to hurt Data Center Group revenues.

Some of the firms believe that sluggish PC-market along with weak competitive positioning in connected devices such as tablets and smartphones is a concern. Moreover, increasing competition from the likes of AMD is a headwind for the Client Computing Group.

Please refer to the INTC Zacks Research Digest spreadsheet for more details on revenue estimates.

Margins

Zacks Investment Research Page 8 www.zackspro.com According to the press release, gross margin for the quarter was 64.8%, which expanded 170 basis points (bps) on a y/y basis and 90 bps sequentially, better than management’s guidance.

Research & development (R&D) expenses and marketing, general & administrative (MG&A) expenses decreased 5.8% on a y/y basis but increased 7.3% sequentially to $5.12 billion, higher than management’s guided figure of $5.10 billion. As percentage of revenues, R&D and MG&A declined 320 bps on a y/y basis but increased 50 bps sequentially in the quarter.

Intel stated that total spending declined 6% in the reported quarter.

The operating margin was 34.8%, up 490 bps y/y and 40 bps sequentially. Segment operating margin expanded 400 bps on a y/y basis and remained unchanged sequentially.

Client Computing Group operating margin was 36.4% compared with 38.6% in the year-ago quarter. The contraction can primarily be attributed to higher costs related to 10 nm technology. Intel noted strength in the commercial gaming business. The company also believes that the worldwide PC supply chain is in a healthy state. On a sequential basis, CCG operating margin contracted 420 bps.

Data Center Group operating margin was 53.6% up significantly from 40.3% delivered in the year-ago quarter. Operating margin was positively impacted by improving revenue scale and strength in ASP. Sequentially, segment margin expanded 740 bps.

Internet of Things Group operating margin was 29.6%, up from 25.1% in the year-ago quarter and 17.2% in 3Q17.

Non-Volatile Memory Solutions Group reported profit of $31 million against a loss of $91 million in the year-ago quarter and $52 million in 3Q17. Operating profit resulted from higher yields as well as declining cost per Gigabyte.

Programmable Solutions Group reported operating income of $156 million, up 95% y/y and 38.1% sequentially.

Provided below is a summary of margins as compiled by Zacks Digest:

Margins 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E Gross 63.1% 63.9% 64.8% 60.8% 63.2% 63.8% 61.6% 61.8% Operating 27.6% 31.7% 31.6% 26.9% 21.7% 28.7% 30.0% 31.2% Pre tax 27.1% 36.7% 35.4% 25.9% 21.8% 32.4% 29.9% 31.0% Net 23.6% 30.0% 30.4% 22.3% 22.3% 26.7% 25.7% 26.6%

Guidance

For 1Q18 gross margin is expected to decline almost 3 percentage points and spending as a percent of revenues is anticipated to fall 3 points. Non-GAAP operating margin is projected to be roughly 27%, while EPS are anticipated to be 70 cents (+/- 5 cents), up 15% on a y/y basis.

For FY18, gross margin is expected to decline 2-2.5 percentage points and spending as a percent of revenues are projected to decrease 1-1.5 points. The gross margin decline is primarily anticipated due to growth in the adjacent businesses and transition costs related to 10 nm technology partially offset by higher gross margin from 14 nm products. Operating margin is projected to be roughly 30%. EPS are anticipated to be $3.55 (+/- 5%).

Management expects NSG to remain profitable in FY18.

Zacks Investment Research Page 9 www.zackspro.com Intel now expects the tax rate for FY18 to be approximately 14%. This will be because of lower U.S. statutory tax rate of 21%, lower tax on foreign income benefits of U.S. exporters and the continuation of the R&D credit.

Intel now expects to achieve total spending target of 30% of revenues “no later than” FY19, instead of its earlier projection of FY20.

Firms’ Outlook

Some bullish firms believe that Xeon Scalable has strong growth potential in the near term, which will boost average selling price (ASP) and margins.

According to the Zacks Digest model, R&D expense is expected to increase 0.4% on a y/y basis in FY18. For FY19, R&D expense is expected to increase 0.8% y/y.

Please refer to the Zacks Research Digest spreadsheet on INTC for detailed margins estimates.

Earnings per Share

According to the 4Q17 press release, non-GAAP EPS of $1.08 increased 36.7% on a y/y basis and 6.9% q/q. Robust earnings growth was driven by better-than-expected top-line performance and operating margin expansion.

Provided below is a summary of EPS as compiled by Zacks Digest:

EPS 4Q16A 3Q17A 4Q17A 1Q18E FY16A FY17A FY18E FY19E

Digest Average $0.79 $1.01 $1.08 $0.71 $2.72 $3.47 $3.52 $3.83

Digest High $0.79 $1.01 $1.08 $0.72 $2.73 $3.47 $3.55 $4.29

Digest Low $0.79 $1.01 $1.08 $0.70 $2.72 $3.46 $3.38 $3.31

Y/Y Growth 4.6% 26.2% 36.6% 7.2% 9.7% 27.5% 1.6% 8.8%

Q/Q Growth 39.3%

Guidance

For 1Q18, EPS are anticipated to be 70 cents (+/- 5 cents), up 15% on a y/y basis.

For FY18, the bottom line is anticipated to be driven by strong top-line growth and lower tax rate of approximately 14% (a positive impact of 28 cents).

Firms’ Outlook

Most of the firms believe that the enrichment of product portfolio will help Intel to further penetrate the market, thereby improving EPS growth.

Please refer to the INTC Zacks Research Digest spreadsheet for more details on earnings estimates. August 16, 2016

Research Analyst Radhika N Pujara Copy Editor

Zacks Investment Research Page 10 www.zackspro.com QCA/ Lead Analyst Awantika Poddar

Changes in Estimates & Reason for Update News Update

Zacks Investment Research Page 11 www.zackspro.com