MBA 653 Prof. Weejin December 2013 Binh Duong University

Problem Set 2

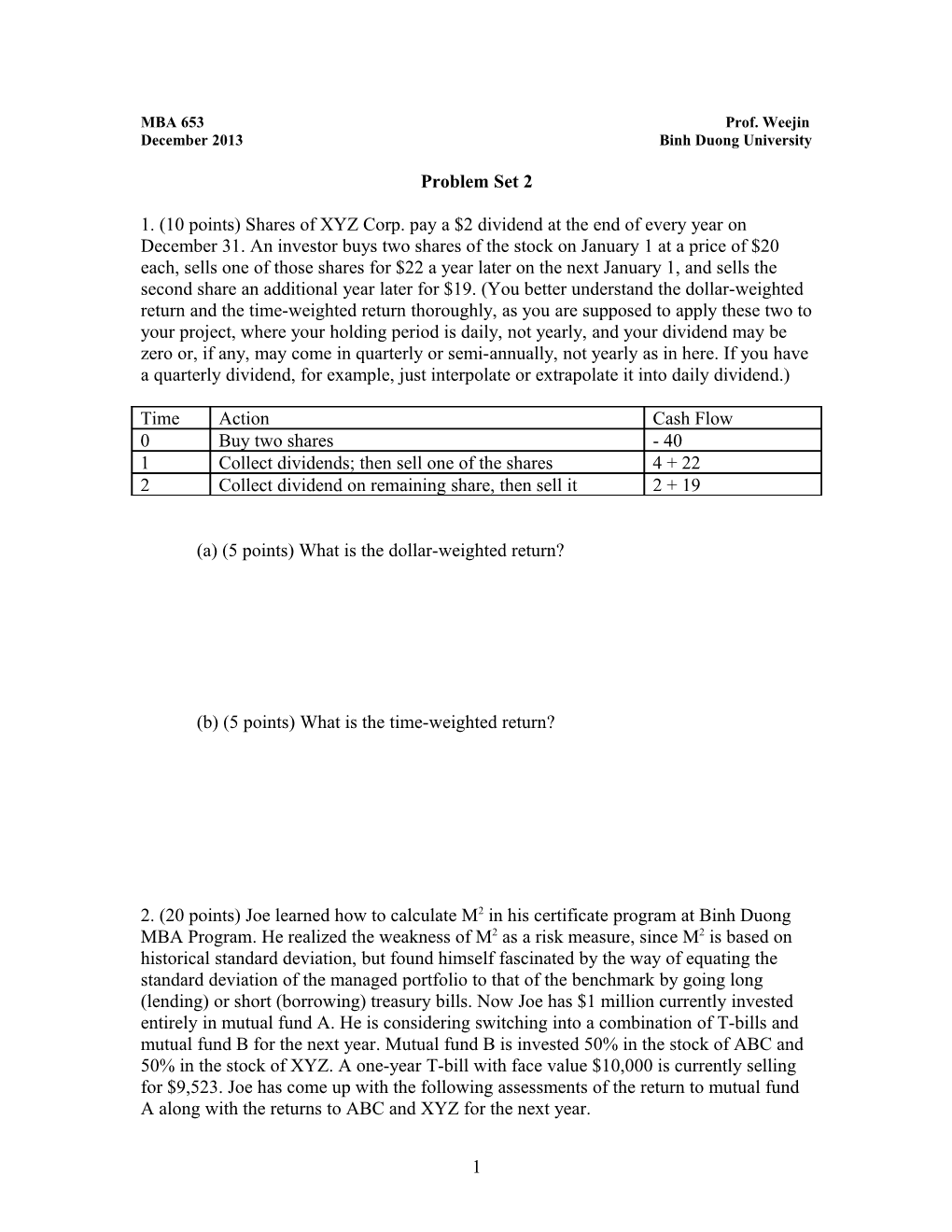

1. (10 points) Shares of XYZ Corp. pay a $2 dividend at the end of every year on December 31. An investor buys two shares of the stock on January 1 at a price of $20 each, sells one of those shares for $22 a year later on the next January 1, and sells the second share an additional year later for $19. (You better understand the dollar-weighted return and the time-weighted return thoroughly, as you are supposed to apply these two to your project, where your holding period is daily, not yearly, and your dividend may be zero or, if any, may come in quarterly or semi-annually, not yearly as in here. If you have a quarterly dividend, for example, just interpolate or extrapolate it into daily dividend.)

Time Action Cash Flow 0 Buy two shares - 40 1 Collect dividends; then sell one of the shares 4 + 22 2 Collect dividend on remaining share, then sell it 2 + 19

(a) (5 points) What is the dollar-weighted return?

(b) (5 points) What is the time-weighted return?

2. (20 points) Joe learned how to calculate M2 in his certificate program at Binh Duong MBA Program. He realized the weakness of M2 as a risk measure, since M2 is based on historical standard deviation, but found himself fascinated by the way of equating the standard deviation of the managed portfolio to that of the benchmark by going long (lending) or short (borrowing) treasury bills. Now Joe has $1 million currently invested entirely in mutual fund A. He is considering switching into a combination of T-bills and mutual fund B for the next year. Mutual fund B is invested 50% in the stock of ABC and 50% in the stock of XYZ. A one-year T-bill with face value $10,000 is currently selling for $9,523. Joe has come up with the following assessments of the return to mutual fund A along with the returns to ABC and XYZ for the next year.

1 E(rA) = 0.10 E(rABC ) = 0.10 E(rXYZ) = 0.18 σA = 0.20 σABC = 0.20 σXYZ = 0.30

ρABC,XYZ = 0.5

Using both the T-bill and mutual fund B, you’d like to help Joe to come up with his new portfolio construction by showing clearly why his new combo portfolio of treasuries and mutual fund B is better than his current mutual fund A only. In other words, you must help your friend with the task of how he can construct an investment of his $1 million such that the new portfolio is better than his current investment in mutual fund A by indicating the dollar investment (“the weight”) in T-bills and in mutual fund B.

(Hint: you might want to divide the task into two cases. The first case may be about the lower risk with the same return, whereas the second case may be the better return with the same risk. And for your reference the risk-free rate is calculated like this: 1 + rf =10,000/9523= 1.05 Therefore rf = 5%)

2 3. (15 points) Meina is considering investing in two stocks. After analyzing the two stocks she thinks that there are two possible states for the economy over the next year: “Good” and “Bad.” Each state is equally likely (probability 0.5). The returns of the two securities in each state are as follows:

State Return to Stock #1 Return to Stock #2 Good 30% 5% Bad 10% 10%

(a) (10 points) What is the covariance and the correlation between the two stock returns?

(b) (5 points) Given the correlation between the two stocks is -1, Meina can draw a picture of the Capital Allocation Line as she learned in the classroom to illustrate the tradeoff between risk and return that is available by investing in these two stocks. And 2 2 2 2 2 using two equations, E(rp) = W1 x E(r1) + W2 x E(r2) and σp = W1 x σ1 + W2 x σ2 + 2W1 W2 σ1,2 , it is possible for her to create a risk-free return in the two stocks by holding 20% in stock #1 and 80% in stock #2 (why 20% and 80%? We will learn the minimum variance portfolio along with the tangency portfolio in the class 5). As she sees it in the following graph, this has a return of 10%. Now suppose that a risk-free investment of 5% (in treasury bills) is also available. Does this present an arbitrage opportunity to Meina? Why or why not?

3 4. (15 points) In our class note 6, I gave you an example to explain to you the principle of diversification. I repeat it here:

Ex) suppose both stock variances are 0.04 and we invest equally in stocks 1 and 2. Then, the variance of this portfolio is,

2 2 1/2 1/2 Var(Rp) = (0.5) (0.04) + (0.5) (0.04) + 2(0.5)(0.5) ρ1,2 (0.04) (0.04)

= 0.02 + 0.02 ρ1,2 Key Result: This illustrates a key point: the variance of the resulting portfolio will always be less than the variance of each of the two individual stocks (which are 0.04 in this case), so long as the correlation, ρ1,2, between the two stocks is less than 1 (i.e., so long as they are not perfectly positively correlated). Also, the lower the correlation, the lower the variance of the resulting portfolio.

And then we stopped here because we hit the class ending time, 9:15 pm. Here I want all of you to go further to see if this conventional diversification principle is always true or not.

4 (a) (10 points) To show that the above principle is not always true, do the following simple diversification math:

Ex) suppose that σ1 of stock 1 is 0.1 and σ2 of stock 2 is 0.3 and the correlation between stocks 1 and 2 is less than 1, say, ρ1,2 = 0. What is the variance of the equally weighted portfolio of stocks 1 and 2? You must show the process leading to the answer, e.i., the variance of the equally weighted portfolio, and explain your finding briefly.

(b) (5 points) The following summarizes one of the causes for why the LTCM collapsed in relation to the diversification effects based on the correlation as shown in the documentary movie, “The Trillion Dollar Bet.” (by the way, if you want, you can borrow this movie from me. This indeed is an excellent movie.)

LTCM’s numerous strategies, including

o Fixed income spread trades (e.g. mortgage vs. Treasury) o Convertible arb and M&A trades o Equity spread trades

Big positions included $540 million in equity positions and $1.25 trillion notional in swaps outstanding

August 1998

o The Russian ruble collapse caused a massive flight to quality that drove Treasury prices up and yields down but did not affect MBS yields

5 o Traditionally “stable” correlations across markets broke down

o LTCM experienced a 44% decline in NAV ($1.8 billion loss) in August

We call this correlation-break-down phenomenon “the phase locking effect.” What is it? Explain it briefly.

5. (20 points) Please answer the following questions based on the table below.

Impact of Volatility on Terminal Wealth

Period Return (%) of Fund A Return (%) of Fund B 1 8.0 -3.0 2 12.0 25.0 3 9.0 2.0 4 13.0 30.0 5 8.0 -4.0

Average Return (%) 10.0 10.0 Variance 4.4 210.8 Beginning Amount $1,000,000 $1,000,000 Ending Amount $1,609,053 $1,543,464

(a) (10 points) We now understand that compounding with less deviation (or less risk) about the average or expected return can give us the greater ending balance as shown in the above table. The conventional return-risk trade-off, on the other hand, says if you want to make more money, you have to take on more risk. This apparent inconsistency can be no problem, because the return-risk trade-off may be explained in the world of expected return. That is, what really happens (realized return) is different from what should be expected to happen (expected return). And there are also risk neutral or loving people out there in addition to the risk averse people. However, we still have problems

6 with this standard deviation as a risk measure. As we discussed, all those traditional return-risk measures like Sharpe ratio, Sortino ratio, M2, Tracking Error, Information ratio can be problematic because of their dependence on standard deviation. Why do you think that risk measures based on standard deviation can have problems? (hint: I gave you a humor in the classroom that I put my right leg in a hot oven and left leg in a freezing freezer. When somebody asks me how I feel, as a statistical guru I have to say, “on the average I feel fine.” But that is not what really happens.)

(b) (10 points) Due to the problems shown in the above question (a) the hedge fund managers adopted the Maximum Drawdown measure as a simplest and best way to measure risk more consistent with return. What are the core ideas and business practice conventions of the Maximum Drawdown method?

6. (5 points) Answer the following question briefly and justify your answers ( present value equations can be useful).

Is the following statement True, False, or Uncertain?

7 If inflation rises above expectations, then both bond and stock prices will fall in the short-term, but stock prices will not fall by as much.

7. (15 points) Consider the following info regarding the performance of a money manager in a recent month. The table represents the actual return of each sector of the manager’s portfolio in column 1, the fraction of the portfolio allocated to each sector in column 2, the benchmark or neutral sector allocations in column 3, and the returns of sector indices in column 4.

Actual Return Actual Weight Benchmark Weight Index Return Equity 2% .70 .60 2.5% (S&P 500) Bonds 1 .20 .30 1.2 (Salomon Index) Cash 0.5 .10 .10 0.5

(a) (5 points) What was the manager’s return in the month? What was her overperformance or underperformance?

8 (b) (5 points) What was the contribution of security selection to relative performance?

(c) (5 points) What was the contribution of asset allocation to relative performance? Confirm that the sum of selection and allocation contributions equals her total “excess” return relative to the bogey.

8. (Just for fun) On January 1, you sold short one round lot (i.e., 100 shares) of Zenith stock at $14 per share. On March1, a dividend of $2 per share was paid. On April 1, you covered the short sale by buying the stock at a price of $9 per share. You paid 50 cents per share in commissions for each transaction. What is your account value on April 1?

The proceeds from the short sale (net of commission) were $14 x 100 – $50 = $1,350. A dividend payment of $200 was withdrawn from the account. Coverage at $9 cost you (including commission) $900 + $50 = $950, leaving you with a profit of $1350 – $200 – $950 = $200.

Note that your profit, $200, equals 100 shares x profit per share of $2. Your net proceeds per share were: $14 sales price of stock –$ 9 repurchase price of stock –$ 2 dividend per share –$ 1 2 trades x $.50 commission per share on each trade. ––––––– $ 2

9