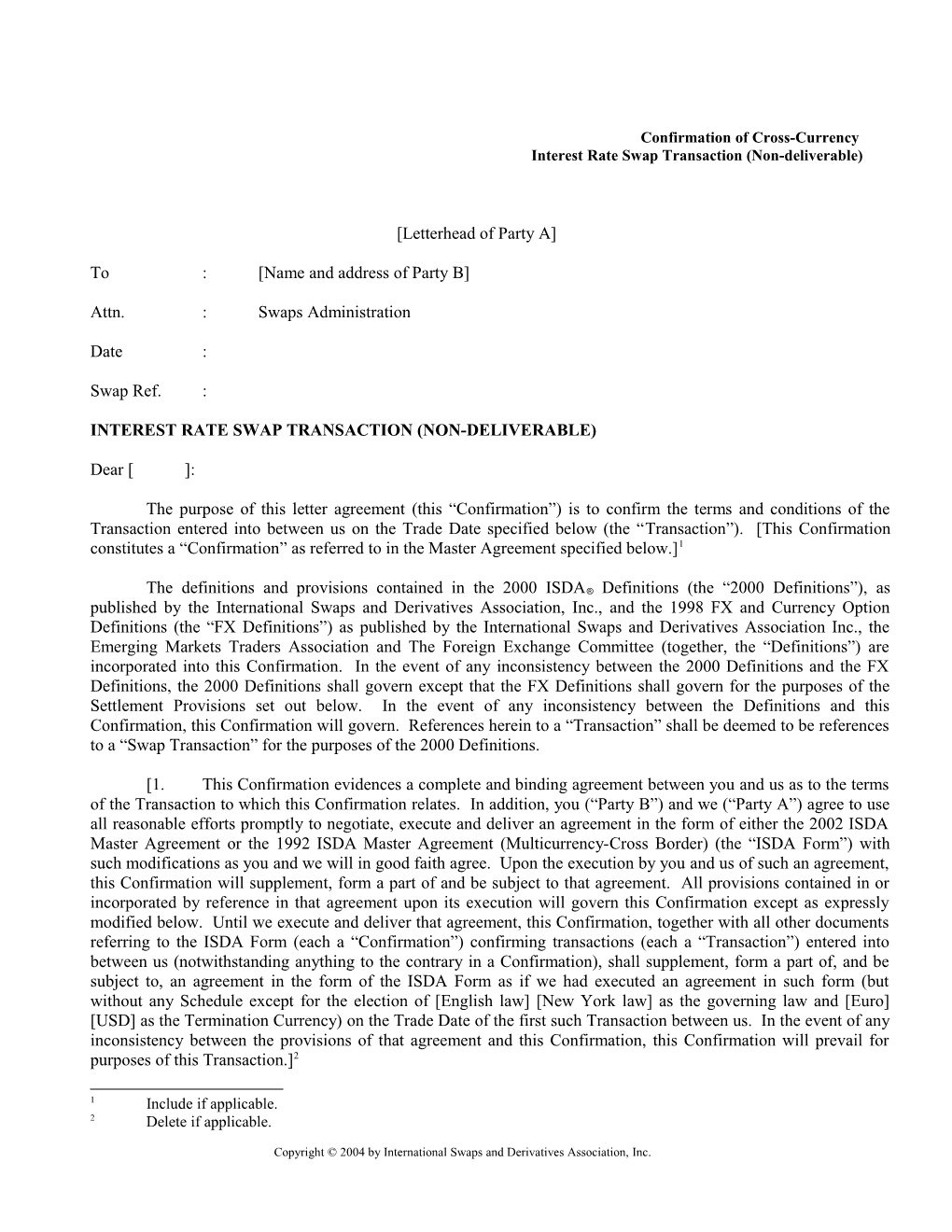

Confirmation of Cross-Currency Interest Rate Swap Transaction (Non-deliverable)

[Letterhead of Party A]

To : [Name and address of Party B]

Attn. : Swaps Administration

Date :

Swap Ref. :

INTEREST RATE SWAP TRANSACTION (NON-DELIVERABLE)

Dear [ ]:

The purpose of this letter agreement (this “Confirmation”) is to confirm the terms and conditions of the Transaction entered into between us on the Trade Date specified below (the “Transaction”). [This Confirmation constitutes a “Confirmation” as referred to in the Master Agreement specified below.]1

The definitions and provisions contained in the 2000 ISDA® Definitions (the “2000 Definitions”), as published by the International Swaps and Derivatives Association, Inc., and the 1998 FX and Currency Option Definitions (the “FX Definitions”) as published by the International Swaps and Derivatives Association Inc., the Emerging Markets Traders Association and The Foreign Exchange Committee (together, the “Definitions”) are incorporated into this Confirmation. In the event of any inconsistency between the 2000 Definitions and the FX Definitions, the 2000 Definitions shall govern except that the FX Definitions shall govern for the purposes of the Settlement Provisions set out below. In the event of any inconsistency between the Definitions and this Confirmation, this Confirmation will govern. References herein to a “Transaction” shall be deemed to be references to a “Swap Transaction” for the purposes of the 2000 Definitions.

[1. This Confirmation evidences a complete and binding agreement between you and us as to the terms of the Transaction to which this Confirmation relates. In addition, you (“Party B”) and we (“Party A”) agree to use all reasonable efforts promptly to negotiate, execute and deliver an agreement in the form of either the 2002 ISDA Master Agreement or the 1992 ISDA Master Agreement (Multicurrency-Cross Border) (the “ISDA Form”) with such modifications as you and we will in good faith agree. Upon the execution by you and us of such an agreement, this Confirmation will supplement, form a part of and be subject to that agreement. All provisions contained in or incorporated by reference in that agreement upon its execution will govern this Confirmation except as expressly modified below. Until we execute and deliver that agreement, this Confirmation, together with all other documents referring to the ISDA Form (each a “Confirmation”) confirming transactions (each a “Transaction”) entered into between us (notwithstanding anything to the contrary in a Confirmation), shall supplement, form a part of, and be subject to, an agreement in the form of the ISDA Form as if we had executed an agreement in such form (but without any Schedule except for the election of [English law] [New York law] as the governing law and [Euro] [USD] as the Termination Currency) on the Trade Date of the first such Transaction between us. In the event of any inconsistency between the provisions of that agreement and this Confirmation, this Confirmation will prevail for purposes of this Transaction.]2

1 Include if applicable. 2 Delete if applicable.

Copyright © 2004 by International Swaps and Derivatives Association, Inc. [1. This Confirmation supplements, forms part of, and is subject to, the ISDA Master Agreement dated as of [date], as amended and supplemented from time to time (the “Agreement”), between [ ] (“Party A”) and [] (“Party B”). All provisions contained in the Agreement govern this Confirmation except as expressly modified below.]3

2. The terms of the particular Transaction to which this Confirmation relates are as follows:

Trade Date: [ ]

Effective Date: [ ]

Termination Date: [ ] [, subject to adjustment in accordance with the Modified Following Business Day Convention], and subject as provided below.

Fixed Amounts:

Fixed Rate Payer: [Party A/B]

Fixed Rate Payer Currency Amount: [ ]

Fixed Rate Payer Payment Dates: [scheduled Fixed Rate Payer Payment Dates] [, subject to adjustment in accordance with the Modified Following Business Day Convention], and subject as provided below.

[Fixed Rate Payer Period End Dates: [scheduled Fixed Rate Payer Payment Dates] [, subject to adjustment in accordance with the Modified Following Business Day Convention]]

Fixed Amount [or Fixed Rate and Fixed [ ] Rate Day Count Fraction]:

Floating Amounts:

Floating Rate Payer: [Party B/A]

Floating Rate Payer Currency Amount: [ ]

Floating Rate Payer Payment Dates: [scheduled Floating Rate Payer Payment Dates ] [, subject to adjustment in accordance with the Modified Following Business Day Convention] , and subject as provided below.

Floating Rate Payer Period End Dates: [scheduled Floating Rate Payer Payment Dates ] [, subject to adjustment in accordance with the Modified Following Business Day Convention]

[Floating Rate for initial Calculation [ ] Period:]4 3 Delete if applicable. Page 2 of 8 Floating Rate Option:

Spread: [Plus/Minus %] [None]

Floating Rate Day Count Fraction: [ ]

Reset Date: First day of each Calculation Period

[Rate Cut-off Dates:] [ ]

[Method of Averaging:] [Unweighted/Weighted Average]

Compounding: [Applicable/Inapplicable]

[Compounding Dates:] [ ]

[Discounting:

Discount Rate: [ ]

Discount Rate Day Count Fraction:] [ ]

[Initial Exchange: None

[Final Exchange:

Final Exchange Date: Termination Date

Party A Final Exchange Amount: [ ]

Party B Final Exchange Amount: [ ]]

4 Only insert where the figure is known at the time the Confirmation is issued. Page 3 of 8 Calculation Agent: Party A [and Party B]

[If the parties are unable to agree on a determination within one Business Day, each party agrees to be bound by the determination of an independent leading dealer in transactions in the nature of this Transaction (“Independent Leading Dealer”), mutually selected by the parties, who shall act as the substitute Calculation Agent. If the parties are unable to agree on an Independent Leading Dealer to act as substitute Calculation Agent, each party shall select an Independent Leading Dealer and such Independent Leading Dealers shall agree on an independent third party who shall deemed to be the substitute Calculation Agent. The fees and expenses of such substitute Calculation Agent (if any) shall be met equally by the parties.]5

[Broker/Arranger:]

SETTLEMENT PROVISIONS:

Settlement: Non-deliverable, with the effect that any Reference Currency amounts payable hereunder on a Payment Date (“Reference Currency Payment Date”) or an Exchange Date (“Reference Currency Exchange Date”) shall be converted into Settlement Currency amounts by reference to the Settlement Rate Option on the applicable Valuation Date. All payments (including exchanges) hereunder shall be made in the Settlement Currency.

Settlement Rate Option: [ ]

Reference Currency: [ ]

Settlement Currency: [ ]

Valuation Date: In respect of a Reference Currency Payment Date or a Reference Currency Exchange Date, the date which is two Business Days prior to that Reference Currency Payment Date or Reference Currency Exchange Date, provided that if a day that, but for the occurrence on that day of an Unscheduled Holiday would have been a Valuation Date (a “Scheduled Valuation Date”), is as a result of such occurrence not a Business Day, the Valuation Date in question shall be the next following Business Day to such Scheduled Valuation Date on which an Unscheduled Holiday does not occur, provided that 5 The bracketed language is commonly used in the interdealer market, but parties remain free to bilaterally agree on a different approach. Page 4 of 8 if the Valuation Date has not occurred on or before the fourteenth consecutive day after the relevant Scheduled Valuation Date (any such period being the “Deferral Period”), then the next day after the Deferral Period that would have been a Business Day but for the Unscheduled Holiday, shall be deemed to be the relevant Valuation Date.

DISRUPTION EVENTS: Event Currency: Each Reference Currency Price Source Disruption: Applicable

DISRUPTION FALLBACKS: 1. Valuation Postponement 2. Fallback Reference Price 3. Fallback Survey Valuation Postponement 4. Calculation Agent Determination of Settlement Rate

OTHER TERMS: Unscheduled Holiday “ Unscheduled Holiday” means that a day is not a Business Day and the market was not aware of such fact (by means of a public announcement or by reference to other publicly available information) until a time later than 9:00 a.m. local time in the Principal Financial Center(s) of the Reference Currency two Business Days prior to the Scheduled Valuation Date.

Valuation Postponement “ Valuation Postponement” means, for purposes of for Price Source Disruption: obtaining a Settlement Rate, that the Spot Rate will be determined on the Business Day first succeeding the day on which the Price Source Disruption ceases to exist, unless the Price Source Disruption continues to exist (measured from the date that, but for the occurrence of the Price Source Disruption, would have been the Valuation Date) for a consecutive number of calendar days equal to the Maximum Days of Postponement. In such event, the Spot Rate will be determined on the next Business Day after the Maximum Days of Postponement (which will, subject to the provisions relating to Fallback Survey Valuation Postponement, be deemed to be the applicable Valuation Date) in accordance with the next applicable Disruption Fallback.

Fallback Survey Valuation Postponement: “ Fallback Survey Valuation Postponement” means that, in the event that the Fallback Reference Price is not available on or before the third Business Day (or day that would have been a Business Day but for an Page 5 of 8 Unscheduled Holiday) succeeding the end of either (i) Valuation Postponement for Price Source Disruption, (ii) Deferral Period for Unscheduled Holiday, or (iii) Cumulative Events, then the Settlement Rate will be determined in accordance with the next applicable Disruption Fallback on such day (which will be deemed to be the applicable Valuation Date). For the avoidance of doubt, Cumulative Events, if applicable, does not preclude postponement of valuation in accordance with this provision.

Cumulative Events: Except as provided below, in no event shall the total number of consecutive calendar days during which either (i) valuation is deferred due to an Unscheduled Holiday, or (ii) a Valuation Postponement shall occur (or any combination of (i) and (ii)), exceed 14 consecutive calendar days in the aggregate. Accordingly, (x) if, upon the lapse of any such 14 calendar day period, an Unscheduled Holiday shall have occurred or be continuing on the day following such period that otherwise would have been a Business Day, then such day shall be deemed to be a Valuation Date, and (y) if, upon the lapse of any such 14 calendar day period, a Price Source Disruption shall have occurred or be continuing on the day following such period on which the Spot Rate otherwise would be determined, then Valuation Postponement shall not apply and the Spot Rate shall be determined in accordance with the next Disruption Fallback.

Maximum Days of Postponement: 14 calendar days

Page 6 of 8 Adjustment to Termination Date, If the Valuation Date in respect of a Reference Payment Dates and Exchange Dates: Currency Payment Date, a Reference Currency Exchange Date or the Termination Date is not the Scheduled Valuation Date in respect of such Reference Currency Payment Date, Reference Currency Exchange Date or Termination Date, then such Reference Currency Payment Date, Reference Currency Exchange Date or Termination Date (as applicable) shall be as soon as practicable after the relevant Valuation Date, but in no event later than the day which is two Business Days after the relevant Valuation Date. Further, if payments are scheduled to be made by both parties on a Payment Date, Exchange Date or Termination Date, and such date is adjusted due to the occurrence of an Unscheduled Holiday in accordance with the previous sentence, then such Payment Date, Exchange Date or Termination Date shall be adjusted in respect of both parties’ payments.

For the avoidance of doubt, such adjustments shall not apply in respect of Period End Dates (including the Termination Date) for the purposes of determining the Calculation Periods.

Business Day (as defined in the FX [ ] Definitions) for Valuation Date(s): Business Day (as defined in the 2000 [ [and] ] Definitions) for all other purposes:

3. Account Details:

Account(s) for payments to Party A: [ ]

Account(s) for payments to Party B: [ ]

4. Offices:

(a) The Office of Party A for the Transaction is [ ]; and

(b) The Office of Party B for the Transaction is [ ].

[5. Other Terms . [[(i)] Relationship Between Parties. Each party will be deemed to represent to the other party on the date on which it enters into a Transaction that (absent a written agreement between the parties that expressly imposes affirmative obligations to the contrary for that Transaction):―

[(1)] Non-Reliance. It is acting for its own account, and it has made its own independent decisions to enter into that Transaction and as to whether that Transaction is appropriate or proper for it based upon its own judgment and upon advice from such advisers as it Page 7 of 8 has deemed necessary. It is not relying on any communication (written or oral) of the other party as investment advice or as a recommendation to enter into that Transaction, it being understood that information and explanations related to the terms and conditions of a Transaction will not be considered investment advice or a recommendation to enter into that Transaction. No communication (written or oral) received from the other party will be deemed to be an assurance or guarantee as to the expected results of that Transaction.

[(2)] Assessment and Understanding. It is capable of assessing the merits of and understanding (on its own behalf or through independent professional advice), and understands and accepts, the terms, conditions and risks of that Transaction. It is also capable of assuming, and assumes, the risks of that Transaction.

[(3)] Status of Parties. The other party is not acting as a fiduciary for or an adviser to it in respect of that Transaction.]]6

[(ii) Fallback Reference Price. The other party, acting directly or through a branch or an affiliate, may be requested to provide a quotation or quotations from time to time for the purpose of determining the Fallback Reference Price and such quotation may affect, materially or otherwise, the settlement of this Transaction.]

6. Closing:

Please confirm your agreement to be bound by the terms of the foregoing by executing a copy of this Confirmation and returning it to us [by facsimile].

Yours sincerely,

______For and on behalf of [ ]

Confirmed as of the date first above written: [Counterparty]

by: ______Authorised Signature Name: Title:

6 Parties may wish to consider using this wording where no ISDA Master Agreement is in place between the parties. Page 8 of 8