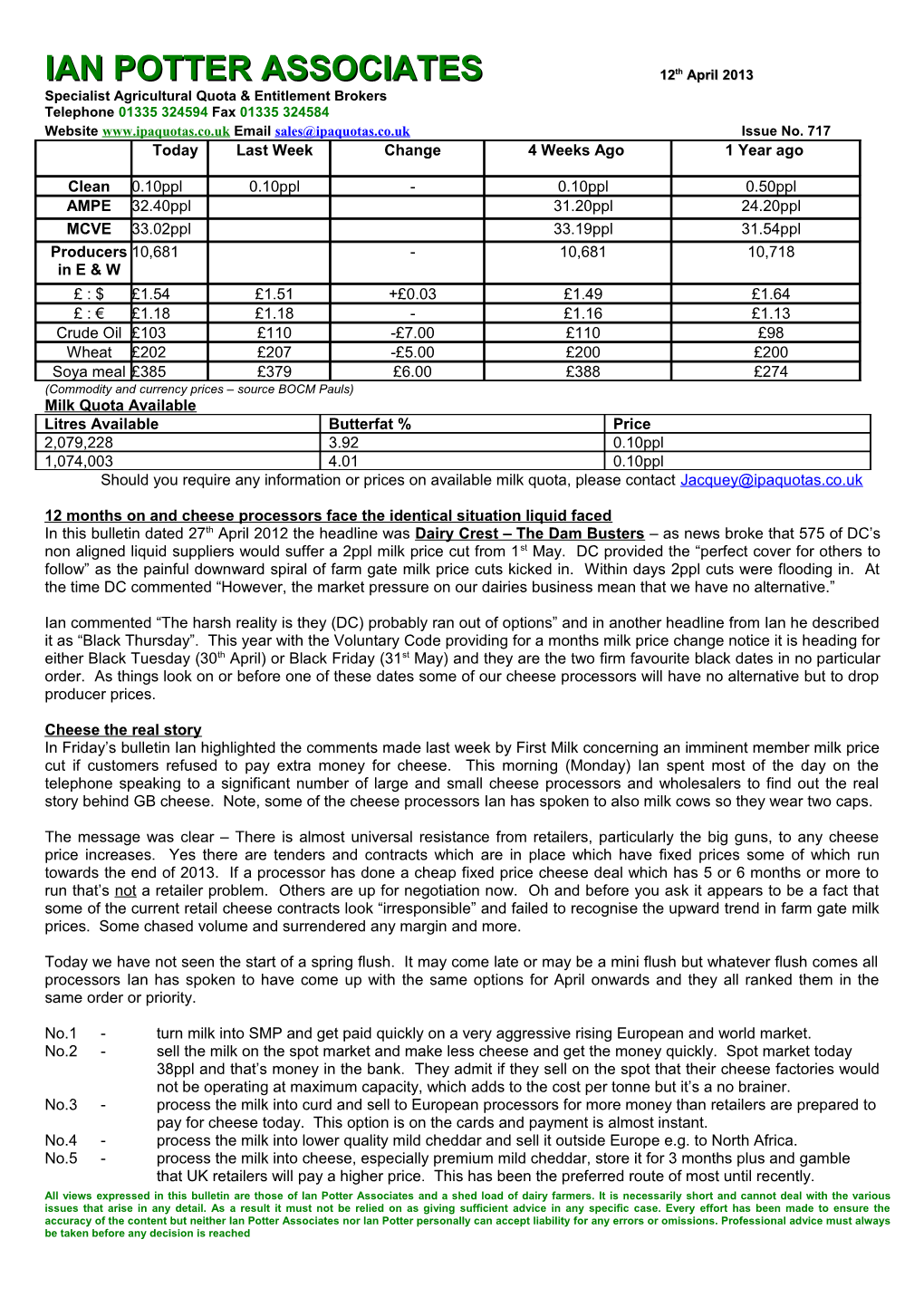

IAN POTTER ASSOCIATES 12th April 2013 Specialist Agricultural Quota & Entitlement Brokers Telephone 01335 324594 Fax 01335 324584 Website www.ipaquotas.co.uk Email [email protected] Issue No. 717 Today Last Week Change 4 Weeks Ago 1 Year ago

Clean 0.10ppl 0.10ppl - 0.10ppl 0.50ppl AMPE 32.40ppl 31.20ppl 24.20ppl MCVE 33.02ppl 33.19ppl 31.54ppl Producers 10,681 - 10,681 10,718 in E & W £ : $ £1.54 £1.51 +£0.03 £1.49 £1.64 £ : € £1.18 £1.18 - £1.16 £1.13 Crude Oil £103 £110 -£7.00 £110 £98 Wheat £202 £207 -£5.00 £200 £200 Soya meal £385 £379 £6.00 £388 £274 (Commodity and currency prices – source BOCM Pauls) Milk Quota Available Litres Available Butterfat % Price 2,079,228 3.92 0.10ppl 1,074,003 4.01 0.10ppl Should you require any information or prices on available milk quota, please contact [email protected]

12 months on and cheese processors face the identical situation liquid faced In this bulletin dated 27th April 2012 the headline was Dairy Crest – The Dam Busters – as news broke that 575 of DC’s non aligned liquid suppliers would suffer a 2ppl milk price cut from 1st May. DC provided the “perfect cover for others to follow” as the painful downward spiral of farm gate milk price cuts kicked in. Within days 2ppl cuts were flooding in. At the time DC commented “However, the market pressure on our dairies business mean that we have no alternative.”

Ian commented “The harsh reality is they (DC) probably ran out of options” and in another headline from Ian he described it as “Black Thursday”. This year with the Voluntary Code providing for a months milk price change notice it is heading for either Black Tuesday (30th April) or Black Friday (31st May) and they are the two firm favourite black dates in no particular order. As things look on or before one of these dates some of our cheese processors will have no alternative but to drop producer prices.

Cheese the real story In Friday’s bulletin Ian highlighted the comments made last week by First Milk concerning an imminent member milk price cut if customers refused to pay extra money for cheese. This morning (Monday) Ian spent most of the day on the telephone speaking to a significant number of large and small cheese processors and wholesalers to find out the real story behind GB cheese. Note, some of the cheese processors Ian has spoken to also milk cows so they wear two caps.

The message was clear – There is almost universal resistance from retailers, particularly the big guns, to any cheese price increases. Yes there are tenders and contracts which are in place which have fixed prices some of which run towards the end of 2013. If a processor has done a cheap fixed price cheese deal which has 5 or 6 months or more to run that’s not a retailer problem. Others are up for negotiation now. Oh and before you ask it appears to be a fact that some of the current retail cheese contracts look “irresponsible” and failed to recognise the upward trend in farm gate milk prices. Some chased volume and surrendered any margin and more.

Today we have not seen the start of a spring flush. It may come late or may be a mini flush but whatever flush comes all processors Ian has spoken to have come up with the same options for April onwards and they all ranked them in the same order or priority.

No.1 - turn milk into SMP and get paid quickly on a very aggressive rising European and world market. No.2 - sell the milk on the spot market and make less cheese and get the money quickly. Spot market today 38ppl and that’s money in the bank. They admit if they sell on the spot that their cheese factories would not be operating at maximum capacity, which adds to the cost per tonne but it’s a no brainer. No.3 - process the milk into curd and sell to European processors for more money than retailers are prepared to pay for cheese today. This option is on the cards and payment is almost instant. No.4 - process the milk into lower quality mild cheddar and sell it outside Europe e.g. to North Africa. No.5 - process the milk into cheese, especially premium mild cheddar, store it for 3 months plus and gamble that UK retailers will pay a higher price. This has been the preferred route of most until recently. All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached “ UK retailers never want to pay and to go for option 5 will provide by far the worst return” commented one with experience.

All of the cheese processors and wholesalers Ian has spoken to say they will process and handle significantly less UK cheese in 2013 than they did in 2012. One industry guru said in his/her opinion it is a certainty in 2013 retailers will run short of cheese and panic.

All of them appear to have paid their farmers more money for milk in anticipation of achieving higher cheese prices.

What’s the solution? Retailers wake up and look 100 yards down the road to see what’s coming.

Twelve months ago processors dropped liquid milk prices and all hell broke out. Now, rightly or wrongly, First Milk have broke cover and said there are two choices. Either the price of cheese to retailers’ increases or the price paid to farmers is cut.

If milk purchasers cut milk prices it will be suicidal and Ian predicts a dairy farmer revolt on a scale never seen before, will hit the news.

Security of cheese supply is under threat and there is minimal, if any, unallocated GB cheese to be traded. Will retailers be able to cough up, find and pay for the cheese to go on the shelves in 3-6 months time? The wise people Ian spoke to today say not. The real question is, do retailers really have a choice not to pay more?

The British Retail Consortium (BRC) needs educating On the front page of today’s Farmers Guardian the BRC have been allowed to get away with the comment “but farmers need to acknowledge cheese is a globally traded commodity with prices set on the world stage”. I realise they are there to defend retailers but surely not to tell porkies.

Out of the 410,000 tonnes or so of cheese we consume in the UK we produce around 320,000 tonnes with 80,000 tonnes coming from Ireland, a bit from Holland and New Zealand.

British and, for that matter, Irish cheese is not globally traded and if members of the BRC want to import their cheese from the USA or South Africa then crack on lads. With ASDA having found bute in its Smart Price corned beef produced in France and the whole horsemeat scandal with 50,000 tonnes of Dutch beef products recalled when will the retailers, discounters and food service learn.

The main customer for Irish cheese is the UK and the lions share of UK produced cheese is domestically consumed.

As the Scottish NFU President Nigel Miller stated this week, “I suspect the general public will be disappointed to hear that, at the moment, the rewards from cheese production are largely filling retailer coffers” and that the cheese market is dysfunctional.

The clock is ticking and a solution will be found either by negotiation or confrontation.

NFU Dairy Producer Rep Summit calls for naming and shaming At the end of yesterday’s Annual Producer Representative Summit at Stoneleigh there was an extremely lively discussion involving David Handley and yours truly on centre stage concerning comments made in this bulletin last Friday and again on Monday over imminent milk for cheese price cuts.

There was a very loud call for naming and shaming of those who refuse to pay more money for their cheese. If negotiation and naming and shaming still results in farmer price cuts the call was for mass retailer and food service protests to be organised. The appetite for protesting is mind boggling and fingers crossed it will not happen.

Given the fact First Milk were the first cheese processor to break cover it will be their cheese customers who are first under the spotlight. That means ASDA, Morrisons, several discounters and numerous food service and catering operations.

Plans are moving at speed and all bullets are aimed at UK cheese customers. Whilst the potential for farmer protests is one useful weapon it’s one the retailers, discounters and food service people might be prepared to defend and have a go at. However, it’s a whole new ball game when from stage left the super guns of the WI step forward. Ian’s hope is for fair negotiations based on the facts to result in common sense deals and avoid more media coverage and antagonism.

UK supermarkets rationing baby milk could soon be rationing cheese All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached In an article by milksources.com this week they report that UK retailers are now rationing sales of baby milk powder due to the surge in demand for infant formula milk from China. The French firm Danone manufacture Aptamil and Cow & Gate brands and retailers including Tesco, ASDA, Sainsburys and Morrisons all have a 2 cartons per customer limit.

If any of those who buy cheddar do not look at what’s happening to the cheese market and fail to take action cheese rationing could be another headache for retailers to contend with.

Production plummets 7.5% The RPA’s latest UK monthly milk production figures indicate March milk production down 7.5% to only 1.108 billion litres, the largest monthly drop in 30 years. The early indications are that the UK finished the 2012/13 year 13.6% under quota at under 13 billion litres (12.97 billion). Cumulative butterfat stands at 4.07% and 10 points above our national base.

Do you like the latest DairyCo video? DairyCo have commissioned a short animated cartoon. One of the ideas is to help farmers feel a bit better about things.

So Ian is conducting a "poll" today as to what farmers think of this 90 second clip: http://www.thisisdairyfarming.com/at-the-moovies/the-everyday-things.aspx#.UWMDpqvwI7S

Watch it and email either “Yes, I like it” or “No, it’s a waste of money”. Note DairyCo are keen to point out the video is aimed at consumers not farmers. It’s a pity DairyCo have not posted it on YouTube so levy paying farmers can monitor the number of times it is watched and the viewing figures.

Silage - For Sale 100 bales, could be split, late cut near Ashbourne (DE6) £15.00/ bale. Contact the office.

All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached