MSIL reported a Q2 PAT of Rs8.6bn, which was ahead of street expectation but BUY marginally below our expectation. Although margins were a tad below our expectations, we remain confident of margin improvement in coming quarters MSIL IN | CMP RS 3140 based on mix improvement (higher share of non-discounted models and new TARGET RS 3430 (+9%) launches within discounted models) and favourable currency. Being on the Company Data favorable side of the model cycle, we maintain our view that MSIL to grow O/S SHARES (MN) : 302 ahead of market in FY16/17. We maintain our BUY rating with a TP of Rs3,430. MARKET CAP (RSBN) : 932 MARKET CAP (USDBN) : 15.3 Revenues broadly in inline: Revenues at Rs123bn were broadly in-line to our 52 - WK HI/LO (RS) : 2980 / 1334 LIQUIDITY 3M (USDMN) : 16.5 estimates (~1% ahead of consensus) on account of realization growth (+1% Q-o- FACE VALUE (RS) : 5

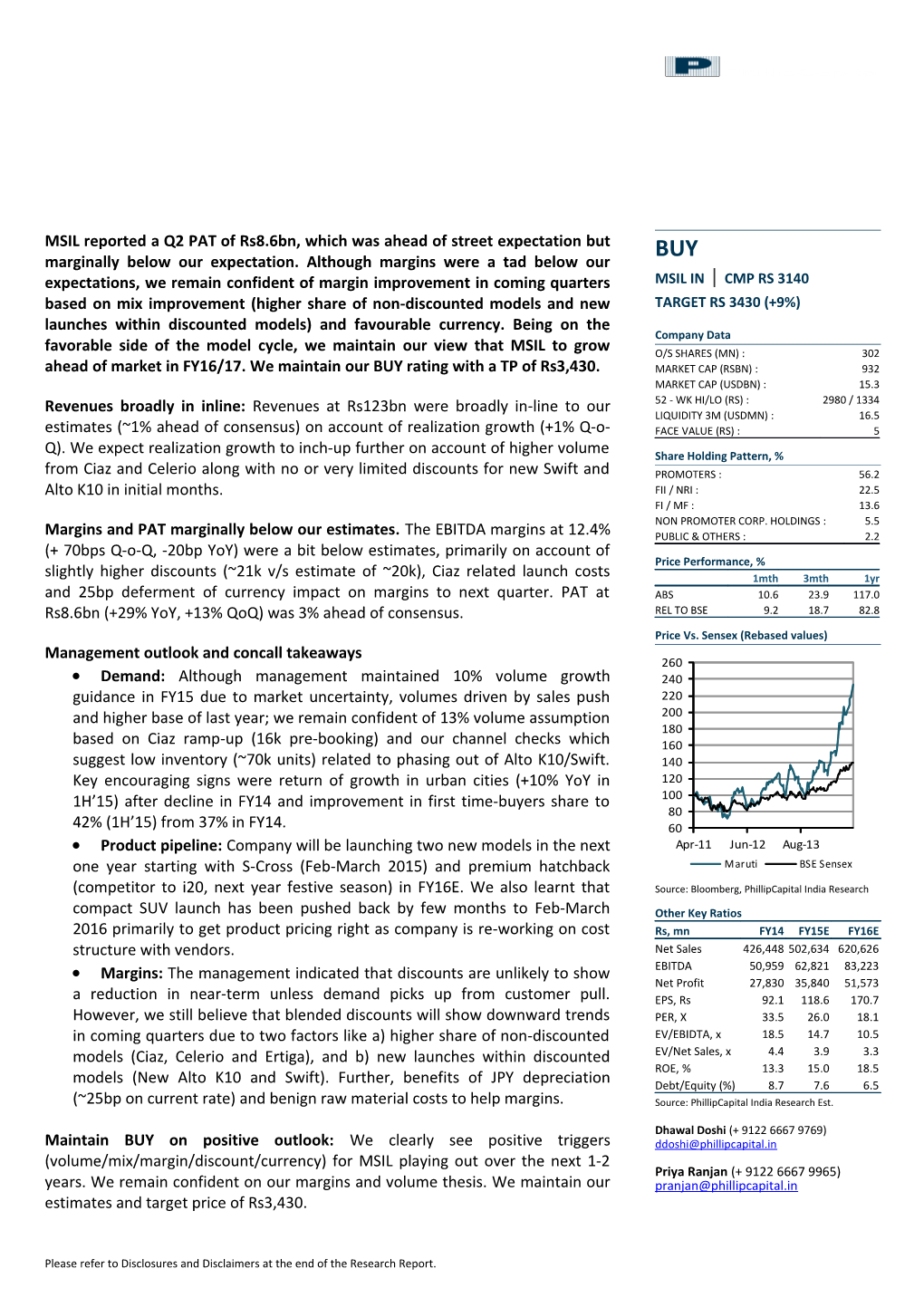

Q). We expect realization growth to inch-up further on account of higher volume Share Holding Pattern, % from Ciaz and Celerio along with no or very limited discounts for new Swift and PROMOTERS : 56.2 Alto K10 in initial months. FII / NRI : 22.5 FI / MF : 13.6 NON PROMOTER CORP. HOLDINGS : 5.5 Margins and PAT marginally below our estimates. The EBITDA margins at 12.4% PUBLIC & OTHERS : 2.2 (+ 70bps Q-o-Q, -20bp YoY) were a bit below estimates, primarily on account of Price Performance, % slightly higher discounts (~21k v/s estimate of ~20k), Ciaz related launch costs 1mth 3mth 1yr and 25bp deferment of currency impact on margins to next quarter. PAT at ABS 10.6 23.9 117.0 Rs8.6bn (+29% YoY, +13% QoQ) was 3% ahead of consensus. REL TO BSE 9.2 18.7 82.8 Price Vs. Sensex (Rebased values) Management outlook and concall takeaways 260 Demand: Although management maintained 10% volume growth 240 guidance in FY15 due to market uncertainty, volumes driven by sales push 220 and higher base of last year; we remain confident of 13% volume assumption 200 180 based on Ciaz ramp-up (16k pre-booking) and our channel checks which 160 suggest low inventory (~70k units) related to phasing out of Alto K10/Swift. 140 Key encouraging signs were return of growth in urban cities (+10% YoY in 120 1H’15) after decline in FY14 and improvement in first time-buyers share to 100 80 42% (1H’15) from 37% in FY14. 60 Product pipeline: Company will be launching two new models in the next Apr-11 Jun-12 Aug-13 one year starting with S-Cross (Feb-March 2015) and premium hatchback Maruti BSE Sensex (competitor to i20, next year festive season) in FY16E. We also learnt that Source: Bloomberg, PhillipCapital India Research compact SUV launch has been pushed back by few months to Feb-March Other Key Ratios 2016 primarily to get product pricing right as company is re-working on cost Rs, mn FY14 FY15E FY16E structure with vendors. Net Sales 426,448 502,634 620,626 Margins: The management indicated that discounts are unlikely to show EBITDA 50,959 62,821 83,223 Net Profit 27,830 35,840 51,573 a reduction in near-term unless demand picks up from customer pull. EPS, Rs 92.1 118.6 170.7 However, we still believe that blended discounts will show downward trends PER, X 33.5 26.0 18.1 in coming quarters due to two factors like a) higher share of non-discounted EV/EBIDTA, x 18.5 14.7 10.5 models (Ciaz, Celerio and Ertiga), and b) new launches within discounted EV/Net Sales, x 4.4 3.9 3.3 ROE, % 13.3 15.0 18.5 models (New Alto K10 and Swift). Further, benefits of JPY depreciation Debt/Equity (%) 8.7 7.6 6.5 (~25bp on current rate) and benign raw material costs to help margins. Source: PhillipCapital India Research Est.

Dhawal Doshi (+ 9122 6667 9769) Maintain BUY on positive outlook: We clearly see positive triggers [email protected] (volume/mix/margin/discount/currency) for MSIL playing out over the next 1-2 Priya Ranjan (+ 9122 6667 9965) years. We remain confident on our margins and volume thesis. We maintain our [email protected] estimates and target price of Rs3,430.

Please refer to Disclosures and Disclaimers at the end of the Research Report. Please refer to Disclosures and Disclaimers at the end of the Research Report. Q2FY15: Volume Analysis Volumes Analysis Q2FY15 Q2FY14 % change Q1FY15 % change PC Comments Volumes Units sold (nos) 321,898 275,586 16.8 299,894 7.3 Volume improvement led by higher discounts and festive season Domestic 287,687 241,562 19.1 270,643 6.3 Exports 34,211 34,024 0.5 29,251 17.0 Realisation (INR) 372,675 365,617 1.9 369,247 0.9 Sequential improvement due to better mix

Q2FY15: Financial analysis Year To March Q2FY15 Q2FY14 % change Q1FY15 % change PC Comments Total revenues 123,038 104,681 17.5 113,696 8.2 In-line with expectation Raw material 87,749 72,644 20.8 81,843 7.2 Marginally better than expected Staff costs 3,698 3,723 (0.7) 3,535 4.6 Other expenses 16,383 15,099 8.5 15,036 9.0 Higher than expected due to higher blended discounts and Ciaz launch costs Total expenditure 107,829 91,466 17.9 100,414 7.4 EBIDTA 15,208 13,214 15.1 13,282 14.5 3.5% below estimates Other income 1,933 1,010 91.3 2,965 (34.8) Interest 348 434 (19.8) 386 (9.8) Depreciation 5,989 4,992 20.0 5,836 2.6 PBT 10,805 8,799 22.8 10,025 7.8 Tax 2,180 2,097 4.0 2,403 (9.3) Lower than expected due to deferred tax assets Adjusted net profit 8,625 6,702 28.7 7,623 13.1 ~2% below estimates Extraordinary exp - - Net profit 8,625 6,702 28.7 7,623 13.1

Q2FY15: Margin analysis (As % of net Revenues) As % Of Net Revenues Q2FY15 Q2FY14 % change Q1FY15 % change Comments Raw material 71.3 69.4 192.3 72.0 (66.5) Sequentially decline due to mix and benign raw material costs Staff costs 3.0 3.6 (55.1) 3.1 (10.4) Other expenses 13.3 14.4 (110.9) 13.2 9.0 EBIDTA 12.4 12.6 (26.3) 11.7 67.9 35bp below estimates adjusted to 25bp deferment of currency gains to next quarter Adjusted net profit 7.0 6.4 60.7 6.7 30.6 Tax rate 20.2 23.8 (365.6) 24.0 (379.3) Source: Company, PhillipCapital India Research

– 3 of 7 – Financials

Income Statement Cash Flow Y/E Mar, Rs mn FY13 FY14E Y/E Mar, Rs mn FY13 FY14E Net sales 426,126 426,448 Pre-tax profit 29,910 36,585 Growth, % 23 Depreciation 18,612 20,844 Other income 9,753 10,558 Chg in working capital -133 6,974 Total income 435,879 437,006 Total tax paid -4,326 -8,320 Raw material expenses -325,590 -313,488 Cash flow from operating activities 44,063 56,083 Employee expenses -10,696 -13,681 Capital expenditure -54,692 -37,561 Other Operating expenses -57,297 -58,878 Chg in investments -9,309 -30,396 EBITDA (Core) 42,296 50,959 Cash flow from investing activities -64,001 -67,957 Growth, % 68.3 20.5 Free cash flow -19,938 -11,874 Margin, % 9.9 11.9 Equity raised/(repaid) 12,822 402 Depreciation -18,612 -20,844 Debt raised/(repaid) 1,523 4,347 EBIT 23,684 30,115 Dividend (incl. tax) -2,517 -2,828 Growth, % 72.3 27.2 Cash flow from financing activities 11,827 1,921 Margin, % 5.6 7.1 Net chg in cash -8,111 -9,953 Interest paid -1,898 -1,759 Other Non-Operating Income 8,124 8,229 Valuation Ratios Pre-tax profit 29,910 36,585 FY13 FY14E Tax provided -5,989 -8,755 Profit after tax 23,921 27,830 Per Share data Net Profit 23,921 27,830 EPS (INR) 79.2 92.1 Growth, % 46.3 16.3 Growth, % 39.9 16.3 Net Profit (adjusted) 23,921 27,830 Book NAV/share (INR) 615.0 694.5 Unadj. shares (m) 302 302 FDEPS (INR) 79.2 92.1 Wtd avg shares (m) 302 302 CEPS (INR) 140.8 161.1 CFPS (INR) 119.0 158.4 DPS (INR) 8.0 12.0 Balance Sheet Return ratios Y/E Mar, Rs mn FY13 FY14E Return on assets (%) 10.3 10.1 Cash & bank 16,250 6,297 Return on equity (%) 12.9 13.3 Debtors 14,699 14,137 Return on capital employed (%) 13.3 13.0 Inventory 18,407 17,059 Turnover ratios Loans & advances 29,802 32,567 Asset turnover (x) 4.0 3.3 Total current assets 79,158 70,060 Sales/Total assets (x) 1.7 1.5 Investments 70,783 101,179 Sales/Net FA (x) 4.3 3.4 Gross fixed assets 198,007 227,018 Working capital/Sales (x) 0.0 (0.0) Less: Depreciation -100,015 -119,114 Working capital days 2.8 (3.2) Add: Capital WIP 19,409 26,214 Liquidity ratios Net fixed assets 117,401 134,118 Current ratio (x) 1.3 1.0 Total assets 267,342 305,357 Quick ratio (x) 1.0 0.8 Interest cover (x) 12.5 17.1 Current liabilities 54,833 62,715 Dividend cover (x) 9.9 7.7 Provisions 8,741 8,757 Total debt/Equity (%) 7.5 8.7 Total current liabilities 63,574 71,472 Net debt/Equity (%) (1.3) 5.7 Non-current liabilities 17,979 24,105 Valuation Total liabilities 81,553 95,577 PER (x) 39.0 33.5 Paid-up capital 1,510 1,510 Price/Book (x) 5.0 4.4 Reserves & surplus 184,279 208,270 Yield (%) 0.3 0.4 Shareholders’ equity 185,789 209,780 EV/Net sales (x) 2.2 2.2 Total equity & liabilities 267,342 305,357 EV/EBITDA (x) 22.0 18.5 Source: Company, PhillipCapital India Research EV/EBIT (x) 39.2 31.3 Estimates

– 4 of 7 – Recommendation Chart

3500

3000 N (TP 2583) 2500 N (TP 1940) 2000 B (TP 1980) N (TP 1520) N (TP 1275) B (TP 1800) N (TP 1765) 1500 N (TP 1075) N (TP 1520) S (TP 1100) N (TP 1340) N (TP 1490) 1000 S (TP 1070) N (TP 1275) N (TP 920) 500

0 4/1/2011 9/19/2011 3/5/2012 8/17/2012 2/4/2013 7/19/2013 1/7/2014 6/25/2014

Source: PhillipCapital India Research

– 5 of 7 – Contact Information (Regional Member Companies)

SINGAPORE MALAYSIA HONG KONG Phillip Securities Pte Ltd Phillip Capital Management Sdn Bhd Phillip Securities (HK) Ltd 250 North Bridge Road, #06-00 Raffles City Tower, B-3-6 Block B Level 3, Megan Avenue II, 11/F United Centre 95 Queensway Hong Kong Singapore 179101 No. 12, Jalan Yap Kwan Seng, 50450 Kuala Lumpur Tel (852) 2277 6600 Fax: (852) 2868 5307 Tel : (65) 6533 6001 Fax: (65) 6535 3834 Tel (60) 3 2162 8841 Fax (60) 3 2166 5099 www.phillip.com.hk www.phillip.com.sg www.poems.com.my JAPAN INDONESIA CHINA Phillip Securities Japan, Ltd PT Phillip Securities Indonesia Phillip Financial Advisory (Shanghai) Co. Ltd. 4-2 Nihonbashi Kabutocho, Chuo-ku ANZ Tower Level 23B, Jl Jend Sudirman Kav 33A, No 550 Yan An East Road, Ocean Tower Unit 2318 Tokyo 103-0026 Jakarta 10220, Indonesia Shanghai 200 001 Tel: (81) 3 3666 2101 Fax: (81) 3 3664 0141 Tel (62) 21 5790 0800 Fax: (62) 21 5790 0809 Tel (86) 21 5169 9200 Fax: (86) 21 6351 2940 www.phillip.co.jp www.phillip.co.id www.phillip.com.cn THAILAND FRANCE UNITED KINGDOM Phillip Securities (Thailand) Public Co. Ltd. King & Shaxson Capital Ltd. King & Shaxson Ltd. 15th Floor, Vorawat Building, 849 Silom Road, 3rd Floor, 35 Rue de la Bienfaisance 6th Floor, Candlewick House, 120 Cannon Street Silom, Bangrak, Bangkok 10500 Thailand 75008 Paris France London, EC4N 6AS Tel (66) 2 2268 0999 Fax: (66) 2 2268 0921 Tel (33) 1 4563 3100 Fax : (33) 1 4563 6017 Tel (44) 20 7929 5300 Fax: (44) 20 7283 6835 www.phillip.co.th www.kingandshaxson.com www.kingandshaxson.com UNITED STATES AUSTRALIA SRI LANKA Phillip Futures Inc. PhillipCapital Australia Asha Phillip Securities Limited 141 W Jackson Blvd Ste 3050 Level 37, 530 Collins Street Level 4, Millennium House, 46/58 Navam Mawatha, The Chicago Board of Trade Building Melbourne, Victoria 3000, Australia Colombo 2, Sri Lanka Chicago, IL 60604 USA Tel: (61) 3 9629 8380 Fax: (61) 3 9614 8309 Tel: (94) 11 2429 100 Fax: (94) 11 2429 199 Tel (1) 312 356 9000 Fax: (1) 312 356 9005 www.phillipcapital.com.au www.ashaphillip.net/home.htm INDIA PhillipCapital (India) Private Limited No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013 Tel: (9122) 2300 2999 Fax: (9122) 6667 9955 www.phillipcapital.in

– 6 of 7 – Disclosures and Disclaimers

PhillipCapital (India) Pvt. Ltd. has three independent equity research groups: Institutional Equities, Institutional Equity Derivatives and Private Client Group. This report has been prepared by Institutional Equities Group. The views and opinions expressed in this document may or may not match or may be contrary at times with the views, estimates, rating, target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd.

This report is issued by PhillipCapital (India) Pvt. Ltd. which is regulated by SEBI. PhillipCapital (India) Pvt. Ltd. is a subsidiary of Phillip (Mauritius) Pvt. Ltd. References to "PCIPL" in this report shall mean PhillipCapital (India) Pvt. Ltd unless otherwise stated. This report is prepared and distributed by PCIPL for information purposes only and neither the information contained herein nor any opinion expressed should be construed or deemed to be construed as solicitation or as offering advice for the purposes of the purchase or sale of any security, investment or derivatives. The information and opinions contained in the Report were considered by PCIPL to be valid when published. The report also contains information provided to PCIPL by third parties. The source of such information will usually be disclosed in the report. Whilst PCIPL has taken all reasonable steps to ensure that this information is correct, PCIPL does not offer any warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading does so entirely at his or her own risk and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements and past performance is not necessarily an indication to future performance.

This report does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors must undertake independent analysis with their own legal, tax and financial advisors and reach their own regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. In no circumstances it be used or considered as an offer to sell or a solicitation of any offer to buy or sell the Securities mentioned in it. The information contained in the research reports may have been taken from trade and statistical services and other sources, which we believe are reliable. PhillipCapital (India) Pvt. Ltd. or any of its group/associate/affiliate companies do not guarantee that such information is accurate or complete and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice

Important: These disclosures and disclaimers must be read in conjunction with the research report of which it forms part. Receipt and use of the research report is subject to all aspects of these disclosures and disclaimers. Additional information about the issuers and securities discussed in this research report is available on request.

Certifications: The research analyst(s) who prepared this research report hereby certifies that the views expressed in this research report accurately reflect the research analyst’s personal views about all of the subject issuers and/or securities, that the analyst have no known conflict of interest and no part of the research analyst’s compensation was, is or will be, directly or indirectly, related to the specific views or recommendations contained in this research report. The Research Analyst certifies that he /she or his / her family members does not own the stock(s) covered in this research report.

Independence/Conflict: PhillipCapital (India) Pvt. Ltd. has not had an investment banking relationship with, and has not received any compensation for investment banking services from, the subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek compensation for investment banking services from the subject issuers in the next three (3) months. PhillipCapital (India) Pvt. Ltd is not a market maker in the securities mentioned in this research report, although it or its employees, directors, or affiliates may hold either long or short positions in such securities. PhillipCapital (India) Pvt. Ltd may not hold more than 1% of the shares of the company(ies) covered in this report.

Suitability and Risks: This research report is for informational purposes only and is not tailored to the specific investment objectives, financial situation or particular requirements of any individual recipient hereof. Certain securities may give rise to substantial risks and may not be suitable for certain investors. Each investor must make its own determination as to the appropriateness of any securities referred to in this research report based upon the legal, tax and accounting considerations applicable to such investor and its own investment objectives or strategy, its financial situation and its investing experience. The value of any security may be positively or adversely affected by changes in foreign exchange or interest rates, as well as by other financial, economic or political factors. Past performance is not necessarily indicative of future performance or results.

Sources, Completeness and Accuracy: The material herein is based upon information obtained from sources that PCIPL and the research analyst believe to be reliable, but neither PCIPL nor the research analyst represents or guarantees that the information contained herein is accurate or complete and it should not be relied upon as such. Opinions expressed herein are current opinions as of the date appearing on this material and are subject to change without notice. Furthermore, PCIPL is under no obligation to update or keep the information current.

Copyright: The copyright in this research report belongs exclusively to PCIPL. All rights are reserved. Any unauthorized use or disclosure is prohibited. No reprinting or reproduction, in whole or in part, is permitted without the PCIPL’s prior consent, except that a recipient may reprint it for internal circulation only and only if it is reprinted in its entirety.

Caution: Risk of loss in trading in can be substantial. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances.

For U.S. persons only: This research report is a product of PhillipCapital (India) Pvt Ltd. which is the employer of the research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account.

This report is intended for distribution by PhillipCapital (India) Pvt Ltd. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities andExchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major Institutional Investors, PhillipCapital (India) Pvt Ltd. has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").Transactions in securities discussed in this research report should be effected through Marco Polo or another U.S. registered broker dealer.

PhillipCapital (India) Pvt. Ltd. Registered office: No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013

– 7 of 7 –