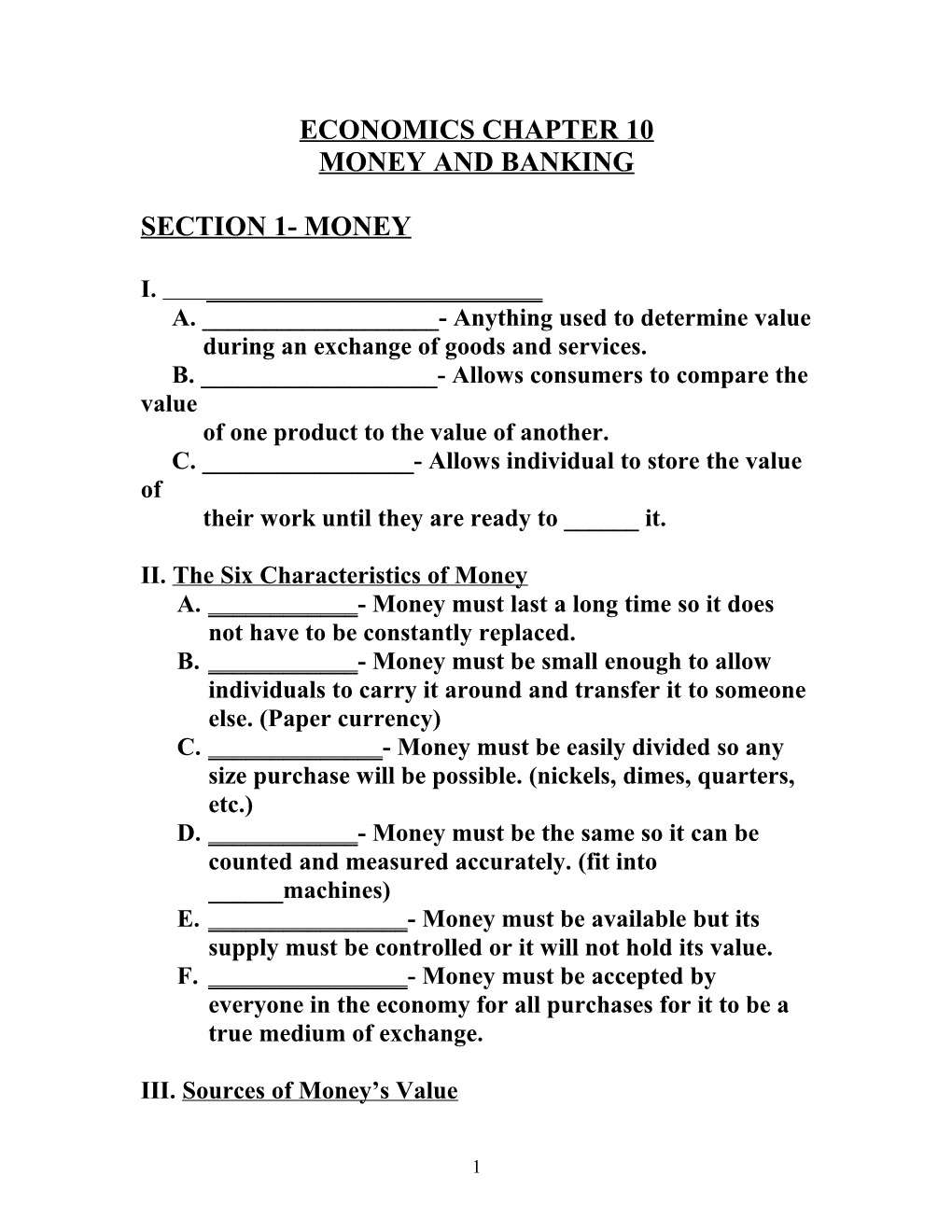

ECONOMICS CHAPTER 10 MONEY AND BANKING

SECTION 1- MONEY

I. ______A. ______- Anything used to determine value during an exchange of goods and services. B. ______- Allows consumers to compare the value of one product to the value of another. C. ______- Allows individual to store the value of their work until they are ready to ______it.

II. The Six Characteristics of Money A. ______- Money must last a long time so it does not have to be constantly replaced. B. ______- Money must be small enough to allow individuals to carry it around and transfer it to someone else. (Paper currency) C. ______- Money must be easily divided so any size purchase will be possible. (nickels, dimes, quarters, etc.) D. ______- Money must be the same so it can be counted and measured accurately. (fit into ______machines) E. ______- Money must be available but its supply must be controlled or it will not hold its value. F. ______- Money must be accepted by everyone in the economy for all purchases for it to be a true medium of exchange.

III. Sources of Money’s Value

1 A. ______- Money that has an alternative use in the economy other than money. ( tobacco leaves, fur pelts) B. ______- Money that can be exchanged for something else that has value. (paper money) C. ______- Money by government decree. The money is valuable because the government backs it. (______)

SECTION 2 The History of American Banking

I. Two views of ______A. ______- (led by ______) believed that there should be a central banking system controlled by the federal government. B. ______View- (led by T______) believed that the states should establish their own banking system and have control over them.

II. The ______Bank of the United States (Federalist View est. 1791) had a 24 year charter. Its functions were: A. Hold money that government ______in taxes. B. Regulated ______, public interest, and interest and foreign commerce. C. Issue ______in the form of bank notes backed by gold and silver. D. Ensure that ______banks followed banking rules.

III. Chaos in American Banking

2 A. Charter ______for First Bank of the United States. B. State banks issued their own ______. C. State chartered banks that were not ______. D. People lost ______in the banking system.

IV. Second Bank of the United States A. Eliminated ______in banking system B. Charted for ___ years C. Kept ______controls on state-charted banks V. The Free Banking Era A. Bank runs and ______B. ______banks over printed money C. ______in the banking industry was wide spread D. Each bank issued its own ______and this led to confusion over the value of the money.

VI. The later 1800’s A. ______caused both the north and south to issue currency. North currency was called greenbacks. South backed its currency with cotton and was worthless after the war. B. National Banking System (1864) 1. Power to ______banks. 2. Power to ______bank reserves. 3. Power to issue a ______national currency. C. The Gold Standard 1. Currency is equal to a set amount of _____ or ______and can be ______for it. 2. ______could only issue as much currency as it could back with gold and silver in the Federal Reserve.

VII. The Federal Reserve System (The Fed)

3 A. The nations ______bank B. ______banks own the Fed C. Controls the ______

SECTION 3 BANKING TODAY

I. Measuring the Money Supply A. _____-Represents the transactional component of money. Money that can be easily spent. (_____, currency, and demand deposits/checking accounts) B. _____-A broader definition of the money supply. Represents all the methods of saving money. Includes all of M1 plus savings accounts and money market accounts up to and including ______. II. Functions of Financial Institutions A. ______- Banks provides a safe place to store money. Money insured up to $100.000 by the FDIC. B. ______- Banks offer a variety of ways for depositors to accumulate money. C. ______- Banks loan to individuals to buy homes, cars, etc. D. ______- Banks lend money to individuals to buy homes. E. ______- Banks provide credit cards to customers who make it easier for them to buy goods and services.

III. Types of Financial Institutions

4 A. ______- Provide services to businesses and offer checking accounts, accept deposits and make loans. B. ______- (thrifts) originally provided funds to individuals to buy homes. Now they provide all the ______of commercial banks. C. ______- Originally took in small deposits and made small loans. First financial institution to offer ______. D. ______- Provides low interest loans to members and take in deposits from ______. E. ______- Provide ______to individuals and allows them to repay money in ______. Usually charge higher ______because of the higher _____.

5