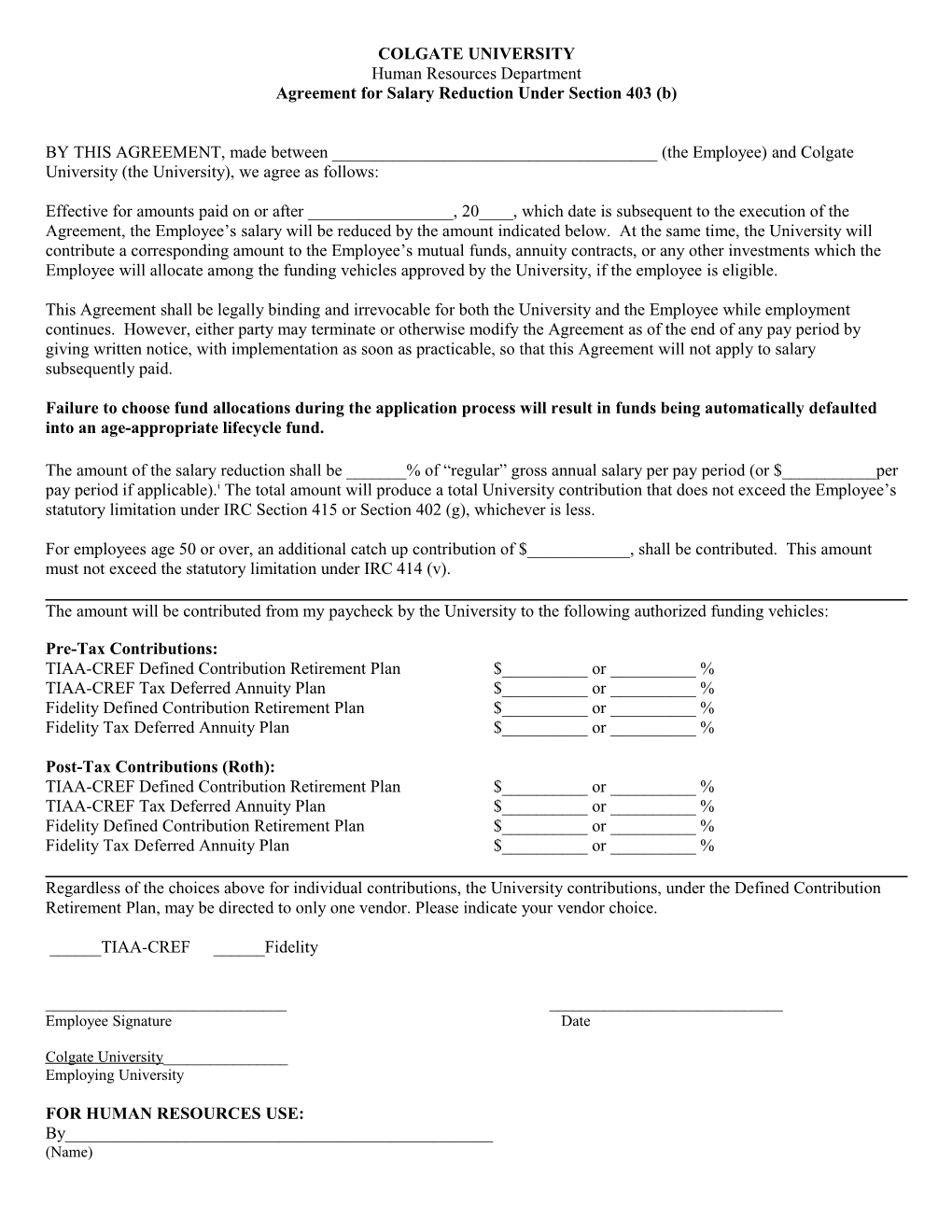

COLGATE UNIVERSITY Human Resources Department Agreement for Salary Reduction Under Section 403 (b)

BY THIS AGREEMENT, made between ______(the Employee) and Colgate University (the University), we agree as follows:

Effective for amounts paid on or after ______, 20____, which date is subsequent to the execution of the Agreement, the Employee’s salary will be reduced by the amount indicated below. At the same time, the University will contribute a corresponding amount to the Employee’s mutual funds, annuity contracts, or any other investments which the Employee will allocate among the funding vehicles approved by the University, if the employee is eligible.

This Agreement shall be legally binding and irrevocable for both the University and the Employee while employment continues. However, either party may terminate or otherwise modify the Agreement as of the end of any pay period by giving written notice, with implementation as soon as practicable, so that this Agreement will not apply to salary subsequently paid.

Failure to choose fund allocations during the application process will result in funds being automatically defaulted into an age-appropriate lifecycle fund.

The amount of the salary reduction shall be ______% of “regular” gross annual salary per pay period (or $______per pay period if applicable).i The total amount will produce a total University contribution that does not exceed the Employee’s statutory limitation under IRC Section 415 or Section 402 (g), whichever is less.

For employees age 50 or over, an additional catch up contribution of $______, shall be contributed. This amount must not exceed the statutory limitation under IRC 414 (v).

The amount will be contributed from my paycheck by the University to the following authorized funding vehicles:

Pre-Tax Contributions: TIAA-CREF Defined Contribution Retirement Plan $______or ______% TIAA-CREF Tax Deferred Annuity Plan $______or ______% Fidelity Defined Contribution Retirement Plan $______or ______% Fidelity Tax Deferred Annuity Plan $______or ______%

Post-Tax Contributions (Roth): TIAA-CREF Defined Contribution Retirement Plan $______or ______% TIAA-CREF Tax Deferred Annuity Plan $______or ______% Fidelity Defined Contribution Retirement Plan $______or ______% Fidelity Tax Deferred Annuity Plan $______or ______%

Regardless of the choices above for individual contributions, the University contributions, under the Defined Contribution Retirement Plan, may be directed to only one vendor. Please indicate your vendor choice.

______TIAA-CREF ______Fidelity

______Employee Signature Date

Colgate University______Employing University

FOR HUMAN RESOURCES USE: By______(Name) i This amount should be reviewed with Human Resources prior to the execution of the Agreement.