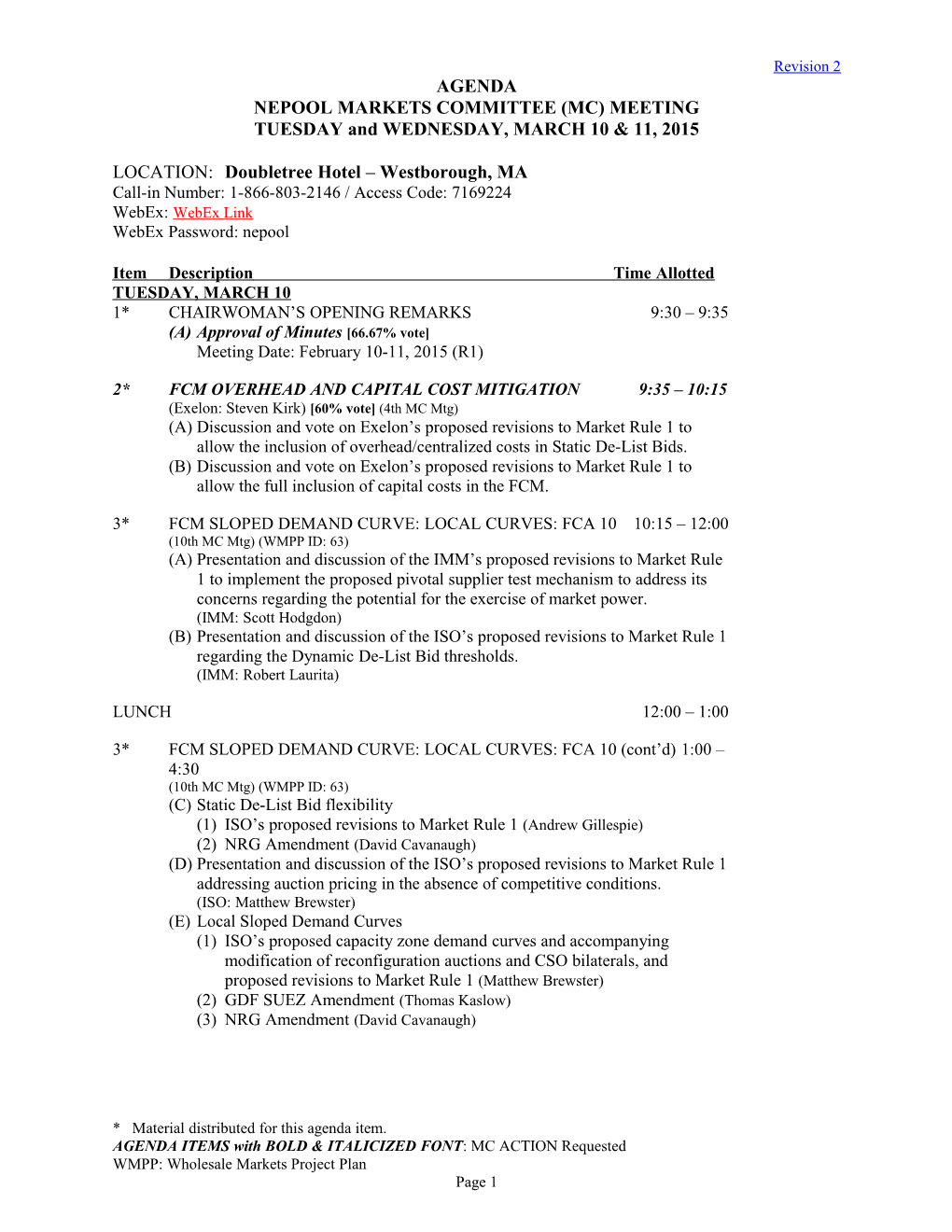

Revision 2 AGENDA NEPOOL MARKETS COMMITTEE (MC) MEETING TUESDAY and WEDNESDAY, MARCH 10 & 11, 2015

LOCATION: Doubletree Hotel – Westborough, MA Call-in Number: 1-866-803-2146 / Access Code: 7169224 WebEx: WebEx Link WebEx Password: nepool

Item Description Time Allotted TUESDAY, MARCH 10 1* CHAIRWOMAN’S OPENING REMARKS 9:30 – 9:35 (A) Approval of Minutes [66.67% vote] Meeting Date: February 10-11, 2015 (R1)

2* FCM OVERHEAD AND CAPITAL COST MITIGATION 9:35 – 10:15 (Exelon: Steven Kirk) [60% vote] (4th MC Mtg) (A) Discussion and vote on Exelon’s proposed revisions to Market Rule 1 to allow the inclusion of overhead/centralized costs in Static De-List Bids. (B) Discussion and vote on Exelon’s proposed revisions to Market Rule 1 to allow the full inclusion of capital costs in the FCM.

3* FCM SLOPED DEMAND CURVE: LOCAL CURVES: FCA 10 10:15 – 12:00 (10th MC Mtg) (WMPP ID: 63) (A) Presentation and discussion of the IMM’s proposed revisions to Market Rule 1 to implement the proposed pivotal supplier test mechanism to address its concerns regarding the potential for the exercise of market power. (IMM: Scott Hodgdon) (B) Presentation and discussion of the ISO’s proposed revisions to Market Rule 1 regarding the Dynamic De-List Bid thresholds. (IMM: Robert Laurita)

LUNCH 12:00 – 1:00

3* FCM SLOPED DEMAND CURVE: LOCAL CURVES: FCA 10 (cont’d) 1:00 – 4:30 (10th MC Mtg) (WMPP ID: 63) (C) Static De-List Bid flexibility (1) ISO’s proposed revisions to Market Rule 1 (Andrew Gillespie) (2) NRG Amendment (David Cavanaugh) (D) Presentation and discussion of the ISO’s proposed revisions to Market Rule 1 addressing auction pricing in the absence of competitive conditions. (ISO: Matthew Brewster) (E) Local Sloped Demand Curves (1) ISO’s proposed capacity zone demand curves and accompanying modification of reconfiguration auctions and CSO bilaterals, and proposed revisions to Market Rule 1 (Matthew Brewster) (2) GDF SUEZ Amendment (Thomas Kaslow) (3) NRG Amendment (David Cavanaugh)

* Material distributed for this agenda item. AGENDA ITEMS with BOLD & ITALICIZED FONT: MC ACTION Requested WMPP: Wholesale Markets Project Plan Page 1 TUESDAY and WEDNESDAY, MARCH 10 & 11, 2015 – AGENDA (Cont’d)

WEDNESDAY, MARCH 11 4* FORWARD RESERVE OBLIGATON CHARGE ENHANCEMENTS – CONFORMING MANUAL CHANGES 9:30 – 10:00 (ISO: Christopher Denmark) (1st MC Mtg) (WMPP ID: 82) Presentation and discussion of the ISO’s proposed revisions to conform ISO-NE Manual M-28 to Market Rule 1 implementing the Forward Reserve Obligation Charge enhancements.

5* WINTER RELIABILITY SOLUTION: WINTER PERIODS PRIOR TO JUNE 1, 2018 10:00 – 12:00 (5th MC Mtg) (WMPP ID: 81) (A) Update on effort to develop a winter reliability solution for the winter periods prior to the June 1, 2018 implementation date of FCM Performance Incentives. (ISO: Andrew Gillespie) (B) Presentation and discussion of the NextEra, Exelon, GDF SUEZ and Entergy proposal to implement a market-based winter reliability solution for the winter periods prior to June 1, 2018. (NextEra: Michelle Gardner)

LUNCH 12:00 – 1:00

6 MARKETS COMMITTEE WORKING GROUP REPORTS 1:00 – 1:05 - Demand Resources (Chair: Henry Yoshimura) GUEST COMMITTEE REPORT - NEPOOL Budget & Finance Subcommittee (Chair: Kenneth Dell Orto)

7* INTERPLAY BETWEEN BEHIND THE METER SOLAR PV IMPACTS ON ICR AND THE RENEWABLE TECHNOLOGY RESOURCE EXEMPTION 1:05 – 1:45 (NEPGA: Bruce Anderson) (1st MC Mtg) Presentation and discussion of NEPGA’s issues regarding the interplay between behind the meter solar PV impacts on ICR and the Renewable Technology Resource exemption.

8* FAST START PRICING 1:45 – 3:15 (ISO: Jonathan Lowell) (2nd MC Mtg) (WMPP ID: 85) Presentation and discussion of the ISO’s proposal to improve the Real-Time Energy Market’s pricing logic when fast start assets are deployed to supply energy.

9 OTHER BUSINESS 3:15 – 3:20

* Material distributed for this agenda item. AGENDA ITEMS with BOLD & ITALICIZED FONT: MC ACTION Requested WMPP: Wholesale Markets Project Plan Page 2