MISD Payroll Encumbrance Processing

PYENFCFC, Force Encumbrance Calculation

Run PYENFCFC on 1101115 through 1201114 (as defined in common code PYFG / ENCALC01) to encumber a range of periods. If encumbering multiple periods, each must be encumbered separately.

The PYEN process utilizes the standard PY calculation engine applied across the encumbered range of pay periods (so if for some reason PYENFCFC is not working on that employee, take a look at the PYPAFC debug to help determine why). It also incorporates the standard PY to GL posting logic with its full range of capabilities. For these reasons, the PY encumbrance values generated in this process are very precise and very detailed.

The results from PYENFCFC are stored in a PY transaction table. This table serves as the basis for both detailed reporting and the creation of the EN batch that is posted to the EN database. Those ENDB entries are posted in summary by pay period and account number.

Each employee is calculated for each pay period in the encumbered range. Detailed calculations with associated GL account numbers are written to a payroll transaction table (referred to as the PYEN Detail Table). The PYEN Detail records are stored by employee, pay period, CDH, account number, and job number. Those detailed transactions are the basis for any detailed reporting. The process may be run at any time and as often as needed to maintain accurate, current PYEN values. Selection criteria may be used to target only a select group of employees if needed.

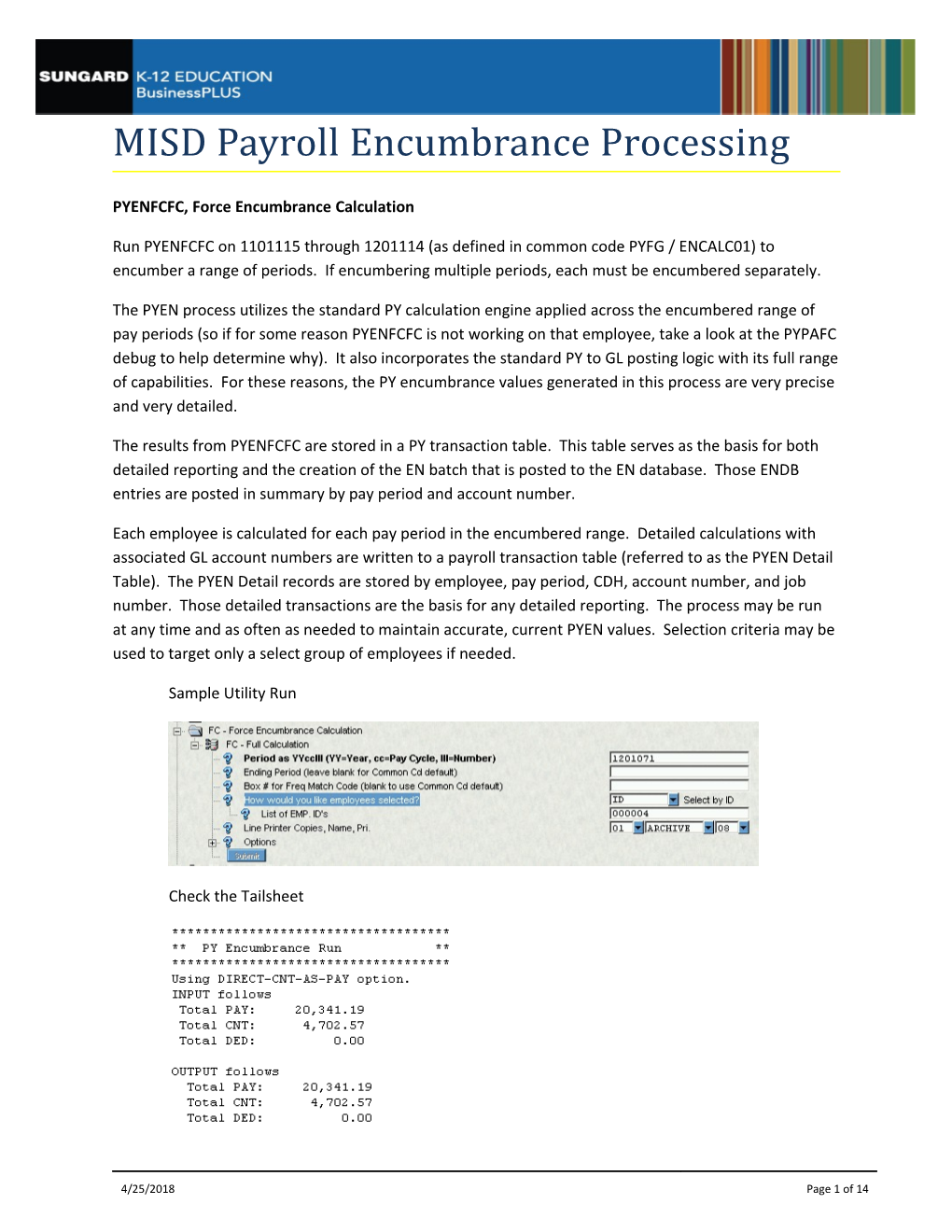

Sample Utility Run

Check the Tailsheet

4/25/2018 Page 1 of 14 Reporting

There are three standard PYEN Reports available. These reports are actually pulled from the PYEN Detail table, so these entries are in more detail than the entries from the ENDB Set.

PYENRPSA – Summary Report by Account

Sample Report Run

Check the Jobs Monitor to see that the report completed and produces a report Click on to see the Report Output

PYENRPSU – Summary Report by Account/Period

Sample Report Run

Check the Jobs Monitor to see that the report completed and produces a report Click on to see the Report Output

PYENRPEM – Employee Detail Report

Sample Report Run

4/25/2018 Page 2 of 14 Check the Jobs Monitor to see that the report completed and produces a report Click on to see the Report Output

PYENBT, Create ENCB Batch / Set

This step takes the PYEN Detail records and creates a standard ENDB batch that may be proofed and posted to the EN database. The entries in the ENDB batch are summarized by pay period and account number. We recommend you use a standard naming convention for your encumbered batches. Our recommended naming convention is EN + Period (e.g. EN1001070).

Sample Utility Run

Check the Jobs Monitor to see that the job completed and produces a tailsheet

Click on job number to see the Tailsheet Output

PYENBP, ENDB Batch / Set Proof Listing

This is the standard ENDB Set Proof Listing used to review the summary entries in the Set prior to posting to the EN Database. Run this report to review the set that was created in the above step.

Sample Utility Run

4/25/2018 Page 3 of 14 Check the Jobs Monitor to see that the job completed and produces a tailsheet

Click on STDLIST to see the Tailsheet Output

PYENUB, Update ENDB Set

This mask will run the standard EN Set Update screen, which allows for review and direct update of the ENDB Set if needed. You can enter this screen to make modification to the above batch that was created.

Sample EN Set that was created with the PYENBT process above

4/25/2018 Page 4 of 14 PYENDS, Distribute ENDB Set

This step distributes (posts) the ENDB Set to the GL Database. This step should not be completed until you are ready to post. This is where we can specify the posting date for this batch.

Sample Utility Run

Check the Jobs Monitor to see that the job completed and produces a tailsheet

Click on STDLIST to see the Tailsheet Output

PYENDEDE, Disencumber ENDB Set

Run this process to disencumber a period after you distribute and pay that period. The dis-encumbering of a paid period simply removes the encumbrance entries for that period. The actual PY expense has no relevance.

Sample Utility Run

Check the Jobs Monitor to see that the job completed and produces a tailsheet

Click on STDLIST to see the Tailsheet Output

4/25/2018 Page 5 of 14 Making Corrections

Typically, there will be changes within the organization after initial encumbered values are set. In order to correct the encumbered values, we must recalculate the PYEN Details and fix the ENDB postings. Common examples of changes that will affect encumbrances are these:

New Employees, Terminated Employees Account Changes Pay Rate Changes Pay Assignments Added or Removed Changed CDH Calculation Formula CDH Assignments Added or Removed

Fixing the PYEN Details

The PYEN calculation process may be re-run at any time and as often as needed. The process uses standard PY selection criteria if only certain employees need to be re-calculated. Mask PYENEC will target only those employees in the IDLIST whose PYEN Modified Switch (9) is set. Mask PYENFC will calculate all employees in the IDLIST regardless of Switch (9). Under both masks, all PYEN transactions in the calculated range for the selected employees are fully deleted and re-created in this process.

Fixing the ENDB Postings

Once the PYEN Details have been corrected, the ENDB Postings must be changed as well. The simple, direct method is to fully delete the old ENDB entries, create a new ENDB Set and post the new values. Run mask PYENDEDL to delete ENDB entries by Pay Period. Then run mask PYENBT to create a new ENDB Set, which will be proofed and posted.

CAUTION: When making mid-year corrections, be aware that each Period must be cleared (deleted) from the ENDB prior to posting the new values. Otherwise, the encumbered values will include both old and new values and be overstated.

Disencumbering

There are 2 basic options for disencumbering a Pay Period once it has been paid. The user may either delete the ENDB entries or mark them as Disencumbered.

PYENDEDE – Disencumber: Mark each entry in the ENDB with “DE” status for the targeted period. PYENDEDL – Delete: Delete each entry in the ENDB for the targeted period.

Purging

This mask is used to purge PYEN transactions that are either obsolete or in error. The process may be run by a range of periods or a single period against a selected list of employees. It may also select by a single Job # if needed.

PYENPE – Purge PYEN Entries.

4/25/2018 Page 6 of 14 MISD Payroll Encumbrance Setup

PYUPPR Pay Periods to be included in the encumbrance process need to have a Period Type of ‘REG’ If you will not want to encumber all periods with ‘REG’ then common code PYFG / ENCALCnn must be setup (see below)

NUUPCD PYFG / ENCALCnn (where nn = pay cycle

4/25/2018 Page 7 of 14 One entry needs to be created for each pay cycle

Associated Numeric Value 3: Box number used in conjunction with the Frequency Match Code

Associated Code 2: Set to the default ending Pay Period in the encumbered range This period is used unless a different one is specified at the standard question prompt

4/25/2018 Page 8 of 14 Associated Code 3: Frequency Matching Code that will be used to identify which Pay Periods are to be included in the PYEN calculation.

PEUPPE A pseudo vendor PEID of “PYENCUMB” must be created. This PEID is used as the Vendor in the ENDB set

PYUPCC/DD/HH All CDH’s that are to be included in the encumbrance process must be marked:

E Include in calculation and create a PYEN transaction Y Include in calculation but do not create a PYEN transaction Blank Ignore during PYEN transaction

Note: All pay hours and contributions must be set to ‘E’. Deductions are usually omitted with some exceptions, such as FICA (because the FICA contribution is calculated using the FICA deduction). Hour codes such as leave accruals that carry no dollar costs may also be omitted.

PYUPHH All employees who require timecards for normal payroll calculations must be accommodated in the

4/25/2018 Page 9 of 14 PYEN calculations. Either timecards must be provided for each pay period in the encumbered range or one of the below alternatives must take place:

Patch by Payline: Creates a timecard set for a specified pay period. You can run this mask for each period in the range prior to running the PYEN process. This approach has the disadvantage that it must be re-run occasionally for any employees with changes that would affect these timecards.

Calc Code: A calc code can be written which calculates the number of hours specified on the employee’s calendar. That calc code logic can be added to existing timecard hour definitions or used with a special hour code dedicated to PYEN processing only. The hour code must be added to the pay class where applicable. See hour codes 3998 and 3999 below for YCOE setup.

4/25/2018 Page 10 of 14 TIMECARD PYEN CALC.txt

4/25/2018 Page 11 of 14 CONTRACT PYEN CALC.txt

4/25/2018 Page 12 of 14 PYUPPY The above hour codes must be added to the applicable payclasses

GLUTSPSI Configure a dedicated GL / EN interface. The GL / EN is typically just the debit side EREG and CREG entries from your regular GL / PY Interface setup. The GL / EN settings can be different from the GL / PY interface if needed.

GL / EN / CREG

GL / EN / EREG

4/25/2018 Page 13 of 14 PYUPEM Switch 09 on the payroll Employee Master keeps track of which employees need to be recalculated for PY Encumbrance purposes. It is automatically set when any employee data is changed and is automatically cleared when the employee is recalculated.

It may be set or cleared manually as well.

4/25/2018 Page 14 of 14