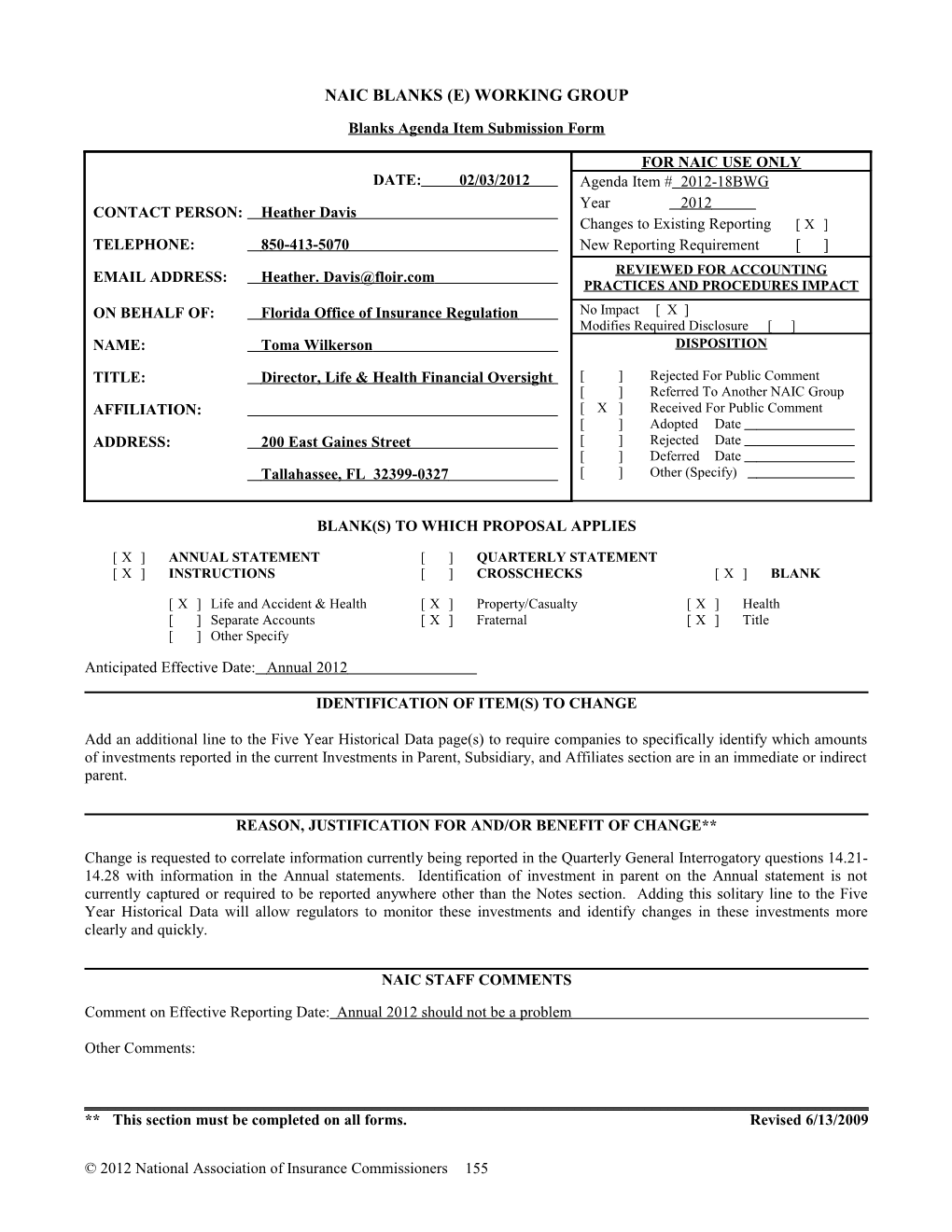

NAIC BLANKS (E) WORKING GROUP

Blanks Agenda Item Submission Form

FOR NAIC USE ONLY DATE: 02/03/2012 Agenda Item # 2012-18BWG Year 2012 CONTACT PERSON: Heather Davis Changes to Existing Reporting [ X ] TELEPHONE: 850-413-5070 New Reporting Requirement [ ]

EMAIL ADDRESS: Heather. [email protected] REVIEWED FOR ACCOUNTING PRACTICES AND PROCEDURES IMPACT ON BEHALF OF: Florida Office of Insurance Regulation No Impact [ X ] Modifies Required Disclosure [ ] NAME: Toma Wilkerson DISPOSITION

TITLE: Director, Life & Health Financial Oversight [ ] Rejected For Public Comment [ ] Referred To Another NAIC Group AFFILIATION: [ X ] Received For Public Comment [ ] Adopted Date ADDRESS: 200 East Gaines Street [ ] Rejected Date [ ] Deferred Date Tallahassee, FL 32399-0327 [ ] Other (Specify)

BLANK(S) TO WHICH PROPOSAL APPLIES

[ X ] ANNUAL STATEMENT [ ] QUARTERLY STATEMENT [ X ] INSTRUCTIONS [ ] CROSSCHECKS [ X ] BLANK

[ X ] Life and Accident & Health [ X ] Property/Casualty [ X ] Health [ ] Separate Accounts [ X ] Fraternal [ X ] Title [ ] Other Specify

Anticipated Effective Date: Annual 2012

IDENTIFICATION OF ITEM(S) TO CHANGE

Add an additional line to the Five Year Historical Data page(s) to require companies to specifically identify which amounts of investments reported in the current Investments in Parent, Subsidiary, and Affiliates section are in an immediate or indirect parent.

REASON, JUSTIFICATION FOR AND/OR BENEFIT OF CHANGE**

Change is requested to correlate information currently being reported in the Quarterly General Interrogatory questions 14.21- 14.28 with information in the Annual statements. Identification of investment in parent on the Annual statement is not currently captured or required to be reported anywhere other than the Notes section. Adding this solitary line to the Five Year Historical Data will allow regulators to monitor these investments and identify changes in these investments more clearly and quickly.

NAIC STAFF COMMENTS

Comment on Effective Reporting Date: Annual 2012 should not be a problem

Other Comments:

______** This section must be completed on all forms. Revised 6/13/2009

© 2012 National Association of Insurance Commissioners 155 ANNUAL STATEMENT BLANK – HEALTH

FIVE–YEAR HISTORICAL DATA

1 2 3 4 5 2012 2011 2010 2009 2008 Balance Sheet (Pages 2 and 3) 1. Total admitted assets (Page 2, Line 28)...... 2. Total liabilities (Page 3, Line 24)...... 3. Statutory surplus...... 4. Total capital and surplus (Page 3, Line 33)...... Income Statement (Page 4) 5. Total revenues (Line 8)...... 6. Total medical and hospital expenses (Line 18)...... 7. Claims adjustment expenses (Line 20)...... 8. Total administrative expenses (Line 21)...... 9. Net underwriting gain (loss) (Line 24)...... 10. Net investment gain (loss) (Line 27)...... 11. Total other income (Lines 28 plus 29)...... 12. Net income or (loss) (Line 32)...... Cash Flow (Page 6) 13. Net cash from operations (Line 11)...... Risk-Based Capital Analysis 14. Total adjusted capital...... 15. Authorized control level risk-based capital...... Enrollment (Exhibit 1) 16. Total members at end of period (Column 5, Line 7)...... 17. Total members months (Column 6, Line 7)...... Operating Percentage (Page 4) (Item divided by Page 4, sum of Lines 2, 3, and 5) x 100.0 18. Premiums earned plus risk revenue (Line 2 plus Lines 3 and 5) 100.0 100.0 100.0 100.0 100.0 19. Total hospital and medical plus other non-health (Lines 18 plus ...... Line 19)...... 20. Cost containment expenses...... 21. Other claims adjustment expenses...... 22. Total underwriting deductions (Line 23)...... 23. Total underwriting gain (loss) (Line 24)...... Unpaid Claims Analysis (U&I Exhibit, Part 2B) 24. Total claims incurred for prior years (Line 13, Col. 5)...... 25. Estimated liability of unpaid claims-[prior year (Line 13, Col. 6)] ...... Investments In Parent, Subsidiaries and Affiliates 26. Affiliated bonds (Sch. D Summary, Line 12, Col. 1)...... 27. Affiliated preferred stocks (Sch. D Summary, Line 18, Col. 1)...... 28. Affiliated common stocks (Sch. D Summary, Line 24, Col. 1)...... 29. Affiliated short-term investments (subtotal included in Sch. DA Verification, Col. 5, Line 10)...... 30. Affiliated mortgage loans on real estate...... 31. All other affiliated...... 32. Total of above Lines 26 to 31 ...... 33 Total Investment in Parent included in Lines 26 to 31 above. . .

NOTE: If a party to a merger, have the two most recent years of this exhibit been restated due to a merger in compliance with the disclosure requirements of SSAP No. 3, Accounting Changes and Correction of Errors? Yes [ ] No [ ] If no, please explain ......

© 2012 National Association of Insurance Commissioners 156 ANNUAL STATEMENT BLANK – LIFE

FIVE – YEAR HISTORICAL DATA (Continued)

1 2 3 4 5 2012 2011 2010 2009 2008 Investments in Parent, Subsidiaries and Affiliates 44. Affiliated bonds (Sch. D Summary, Line 12, Col. 1)...... 45. Affiliated preferred stocks (Sch. D Summary, Line 18, Col. 1)...... 46. Affiliated common stocks (Sch. D Summary, Line 24, Col. 1)...... 47. Affiliated short-term investments (subtotal included in Schedule DA Verification, Col. 5, Line 10)...... 48. Affiliated mortgage loans on real estate...... 49. All other affiliated...... 50. Total of above Lines 44 to 49...... 51. Total Investment in Parent included in Lines 44 to 49 above ......

Total Nonadmitted and Admitted Assets 5152. Total nonadmitted assets (Page 2, Line 28, Col. 2)...... 5253. Total admitted assets (Page 2, Line 28, Col. 3)......

Investment Data 5354. Net investment income (Exhibit of Net Investment Income)...... 5455. Realized capital gains (losses) (Page 4, Line 34, Column 1)...... 5556. Unrealized capital gains (losses) (Page 4, Line 38, Column 1)...... 5657. Total of above Lines 5354, 54 55 and 5556......

Benefits and Reserve Increase (Page 6) 5758. Total contract benefits-life (Lines 10, 11, 12, 13, 14 and 15, Col.1 minus Lines 10, 11, 12, 13, 14 and 15, Cols. 9, 10 and 11)...... 5859. Total contract benefits-A & H (Lines 13 & 14, Cols. 9, 10 & 11)...... 5960. Increase in life reserves-other than group and annuities (Line 19, Cols. 2 & 3)...... 6061. Increase in A & H reserves (Line 19, Cols. 9, 10 & 11)...... 6162. Dividends to policyholders (Line 30, Col. 1)......

Operating Percentages 6263. Insurance expense percent (Page 6, Col. 1, Lines 21, 22 & 23 less Line 6)/(Page 6 Col. 1, Line 1 plus Exhibit 7, Col. 2, Line 2) x 100.00...... 6364. Lapse percent (ordinary only) [Exhibit of Life Insurance, Column 4, Lines 14 & 15) / ½ (Exhibit of Life Insurance, Column 4, Lines 1 & 21)] x 100.00...... 6465. A & H loss percent (Schedule H, Part 1, Lines 5 & 6, Col. 2)...... 6566. A & H cost containment percent (Schedule H, Part 1, Line 4, Col. 2)...... 6667. A & H expense percent excluding cost containment expenses (Schedule H, Part 1, Line 10, Col. 2)......

A & H Claim Reserve Adequacy 6768. Incurred losses on prior years' claims-group health (Sch. H, Part 3, Line 3.1, Col. 2)...... 6869. Prior years' claim liability and reserve-group health (Sch. H, Part 3, Line 3.2, Col. 2) ...... 6970. Incurred losses on prior years' claims-health other than group (Sch. H, Part 3, Line 3.1, Col. 1 less Col. 2)...... 7071. Prior years' claim liability and reserve-health other than group (Sch. H, Part 3, Line 3.2, Col. 1 less Col. 2)......

Net Gains From Operations After Federal Income Taxes by Lines of Business (Page 6, Line 33) 7172. Industrial life (Col. 2)...... 7273. Ordinary-life (Col. 3)...... 7374. Ordinary-individual annuities (Col. 4)...... 7475. Ordinary-supplementary contracts (Col. 5)...... 7576. Credit life (Col. 6)...... 7677. Group life (Col. 7)...... 7778. Group annuities (Col. 8)...... 7879. A & H-group (Col. 9)...... 7980. A & H-credit (Col. 10)...... 8081. A & H-other (Col. 11)...... 8182. Aggregate of all other lines of business (Col. 12)...... 8283. Total (Col. 1)

NOTE: If a party to a merger, have the two most recent years of this exhibit been restated due to a merger in compliance with the disclosure requirements of SSAP No. 3, Accounting Changes and Correction of Errors? Yes [ ] No [ ] If no, please explain ......

© 2012 National Association of Insurance Commissioners 157 ANNUAL STATEMENT BLANK – PROPERTY

FIVE–YEAR HISTORICAL DATA Show amounts in whole dollars only, no cents; show percentages to one decimal place, i.e., 17.6.

1 2 3 4 5 2012 2011 2010 2009 2008 Gross Premiums Written (Page 8, Part 1B, Cols. 1, 2 & 3) 1. Liability lines (Lines 11.1, 11.2, 16, 17.1, 17.2, 17.3, 18.1, 18.2, 19.1, 19.2 & 19.3, 19.4) ...... 2. Property lines (Lines 1, 2, 9, 12, 21 & 26)...... 3. Property and liability combined lines (Lines 3, 4, 5, 8, 22 & 27)...... 4. All other lines (Lines 6, 10, 13, 14, 15, 23, 24, 28, 29, 30 & 34)...... 5. Nonproportional reinsurance lines (Lines 31, 32 & 33)...... 6. Total (Line 35)...... Net Premiums Written (Page 8, Part 1B, Col. 6) 7. Liability lines (Lines 11.1, 11.2, 16, 17.1, 17.2, 17.3, 18.1, 18.2, 19.1, 19.2 & 19.3,19.4)...... 8. Property lines (Lines 1, 2, 9, 12, 21 & 26)...... 9. Property and liability combined lines (Lines 3, 4, 5, 8, 22 & 27)...... 10. All other lines (Lines 6, 10, 13, 14, 15, 23, 24, 28, 29, 30 & 34)...... 11. Nonproportional reinsurance lines (Lines 31, 32 & 33)...... 12. Total (Line 35)...... Statement of Income (Page 4) 13. Net underwriting gain (loss) (Line 8)...... 14. Net investment gain (loss) (Line 11)...... 15. Total other income (Line 15)...... 16. Dividends to policyholders (Line 17)...... 17. Federal and foreign income taxes incurred (Line 19)...... 18. Net income (Line 20)...... Balance Sheet Lines (Pages 2 and 3) 19. Total admitted assets excluding protected cell business (Page 2, Line 26, Col. 3) ...... 20. Premiums and considerations (Page 2, Col. 3)...... 20.1 In course of collection (Line 15.1)...... 20.2 Deferred and not yet due (Line 15.2)...... 20.3 Accrued retrospective premiums (Line 15.3)...... 21. Total liabilities excluding protected cell business (Page 3, Line 26)...... 22. Losses (Page 3, Line 1)...... 23. Loss adjustment expenses (Page 3, Line 3)...... 24. Unearned premiums (Page 3, Line 9)...... 25. Capital paid up (Page 3, Lines 30 & 31)...... 26. Surplus as regards policyholders (Page 3, Line 37)...... Cash Flow (Page 5) 27. Net cash from operations (Line 11) ...... Risk-Based Capital Analysis...... 28. Total adjusted capital...... 29. Authorized control level risk-based capital...... Percentage Distribution of Cash, Cash Equivalents and Invested Assets ...... (Page 2, Col. 3) (Item divided by Page 2, Line 12, Col. 3) x 100.0 30. Bonds (Line 1)...... 31. Stocks (Lines 2.1 & 2.2)...... 32. Mortgage loans on real estate (Lines 3.1 and 3.2)...... 33. Real estate (Lines 4.1, 4.2 & 4.3)...... 34. Cash, cash equivalents and short-term investments (Line 5)...... 35. Contract loans (Line 6)...... 36. Derivatives (Line 7) ...... XXX XXX 37. Other invested assets (Line 8)...... 38. Receivables for securities (Line 9)...... 39. Securities lending reinvested collateral assets (Line 10)...... XXX XXX 40. Aggregate write-ins for invested assets (Line 11)...... 41. Cash, cash equivalents and invested assets (Line 12)...... 100.0 100.0 100.0 100.0 100.0 Investments in Parent, Subsidiaries and Affiliates 42. Affiliated bonds, (Sch. D, Summary, Line 12, Col. 1)...... 43. Affiliated preferred stocks (Sch. D, Summary, Line 18, Col. 1)...... 44. Affiliated common stocks (Sch. D, Summary, Line 24, Col. 1)...... 45. Affiliated short-term investments (subtotals included in Schedule DA Verification, Col. 5, Line 10)...... 46. Affiliated mortgage loans on real estate...... 47. All other affiliated...... 48. Total of above Lines 42 to 47...... 49. Total Investment in Parent included in Lines 42 to 47 above ...... 4950. Percentage of investments in parent, subsidiaries and affiliates to surplus as regards policyholders (Line 48 above divided by Page 3, Col. 1, Line 37 x 100.0)

© 2012 National Association of Insurance Commissioners 158 FIVE – YEAR HISTORICAL DATA (Continued)

1 2 3 4 5 2012 2011 2010 2009 2008 Capital and Surplus Accounts (Page 4)

5051. Net unrealized capital gains (losses) (Line 24)...... 5152. Dividends to stockholders (Line 35)...... 5253. Change in surplus as regards policyholders for the year (Line 38)......

Gross Losses Paid (Page 9, Part 2, Cols. 1 & 2)

5354. Liability lines (Lines 11.1, 11.2, 16, 17.1, 17.2, 17.3, 18.1, 18.2, 19.1, 19.2 & 19.3 19.4)...... 5455. Property lines (Lines 1, 2, 9, 12, 21 & 26)...... 5556. Property and liability combined lines (Lines 3, 4, 5, 8, 22 & 27)...... 5657. All other lines (Lines 6, 10, 13, 14, 15, 23, 24, 28, 29, 30 & 34)...... 5758. Nonproportional reinsurance lines (Lines 31, 32 & 33)...... 5859. Total (Line 35)......

Net Losses Paid (Page 9, Part 2, Col. 4)

5960. Liability lines (Lines 11.1, 11.2, 16, 17.1, 17.2, 17.3, 18.1, 18.2, 19.1, 19.2 & 19.3, 19.4)...... 6061. Property lines (Lines 1, 2, 9, 12, 21 & 26)...... 6162. Property and liability combined lines (Lines 3, 4, 5, 8, 22 & 27)...... 6263. All other lines (Lines 6, 10, 13, 14, 15, 23, 24, 28, 29, 30 & 34)...... 6364. Nonproportional reinsurance lines (Lines 31, 32 & 33)...... 6465. Total (Line 35)......

Operating Percentages (Page 4) (Item divided by Page 4, Line 1) x 100.0

6566. Premiums earned (Line 1)...... 100.0 100.0 100.0 100.0 100.0 6667. Losses incurred (Line 2)...... 6768. Loss expenses incurred (Line 3)...... 6869. Other underwriting expenses incurred (Line 4)...... 6910. Net underwriting gain (loss) (Line 8)......

Other Percentages

7071. Other underwriting expenses to net premiums written (Page 4, Lines 4+5-15 divided by Page 8, Part 1B, Col. 6, Line 35 x 100.0)...... 7172. Losses and loss expenses incurred to premiums earned (Page 4, Lines 2+3 divided by Page 4, Line 1 x 100.0)...... 7273. Net premiums written to policyholders' surplus (Page 8, Part 1B, Col. 6, Line 35 divided by Page 3, Line 37, Col. 1 x 100.0)......

One Year Loss Development (000 omitted)

7374. Development in estimated losses and loss expenses incurred prior to current year (Schedule P, Part 2-Summary, Line 12, Col. 11)...... 7475. Percent of development of losses and loss expenses incurred to policyholders' surplus of prior year end (Line 73 74 above divided by Page 4, Line 21, Col. 1 x 100.0)......

Two Year Loss Development (000 omitted)

7576....Development in estimated losses and loss expenses incurred 2 years before the current year and prior year (Schedule P, Part 2-Summary, Line 12, Col. 12)...... 7677...... Percent of development of losses and loss expenses incurred to reported policyholders' surplus of second prior year end (Line 75 76 above divided by Page 4, Line 21, Col. 2 x 100.0)

NOTE: If a party to a merger, have the two most recent years of this exhibit been restated due to a merger in compliance with the disclosure requirements of SSAP No. 3, Accounting Changes and Correction of Errors? Yes [ ] No [ ] If no, please explain ......

© 2012 National Association of Insurance Commissioners 159 ANNUAL STATEMENT BLANK – FRATERNAL

FIVE–YEAR HISTORICAL DATA Show amounts in whole dollars only, no cents; show percentages to one decimal place, i.e. 17.6. Amounts of life insurance in this exhibit should be shown in thousands (OMIT 000).

1 2 3 4 5 2012 2011 2010 2009 2008 Life Insurance in Force (Exhibit of Life Insurance)

1. Total (Line 21, Column 2)......

New Business Issued (Exhibit of Life Insurance)

2. Total (Line 2, Column 2)......

Premium Income (Exhibit 1, Part 1)

3. Life insurance—first year (Line 9.4, Column 2)...... 4. Life insurance—single and renewal (Lines 10.4 and 19.4, Column 2)...... 5. Annuity (Line 20.4, Column 3)...... 6. Accident and health (Line 20.4, Column 4)...... 7. Aggregate of all other lines of business (Line 20.4, Column 5)...... 8. Total (Line 20.4, Column 1)......

Balance Sheet (Pages 2 and 3)

9. Total admitted assets excluding Separate Accounts business (Page 2, Line 26, Col. 3)...... 10. Total Liabilities excluding Separate Accounts business (Page 3, Line 23)...... 11. Aggregate reserve for life certificates and contracts (Page 3, Line 1)...... 12. Aggregate reserve for accident and health certificates (Page 3, Line 2)...... 13. Deposit-type contract funds (Page 3, Line 3)...... 14. Asset Valuation Reserve (Page 3, Line 21.1)...... 15. Surplus (Page 3, Line 30)......

Cash Flow (Page 5) 16. Net cash from operations (Line 11) ......

Risk-Based Capital Analysis

17. Total adjusted capital...... 18. 50% of the calculated RBC amount...... Percentage Distribution of Cash, Cash Equivalents and Invested Assets (Page 2, Col. 3) (Item No. ÷ Page 2, Line 12, Col. 3) x 100.0

19. Bonds (Line 1)...... 20. Stocks (Lines 2.1 and 2.2)...... 21. Mortgage loans on real estate (Lines 3.1 and 3.2)...... 22. Real estate (Lines 4.1, 4.2 and 4.3)...... 23. Cash, cash equivalents and short-term investments (Line 5)...... 24. Contract loans (Line 6)...... 25. Derivatives (Line 7) ...... XXX XXX 26. Other invested assets (Line 8)...... 27. Receivables for securities (Line 9)...... 28. Securities lending reinvested collateral assets (Line 10)...... XXX XXX 29. Aggregate write-ins for invested assets (Line 11)...... 30. Cash, cash equivalents and invested assets (Line 12)...... 100.0 100.0 100.0 100.0 100.0 Investments in Subsidiaries and Affiliates

31. Affiliated bonds (Schedule D Summary, Line 12, Col. 1)...... 32. Affiliated preferred stock (Schedule D Summary, Line 18, Col. 1)...... 33. Affiliated common stock (Schedule D Summary, Line 24, Col. 1)...... 34. Affiliated short-term investments (subtotals included in ...... Schedule DA Verification, Col. 5, Line 10)...... 35. Affiliated mortgage loans on real estate...... 36. All other affiliated...... 37. Total of above Lines 31 to 36...... 38. Total Investment in Parent included in Lines 31 to 36 above ...... Total Nonadmitted Assets and Admitted Assets

3839. Total nonadmitted assets (Page 2, Line 28, Col. 2)...... 3940. Total admitted assets (Page 2, Line 28, Col. 3)...... Investment Data

4041. Net investment income (Exhibit of Net Investment Income, Line 17)...... 4142. Realized capital gains (losses) (Page 4, Line 30, Column 1)...... 4243. Unrealized capital gains (losses) (Page 4, Line 34, Column 1)...... 4344. Total of above Lines 4041, 41 42 and 4243 ......

© 2012 National Association of Insurance Commissioners 160 FIVE – YEAR HISTORICAL DATA (Continued)

1 2 3 4 5 2012 2011 2010 2009 2008

Benefits and Reserve Increases (Page 6)

4454. Total certificate benefits—life (Lines 10, 11, 12, 13 and 14 Column 7 less Line 13, Column 5)......

4546. Total certificate benefits—accident and health (Line 13, Column 5)...... ) ...... 4647. Increase in life reserves (Line 17, Column 2)...... 4748. Increase in accident and health reserves (Line 17, Column 5)...... ) ......

4849. Refunds to members (Line 28, Column 1)......

Operating Percentages ...... 4950. Insurance expense percent (Page 6, Column 1, Lines 19, 20 and 21 less Line 6, Column 1) ÷ (Page 6, Column 1, Line 1) x 100.0...... 5051. Lapse percent [(Exhibit of Life Insurance, Column 2, Lines 14 and 15) / ½ (Exhibit of Life Insurance, Column 2, Lines 1 & 21)] x 100.0......

5152. Accident and health loss percent (Schedule H, Part 1, Lines 5 and 6, Column 2)......

5253. A&H cost containment percent (Schedule H, Part 1, Line 4, Column 2)...... 5354. Accident and health expense percent excluding cost containment expenses (Schedule H, Part 1, Line 10, Column 2) ...... Column 1, % Shown) ...... Accident and Health Reserve Adequacy

5455. Incurred losses on prior years' claims (Schedule H, Part 3, Line 3.1, ...... Column 1)......

5556. Prior years' liability and reserve (Schedule H, Part 3, Line 3.2, Column 1)......

Net Gains from Operations After Refunds to Members ...... by Lines of Business (Page 6, Line 29) ......

5657. Life insurance (Column 2)......

5758. Annuity (Column 3)......

5859. Supplementary contracts (Column 4)......

5960. Accident and health (Column 5)......

6061. Aggregate of all other lines of business (Column 6)......

6162. Fraternal (Column 8)......

6263. Expense (Column 9)......

6364. Total (Column 1)

NOTE: If a party to a merger, have the two most recent years of this exhibit been restated due to a merger in compliance with the disclosure requirements of SSAP No. 3, Accounting Changes and Correction of Errors? Yes [ ] No [ ]

If no, please explain ......

© 2012 National Association of Insurance Commissioners 161 ANNUAL STATEMENT BLANK – TITLE

FIVE – YEAR HISTORICAL DATA Show amounts in whole dollars only, no cents; show percentages to one decimal place, i.e. 17.6.

1 2 3 4 5 2012 2011 2010 2009 2008 Source of Direct Title Premiums Written (Part 1A)

1. Direct operations (Part 1A, Line 1, Col. 1)...... 2. Non-affiliated agency operations (Part 1A, Line 1, Col. 2)...... 3. Affiliated agency operations (Part 1A, Line 1, Col. 3)...... 4. Total ......

Operating Income Summary (Page 4 & Part 1)

5. Premiums earned (Part 1B, Line 3)...... 6. Escrow and settlement service charges (Part 1A, Line 2)...... 7. Title examinations (Part 1A, Line 3)...... 8. Searches and abstracts (Part 1A, Line 4)...... 9. Surveys (Part 1A, Line 5)...... 10. Aggregate write-ins for service charges (Part 1A, Line 6)...... 11. Aggregate write-ins for other operating income (Page 4, Line 2)...... 12. Total operating income (Page 4, Line 3)......

Statement of Income (Page 4)

13. Net operating gain or (loss) (Line 8)...... 14. Net investment gain or (loss) (Line 11)...... 15. Total other income (Line 12)...... 16. Federal and foreign income taxes incurred (Line 14)...... 17. Net income (Line 15)......

Balance Sheet (Pages 2 and 3)

18. Title insurance premiums and fees receivable (Page 2, Line 15, Col. 3)...... 19. Total admitted assets excluding segregated accounts (Page 2, Line 26, Col. 3)...... 20. Known claims reserve (Page 3, Line 1)...... 21. Statutory premium reserve (Page 3, Line 2)...... 22. Total liabilities (Page 3, Line 23)...... 23. Capital paid up (Page 3, Lines 25 + 26)...... 24. Surplus as regards policyholders (Page 3, Line 32)......

Cash Flow (Page 5)

25. Net cash from operations (Line 11)......

Percentage Distribution of Cash, Cash-Equivalents and Invested Assets (Page 2, Col. 3) (Item divided by Page 2, Line 12, Col. 3) x 100.0

26. Bonds (Line 1)...... 27. Stocks (Lines 2.1 & 2.2)...... 28. Mortgage loans on real estate (Line 3.1 and 3.2)...... 29. Real estate (Lines 4.1, 4.2 & 4.3)...... 30. Cash, cash equivalents and short-term investments (Line 5)...... 31. Contract loans (Line 6)...... 32. Derivatives (Line 7) ...... XXX XXX 33. Other invested assets (Line 8)...... 34. Receivable for securities (Line 9)...... 35. Securities lending reinvested collateral assets (Line 10)...... XXX XXX 36. Aggregate write-ins for invested assets (Line 11)...... 37. Subtotals cash, cash equivalents and invested assets (Line 12)...... 100.0 100.0 100.0 100.0 100.0

Investments in Parent, Subsidiaries and Affiliates

38. Affiliated bonds (Sch. D Summary, Line 12, Col. 1)...... 39. Affiliated preferred stocks (Sch. D, Summary, Line 18, Col. 1)...... 40. Affiliated common stocks (Sch. D, Summary, Line 24, Col. 1)...... 41. Affiliated short-term investments (subtotals included in Schedule DA Verification, Col. 5, Line 10)...... 42. Affiliated mortgage loans on real estate...... 43. All other affiliated...... 44. Total of above Lines 38 to 43...... 45. Total Investment in Parent included in Lines 38 to 43 above ...... 4546. Percentage of investments in parent, subsidiaries and affiliates to surplus as regards policyholders (Line 44 above divided by Page 3, Line 32, Col. 1 x 100.0)

© 2012 National Association of Insurance Commissioners 162 FIVE – YEAR HISTORICAL DATA (Continued)

1 2 3 4 5 2012 2011 2010 2009 2008 Capital and Surplus Accounts (Page 4)

4647. Net unrealized capital gains or (losses) (Line 18)...... 4748. Change in nonadmitted assets (Line 21)...... 4849. Dividends to stockholders (Line 28)...... 4950. Change in surplus as regards policyholders for the year (Line 31)......

Losses Paid and Incurred (Part 2A)

5051. Net payments (Line 5, Col. 4)...... 5152. Losses and allocated LAE incurred (Line 8, Col. 4)...... 5253. Unallocated LAE incurred (Line 9, Col. 4)...... 5354. Losses and loss adjustment expenses incurred (Line 10, Col. 4)......

Operating Expenses to Total Operating Income (Part 3)(%) (Line item divided by Page 4, Line 3 x 100.0)

5455. Personnel costs (Part 3, Line 1.5, Col. 4)...... 5556. Amounts paid to or retained by title agents (Part 3, Line 2, Col. 4)...... 5657. All other operating expenses (Part 3, Lines 24 minus 1.5 minus 2, Col. 4)...... 5758. Total (Lines 54 55 to 5657)......

Operating Percentages (Page 4) (Line item divided by Page 4, Line 3 x 100.0)

5859. Losses and loss adjustment expenses incurred (Line 4)...... 5960. Operating expenses incurred (Line 5)...... 6061. Other operating expenses (Line 6)......

6162. Total operating deductions (Line 7)...... 6263. Net operating gain or (loss) (Line 8)......

Other Percentages (Line item divided by Part 1B, Line 1.4 x 100.0)

6364. Losses and loss expenses incurred to net premiums written (Page 4, Line 4)...... 6465. Operating expenses incurred to net premiums written (Page 4, Line 5)

NOTE: If a party to a merger, have the two most recent years of this exhibit been restated due to a merger in compliance with the disclosure requirements of SSAP No. 3, Accounting Changes and Correction of Errors? Yes [ ] No [ ] If no, please explain ......

© 2012 National Association of Insurance Commissioners 163 ANNUAL STATEMENT INSTRUCTIONS – HEALTH

FIVE - YEAR HISTORICAL DATA

Detail Eliminated To Conserve Space

Investments in Parent, Subsidiaries and Affiliates

Line 26 – Affiliated Bonds

2009 through current year...... Schedule D Summary, Line 12, Column 1 2008 and prior...... Schedule D Summary, Line 25, Column 1

Line 27 – Affiliated Preferred Stocks

2009 through current year...... Schedule D Summary, Line 18, Column 1 2008 and prior...... Schedule D Summary, Line 39, Column 1

Line 28 – Affiliated Common Stocks

2009 through current year...... Schedule D Summary, Line 24, Column 1 2008 and prior...... Schedule D Summary, Line 53, Column 1

Line 29 – Affiliated Short-term Investment

2008 through current year...... Subtotal included in Schedule DA, Verification Between Years, Column 5, Line 10 2007...... Subtotal included in Schedule DA, Part 2, Column 5, Line 7

Line 33 – Total Investment in Parent

Report the amount of investments reported Lines 26 to 31 above which are in an immediate or indirect parent.

© 2012 National Association of Insurance Commissioners 164 ANNUAL STATEMENT INSTRUCTIONS – LIFE

FIVE - YEAR HISTORICAL DATA

Detail Eliminated To Conserve Space

Investments in Parent, Subsidiaries and Affiliates

Line 44 – Affiliated Bonds

2009 through current year...... Schedule D Summary, Line 12, Column 1 2008 and prior...... Schedule D Summary, Line 25, Column 1

Line 45 – Affiliated Preferred Stocks

2009 through current year...... Schedule D Summary, Line 18, Column 1 2008 and prior...... Schedule D Summary, Line 39, Column 1

Line 46 – Affiliated Common Stocks

2009 through current year...... Schedule D Summary, Line 24, Column 1 2008 and prior...... Schedule D Summary, Line 53, Column 1

Line 47 – Affiliated Short-term Investments

2008 through current year...... Subtotal included in Schedule DA, Verification Between Years, Column 5, Line 10 2007...... Subtotal included in Schedule DA, Part 2, Column 5, Line 7

Line 51 – Total Investment in Parent

Report the amount of investments reported Lines 44 to 49 above which are in an immediate or indirect parent.

Total Nonadmitted and Admitted Assets

Line 5152 – Total Nonadmitted Assets

2010 through current year...... Page 2, Line 28, Column 2 2009 and prior...... Page 2, Line 26, Column 2

Line 5253 – Total Admitted Assets

2010 through current year...... Page 2, Line 28, Column 3 2009 and prior...... Page 2, Line 26, Column 3

Investment Data

Line 5354 – Net Investment Income

All years...... Exhibit of Net Investment Income, Line 17

Line 5455 – Realized Capital Gains (Losses)

All years...... Summary of Operations, Line 34, Column 1

Line 5556 – Unrealized Capital Gains (Losses)

All years...... Summary of Operations, Line 38, Column 1 © 2012 National Association of Insurance Commissioners 165 Benefits and Reserve Increase (Page 6)

Line 5758 – Total Contract Benefits- Life

All years...... Lines 10, 11, 12, 13, 14 and 15, Column 1 less Lines 10, 11, 12, 13, 14 and 15 Columns 9, 10 and 11

Line 5859 – Total Contract Benefits- A & H

All years...... Lines 13 & 14, Column 9, 10 & 11

Line 5960 – Increase in Life Reserves – Other than Group and Annuities

All years...... Line 19, Columns 2 & 3

Line 6061 – Increases in A & H Reserves

All years...... Line 19, Columns 9, 10 & 11

Line 6162 – Dividends to Policyholders

All years...... Line 30, Column 1

Operating Percentages

Line 6263 – Insurance Expense Percent

All years...... (Page 6, Column 1, Lines 21, 22 & 23 less Line 6) / (Page 6, Column 1, Line 1 plus Exhibit 7, Column 2, Line 2) x 100.00

Line 6354 – Lapse Percent (ordinary only)

All years...... (Exhibit of Life Insurance, Column 4, Lines 14 & 15) / ½ (Exhibit of Life Insurance, Column 4, Lines 1 & 21) x 100.00

Line 6465 – A & H Loss Percent

All years...... Schedule H, Part 1, Lines 5 & 6, Column 2

Line 6566 – A&H Cost Containment

All years...... Schedule H, Part 1, Line 4, Column 2

Line 6667 – A & H Expense Percent excluding Cost Containment Expenses

All years...... Schedule H, Part 1, Line 10, Column 2

In 2007, this percentage should exclude Cost Containment Expenses.

A & H Claim Reserve Adequacy

Line 6768 – Incurred Losses on Prior Years’ Claims – Group Health

All years...... Schedule H, Part 3, Line 3.1, Column 2

Line 6869 – Prior Years’ Claim Liability and Reserve – Group Health

All years...... Schedule H, Part 3, Line 3.2, Column 2

© 2012 National Association of Insurance Commissioners 166 Line 6970 – Incurred Losses on Prior Years’ Claims – Health Other than Group

All years...... Schedule H, Part 3, Line 3.1, Column 1 less Column 2

Line 7071 – Prior Years’ Claim Liability and Reserve – Health Other than Group

All years...... Schedule H, Part 3, Line 3.2, Column 1 less Column 2

Net Gains From Operations After Federal Income Taxes by Lines of Business

All years...... Page 6, Line 33

Line 7172 – Industrial Life

All years...... Page 6, Line 33, Column 2

Line 7273 – Ordinary – Life

All years...... Page 6, Line 33, Column 3

Line 7374 – Ordinary – Individual Annuities

All years...... Page 6, Line 33, Column 4

Line 74 75 – Ordinary – Supplementary Contracts

All years...... Page 6, Line 33, Column 5

Line 75 76 – Credit Life

All years...... Page 6, Line 33, Column 6

Line 7677 – Group Life

All years...... Page 6, Line 33, Column 7

Line 7778 – Group Annuities

All years...... Page 6, Line 33, Column 8

Line 7879 – A & H – Group

All years...... Page 6, Line 33, Column 9

Line 7980 – A & H – Credit

All years...... Page 6, Line 33, Column 10

Line 8081 – A & H – Other

All years...... Page 6, Line 33, Column 11

Line 8182 – Aggregate of All Other Lines of Business

All years...... Page 6, Line 33, Column 12

© 2012 National Association of Insurance Commissioners 167 ANNUAL STATEMENT INSTRUCTIONS – PROPERTY

FIVE - YEAR HISTORICAL DATA

Detail Eliminated To Conserve Space

Investments in Parent, Subsidiaries and Affiliates

Line 42 – Affiliated Bonds

2009 through current year...... Schedule D Summary, Line 12, Column 1 2008 and prior ...... Schedule D Summary, Line 25, Column 1

Line 43 – Affiliated Preferred Stocks

2009 through current year...... Schedule D Summary, Line 18, Column 1 2008 and prior ...... Schedule D Summary, Line 39, Column 1

Line 44 – Affiliated Common Stock

2009 through current year...... Schedule D Summary, Line 24, Column 1 2008 and prior ...... Schedule D Summary, Line 53, Column 1

Line 45 – Affiliated Short-term Investments

2008 through current year...... Schedule DA Verification Between Years, Column 5, Line 10 2007...... Schedule DA Part 2, Column 5, Line 7

Line 49 – Total Investment in Parent

Report the amount of investments reported Lines 42 to 47 above which are in an immediate or indirect parent.

Line 4950 – Percentage of Investments in Parents, Subsidiaries and Affiliates to Surplus as Regards Policyholders

2010 through current year...... Five Year Historical, Line 48 divided by Page 3, Column 1, Line 37 x 100.0 2009 and prior...... Five Year Historical, Line 46 divided by Page 3, Column 1, Line 35 x 100.0

Capital and Surplus Accounts (Page 4)

Line 5051 – Net Unrealized Capital Gains (Losses)

All Years...... Line 24

Line 5152 – Dividends to Stockholders

All Years...... Line 35

Line 5253 – Change in Surplus as Regards Policyholders for the Year

All Years...... Line 38

Gross Losses Paid

All years...... Page 9, Part 2, Columns 1 & 2

Line 5354 – Liability Lines

2009 through current year...... Lines 11.1, 11.2, 16, 17.1, 17.2, , 17.3, 18.1, 18.2, 19.1, 19.2, 19.3 & 19.4 2008 and prior...... Lines 11.1, 11.2, 16, 17.1, 17.2, 18.1, 18.2, 19.1, 19.2, 19.3 & 19.4

© 2012 National Association of Insurance Commissioners 168 Line 5455 – Property Lines

All years...... Lines 1, 2, 9, 12, 21 & 26

Line 5556 – Property and Liability Combined Lines

All years...... Lines 3, 4, 5, 8, 22 & 27

Line 5657 – All Other Lines

2008 through current year...... Lines 6, 10, 13, 14, 15, 23, 24, 28, 29, 30 & 34 2007...... Lines 6, 10, 13, 14, 15, 23, 24, 28, 29 & 33

Line 5758 – Nonproportional Reinsurance Lines

2008 through current year...... Lines 31, 32 & 33 2007...... Lines 30, 31 & 32

Line 5859 – Total

2008 through current year...... Line 35 2007...... Line 34

Net Losses Paid

All years Page 9, Part 2, Column 4

Line 5960 – Liability Lines

2009 through current year...... Lines 11.1, 11.2, 16, 17.1, 17.2, , 17.3, 18.1, 18.2, 19.1, 19.2, 19.3 & 19.4 2008 and prior ...... Lines 11.1, 11.2, 16, 17.1, 17.2, 18.1, 18.2, 19.1, 19.2, 19.3 & 19.4

Line 6061 – Property Lines

All years...... Lines 1, 2, 9, 12, 21 & 26

Line 6162 – Property and Liability Combined Lines

All years...... Lines 3, 4, 5, 8, 22 & 27

Line 6263 – All Other Lines

2008 through current year...... Lines 6, 10, 13, 14, 15, 23, 24, 28, 29, 30 & 34 2007...... Lines 6, 10, 13, 14, 15, 23, 24, 28, 29 & 33

Line 6364 – Nonproportional Reinsurance Lines

2008 through current year...... Lines 31, 32 & 33 2007...... Lines 30, 31 & 32

Line 6465 – Total

2008 through current year...... Line 35 2007...... Line 34

© 2012 National Association of Insurance Commissioners 169 Operating Percentages

All years...... (Page 4) (Item Divided by Page 4, Line 1) x 100.0

Line 6566 – Premiums Earned

All years...... Line 1

Line 6667 – Losses Incurred

All years...... Line 2

Line 6768 – Loss Expenses Incurred

All years...... Line 3

Line 6869 – Other Underwriting Expenses Incurred

All years...... Line 4

Line 6970 – Net Underwriting Gain (Loss)

All years...... Line 8

Other Percentages

Line 7071 – Other Underwriting Expenses to Net Premiums Written

All years...... Page 4, Lines 4 + 5 – 15 divided by Page 8, Part 1B, Column 6, Line 35 x 100.0

Line 7172 – Losses and Loss Expenses Incurred to Premiums Earned

All years...... Page 4, Lines 2 + 3 divided by Page 4, Line 1 x 100.0

Line 7273 – Net Premiums Written to Policyholders’ Surplus

2010 through current year...... Page 8, Part 1B, Column 6, Line 35 divided by Page 3, Line 37, Column 1 x 100.0 2009 and prior...... Page 8, Part 1B, Column 6, Line 35 divided by Page 3, Line 35, Column 1 x 100.0

One-Year Loss Development (000 omitted)

Line 7374 – Development in Estimated Losses and Loss Expenses Incurred Prior to Current Year

All years...... Schedule P, Part 2 Summary, Line 12, Column 11

Line 7475 – Percent of Development of Losses and Loss Expenses Incurred to Policyholders’ Surplus of Prior Year End

2010 through current year...... Five Year Historical, Line 73 divided by Page 4, Line 21, Column 1 x 100.0 2007 through 2009...... Five Year Historical, Line 71 divided by Page 4, Line 21, Column 1 x 100.0

Two-Year Loss Development (000 omitted)

Line 7576 – Development in Estimated Losses and Loss Expenses Incurred 2 Years Before the Current Year and Prior Year

All years...... Schedule P, Part 2 Summary Line 12, Column 12

Line 7677 – Percent of Development of Losses and Loss Expenses Incurred to Reported Policyholders’ Surplus of Second Year Prior Year End

2010 through current year...... Five Year Historical, Line 75 divided by Page 4, Line 21, Column 2 x 100.0 2007 through 2009...... Five Year Historical, Line 73 divided by Page 4, Line 21, Column 2 x 100.0

© 2012 National Association of Insurance Commissioners 170 ANNUAL STATEMENT INSTRUCTIONS – FRATERNAL

FIVE - YEAR HISTORICAL DATA

Detail Eliminated To Conserve Space

Investments in Subsidiaries and Affiliates

Line 31 – Affiliated Bonds

2009 through current year...... Schedule D Summary, Line 12, Column 1 2008 and prior...... Schedule D Summary, Line 25, Column 1

Line 32 – Affiliated Preferred Stock

2009 through current year...... Schedule D Summary, Line 18, Column 1 2008 and prior...... Schedule D Summary, Line 39, Column 1

Line 33 – Affiliated Common Stock

2009 through current year...... Schedule D Summary, Line 24, Column 1 2008 and prior...... Schedule D Summary, Line 53, Column 1

Line 34 – Affiliated Short-term Investments

2008 through current year...... Subtotal included in Schedule DA, Verification Between Years, Column 5, Line 10 2007...... Subtotals included in Schedule DA, Part 2, Line 7, Column 5

Line 38 – Total Investment in Parent

Report the amount of investments reported Lines 31 to 36 above which are in an immediate or indirect parent.

Total Nonadmitted Assets and Admitted Assets

Line 3839 – Total Nonadmitted Assets

2010 through current year...... Page 2, Line 28, Column 2 2009 and prior...... Page 2, Line 26, Column 2

Line 3940 – Total Admitted Assets

2010 through current year...... Page 2, Line 28, Column 3 2009 and prior...... Page 2, Line 26, Column 3

Investment Data

Line 4041 – Net Investment Income

Current year and prior...... Exhibit of Net Investment Income, Line 17

Line 4142 – Realized Capital Gains (Losses)

All years...... Summary of Operations, Line 30, Column 1

Line 4243 – Unrealized Capital Gains (Losses)

All years...... Summary of Operations, Line 34, Column 1 © 2012 National Association of Insurance Commissioners 171 Benefits and Reserve Increases (Page 6)

Line 4454 – Total Certificate Benefits – life

All years...... Lines 10, 11, 12, 13 and 14, Column 7 less Line 13, Column 5

Line 4546 – Total Certificate Benefits – Accident and Health

All years...... Line 13, Column 5

Line 46 47– Increase in Life Reserves

All years...... Line 17, Column 2

Line 4748 – Increase in Accident and Health Reserves

All years...... Line 17, Column 5

Line 4849 – Refunds to Members

All years...... Line 28, Column 1

Operating Percentages

Line 4950 – Insurance Expense Percent

All years...... (Page 6, Column 1, Lines 19, 20 and 21 less Line 6, Column 1) divided by (Page 6, Column 1, Line 1) x 100.0

Line 5051 – Lapse Percent

All years...... (Exhibit of Life Insurance, Column 2, Lines 14 & 15) divided ½ (Exhibit of Life Insurance, Column 2, Lines 1 & 21) x 100.0

Line 5152 – Accident and Health Loss Percent

All years...... Schedule H, Part 1, Lines 5 and 6, Column 2

Line 5253 – A&H Cost Containment Percent

All years...... Schedule H, Part 1, Line 4, Column 2

Line 5354 – Accident and Health Expense Percent excluding Cost Containment Expenses

All years...... Schedule H, Part 1, Line 10, Column 2

Accident and Health Reserve Adequacy

Line 5455 – Incurred Losses on Prior Years’ Claims

All years...... Schedule H, Part 3, Line 3.1, Column 1

Line 5556 – Prior Years’ Liability and Reserve

All years...... Schedule H, Part 3, Line 3.2, Column 1

© 2012 National Association of Insurance Commissioners 172 Net Gains from Operations After Refunds to Members by Lines of Business

All years...... Page 6, Line 29

Line 5657 – Life Insurance

All years...... Page 6, Line 29, Column 2

Line 5758 – Annuity

All years...... Page 6, Line 29, Column 3

Line 5859 – Supplementary Contracts

All years...... Page 6, Line 29, Column 4

Line 5960 – Accident and Health

All years...... Page 6, Line 29, Column 5

Line 6061 – Aggregate of All Other Lines of Business

All years...... Page 6, Line 29, Column 6

Line 6162 – Fraternal

All years...... Page 6, Line 29, Column 8

Line 6263 – Expense

All years...... Page 6, Line 29, Column 9

Line 6364 – Total

All years...... Page 6, Line 29, Column 1

© 2012 National Association of Insurance Commissioners 173 ANNUAL STATEMENT INSTRUCTIONS – TITLE

FIVE - YEAR HISTORICAL DATA

Detail Eliminated To Conserve Space

Investment in Parent, Subsidiaries and Affiliates

Line 38 – Affiliated Bonds

2009 through current year...... Schedule D Summary, Line 12, Column 1 2008 and prior...... Schedule D, Summary, Line 25, Column 1

Line 39 – Affiliated Preferred Stock

2009 through current year...... Schedule D Summary, Line 18, Column 1 2008 and prior...... Schedule D, Summary, Line 39, Column 1

Line 40 – Affiliated Common Stock

2009 through current year...... Schedule D Summary, Line 24, Column 1 2008 and prior...... Schedule D, Summary, Line 53, Column 1

Line 41 – Affiliated Short-term Investments

2008 through current year...... Subtotal included in Schedule DA, Verification Between Years, Column 5, Line 10 2007...... Subtotals included in Schedule DA, Part 2, Column 5, Line 7

Line 45 – Total Investment in Parent

Report the amount of investments reported Lines 38 to 43 above which are in an immediate or indirect parent.

Line 4546 – Percentage of Investments in Parent, Subsidiaries and Affiliates to Surplus as Regards to Policyholders

2010 through current year...... Line 44 divided by Page 3, Line 32, Column 1 x 100.0 2009 and prior...... Line 42 divided by Page 3, Line 30, Column 1 x 100.0

Capital and Surplus Accounts

Line 4647 – Net Unrealized Capital Gains (Losses)

All years...... Page 4, Line 18

Line 4748 – Change in Nonadmitted Assets

All years...... Page 4, Line 21

Line 4849 – Dividends to Stockholders

All years...... Page 4, Line 28

Line 4950 – Change in Surplus as Regards Policyholders

All years...... Page 4, Line 31

© 2012 National Association of Insurance Commissioners 174 Losses Paid and Incurred

All years...... Operations and Investment Exhibit, Part 2A

Line 5051 – Net Payments

All years...... Part 2A, Line 5, Column 4

Line 5152 – Losses and Allocated LAE Incurred

All years...... Part 2A Line 8, Column 4

Line 5253 – Unallocated LAE Incurred

All years...... Part 2A, Line 9, Column 4

Line 5354 – Losses and Loss Adjustment Expenses Incurred

All years...... Part 2A, Line 10, Column 4

Operating Expenses to Total Operating Income

All years...... (Operations and Investment Exhibit, Part 3) (%) (Line item divided by Page 4, Line 3 x 100.0)

Line 5455 – Personnel Costs

All years...... Part 3, Line 1.5, Column 4

Line 5556 – Amounts Paid To Or Retained By Title Agents

All years...... Part 3, Line 2, Column 4

Line 5657 – All Other Operating Expenses

All years...... Part 3, Lines 24 minus 1.5 minus 2, Column 4

Operating Percentages

All years...... (Line item divided by Page 4, Line 3 x 100.0)

Line 5859 – Losses & Loss Adjustment Expenses Incurred

All years...... Page 4, Line 4

Line 5960 – Operating Expenses Incurred

All years...... Page 4, Line 5

Line 6061 – Other Operating Expenses

All years...... Page 4, Line 6

Line 6162 – Total Operating Deductions

All years...... Page 4, Line 7

Line 6263 – Net Operating Gain or (Loss)

All years...... Page 4, Line 8

© 2012 National Association of Insurance Commissioners 175 Other Percentages

All years...... (Line item divided by Part 1B, Line 1.4 x 100.0)

Line 6364 – Losses and Loss Expenses Incurred to Net Premiums Written

All years...... Page 4, Line 4

Line 6465 – Operating Expenses Incurred to Net Premiums Written

All years...... Page 4, Line 5

D:\Docs\2018-04-19\0a04292b5410859ee18117748e22c93c.doc

© 2012 National Association of Insurance Commissioners 176