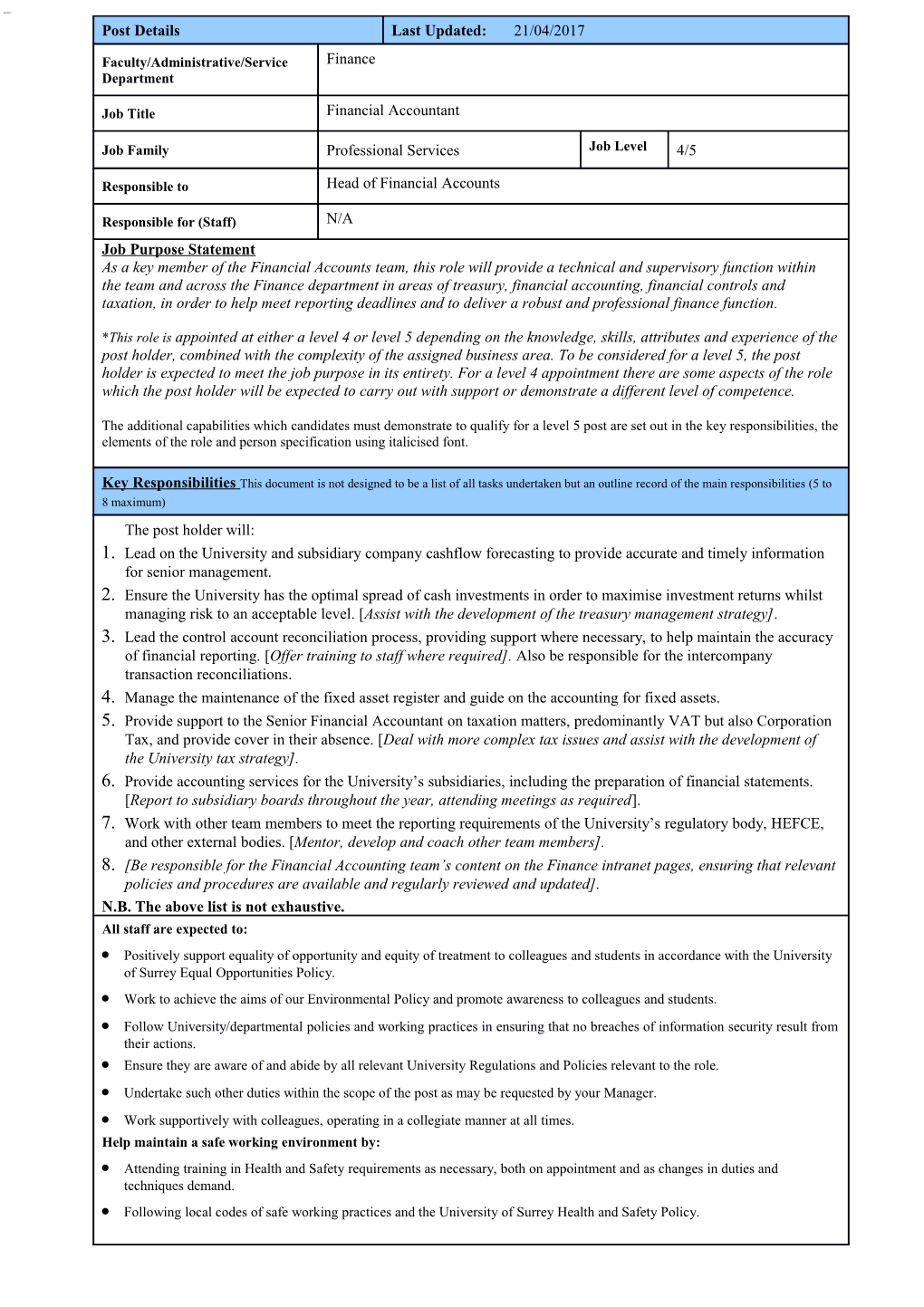

Post Details Last Updated: 21/04/2017

Faculty/Administrative/Service Finance Department

Job Title Financial Accountant

Job Family Professional Services Job Level 4/5

Responsible to Head of Financial Accounts

Responsible for (Staff) N/A Job Purpose Statement As a key member of the Financial Accounts team, this role will provide a technical and supervisory function within the team and across the Finance department in areas of treasury, financial accounting, financial controls and taxation, in order to help meet reporting deadlines and to deliver a robust and professional finance function.

*This role is appointed at either a level 4 or level 5 depending on the knowledge, skills, attributes and experience of the post holder, combined with the complexity of the assigned business area. To be considered for a level 5, the post holder is expected to meet the job purpose in its entirety. For a level 4 appointment there are some aspects of the role which the post holder will be expected to carry out with support or demonstrate a different level of competence.

The additional capabilities which candidates must demonstrate to qualify for a level 5 post are set out in the key responsibilities, the elements of the role and person specification using italicised font.

Key Responsibilities This document is not designed to be a list of all tasks undertaken but an outline record of the main responsibilities (5 to 8 maximum) The post holder will: 1. Lead on the University and subsidiary company cashflow forecasting to provide accurate and timely information for senior management. 2. Ensure the University has the optimal spread of cash investments in order to maximise investment returns whilst managing risk to an acceptable level. [Assist with the development of the treasury management strategy]. 3. Lead the control account reconciliation process, providing support where necessary, to help maintain the accuracy of financial reporting. [Offer training to staff where required]. Also be responsible for the intercompany transaction reconciliations. 4. Manage the maintenance of the fixed asset register and guide on the accounting for fixed assets. 5. Provide support to the Senior Financial Accountant on taxation matters, predominantly VAT but also Corporation Tax, and provide cover in their absence. [Deal with more complex tax issues and assist with the development of the University tax strategy]. 6. Provide accounting services for the University’s subsidiaries, including the preparation of financial statements. [Report to subsidiary boards throughout the year, attending meetings as required]. 7. Work with other team members to meet the reporting requirements of the University’s regulatory body, HEFCE, and other external bodies. [Mentor, develop and coach other team members]. 8. [Be responsible for the Financial Accounting team’s content on the Finance intranet pages, ensuring that relevant policies and procedures are available and regularly reviewed and updated]. N.B. The above list is not exhaustive. All staff are expected to: Positively support equality of opportunity and equity of treatment to colleagues and students in accordance with the University of Surrey Equal Opportunities Policy. Work to achieve the aims of our Environmental Policy and promote awareness to colleagues and students. Follow University/departmental policies and working practices in ensuring that no breaches of information security result from their actions. Ensure they are aware of and abide by all relevant University Regulations and Policies relevant to the role. Undertake such other duties within the scope of the post as may be requested by your Manager. Work supportively with colleagues, operating in a collegiate manner at all times. Help maintain a safe working environment by: Attending training in Health and Safety requirements as necessary, both on appointment and as changes in duties and techniques demand. Following local codes of safe working practices and the University of Surrey Health and Safety Policy. Elements of the Role This section outlines some of the key elements of the role, which allow this role to be evaluated within the University’s structure. It provides an overview of what is expected from the post holder in the day-to-day operation of the role.

Planning and Organising A lot of the tasks within this role have fixed deadlines, either statutory or internal, ranging from daily to annual. The post holder will be required to plan their work, including any necessary collaboration with colleagues, in order to ensure that the deadlines are met. The post holder will also be expected to respond to requests for ad hoc tasks from other members of the Finance team, including the Deputy Director of Finance, being able to prioritise these tasks alongside regular reporting requirements.

Problem Solving and Decision Making The post holder will: Be expected to formulate and compile forecasts based upon advice and knowledge from colleagues and advisors. There will be a requirement to apply knowledge, experience and judgement as well as analytical and interpretive skills in order to arrive at the forecasts. [Be expected to lead other finance colleagues in understanding and agreeing a process for control account reconciliations]. Provide VAT advice to the department and wider University community on straightforward/[more complex] issues. Assistance would be provided for more/[highly] complex problems from more senior team members. Continuous Improvement The post holder will: Be expected to identify and suggest to the Head of Financial Accounting relevant improvements or developments to current working practices [and where appropriate to implement them]. Assisting with/[taking responsibility] for ensuring relevant staff have adequate understanding of control account reconciliations.

Accountability Latitude will exist for the post holder to set their own agenda within specific parameters and to organise and prioritise work to ensure that key deadlines and objectives are met, without supervisory approval. The post holder is accountable for ensuring relevant controls operate in accordance within University policies, procedures and regulations.

Dimensions of the role The post holder will: Be responsible for planning multi-million pound cash investments and assisting/preparing VAT returns of over £1million. Prepare cashflow forecasts covering inflows/outflows of up to £300m p.a. each.

Supplementary Information Success in many parts of this role is dependent on building good relationships and communication with other member of the Finance department.

Person Specification This section describes the sum total of knowledge, experience & competence required by the post holder that is necessary for standard acceptable performance in carrying out this role.

Qualifications and Professional Memberships

Qualified Accountant (CCAB or equivalent) plus relevant experience showing clear professional E development

Technical Competencies (Experience and Knowledge) This section contains the level of Essential/ Level competency required to carry out the role (please refer to the Competency Framework for clarification where Desirable 1-3 needed and the Job Matching Guidance).

Thorough knowledge and understanding of the principles, theory and practice of E 3 financial accounting, financial controls and treasury. Knowledge and understanding of tax legislation, particularly VAT and Corporation Tax E 1/[2] Knowledge and/or experience of FRS102 or international accounting standards E 3 Good working knowledge of Excel E 2 A detailed knowledge of AGRESSO or similar large scale accounting software package E 2

Special Requirements: Essential/ Desirable

Core Competencies This section contains the level of competency required to carry out this role. (Please refer to the Level competency framework for clarification where needed). n/a (not applicable) should be placed, where the competency is not a 1-3 requirement of the grade.

Communication 2/[3] Adaptability / Flexibility 2 Customer/Client service and support 3 Planning and Organising 3 Continuous Improvement 2/[3] Problem Solving and Decision Making Skills 2/[3] Managing and Developing Performance 1/[2] Creative and Analytical Thinking 2 Influencing, Persuasion and Negotiation Skills 2 Strategic Thinking & Leadership 1/[2]

This Job Purpose reflects the core activities of the post. As the Department/Faculty and the post holder develop, there will inevitably be some changes to the duties for which the post is responsible, and possibly to the emphasis of the post itself. The University expects that the post holder will recognise this and will adopt a flexible approach to work. This could include undertaking relevant training where necessary.

Should significant changes to the Job Purpose become necessary, the post holder will be consulted and the changes reflected in a revised Job Purpose.

Organisational/Departmental Information & Key Relationships Background Information The Finance department has approximately 75 FTEs. The Financial Accounting team leads on the University and subsidiary company external financial reporting requirements and is responsible for advising on and implementing financial controls. It also takes responsibility for all University Treasury decisions, including investment strategy, foreign exchange management and financing arrangements. Department Structure Chart

Relationships Internal Key contacts within Finance will be: o Financial Planning and Analysis (FP&A) o Finance Support, Finance Services and Student Finance o Business Finance Managers o Research Finance The post holder will also have regular contact with staff of the University Research Park and Surrey Sports Park Limited

External The University’s external auditors Financial advisors and bankers The post holder’s peers within other universities