NEW YORK UNIVERSITY STERN SCHOOL OF BUSINESS Professor Richardson International Fixed Income

Solutions to Problem Set #1

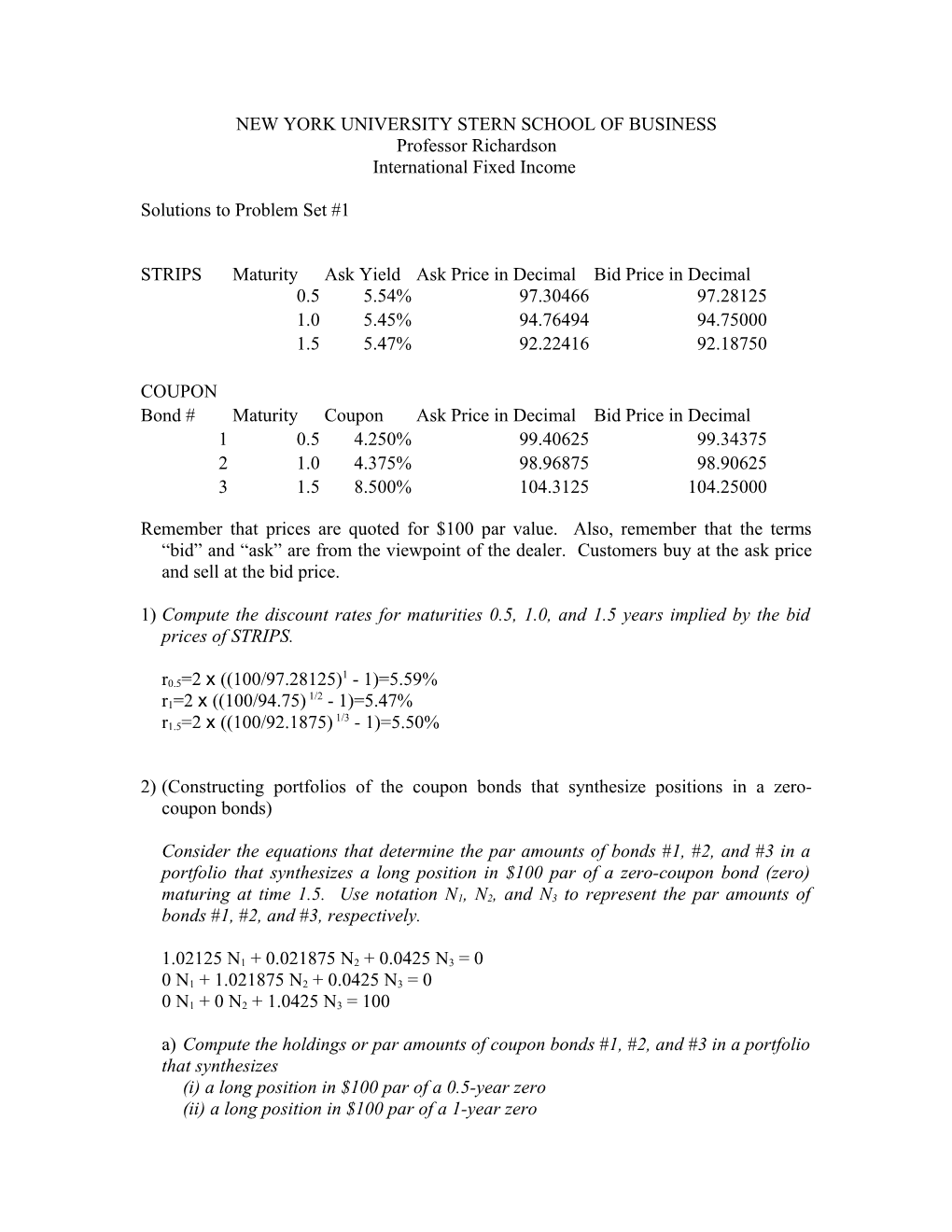

STRIPS Maturity Ask Yield Ask Price in Decimal Bid Price in Decimal 0.5 5.54% 97.30466 97.28125 1.0 5.45% 94.76494 94.75000 1.5 5.47% 92.22416 92.18750

COUPON BondBONDS # Maturity Coupon Ask Price in Decimal Bid Price in Decimal 1 0.5 4.250% 99.40625 99.34375 2 1.0 4.375% 98.96875 98.90625 3 1.5 8.500% 104.3125 104.25000

Remember that prices are quoted for $100 par value. Also, remember that the terms “bid” and “ask” are from the viewpoint of the dealer. Customers buy at the ask price and sell at the bid price.

1) Compute the discount rates for maturities 0.5, 1.0, and 1.5 years implied by the bid prices of STRIPS.

1 r0.5=2 x ((100/97.28125) - 1)=5.59% 1/2 r1=2 x ((100/94.75) - 1)=5.47% 1/3 r1.5=2 x ((100/92.1875) - 1)=5.50%

2) (Constructing portfolios of the coupon bonds that synthesize positions in a zero- coupon bonds)

Consider the equations that determine the par amounts of bonds #1, #2, and #3 in a portfolio that synthesizes a long position in $100 par of a zero-coupon bond (zero) maturing at time 1.5. Use notation N1, N2, and N3 to represent the par amounts of bonds #1, #2, and #3, respectively.

1.02125 N1 + 0.021875 N2 + 0.0425 N3 = 0 0 N1 + 1.021875 N2 + 0.0425 N3 = 0 0 N1 + 0 N2 + 1.0425 N3 = 100

a) Compute the holdings or par amounts of coupon bonds #1, #2, and #3 in a portfolio that synthesizes (i) a long position in $100 par of a 0.5-year zero (ii) a long position in $100 par of a 1-year zero (iii) a long position in $100 par of a 1.5-year zero Feel free to compute the portfolio holdings either by solving equations by hand, or by using matrix operations in Excel.

(i) (ii) (iii) N1 97.919 -2.096 -3.906 N2 0 97.859 -3.989 N3 0 0 95.923

b) Determine the cost to a customer of buying $100 par of the synthetic (i) 0.5-year zero 97.919 x 0.9940625 = 97.338 The cost of the synthetic is the cost of the component bonds. Positive holdings represent purchases which must be made at the ask price. Negative holdings represent sales which must be made at the bid price.

(ii) 1-year zero (-2.096 x 0.9934375) + (97.859 x 0.9896875) = 94.768

(iii) 1.5-year zero. (-3.906 x 0.9934375) + (-3.989 x 0.9890625) + (95.923 x 1.043125) = 92.233

c) Determine the revenue a customer would receive from selling $100 par of the synthetic (i) 0.5-year zero 97.919 x 0.9934375= 97.277 Now positive par amounts represent sales which must be done at the bid, while negative par amounts represent purchases to be done at the ask.

(ii) 1-year zero (-2.096 x 0.9940625) + (97.859 x 0.9890625) = 94.705

(iii) 1.5-year zero. (-3.906 x 0.9940625) + (-3.989 x 0.9896875) + (95.923 x 1.0425) = 92.168

d) Are there any arbitrage opportunities between synthetic zeroes and the actual STRIPS? No. The cost of buying the synthetic zero is always more than the bid price at which you could sell the offsetting STRIP. In addition, the revenue from selling the synthetic zero is always less than the ask price at which you could by the offsetting STRIP. For the remaining problems, use discount factors and rates from the STRIPS, not the synthetic zeroes. 3) A firm is planning to undertake a project at time 1 that will require an investment of $500,000. Funds won’t become available until time 1.5. Thus, at time 1, the firm will have to borrow $500,000 for 6 months. a) The firm uses the spot market to construct a loan from time 1 to time 1.5. How much will the firm have to pay back at time 1.5?

To create an inflow at time 1 of $500,000, the firm could buy $500,000 par value of the 1-year STRIP. This would cost $500,000 x 0.9476494 = $473,825 today. The firm does not want to pay this today, but rather wants to pay at time 1.5. So the firm sells enough 1.5-year STRIPS to raise $473,825 today. The par amount necessary to sell to raise $473,825 today is $473,825/0.921875 = $513,979. On net, the firm has no cash flow today, receives $500,000 at time 1 (from the 1-year STRIP it bought), and pays back $513,979 at time 1.5 (to cover the 1.5-year STRIP it sold).

b) What is the firm’s forward borrowing rate from time 1 to time 1.5? 2 x((513,979/500,000)1-1)=5.59%

4) A firm has an obligation to pay $1,000,000 at time 1. It will be receiving a large amount of cash at time 0.5. a) The firm uses the spot market to lock in a reinvestment rate from time 0.5 to time 1. How much will the firm have to lend at time 0.5 to cover its obligation at time 1? The firm buys 1,000,000 par value of 1-year STRIPS and sells an equal market value of 0.5-year STRIPS. The cost of the 1-year STRIPS is $1,000,000 x 0.9476494 = $947,649. The par amount of 0.5-year STRIPS to sell with the same market value is $947,649/0.9728125 = $974,134. $974,134 represents the amount the firm lends at time 0.5 to generate enough cash at time 1 to meet its obligation.

b) What forward lending rate from time 0.5 to time 1 has the firm locked in? 2 x((1,000,000/974,134)1-1)=5.31%

5) A dealer offers to enter into a contract with a customer in which he will deliver to the customer, at time 0.5, $100,000 par of a zero maturing at time 1.5, in exchange for $94,720. Does the customer have an arbitrage opportunity? If so, how?

Yes. If the customer enters the contract, he pays 0 today, he will pay $94,720 at time 0.5 and receive $100,000 at time 1.5.

He can offset the future cash flows of the contract by selling $100,000 par of the 1.5- year zero and buying $94,720 par of the 0.5-year zero. This will generate net revenue of (100,000 x 0.921875) - (94,720 x 0.9730466) = $20.53 which represents arbitrage profit taken today. Alternatively, he could synthetically sell the forward contract by selling the 1.5-year zero today and reinvesting the proceeds to time 0.5. Selling the 1.5 year zero generates revenue (100,000 x 0.921875) = $92.1875 today. Reinvesting that revenue in the 0.5-year bond will payoff $92.1875/0.9730466 =$94,741 at time 0.5. Then the net cash inflows from the synthetic forward sale combined with the forward purchase contract with the dealer are: 0 - 0 = 0 at time 0, $94,741-$94,720 = $21 at time 0.5, and $100,000 - $100,000 = 0 at time 1.5. So he takes an arbitrage profit of $21 at time 0.5.

6) a) What forward price can an investor lock in today to buy $100 par of a zero maturing at time 1.5 for settlement at time 1? $100 x 0.9222416/0.9475000 = $97.33

b) What forward price can an investor lock in today to sell $100 par of a zero maturing at time 1.5 for settlement at time 1? $100 x 0.921875/0.9476494 = $97.28

7) What is the forward lending rate from time 0.5 to time 1.5 (the lending rate a customer can lock in)?

Forward lending involves lending long term at the ask rate and borrowing short term at the bid rate: 1.5 2 3 1 (1+f0.5 /2) = (1+(ask rate)r1.5/2) / (1+(bid rate) r0.5/2) = 3 1 1.5 = (1+0.0547/2) / (1+0.0559/2) f0.5 = 5.41%

8) For the next question, suppose that the par yield curve (that is, the yield corresponding to a bond whose price is at par) is given by:

Maturity (yrs) 1 2 3 4 5 ParYield (in %) 3 4 5 6 7

There are two default-free bonds, A and B. Cash flows and prices are as follows:

Bond # Price CF (yr 1) CF (yr 2) CF (yr 3) CF (yr 4) CF (yr 5) A 110 10 110 B 116.84 10 10 10 10 110 a) Calculate the yield to maturity for bonds A and B. Which bond has a higher yield?

The yield is calculated by finding the y that sets the discounted cash flow equal to the price, e.g., for bond A, 10 110 110 2 . 1 y A (1 y A ) You actually do not need a calculator to solve this yield (i.e., you could use the

quadratic formula). In any event, yA 4.65% . For bond B, we have 10 10 110 116.84 2 ... 5 . (1 yB ) (1 yB ) (1 yB )

Solving numerically (i.e., trial and error, or via a calculator), we get a yield yB 6%. Thus, bond B has the higher yield.

b) What is the true value of each bond? Is yield to maturity a good criterion for investment decisions?

In order to find the true value of these bonds, we have to find the proper discount rate. We are given the par yields, so that

103 100 r1 3% 1 r1 4 104 100 2 r2 4.02% 1.03 (1 r2 ) 5 5 104 100 2 3 r3 5.07% 1.03 (1.0402) (1 r3 ) 6 6 6 106 100 2 3 4 r4 6.15% 1.03 (1.0402) (1.0507) (1 r4 ) 7 7 7 7 107 100 2 3 4 5 r5 7.31% 1.03 (1.0402) (1.0507) (1.0615) (1 r5 )

Therefore,

10 110 PV ( A) $111.37 1.03 (1.0402)2 NPV ( A) 111.37 110 $1.37

10 10 10 10 110 PV (B) $112.75 1.03 (1.0402)2 (1.0507)3 (1.0615)4 (1.0731)5 NPV (B) 112.75116.84 $4.09

Thus, investing in bond B is a negative NPV project and investing in bond A is a positive NPV project. Although bond B has the higher yield than bond A, it is better to invest in Bond A. This is because the spot curve is upward sloping, and the higher yield on B simply reflects this. In general, yield to maturity is not a universally good criterion for investment decisions.

9) Discount rates out to 3 years are r0.5 = 5.5%, r1 = 6%, r1.5 = 6.5%, r2 = 7%, r2.5 = 7.5%, r3 = 8%. a) The tables below consider bonds with various coupon rates (0%, 4%, and 10%) and maturities (1 year, 2 years, 3 years). Compute the prices and yields of these 9 different bonds and fill in the tables, assuming there is no arbitrage:

PRICES YIELDS (PER $1 Coupon Coupon MaturityPAR) 0% Rate 4% 10% Maturity 0% Rate 4% 10% 1 year 0.9426 0.9809 1.0384 1 year 6.000% 5.995% 5.988% 2 years 0.8714 0.9454 1.0562 2 years 7.000% 6.974% 6.940% 3 years 0.7903 0.8967 1.0562 3 years 8.000% 7.938% 7.860%

Example: For the yield on the 3-year 10%-coupon bond, 1.0562 = (0.10/y) x [1-(1/(1+y/2))6] + (1/(1+y/2))6 y = 7.86%.

Extra Credit: Compute the par rate, or in other words, the coupon rate that would make a bond’s price equal to par if its maturity is (i) one year (ii) two years (iii) three years.

Based on the discount rates above, discount rates for maturities out to three years are

Maturity Discount Factor 0.5 0.9732 1.0 0.9426 1.5 0.9085 2.0 0.8714 2.5 0.8319 3.0 0.7903

The par rate is the coupon rate that sets the bond price equal to its par value. Thus, for $1 par bond, we get:

2T cT 1 ds/2 dT 2 s1

2(1 dT ) cT 2T ds/2 s1 The par rate for 1 year is 2(1-0.9426)/(0.9732+0.9426) = 5.993% The par rate for 2 years is 2(1-0.8714)/(0.9732+0.9426+0.9085+0.8714) = 6.957% The par rate for 3 years is 2(1-0.7903)/(0.9732 + 0.9426+0.9085+0.8714+0.8319+0.7903) = 7.886%

Compare the term structure to the par rates, and to the yields on the coupon bonds. What do you conclude?

The term structure for 1,2 and 3 years out is upward sloping from 6% to 8%. Thus, the yield curve for the coupon bonds lie below the term structure, with the 4%, par yield curve and 10% in descending order. The higher coupons put more relative weight on earlier cash flows which are subject to lower spot rates, and this pushes down their yields.

10) Answer the following true/false questions? a) If the spot curve is upward sloping, then the forward curve is also upward sloping.

False. The forward curve measures the rate of change in the spot curve; thus, it is possible that the spot curve is upward sloping, but that the forward rate (i.e., the rate between say maturity T and T+1) is falling. b) If the forward curve is rising, then the yields on bonds that mature in 10 years with 10% coupons are higher than those of the same maturity with 5% coupons.

False. If the forward curve is rising, then the spot curve is upward sloping. Thus, higher coupon bonds of the same maturity have lower yields than their lower coupon counterparts. This is because high coupon bonds put relatively more weight on earlier cash flows which are subject to lower spot rates. c) Consider two U.S. gov’t bonds with the same remaining time to maturity. One bond pays a high coupon while the other pays a relatively low coupon. The higher coupon bond has a higher yield to maturity. If the term structure is upward sloping, then one can infer that the bonds are mispriced.

True. Because the spot curve is upward sloping, the higher coupon bond should have a lower yield to maturity. The fact that it doesn’t suggests that its price is too low relative to the lower coupon bond. Note that yield to maturity is just a definition --- once the bond’s price and its cash flows are known, it is a given.