Chapter 5 1 CHAPTER 4

THE MECHANICS OF FINANCIAL ACCOUNTING

BRIEF EXERCISES

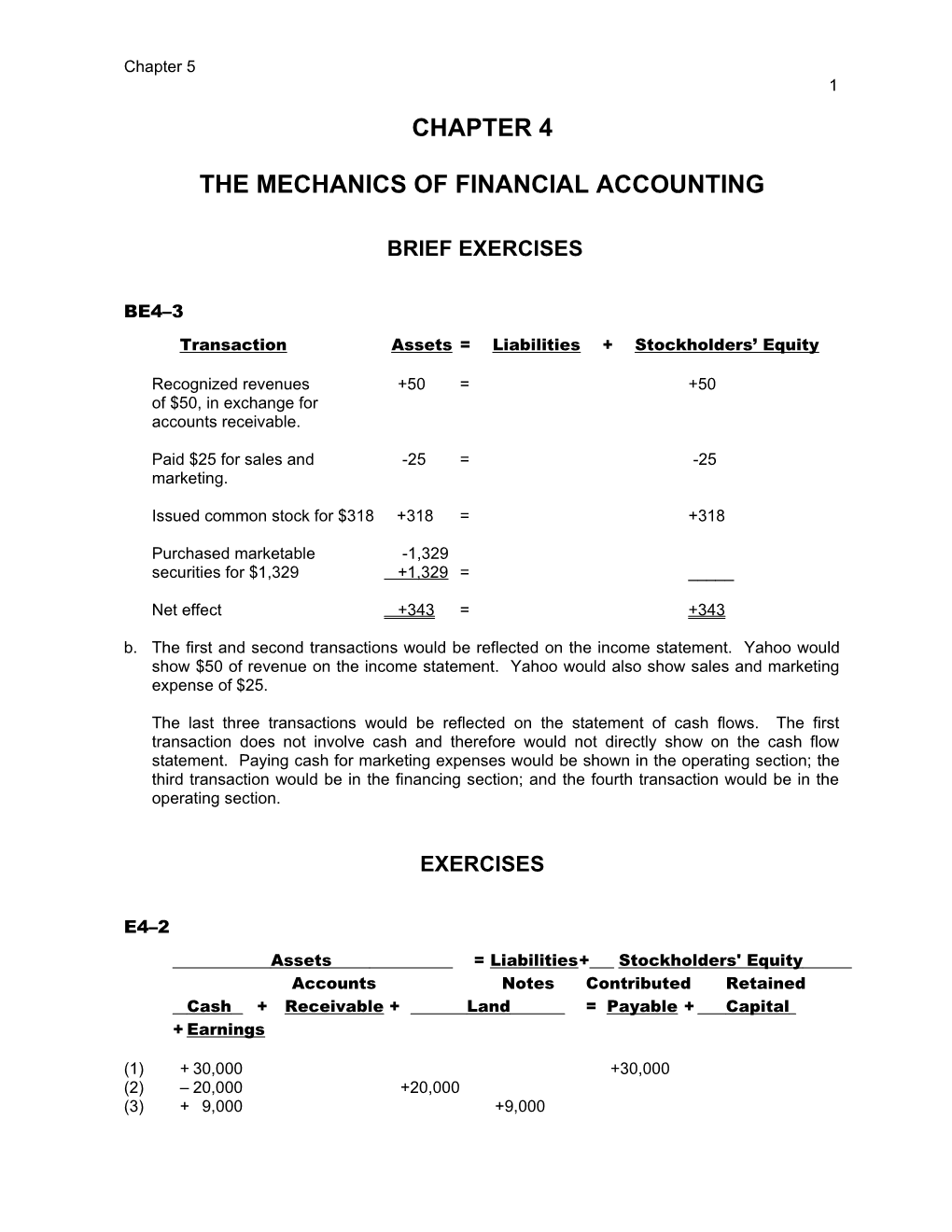

BE4–3 Transaction Assets = Liabilities + Stockholders’ Equity

Recognized revenues +50 = +50 of $50, in exchange for accounts receivable.

Paid $25 for sales and -25 = -25 marketing.

Issued common stock for $318 +318 = +318

Purchased marketable -1,329 securities for $1,329 +1,329 = _____

Net effect +343 = +343 b. The first and second transactions would be reflected on the income statement. Yahoo would show $50 of revenue on the income statement. Yahoo would also show sales and marketing expense of $25.

The last three transactions would be reflected on the statement of cash flows. The first transaction does not involve cash and therefore would not directly show on the cash flow statement. Paying cash for marketing expenses would be shown in the operating section; the third transaction would be in the financing section; and the fourth transaction would be in the operating section.

EXERCISES

E4–2 Assets = Liabilities+ Stockholders' Equity Accounts Notes Contributed Retained Cash + Receivable + Land = Payable + Capital + Earnings

(1) + 30,000 +30,000 (2) – 20,000 +20,000 (3) + 9,000 +9,000 (4) +8,000 + 8,000 (5) – 5,500 – 5,500 (6) – 500 – 500 Total 13,000 8,000 20,000 9,000 30,000 2,000

Note: Transactions (4), (5), and (6) are initially recorded in temporary accounts and are closed into the Retained Earnings account, which is part of stockholders' equity.

E4–5 (1) This financial event does not have accounting significance. Entries are made to record financial events that affect the company's current financial condition. In this case, the new contract will affect the company's future financial condition by affecting the dollar value of future events as the new contract is implemented. Simply signing the contract does not affect the company's current financial position.

(2) This financial event does have accounting significance. The receipt of cash in exchange for issuing debt affects the company's current financial position by increasing both the amount of cash the company has and the obligations the company has to other entities. Thus, an entry is necessary, and the entry would be:

Cash (+A) 200,000 Bonds Payable (+L) 200,000 Issued bonds.

(3) This event does not have accounting significance. The retirement of an official does not influence the company's current financial position.

(4) This financial event does have accounting significance. Receiving cash from a customer would change the company's current financial position. The entry would be:

Cash (+A) 10,000 Accounts Receivable (–A) 10,000 Collected cash from customers.

(5) This financial event does have accounting significance. Payment of a liability will change a company's current financial position by decreasing both the amount of cash the company has and the company's obligations to other entities. The entry would be:

Accrued Interest Payable (–L) 1,000 Cash (–A) 1,000 Paid interest previously incurred.

(6) This financial event does not have accounting significance. Long-lived assets are reported at original cost less accumulated depreciation. Increases in market value above the reported amounts are not reported because market values on long-lived assets are not objective (i.e., are not reliable).

(7) This financial event does have accounting significance. The purchase of an insurance policy represents a change in the company's financial position because the company has less cash and because the company has acquired the benefit of insurance coverage. However, the value of the policy has no influence on the company. The appropriate entry would be:

Prepaid Insurance (+A) 1,500 Cash (–A) 1,500 Purchased insurance coverage.

(8) This financial event does not have accounting significance. Simply placing an order does not affect a company's financial position. That is, the company has not experienced a change in the amount of cash it has, the amount it owes other entities, and so forth. The company's position does not change until it legally owns the goods.

E4–8 a. Ending cash = Beginning cash + Cash inflows – Cash outflows = $9,000 + $133,500 – $99,500 = $43,000

Note: Since Cash is an asset, cash inflows are recorded on the debit, or left-hand side of the T account, and cash outflows are recorded on the credit, or right-hand side of the T account. b. Miller Manufacturing Statement of Cash Flows For the Year Ended December 31, 2009 Cash flows from operating activities: Cash collections from customers $ 95,000 Payment of salaries (26,500) Payment of miscellaneous expenses (13,000) Payment of rent (7,000) Payment of interest (3,000) Net cash increase from operating activities $ 45,500 Cash flows from investing activities: Proceeds from sale of land $ 7,500 Purchase of long-term investments (10,000) Purchase of equipment (24,000) Net cash decrease from investing activities (26,500) Cash flows from financing activities: Proceeds from issuance of common stock $ 15,000 Proceeds from borrowing 16,000 Payment of bank loan (12,000) Payment of dividends (4,000) Net cash increase from financing activities 15,000 Increase (decrease) in cash balance $ 34,000 Beginning cash balance 9,000 Ending cash balance $ 43,000

E4–14 a. 12/31/09 Wage Expense (E, –SE) 42,000* Wages Payable (+L) 42,000 Incurred, but did not pay, wages. ______* $42,000 = $70,000 (3 days in December ÷ 5 days total) b. 1/2/10 Wage Expense (E, –SE) 28,000 Wages Payable (–L) 42,000 Cash (–A) 70,000 Paid wages. c. 2009 2010 Total Wage expense $42,000 $28,000 $70,000 Cash outflow associated with wages 0 70,000 70,000 d. The purpose of the adjusting journal entry on December 31, 2009 is to recognize an economic event that has not yet been captured by an exchange transaction. The economic event is that the Hurst Corporation consumed the benefits of its employees' labor, and in doing so, has become obligated to its employees. Hurst Corporation will not fulfill its obligation to its employees until the subsequent period when it actually pays the employees their wages. Consequently, an accrual adjusting entry is required on December 31 to record this economic event in the correct accounting period.

PROBLEMS

P4–6 Net Operating Accounts Direction Net Income Cash Flow

(1) Cash + Contributed Capital + NE NE (2) Inventory + Accounts Payable + NE NE (3) Accounts Receivable + Fees Earned + + NE (4) Cash + Accounts Receivable – NE + (5) Equipment + NE NE Cash – (6) Wages Payable – Cash – NE – (7) Cash + Fees Earned + + + (8) Cash – Long-Term Note Payable – NE NE (9) Cash – Interest Expense + – – (10) Cash + Land – Gain on Sales of Land + + NE P4–8 Assets Liabilities Stockholders' Equity Revenues Expenses (a) _ NE – NE + (b) NE + – NE + (c) NE _ + + NE (d) _ NE _ NE + (e) NE + – NE + (f) NE + – NE + (g) _ NE _ NE +

P4–8 a. Supplies Expense (E, –SE) 55,000 Supplies Inventory (–A) 55,000 Adjusted for supplies used. b. Rent Expense (E, –SE) 2,400 Rent Payable (+L) 2,400 Incurred, but did not pay, rent. c. Unearned Service Revenues (–L) 12,000 Fees Earned (R, +SE) 12,000 Rendered services for cash collected in advance. d. Depreciation Expense (E, –SE) 50,000 Accumulated Depreciation (–A) 50,000 Depreciated fixed assets for 2008. e. Interest Expense (E, –SE) 600 Interest Payable (+L) 600 Incurred, but did not pay, interest. f. Advertising Expense (E, –SE) 28,000 Advertising Payable (+L) 28,000 Incurred, but did not pay, advertising. g. Insurance Expense (E, –SE) 175 Prepaid Insurance (–A) 175 Adjusted for expiration of prepaid insurance.

P4–12 Net Income Current Ratio Working Capital Debt/Equity Ratio (1) NE + + – (2) NE – – NE (3) NE – – – (4) + + + –a (5) NE – – + (6) NE +b NE – (7) NE NE NE NE (8) – – – +c ______a Transaction (4) increases revenues, thereby increasing the net income amount closed into Retained Earnings. Since increasing Retained Earnings increases stockholders' equity, Transaction (4) decreases the debt/equity ratio. Note that the inventory was sold above cost. b Transaction (6) reduces cash and accounts payable by the same amount. Reducing the numerator and the denominator by the same amount has the impact of increasing the ratio ($9,448/$5,755 become $9,248/$5,555). Therefore this transaction has the impact of increasing the current ratio. c Transaction (8) increases expenses, thereby decreasing the net income amount closed into Retained Earnings. Since reducing Retained Earnings reduces stockholders' equity, Transaction (8) increases the debt/equity ratio.

ISSUES FOR DISCUSSION

ID4–4 a. There are a number of items that could explain why cash flows from operations would be less than net income. These items fall into two general classes: (1) items that affect net income but not cash flows from operating activities and (2) items that affect cash flows from operating activities but not net income. Specific examples of the former include gains, sales on account, accrual of other receivables, and so forth. Specific examples of the latter include payments to suppliers for inventory purchased previously on account, payments of other previously accrued payables, and so forth. b. There are four places in the financial statements that would probably be particularly informative about cash flow problems. First, a big increase in the balance of Accounts Receivable, particularly if the balance in Sales has not increased, could indicate that the company is having trouble collecting on credit sales. This would imply that the company has less cash flowing in. Second, a big increase in the company's payables could signal cash flow problems. That is, if a company is having cash flow problems, it would try to delay paying its payables as long as possible so that it can use its cash for more immediate problems. Third, a big decrease in inventory could result from cash flow problems because the company cannot afford to tie up as much cash in inventory. Finally, the statement of cash flows can provide lots of information about a company's cash flows and solvency. For example, a company that repeatedly fails to generate cash from operating activities could experience some solvency problems because a company cannot borrow or issue stock indefinitely. In addition, the investing activities section of the statement of cash flows would reveal whether the company is selling off lots of assets. This could indicate that the company is liquidating its productive base in an effort to raise enough capital to stay in business.