ACCT 5301 Module 8 Exercises 1

M8-9. Analyzing and Determining Liability Amounts For each of the following situations, indicate the liability amount, if any, that is reported on the balance sheet of Basu, Inc., at December 31, 2012. a. Basu owes $110,000 at year-end 2012 for inventory purchases. b. Basu agreed to purchase a $28,000 drill press in January 2013. c. During November and December of 2012, Basu sold products to a customer and warranted them against product failure for 90 days. Estimated costs of honoring this 90-day warranty during 2013 are $2,200. d. Basu provides a profit-sharing bonus for its executives equal to 5% of reported pretax annual income. The estimated pretax income before the bonus for 2012 is $600,000. Bonuses are not paid until January of the following year. E8-23. Analyzing and Computing Accrued Warranty Liability and Expense Waymire Company sells a motor that carries a 60-day unconditional warranty against product failure. From prior years' experience, Waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. During the current period, Waymire sold 69,000 units and repaired 1,000 of those units. a. How much warranty expense must Waymire report in its current-period income statement? b. What warranty liability related to current-period sales will Waymire report on its current period- end balance sheet? (Hint: Remember that some units were repaired in the current period.)

M8-19. Computing Bond Issue Price Bushman, Inc., issues $500,000 of 9% bonds that pay interest semiannually and mature in 10 years. Compute the bond issue price assuming that the prevailing market rate of interest is: a. 8% per year compounded semiannually.

b. 10% per year compounded semiannually. ACCT 5301 Module 8 Exercises 2

M8-16. Analyzing Financial Statement Effects of Bond Redemption Dechow, Inc., issued $250,000 of 8%, 15-year bonds at 96 on July 1, 2007. Interest is payable semiannually on December 31 and June 30. Dechow, Inc. amortizes the discount at a rate of $333 per each semi-annual period. Through June 30, 2012, Dechow has amortized $3,330 of the bond discount. On July 1, 2012, Dechow retired the bonds at 101. Prepare the following journal entries: a. Bond issuance on July 1, 2007.

b. Recognize interest expense on December 31, 2007.

c. Bond retirement on July 1, 2012.

E8-28. Analyzing and Reporting Financial Statement Effects of Mortgages On January 1, Piotroski, Inc., borrowed $700,000 on a 6%, 10-year mortgage note payable that was issued at face value. The note is to be repaid in equal semiannual installments of $47,050 (payable on June 30 and December 31). Each mortgage payment includes both principal and interest. Interest is computed using the effective interest method. Prepare the journal entries: (a) Issuance of the mortgage note payable.

(b) Payment of the first installment on June 30.

(c) Payment of the second installment on December 31.

Mortgage Note Payable $700,000

\ E8-31. Analyzing and Reporting Financial Statement Effects of Bond Transactions. On January 1, 2012, McKeown, Inc., issued $250,000 of 8%, 9-year bonds for $220,776, which implies a market (yield) rate of 10%. Semiannual interest is payable on June 30 and December 31 of each year. (a) Show computations to confirm the bond issue price. Principal = $250,000 * ______= Interest annuity = $250,000 * 8%/2 = $______* ______= Total (b) Prepare the journal entries for ACCT 5301 Module 8 Exercises 3 (1) bond issuance

(2) semiannual interest payment and discount amortization on June 30, 2012

(3) semiannual interest payment and discount amortization on December 31, 2012.

Bond Amortization Table Disc. Amortization Discount Interest Bonds Net CR on BP Expense= Payable (CR) Balance (DR) NB*5% DR = Interest Exp. - Date $10,000 6/30/2012 250,000 29,224 220,776 11,039 1,039 12/31/2012 250,000 28,185 221,815 11,091 1,091 6/30/2013 250,000 27,094 222,906 11,145 1,145 12/31/2013 250,000 25,949 224,051 11,203 1,203 6/30/2014 250,000 24,747 225,253 11,263 1,263 12/31/2014 250,000 23,484 226,516 11,326 1,326 6/30/2015 250,000 22,158 227,842 11,392 1,392 12/31/2015 250,000 20,766 229,234 11,462 1,462 6/30/2016 250,000 19,304 230,696 11,535 1,535 12/31/2016 250,000 17,770 232,230 11,612 1,612 6/30/2017 250,000 16,158 233,842 11,692 1,692 12/31/2017 250,000 14,466 235,534 11,777 1,777 6/30/2018 250,000 12,689 237,311 11,866 1,866 12/31/2018 250,000 10,824 239,176 11,959 1,959 6/30/2019 250,000 8,865 241,135 12,057 2,057 12/31/2019 250,000 6,808 243,192 12,160 2,160 6/30/2020 250,000 4,649 245,351 12,268 2,268 12/31/2020 250,000 2,381 247,619 12,381 2,381

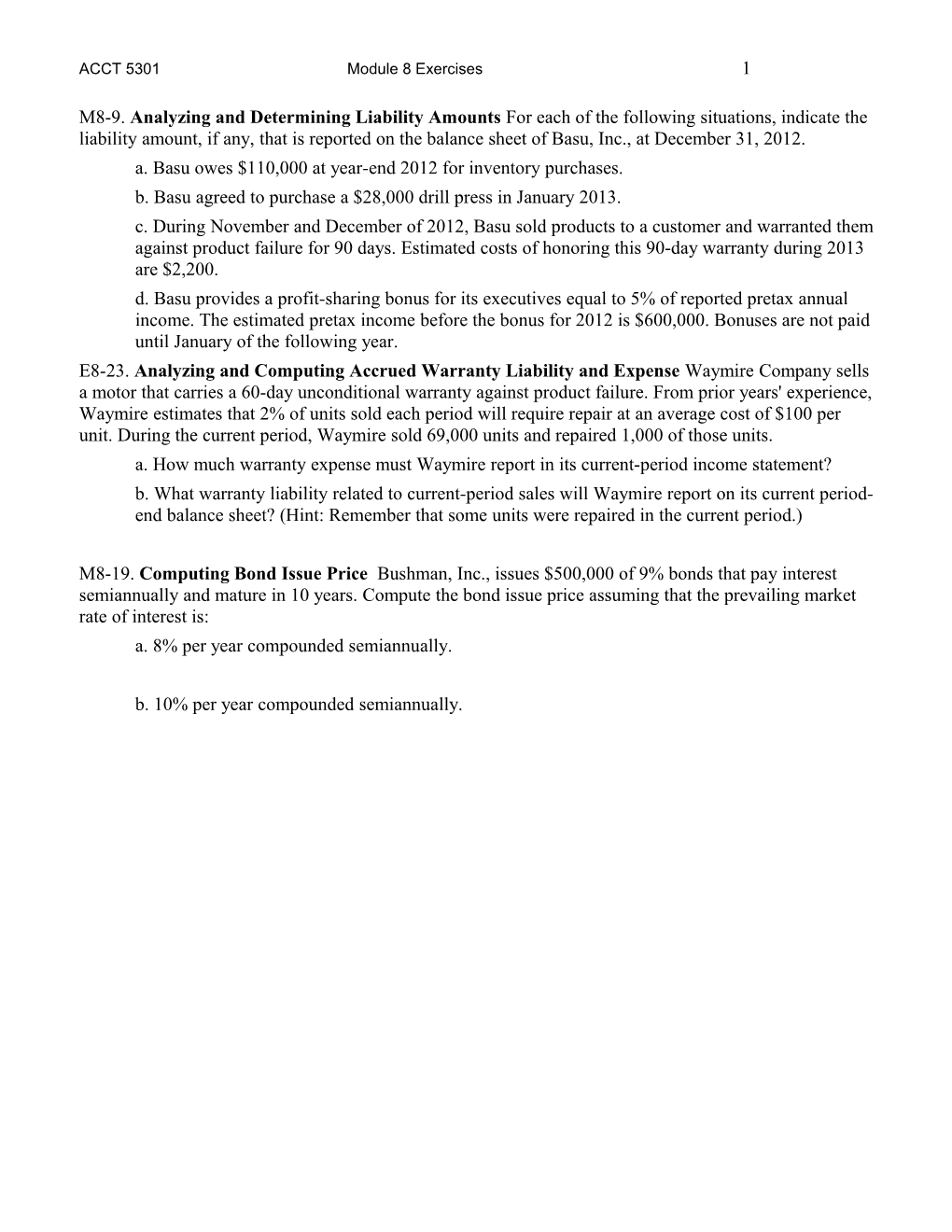

Pr. Val of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.9 52 0.93 0.9174 1 0.99010 0.98039 0.97087 0.96154 38 0.94340 458 0.92593 3 0.90909 0.9 07 0.87 0.8416 2 0.98030 0.96117 0.94260 0.92456 03 0.89000 344 0.85734 8 0.82645 0.8 63 0.81 0.7721 3 0.97059 0.94232 0.91514 0.88900 84 0.83962 630 0.79383 8 0.75131 0.8 22 0.76 0.7084 4 0.96098 0.92385 0.88849 0.85480 70 0.79209 290 0.73503 3 0.68301 0.7 83 0.71 0.6499 5 0.95147 0.90573 0.86261 0.82193 53 0.74726 299 0.68058 3 0.62092 0.7 46 0.66 0.5962 6 0.94205 0.88797 0.83748 0.79031 22 0.70496 634 0.63017 7 0.56447 0.7 10 0.62 0.5470 7 0.93272 0.87056 0.81309 0.75992 68 0.66506 275 0.58349 3 0.51316 8 0.92348 0.85349 0.78941 0.73069 0.6 0.62741 0.58 0.54027 0.5018 0.46651 ACCT 5301 Module 8 Exercises 4 76 84 201 7 0.6 44 0.54 0.4604 9 0.91434 0.83676 0.76642 0.70259 61 0.59190 393 0.50025 3 0.42410 0.6 13 0.50 0.4224 10 0.90529 0.82035 0.74409 0.67556 91 0.55839 835 0.46319 1 0.38554 0.5 84 0.47 0.3875 11 0.89632 0.80426 0.72242 0.64958 68 0.52679 509 0.42888 3 0.35049 0.5 56 0.44 0.3555 12 0.88745 0.78849 0.70138 0.62460 84 0.49697 401 0.39711 3 0.31863 0.5 30 0.41 0.3261 13 0.87866 0.77303 0.68095 0.60057 32 0.46884 496 0.36770 8 0.28966 0.5 05 0.38 0.2992 14 0.86996 0.75788 0.66112 0.57748 07 0.44230 782 0.34046 5 0.26333 0.4 81 0.36 0.2745 15 0.86135 0.74301 0.64186 0.55526 02 0.41727 245 0.31524 4 0.23939 0.4 58 0.33 0.2518 16 0.85282 0.72845 0.62317 0.53391 11 0.39365 873 0.29189 7 0.21763 0.4 36 0.31 0.2310 17 0.84438 0.71416 0.60502 0.51337 30 0.37136 657 0.27027 7 0.19784 0.4 15 0.29 0.2119 18 0.83602 0.70016 0.58739 0.49363 52 0.35034 586 0.25025 9 0.17986 0.3 95 0.27 0.1944 19 0.82774 0.68643 0.57029 0.47464 73 0.33051 651 0.23171 9 0.16351 0.3 76 0.25 0.1784 20 0.81954 0.67297 0.55368 0.45639 89 0.31180 842 0.21455 3 0.14864 ACCT 5301 Module 8 Exercises 5

PV of $1 per Year 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.9 52 0.93 0.9174 1 0.99010 0.98039 0.97087 0.96154 38 0.94340 458 0.92593 3 0.90909 1.8 59 1.80 1.7591 2 1.97040 1.94156 1.91347 1.88609 41 1.83339 802 1.78326 1 1.73554 2.7 23 2.62 2.5312 3 2.94099 2.88388 2.82861 2.77509 25 2.67301 432 2.57710 9 2.48685 3.5 45 3.38 3.2397 4 3.90197 3.80773 3.71710 3.62990 95 3.46511 721 3.31213 2 3.16987 4.3 29 4.10 3.8896 5 4.85343 4.71346 4.57971 4.45182 48 4.21236 020 3.99271 5 3.79079 5.0 75 4.76 4.4859 6 5.79548 5.60143 5.41719 5.24214 69 4.91732 654 4.62288 2 4.35526 5.7 86 5.38 5.0329 7 6.72819 6.47199 6.23028 6.00205 37 5.58238 929 5.20637 5 4.86842 6.4 63 5.97 5.5348 8 7.65168 7.32548 7.01969 6.73274 21 6.20979 130 5.74664 2 5.33493 7.1 07 6.51 5.9952 9 8.56602 8.16224 7.78611 7.43533 82 6.80169 523 6.24689 5 5.75902 7.7 21 7.02 6.4176 10 9.47130 8.98259 8.53020 8.11090 73 7.36009 358 6.71008 6 6.14457 8.3 06 7.49 6.8051 11 10.36763 9.78685 9.25262 8.76048 41 7.88687 867 7.13896 9 6.49506 8.8 63 7.94 7.1607 12 11.25508 10.57534 9.95400 9.38507 25 8.38384 269 7.53608 3 6.81369 9.3 93 8.35 7.4869 13 12.13374 11.34837 10.63496 9.98565 57 8.85268 765 7.90378 0 7.10336 9.8 98 8.74 7.7861 14 13.00370 12.10625 11.29607 10.56312 64 9.29498 547 8.24424 5 7.36669 10. 37 96 9.10 8.0606 15 13.86505 12.84926 11.93794 11.11839 6 9.71225 791 8.55948 9 7.60608 10. 83 77 9.44 8.3125 16 14.71787 13.57771 12.56110 11.65230 7 10.10590 665 8.85137 6 7.82371 11. 27 40 9.76 8.5436 17 15.56225 14.29187 13.16612 12.16567 7 10.47726 322 9.12164 3 8.02155 11. 68 95 10.0 8.7556 18 16.39827 14.99203 13.75351 12.65930 9 10.82760 5909 9.37189 3 8.20141 12. 08 53 10.3 8.9501 19 17.22601 15.67846 14.32380 13.13394 2 11.15812 3560 9.60360 1 8.36492 12. 46 22 10.5 9.1285 20 18.04555 16.35143 14.87747 13.59033 1 11.46992 9401 9.81815 5 8.51356